Global Smart Glasses Microdisplay Market Size, Share Report Analysis By Display Technology (OLED, LCD, LCoS, DLP, MicroLED, Others), By End-User (Enterprises, Consumer Electronics, Healthcare, Industrial, Military & Defense, Sports & Fitness, Others, Individuals), By Distribution Channel (Online, Offline), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169899

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

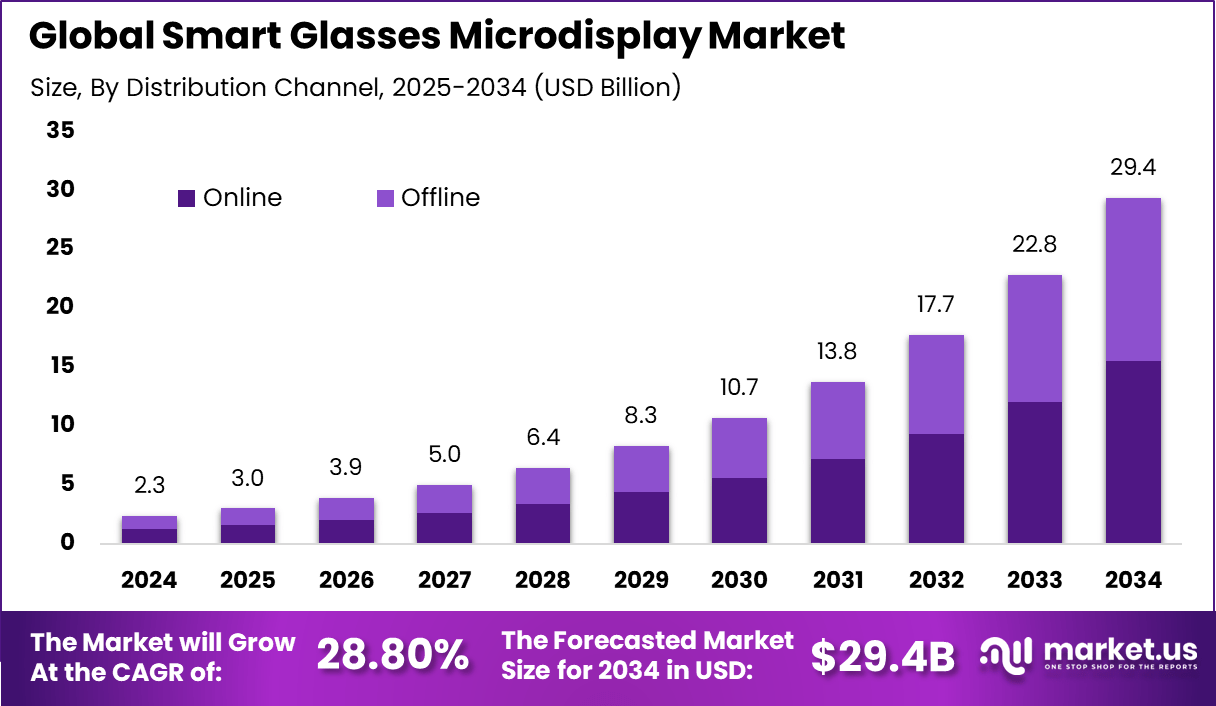

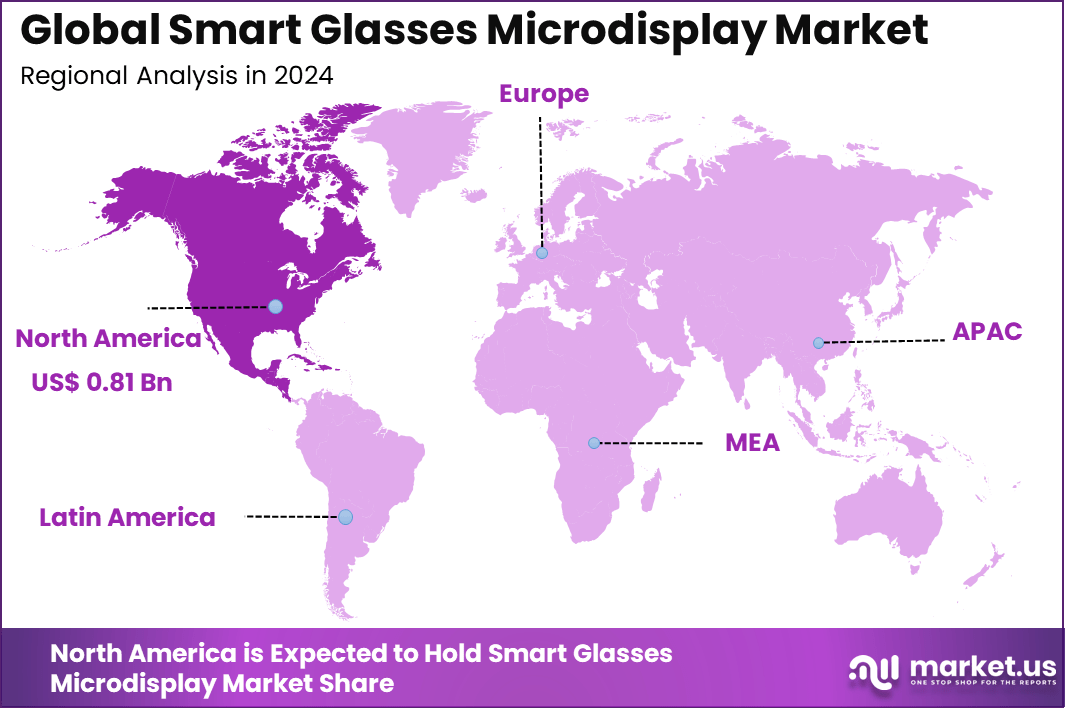

The Global Smart Glasses Microdisplay Market generated USD 2.3 billion in 2024 and is predicted to register growth from USD 3.0 billion in 2025 to about USD 29.4 billion by 2034, recording a CAGR of 28.80% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 34.8% share, holding USD 0.81 Billion revenue.

The smart glasses microdisplay market refers to the segment of display components designed specifically for wearable eyewear systems that overlay digital information onto the wearer’s view of the physical world. These microdisplays are compact high-resolution screens integrated into smart glasses to support augmented reality (AR),virtual reality (VR), and assisted visual applications that require clear image projection in a small form factor.

The increasing demand for wearable technology that enhances real-time visual engagement, particularly in enterprise and consumer applications. Advanced microdisplay technologies such as OLED, MicroLED, and liquid crystal on silicon (LCoS) enable sharper images and lower power consumption, which are essential for extended wear. The expanding use of AR and VR in industrial operations, healthcare diagnostics, and remote assistance has also raised interest in smart glasses with integrated microdisplays.

Demand for microdisplays in smart glasses is closely tied to the increasing deployment of wearable AR systems across sectors such as manufacturing, logistics, enterprise communication, and consumer electronics. Enterprises are adopting smart glasses to support hands-free workflows and real-time data access, reducing errors and improving efficiency in complex tasks.

Top Market Takeaways

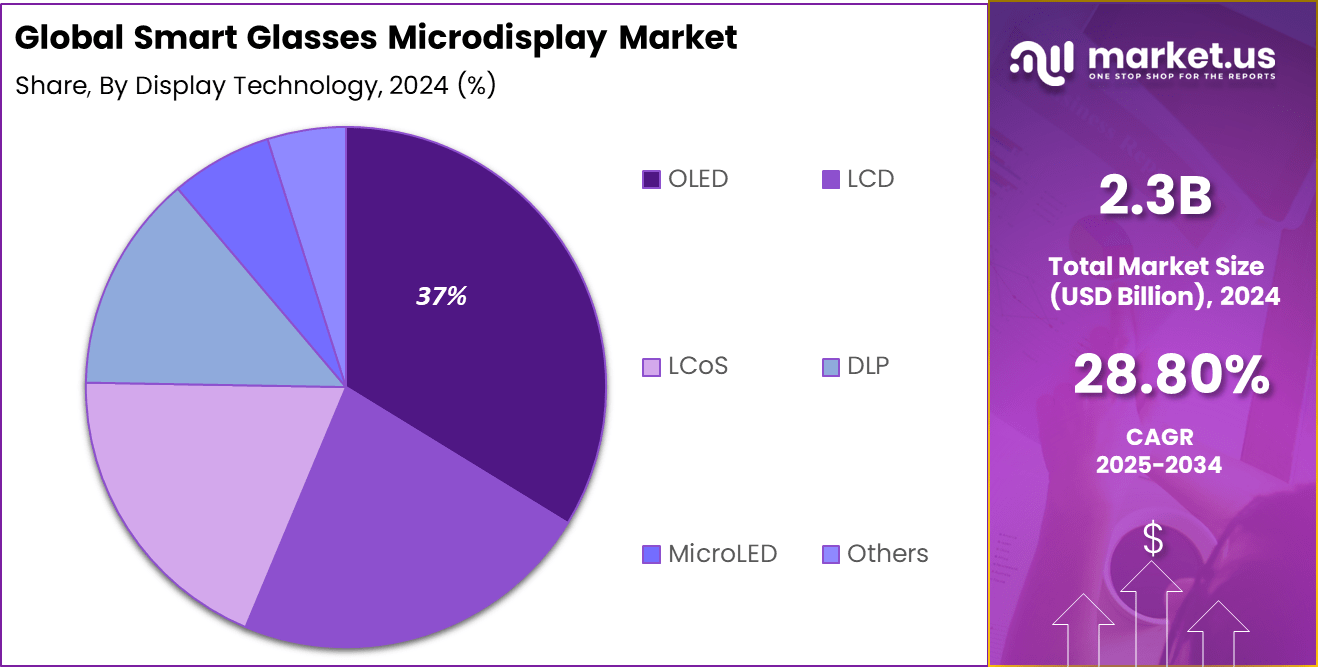

- By display technology, OLED accounted for 37.4% of the smart glasses microdisplay market, reflecting preference for high contrast, brightness, and energy efficiency in near-eye displays.

- By end-user, enterprises held 67.8% share, driven by adoption of smart glasses for hands-free workflows in logistics, field service, manufacturing, and healthcare.

- By distribution channel, online sales contributed 52.7%, supported by specialized B2B e-commerce platforms and direct OEM channels for smart glasses hardware.

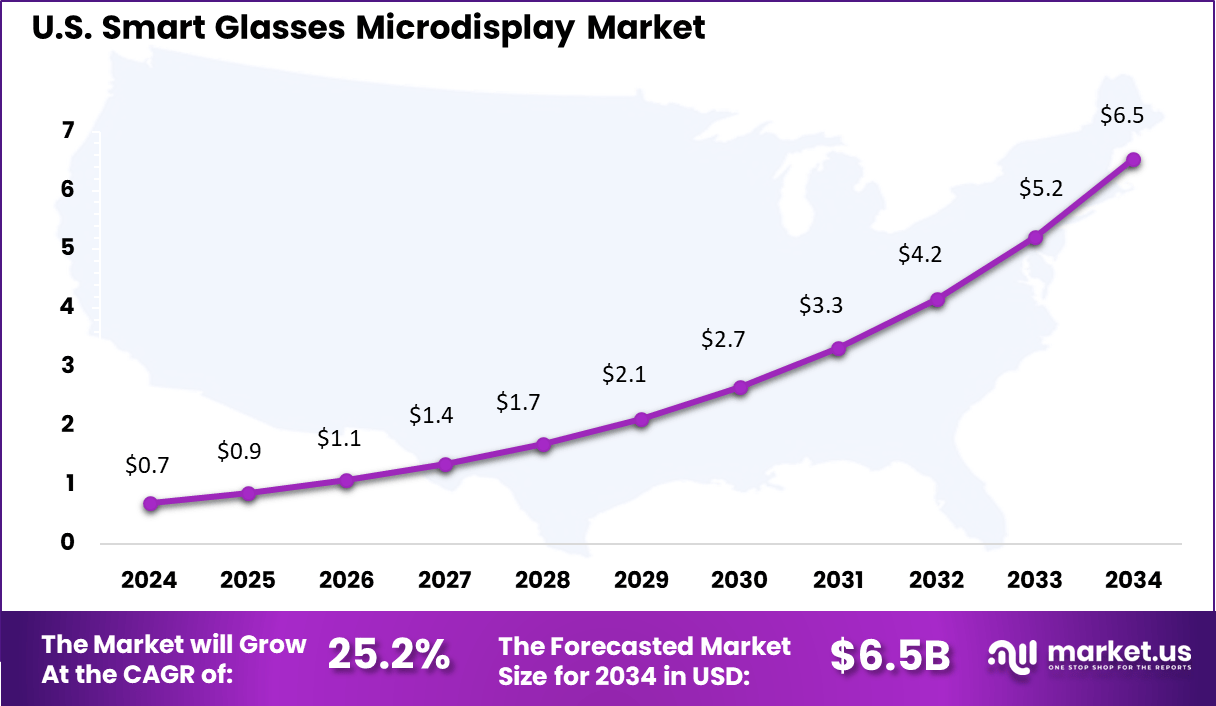

- North America represented 34.8% of the global market, with the U.S. valued at USD 0.69 billion in 2025 and projected to grow at a CAGR of 25.2% on the back of strong AR deployment in enterprises.

By Display Technology

OLED technology accounts for 37% of the total market share in smart glasses microdisplays, making it the leading display type in this segment. This strong position is supported by its ability to deliver high contrast, deep black levels, and sharp image quality in compact display sizes. OLED microdisplays are widely used in smart glasses for augmented reality and wearable viewing applications where visual clarity and low power use are essential.

Another important advantage of OLED is its lightweight structure and thin design, which helps reduce the overall weight of smart glasses. This improves user comfort during long usage hours. The flexibility of OLED panels also supports innovative product designs. As smart wearables continue to focus on visual performance and compact form factors, OLED adoption is expected to remain strong.

By End-User

Enterprises hold a dominant 67.8% share of the smart glasses microdisplay market, showing that business and industrial users are the primary adopters. These devices are widely used in manufacturing, logistics, healthcare, field services, and training environments. Enterprises use smart glasses for remote assistance, step-by-step work guidance, safety monitoring, and real-time data access.

Another key factor driving enterprise demand is the productivity benefit offered by hands-free visual tools. Workers can view instructions, schematics, and alerts without stopping their tasks. Many companies also see smart glasses as a long-term digital transformation tool. As industrial automation and digital workplace adoption increase, enterprise demand for smart glasses microdisplays continues to expand.

By Distribution Channel

Online channels contribute 52.7% of the total distribution share, making them the leading sales route for smart glasses microdisplays. Buyers prefer online platforms for easy product comparison, access to detailed specifications, and faster procurement options. This channel is widely used by both enterprise buyers and individual technology buyers due to convenience and broader product availability.

Another factor supporting online sales growth is the rising role of direct-to-customer strategies by manufacturers. Many suppliers are using their own websites and digital platforms to offer customized configurations, technical documentation, and customer support. As digital purchasing becomes standard across hardware markets, online distribution is expected to maintain its leading role.

Reasons for Adoption

- Device makers adopt microdisplays to keep smart glasses light and compact while still giving sharp, high‑resolution visuals close to the eye.

- Rising interest in AR use cases across industry, healthcare, logistics, and field service drives demand for embedded displays that can overlay data in real time.

- Advances in micro OLED and micro LED technology offer higher brightness and contrast with lower power use, which fits the tight battery limits of wearables.

- Enterprises see productivity gains from hands‑free access to instructions and checklists, pushing OEMs to integrate better microdisplays into industrial smart glasses.

- Large investments in AR and AI‑enabled glasses from big tech vendors signal long‑term scale, encouraging component suppliers and adopters to standardize on microdisplay platforms.

Key Benefits

- Microdisplays deliver crisp text and graphics at short viewing distances, making alerts, schematics, and workflows easy to read without eye strain.

- High brightness options, especially with micro LED, keep overlays visible outdoors, which is crucial for field workers and first responders.

- Power‑efficient architectures extend battery life so smart glasses can run through full shifts in factories, warehouses, or hospitals.

- Compact size and silicon‑based designs free up space in the frame for sensors, cameras, and radios, improving overall device capability.

- Support for fast response times and high refresh rates helps reduce motion blur and latency, improving comfort in AR and mixed reality tasks.

Usage

- Industrial technicians use AR smart glasses with microdisplays to see step‑by‑step repair guides and wiring diagrams while keeping hands on tools.

- Warehouse and logistics staff get pick‑by‑vision instructions, inventory data, and navigation arrows directly in their field of view.

- Surgeons and clinicians access patient vitals or imaging overlays during procedures without turning away from the operating area.

- Field service engineers connect to remote experts who annotate their view in real time, improving first‑time fix rates.

- Consumer and prosumer users leverage smart glasses for immersive gaming, media, and contextual notifications while on the move.

Emerging Trends

Key Trend Description Shift to OLED, LCoS and MicroLED Smart glasses increasingly adopt OLED, LCoS, and emerging microLED microdisplays to deliver high brightness, contrast, and energy efficiency in compact form factors. Waveguide and Holographic Optics Integration of waveguide and holographic combiners with microdisplays enables thin, lightweight AR glasses with wider field of view and better transparency. Enterprise and Industrial AR Focus Microdisplays are optimized for rugged, high-brightness smart glasses used in manufacturing, logistics, field service, and healthcare workflows. AI-Enhanced Visual Experience Pairing microdisplays with on-device AI and computer vision supports context-aware overlays, foveated rendering, and eye tracking for more natural AR. Miniaturization and Power Efficiency Advances in OLED-on-silicon and LCoS architectures reduce size and power consumption, improving wearability for all-day smart glasses. Growth Factors

Key Factors Description Rising Adoption of AR Smart Glasses Expanding use of AR glasses in consumer, enterprise, and industrial settings directly increases demand for high-resolution microdisplays. Wearable and Metaverse Ecosystem Growth Growth of wearables and metaverse-driven applications fuels demand for immersive, head-worn displays powered by advanced microdisplay engines. Technological Advancements in Microdisplay Improvements in OLED, microLED, and LCoS technologies enhance brightness, lifetime, and image quality, driving product upgrades. Investment by Big Tech and ODMs Major technology brands invest in AR, VR, and smart glasses programs, creating stable demand for microdisplay suppliers and scaling volumes. Expanding Use Cases Across Sectors Applications in healthcare visualization, remote assistance, training, logistics, and defense broaden the addressable market for smart glasses microdisplays. Key Market Segments

By Display Technology

- OLED

- LCD

- LCoS

- DLP

- MicroLED

- Others

By End-User

- Enterprises

- Consumer Electronics

- Healthcare

- Industrial

- Military & Defense

- Sports & Fitness

- Others

- Individuals

By Distribution Channel

- Online

- Offline

Regional Analysis

North America holds about 34.8% of the global Smart Glasses Microdisplay market, supported by strong demand from tech companies, defense projects, healthcare providers, and industrial users. The region is seeing fast adoption of AR smart glasses for remote assistance, training, field service, and surgery support, which pushes demand for compact, bright, and power‑efficient microdisplays. Growing investments in 5G, edge computing, and enterprise AR pilots help microdisplay makers scale volumes and improve performance, supporting a high growth rate near 25.2% in this category.

In United States, the Smart Glasses Microdisplay market is valued at around USD 0.69 billion and is growing quickly at a CAGR of 25.2%, driven by large technology firms, startups, and government projects. U.S. companies use smart glasses in logistics, manufacturing, and maintenance to increase worker productivity and reduce errors, which directly boosts demand for advanced OLED, LCOS, and microLED microdisplays. Strong venture funding, early trials in retail and healthcare, and defense contracts for rugged AR headsets make the U.S. the main contributor to North America’s share in this market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Adoption of AR Smart Glasses in Enterprise

Growing use of augmented reality smart glasses in logistics, field service, manufacturing and healthcare is a major demand driver for microdisplays. Enterprises are deploying head‑worn devices for remote assistance, step‑by‑step workflow guidance and real time data visualization, which depends on compact, bright and power efficient near‑eye displays.

As more pilots move into scaled deployments across warehouses, production lines and hospitals, OEMs are asking suppliers for higher resolution, high contrast micro‑OLED, LCoS and emerging microLED engines that can fit into lighter frames without sacrificing image quality.

This enterprise focus helps stabilize volumes and justifies investment in advanced microdisplay fabs tailored for smart glasses.The broader smart glasses market is already on a strong growth path, with analysts projecting rapid expansion as devices become more comfortable and offer better optics and battery life, which directly pulls through demand for microdisplay modules.

Restraint

High Cost and Manufacturing Complexity of Advanced Microdisplays

Despite strong demand signals, the smart glasses microdisplay market faces a key restraint in the form of high production cost and process complexity, especially for micro‑OLED and microLED devices. Fabricating ultra high pixel density panels on silicon backplanes requires expensive equipment, tight process control and high material usage, while current yields for very fine pixel pitches remain a challenge.

For microLED in particular, aligning and transferring massive numbers of tiny emitters or building full color structures on a single chip pushes up capital intensity, which keeps device prices high and limits the ability of smart glasses makers to hit consumer price points.These cost and yield issues translate into higher bill of materials for smart glasses, which slows adoption beyond premium industrial and defense segments where customers can tolerate higher prices

Opportunity

MicroLED and High‑Brightness Engines for Outdoor and All‑Day Use

One of the strongest opportunities lies in next generation microLED and high brightness microdisplay engines that can enable comfortable outdoor and all day smart glasses. MicroLED microdisplays promise very high luminance levels, excellent contrast and energy efficiency, which are critical to overcome sunlight and still provide clear overlays through waveguide combiners.

Vendors and research groups have already shown prototype near‑eye panels with very high nit levels and fine pixel densities, suggesting that once manufacturing issues are addressed, these devices can support thin, lightweight AR glasses suited for navigation, field work and consumer information services.

This technology roadmap aligns well with market needs as brands explore everyday smart glasses and AI‑assisted eyewear that must look close to regular frames but still project legible content in varying lighting conditions.

Challenge

Balancing Brightness, Power, Optics and Form Factor in Glasses

A central technical challenge for the smart glasses microdisplay market is finding the right balance between brightness, power consumption, optical performance and industrial design. Near‑eye systems must deliver enough luminance to work through waveguides or other combiners while competing with ambient light, but higher brightness typically drives up power draw and heat, which are difficult to manage in thin temples and small frames.

At the same time, optics must maintain a usable field of view, eyebox and image uniformity, all within strict size and weight limits so that glasses remain comfortable for long wear.Integrating micro‑OLED or microLED panels into curved or compact optics can also introduce alignment, distortion and light leakage issues, which require careful optical design and coatings to correct.

Competitive Analysis

Sony Corporation, Kopin Corporation, Himax Technologies, and Microoled lead the smart glasses microdisplay market with advanced OLED, LCOS, and micro-LED technologies that deliver high brightness, compact form factors, and low power consumption. Their displays support augmented reality functions, industrial workflows, and consumer entertainment. These companies focus on clarity, durability, and seamless integration with optical engines.

Seiko Epson, Jade Bird Display, BOE Technology Group, eMagin, Samsung Electronics, and LG Display strengthen the market through high-resolution microdisplay production and innovation in micro-LED efficiency. Their solutions enhance visual fidelity in outdoor environments and support wide field-of-view designs. These manufacturers prioritize mass production capability, energy efficiency, and long component lifecycles.

Lumus, Vuzix, Syndiant, AU Optronics, Innolux, Raontech, WiseChip, Plessey, Magic Leap, Goertek, and others broaden the landscape with optical waveguides, projection engines, and customized microdisplay modules. Their technologies enable slim smart glasses, improved color accuracy, and enhanced user comfort. These players focus on optics miniaturization, integration flexibility, and reduced heat generation.

Top Key Players in the Market

- Sony Corporation

- Kopin Corporation

- Himax Technologies, Inc.

- Microoled

- Seiko Epson Corporation

- Jade Bird Display (JBD)

- BOE Technology Group Co., Ltd.

- eMagin Corporation

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- Lumus Ltd.

- Vuzix Corporation

- Syndiant, Inc.

- AU Optronics Corp.

- Innolux Corporation

- Raontech Inc.

- WiseChip Semiconductor Inc.

- Plessey Semiconductors Ltd.

- Magic Leap, Inc.

- Goertek Inc.

- Others

Future Outlook

The Smart Glasses Microdisplay market is poised for strong growth as consumer and enterprise demand shifts toward lighter, more immersive wearable displays for navigation, collaboration, training, and entertainment. Compact microdisplay technologies such as OLED, LCOS, and emerging microLED will remain central to next‑generation smart glasses, enabling brighter visuals, lower power use, and slimmer form factors that are suitable for all‑day wear in industrial, medical, retail, and consumer settings.

As AR platforms mature and AI features become standard in wearables, microdisplay suppliers will focus on higher resolution, better outdoor visibility, and tighter integration with optics and sensors, helping smart glasses move from niche pilots to mainstream productivity and consumer devices.

Opportunities lie in

- Designing ultra‑low‑power microdisplays optimized for always‑on AR overlays in logistics, field service, and healthcare workflows.

- Partnering with smart glasses and chipset vendors to co‑develop integrated optical modules that combine microdisplays, waveguides, and sensors in compact packages.

- Targeting specialized segments such as industrial training, remote assistance, and immersive retail experiences where high‑brightness, high‑resolution microdisplays can justify premium pricing.

Recent Development

- September, 2024, Sony launched the ECX350F full HD OLED microdisplay optimized for next‑generation AR smart glasses with around five‑thousand pixels per inch and peak brightness near ten‑thousand candelas per square meter.

- January, 2025, Kopin announced it would showcase newly advanced near‑to‑eye OLED, ferroelectric LCOS, and microLED microdisplays plus Neuraldisplay eye‑tracking software at the SPIE AR/VR/MR conference.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 29.4 Bn CAGR(2025-2034) 28.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Display Technology (OLED, LCD, LCoS, DLP, MicroLED, Others), By End-User (Enterprises, Consumer Electronics, Healthcare, Industrial, Military & Defense, Sports & Fitness, Others, Individuals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sony Corporation, Kopin Corporation, Himax Technologies, Inc., Microoled, Seiko Epson Corporation, Jade Bird Display (JBD), BOE Technology Group Co., Ltd., eMagin Corporation, Samsung Electronics Co., Ltd., LG Display Co., Ltd., Lumus Ltd., Vuzix Corporation, Syndiant, Inc., AU Optronics Corp., Innolux Corporation, Raontech Inc., WiseChip Semiconductor Inc., Plessey Semiconductors Ltd., Magic Leap, Inc., Goertek Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Glasses Microdisplay MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Glasses Microdisplay MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sony Corporation

- Kopin Corporation

- Himax Technologies, Inc.

- Microoled

- Seiko Epson Corporation

- Jade Bird Display (JBD)

- BOE Technology Group Co., Ltd.

- eMagin Corporation

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- Lumus Ltd.

- Vuzix Corporation

- Syndiant, Inc.

- AU Optronics Corp.

- Innolux Corporation

- Raontech Inc.

- WiseChip Semiconductor Inc.

- Plessey Semiconductors Ltd.

- Magic Leap, Inc.

- Goertek Inc.

- Others