Global Smart Implants Market By Type (Orthopedic implants, Cardiovascular implants, Dental implants, Cosmetic implants and other), By Surgery (Open, Minimally Invasive), By Application (Knee & Hip arthroplasty, Spine Fusion, Stents, Intraocular lens, Pacing devices), By End-User (Hospitals, Ambulatory Surgical Centres, Specialty Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117390

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

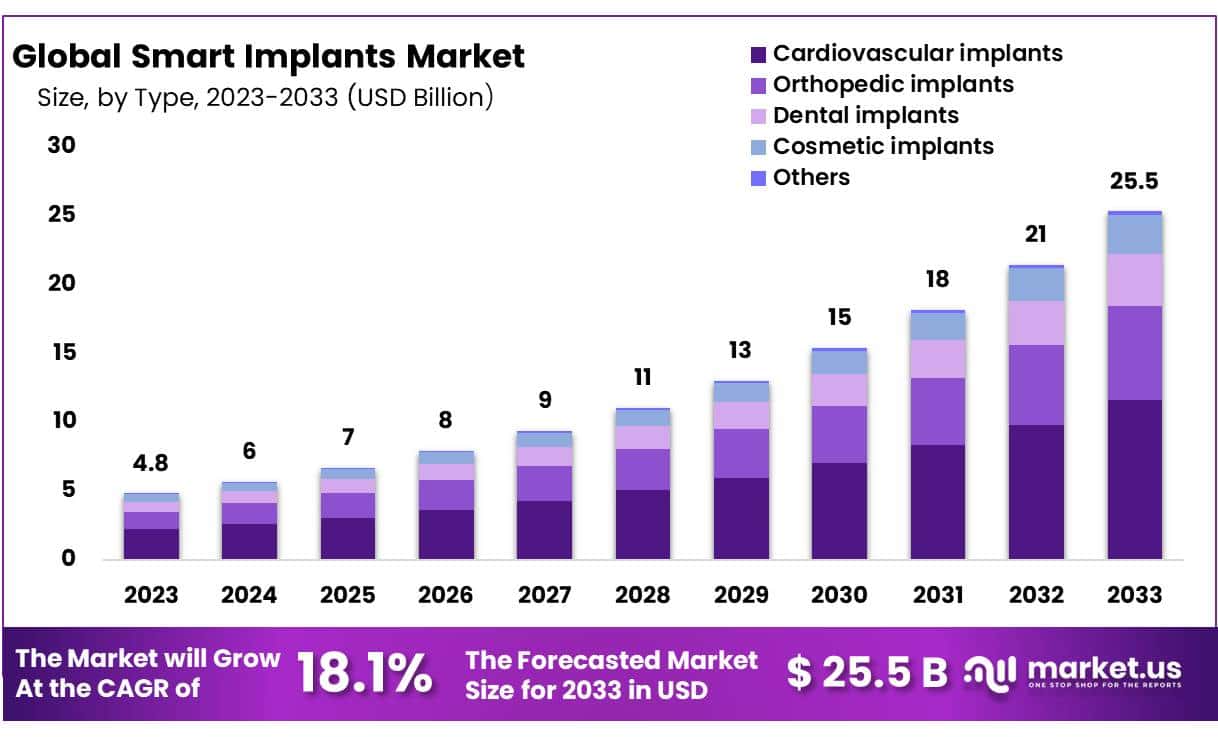

The Global Smart Implants Market size is expected to be worth around USD 25.5 Billion by 2033 from USD 4.8 Billion in 2023, growing at a CAGR of 18.1% during the forecast period from 2024 to 2033.

The sophisticated medical devices that are surgically placed inside the body and are equipped with advanced sensors, connectivity features and electronic components are identified as smart implants. The purpose of smart implants is to monitor physiological parameters, deliver targeted therapies and provide real time data to healthcare professionals. Smart implants potently reduce infection at the site, maintains speedy recovery, and reduce hospital readmissions, providing benefits for the patients under emergencies.

The market for smart implants is robustly triggered by combinatory of benefactors including ongoing technological advancements, growing healthcare spendings, increasing preference for innovations in spine surgery technologies, increase in chronic disorders, and lastly the increasing number of global surgeries. In addition to this, the market rapidly up scales with new product launches and strategies by major industry players. However, the high cost of implants and stringent regulatory framework is likely to impede the market for smart implants during the foreseeable days.

- According to National Centre for Biotechnology Information, the number of surgeries performed per surgeon boosted from 61.4 to 102.8 across the globe.

- In August 2021, INHANCE Shoulder System is introduced by Johnson and Johnson.

- In August 2020, the tibial extension for Persona IQ by Zimmer Biomet Holdings received authorization by US Food and Drug Administration.

Key Takeaways

- Based on type, cardiovascular implant segment secured a commendable market revenue share in the year 2023.

- Based on surgery, open surgery segment occupied a hefty market share of 64.3%.

- Based on applications, pacing devices segment captured an impressive market share of 43.2% owing to rising prevalence of cardiovascular illnesses.

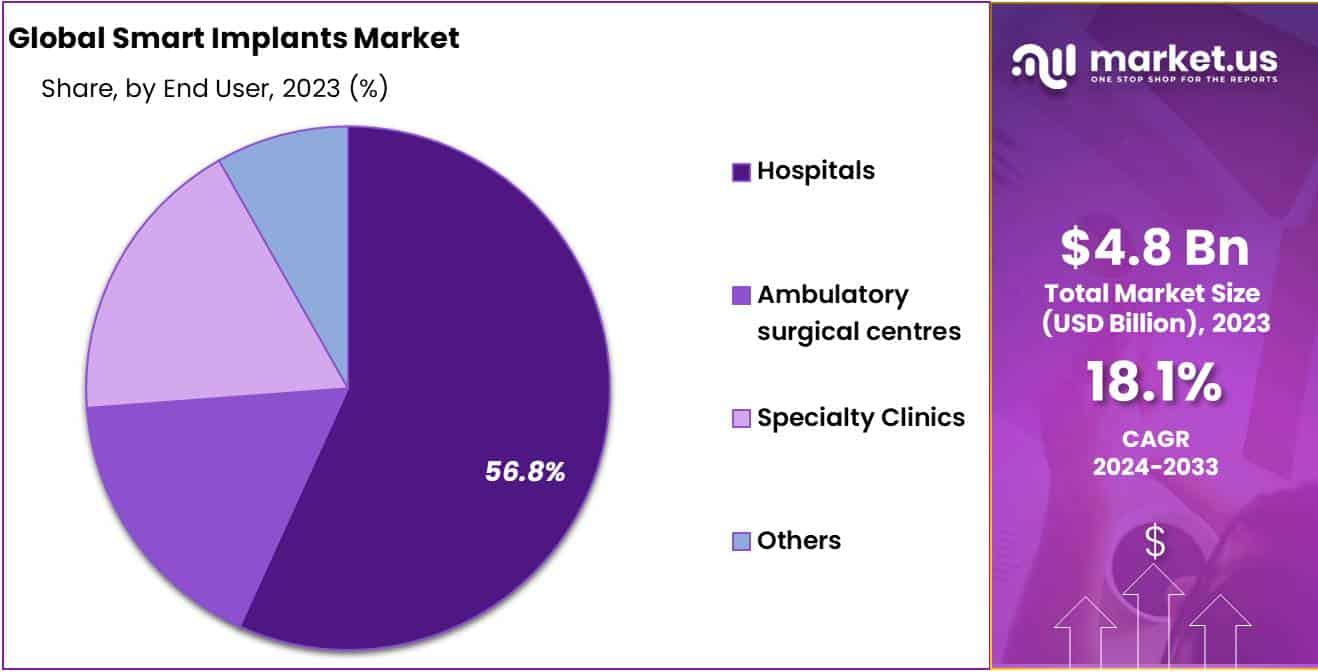

- Based on end use, hospital segment overshadowed the global smart implant market owing to the presence of improved healthcare infrastructure and healthcare professionals.

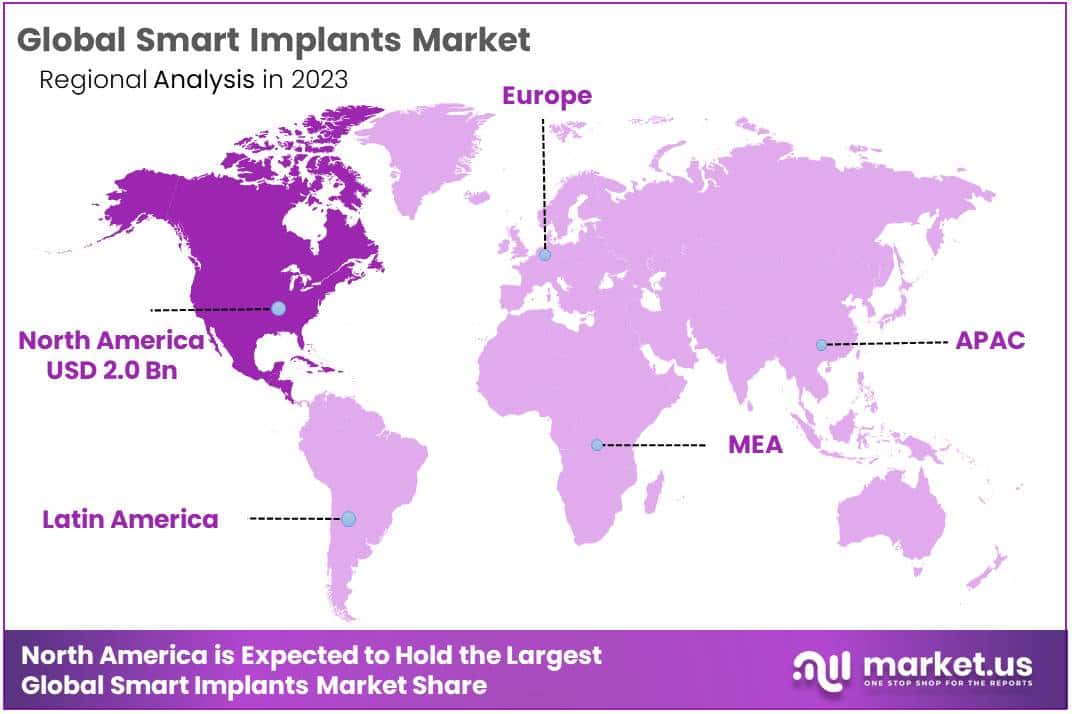

- North America ranked first in the global smart implants market in the year 2023.

By Type Analysis

Orthopedic implants boosts the market space

Based on type of implant, the global smart implants market is broadly categorized into Orthopedic implants, Cardiovascular implants, Dental implants, Cosmetic implants and other segments. Amongst these, orthopedic implants segment occupied a major market revenue share of 45.8% in the year 2023. The dominance of the segment owes to the rising demand of orthopedic implants to be used as therapeutically and diagnostically for knee and hip replacements, spine fusion surgeries, and fractures all over the world.

Orthopedic implants reduce the complications of total hip arthroplasty by detecting pressure and temperature combined with it avoid loosening of prostheses. The segmental growth further accelerates with continuous collaboration among major industry players, optimistically impacting the growth of the market.

- In November 2020, Medtronic Plc announced its completion of friendly tender offer for France based Medicrea International, a pioneer in the transformation of spinal surgery through artificial intelligence, predictive modelling, and patient specific implants.

By Surgery Analysis

Open Surgery segment overshadowed the market

Based on Surgery, the global smart implants market bifurcates into open and minimally invasive segments. An impressive market revenue share of 64.3% is withheld by open surgery segment dominating the smart implants market in the year 2023. The prominent share withheld by the segment is due to a standard approach employed by many healthcare professionals since decades.

Furthermore, healthcare professionals are trained enough pertaining excellent experience to perform these procedures, resulting in satisfactory outcomes. Spinal surgeries particularly require open surgery owing to the intricacy of the condition or the anatomical location involved, ensuring appropriate implant placement and fixation.

- According to World Health Organization, over 300 million open surgeries are performed each year across the globe.

By Application Analysis

Pacing devices segment escalates owing to rising number of cardiac surgeries

With respect to applications, the market for smart implants is fragmented into Knee & Hip arthroplasty, Spine Fusion, Stents, Intraocular lens and Pacing devices segment. A commendable market revenue share of 43.2% is occupied by pacing devices segment dominating the market in the year 2023. The segment being predominant is highly attributed to the technological advancement related to medical implants. To exemplify, remote monitoring and telehealth allow healthcare providers to monitor patients’ cardiac status and adjust treatment plans as and when needed avoiding in-person visits.

In addition to this, smart cardiac implants aids to manage and ameliorate patients’ outcomes in case of coronary artery disease, arrhythmias, and heart valve disorders by detecting abnormalities and delivering tailored therapies. Moreover, the segment robustly penetrates the market growth owing to the increasing prevalence of cardiovascular illnesses, demand for personalized medicines and growing geriatric population more susceptible to cardiac strokes.

- According to National Library of Medicine, cardiovascular diseases has become leading cause of morbidity and mortality in India during the last 3 decades.

- According to indian Journal of Thoracic and Cardiovascular Surgery, the number of cardiac surgeries performed are estimated to be around 300,000 per year across the globe.

By End-User Analysis

Hospitals marks dominance in the global smart implants market

Based on end use, the global smart implants market is broadly classified into Hospitals, Ambulatory Surgical Centres, Specialty Clinics and Other segments. Hospital segment emerged as a major leader in the global smart implants market capturing a praiseworthy market revenue share of 56.8% in the year 2023. A large patient pool prioritize hospitals to undergo major as well as minor treatments as hsopitals serve as a central hub for smart implants.

In addition to this, hospital ecosystems comprise well organized healthcare infrastructure, equipment and skilled healthcare professionals to perform intricate surgeries, forming a satisfactoring choice for patients demanding implantable devices. Furthermore, the availability of diverse departments such as orthopedic, dental, ophthalmic, makes it a all round place to carry out vital treatments with favourable reimbursement policies, loosing the financial burdens over low income facilities all around the world.

Market key segments

By Type

- Orthopedic implants

- Cardiovascular implants

- Dental implants

- Cosmetic implants

- Other

By Surgery

- Open

- Minimally invasive

By Application

- Knee & Hip arthroplasty

- Spine Fusion

- Stents

- Intraocular lens

- Pacing devices

By End-User

- Hospitals

- Ambulatory Surgical Centres

- Specialty Clinics

- Other

Drivers

Need for personalized treatments

The global smart implants market is heavily driven by rising need for personalized treatments. Depending upon the need, smart implants are not only employed for continuous internal diagnosis also their external connectivity feature enables therapy customization. From a long distance or through video calls, patients and healthcare workers are benefitted by personalized therapies by remotely accessing internal diagnosis. This remote monitoring aspect of smart implants aids in reduction of in person consultation frequency gain of patients’ confidence of control, thereby thriving the market growth.

Management of chronic pain with smart implants

The management of pain arriving through diverse chronic conditions poses many issues both for patients and healthcare practitioners. Traditional means of treatment such as drugs or physical therapies proves to be insufficient in managing pain along with occurrence of adverse effects. Fortunately, the emergence of smart implants helps to better provide a customized and possibly radical approach to pain management. For instance, spinal cord stimulation deliver mild electrical pulses to spinal cord, inhibiting the pain sensation approaching towards the brain.

- According to World Health Organization, around 18 million people worldwide were living with rheumatoid arthritis, with about 70% of people are women above 55%, experiencing moderate to severe pain in joints of hands, feet, knees, ankles, shoulders and elbows.

Restraints

Limited capacity for data storage

Though smart implants are linked with a variety of benefits providing comfort to the patients, still it is associated with a significant constraint. Being small sized, smart implants does not have an option for large storage of data. In addition to this, these small sized smart implants also finds it difficult to store the sensed information for a long period. Furthermore, the market could also constrict due to additional challenges including communication range, power consumption, transfer data size, and robustness impacting the integration of smart implants.

Opportunities

Rising prevalence of age related diseases

The rising elder population being more susceptible to chronic illnesses such as diabetes, cardiovascular diseases, neurological disorders and orthopedic conditions creates lucrative opportunities for the major industry players operating in smart implants market. This rise of age related diseases necessitates the demand for digital health implants to an unexpected level. The smart medical implants aids to address the unique healthcare needs of elderly people by enabling continuous monitoring, detection of complications at on set stage and personalized care.

This enables collection of real time data, which can be utilized to tailor treatment plans, optimize therapies and thereby ameliorate patient outcomes. Thus, market is expected to witness significant growth opportunities in the near future.

According to National Institute of Health, approximately 21% of geriatric population have at least one chronic disease, with 17% in rural areas and 29% in urban areas. Hypertension and diabetes account for 68% of all chronic diseases.

Impact of Macroeconomic Factors

The cost of manufacturing medical devices and surgical implants along with their shipping has raised enormously due to inflation. These companies may try to renegotiate contracts to pass along some of those increased costs. At the end of March 2022, the U.S. inflation rate was 8.5%, the highest rate in more than 40 years, making the implant manufacturing companies pay more for the material for the production of goods.

In addition to this, the labour and shipping costs had also upsurged. Strykers Executives discussed the inflationary pressures the company is facing during an April 28 earnings call. There were more overnight deliveries to customers due to tight supply chain being costly. The company used more air freight than more economical modes of transportation because of supply shortages, costs and urgency to deliver medical products.

Latest Trends

There are various technologies which provides a helping hand for the revenue generation in smart implants companies. These are as follows:

Smart Magnetic Drug Delivery: The device when placed inside the body automatically check the health and provide presise dosages of medication as and when needed. This helps the physicians to remotely control the release of medication via magnetic fields, assuring precise and targeted delivery while minimizing undesirable effects.

Brain Computer Interface Synchron: Synchron, a brain computer interface helps paralysed people recover control of their lives. The device is implanted in brain, allowing users to control technology solely with their minds, by detecting brain signals associated with thought and movement.

Regional Analysis

North America dominated the global Smart implants market with the highest revenue share of 41.8% in 2023.

North America came up as a frontrunner in the global smart implants market grabbing a meritorious market revenue share of 41.8% in the year 2023. The region proves to be a place of choice owing to easy accessibility towards advanced technologies, high recognition regarding implant surgeries among consumers, ameliorated healthcare infrastructure, and enlarging pharmaceutical and biotechnology firms in the region. The surge in the usage of smart implants for quick witted and efficient results in the United States forms a key factor leading to the market growth in recent years.

- According to the data provided in Stanford Childrens’ Health Organization, Sport Injuries Statistics, around 30 million children and teens participated in some form of organized sports and more than 3.5 million have injuries each year in United States.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major market players are currently focused on the implementation of various growth strategies to increase their market presence. In addition, they are also involved in partnerships, collaborations, mergers & acquisitions, and competitive pricing. Also, they are focusing on geographic expansions to increase their presence in foreign markets. This forms the competitive landscape in the global market, enhancing the smart implants portfolio and manufacturing of various smart implants. As a result, it significantly drives the market growth.

Market Key Players

- Zimmer Biomet

- DirectSync Surgical

- Medtronic

- Boston Scientific Corporation

- Abbott Laboratories

- NEVRO CORP

- Biotronic

- Cochlear ltd

- Exactech Inc.

- Stryker

- CONMED

Recent Developments

- In January 2024: Percept RC Deep Brain Stimulation (DBS) system by Medtronic received FDA approval. The system includes BrainSense Technology, Percept PC neurostimulator, and SenSight directional leads.

- In May 2023: Patient-powered smart spinal fusion device introduced by DirectSync Surgical received US Food and Drug Administration approval.

Report Scope

Report Features Description Market Value (2023) USD 4.8 Billion Forecast Revenue (2033) USD 25.5 Billion CAGR (2024-2033) 18.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Orthopedic implants, Cardiovascular implants, Dental implants, Cosmetic implants and other), By Surgery (Open, Minimally Invasive), By Application (Knee & Hip arthroplasty, Spine Fusion, Stents, Intraocular lens, Pacing devices), By End-User (Hospitals, Ambulatory Surgical Centres, Specialty Clinics, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Zimmer Biomet, DirectSync Surgical, Medtronic, Boston Scientific Corporation, Abbott Laboratories, NEVRO CORP, Biotronic, Cochlear ltd, Exactech Inc., Stryker, CONMED Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are smart implants?Smart implants are medical devices embedded with sensors, actuators, or other intelligent components that can monitor physiological parameters, deliver therapeutic agents, or provide feedback to clinicians. These implants are designed to enhance patient care, improve treatment outcomes, and enable remote monitoring of health conditions.

How big is the Smart Implants Market?The global Smart Implants Market size was estimated at USD 4.8 Billion in 2023 and is expected to reach USD 25.5 Billion in 2033.

What is the Smart Implants Market growth?The global Smart Implants Market is expected to grow at a compound annual growth rate of 18.1%. From 2024 To 2033

Who are the key companies/players in the Smart Implants Market?Some of the key players in the Smart Implants Markets are Zimmer Biomet, DirectSync Surgical, Medtronic, Boston Scientific Corporation, Abbott Laboratories, NEVRO CORP, Biotronic, Cochlear ltd, Exactech Inc., Stryker, CONMED.

How do smart implants work?Smart implants utilize advanced technology to monitor specific physiological parameters, such as temperature, pressure, glucose levels, or drug concentrations, within the body. They can wirelessly transmit data to external devices or healthcare professionals, allowing real-time monitoring and adjustment of treatment protocols as needed.

What are the common applications of smart implants?Smart implants have diverse applications across medical specialties, including orthopedics, cardiology, neurology, and diabetes management. They can be used for continuous glucose monitoring in diabetic patients, real-time monitoring of cardiac activity in heart disease patients, tracking of orthopedic implant performance, and delivery of targeted therapies in cancer treatment.

What are the benefits of smart implants?Smart implants offer several benefits, including improved patient outcomes through real-time monitoring and personalized treatment adjustments, enhanced patient comfort and convenience, early detection of complications or disease progression, reduced healthcare costs through preventive interventions, and increased patient compliance with treatment regimens.

-

-

- Zimmer Biomet

- DirectSync Surgical

- Medtronic

- Boston Scientific Corporation

- Abbott Laboratories

- NEVRO CORP

- Biotronic

- Cochlear ltd

- Exactech Inc.

- Stryker

- CONMED