Global Smart Learning Market By Component (Hardware (Interactive White Boards, Interactive Projector, Smart table, Others), Solution (LMS, Assessment System, Adaptive Learning Platform, Educational Content Management Systems, Others), Services (Professional Services, Managed Services)), By End User (Academic (K-12, Higher Education), Corporate (SMEs, Large Enterprises)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121838

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

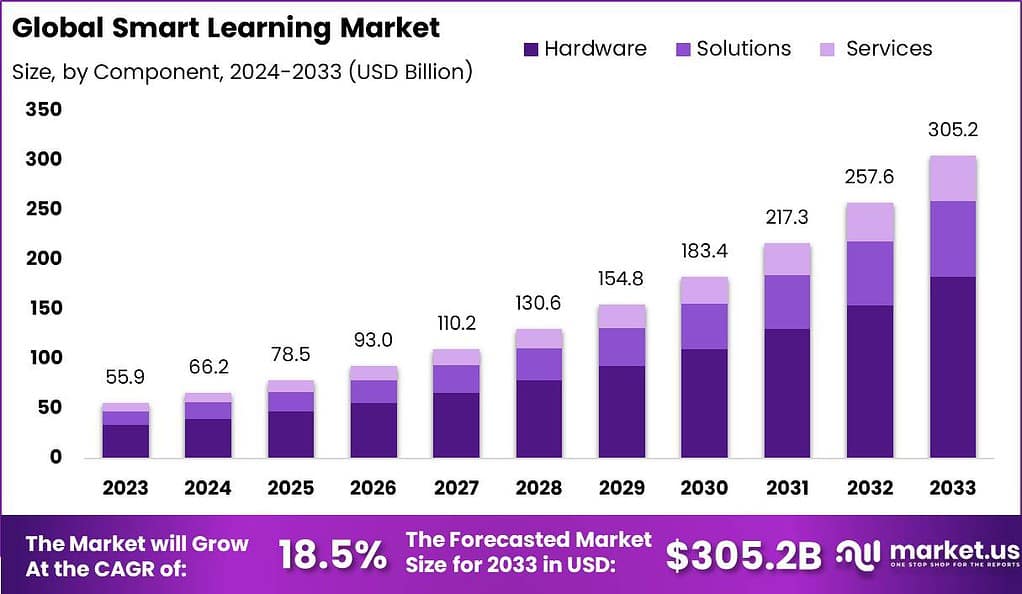

The Global Smart Learning Market size is expected to be worth around USD 305.2 Billion By 2033, from USD 55.9 Billion in 2023, growing at a CAGR of 18.5% during the forecast period from 2024 to 2033.

Smart learning, also known as digital or technology-enhanced learning, is a modern approach to education that leverages digital technologies and interactive platforms to enhance the learning experience. It encompasses various tools and techniques such as online courses, virtual classrooms, educational apps, and adaptive learning systems. Smart learning aims to make education more engaging, personalized, and accessible, enabling learners to acquire knowledge and skills in a flexible and interactive manner.

The smart learning market is experiencing robust growth, driven by the increasing adoption of digital technologies in education and the growing demand for personalized learning experiences. As educational institutions and corporate training programs seek to optimize learning outcomes and efficiency, the integration of smart technologies into learning environments is becoming more widespread. The market is characterized by a variety of offerings, such as learning management systems (LMS), smart content, and AI-enabled learning solutions.

Another growth factor is the push for personalized and adaptive learning experiences. Smart learning solutions utilize data analytics and artificial intelligence algorithms to understand learners’ needs, preferences, and performance. By tailoring content and recommendations to individual learners, smart learning provides a more engaging and effective learning experience, ultimately leading to better learning outcomes.

Furthermore, the scalability and cost-effectiveness of digital learning solutions contribute to market growth. Online courses and resources can reach a wide audience at a fraction of the cost of traditional in-person education. This scalability not only benefits students but also provides opportunities for educational institutions, content creators, and edtech startups to enter the market and offer innovative solutions.

While the smart learning market presents opportunities for new entrants, it also comes with its own set of challenges. One of the primary challenges is the need for continuous innovation and staying ahead of rapidly evolving technologies and learner expectations. New entrants need to bring fresh ideas, unique features, and user-friendly platforms to differentiate themselves in a competitive market.

Additionally, ensuring equal access to smart learning solutions is a challenge. Bridging the digital divide and addressing the disparities in internet connectivity and access to devices is crucial for reaching underserved communities and creating inclusive educational opportunities.

Despite these challenges, the smart learning market offers significant opportunities for new entrants. By focusing on niche markets, developing innovative solutions, and addressing specific learning needs, new players can carve out their own space in the market. Collaborations with educational institutions, partnerships with content creators, and leveraging emerging technologies such as virtual reality and artificial intelligence can provide a competitive edge and drive growth in the smart learning industry.

Key Takeaways

- The Smart Learning Market size is estimated to reach USD 305.2 billion in the year 2033 with a CAGR of 18.5% during the forecast period and was valued at USD 55.9 billion in the year 2023.

- In 2023, the hardware segment held a dominant market position, capturing more than a 60% share of the Smart Learning Market.

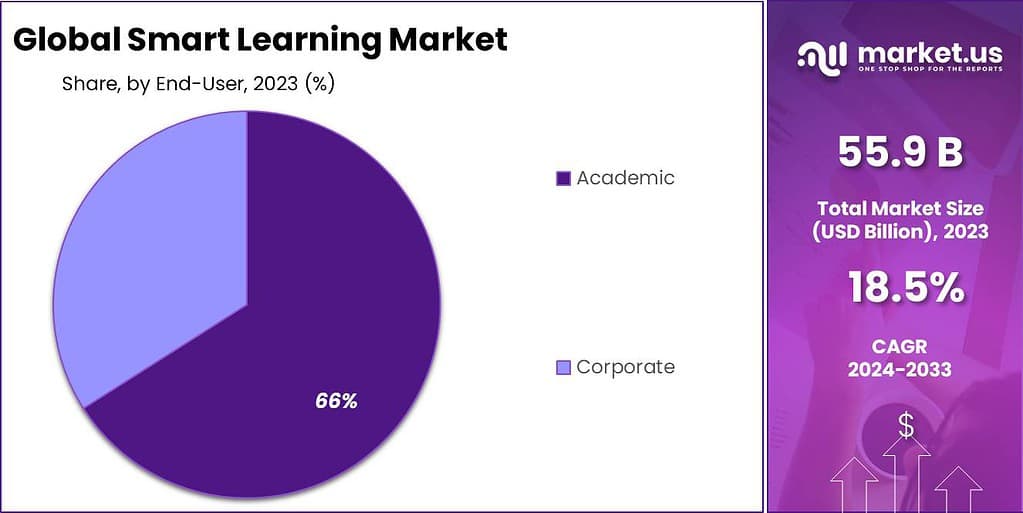

- In 2023, the academic segment held a dominant market position, capturing more than a 66% share of the Smart Learning Market.

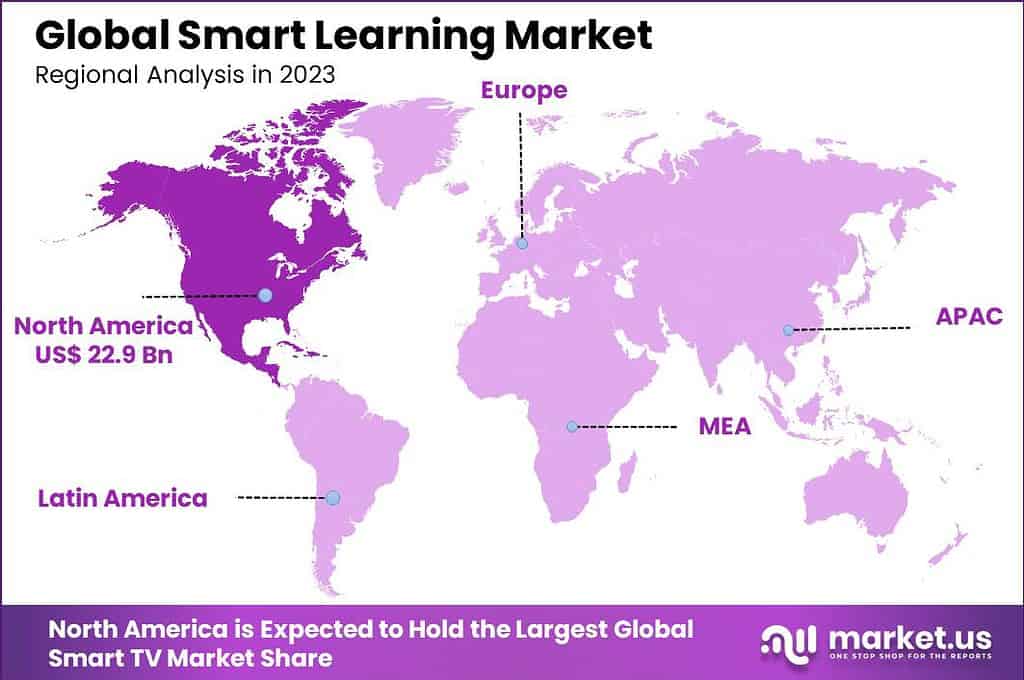

- In 2023, North America held a dominant market position in the Smart Learning sector, capturing more than a 36.4% share and generating USD 41 billion in revenue.

Component Analysis

In 2023, the Hardware segment held a dominant market position in the smart learning industry, capturing more than a 60% share. This significant market share can be attributed to the essential role that hardware components like interactive whiteboards, projectors, and smart tables play in creating interactive and engaging learning environments.

The increasing adoption of these tools in classrooms and corporate training settings has driven substantial investments in educational hardware. Schools and institutions have been upgrading their traditional setups to smart classrooms, which are equipped with state-of-the-art hardware, to enhance the learning experience and improve educational outcomes.

The demand for interactive hardware is further bolstered by the need for tangible, hands-on interaction in learning, which is crucial for subjects that benefit from visual aids and interactive participation. Interactive whiteboards and projectors, for instance, allow educators to integrate multimedia resources and real-time content updates, which make lessons more engaging and accessible.

Smart tables provide collaborative opportunities for students, fostering teamwork and communication skills among learners of all ages. These technologies not only support a wide range of learning styles but also facilitate the shift towards more collaborative and inclusive educational practices.

The Solutions segment, encompassing Learning Management Systems (LMS), assessment systems, adaptive learning platforms, and educational content management systems, also plays a pivotal role in the smart learning market. These solutions help in managing educational content, tracking student progress, and delivering personalized learning experiences based on data-driven insights. Although they hold a smaller share compared to hardware, their importance is growing as educational institutions seek more scalable and efficient ways to manage and deliver content.

Services associated with smart learning, including professional and managed services, are critical in ensuring the effective implementation and maintenance of both hardware and software components. Professional services provide necessary training and support to educators, enabling them to maximize the benefits of smart learning technologies. Managed services, on the other hand, help institutions maintain and update their technology infrastructure, ensuring smooth operation and up-to-date software capabilities.

End-Users Analysis

In 2023, the Academic segment held a dominant market position within the smart learning industry, capturing more than a 66% share. This prominence is primarily due to the widespread integration of digital technologies across K-12 and higher education institutions.

Schools and universities are increasingly adopting smart learning solutions to cater to a generation of digital natives, for whom technology is an integral part of daily life. This segment’s growth is driven by the need to enhance learning outcomes through more engaging, interactive, and personalized educational experiences.

The increasing reliance on technology in educational settings has been accelerated by factors such as global educational policies advocating for digital literacy and the necessity for remote learning solutions brought on by recent global challenges. In K-12 settings, smart learning technologies are used to create more engaging and interactive lessons that appeal to young learners.

For higher education, these technologies allow institutions to offer more flexible learning models, including hybrid and fully online courses, which are essential for accommodating diverse student needs and schedules. Meanwhile, the Corporate segment, which includes both SMEs and large enterprises, is also recognizing the benefits of smart learning for professional development and training.

Corporate adoption is driven by the need to continuously upgrade employee skills in a rapidly changing business environment. However, this segment has not grown at the same rate as the Academic segment, largely due to varying levels of technology adoption and budget constraints, particularly among SMEs.

Key Market Segments

By Component

- Hardware

- Interactive White Boards

- Interactive Projector

- Smart table

- Others

- Solution

- LMS

- Assessment System

- Adaptive Learning Platform

- Educational Content Management Systems

- Others

- Services

- Professional Services

- Managed Services

By End User

- Academic

- Corporate

- SMEs

- Large Enterprises

Driver

Integration of gamification in EdTech

The integration of gamification in EdTech is a significant driver for the global Smart Learning Market. Gamification involves incorporating game design elements such as point scoring, leaderboards, and rewards into educational activities, making learning more engaging and enjoyable for students.

In 2023, it was observed that educational platforms utilizing gamification saw a 30% increase in student engagement compared to traditional methods. This heightened engagement translates to better retention of information and improved learning outcomes, making gamified learning tools highly attractive to educators and institutions worldwide. One of the primary reasons gamification is driving the smart learning market is its ability to cater to diverse learning styles.

By transforming educational content into interactive and playful experiences, gamification appeals to visual, auditory, and kinesthetic learners alike. For instance, math apps that turn problem-solving into a game or language learning platforms that use quizzes and challenges to reinforce vocabulary are becoming increasingly popular. These tools not only make learning more fun but also encourage continuous practice and effort, leading to better academic performance. The effectiveness of gamification in fostering a positive learning environment is a key factor behind its growing adoption in both K-12 and higher education.

Restraint

Inadequate Infrastructure

Inadequate infrastructure is a significant restraint for the global Smart Learning Market. Despite the numerous benefits of smart learning technologies, their effectiveness is heavily dependent on robust and reliable infrastructure. Many regions, particularly in developing countries, lack the necessary technological infrastructure, such as high-speed internet, modern computers, and advanced networking equipment.

In 2023, it was estimated that around 40% of schools in low-income countries had limited or no access to the internet, severely hindering the adoption of smart learning solutions. This digital divide creates a substantial barrier to the widespread implementation of smart learning tools, limiting their reach and impact.

The lack of infrastructure also affects the quality of education that can be delivered through smart learning platforms. Without stable internet connections and up-to-date hardware, students and teachers may experience frequent disruptions, slow loading times, and difficulty accessing online resources.

These technical issues can frustrate users and detract from the learning experience, reducing the effectiveness of smart learning initiatives. Moreover, schools and educational institutions may struggle to maintain and update their technology due to financial constraints, further exacerbating the problem. This inadequacy in infrastructure not only hampers the learning process but also discourages institutions from investing in smart learning technologies.

Opportunity

Increasing Transnational Education

Transnational education (TNE) is emerging as a significant opportunity for the global Smart Learning Market. TNE involves students pursuing their education in a country different from the one where the institution providing the education is based. This trend is rapidly growing, with an estimated 6 million students expected to be enrolled in TNE programs by 2025.

This surge is driven by the increasing demand for high-quality education and the globalization of higher education institutions. Smart learning technologies, such as virtual classrooms, online learning platforms, and adaptive learning software, are crucial in facilitating TNE by enabling institutions to deliver courses across borders efficiently.

The rise in TNE programs creates a substantial market for smart learning solutions. Educational institutions are increasingly investing in advanced technologies to provide a seamless learning experience for their international students. For example, the global e-learning market is projected to reach $325 billion by 2025, indicating the vast potential for smart learning tools.

Additionally, smart learning platforms enhance the accessibility and quality of education, making it possible for students to access world-class resources and instructors from anywhere in the world. This growth not only benefits students but also opens new revenue streams for educational technology providers, driving further innovation and expansion in the smart learning market.

Challenge

Privacy issues and Data Security Concern

Privacy issues and data security concerns pose significant challenges for the global Smart Learning Market. As smart learning technologies increasingly rely on data to personalize and enhance the learning experience, the risk of data breaches and unauthorized access to sensitive information grows.

In 2023, educational institutions faced over 1,300 data breaches, affecting millions of students worldwide. These incidents highlight the vulnerability of smart learning platforms to cyber-attacks, which can compromise personal information such as student records, financial details, and academic performance data.

The growing use of smart learning tools, including online learning platforms, virtual classrooms, and AI-driven educational software, requires the collection and storage of vast amounts of data. Ensuring this data is secure is a daunting task, as many educational institutions lack the resources and expertise to implement robust cybersecurity measures. A survey conducted in 2022 revealed that 58% of educational institutions do not have adequate cybersecurity policies in place. This gap exposes the smart learning market to potential risks, eroding trust among users and stakeholders.

Growth Factors

- Technological Advancements: Rapid advancements in technology, such as artificial intelligence and machine learning, are revolutionizing the education sector, facilitating personalized learning experiences and adaptive teaching methods.

- Increasing Internet Penetration: The widespread availability of high-speed internet connectivity is facilitating access to online educational resources and platforms, enabling learners to engage in remote learning from anywhere in the world.

- Rising Demand for E-Learning Solutions: With the growing need for lifelong learning and professional development, there is a surge in demand for e-learning solutions that offer flexible and convenient learning opportunities.

- Adoption of Mobile Learning: The proliferation of smartphones and tablets has led to the popularity of mobile learning apps and platforms, allowing learners to access educational content on-the-go.

- Government Initiatives: Governments worldwide are investing in digital infrastructure and educational technology initiatives to enhance the quality of education and promote digital literacy among students.

Latest Trends

- Increased Use of AI and Machine Learning: AI and machine learning technologies are being integrated into smart learning platforms to provide personalized learning experiences, automate administrative tasks, and offer predictive analytics to improve educational outcomes.

- Growth of Mobile Learning: With the widespread use of smartphones and tablets, mobile learning is becoming more prevalent, allowing learners to access educational content anytime and anywhere, enhancing flexibility and convenience.

- Adoption of Gamification: Gamification elements, such as badges, leader boards, and interactive quizzes, are being incorporated into learning platforms to increase engagement and motivation among learners.

- Rise of E-Learning in Corporate Training: Companies are increasingly utilizing e-learning solutions for employee training and development, driven by the need for continuous learning and upskilling in a rapidly changing job market.

- Expansion of Virtual and Augmented Reality: VR and AR technologies are being used to create immersive learning experiences, making complex subjects more understandable and engaging through interactive simulations and visualizations.

- Emphasis on Data-Driven Insights: Educational institutions and organizations are leveraging data analytics to track learner progress, identify areas for improvement, and make informed decisions to enhance the learning experience.

Regional Analysis

North America region is leading the market

In 2023, North America held a dominant market position in the Smart Learning sector, capturing more than a 36.4% share and generating USD 41 billion in revenue. This significant market presence can be attributed to several factors.

North America boasts advanced technological infrastructure and widespread internet penetration, facilitating the adoption of smart learning solutions across educational institutions and corporate training programs. Additionally, the region’s robust investment in research and development, coupled with a highly skilled workforce, fosters innovation in the education technology sector, driving the development of cutting-edge smart learning platforms and tools.

Moreover, the proactive approach of governments and educational authorities towards integrating technology into the education system further accelerates market growth in North America, with initiatives aimed at enhancing digital literacy and promoting e-learning initiatives. As a result, North America remains a frontrunner in the global Smart Learning Market, poised for sustained expansion in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Smart Learning Market, several key players dominate the landscape, each contributing to the market share and shaping industry dynamics. In North America, prominent companies such as Coursera, Udemy, and Pearson Education hold significant market share due to their extensive portfolio of online courses, adaptive learning platforms, and digital content solutions.

These players leverage advanced technologies such as AI and machine learning to deliver personalized learning experiences, catering to diverse learner needs. Additionally, established education technology companies like Adobe Inc. and Microsoft Corporation play a vital role in driving market growth through their innovative software solutions and learning management systems.

In Europe, key players such as Blackboard Inc., D2L Corporation, and Google LLC are at the forefront of the Smart Learning Market, offering comprehensive e-learning platforms and collaborative tools for both academic and corporate sectors.

These companies focus on enhancing user engagement, scalability, and interoperability to meet the evolving demands of the education landscape. Moreover, partnerships with educational institutions and government agencies further bolster their market presence, enabling them to penetrate new markets and expand their customer base.

Top Key Players in the Market

- Blackboard Inc.

- Pearson PLC

- Ellucian Company

- Smart Technologies Inc.

- Promethean World

- Adobe

- SMART Technologies

- Cisco

- Google LLC

- Huawei

- Microsoft

- Other Key Players

Recent Developments

- In March 2024, Talisma Corporation has developed a strategic partnership with the Anthology and serve as a reseller partner for the Anthology’s well known Learning Management System in India.

- In March 2024, Usher’s New Look (UNL) as well as IBM has collaborated to provide a free career readiness training through IBM SkillsBuild.

Report Scope

Report Features Description Market Value (2023) USD 55.9 Bn Forecast Revenue (2033) USD 305.2 Bn CAGR (2024-2033) 18.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware (Interactive White Boards, Interactive Projector, Smart table, Others), Solution (LMS, Assessment System, Adaptive Learning Platform, Educational Content Management Systems, Others), Services (Professional Services, Managed Services)), By End User (Academic (K-12, Higher Education), Corporate (SMEs, Large Enterprises)) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Blackboard Inc., Pearson PLC, Ellucian Company, Smart Technologies Inc., Promethean World, Adobe, SMART Technologies, Cisco, Google LLC, Huawei, Microsoft, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Smart Learning?Smart learning, also known as e-learning or digital learning, leverages digital technologies to enhance and transform the educational process. It involves using various tools and platforms such as Learning Management Systems (LMS), mobile learning applications, artificial intelligence (AI), augmented reality (AR), virtual reality (VR), and gamification.

What is the market size of the Smart Learning market?The Global Smart Learning Market size is expected to be worth around USD 305.2 Billion By 2033, from USD 55.9 Billion in 2023, growing at a CAGR of 18.5% during the forecast period from 2024 to 2033.

Who are the key players in the Smart Learning market?Prominent players in the smart learning market include Blackboard Inc., Pearson PLC, Ellucian Company, Smart Technologies Inc., Promethean World, Adobe, SMART Technologies, Cisco, Google LLC, Huawei, Microsoft, Other Key Players

What are the key factors driving the growth of the Smart Learning Market?The key factors driving the growth include increasing demand for Learning Management Systems (LMS), the use of gamification, the role of AI in personalizing learning, enterprise focus on human capital development, and rising enrollments in higher education.

What are the current trends and advancements in the Smart Learning Market?Current trends include the integration of AI, AR, and VR for immersive learning, growing adoption of mobile learning, cloud-based platforms, and the development of interactive whiteboards and AI-driven personalized learning solutions.

What are the major challenges and opportunities in the Smart Learning Market?Major challenges involve ensuring equitable access to technology, managing data privacy, and integrating new technologies into traditional systems. Opportunities lie in emerging markets with a push to modernize education and the growing demand for innovative, scalable learning solutions driven by mobile and cloud technologies.

-

-

- Blackboard Inc.

- Pearson PLC

- Ellucian Company

- Smart Technologies Inc.

- Promethean World

- Adobe

- SMART Technologies

- Cisco

- Google LLC

- Huawei

- Microsoft

- Other Key Players