Global Smart Mining Market Size, Share Analaysis Report By Component (Solution (Smart Control System, Smart Asset Management, Safety and Security System, Monitoring System, Other Solutions), Services (Support and Maintenance, System Integration, Consulting Services)), By Mining Type (Underground Mining, Surface Mining), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154215

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

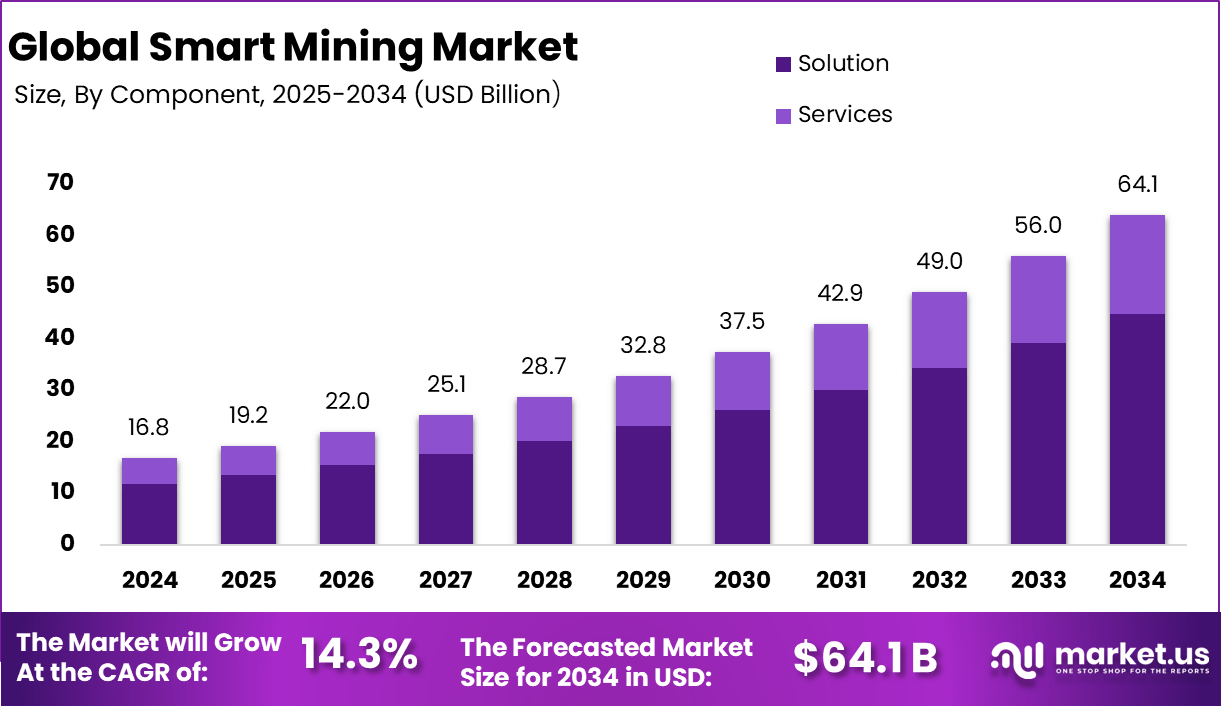

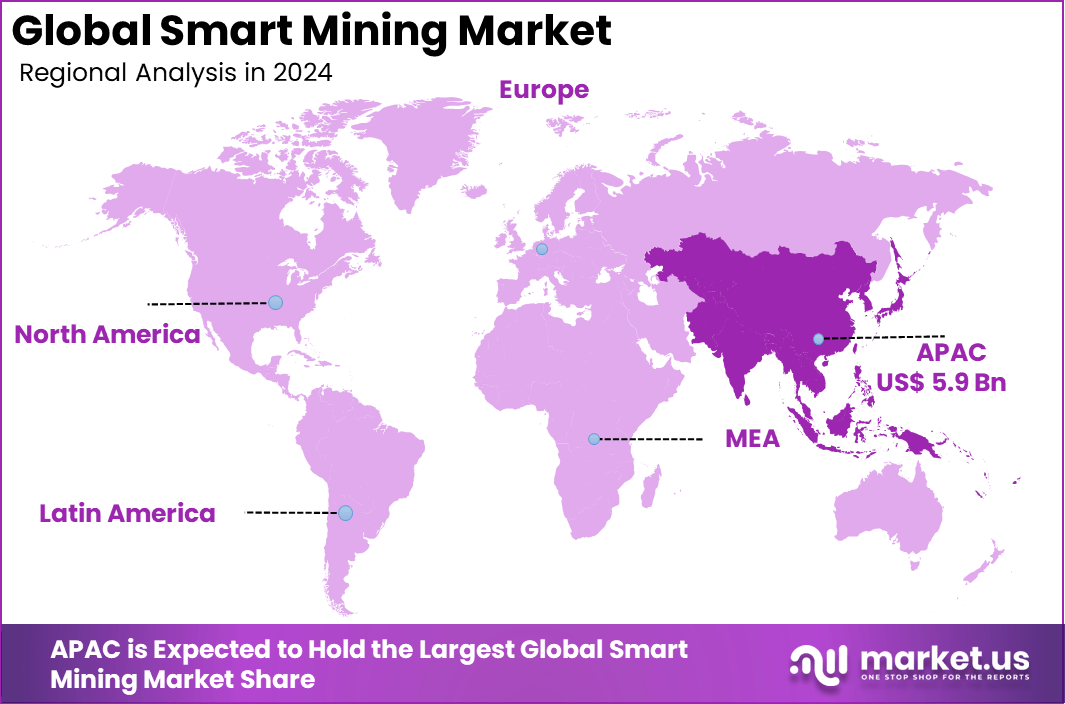

The Global Smart Mining Market size is expected to be worth around USD 64.1 Billion by 2034, from USD 16.8 Billion in 2024, growing at a CAGR of 14.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 35% share, holding USD 5.9 Billion revenue.

The Smart Mining Market is evolving with increasing sophistication, as data‑driven automation becomes central to modern extraction. This market reflects a strategic transition wherein advanced technologies are embedded into traditional mining operations to enhance safety, efficiency and oversight. The growth of the sector can be attributed to pressures such as rising demand for critical minerals and the imperative to reduce environmental footprint.

Top driving factors in smart mining are the relentless push for greater efficiency, safety, and environmental responsibility. Mining companies face rising pressure to deliver more with fewer resources while reducing risks to workers and minimizing environmental impact. Smart mining solutions help reduce accidents, improve compliance, and keep operations running through automation and predictive maintenance.

For instance, In July 2024, Sany introduced its Smart Mining Solution 3.0 and deployed it across more than 10 mining sites in China, including Inner Mongolia and Jiangsu. This solution addresses key challenges in vehicle-assisted open-pit mining, such as low operational efficiency, weak feedback systems, and insufficient safety measures, aiming to enhance overall productivity and safety standards.

Demand analysis shows a clear upward trend as industries such as electric vehicles, renewable energy, and electronics stimulate unprecedented global appetite for metals and minerals. The mining sector is evolving rapidly to meet this surge, deploying smart mining solutions that support faster exploration, better ore discovery, and more efficient extraction.

Key Takeaway

- In 2024, the Solution segment held a dominant market position, capturing a 70% share of the Smart Mining market.

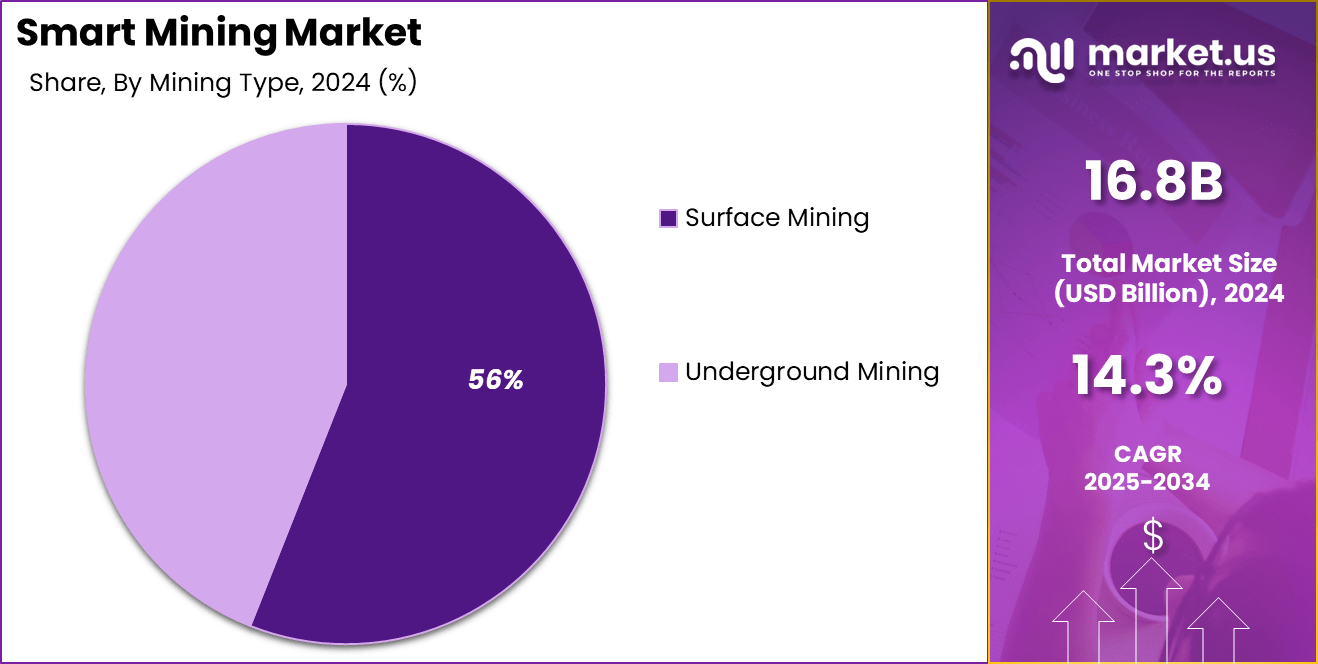

- In 2024, the Surface Mining segment held a dominant market position, capturing a 56% share of the Global Smart Mining market.

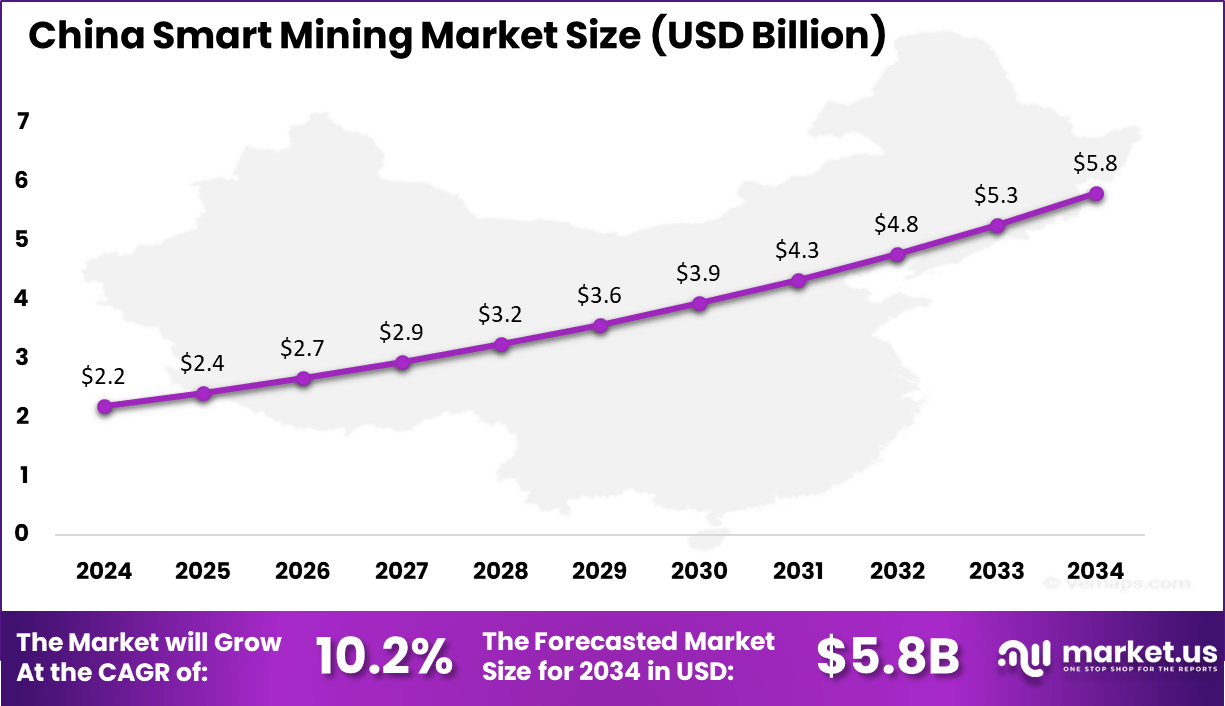

- The China Smart Mining market was valued at USD 2.2 Billion in 2024, with a robust CAGR of 2%.

- In 2024, Asia Pacific held a dominant market position in the Global Smart Mining market, capturing around a 35% share.

China Market Worth

The China Smart Mining Market was valued at USD 2.2 Billion in 2024 and is anticipated to reach approximately USD 5.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 10.2% during the forecast period from 2025 to 2034.

China is advancing rapidly in smart mining through major investments and regulatory support. In 2024, China Minmetals launched a USD 1.41 billion project in Qinghai to establish a lithium mining company focused on securing critical materials like lithium and potassium for electric vehicle batteries and solar panels. This initiative, supported by local partners, reflects China’s intent to build a resilient supply chain for green technologies.

Further reinforcing this vision, the National Energy Administration issued guidelines in May 2024 mandating that all new coal mines follow intelligent standards. Mines with annual capacities above 3 million tons must lead the development of fully intelligent coal operations by 2025. These measures highlight the government’s commitment to integrating advanced technologies for improved safety, efficiency, and environmental sustainability.

In 2024, Asia Pacific held a dominant market position in the global Smart Mining market, capturing more than a 35% share. The Asia Pacific region is seeing major developments in smart mining, which are largely due to the strategic government initiatives and technological innovations. For example, the government in Australia has pledged USD 22.7 billion over the next ten years under the policy “Future Made in Australia”.

The goal is to support domestic manufacturing in the sustainable energy sectors, minerals included. There will be a USD 1 billion “Solar Sunshot” program to encourage solar panel production and an initiative, “Resourcing Australia’s Prosperity”, worth USD 566 million for mining resources through geomapping, among other things.

Japan’s Ministry of Economy, Trade, and Industry (METI) has also been very proactive in promoting the use of smart mining technologies through subsidies and pilot projects. Their main focus is on automation and IoT integration. As a result, they expect operations to become more efficient and safer. The Morowali Industrial Park in Indonesia is also playing its part.

It is a major nickel processing hub that is the reason for the global electric vehicle battery supply chain. Together, these are the developments that show the Asia Pacific region’s commitment to moving forward with smart mining by strategic investments, policy support, and thus making it a leader in the global mining industry.

Growth Factors

Key Factor Description Adoption of Automation, IoT, and AI Integration of automation, Internet of Things (IoT), and artificial intelligence (AI) technologies improves efficiency, productivity, and decision-making in mining operations. Focus on Safety and Health Increasing attention to worker safety drives the adoption of autonomous vehicles, wearable tech, and real-time monitoring systems to mitigate risks in hazardous environments. Environmental Sustainability & Regulation Stricter environmental regulations and climate commitments are pushing the mining sector to embrace smart, green, and energy-efficient solutions for emissions and waste management. Surge in Demand for Critical Minerals Electrification, electric vehicles (EVs), and renewable energy growth are boosting demand for minerals, requiring efficient extraction via smart mining technologies. Cost Efficiency and Resource Optimization Data analytics, predictive maintenance, and resource optimization reduce production costs, downtime, and energy usage, increasing competitiveness. Emerging Trends

Key Trend Description Autonomous Vehicles, Drones, and Robotics Deployment of driverless trucks, robotic drills, and drones for surveying enhances safety, precision, and operational efficiency. Digital Twins & Predictive Analytics Use of digital twin models and AI-powered analytics for asset management, plant optimization, and predictive maintenance. Real-Time Monitoring & Remote Operations IoT sensors and cloud platforms enable real-time tracking of equipment, resource extraction, and environmental conditions, supporting remote and centralized operations. Energy-Efficient & Low-Emission Technologies Electrification of mining equipment, adoption of green mining practices, and real-time emissions monitoring address sustainability and compliance requirements. Cloud, Edge & Advanced Data Security Solutions Expansion of cloud and edge computing for centralized control, improved data security protocols, and cyber-resilience in highly connected mining operations. By Component: Solution

In 2024, the Solution segment led the Smart Mining Market, contributing a commanding 70% share. This category includes advanced digital systems such as fleet management software, real-time data analytics platforms, automated scheduling tools, and integrated mine control solutions.

The high adoption rate is driven by the mining sector’s focus on increasing operational efficiency, reducing safety risks, and minimizing environmental impacts. Digital solutions enable centralized monitoring, predictive maintenance, and process automation, which are critical in optimizing output while controlling costs.

As more mines transition toward autonomous operations, the demand for AI-enabled solutions and smart dashboards continues to grow, positioning this segment as the technological backbone of modern mining operations.

By Mining Type: Surface Mining

Surface Mining accounted for 56% of the market share in 2024, making it the leading mining type in the smart mining ecosystem. This dominance is due to the higher operational scale, accessibility, and visibility of surface mining activities, which allow for easier integration of smart technologies such as GPS-based tracking, real-time surveillance, and automated drilling systems.

Compared to underground mining, surface operations offer a more favorable environment for deploying robotics, drones, and autonomous haulage systems. The ability to gather continuous performance data and respond rapidly to environmental or safety issues has made surface mines the primary sites for early adoption of digital innovations in the mining industry.

Emerging Trend

AI-Driven Automation Reshaping Mining Operations

Smart mining is seeing a dramatic shift with the rise of AI-driven automation. Across the industry, cutting-edge technologies like autonomous vehicles, robotic drills, and advanced sensors are now at the heart of mining operations. These smart machines work around the clock and collect vast amounts of data that is processed by intelligent algorithms to optimize everything from ore extraction to equipment maintenance.

The integration of artificial intelligence enables mines to predict breakdowns before they occur, coordinate resources more efficiently, and handle complex tasks remotely, keeping workers out of harm’s way and reducing operational interruptions. This trend finds its roots in the growing demands for safety, efficiency, and sustainability.

Mining operations powered by AI allow for real-time decision-making, less energy usage, and better conservation of resources. In today’s environment, where there is pressure to meet higher environmental standards and consumers expect greater transparency, these intelligent tools enable miners to minimize waste and monitor their impact on surroundings. As a result, AI automation is making mining smarter, safer, and more adaptable to future challenges.

Key Driver

Growing Emphasis on Safety and Regulatory Compliance

A major force accelerating smart mining adoption is the focus on keeping workers safe and making sure environmental rules are followed. Mining has always been risky, but by using connected devices, drones, and AI-powered monitoring, companies can now identify hazards and act before they become problems.

This has radically improved workplace safety, lowering the number of accidents and making mines less hazardous for everyone involved. Stricter government regulations have also played a role in this shift. Mines are now required to reduce emissions, lower pollution, and use energy more efficiently.

Smart mining technologies make it much easier to meet these standards by constantly monitoring conditions, allowing for instant corrections and thorough reporting. This combination of enhanced workforce protection and environmental stewardship has created strong momentum for the widespread use of smart mining solutions.

Primary Restraint

High Initial Investment and Skills Gap

Despite its benefits, the move to smart mining faces real obstacles, with the biggest being the significant upfront cost of advanced systems and equipment. Investing in autonomous machinery, IoT sensors, and AI software can stretch budgets, especially for smaller operators who may find the price hard to justify.

Traditional mines may also struggle with integrating new solutions into their existing infrastructure, leading to compatibility issues and further expenses. Another key barrier is the skills gap in the workforce. Mining staff who are used to traditional methods may lack training to operate, maintain, and secure new technologies, slowing down their adoption.

Upskilling employees or hiring fresh talent becomes a necessity, introducing both time and cost considerations. These factors combine to make the transition to smart mining a complex journey rather than an overnight switch.

Opportunity

Sustainable and Eco-Friendly Mining Practices

The push for more sustainable and environmentally responsible mining presents a unique opportunity for those adopting smart technologies. With increasing global scrutiny on the impact of mining, smart solutions empower companies to track emissions, recycle water, and reduce waste in ways that were impossible before.

Real-time environmental monitoring, for instance, can detect leaks or abnormal emissions immediately, so corrective actions are fast and precise. Such approaches appeal not only to regulators, but also to communities and partners who want to support earth-friendly mining.

By leveraging renewable energy, optimizing resource extraction, and promoting transparency, smart mines set themselves apart as responsible players in a sector often criticized for its environmental toll. As sustainability becomes a central expectation, early adopters of smart mining stand to gain both operational advantages and public trust.

Challenge

Cybersecurity and Data Privacy Concerns

Alongside progress, smart mining introduces new risks, chief among them the threat to data security. As more equipment, sensors, and control systems connect to company networks, the attack surface for cybercriminals expands.

Sensitive data, operational controls, and even worker safety can be at risk if robust defenses are not built into these systems from the start. The move to digital also demands continuous vigilance, with companies needing to implement strong authentication, constant monitoring, and ongoing employee training to stay ahead of cyber threats.

Failure to protect systems could lead to operational shut-downs, loss of corporate secrets, or even manipulation of machinery. Navigating this digital minefield is essential for sustaining trust and ensuring that mines of the future remain as secure as they are smart.

Key Market Segments

By Component

- Solution

- Smart Control System

- Smart Asset Management

- Safety and Security System

- Monitoring System

- Other Solutions

- Services

- Support and Maintenance

- System Integration

- Consulting Services

By Mining Type

- Underground Mining

- Surface Mining

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global smart mining market is characterized by intense competition among industry leaders striving to innovate and capture market share. Companies like ABB Ltd., Caterpillar Inc., Cisco Systems Inc., and Hitachi Ltd. are at the forefront, offering integrated solutions encompassing automation, electrification, and digitalization.

ABB’s eMine framework exemplifies its commitment to sustainable mining through electrification and automation. Caterpillar’s MineStar suite provides comprehensive mine operations management, enhancing productivity and safety. Cisco’s networking solutions enable secure and efficient data communication across mining operations. Hitachi Ltd. focuses on IoT and AI-driven solutions to optimize mining processes.

These companies are adopting strategies such as strategic partnerships, technological advancements, and regional expansions to strengthen their market position. For instance, ABB’s collaboration with Epiroc aims to advance underground trolley solutions, while Hitachi’s partnership with Ouster enhances its autonomous equipment capabilities.

Top Key Players in the Market

- ABB Ltd.

- Caterpillar Inc.

- Cisco Systems Inc.

- Hexagon AB

- Hitachi Ltd.

- Komatsu Ltd.

- Robert Bosch GmbH

- Sandvik AB

- SAP SE

- Trimble Inc.

- Wenco International Mining Systems Ltd

- SAP SE

- Rockwell Automation Inc.

- Symboticware Inc.

- IBM Corporation

- Epiroc AB

- MineExcellence

- Metso Outotec OYJ

- Other Key Players

Recent Developments

- On April 7, 2025, Hitachi Construction Machinery Europe introduced the LANDCROS Connect Fleet Management System and LANDCROS Innovation Studios at bauma 2025. These solutions aim to streamline operations and foster co-creation with startup companies to enhance mining efficiency.

- On June 10, 2025, Cisco showcased its AI-powered machine vision and industrial networking solutions at Cisco Live US 2025. These innovations are designed to improve operational efficiency and safety in mining operations.

- On March 6, 2025, Caterpillar launched the Cat® 789D Autonomous Water Truck, the first commercially available autonomous water truck. This vehicle enhances productivity by enabling mine operations to digitally track water consumption and reduce waste.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution {Smart Control System, Smart Asset Management, Safety and Security System, Monitoring System, Other Solutions}, Services {Support and Maintenance, System Integration, Consulting Services}), By Mining Type (Underground Mining, Surface Mining) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., Caterpillar Inc., Cisco Systems Inc., Hexagon AB, Hitachi Ltd., Komatsu Ltd., Robert Bosch GmbH, Sandvik AB, SAP SE, Trimble Inc., Wenco International Mining Systems Ltd, SAP SE, Rockwell Automation Inc., Symboticware Inc., IBM Corporation, Epiroc AB, MineExcellence, Metso Outotec OYJ, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Caterpillar Inc.

- Cisco Systems Inc.

- Hexagon AB

- Hitachi Ltd.

- Komatsu Ltd.

- Robert Bosch GmbH

- Sandvik AB

- SAP SE

- Trimble Inc.

- Wenco International Mining Systems Ltd

- SAP SE

- Rockwell Automation Inc.

- Symboticware Inc.

- IBM Corporation

- Epiroc AB

- MineExcellence

- Metso Outotec OYJ

- Other Key Players