Global Smart Microloan Platforms Market Size, Share, Growth Analysis By Platform Type (Mobile-based Platforms, Web-based Platforms, API-based Platforms), By Deployment Mode (Cloud-based, On-premises), By Loan Type (Personal Microloans, Business Microloans, Agricultural Microloans), By End User (Individual Borrowers, Small and Medium Enterprises (SMEs), Farmers), By Application (Consumer Loans, Business Loans), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163808

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Financial Demands

- Analysts’ Viewpoint

- Emerging Trends

- US Market Size

- By Platform Type

- By Deployment Mode

- By Loan Type

- By End User

- By Application

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint factors

- Growth opportunities

- Challenging factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

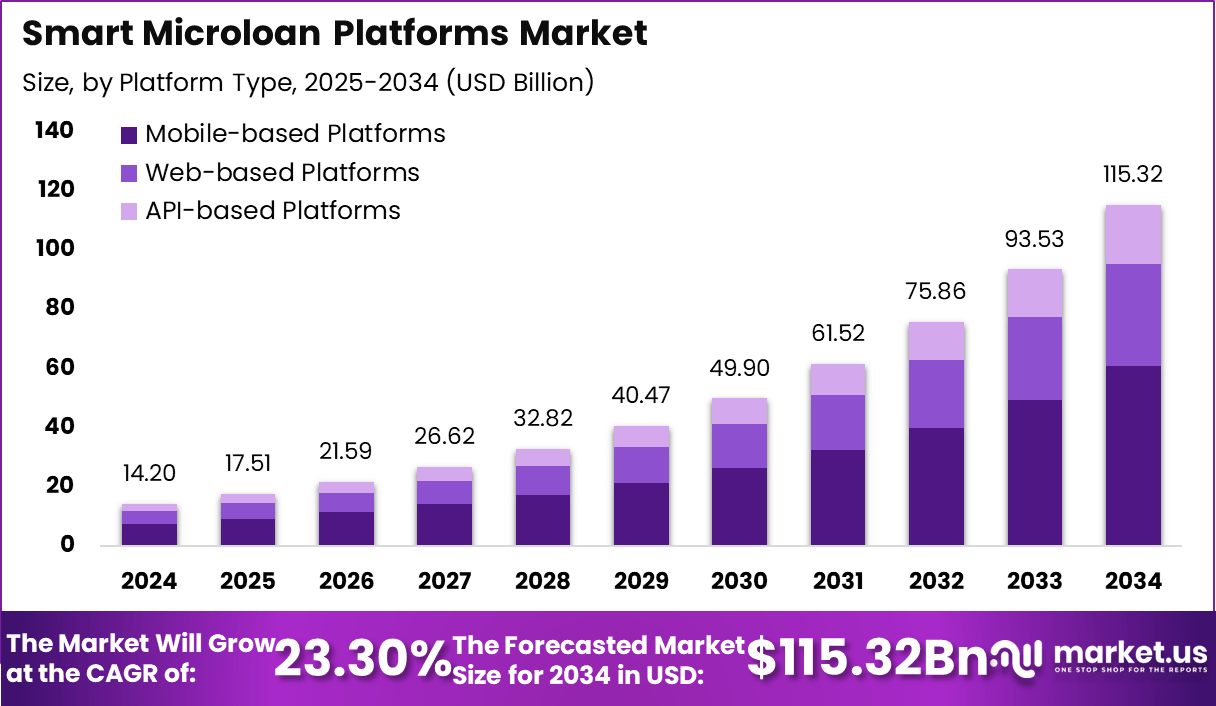

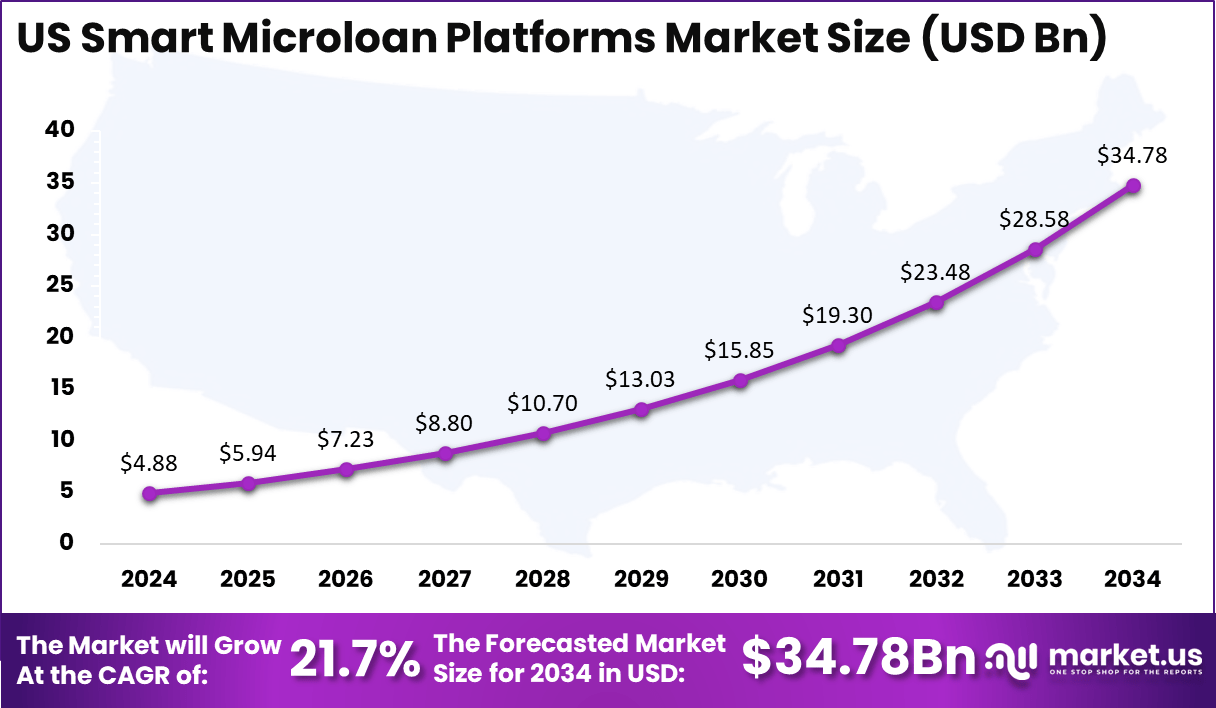

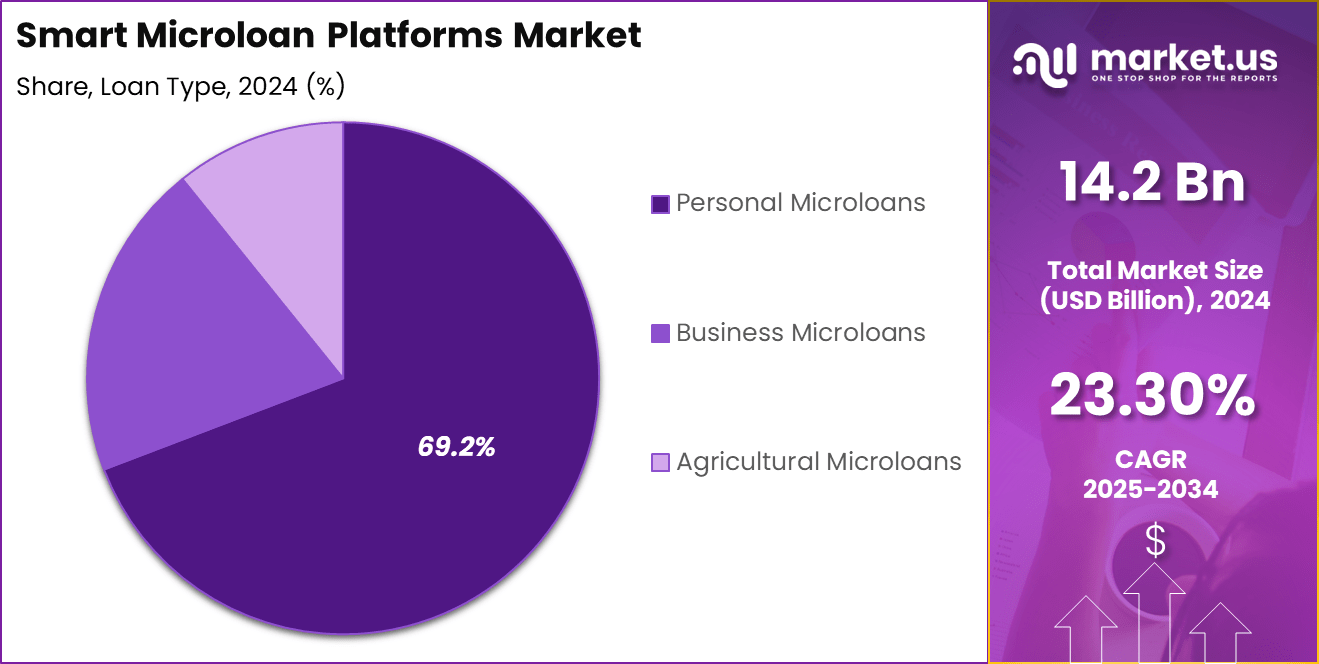

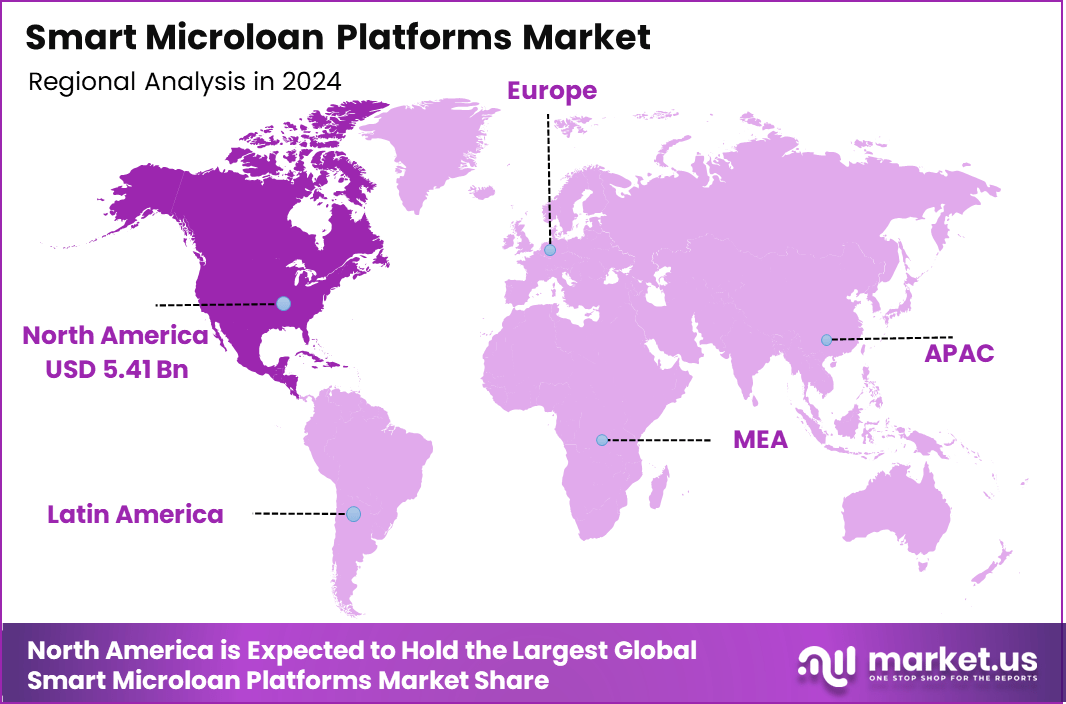

The global smart microloan platforms market, valued at USD 14.2 billion in 2024, is projected to reach USD 115.42 billion by 2034, expanding at a strong CAGR of 23.3%. North America accounts for 38.1% of the market, with a 2024 valuation of USD 5.41 billion, driven primarily by the US, which stands at USD 4.88 billion and is expected to grow to USD 34.78 billion by 2034 at a CAGR of 21.7%. This rapid growth is attributed to increasing fintech adoption, growing demand for real-time credit approvals, and the integration of AI-driven risk assessment tools that enhance lending efficiency and transparency.

Globally, the market is witnessing a significant transformation as digital lending ecosystems evolve to serve underserved and unbanked populations. Smart microloan platforms are leveraging technologies such as blockchain, predictive analytics, and machine learning to automate credit scoring, reduce operational costs, and expand financial inclusion.

The shift toward mobile-based lending, combined with regulatory support for digital finance, is accelerating platform adoption across emerging economies. Furthermore, the growing collaboration between traditional banks and fintech startups is redefining lending models, ensuring faster, secure, and more accessible credit delivery to individuals and small businesses worldwide.

Smart microloan platforms are transforming the global lending landscape by combining financial technology with intelligent automation to deliver fast, accessible, and data-driven credit solutions. These platforms leverage advanced analytics, artificial intelligence, and blockchain to assess borrower profiles in real time, streamline loan approvals, and reduce default risks. By eliminating the inefficiencies of traditional lending, they enable instant microfinancing for individuals, entrepreneurs, and small businesses who often lack access to conventional banking services.

The growing integration of mobile applications, digital wallets, and cloud-based systems has further expanded the reach of smart microloan platforms, particularly in emerging economies where financial inclusion is a key priority. Partnerships between fintech startups, banks, and digital payment providers are enhancing the scalability and security of these systems.

As AI algorithms become more sophisticated, lenders are increasingly able to personalize loan offerings, improve credit risk management, and ensure faster disbursal. This technological evolution is positioning smart microloan platforms as a cornerstone of the future digital finance ecosystem.

Over the past year, more than 115 companies have merged or been acquired in microfinance, highlighting considerable consolidation. Indian fintech, in particular, saw 16 acquisitions in just the first half of 2025, a 45% increase from the previous year. For example, Swiss PE firm Partners Group invested $230 million for a majority stake in Infinity Fincorp, boosting access to small business loans and driving expansion in India’s MSME lending market.

Funding trends also reveal a shift, with venture capital slowing down but new alternatives like PE and strategic M&A becoming prominent. The average investment in microfinance funding rounds is $17.5 million, while top investors—including IFC and IndusInd Bank—have contributed a combined total above $1 billion to over 400 companies.

New product launches focus on digital onboarding, embedded finance, and AI-powered credit scoring. Now, over 70% of lenders use alternative data for risk assessment to approve more microloans with greater accuracy. Mobile-first platforms have become key, enabling clients in remote regions to apply for and manage loans easily.

Embedded micro-lending inside third-party apps (like marketplaces and gig platforms) is expanding financing access at the point of need. Microfinance software providers now offer tools for automation, multi-currency support, and KYC compliance—all vital for scaling operations. Green financing and gender-inclusive lending solutions are now on the rise, attracting impact-driven investment and ESG-aligned support.

Regulatory changes are also being enforced by central banks to strengthen digital compliance and data privacy, making the smart microloan ecosystem safer for both lenders and borrowers. The overall microfinance market is projected to reach almost $366 billion by 2029, with an average annual growth rate of 11.2%.

Key Takeaways

- The global smart microloan platforms market is projected to grow at a strong CAGR of 23.3% between 2024 and 2034.

- North America holds a 38.1% share of the market, valued at USD 5.41 billion in 2024, highlighting its leading position in digital lending innovation.

- The US market contributes USD 4.88 billion in 2024 and is expected to reach USD 34.78 billion by 2034, expanding at a CAGR of 21.7%.

- Mobile-based platforms dominate the market with a 52.8% share, driven by increasing smartphone penetration and the convenience of mobile lending applications.

- Cloud-based deployment accounts for 68.7% of total adoption, reflecting the industry’s transition toward scalable, flexible, and secure cloud infrastructures.

- Personal microloans represent the largest loan type segment at 69.2%, supported by rising demand for instant, small-scale financial assistance among individuals.

- Individual borrowers make up 43.5% of the end-user base, highlighting the growing accessibility of microloan platforms for personal financing needs.

- Consumer loans lead the application segment with a 71.8% share, emphasizing the dominance of short-term lending for retail and lifestyle expenses.

- North America’s share of USD 5.41 billion represents 38.1% of the 2024 global value, confirming regional alignment with overall growth trends.

Financial Demands

Financial demand in the smart microloan platforms market is being driven by the growing need for quick, accessible, and affordable credit among underbanked individuals and small enterprises. As traditional banking systems often impose strict eligibility requirements, digital microloan platforms have emerged as an alternative for borrowers seeking instant financial support.

The increasing penetration of smartphones and mobile internet has further amplified this demand by allowing users to apply for and receive loans within minutes through mobile-based applications. Fintech innovation, particularly in AI-driven credit scoring and alternative data analytics, is enabling lenders to assess borrower risk more accurately, expanding financial inclusion and unlocking new customer segments.

Government-led initiatives promoting digital finance and inclusive lending are strengthening the market’s foundation, especially in developing economies where microcredit demand is rising rapidly. The transition from traditional, one-time lending to continuous, service-based microloan models has also encouraged recurring borrowing behavior.

Moreover, collaborations between fintech companies, digital wallets, and banks are streamlining disbursements, improving customer trust, and accelerating adoption. Consumer-driven microloans for lifestyle, retail, and small business purposes represent a significant portion of this demand. Collectively, the fusion of advanced technology, supportive regulation, and rising digital literacy is sustaining strong financial demand for smart microloan platforms worldwide.

Analysts’ Viewpoint

Analysts highlight that the rise of smart microloan platforms is underpinned by advanced digital-lending technologies and strong regulatory momentum, which they expect to continue propelling growth in the sector. They emphasize that platforms leveraging artificial intelligence, alternative-data credit scoring, and mobile-first distribution are best positioned to expand their borrower base, enhance underwriting accuracy, and reduce default risk—a combination seen as pivotal for market success.

Analysts also point out that while major growth will occur in emerging markets, competition will intensify as traditional banks, fintech startups, and large platform players vie for the same segments. They stress that sustainable competitive advantage will depend not only on tech innovation but also on customer trust, regulatory compliance, and robust risk-management frameworks.

Further, given the high projected CAGR, analysts believe that the scalability of operations, data-security protocols, and partnerships with digital-wallet or payment services will be critical. In their view, smart microloan platforms that align flexible loan products, cloud-based deployment, and real-time decision-making stand to gain the most, though they note that ongoing vigilance around regulation, default rates, and data ethics remains essential.

Emerging Trends

Emerging trends in the smart microloan platforms market indicate a shift towards mobile-first, data-driven models that challenge traditional credit paradigms. One major trend is the increasing use of artificial intelligence and machine learning for real-time risk assessment and decision-making. These technologies enable platforms to incorporate alternative data (such as mobile usage, social media, and behavioural patterns) to evaluate borrowers with limited or nonexistent credit histories.

Another notable trend is the move toward cloud-native and API-based lending infrastructures, which support scalable and rapid deployment of microloan services across geographies. This cloud-based architecture allows for flexible product updates, faster onboarding, and integration with digital wallets, e-commerce platforms, and embedded finance ecosystems.

Finally, there is a growing emphasis on financial inclusion and expansion into underserved markets. Smart microloan platforms are targeting regions and populations traditionally excluded from formal banking — offering small-ticket loans, automated underwriting, and mobile channel access to reach informal sector individuals and small enterprises. This trend is supported by regulatory encouragement of digital lending and fintech innovation.

US Market Size

The US smart microloan platforms market is growing rapidly, supported by widespread fintech adoption, strong digital infrastructure, and evolving consumer lending preferences. Valued at USD 4.88 billion in 2024, the market is projected to reach USD 34.78 billion by 2034, expanding at a CAGR of 21.7%.

This impressive growth reflects the country’s increasing shift toward automated, data-driven financial services that prioritize speed, accessibility, and efficiency. The integration of artificial intelligence, machine learning, and blockchain technology into lending ecosystems has enhanced credit evaluation accuracy and enabled instant approvals, particularly for underbanked individuals and small business owners.

Mobile-based and cloud-enabled platforms are playing a pivotal role in expanding reach and reducing operational costs for lenders. The growing collaboration between traditional banks, fintech startups, and payment platforms is driving ecosystem connectivity and improving financial inclusion. The popularity of digital wallets, real-time payment systems, and embedded lending features within e-commerce and banking apps is further accelerating platform adoption.

Additionally, regulatory support for responsible digital lending and transparent risk assessment is fostering a secure and trustworthy environment. As consumer demand for short-term, flexible credit continues to rise, the US is emerging as a global hub for innovation in the smart microloan platforms industry.

By Platform Type

Mobile-based platforms account for 52.8% of the smart microloan platforms market, making them the dominant delivery channel due to their convenience, accessibility, and widespread smartphone adoption. These platforms enable users to apply for, track, and repay microloans directly through mobile applications, often within minutes.

The integration of AI and machine learning algorithms allows lenders to conduct instant credit assessments using alternative data such as transaction history, mobile usage, and social behavior, thereby improving financial inclusion for unbanked and underbanked populations. The mobile-first model also benefits from seamless integration with digital wallets and payment gateways, simplifying loan disbursement and repayment processes.

Web-based platforms continue to serve a crucial role, particularly for larger financial institutions and enterprise clients seeking detailed analytics and portfolio management tools. API-based platforms are gaining momentum as they enable interoperability between financial service providers, digital payment systems, and third-party apps, facilitating embedded finance solutions.

However, the dominance of mobile-based lending is expected to strengthen further as 5G networks expand, mobile security improves, and user experience design advances. Collectively, these platform types are transforming the lending ecosystem by prioritizing speed, personalization, and accessibility, with mobile-based systems at the forefront of the global shift toward smart, data-driven financial solutions.

By Deployment Mode

Cloud-based deployment holds a dominant 68.7% share of the smart microloan platforms market, reflecting the industry’s strong shift toward scalable, flexible, and cost-efficient digital lending infrastructure. Cloud technology enables lenders to process large volumes of loan applications in real time while maintaining high levels of data security and system uptime.

Its adaptability allows institutions to integrate advanced analytics, AI-driven credit scoring, and automated decision-making into their workflows with minimal hardware investment. This deployment model also supports remote access, rapid updates, and seamless collaboration between lenders, borrowers, and fintech partners, making it particularly appealing to both startups and established financial institutions.

On-premises deployment, though declining in preference, remains relevant among traditional banks and regulatory-sensitive organizations that prioritize full control over their IT environments. However, the high upfront costs and limited scalability of on-premises systems make them less attractive compared to cloud-based alternatives.

The ongoing digital transformation of financial services, coupled with the growing need for real-time loan processing and flexible API integrations, continues to accelerate the adoption of cloud technology. As cybersecurity frameworks strengthen and regulatory compliance solutions improve, cloud-based deployment is expected to remain the backbone of innovation and efficiency within the smart microloan platforms ecosystem.

By Loan Type

Personal microloans dominate the smart microloan platforms market with a 69.2% share, driven by the growing need for small, short-term credit among individuals for personal, educational, or emergency purposes. The convenience of instant approvals, flexible repayment options, and minimal documentation requirements has made personal microloans highly popular among digitally active borrowers.

Mobile and cloud-based lending platforms enable real-time credit scoring using AI and alternative data sources such as transaction history, utility payments, and social behavior, expanding access for individuals with limited credit history. This democratization of lending is playing a key role in advancing financial inclusion globally.

Business microloans are also witnessing strong adoption, particularly among micro and small enterprises seeking quick funding for inventory, expansion, or cash flow management. Meanwhile, agricultural microloans are gaining traction in developing economies, helping farmers access small-scale financing for seeds, fertilizers, and equipment through digital platforms.

However, the personal microloan segment remains dominant due to its broad user base, frequent borrowing cycles, and strong integration with mobile payment systems. The continued rise of digital lending ecosystems, along with regulatory support for fintech-led credit innovation, is expected to further boost personal microloan adoption across global markets over the coming decade.

By End User

Individual borrowers represent 43.5% of the smart microloan platforms market, making them the largest end-user segment. This dominance is driven by the rising adoption of digital financial services, particularly among individuals seeking instant, low-value credit for personal, educational, or emergency needs. The increasing penetration of mobile-based lending apps, combined with AI-driven credit scoring, has simplified access to loans without requiring extensive credit history or collateral.

These platforms leverage real-time analytics and alternative data to assess borrower eligibility, enabling faster approvals and reducing default risks. The ease of application and quick disbursement process have made smart microloan platforms especially appealing to salaried professionals, gig workers, and students.

Small and Medium Enterprises (SMEs) are another key user group, utilizing microloans for working capital, inventory management, and business expansion. The growing collaboration between fintech platforms and banks is improving access to finance for SMEs that traditionally faced barriers to credit.

Farmers also represent an emerging segment, particularly in developing economies, where agricultural microloans are enabling access to funds for crop inputs and equipment. However, individual borrowers remain the backbone of market growth, reflecting the increasing consumer preference for digital-first lending solutions that prioritize speed, accessibility, and minimal documentation.

By Application

Consumer loans dominate the smart microloan platforms market with a 71.8% share, reflecting the growing reliance of individuals on digital lending solutions for personal and lifestyle-related financing needs. The surge in demand for short-term credit to cover expenses such as education, healthcare, travel, and e-commerce purchases has fueled this segment’s expansion.

Smart microloan platforms enable instant loan approvals, real-time credit scoring, and flexible repayment options, making them highly attractive to tech-savvy borrowers. The integration of AI, predictive analytics, and digital wallets ensures a seamless user experience, allowing consumers to access funds within minutes without visiting a bank or completing lengthy documentation.

Business loans form the remaining segment, primarily catering to micro and small enterprises seeking working capital or expansion funding. These loans are gaining traction as fintech platforms collaborate with banks and investors to develop risk-sharing models that support SME financing.

However, consumer loans remain the driving force of the market due to their frequency, low-value ticket sizes, and broad customer base. The combination of convenience, transparency, and speed offered by smart microloan platforms continues to position consumer lending as the cornerstone of digital credit ecosystems, promoting financial inclusion and reshaping traditional lending dynamics worldwide.

Key Market Segments

By Platform Type

- Mobile-based Platforms

- Web-based Platforms

- API-based Platforms

By Deployment Mode

- Cloud-based

- On-premises

By Loan Type

- Personal Microloans

- Business Microloans

- Agricultural Microloans

By End User

- Individual Borrowers

- Small and Medium Enterprises (SMEs)

- Farmers

By Application

- Consumer Loans

- Business Loans

Regional Analysis

The North American region represents approximately 38.1 % of the global smart microloan platforms market, with an estimated size of USD 5.41 billion in 2024. This strong regional presence is driven by robust digital infrastructure, widespread smartphone penetration, and sophisticated fintech ecosystems that facilitate rapid adoption of mobile-based lending solutions.

Many platforms in the region are deeply integrated with digital wallets, instant-credit scoring, and cloud-native operations, making the North American market a proving ground for scalable smart microloan models. The supportive regulatory environment and high consumer familiarity with online finance services further underpin regional leadership.

Within North America, the United States dominates market activity, supported by a large base of individual borrowers and small businesses seeking quick access to financing. Fintech disruptors and bank-fintech partnerships alike are investing heavily in AI-driven underwriting and alternative credit-data models to expand reach and reduce loan-approval timelines.

The region continues to serve as an innovation hub for smart microloan platforms, setting trends in personalization, embedded finance, and real-time lending. As emerging markets mature, North America is expected to retain a high-share, high-value position, even as incremental growth shifts toward under-penetrated geographies.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The expansion of smart microloan platforms is propelled by rapidly increasing smartphone and internet penetration, which allows borrowers to access credit conveniently through mobile applications. The integration of advanced analytics, AI, and machine learning in lending workflows enhances credit-scoring accuracy and reduces turnaround times for loan approvals, driving higher adoption.

Digital-first platforms supported by cloud infrastructure provide scalable, cost-efficient services and enable lenders to target underserved populations and the under-banked, supporting financial inclusion. Growing consumer demand for flexible, small-ticket loans in personal and lifestyle segments is also supporting market growth, as borrowers seek easy access to micro-financing without the heavy requirements of traditional banking.

Restraint factors

Despite the strong growth, smart microloan platforms face significant headwinds in the form of regulatory uncertainty, especially in regions where digital lending is new and consumer-protection frameworks are still evolving. The dependence on alternative data for credit assessment raises concerns around data privacy, bias, and the accuracy of underwriting decisions.

High default risk remains a challenge since many borrowers lack formal credit histories, and overlapping borrowings or multiple lender exposure can intensify credit deterioration. Infrastructure gaps, including low digital and financial literacy among segments of potential borrowers, also inhibit adoption and raise operational risk.

Growth opportunities

Smart microloan platforms have a considerable opportunity to expand into emerging markets where traditional banking services are limited and there is a large unbanked population. Embedded finance models, where microloans are integrated into mobile wallets, e-commerce, and digital payment ecosystems, provide new touchpoints and increase cross-sell potential.

Continuous innovation in personalized product design, flexible repayment terms, and hybrid business models (combining subscription and micro-loan services) can deepen customer engagement. Partnerships between fintechs and established banks or payment providers can broaden distribution and enhance trust. The rise of cloud-native platforms and API-driven services also supports rapid geographic expansion and operational scalability.

Challenging factors

Operational risk remains a significant challenge as the rapid growth of lending volumes can strain risk-management frameworks, especially where automated underwriting is used. Cybersecurity threats and fraud risk escalate as digital lending expands, raising implications for borrower trust and regulatory oversight.

The rising cost of customer acquisition and the heightened competition among numerous fintech players also pressure margins and profitability. Economic downturns or regulatory tightening in key markets can reduce loan demand or increase default rates, undermining growth projections. Finally, maintaining technological and regulatory compliance in multiple jurisdictions adds complexity and cost for global scale-up.

Competitive Analysis

In the competitive landscape of the smart microloan platforms market, a diverse array of fintech firms, digital lenders, and embedded-finance providers are vying for leadership by differentiating on speed, data intelligence, and distribution reach. Many players emphasise mobile-first origination, alternative-data credit scoring, and cloud-native infrastructure to reduce borrower friction and expand to under-banked customer segments.

Partnerships between fintechs, digital-wallet operators, and banks are becoming increasingly common, enabling platforms to tap established customer bases while managing compliance and risk-management overheads more efficiently. Incumbent financial institutions are also accelerating their own digital micro-loan offerings or partnering with specialist platforms to compete effectively.

From an analyst viewpoint, market leadership will tend to favour platforms that combine strong borrower acquisition capability, robust AI/ML-based underwriting, and a scalable API ecosystem for embedded lending.

Price competition, regulatory scrutiny of lending practices, and borrower credit-quality risk are creating pressure on margins, thus intensifying the race for operational efficiency and differentiated product design. As a result, only those platforms that can execute at scale while maintaining credit discipline, seamless user experience, and regulatory trust are expected to emerge as dominant players in this rapidly evolving segment.

Top Key Players in the Market

- Kabbage

- LendingClub

- OnDeck

- Funding Circle

- Prosper

- Avant

- Zopa

- Upstart

- Tala

- Branch

- Kiva

- Creditas

- Lendio

- Others

Major Developments

- March 19, 2025: Tala secured a USD 150 million debt facility led by Neuberger Berman to expand its micro-loan operations in Mexico and other Latin American markets, underscoring the growing emphasis on emerging-market expansion for digital lenders.

- June 25, 2025: A global survey by the World Economic Forum revealed that 83 % of fintech firms identified AI adoption as critical to improving customer experience, 74 % cited improved profitability, and 75 % reported cost-reduction benefits, highlighting the increasing role of advanced analytics in supporting micro-lending operations.

- September 24, 2025: Venture capital funding for digital-lending and micro-loan platforms dropped by more than 50 % year-on-year in the first eight months of 2025, signaling rising investor caution due to increasing defaults and tightening regulatory scrutiny in the short-term consumer credit segment.

Report Scope

Report Features Description Market Value (2024) USD 14.2 Billion Forecast Revenue (2034) USD 115.42 Billion CAGR(2025-2034) 23.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Platform Type (Mobile-based Platforms, Web-based Platforms, API-based Platforms), By Deployment Mode (Cloud-based, On-premises), By Loan Type (Personal Microloans, Business Microloans, Agricultural Microloans), By End User (Individual Borrowers, Small and Medium Enterprises (SMEs), Farmers), By Application (Consumer Loans, Business Loans) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kabbage, LendingClub, OnDeck, Funding Circle, Prosper, Avant, Zopa, Upstart, Tala, Branch, Kiva, Creditas, Lendio, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Smart Microloan Platforms MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Microloan Platforms MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kabbage

- LendingClub

- OnDeck

- Funding Circle

- Prosper

- Avant

- Zopa

- Upstart

- Tala

- Branch

- Kiva

- Creditas

- Lendio

- Others