Global Smart Contracts in Rental Market Size, Share, Industry Analysis Report By Blockchain Type (Public Blockchain, Private Blockchain, Hybrid Blockchain), By Platform (Ethereum, Solana, Cardano, BNB Smart Chain, Others), By Contract Type (Decentralized Autonomous Organizations (DAOs), Tokenized Asset Contracts, Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156475

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

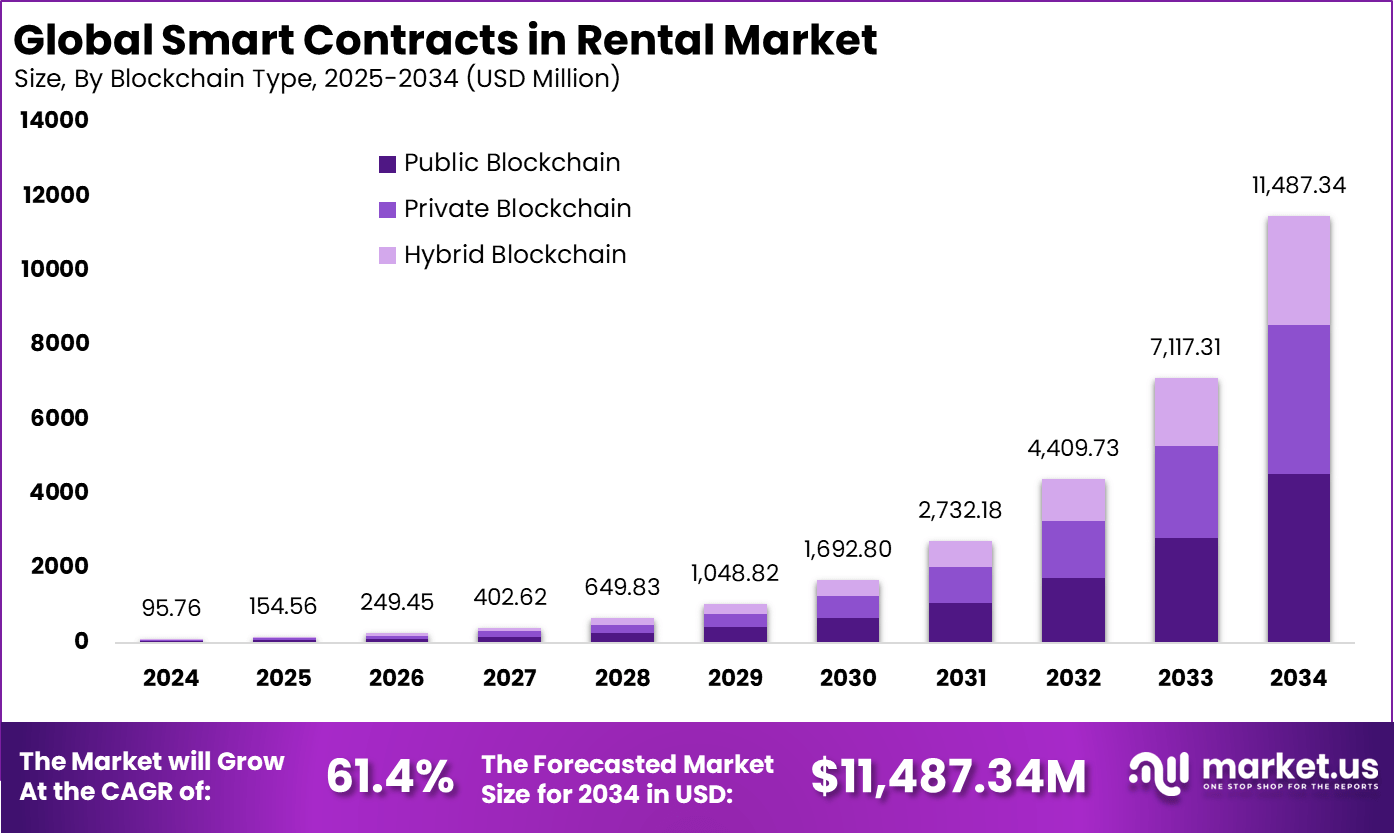

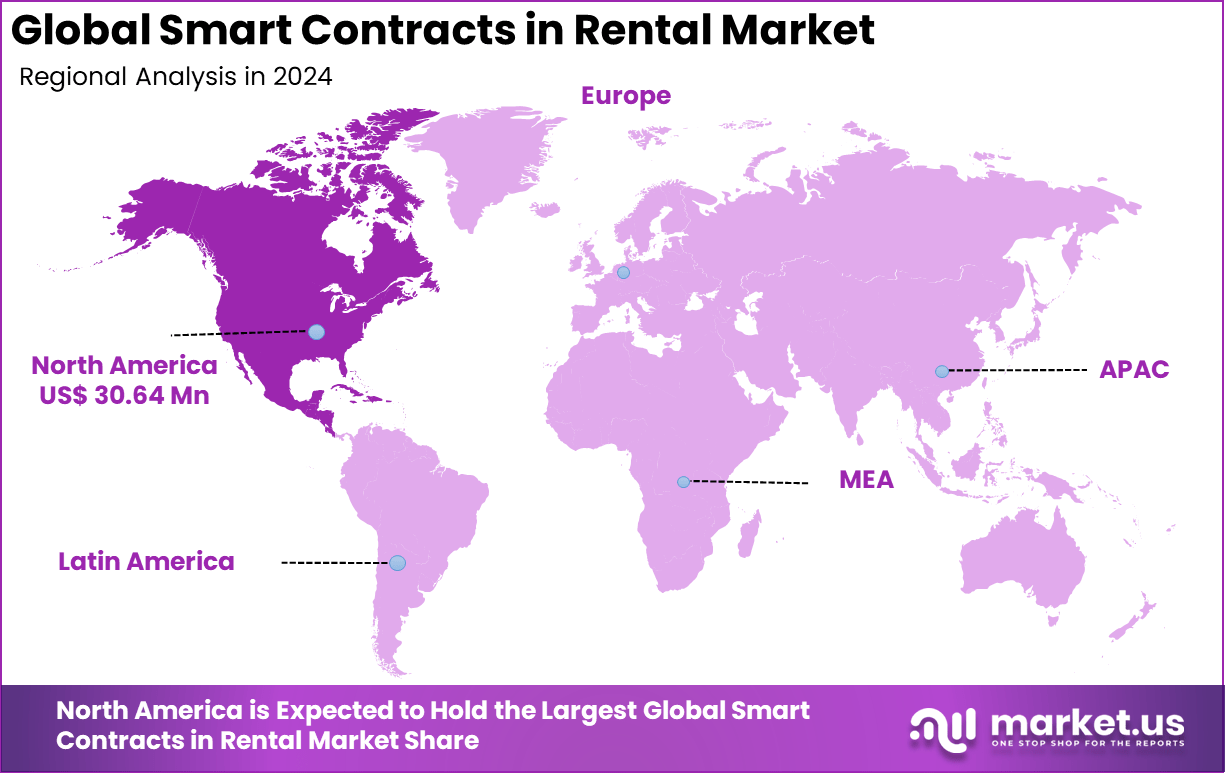

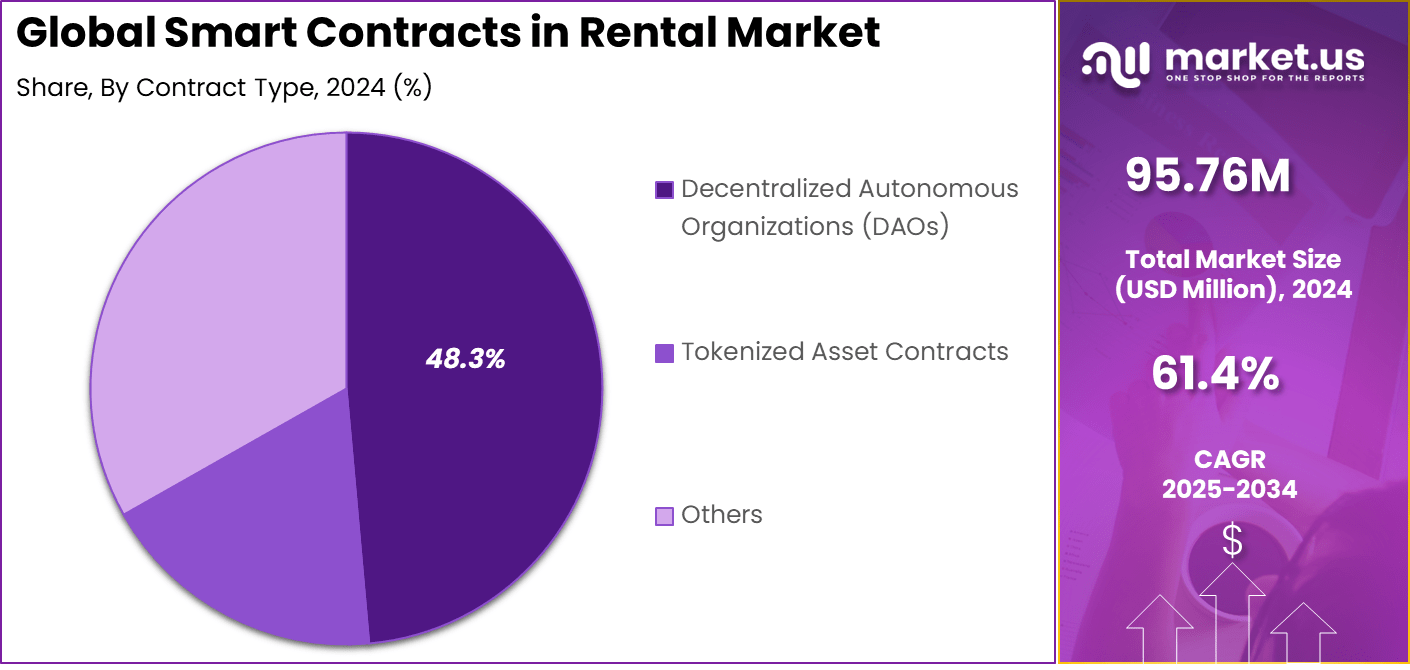

The Global Smart Contracts in Rental Market size is expected to be worth around USD 11,487.34 million by 2034, from USD 95.76 million in 2024, growing at a CAGR of 61.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32% share, holding USD 30.64 million in revenue.

Smart contracts in the rental market are self-executing agreements recorded on distributed ledgers that automate the lease lifecycle, including identity checks, agreement formation, payment scheduling, deposit handling, access control, and end-of-tenancy settlement. Their enforceability as “smart legal contracts” under existing law has been affirmed in England and Wales, while major industry analyses describe clear time and cost benefits for leasing workflows when blockchain is applied.

Top driving factors include renters’ digital behavior and the need for faster, more transparent payments and deposits. Recent renters searched primarily on mobile, with 75% using mobile websites and 64% using apps. More than half of tenants prefer to pay rent online and 77% cite ease and speed. Although deposit disputes affect fewer than 1% of protected deposits, adjudications still numbered 36,609 in one year, and consumer awareness remains weak, which sustains demand for automation and objective rules.

According to Market.us, The Global Smart Contracts Market is set to grow rapidly as blockchain adoption accelerates across industries. Valued at nearly USD 1.9 Billion in 2024, the market is projected to expand to about USD 14.9 Billion by 2033, advancing at a strong CAGR of 25.8% during the forecast period. This expansion is being driven by increasing demand for automation, transparency, and security in digital transactions, with smart contracts enabling trustless execution of agreements across finance.

Key Takeaway

- In 2024, the Public Blockchain segment dominated with a 39.4% share, reflecting trust in transparent and decentralized systems for rental agreements.

- The Ethereum segment held the leading position with a 52.7% share, underlining its role as the most widely used blockchain for smart contract deployment.

- Decentralized Autonomous Organizations (DAOs) captured 48.3% share, showing strong traction for community-driven and automated governance in rental ecosystems.

- The Large Enterprises segment led with a 72.9% share, driven by their capacity to adopt blockchain-based rental solutions at scale.

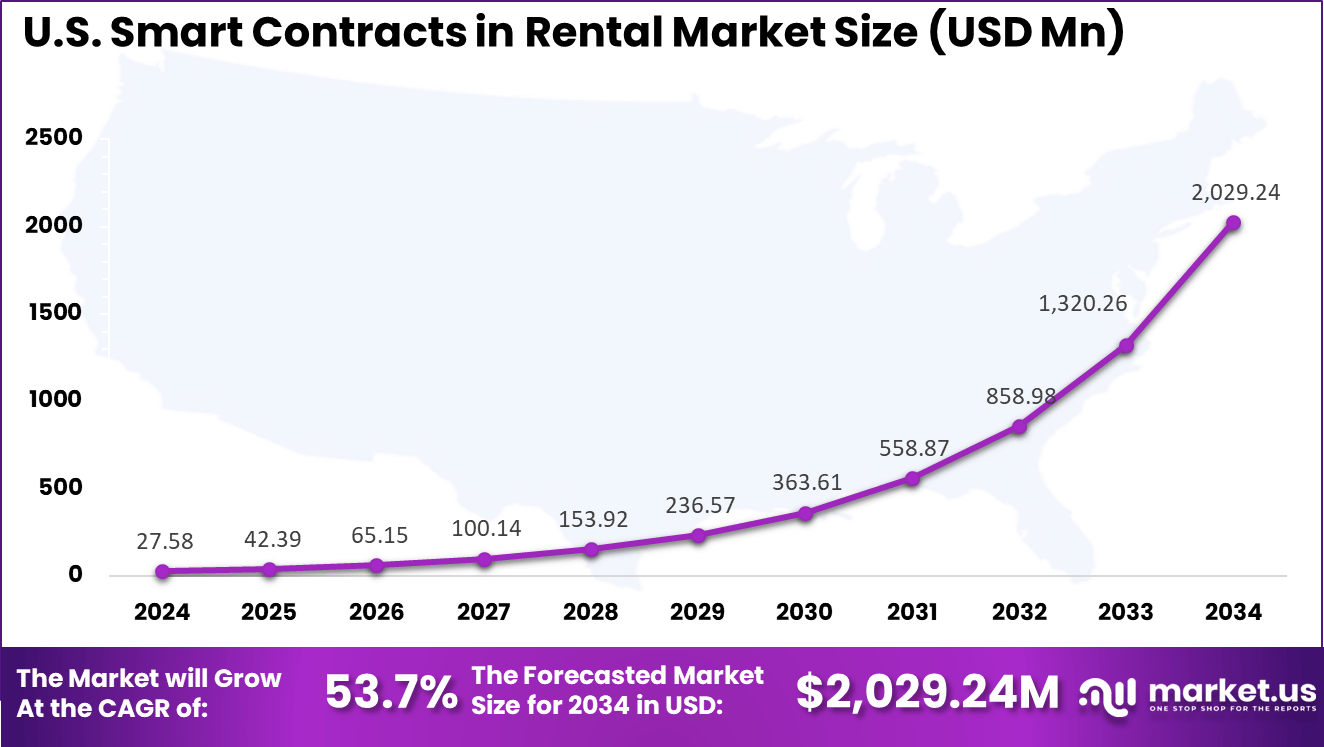

- The U.S. market was valued at USD 27.58 Million in 2024, projected to expand at a strong CAGR of 53.7%.

- North America dominated regionally, securing over 32% share of the global market in 2024.

U.S. Market Size

The market for Smart Contracts in Rental within the U.S. is growing tremendously and is currently valued at USD 27.58 million, the market has a projected CAGR of 53.7%. The market is rapidly expanding due to a growing need for efficiency, security, and transparency in real estate transactions.

As blockchain technology becomes more widely adopted, landlords and tenants are increasingly turning to automated solutions to simplify processes like rent payments, lease agreements, and property management. This demand, coupled with rising investments and digital transformation in the real estate sector, is driving significant growth.

For instance, in February 2025, RealNoi’s launch of a blockchain platform managing $570 million in rental income showcases the growing dominance of the U.S. region in the adoption of smart contracts in rental markets. This platform uses blockchain technology to enhance transparency, reduce transaction costs, and automate rental income management.

In 2024, North America held a dominant market position in the Global Smart Contracts in Rental Market, capturing more than a 32% share, holding USD 30.64 million in revenue. This dominance is due to its early adoption of blockchain technology and a highly developed real estate sector.

The region benefits from a strong regulatory framework, advanced infrastructure, and a growing demand for automation and digital solutions in property management. Additionally, the increasing focus on reducing transaction costs, improving security, and enhancing transparency in rental agreements has driven widespread adoption of smart contracts in North America.

Blockchain Type Analysis

Public blockchains hold a significant 39.4% share in the rental market’s adoption of smart contracts. Their popularity comes from the transparency and openness they offer, as any participant can verify transactions without the need for intermediaries. This feature is particularly important in rental applications where trust between tenants and property owners is often a challenge.

The inherent security of public blockchains helps reduce disputes and ensures that rental agreements cannot be altered once deployed. The growing preference for public blockchains highlights tenants’ and property owners’ confidence in decentralized verification.

However, scalability and transaction cost issues remain barriers for larger-scale adoption. Despite these challenges, their share indicates that decentralized trust and auditability are becoming key factors in driving demand, especially within peer-to-peer rental models and cross-border leasing.

For Instance, in January 2022, Coldwell Banker announced its plan to use public blockchain technology to tokenize real estate, a development that significantly impacts the use of smart contracts in the rental market. By leveraging the transparency and security of public blockchains, the company aims to streamline property transactions, including rental agreements.

Platform Analysis

Ethereum accounts for 52.7% of smart contract usage in the rental market, making it the leading platform in this segment. Its dominance is largely due to its established ecosystem, developer community, and advanced smart contract capabilities that provide flexibility for building secure rental agreements. Ethereum’s high adoption among startups and property tech firms reflects its reliability and long track record in decentralized applications.

At the same time, Ethereum’s position is supported by a wide array of tools and decentralized finance (DeFi) integrations that can be applied in rental payments, deposits, and automated settlement. That said, ongoing network congestion and transaction costs have driven some market participants to explore alternatives. Still, Ethereum remains the benchmark platform for most rental market applications, and its share demonstrates that maturity and trustworthiness outweigh performance limitations for now.

For instance, in August 2025, the Ethereum platform continues to play a crucial role in the real estate sector, particularly in rental markets, through its support for blockchain-based smart contracts. Ethereum’s robust and scalable infrastructure enables the secure automation of rental agreements, including rent payments, lease renewals, and property management.

Contract Type Analysis

DAOs represent 48.3% of the contract type adoption in the rental sector, signaling a gradual shift toward community-driven and decentralized governance in property management. The main advantage of DAOs is the ability to collectively manage rental assets, agree on terms, and automate decision-making without centralized intermediaries. This approach appeals particularly to investment groups and co-living operators who want transparent mechanisms for handling shared property rights and income distribution.

The increasing share for DAOs shows that property owners and investors are beginning to see value in pooling resources transparently and distributing returns through pre-set rules. While regulatory uncertainty around DAOs remains, their adoption in the rental market suggests a growing interest in collaborative ownership structures.

For Instance, in July 2021, the concept of using Ethereum tokens to create a decentralized rent-to-own network was introduced, highlighting the role of Decentralized Autonomous Organizations (DAOs) and smart contracts in real estate. By leveraging blockchain technology, this approach enables transparent and automated property transactions without the need for intermediaries.

Enterprise Size Analysis

Large enterprises dominate adoption, with 72.9% of smart contract use in the rental market coming from them. This leadership is largely a result of their ability to invest in advanced blockchain solutions and integrate them into existing property management systems.

For multinational leasing companies, smart contracts provide efficiency in managing large rental portfolios, reducing paper-based agreements, and ensuring timely automations for rent collection and maintenance scheduling.

This high share also reflects enterprise priorities around reducing legal disputes and enhancing compliance in rental transactions. Large firms are motivated by cost savings over time, transparency with clients, and integration opportunities with enterprise resource planning (ERP) systems.

For Instance, in June 2024, Vairt highlighted the growing importance of blockchain technology and fractional ownership in real estate, particularly for large organizations utilizing smart contracts in rental markets. By enabling fractional ownership through tokenized assets, large enterprises can streamline property investments and rentals, offering greater flexibility and access to capital.

Key Market Segments

By Blockchain Type

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

By Platform

- Ethereum

- Solana

- Cardano

- BNB Smart Chain

- Others

By Contract Type

- Decentralized Autonomous Organizations (DAOs)

- Tokenized Asset Contracts

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Automation and Efficiency in Rental Transactions

Smart contracts significantly streamline rental dealings by automating lease agreements and rent payments. This automation reduces the need for manual intervention, which cuts down administrative costs and speeds up transaction processes. Tenants and landlords benefit from timely and reliable rental payments as the contract self-executes predefined terms. The result is less likelihood of disputes and improved payment collection efficiency.

The transparency smart contracts provide by recording agreements on a secure blockchain increases trust among parties. Both tenants and landlords can access immutable records of rental terms and payment history. This reduces misunderstandings and enhances compliance with lease conditions, making rental management smoother and more predictable.

For instance, in July 2025, the integration of cryptocurrency and blockchain technology in real estate is enhancing the automation of rental processes through smart contracts. With tokenized properties and blockchain-based agreements, tasks like rent collection, lease renewals, and property management can be automated, reducing the need for intermediaries.

Restraint

Legal and Regulatory Uncertainty

Despite clear advantages, the legal recognition of smart contracts in many jurisdictions remains unsettled. This uncertainty restricts widespread adoption, as landlords, tenants, and property managers are hesitant to fully rely on contracts that might not be enforceable in court. The lack of cohesive regulatory frameworks creates risks around contract validity, dispute resolution, and liability.

Additionally, real estate rental agreements often involve complicated clauses requiring manual interpretation, which can challenge the programming of smart contracts. This complexity increases the risk of errors or oversimplification, limiting the trust professionals place in this technology. Until clear legal standards and guidelines evolve, the growth potential will be restrained.

For instance, in July 2025, a report highlighted that over $3.4 billion in Ethereum was lost due to user mistakes and contract bugs, underscoring the critical risk of errors in smart contracts. In the context of rental smart contracts, this could have significant implications, particularly when it comes to financial transactions like rent payments or deposits.

Opportunities

Fractional Ownership and Investment Accessibility

Smart contracts empower fractional ownership models in rental real estate, opening new investment opportunities. By tokenizing rental properties, investors can own smaller, more affordable shares instead of entire properties. This widens access to rental real estate investment beyond traditional high-net-worth individuals or institutions, democratizing the market.

The automatic distribution of rental income and voting rights via smart contracts ensures investors receive transparent, timely returns without manual intervention. Fractional ownership also increases liquidity in a typically illiquid asset class by making shares easier to trade on secondary markets.

For instance, in July 2025, cryptocurrency developments in real estate, especially the enabling of tokenized property transactions, are facilitating the integration of microtransactions into rental smart contracts. By leveraging blockchain technology, these innovations allow tenants to pay rent in smaller, more flexible increments, such as daily or weekly payments, instead of traditional monthly installments.

Challenges

Technical Complexity and Integration Issues

One major challenge is the technical complexity involved in creating and implementing smart contracts for rentals. Many real estate professionals lack blockchain expertise, creating a knowledge gap that slows adoption. Programming contracts also requires precision to avoid coding errors that can lead to financial losses or disputes.

Integrating smart contracts with existing rental management systems and processes is another hurdle. Legacy platforms may not be compatible with blockchain technology, requiring costly and time-consuming upgrades. Without smooth integration, operational disruption risks limit broader technology acceptance.

For instance, in July 2025, the HS2 project faced challenges related to property condition verification for its tenants, highlighting the limitations of current smart contract systems in the rental market. While smart contracts can automate payments and agreements, verifying physical property conditions, such as monitoring damages or conducting inspections, remains a complex task.

Key Players Analysis

The Smart Contracts in Rental Market is shaped by a range of innovative players focusing on property tokenization, blockchain-based transactions, and rental automation. Companies such as SMARTRealty, Propy, and RealT have been active in creating transparent and secure rental agreements. Their platforms are designed to simplify processes like rent collection and property management, ensuring higher trust among landlords and tenants.

Other significant contributors include Ubitquity, Vairt, and RealBlocks, which are expanding rental investments through fractional ownership and cross-border transactions. These platforms provide rental property investors with new ways to diversify holdings while improving efficiency through smart contract automation. Their presence has increased demand from investors seeking faster, tamper-proof agreements.

Meanwhile, companies such as Tokeny Solutions, Slice, SolidBlock, BrickBlock, Harbor, and Metlabs are focusing on compliance-driven digital assets and tokenized real estate rentals. Their platforms address regulatory concerns while enabling global participation in property investments. This segment plays a crucial role in bridging traditional rental markets with blockchain-based innovations.

Top Key Players in the Market

- SMARTRealty

- Propy

- RealT

- Ubitquity

- Vairt

- RealBlocks

- Tokeny Solutions

- Slice

- SolidBlock

- BrickBlock

- Harbor

- Metlabs

- Others

Recent Developments

- In May 2024, Propy unveiled its 2024–2025 roadmap, emphasizing the integration of AI to automate workflows behind smart contract settlement protocols. Propy AI analyzes and extracts crucial details from paperwork, streamlining the property acquisition process and enhancing transaction efficiency.

- In February 2024, Tokeny Solutions focused on delivering solutions that empower all participants in the tokenization journey. Their product vision includes standardization, digitalization, collateralization, and distribution, aiming to cultivate liquidity and facilitate the growth of the tokenized economy.

Report Scope

Report Features Description Market Value (2024) USD 95.76 Mn Forecast Revenue (2034) USD 11,487.3 Mn CAGR(2025-2034) 61.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Blockchain Type (Public Blockchain, Private Blockchain, Hybrid Blockchain), By Platform (Ethereum, Solana, Cardano, BNB Smart Chain, Others), By Contract Type (Decentralized Autonomous Organizations (DAOs), Tokenized Asset Contracts, Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SMARTRealty, Propy, RealT, Ubitquity, Vairt, RealBlocks, Tokeny Solutions, Slice, SolidBlock, BrickBlock, Harbor, Metlabs, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Contracts in Rental MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Contracts in Rental MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SMARTRealty

- Propy

- RealT

- Ubitquity

- Vairt

- RealBlocks

- Tokeny Solutions

- Slice

- SolidBlock

- BrickBlock

- Harbor

- Metlabs

- Others