Global Smart Image Labeling Market Size, Share, Industry Analysis Report By Type (Manual Annotation and Automated Annotation), By Data (Type, Image, Video, and Others), By Application (IT & Telecom, Automotive, Healthcare, Financial, Retail, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157399

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Generative AI

- Analysts’ Viewpoint

- Investment and business benefits

- U.S. Market Size

- By Type Analysis

- By Data Type Analysis

- By Application Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

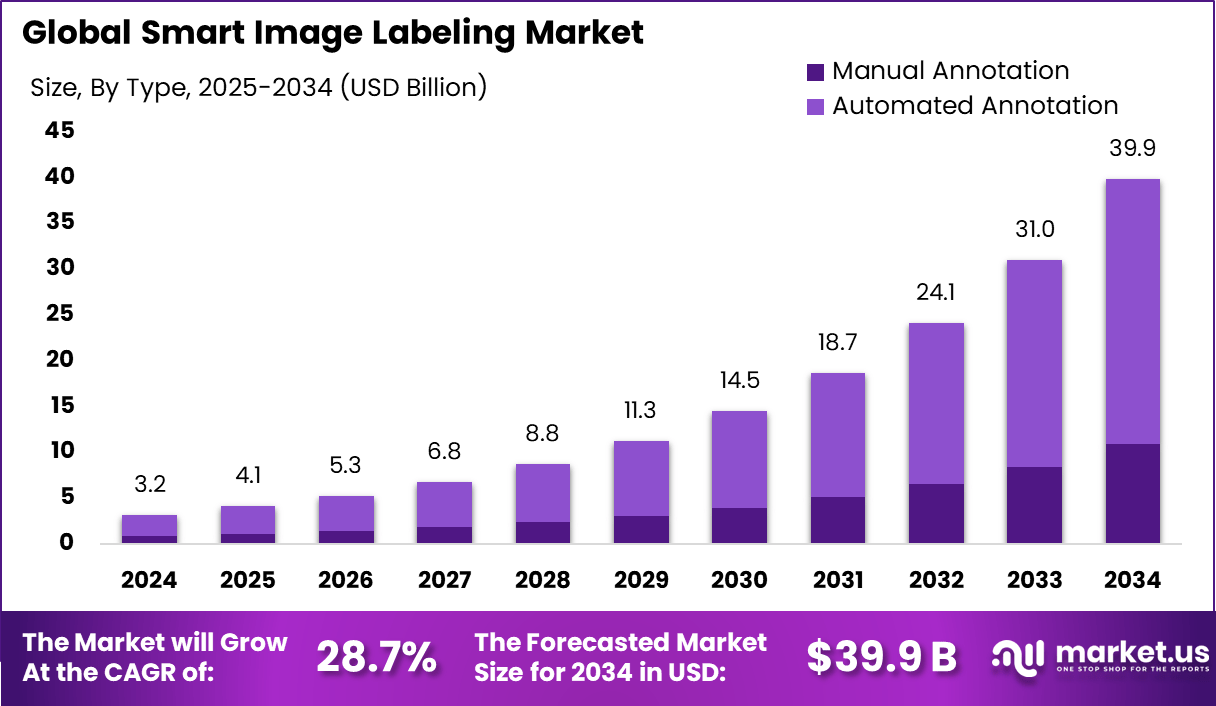

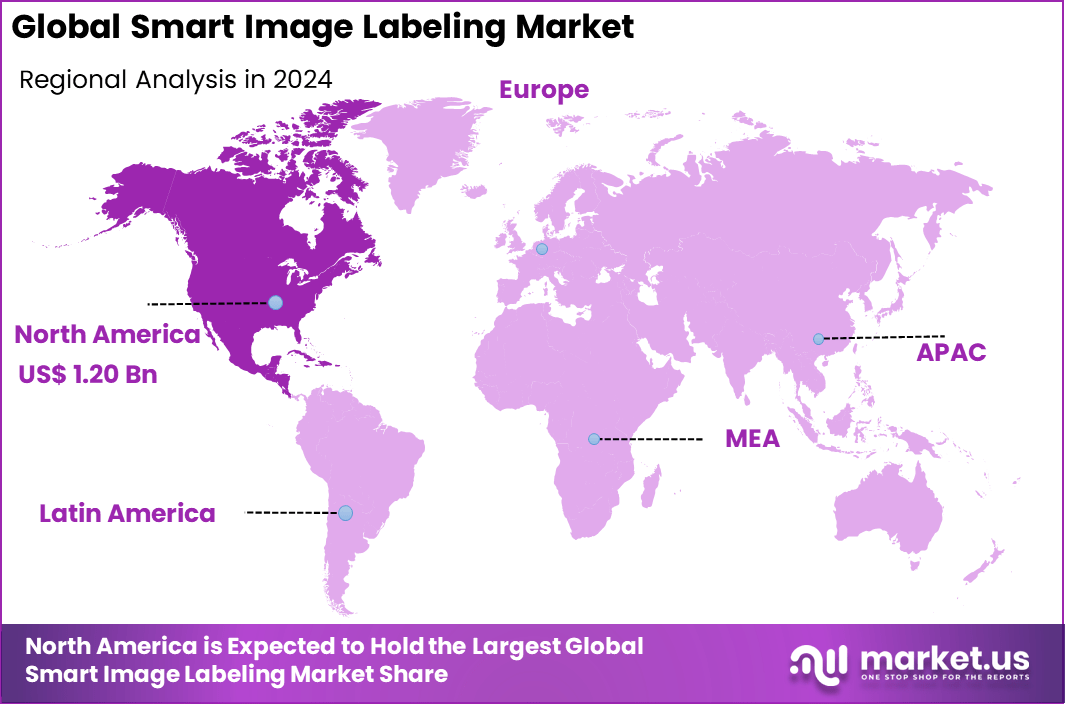

The Global Smart Image Labeling Market size is expected to be worth around USD 39.9 billion by 2034, from USD 3.2 billion in 2024, growing at a CAGR of 28.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.6% share, holding USD 1.20 billion in revenue.

The smart image labeling market involves technologies and platforms that annotate images and videos for training AI and machine learning models, enabling applications like computer vision, autonomous vehicles, healthcare diagnostics, and retail analytics. Key driving factors include the growing demand for high-quality labeled datasets, rapid adoption of AI across industries, and the shift from manual to automated annotation, which improves efficiency and scalability.

Adoption is accelerating, with deep learning methods like object detection, semantic segmentation, and OCR becoming standard in smart labeling tools. Solutions now integrate AI-assisted workflows that combine human oversight with automation. Innovations such as AI‑guided annotation interfaces reduce errors and speed up labeling while maintaining high quality.

Businesses embrace smart image labeling to reduce manual effort, boost throughput, and maintain quality standards. Automation enables labeling at scale, supports rapid deployment of AI models, and frees teams to focus on higher-value tasks. Improved consistency in labels also enhances performance of downstream systems like recommendation engines and diagnostic tools.

Key Takeaways

- The global smart image labeling market size is US$ 3.2 billion in 2024 and is expected to grow at a CAGR of 28.7% from 2025 to 2034.

- Automated annotation dominates by type, accounting for 72.7% of the market share in 2024, driven by the need for speed and scalability in AI model training.

- By data type, image labeling holds the largest share at 52.5%, reflecting its widespread use in computer vision applications.

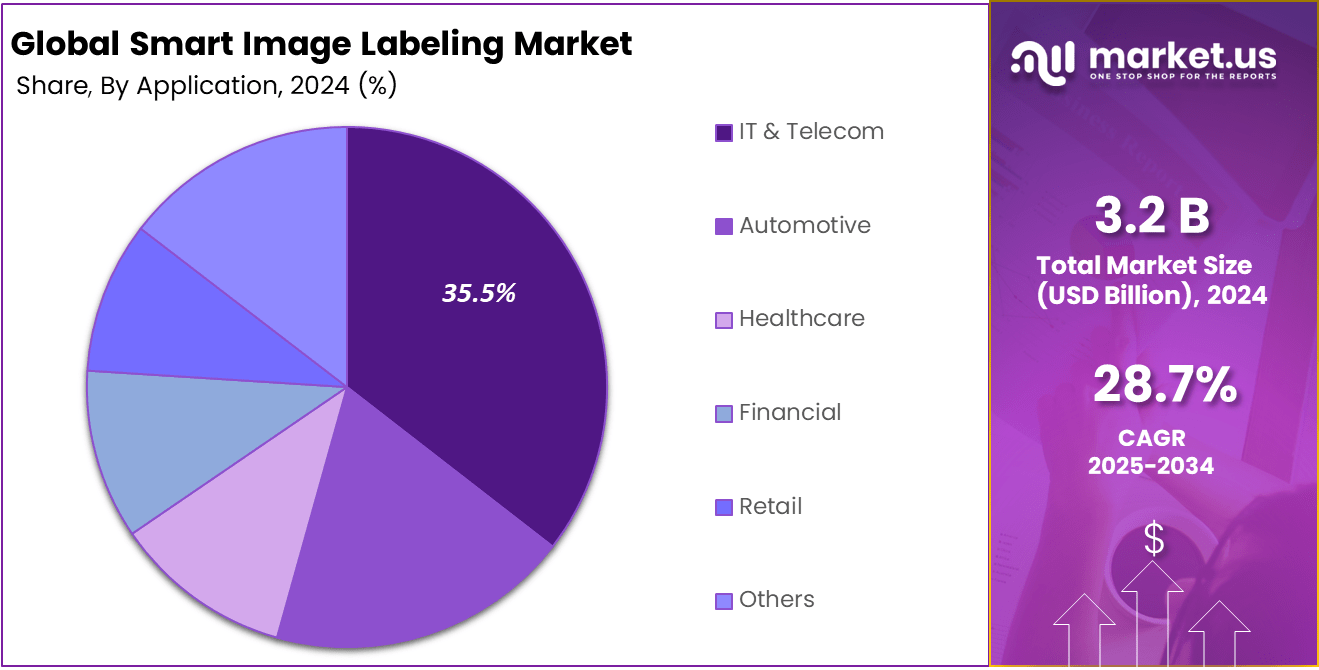

- IT & Telecom is the leading application segment with 35.5% share, due to increasing AI deployment in network optimization, surveillance, and content moderation.

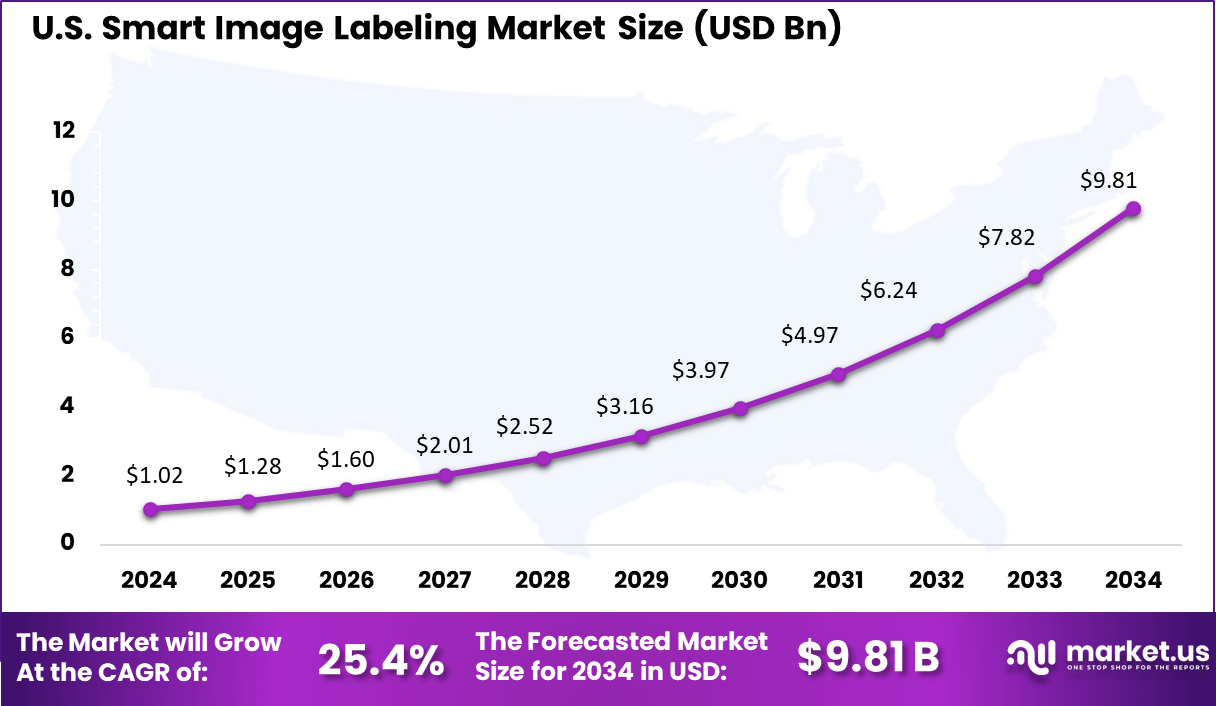

- North America leads regionally with a 37.6% market share, with the U.S. valued at USD 1.02 billion in 2024 and projected to grow at a 25.4% CAGR.

Role of Generative AI

Points Description Enhancing label accuracy Generative AI models improve the precision and quality of image labels by understanding context and semantics in images. Pre-labeling automation Generative AI can automatically generate preliminary labels, reducing manual labeling efforts and speeding up the annotation process. Semantic understanding Generative models help imbue labels with deeper semantic meaning, allowing AI systems to better understand visual content. Fine-tuning data sets Labeled data from generative AI assists in refining large models, enabling more accurate and specialized outputs. Contextual data augmentation Generative AI creates synthetic labeled data to supplement real images, improving model training and handling edge cases. Analysts’ Viewpoint

Several key technologies contribute to the increasing adoption of Smart Image Labeling. These include powerful AI models for image segmentation and object detection, cloud-based annotation platforms that enable collaborative labeling, computer vision advancements, and integration with machine learning pipelines.

The use of pretrained models and transfer learning further enhances accuracy and reduces the cost of developing task-specific models. Together, these technologies underpin the shift from manual annotation to semi-automated and fully automated smart labeling systems.

The key reasons driving adoption of Smart Image Labeling are improved annotation accuracy, substantial time savings, reduction of human error, and enhanced scalability for large datasets. Businesses benefit from more consistent and reliable training data, which directly contributes to more effective AI models and better decision-making insights.

Investment and business benefits

Investment opportunities in Smart Image Labeling revolve around creating more efficient AI-driven tools, developing domain-specific annotation solutions, and expanding cloud platform capabilities for collaborative projects. There is also growing demand for services that combine human expertise with AI automation to balance precision and speed.

Startups and technology companies focusing on AI annotation for specialized industries such as healthcare imaging, automotive, and retail automation are attracting significant attention from investors seeking to capitalize on the AI adoption trend. The business benefits of utilizing Smart Image Labeling include higher operational efficiency, improved quality of machine learning datasets, and cost reduction in annotation projects.

These benefits translate into faster product development, improved accuracy in AI-driven processes, and better customer experiences, especially in applications requiring precise image recognition. As companies gain more confidence in AI’s capabilities through accurate labeling, the return on investment in AI initiatives tends to increase substantially.

U.S. Market Size

The U.S. smart image labeling market, valued at USD 1.02 billion in 2024 and projected to grow at a CAGR of 25.4%, is a key driver of global adoption due to the country’s leadership in AI research, autonomous systems, and cloud computing.

Major technology firms such as Google, Tesla, Microsoft, and Amazon are investing heavily in automated annotation platforms to accelerate computer vision model training. For instance, Tesla employs AI-assisted labeling to process vast volumes of driving footage for its Full Self-Driving (FSD) program, while healthcare AI companies use advanced labeling to annotate medical images for cancer diagnostics and radiology workflow automation.

The U.S. market also benefits from a mature ecosystem of labeling solution providers like Scale AI and Labelbox, which offer AI-powered platforms enabling faster dataset preparation. Additionally, strong government and defense initiatives in surveillance and geospatial intelligence are fueling demand for precise, high-volume image labeling solutions.

North America Dominates the Market with a Major Revenue Share of 37.6%.

In 2024, North America held a dominant market position, capturing more than 37.6% share and generating USD 1.2 billion in revenue in the smart image labeling market. The region’s leadership is driven by the rapid adoption of artificial intelligence and machine learning technologies across industries such as healthcare, automotive, retail, and security.

Companies in the United States and Canada have been quick to implement smart image labeling solutions to improve data accuracy, accelerate model training, and enhance decision-making processes. The strong presence of technology leaders and startups has further strengthened innovation and adoption rates.

North America’s dominance is also supported by significant investments in autonomous systems, medical imaging, and surveillance applications, all of which require highly accurate and scalable image labeling. The region benefits from well-developed digital infrastructure, access to advanced computing resources, and a high availability of skilled professionals in AI and data science.

By Type Analysis

The type segment of the smart image labeling market is dominated by automated annotation, which holds 72.7% of the market share in 2024, reflecting the industry’s shift toward scalable, AI-driven solutions. Automated annotation tools leverage machine learning to classify and tag large datasets rapidly, reducing costs and minimizing human error compared to traditional manual labeling.

For example, Scale AI and SuperAnnotate provide platforms widely adopted in autonomous driving, where millions of images and videos must be annotated for object detection and lane recognition. In healthcare, AI-driven labeling accelerates medical image segmentation in MRI and CT scans, supporting faster diagnosis.

However, manual annotation remains crucial for highly complex or sensitive applications requiring expert validation, such as labeling radiology images by certified specialists or financial document verification. The growing use of human-in-the-loop systems, combining automated speed with manual oversight, ensures high-quality outcomes while meeting the expanding demand for labeled data across industries.

By Data Type Analysis

The data type segment of the smart image labeling market is led by image labeling, accounting for 52.5% of the market share in 2024 due to its broad applications in computer vision and AI model training. Image labeling is critical for tasks such as object detection, facial recognition, and defect inspection across industries.

For example, retail companies use labeled product images to power visual search engines and recommendation systems, while healthcare firms rely on annotated medical images to train AI models for detecting tumors or anomalies in X-rays and MRIs. Automotive leaders like Tesla and Waymo use image labeling to identify pedestrians, traffic signs, and lane markings for autonomous driving systems.

Although video labeling is gaining traction in dynamic applications such as robotics and surveillance, image labeling remains dominant because it is less complex, easier to automate, and requires fewer computational resources, making it a preferred choice for large-scale AI projects.

By Application Analysis

The application segment of the smart image labeling market is dominated by IT & Telecom, holding 35.5% of the market share in 2024, as these industries lead in AI adoption for network optimization, cybersecurity, and customer experience enhancement.

In IT, image labeling supports content moderation on platforms such as social media and streaming services, helping automatically detect inappropriate or harmful imagery. In telecom, it enables infrastructure monitoring, such as identifying defects in cell towers through drone-captured images.

Companies like Google, Meta, and Amazon Web Services leverage labeled image datasets to improve cloud-based AI services and edge computing applications. For example, AI-powered content moderation at Facebook depends on vast image datasets annotated to detect policy violations.

Additionally, labeled data is used for fraud detection in financial services and facial recognition for secure customer onboarding. This dominance reflects how IT and telecom firms are at the forefront of scaling AI solutions that require massive, high-quality labeled datasets.

Emerging Trends

Points Description AI-assisted annotation Integration of foundation and generative AI models to pre-label large data portions with human review. Synthetic data generation Use of AI to create realistic synthetic images with labels for training without needing actual data. Real-time labeling Advances in tools enabling faster, possibly real-time image annotation for dynamic datasets. Increased automation Automation of repetitive and complex labeling tasks using AI, minimizing manual human effort. Cross-industry adoption Expanding use of smart image labeling in industries like healthcare, automotive, retail, and security. Growth Factors

Points Description Rising AI/ML adoption Growing dependence on AI and machine learning across many sectors boosts demand for labeled image data. Autonomous vehicles Need for precise labeled data to train self-driving car vision systems is a major market driver. Healthcare AI expansion Increasing use of labeled medical images to improve diagnostics fuels growth. Big data proliferation Explosion of image data from social media, IoT, and surveillance demands labeling solutions. Technological innovations Continuous improvement in labeling tools and AI models drives market expansion by optimizing accuracy and costs. Key Market Segments

Type

- Manual Annotation

- Automated Annotation

Data Type

- Image

- Video

- Others

Application

- IT & Telecom

- Automotive

- Healthcare

- Financial

- Retail

- Other Applications

Key Regions and Countries Covered

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Driving Factor

Growth of automated annotation tools

The growth of automated annotation tools is a major driver of the global smart image labeling market, as organizations seek faster, cost-effective, and scalable solutions for training AI and machine learning models. Unlike manual labeling, which is labor-intensive and prone to human error, automated annotation leverages AI algorithms to label large datasets with high consistency.

According to industry estimates, automated tools can reduce labeling time by up to 70–80%, significantly accelerating AI development cycles. For instance, companies like Scale AI, Labelbox, and SuperAnnotate have introduced platforms using computer vision and natural language processing to automatically tag images and videos, which are widely used in autonomous driving, surveillance, and medical diagnostics.

In the automotive sector, Waymo and Tesla employ automated annotation to process millions of frames of driving data to improve self-driving algorithms. Similarly, healthcare AI firms use automated labeling for segmenting medical scans, enabling faster detection of tumors or anomalies.

As enterprises continue deploying AI at scale, the ability to quickly and accurately prepare training data becomes essential. This surge in demand is pushing vendors to develop human-in-the-loop hybrid systems combining automation with manual validation to further enhance accuracy while maintaining speed and scalability.

Restraining Factor

High costs of developing and maintaining labeling platforms

The high costs of developing and maintaining labeling platforms pose a significant restraint for the smart image labeling market, particularly for small and mid-sized enterprises. Building a robust annotation platform requires substantial investment in AI models, data infrastructure, quality control systems, and skilled labor.

Development costs can run into millions of dollars, as companies must integrate features like automated annotation, real-time collaboration, and data security measures. Even after deployment, maintaining these platforms involves continuous software updates, cloud storage expenses, and human oversight to correct mislabeled data. For example, Amazon’s Mechanical Turk and Appen rely on large human workforces to supplement automated systems, adding to operational costs.

In high-stakes applications such as healthcare, where labeled datasets must meet stringent regulatory requirements, costs escalate further due to the need for expert annotators like radiologists. The data labeling can consume up to 25% of total AI project budgets, underscoring the financial burden. Startups often face difficulty competing with larger players that can afford proprietary labeling platforms, forcing them to outsource annotation at additional expense.

Growth Opportunity

Integration of AI with labeling platforms

The integration of AI with labeling platforms presents a major opportunity for the smart image labeling market, enabling faster, more accurate, and scalable annotation processes. Traditional manual labeling is time-consuming and costly, but AI-driven platforms can automatically detect, classify, and tag objects, reducing human effort and project timelines.

This integration supports human-in-the-loop systems, where AI performs bulk labeling while humans validate complex cases, combining speed with high accuracy. Companies such as Labelbox, SuperAnnotate, and Scale AI have embedded AI into their platforms to deliver automated workflows for industries like autonomous driving, healthcare, and retail.

For example, Waymo uses AI-enhanced labeling to process millions of hours of driving footage, significantly improving its self-driving models, while healthcare AI firms leverage similar systems to annotate X-rays and MRIs for disease detection. AI-assisted labeling can cut annotation costs by up to 50% while boosting throughput several times.

As deep learning models require exponentially larger datasets, AI-powered labeling tools make it feasible to handle these massive volumes efficiently. This opportunity is further amplified by the rise of synthetic data generation, where AI not only labels but also creates training datasets, accelerating development for industries adopting computer vision at scale.

Key Player Analysis

The Smart Image Labeling Market is characterized by a competitive landscape shaped by established technology providers and emerging AI-focused firms. Indium Software and Roboflow, Inc. are recognized for their strong capabilities in delivering scalable labeling platforms with advanced automation.

Service-based providers such as SunTec Web Services Pvt. Ltd. and HitechDigital Solutions LLP hold a significant role in supporting enterprises that prefer outsourcing. Their cost-effective solutions and skilled workforces provide an advantage for organizations requiring large-scale annotation projects.

Niche-focused firms such as Anolytics.ai, Shaip, and Labelbox, Inc. emphasize data precision and compliance, making them preferred partners in sensitive industries like healthcare and finance. Their focus on high-quality datasets supports the growing need for reliable AI training models.

Top Key Players in the Smart Image Labeling Market

- Indium Software

- Roboflow, Inc.

- SunTec Web Services Pvt. Ltd.

- Supervisely OÜ.

- HitechDigital Solutions LLP.

- CVAT.ai Corporation

- Anolytics.ai

- Shaip

- Labelbox, Inc.

- Others

Recent Developments

- June 2025: Linxens and Dracula Technologies have partnered to develop battery-free, energy-autonomous smart labels using Dracula’s OPV light-harvesting technology and Linxens’ expertise in RFID and flexible components. This collaboration enables sustainable, reusable, and long-lasting traceability solutions, reducing environmental impact while enhancing performance for logistics, supply chain, and IoT applications.

- January 2025: Giesecke+Devrient (G+D) launched the ultra-thin Smart Label, transforming packages into IoT-enabled assets with GPS accuracy, motion and temperature sensors, tamper detection, and cloud-based monitoring. Designed for parcel tracking, fleet management, and luxury goods, it offers reusable, air-travel-certified, end-to-end solutions, enabling real-time asset visibility and automated processes like proof of delivery and payment.

- October 2024: Multi-Color Corporation (MCC) has acquired Starport Technologies, a Kansas City-based smart label and RFID solutions provider, enhancing MCC’s intelligent packaging offerings. The acquisition combines expertise in RFID labeling, decorative and functional smart labels, and supply chain solutions, enabling global scaling, innovation, and strengthened service for consumer goods and retail applications.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 39.9 Bn CAGR(2025-2034) 28.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Manual Annotation and Automated Annotation), By Data (Type, Image, Video, and Others), By Application (IT & Telecom, Automotive, Healthcare, Financial, Retail, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SuperAnnotate, Indium Software, Roboflow, Inc., SunTec Web Services Pvt. Ltd., Supervisely OÜ., Alegion, Appen, Hive, HitechDigital Solutions LLP, CVAT.ai Corporation, Anolytics.ai, Scale AI, Shaip, CloudFactory, Labelbox, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Image Labeling MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Image Labeling MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Indium Software

- Roboflow, Inc.

- SunTec Web Services Pvt. Ltd.

- Supervisely OÜ.

- HitechDigital Solutions LLP.

- CVAT.ai Corporation

- Anolytics.ai

- Shaip

- Labelbox, Inc.

- Others