Global Smart Fitness APPs Market By App Type (Activity Tracking, Diet & Nutrition, Workout & Exercise, Others), By Platform (Android, IOS), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123761

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

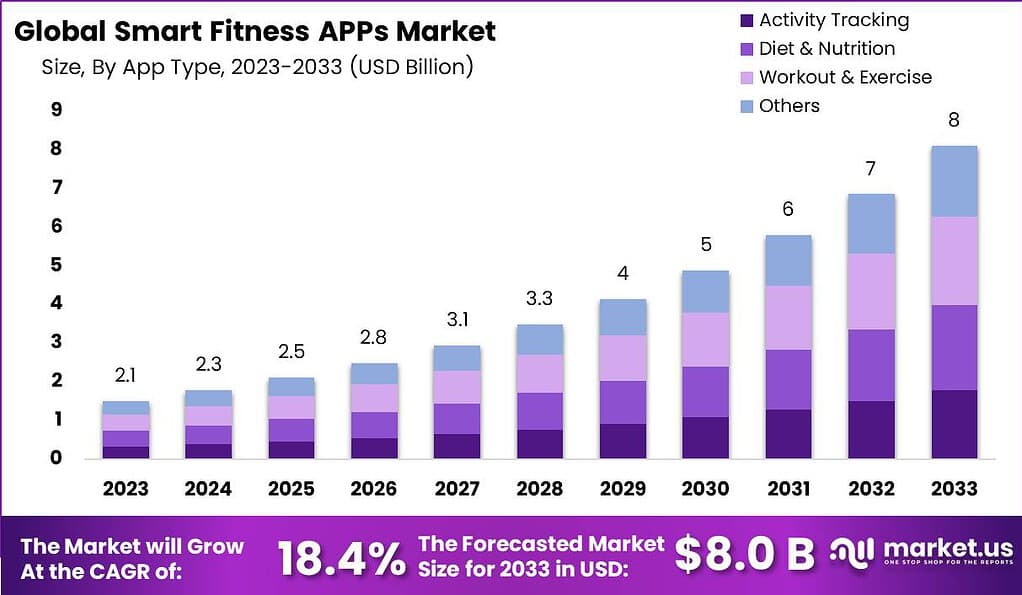

The Global Smart Fitness APPs Market size is expected to be worth around USD 8.0 Billion By 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 18.4% during the forecast period from 2024 to 2033.

The smart fitness apps are digital platforms designed to enhance user fitness through comprehensive tracking and personalized insights on physical activities. These apps, leveraging technologies such as AI, provide tailored fitness programs, diet recommendations, and even mental health advice, aligning well with the modern user’s needs for integrated health management. Users can access these features through smartphones and wearable devices, making fitness regimes more accessible and data-driven.

The smart fitness apps market refers to the industry centered around the development, distribution, and monetization of these fitness applications. This market has witnessed rapid expansion, primarily fueled by increasing health awareness among consumers and the widespread adoption of mobile technology. It encompasses a range of products from free applications offering basic features to premium versions with advanced functionalities.

One of the key growth factors for the smart fitness apps market is the rising awareness of health and fitness among people worldwide. In today’s fast-paced world, where sedentary lifestyles and chronic health issues are prevalent, individuals are actively seeking ways to improve their well-being. Smart fitness apps provide a convenient and accessible solution, allowing users to engage in personalized fitness activities at their own pace and convenience. The ease of access to these apps through smartphones and wearable devices has further contributed to their popularity.

Moreover, advancements in technology have enhanced the capabilities of smart fitness apps, making them more effective and user-friendly. With features like real-time workout tracking, virtual coaching, and personalized recommendations, these apps offer a tailored fitness experience to users. The integration of wearable devices, such as fitness bands and smartwatches, with these apps has also accelerated their adoption, as it allows for seamless data synchronization and comprehensive health monitoring.

According to a research report published in September 2020 by the World Economic Forum, there was a significant surge in global downloads of health and fitness apps, with an impressive growth rate of 46.0%. This remarkable increase is primarily attributed to the growing popularity of online fitness training, which has become a driving force behind the global market for smart fitness apps. Furthermore, the increasing awareness of fitness and mental well-being among individuals has contributed to the expansion of this market.

As per research data, the usage of fitness apps experienced substantial growth in 2023, with a staggering 368 million users recorded. This indicates a significant user base that is actively engaging with fitness apps to support their health and wellness goals. Furthermore, these apps witnessed an impressive download count of over 850 million times during the same year, highlighting the widespread adoption and popularity of fitness apps among individuals seeking fitness-related solutions.

According to Exercise, women represent a substantial 75% of the health and fitness app user base, indicating a crucial demographic focus for developers and marketers. The United States dominates the fitness app market, contributing over 30% of global revenue.

Geographically, the United States holds the largest market share in the fitness app industry, accounting for more than 30% of the global revenue generated. This indicates the prominence of the U.S. market and underscores the opportunities available for app developers and businesses to tap into this lucrative market segment.

In terms of revenue generation, a study conducted by Business of Apps reveals that over 55% of fitness app revenue comes from in-app purchases and subscriptions. This highlights the importance of providing valuable and enticing features and content that encourage users to subscribe or make in-app purchases. By offering premium features, personalized training programs, or exclusive content, app developers can enhance user engagement and monetize their apps effectively.

Moreover, integrating fitness apps with wearable devices proves to be a significant factor in driving user engagement and revenue growth. According to Jabil, fitness apps that seamlessly connect and synchronize with wearables experience a notable 15% increase in user engagement and revenue. This emphasizes the importance of leveraging wearable technology to enhance the user experience and provide accurate and real-time health and fitness data.

Key Takeaways

- The Global Smart Fitness Apps Market is projected to reach USD 8.0 Billion by 2033, up from USD 2.1 Billion in 2023, exhibiting a compound annual growth rate (CAGR) of 18.4% during the forecast period from 2024 to 2033.

- In 2023, the Workout & Exercise segment dominated the Smart Fitness Apps market, securing a share of over 28.4%.

- In 2023, the Android segment held a leading market position within the Smart Fitness Apps market, capturing more than 56.8% of the share.

- In 2023, North America held a dominant market position in the Smart Fitness Apps Market, capturing more than a 34.6% share, with revenues amounting to approximately USD 0.7 billion.

App Type Analysis

In 2023, the Workout & Exercise segment held a dominant position in the Smart Fitness Apps market, capturing more than a 28.4% share. This segment’s leadership is primarily due to the increasing consumer awareness regarding health and fitness, coupled with the rising popularity of personalized workout regimes accessible through mobile applications.

The integration of advanced features such as real-time performance tracking, virtual coaching, and tailored fitness plans that adapt to user feedback has significantly enhanced user engagement. These apps offer the convenience of planning and tracking workouts from home, appealing particularly during the fluctuations of in-person gym availability experienced in recent years.

Furthermore, the proliferation of wearable technology has synergistically expanded the reach and effectiveness of workout and exercise applications. Devices such as fitness bands and smartwatches can seamlessly connect with these apps, providing users with detailed insights into their physical activities and health metrics like heart rate, calorie burn, and sleep patterns. This integration enables a holistic approach to fitness, which is highly valued in today’s health-conscious society.

Additionally, social features such as community challenges, leaderboards, and social media sharing have been pivotal in promoting sustained app usage. These features not only motivate users by fostering a sense of community and competition but also help in retaining users long-term. As people continue to seek efficient and interactive ways to maintain their fitness, the Workout & Exercise apps are likely to sustain their leading position in the market by continually innovating and enhancing user experience.

Platform Analysis

In 2023, the Android segment held a dominant market position within the Smart Fitness Apps market, capturing more than a 56.8% share. This significant market share can be attributed to the widespread adoption of Android devices globally, due to their affordable pricing and wide range of models catering to various economic segments. Android’s open-source platform also allows developers greater flexibility and ease in app development and integration with various hardware, enhancing the appeal for app developers to prioritize Android compatibility.

Moreover, Android’s dominance is bolstered by its significant presence in emerging markets, where mobile penetration is rapidly increasing. These regions often exhibit a higher sensitivity to price, making Android devices a more feasible option for a larger population. Consequently, the availability of fitness apps on Android platforms meets a broad audience, effectively capitalizing on the growing health awareness and the burgeoning fitness culture in these economies.

In addition to its extensive reach, Android continually introduces user-friendly features and updates that improve the overall functionality and user experience of fitness apps. Features such as Google Fit integration enable a more cohesive health management ecosystem, which further drives user engagement and app retention rates. With ongoing innovations and a solid user base, the Android platform is likely to maintain its leading position in the smart fitness apps market.

Key Market Segments

By App Type

- Activity Tracking

- Diet & Nutrition

- Workout & Exercise

- Others

By Platform

- Android

- IOS

Driver

Growing Health Consciousness and Technological Advancements

A significant driver of the smart fitness apps market is the increasing health consciousness among consumers coupled with advancements in wearable technology. As more individuals prioritize fitness and well-being, there is a rising demand for apps that offer convenience and personalized fitness solutions.

Technological enhancements in wearable devices, which can sync seamlessly with these fitness apps, allow users to track real-time health metrics such as heart rate, calories burned, and sleep patterns. This integration provides a holistic view of one’s health, driving the adoption of fitness apps. Moreover, these apps utilize AI and data analytics to offer customized fitness and diet plans, further appealing to health-conscious users.

Restraint

Privacy and Security Concerns

A major restraint in the market growth of smart fitness apps is the concern over data privacy and security. Fitness apps collect a vast amount of personal health information, and users are becoming increasingly wary of how this data is handled and protected.

The risk of data breaches and unauthorized data sharing with third parties can deter potential users from adopting these apps, despite their benefits. Ensuring robust data protection measures and transparent privacy policies are critical challenges that developers must address to reassure users and promote wider adoption.

Opportunity

Expansion into Emerging Markets

There is a significant opportunity for the expansion of smart fitness apps into emerging markets, where smartphone penetration and internet connectivity are rapidly increasing. These markets present a largely untapped user base that is beginning to embrace digital health solutions.

Fitness app companies can capitalize on this trend by offering localized content, multi-language support, and features tailored to regional health and wellness preferences. Moreover, the lower cost of mobile data in these regions provides a conducive environment for the growth of mobile-first health solutions.

Major Challenge

Market Saturation and Differentiation

One of the major challenges facing the smart fitness apps market is the high level of market saturation and the difficulty of differentiating products in a crowded marketplace. With a plethora of apps offering similar functionalities, it becomes challenging for new entrants to stand out and for existing players to maintain their market share.

Companies need to innovate continually and offer unique features or specialized services that not only attract users but also retain them in the long term. This could involve leveraging cutting-edge technologies, integrating more personalized health tracking, or offering community-driven features that enhance user engagement.

Growth Factors

- Increasing Health Awareness: A surge in global health consciousness is driving the demand for fitness apps, as individuals seek convenient tools to monitor and enhance their fitness levels.

- Technological Advancements in Wearable Devices: The integration of fitness apps with wearable technology has significantly boosted their utility, allowing for real-time health monitoring and data analysis.

- Expansion of Mobile Connectivity: As more regions worldwide gain access to high-speed internet and smartphones, the potential user base for smart fitness apps continues to expand.

- Rise in Preventive Healthcare Measures: With an increase in lifestyle diseases, there is a growing trend towards preventive healthcare, which includes regular monitoring of vital health metrics through fitness apps.

- Customization and Personalization: Fitness apps are increasingly offering personalized workout and diet plans based on user data, which enhances user engagement and satisfaction.

Emerging Trends

- AI and Machine Learning: Fitness apps are incorporating AI to provide more personalized fitness coaching and predictive insights into health trends based on user data.

- Social Fitness: More apps are integrating social features that allow users to connect with friends, join challenges, and share their progress, making fitness more engaging and competitive.

- Holistic Health Focus: Beyond physical fitness, apps are expanding to include mental health exercises, meditation, and wellness tracking to offer a more comprehensive health management toolkit.

- Subscription Models: There is a growing trend towards subscription-based fitness apps, which offer exclusive content and features to subscribers, reflecting a shift in consumer willingness to pay for premium digital health services.

- Increased Use of Big Data: Fitness apps are using big data to analyze user trends and improve functionalities, as well as to provide insights to healthcare providers and businesses about population health trends.

Top Fitness Apps

- Future: Best for Personal Training- Future provides personalized training by pairing users with certified fitness professionals who create tailored workout programs. The app offers video demonstrations for exercises and daily follow-ups to track progress. However, the service comes at a premium cost of $199 per month.

- Peloton: Top Pick for Variety and Quality – Peloton offers a wide range of live and on-demand classes focusing on cardio, strength training, and more. It is well-integrated with Apple Watch for tracking metrics during workouts. The subscription costs $12.99 per month and provides access to high-quality exercise courses.

- Nike Training Club: Best Free Fitness App- Nike Training Club offers a rich variety of workouts for free, covering strength training, mobility, yoga, and more. It also provides premium content at a subscription fee, but the free version is comprehensive enough for many users.

- Strava: Best for Community Features– Strava is ideal for runners, cyclists, and swimmers who want to track their activities and engage with a community. It offers features like activity tracking, route discovery, and social sharing. A premium subscription unlocks additional training and analysis tools.

- Apple Fitness+: Best for Apple Users –Apple Fitness+ integrates seamlessly with Apple Watch and other Apple devices. It provides a wide range of workouts, including strength training, yoga, and meditation, with new sessions added weekly. It is free for the first three months with the purchase of an Apple Watch, and then $9.99 per month.

Regional Analysis

In 2023, North America held a dominant market position in the Smart Fitness Apps Market, capturing more than a 34.6% share, with revenues amounting to approximately USD 0.7 billion. This prominent stance can be attributed to several key factors. Primarily, the region’s high penetration of smartphones, coupled with widespread internet connectivity, provides an ideal ecosystem for smart fitness applications.

Additionally, the culture in North America places a strong emphasis on health and fitness, which fuels the demand for innovative digital solutions that can seamlessly integrate into users’ lifestyles. Moreover, North American consumers are typically early adopters of new technology, including health and fitness apps that incorporate the latest in AI and machine learning to offer personalized fitness coaching and health monitoring. This has encouraged a surge in app development and adoption.

The U.S. and Canada also host a vibrant startup culture, fostering a competitive environment that drives innovation in the smart fitness apps sector. With significant investments flowing into health tech, numerous companies in this region are pioneering advancements in app functionalities, further securing North America’s lead in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Smart Fitness Apps Market is fiercely competitive, with several key players driving innovation and market growth. Smart Fitness leads with its comprehensive app suite that integrates various fitness activities and health monitoring features. Their strategic partnerships and continuous investment in R&D help maintain their market prominence.

Another significant contributor is Sakar International, known for its user-friendly interfaces and engaging workout content. Their focus on motivational tools and community building distinguishes their offerings in a crowded market.

Kaia stands out with its focus on personalized fitness through AI, offering users a tailored workout experience that adapts to their individual health needs and fitness levels. This approach has garnered a loyal user base.

Freeletics excels in providing high-intensity interval training (HIIT) programs with minimal equipment requirements, making it popular among users who prefer home workouts. Their app also features strong social connectivity that encourages community engagement.

Top Key Players in the Market

- Smart Fitness

- Sakar International

- Kaia

- Freeletics

- Abvio

- Digifit

- Fitbit

- Map My Run

- TRX

- Fitbod

Recent Developments

- January 2024: Kaia Health launched a new version of its digital therapeutics app for musculoskeletal conditions. This version includes advanced features such as real-time motion tracking and AI-driven feedback to improve exercise accuracy and effectiveness.

- October 2023: Fitbit, a prominent player in the fitness app market, launched a new advanced health and wellness app that integrates AI for personalized health insights. This app aims to provide users with customized workout plans and real-time health monitoring capabilities.

- March 2023: Freeletics introduced a new AI-powered fitness coach feature in their app. This update allows the app to deliver highly personalized fitness routines and diet plans based on user data and preferences, enhancing user engagement and effectiveness of workouts.

- June 2023: Sakar International announced the acquisition of a fast-growing fitness app startup to expand its portfolio in the digital fitness space. This strategic move aims to enhance Sakar’s market presence and technological capabilities in the smart fitness sector.

- November 2023: Under Armour, the parent company of Map My Run, released a significant update to the app, introducing social fitness challenges and enhanced GPS tracking features. This update is designed to boost user engagement by fostering community interaction and competition.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Bn Forecast Revenue (2033) USD 8 Bn CAGR (2024-2033) 18.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By App type- Activity Tracking, Diet & Nutrition, Workout & Exercise, Others. By platform- Android, IOS. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Smart Fitness, Sakar International, Kaia, Freeletics, Abvio, Digifit, Fitbit, Map My Run, TRX, Fitbod Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Smart Fitness

- Sakar International

- Kaia

- Freeletics

- Abvio

- Digifit

- Fitbit

- Map My Run

- TRX

- Fitbod