Global Smart Factory Connectivity Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Connectivity Type (Wired, Wireless, Hybrid), By Application (Process Automation, Asset Management, Remote Monitoring, Predictive Maintenance, Others), By End-Use Industry (Automotive & Transportation, Semiconductor & Electronics, Food & Beverage & Pharmaceuticals, Chemical & Energy, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172327

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- China Market Size

- Component Analysis

- Connectivity Type Analysis

- Application Analysis

- End-Use Industry Analysis

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

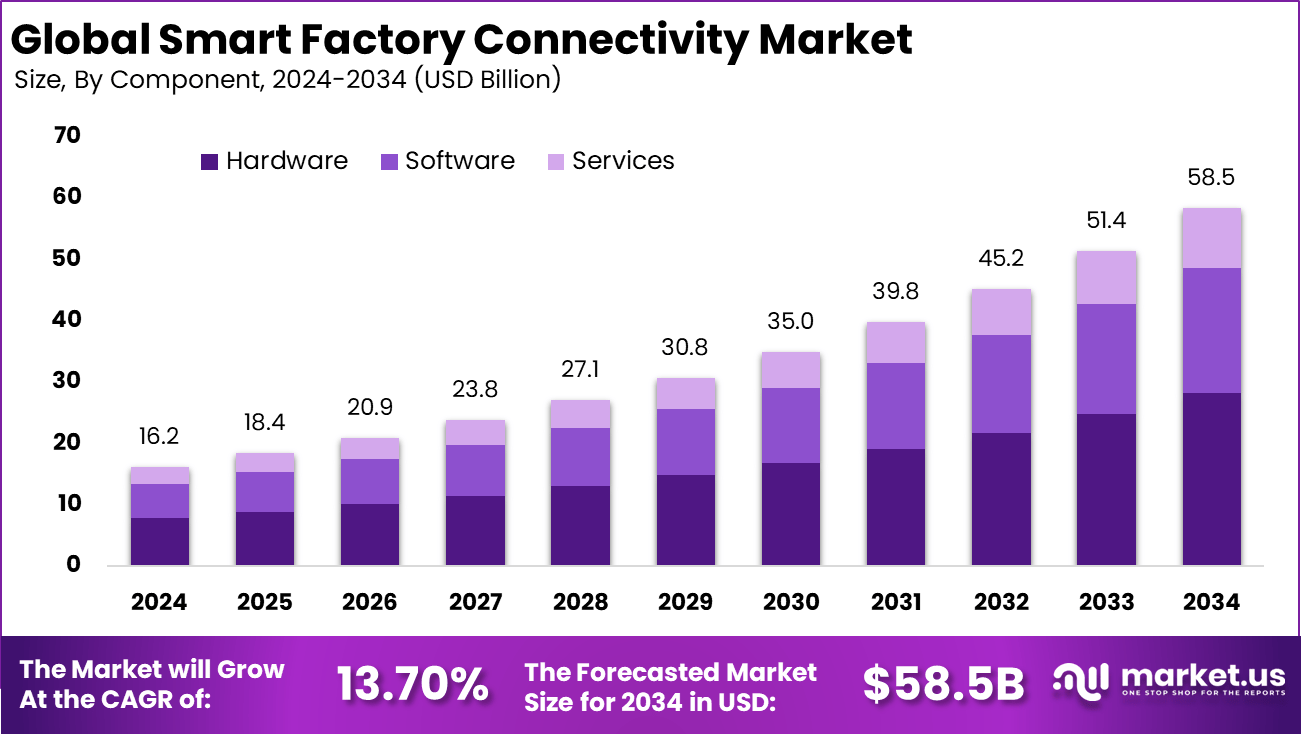

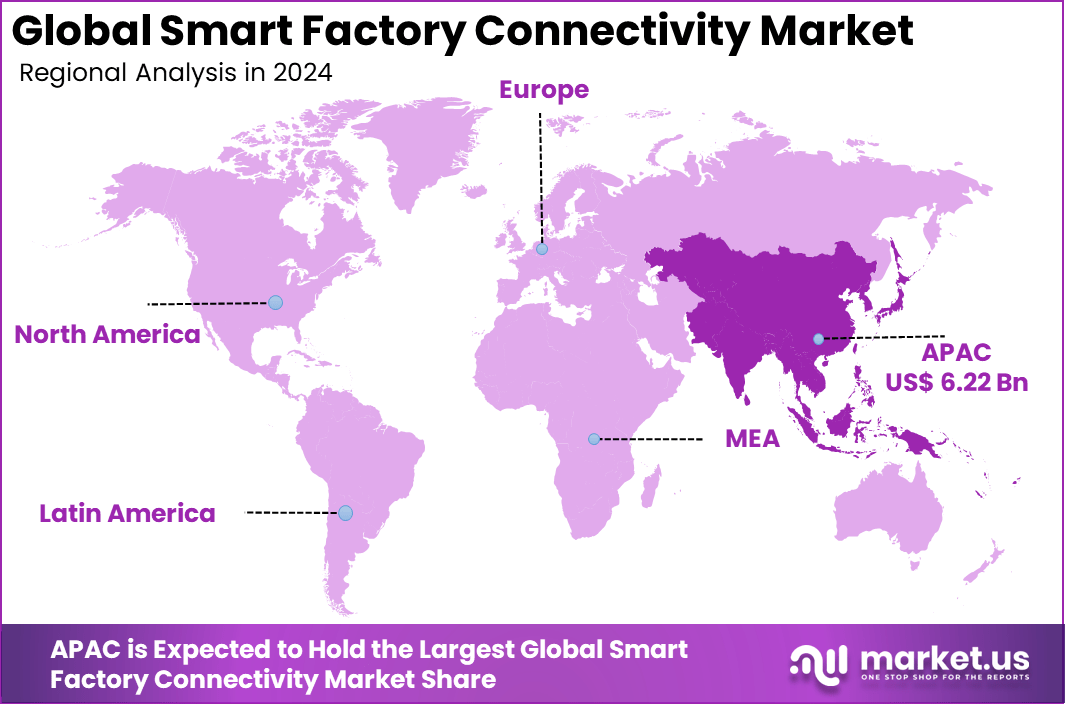

The Global Smart Factory Connectivity Market size is expected to be worth around USD 58.5 billion by 2034, from USD 16.2 billion in 2024, growing at a CAGR of 13.70% during the forecast period from 2025 to 2034. Asia Pacific held a dominant market position, capturing more than a 38.4% share, holding USD 6.22 billion in revenue.

The Smart Factory Connectivity Market refers to the technologies and solutions that enable real-time communication among machines, systems, and people within manufacturing facilities. Connectivity forms the backbone of smart manufacturing by linking industrial equipment through wired, wireless, and hybrid networks. These connected systems support data exchange that drives automation, monitoring, and analytics across production operations.

Connectivity solutions are central to transforming traditional factories into highly digital and responsive environments aligned with Industry 4.0 principles. Smart factory connectivity integrates sensors, industrial Internet of Things (IIoT) devices, and communication protocols to ensure seamless machine-to-machine and system-to-system interaction. This integration allows for predictive decision making and improved operational efficiency in automated production settings.

Demand for smart factory connectivity is driven by manufacturers’ needs to improve productivity and reduce operational costs. Connectivity enables real-time data collection that informs production planning, quality control, and supply chain optimisation. Manufacturers are increasingly adopting connected technologies to respond quickly to market demand and competitive pressures.

For instance, in October 2025, Rockwell Automation unveiled over 30 new products at Automation Fair 2025, including edge AI tools for seamless factory connectivity. These launches focus on integrating OT data with cloud analytics, helping plants go from reactive to predictive operations without massive overhauls.

Key Takeaway

- In 2024, the Hardware segment captured a 48.2% share of the Global Smart Factory Connectivity Market.

- In 2024, the Wired segment captured a 67.5% share of the Global Smart Factory Connectivity Market.

- In 2024, the Process Automation segment captured a 32.2% share of the Global Smart Factory Connectivity Market.

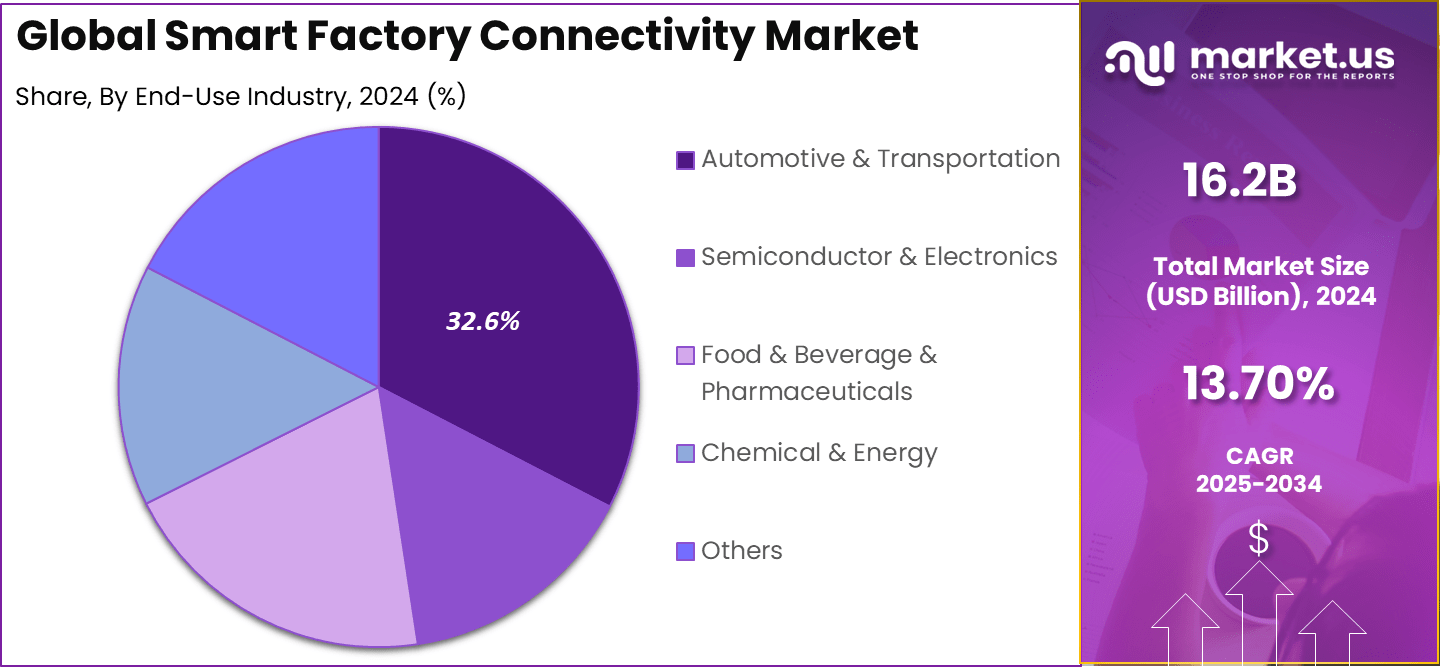

- In 2024, the Automotive and Transportation segment captured a 32.6% share of the Global Smart Factory Connectivity Market.

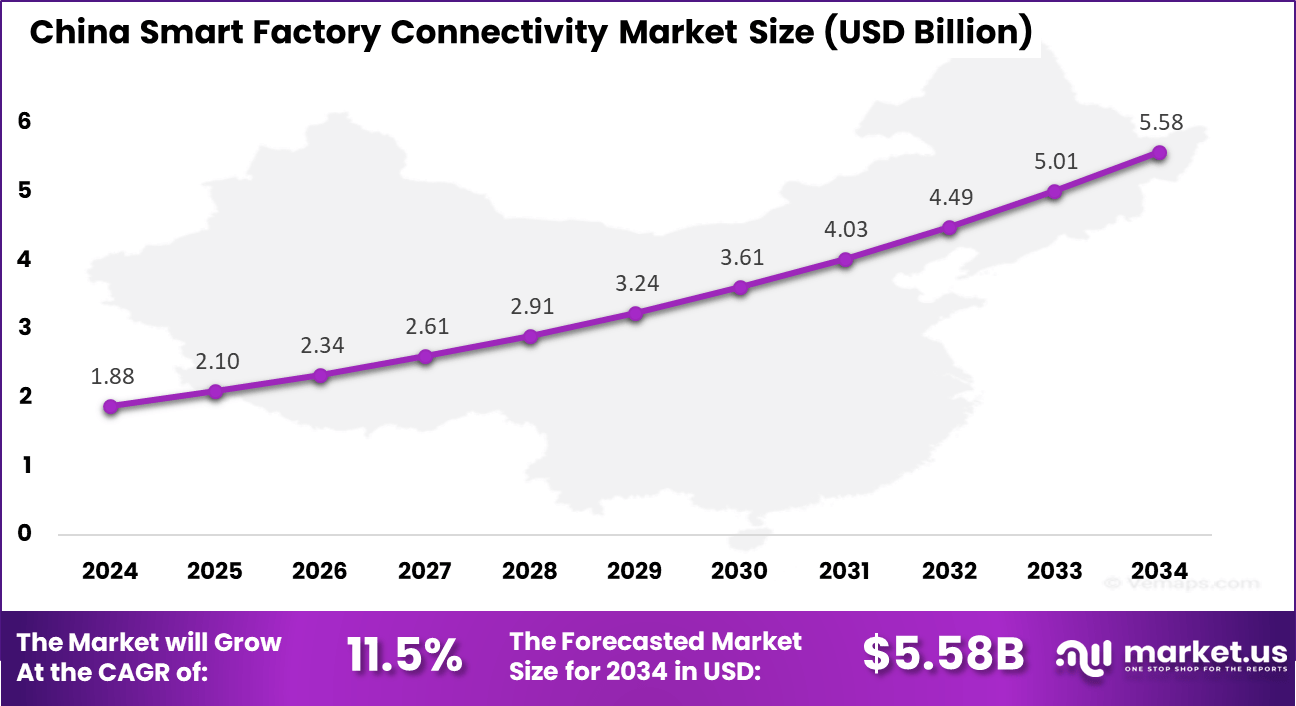

- In 2024, the China Smart Factory Connectivity Market was valued at USD 1.88 billion, with a growth rate of 11.5%.

- In 2024, Asia Pacific held more than a 38.4% share of the Global Smart Factory Connectivity Market.

Quick Market Facts

Key Statistics on Adoption and Growth

- 57% of manufacturers use cloud computing and data analytics.

- 46% of manufacturers use Industrial IoT solutions.

- 42% of manufacturers already use 5G for connectivity.

- Global cellular IoT connections grew by 16% year over year in 2024.

- 5G chipsets are expected to drive future growth in industrial connectivity.

Impact and Benefits

- AI and machine learning enable productivity gains of 20% to 30% in manufacturing operations.

- Connected devices reduce maintenance costs by 10% to 20%.

- Connected systems increase operational productivity by 5% to 10%.

- 75% of advanced manufacturers use digital twin technology.

- Digital twins reduce maintenance costs by 13%.

- Digital twins improve operational efficiency by 15%.

China Market Size

The market for Smart Factory Connectivity within China is growing tremendously and is currently valued at USD 1.88 billion, the market has a projected CAGR of 11.5%. The market is growing due to heavy investments in Industry 4.0 upgrades across manufacturing hubs. Factories adopt sensors and wired networks to link machines for real-time data, cutting downtime and waste.

Government policies push digital transformation, training workers for connected plants. The automotive and electronics sectors lead, demanding precise automation to meet global orders faster. Local tech firms speed rollouts, building resilient supply chains that adapt to shifts smoothly.

For instance, in November 2025, Huawei unveiled Xinghe Intelligent Fabric 2.0 at Connect 2025, featuring AI-centric networking with high-speed interconnects and DPUs to power massive AI clusters in Chinese smart factories, reinforcing China’s connectivity dominance.

In 2024, Asia Pacific held a dominant market position in the Global Smart Factory Connectivity Market, capturing more than a 38.4% share, holding USD 6.22 billion in revenue. This dominance is due to massive manufacturing bases in countries like China and India upgrading to connected systems.

Factories install sensors and wired networks to sync operations, slashing downtime amid rising global demand. Governments fund Industry 4.0 shifts, training workers for digital lines. Automotive and electronics plants lead, linking robots and controls for faster, error-free output that keeps exports competitive.

For instance, in October 2025, Mitsubishi Electric launched the next-generation GOT3000 HMI series, enhancing smart factory connectivity through seamless integration with CC-Link IE TSN networks and IT systems for real-time data visualization and control. This development strengthens the Asia Pacific’s manufacturing ecosystem by enabling efficient digital transformation across production lines.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 48.2% share of the Global Smart Factory Connectivity Market. Sensors and gateways sit at the heart of operations, capturing data from every machine on the floor. These rugged devices withstand harsh factory conditions like vibrations and extreme temperatures. They enable real-time monitoring that helps managers spot wear early and keep lines running without surprises.

Factories rely on this solid foundation to link physical assets with digital systems seamlessly. The focus stays on reliability, as downtime costs add up fast in competitive manufacturing. This hardware edge comes from its proven track record in demanding environments. Controllers and edge devices process data right where it’s generated, cutting delays in decision-making.

Workers see live feeds on dashboards, adjusting processes on the spot. Upgrades often start here because swapping out old sensors brings quick wins in efficiency. Manufacturers prioritize hardware that integrates easily with existing setups. Over time, this builds a network that scales as factories grow smarter step by step.

For Instance, in November 2025, Rockwell Automation showcased new hardware at Automation Fair, focusing on sensors and controllers for factory floors. These devices link machines directly to business systems, helping managers track performance live. The setup cuts data gaps between shop floors and offices, making daily decisions sharper.

Connectivity Type Analysis

In 2024, the Wired segment held a dominant market position, capturing a 67.5% share of the Global Smart Factory Connectivity Market. Ethernet cables and fieldbus systems push data quickly without dropouts, even amid electrical noise. Robots and conveyors depend on this steady flow to sync perfectly during high-speed runs. Factories choose wired for zones where every millisecond counts, like precision welding or assembly. It reduces risks from interference that could halt production lines unexpectedly.

The strength of wired setups lies in their low latency and high bandwidth for heavy data loads. Maintenance teams trust them for long cable runs across large plants without signal loss. While wireless gains ground, wired remains the backbone for core operations. Engineers often mix both, using wired as the reliable spine. This approach ensures smooth data exchange between machines and central controls every shift.

For instance, in November 2024, Schneider Electric launched next-gen industrial gateways for edge-to-cloud links via wired networks. These handle heavy data flows in noisy plants, keeping connections solid during peak runs. Teams rely on them for steady robot syncs across shifts.

Application Analysis

In 2024, The Process Automation segment held a dominant market position, capturing a 32.3% share of the Global Smart Factory Connectivity Market. Sensors feed data to controls that tweak speeds and feeds automatically, matching demand shifts. This cuts waste as materials move efficiently through stages without manual tweaks. Operators gain oversight via simple interfaces, stepping in only when needed. The result shows fewer errors and steadier output across batches, large or small.

Its appeal grows from handling complex sequences like mixing or forming with precision. Feedback loops detect drifts early, keeping quality consistent without constant checks. Factories in batch production see the biggest gains, as automation adapts recipes on the fly. Teams train quickly on these systems, boosting overall plant responsiveness. Over months, it transforms rigid lines into flexible ones ready for varied orders.

For Instance, in October 2025, Schneider Electric debuted the CONNECT software for process intelligence, blending data and AI in automation loops. Factories streamline sequences with feedback that spots drifts early. Teams handle complex batches smoothly, saving time daily.

End-Use Industry Analysis

In 2024, The Automotive & Transportation segment held a dominant market position, capturing a 32.6% share of the Global Smart Factory Connectivity Market. Connectivity links vision cameras, robotic arms, and part trackers for flawless sequencing. Just-in-time delivery thrives as systems alert on delays instantly. Plants churn out vehicles faster with fewer defects, meeting tight consumer timelines. This sector pushes connectivity hardest, as one glitch ripples through the entire chain.

The drive comes from high-volume runs demanding zero tolerance for faults. Supply chain visibility ensures parts arrive precisely when needed, avoiding stockpile costs. Workers collaborate better with real-time stats on handheld devices. Safety improves as connected systems flag hazards before incidents occur. These industries set the pace, pulling others along with proven connectivity gains in speed and accuracy.

For Instance, in November 2025, SAP expanded its Industry Network for automotive supply chains, connecting factory automation to transport tracking. Suppliers share data seamlessly, ensuring parts flow without delays. This boosts responsiveness in fast-paced vehicle production.

Emerging Trend Analysis

The Smart Factory Connectivity Market is witnessing the adoption of edge computing as a key trend that enhances real-time data processing within manufacturing environments. Edge computing enables devices and sensors to process information locally, reducing latency and dependence on central data centers. Manufacturers are leveraging this capability to improve machine responsiveness and support time-sensitive operations.

Another emerging trend is the deployment of private 5G networks within factory premises to support high-bandwidth, low-latency communication among connected devices. Private 5G networks provide stable and secure communication channels that accommodate a growing number of industrial IoT devices. This trend is driven by the need for reliable wireless connectivity that can support advanced automation and remote control systems.

Driver Analysis

Market growth is driven by the rising demand for automation and data-driven decision making in manufacturing operations. Smart factories require robust connectivity frameworks to integrate machines, sensors, and control systems into a cohesive network. This connectivity allows real-time monitoring of equipment performance, predictive maintenance scheduling, and optimization of production processes. As manufacturers prioritize efficiency and uptime, investment in connectivity solutions is increasing.

Another driver is the increasing adoption of industrial IoT devices that generate large volumes of data requiring seamless transfer and analysis. Connectivity solutions enable secure and high-speed data flow between IoT endpoints and central analytics platforms. This capability supports advanced applications such as condition-based monitoring and adaptive process control. As IoT deployment grows across facilities, demand for sophisticated connectivity infrastructure continues to rise.

Restraint Analysis

One restraint in the Smart Factory Connectivity Market is the challenge of ensuring cybersecurity across highly connected environments. As more devices become networked, the risk of unauthorized access and data breaches increases. Manufacturers must invest in advanced security protocols and monitoring tools to safeguard sensitive information and maintain system integrity. These security requirements can add complexity and cost to connectivity implementations.

Another restraint is the need for significant initial capital investment to deploy comprehensive connectivity solutions. Establishing robust networks, integrating legacy equipment, and configuring edge and cloud infrastructures require substantial financial resources. Smaller manufacturers with limited budgets may delay or scale back connectivity projects due to cost constraints. This factor slows market adoption in price-sensitive segments.

Opportunity Analysis

A key opportunity lies in the development of standardized connectivity protocols that can support interoperability among diverse devices and systems. Standardization efforts can reduce integration complexity and enable seamless communication across equipment from multiple vendors. This harmonization can accelerate smart factory deployments and reduce operational friction. As standards mature, connectivity solutions are expected to deliver greater value and simplify implementation.

Another opportunity is the integration of artificial intelligence and machine learning with connectivity frameworks to support autonomous decision making. AI-enabled connectivity can analyze real-time data streams and quickly adjust production parameters to optimize output quality and minimize downtime. This capability enhances overall operational resilience and paves the way for fully autonomous manufacturing ecosystems. Demand for AI integrated connectivity solutions is expected to expand as manufacturers seek competitive advantages.

Challenge Analysis

A notable challenge for the market is bridging the gap between legacy systems and modern connectivity infrastructure. Many existing factories operate older machines that lack built-in connectivity interfaces. Retrofitting these systems to communicate with advanced networks is technically complex and may require custom solutions. This challenge can delay full smart factory transformation and increase implementation effort.

Another challenge is managing the complexity of large-scale connected networks that span multiple facilities and geographic locations. Coordinating data flow, maintaining consistent performance, and ensuring secure access across distributed environments requires sophisticated network management tools and expertise. Without effective governance frameworks, connectivity efforts may lead to inefficiencies and operational bottlenecks.

Key Market Segments

By Component

- Hardware

- Connectivity Devices

- Network Interface Controllers (NICs) & Chipsets

- Software

- Network Management & Security Software

- Industrial Communication Stacks & SDKs

- Data Connectivity Platforms & Middleware

- Services

- Network Design, Consulting & Integration

- Managed Services & Security-as-a-Service

By Connectivity Type

- Wired

- Wireless

- Hybrid

By Application

- Process Automation

- Asset Management

- Remote Monitoring

- Predictive Maintenance

- Others

By End-Use Industry

- Automotive & Transportation

- Semiconductor & Electronics

- Food & Beverage & Pharmaceuticals

- Chemical & Energy

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Siemens AG, Rockwell Automation, Schneider Electric, ABB Ltd., and Honeywell International Inc. lead the smart factory connectivity market with industrial networking, edge connectivity, and automation platforms. Their solutions enable real time data exchange between machines, control systems, and enterprise applications. These companies focus on reliability, cybersecurity, and interoperability across OT and IT layers. Rising adoption of Industry 4.0 continues to reinforce their leadership.

Mitsubishi Electric Corporation, Emerson Electric Co., General Electric Company, Cisco Systems, Inc., Bosch Rexroth AG, Yokogawa Electric Corporation, and FANUC Corporation strengthen the market with industrial Ethernet, wireless connectivity, and connected robotics. Their technologies support low latency communication, predictive maintenance, and flexible production lines. These providers emphasize deterministic networking and seamless integration with automation assets.

Advantech Co., Ltd., Hewlett Packard Enterprise, Intel Corporation, SAP SE, PTC Inc., Oracle Corporation, Huawei Technologies Co., Ltd., and Dassault Systems expand the landscape with edge computing, industrial IoT platforms, and digital twin connectivity. Their offerings help manufacturers connect factory data to analytics and business systems. Increasing focus on real time visibility and data driven operations continues to drive steady growth in smart factory connectivity.

Top Key Players in the Market

- Siemens AG

- Rockwell Automation

- Schneider Electric

- ABB Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- General Electric Company

- Cisco Systems, Inc.

- Bosch Rexroth AG

- Yokogawa Electric Corporation

- FANUC Corporation

- Advantech Co., Ltd.

- Hewlett Packard Enterprise (HPE)

- Intel Corporation

- SAP SE

- PTC Inc.

- Oracle Corporation

- Huawei Technologies Co., Ltd.

- Dassault Systems

- Others

Recent Developments

- In November 2025, Siemens AG joined the Alliance for OpenUSD alongside Schneider Electric and AVEVA to push digital twins and 3D modeling standards. The move aims to create seamless connectivity across factory systems, making AI-driven simulations more accessible and speeding up the smart factory.

- In October 2025, Rockwell Automation unveiled over 30 new products at Automation Fair 2025, including edge AI tools for seamless factory connectivity. These launches focus on integrating OT data with cloud analytics, helping plants go from reactive to predictive operations without massive overhauls.

Report Scope

Report Features Description Market Value (2024) USD 16.2 Bn Forecast Revenue (2034) USD 58.5 Bn CAGR(2025-2034) 13.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Connectivity Type (Wired, Wireless, Hybrid), By Application (Process Automation, Asset Management, Remote Monitoring, Predictive Maintenance, Others), By End-Use Industry (Automotive & Transportation, Semiconductor & Electronics, Food & Beverage & Pharmaceuticals, Chemical & Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, Rockwell Automation, Schneider Electric, ABB Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Emerson Electric Co., General Electric Company, Cisco Systems, Inc., Bosch Rexroth AG, Yokogawa Electric Corporation, FANUC Corporation, Advantech Co., Ltd., Hewlett Packard Enterprise (HPE), Intel Corporation, SAP SE, PTC Inc., Oracle Corporation, Huawei Technologies Co., Ltd., Dassault Systems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Factory Connectivity MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Factory Connectivity MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- Rockwell Automation

- Schneider Electric

- ABB Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- General Electric Company

- Cisco Systems, Inc.

- Bosch Rexroth AG

- Yokogawa Electric Corporation

- FANUC Corporation

- Advantech Co., Ltd.

- Hewlett Packard Enterprise (HPE)

- Intel Corporation

- SAP SE

- PTC Inc.

- Oracle Corporation

- Huawei Technologies Co., Ltd.

- Dassault Systems

- Others