Global Smart Manufacturing Market By Component (Hardware, Software, and Services), By Technology (Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Machine Execution Systems, Programmable Logic Controller and Other Technologies), By End-Use Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2024

- Report ID: 68036

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

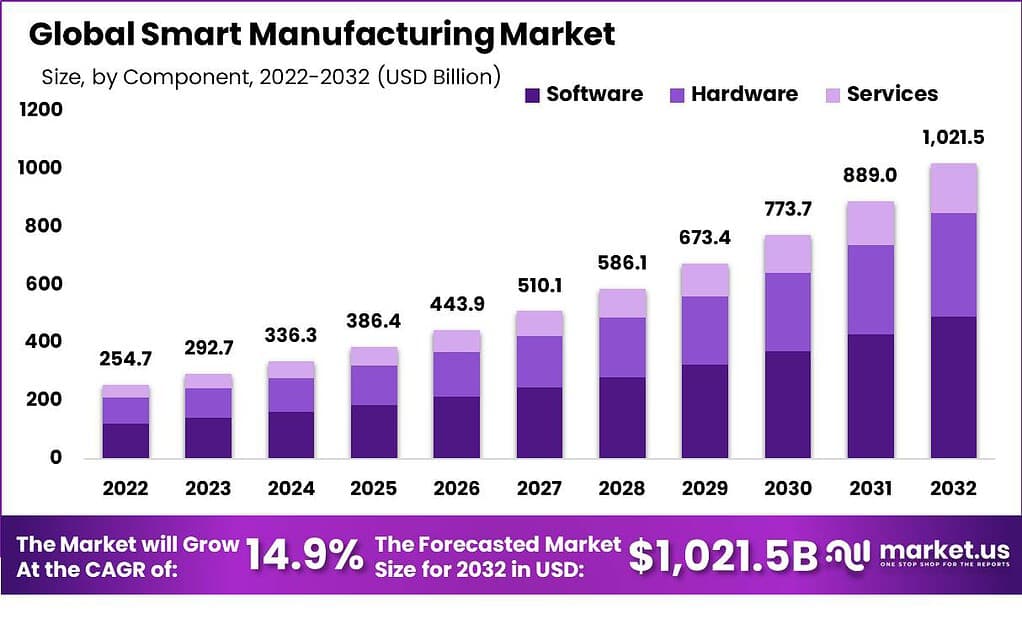

The Global Smart Manufacturing Market size is expected to be worth around USD 1,021.5 Billion by 2032, from USD 292.7 Billion in 2023, growing at a CAGR of 14.9% during the forecast period from 2024 to 2033.

Smart manufacturing represents a powerful industrial revolution. It involves the transformation of traditional manufacturing processes through cutting-edge technologies and digital solutions. Leveraging IoT connectivity, A.I. algorithms, data analytics capabilities, and automation, smart manufacturing can enable factories and production facilities to operate with unprecedented efficiency and intelligence.

It represents a paradigm shift designed to optimize production, enhance product quality, and streamline supply chains. Real-time data monitoring and predictive analytics facilitate agile decision-making while simultaneously reducing downtime and waste production. Smart manufacturing not only enhances operational performance but also fosters sustainability by optimizing resource usage.

Note: Actual Numbers Might Vary In Final Report

With more and more industries embracing Industry 4.0, smart manufacturing technology is set for exponential expansion – revolutionizing industries and shaping the future of manufacturing. Enabling businesses to remain competitive while adapting to shifting market dynamics as well as embark on a journey of continuous improvement and innovation, smart manufacturing technology offers significant opportunity.

The integration of smart manufacturing technologies is anticipated to significantly boost the annual contribution to GDP, with an increase of up to $530 billion by 2025. This surge reflects the efficiency gains from these technologies, as approximately 64% of manufacturers have reported an increase in productivity due to smart manufacturing adoption.

The market for collaborative robots is experiencing robust growth, with projections indicating that the Global Collaborative Robots Market size will escalate from USD 1.5 Billion in 2023 to around USD 23.5 Billion by 2033. This represents a compound annual growth rate (CAGR) of 31.7% from 2024 to 2033.

Investment in smart manufacturing startups has reached a record peak, with venture capital funding surpassing $2 billion in 2023. This investment is a clear indicator of the burgeoning interest in innovative technologies within the manufacturing sector.

A survey conducted by KPMG International of 182 Chief Executive Officers (CEOs) from major manufacturers across Europe, Asia, and North America highlighted a prevailing confidence in achieving profitable growth over the next three years, despite the anticipated economic downturn in 2023.

In the same year, global expenditure on smart factory solutions was reported at $120 billion, focusing predominantly on predictive maintenance and asset tracking.

Furthermore, the Biden-Harris Administration’s announcement of $50 million in funding from President Biden’s Bipartisan Infrastructure Law underscores a significant push to enhance smart manufacturing capabilities at small- and medium-sized facilities. This initiative aims to broaden access to smart technologies and high-performance computing across domestic manufacturing sectors.

Key Takeaways

- In 2023, the Global Smart Manufacturing Market was valued at USD 292.7 Billion.

- The Market is estimated to register the highest CAGR of 14.9% between 2023 and 2032.

- The continuously increasing demand for production and efficient operations are driving market growth.

- The high initial investment can obstruct the growth of the Market

- Growing adoption of advanced manufacturing techniques from organizations across the world has a significant effect on the Market.

- Software dominates the Market with a major revenue share of 48.2% in the component segment.

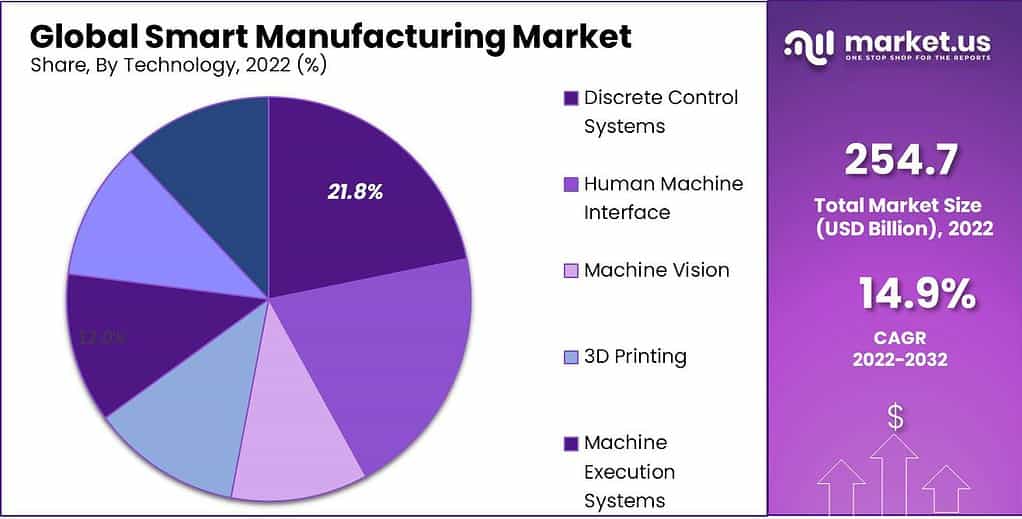

- The discrete control systems hold a major revenue share of 21.8% to lead the technology segment market.

- The automotive industry secures a major revenue share of 23.6% to lead the end-use industry segment of the Market.

- Integration of advanced technologies is expected to create many lucrative opportunities in the Market over the forecast period.

- The adoption of edge computing is trending in the Market.

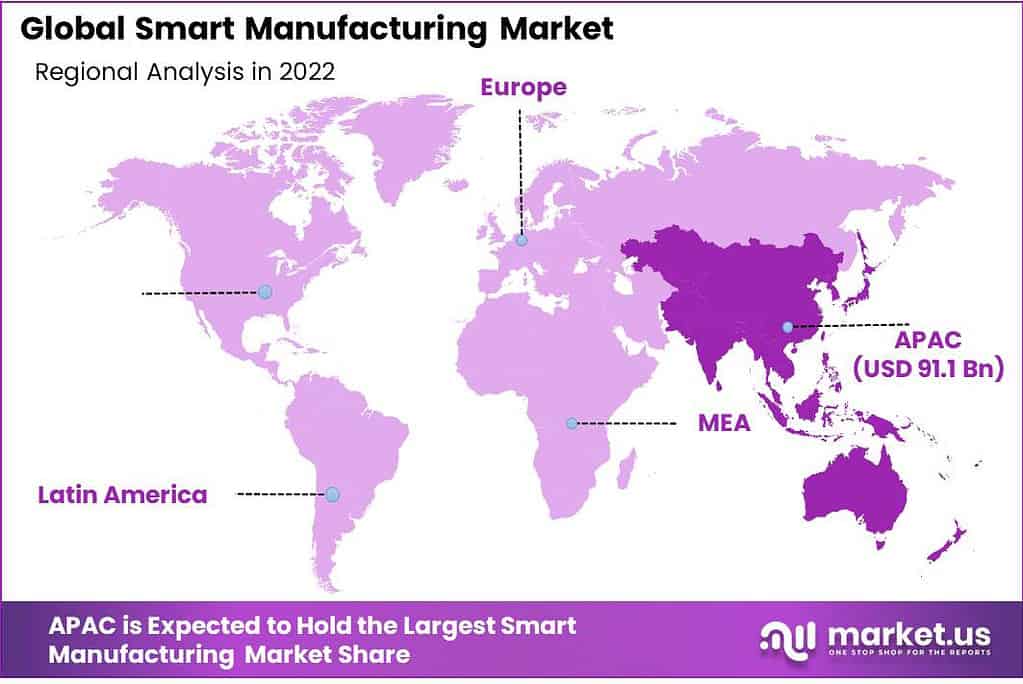

- Asia Pacific holds a major revenue share of 35.8% to dominate the Market.

- Key players in the Market are ABB Ltd., Siemens AG, General Electric, Rockwell Automation Inc., and others.

By Component Analysis

Software leads the Market with a Major Revenue Share of 48.2%.

Based on components, the Market is classified into hardware, software, and services. Among these components, the software leads the segment with a major revenue share of 48.2%. This growth of software is owing to its central role in orchestrating and optimizing manufacturing processes. Smart manufacturing relies heavily on data analytics, automation, and real-time monitoring, all of which are facilitated by software solutions. These software platforms enable seamless integration of IoT devices, data analytics, and machine learning algorithms, enabling manufacturers to gain actionable insights and make data-driven decisions. Furthermore, software solutions in smart manufacturing empower businesses to adapt quickly to changing market demands and customize their operations, leading to increased efficiency, reduced costs, and enhanced competitiveness.

By Technology Analysis

Discrete Control Systems Hold the Major Revenue Share of 21.8% to Dominate the Market.

On the basis of technology, the Market is classified into discrete control systems, human-machine interface, machine vision, 3D Printing, machine execution systems, programmable logic controllers, and other technologies. Among these technologies, discrete control systems hold the major revenue share of 21.8% to lead the Market. This growth of discrete control systems is attributed to their foundational role in industrial automation.

These systems are integral for controlling discrete manufacturing processes such as assembly lines, packaging, and quality control. With the advent of Industry 4.0, discrete control systems have evolved to incorporate advanced features like IoT integration, real-time data analytics, and remote monitoring. Their ability to ensure precision, consistency, and efficiency in manufacturing operations makes them indispensable. As manufacturers strive for increased productivity and quality, discrete control systems remain a cornerstone technology, driving their dominance in the smart manufacturing landscape.

Note: Actual Numbers Might Vary In Final Report

By End-Use Industry Analysis

Automotive Industry Secure the Major Revenue Share of 23.6% to Lead the Market.

Based on the end-use industry, the Market is classified into automotive, aerospace & defense, chemicals & materials, healthcare, electronics, and other end-use industries. From these end-use industries, the automotive industry secured a major revenue share of 23.6% to lead the Market. Smart manufacturing technologies meet automotive manufacturing’s stringent demands for precision, efficiency, and advanced technologies.

Automotive production relies on smart manufacturing for its streamlined production processes, real-time quality control, predictive maintenance capabilities, and reduced production costs – features that are essential in its complex supply chains. Consumer demand for premium vehicles requires it to meet stringent standards while simultaneously cutting production costs and speeding time-to-market; furthermore, with electric and autonomous vehicle adoption propelling its use exponentially, further amplifying smart manufacturing needs and making the automotive sector an innovator and leader within its market segment.

Key Market Segments

Component

- Hardware

- Software

- Services

Technology

- Discrete Control Systems

- Human Machine Interface

- Machine Vision

- 3D Printing

- Machine Execution Systems

- Programmable Logic Controller

- Other Technologies

End-Use Industry

- Automotive

- Aerospace & Defense

- Chemicals & Materials

- Healthcare

- Electronics

- Other End-Use Industries

Driving Factor

The Continuously Increasing Demand for Production and Efficient Operations are Driving the Growth of the Market.

A key driver propelling the smart manufacturing market is the persistent need for increased operational efficiency and productivity. Industries worldwide are adopting smart manufacturing solutions to optimize their processes, reduce production costs, and enhance product quality. The integration of IoT sensors and real-time data analytics allows for predictive maintenance, reducing downtime and preventing costly breakdowns. Additionally, smart manufacturing fosters better resource utilization, reducing waste and environmental impact. As businesses seek to remain competitive in a rapidly evolving market landscape, the pursuit of greater efficiency and agility through smart manufacturing technologies becomes a compelling imperative, fueling the growth of this transformative Market.

Restraining Factor

High Initial Investment Can Obstruct the Growth of the Market.

A notable restraint in the Market is the substantial initial investment required for the deployment of advanced technologies and infrastructure. Implementing smart manufacturing solutions involves significant capital expenditure for upgrading existing systems, acquiring IoT device sensors, and integrating new software. Additionally, the costs associated with training the workforce to operate and maintain these systems can be substantial. Smaller enterprises may find these upfront expenses challenging, potentially limiting their ability to embrace smart manufacturing fully. Moreover, concerns about the cybersecurity of interconnected systems and data privacy issues can hinder adoption, as businesses prioritize mitigating potential risks before embracing this transformative approach to manufacturing.

Geopolitical Impact Analysis

Growing Adoption of Advance Manufacturing Techniques from Organizations across the World Have a Significant Effect on the Market.

As nations strive to secure their positions in the global economy, advanced manufacturing technologies become strategic assets. The development and adoption of these technologies drive innovation, job creation, and economic growth. Competition for leadership in the Market can lead to trade disputes, export restrictions, and international collaborations. Additionally, the protection of intellectual property related to these technologies becomes a crucial concern. The geopolitical landscape influences regulations, standards, and global supply chains, impacting the Market’s growth and shaping the distribution of manufacturing capabilities worldwide.

Growth Opportunity

Integration of advanced technologies is Expected to Create Many Lucrative Opportunities in the Market Over the Forecast Period.

An immense opportunity for the Market lies in the convergence of technologies like IoT, A.I., and data analytics to drive efficiency and innovation. This synergy enables predictive maintenance, minimizing downtime and reducing operational costs. Furthermore, the real-time data insights derived from smart manufacturing systems enhance decision-making, optimizing supply chains and production processes. The growing emphasis on sustainability also presents an opportunity, as smart manufacturing allows for resource optimization and waste reduction. As industries across the globe increasingly embrace Industry 4.0 principles, the smart manufacturing market is poised for significant growth, offering businesses the potential to enhance productivity, reduce environmental impact, and remain competitive in a rapidly evolving landscape.

Latest Trends

Adoption of Edge Computing is Trending in the Market.

A prominent trend in the Market is the adoption of “Edge Computing.” It involves processing data closer to its source, typically at the edge of the network, rather than relying solely on centralized cloud computing. Edge computing minimizes latency, enables real-time decision-making, and enhances security and privacy by processing sensitive data locally. This approach is particularly valuable in manufacturing, where low-latency data processing is critical for tasks like predictive maintenance and quality control. As industries seek to harness the full potential of IoT and A.I. in smart manufacturing, edge computing is emerging as a pivotal trend, revolutionizing data processing and analytics in industrial settings.

Regional Analysis

Asia Pacific Region Holds the Major Revenue Share of 35.8% to Lead the Market.

The Asia Pacific region leads the Market by holding a major revenue share of 35.8%. This massive dominance of the Asia Pacific region is due to the region hosting a significant portion of the world’s manufacturing hubs, including China, Japan, and South Korea, making it a natural hotspot for the adoption of smart manufacturing technologies. The rapid industrialization and urbanization in the Asia Pacific have led to increased demand for efficient manufacturing processes. Additionally, favorable government initiatives and investments in Industry 4.0 technologies have further accelerated adoption. Asia Pacific’s robust ecosystem of technology providers and skilled workforce contribute to its leadership in driving innovation and growth in the sector.

After Asia Pacific, the North American region is expected to grow at the fastest CAGR during the forecast period. The North American region benefits from a robust ecosystem of technology providers, research institutions, and startups specializing in smart manufacturing technologies. It is expected to drive the growth of the region over the forecast period.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Prominent market players, including Siemens, General Electric, Schneider Electric, and Rockwell Automation, maintain substantial market share. Siemens, a renowned global industrial leader, provides a comprehensive array of smart manufacturing solutions encompassing industrial automation and digitalization services. General Electric is recognized for its Predix platform, specializing in industrial IoT and analytics. Schneider Electric concentrates on energy management and automation solutions, while Rockwell Automation delivers industrial automation and information solutions. These industry leaders’ dominance is attributed to their extensive product portfolios, cutting-edge technologies, and worldwide reach, cementing their positions in the Market.

Top Key Players in the Smart Manufacturing Market

- ABB Ltd.

- Siemens AG

- General Electric

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- IBM Corporation

- Fujitsu Global

- Mitsubishi Electric Corporation

- 3D System, Inc.

- Fanuc U.K. Limited

- Cisco System, Inc

- Oracle Corporation

- Oracle

- Other Key Players

Recent Developments

- In June 2023, Honeywell introduced the Honeywell Digital Prime solution, a cloud-based digital twin that enhances the monitoring and management of process control changes. This tool enables frequent testing, improves accuracy, and reduces the need for reactive maintenance.

- Siemens Digital Industries rolled out Industrial Operations X in April 2023. This solution is a component of Siemens Xcelerator, an open digital business platform that includes software, connected hardware, and a marketplace. It aims to automate and streamline industrial production.

- Also in April 2023, Stratasys launched GrabCAD Print Pro software, which integrates quality assurance features from its recent acquisition, Riven. The software is designed for Stratasys 3D printers and focuses on increasing the accuracy of printed parts, minimizing waste, and speeding up production, targeting manufacturers producing end-use parts at scale

Report Scope

Report Features Description Market Value (2023) US$ 292.7 Bn Forecast Revenue (2032) US$ 1,021.5 Bn CAGR (2023-2032) 14.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, and Services), By Technology (Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Machine Execution Systems, Programmable Logic Controller and Other Technologies) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Siemens AG, General Electric, Rockwell Automation Inc., Schneider Electric, Honeywell International Inc., Emerson Electric Co., IBM Corporation, Fujitsu Global, Mitsubishi Electric Corporation, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is smart manufacturing market?The smart manufacturing market encompasses technologies and services designed to increase manufacturer efficiency, productivity, and quality. These can include industrial automation systems; artificial intelligence; machine learning; robotics technologies as well as other cutting edge innovations.

How big is the smart manufacturing market?The Global Smart Manufacturing Market revenue reached USD 254.7 billion in 2022. Sales of smart manufacturing are estimated to total USD 292.7 billion in 2023. Between 2023 and 2032, the market is poised to grow at 14.9% CAGR. Revenue will likely reach USD 1,021.5 billion by 2032.

What is the demand for smart manufacturing?The demand for smart manufacturing is being driven by a number of factors, including:

- The need to improve productivity and efficiency

- The need to reduce costs and waste

- The need to improve product quality

- The need to meet increasing customer demand for customization and personalization

- The need to comply with new regulations

What are the 9 pillars of smart manufacturing?The 9 pillars of smart manufacturing are:

- Smart data collection and analytics

- Interconnectivity

- Cloud computing

- Cybersecurity

- Additive manufacturing

- Advanced robotics

- Artificial intelligence and machine learning

- Simulation and modeling

- Digital twins

What is the future of smart manufacturing?Smart manufacturing is still in its early stages of adoption, but it is rapidly gaining traction. As the cost of new technologies decreases and the benefits of smart manufacturing become more widely understood, it is expected to become increasingly mainstream in the coming years.

What is Industry 4.0, and how does it relate to Smart Manufacturing?Industry 4.0 is a concept that integrates smart technologies into manufacturing, creating a "smart factory." Smart Manufacturing is a practical application of Industry 4.0 principles, focusing on the use of technology to optimize manufacturing processes.

Smart Manufacturing MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Smart Manufacturing MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Siemens AG

- General Electric

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- IBM Corporation

- Fujitsu Global

- Mitsubishi Electric Corporation

- 3D System, Inc.

- Fanuc U.K. Limited

- Cisco System, Inc

- Oracle Corporation

- Oracle

- Other Key Players