Global Smart Card in Government Market Size, Industry Report By Card Type (Contact-Based Smart Cards, Contactless Smart Cards, Dual-Interface Smart Cards, Hybrid Smart Cards), By Component (Hardware (Cards, Chips, Readers, Terminals), Software and Middleware (Operating Systems, Authentication Tools), Services (Consulting, Integration, Maintenance, Managed Services)), By Application (National ID Cards, E-Passports, Driver’s Licenses, Voter ID Cards, Healthcare and Social Security Cards, Subsidy/Welfare Distribution Cards, Border Control and Immigration, Others (Defense, Law Enforcement)), By Technology (Microprocessor Smart Cards, Memory Smart Cards, Biometric-Enabled Smart Cards, Optical/Other Advanced Cards) By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164752

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

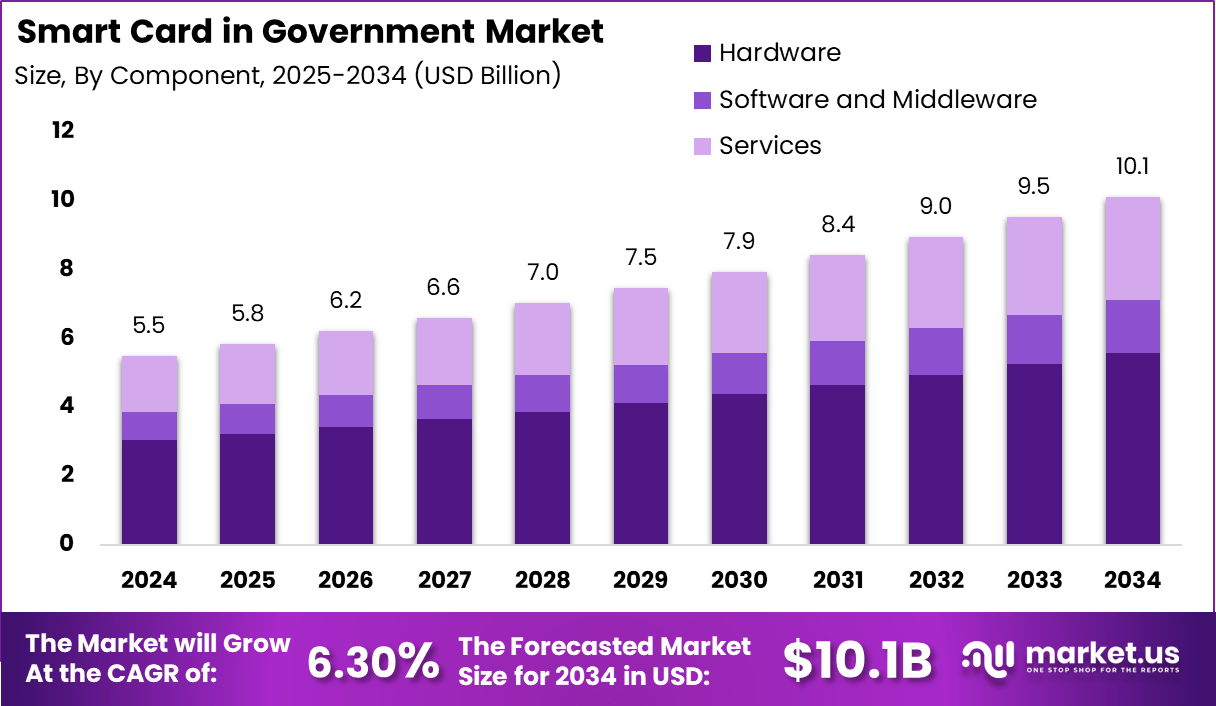

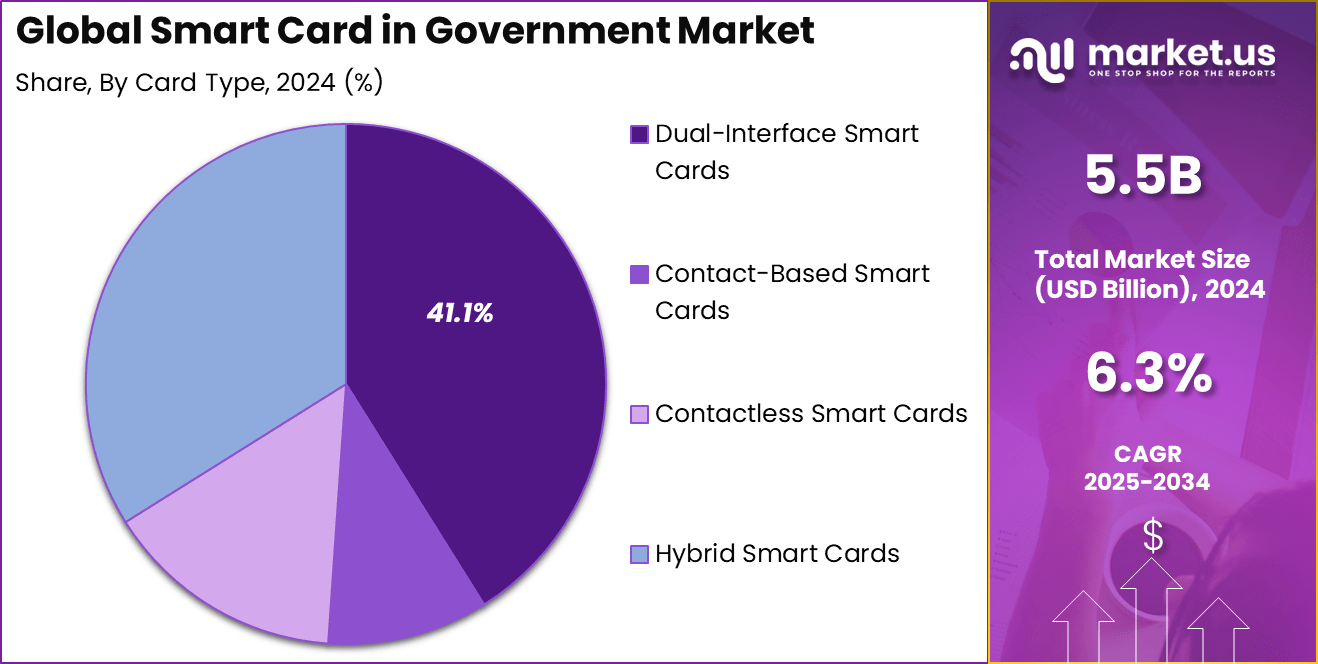

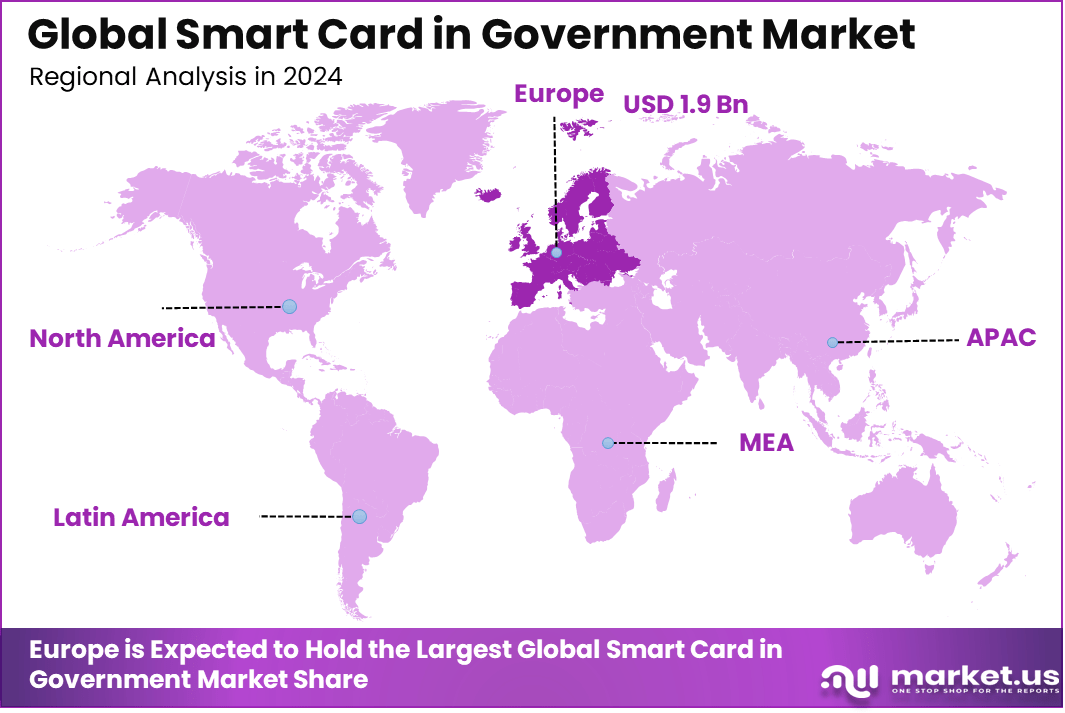

The Global Smart Card in Government Market generated USD 5.5 billion in 2024 and is predicted to register growth from USD 5.8 billion in 2025 to about USD 10.1 billion by 2034, recording a CAGR of 6.30% throughout the forecast span. In 2024, Europe held a dominan market position, capturing more than a 35% share, holding USD 1.92 Billion revenue.

The smart card in the government market refers to secure, tamper-resistant cards with embedded microprocessors or memory chips used for identity verification, authentication, and data storage in public sector applications. These cards are widely applied in e-passports, national IDs, driver’s licenses, healthcare cards, voting systems, and social welfare programs.

Smart card technology supports contact and contactless operations and increasingly integrates biometric verification, encryption, and blockchain solutions to enhance security. Governments worldwide focus on digital identity management, fraud prevention, and e-governance, fueling the adoption of smart card systems.

Key drivers of smart card adoption in government include the rising demand for secure digital identity solutions and growing cybersecurity threats in public services. Digital transformation initiatives and government expenditure on digital infrastructure are boosting market growth. The need for efficient citizen services, fraud-resistant identity verification, and secure access control are critical motivators.

According to Market.us, The Global Smart Card Market is projected to reach USD 29.6 billion by 2033, rising from USD 16.7 billion in 2023, with a steady CAGR of 5.9% from 2024 to 2033. This growth is supported by increasing adoption in banking, telecommunications, and government sectors for secure identification, payment transactions, and data storage.

Demand for smart cards is rapidly growing in national ID systems, e-passports, health cards, and secure voting systems. Governments issue millions of smart cards annually for identity and access control, with increasing interest in contactless technologies to support cashless and digital economies. Healthcare and social security sectors show rising demand for secure data management and privacy protection through smart cards.

Top Market Takeaways

- By card type, the dual-interface smart cards segment holds around 41.1% of the market. These cards support both contact and contactless communication, making them versatile for various government applications.

- By component, the hardware segment dominates with 55.2%, reflecting the importance of secure physical card components in government-issued IDs.

- By application, national ID cards lead with 50.1% market share, as governments increasingly deploy smart cards for citizen identification, authentication, and access control.

- By technology, microprocessor smart cards account for 60.8% of the market, valued for their advanced security features and biometric integration capabilities.

- Europe holds a significant 35% share of the global smart card in government market, estimated at approximately USD 1.71 billion in 2025, with projections to reach around USD 3.02 billion by 2034 at a CAGR of 6.49%.

By Card Type

In 2024, Dual-interface smart cards held about 41.1% of the government smart card market, driven by their ability to support both contact and contactless functions. Governments favor these cards for identification, border control, and secure access applications where fast verification is required. Their flexibility allows citizens to use a single card for multiple services such as voting, welfare distribution, and e-Government transactions.

The dual-interface design also ensures resilience during high-frequency use, making it an efficient choice for large-scale programs. The segment’s rise is supported by broader use of NFC-enabled devices and national efforts to improve service efficiency through digital identity systems. Many agencies now integrate these cards with biometric databases to enhance authentication accuracy and prevent duplication.

The gradual phase-out of contact-only formats has created additional demand for dual-interface cards due to their wider usability and stronger data protection features. This trend is shaping how citizens access public services securely and conveniently.

By Component

In 2024, The hardware segment accounted for about 55.2% of the total market, reflecting the dominance of physical card manufacturing, chips, and readers within government projects. These systems form the base infrastructure for national identification, social welfare, and healthcare card programs. Many governments require certified, tamper-resistant materials and secure chips that meet international security standards.

Hardware reliability directly influences overall system performance and citizen trust in digital credentials. New investments are focusing on high-capacity chips and modular card designs that integrate multiple functionalities such as fingerprint authentication and payment capability.

Governments prefer local or regionally sourced hardware solutions to ensure data sovereignty and continuity of supply. As a result, hardware innovation continues to evolve, combining physical durability with enhanced encryption and interoperability to support cross-border identification initiatives.

By Application

In 2024, National ID cards held the largest share at about 50.1%, remaining the pillar of public identity programs worldwide. These cards serve as the foundation for citizen verification across voting, travel, and taxation services. Governments are increasingly linking national IDs with digital databases to streamline administrative processes and improve transparency.

The use of smart cards in these systems reduces fraud and ensures that public welfare and voting benefits reach the right individuals. Ongoing digitization programs are reinforcing the role of smart ID cards in both emerging and developed economies.

Many countries are adopting integrated identity systems where a single smart card functions across multiple departments. This approach ensures quicker service access, lowers administrative costs, and strengthens data accuracy. The adoption momentum for national ID cards continues to expand as more states modernize legacy systems into unified identity platforms.

By Technology

In 2024, Microprocessor-based smart cards captured nearly 60.8% of the market, as they provide advanced processing power and higher memory capacity for secure data storage. These cards support encryption, digital signatures, and multi-application environments needed for government-level security.

Their strong resistance to tampering and ability to handle complex computations make them ideal for authentication, access control, and secure communication between systems. Technological progress has led to improved chip architectures that enable faster data reading and automatic updates for new encryption algorithms.

Governments now prefer microprocessor cards over memory-only types due to their flexibility and lifespan. Their application extends beyond identity verification to areas like ePassports, driving licenses, and secure travel credentials. As global identity frameworks evolve, this segment will remain central to improving public sector data governance.

Emerging Trends

The Smart Card in Government Market is witnessing important trends shaped by the growing digital transformation in the public sector. Governments are increasingly using smart cards embedded with microprocessors or memory chips for secure identity verification, access control, and transaction management.

A significant development is the integration of biometric authentication and encryption to enhance security and protect citizen data from cyber threats. Contactless smart cards are becoming more common, improving convenience and reducing physical touchpoints in services like healthcare, voting, and transportation.

Artificial intelligence is also influencing this market by enabling automated identity verification and anomaly detection, which makes the systems more reliable and efficient. Digital identity initiatives and e-governance projects are driving governments to adopt smart cards widely for national IDs, social welfare, and public service delivery, making these cards a backbone of secure and modern government operations.

Growth Factors

Growth factors for the smart card market in government are largely driven by the escalating demand for secure identification and fraud-resistant solutions in public services worldwide. The need to protect sensitive citizen information and prevent data breaches compels governments to move towards advanced smart card technologies.

Increasing investments in digital infrastructure, support for contactless and multi-application cards, and the demand to streamline citizen engagement and service delivery all contribute to market expansion. Regions such as Europe lead the adoption due to established programs in national ID cards and e-governance, while Asia Pacific is rapidly growing, driven by large-scale government digital initiatives and expanding public services.

Despite challenges like high implementation costs and the need for standardization, the smart card market remains vital for governments aiming to improve efficiency, security, and trust with their citizens. The focus on sustainability and interoperability also creates opportunities for innovation and long-term growth in this space.

Key Market Segments

By Card Type

- Contact-Based Smart Cards

- Contactless Smart Cards

- Dual-Interface Smart Cards

- Hybrid Smart Cards

By Component

- Hardware (Cards, Chips, Readers, Terminals)

- Software and Middleware (Operating Systems, Authentication Tools)

- Services (Consulting, Integration, Maintenance, Managed Services)

By Application

- National ID Cards

- E-Passports

- Driver’s Licenses

- Voter ID Cards

- Healthcare and Social Security Cards

- Subsidy/Welfare Distribution Cards

- Border Control and Immigration

- Others (Defense, Law Enforcement)

By Technology

- Microprocessor Smart Cards

- Memory Smart Cards

- Biometric-Enabled Smart Cards

- Optical/Other Advanced Cards

Regional Analysis

In 2024, Europe accounted for about 35% of the global market, supported by well-established e-Government systems and tight data privacy regulations. The region has led large-scale adoption of smart cards through EU-funded identity and residency initiatives. Programs such as national eID schemes and digital residence cards rely heavily on chip-based authentication, driving continued volume demand.

Modernization projects in countries like Germany, France, and Italy are further promoting the replacement of older ID systems with more secure, interoperable card models. European policies emphasize privacy-by-design principles and compliance with standards such as GDPR, which encourages secure identity management frameworks.

Card manufacturers across the region invest in energy-efficient chips, sustainable materials, and secure printing technologies. The high adoption rate of contactless infrastructures in Europe also supports wide-scale smart card usage for both local and cross-border applications within the Schengen area.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Secure Identification and Digital Transformation in Government

The smart card market in the government sector is driven by increasing demand for secure identification and authentication processes. Governments worldwide are focusing on digital transformation initiatives that enhance the efficiency and accuracy of public service delivery.

Smart cards embedded with microprocessors enable secure identity verification for applications such as national ID programs, e-passports, social welfare cards, and voter identification. This growing emphasis on secure and fraud-resistant identity solutions is pushing governments to adopt smart card technology more broadly.

Additionally, the rise in cyber threats and the need to protect sensitive citizen data is motivating governments to implement robust authentication measures. Smart cards provide encrypted communication and biometric integration to safeguard digital identities and transactions. As public agencies seek more effective ways to manage identity and access while improving citizen engagement, this trend acts as a significant growth driver in the sector.

Restraint

High Implementation Costs and Integration Complexity

Despite its benefits, high costs associated with implementing smart card technology pose a restraint, especially for developing countries or smaller government departments. Procurement, system integration, and staff training require substantial investment. These expenses can delay rollout or limit deployment scope, particularly in regions with budget constraints.

Moreover, integrating smart cards with existing legacy systems and ensuring interoperability among diverse platforms present technical challenges. These complexities can hinder smooth adoption and increase time-to-market for government projects. Resistance from users accustomed to traditional paper-based or less secure processes further slows the transformation pace.

Opportunity

Expansion through Biometric Integration and E-Governance Initiatives

Biometric-enabled smart cards and e-governance projects provide promising opportunities for smart card adoption in government markets. Combining biometric authentication, such as fingerprints or facial recognition, with smart cards enhances security and user convenience, making these solutions increasingly attractive.

Ongoing government initiatives aimed at digital identity management, smart city infrastructure, and public service automation create vast prospects. For example, contactless smart cards find application in public transport, healthcare access, and border control. Collaboration between public and private sectors is also fostering innovative use cases, boosting market growth potentials in both mature and emerging economies.

Challenge

Data Privacy Concerns and Regulatory Compliance

Managing sensitive citizen data via smart cards raises privacy and security concerns that challenge market expansion. Governments must ensure strict compliance with data protection regulations while implementing these solutions. Any breach or misuse of information can undermine public trust and cause reputational damage.

Furthermore, rapidly evolving regulatory landscapes demand continuous updates to smart card technologies and related policies. Addressing these challenges requires robust encryption, governance frameworks, and transparency. Balancing security needs with ease of access and convenience for citizens remains a key hurdle that governments and solution providers must navigate carefully.

Competitive Analysis

The smart card and digital security market features strong competition among global technology leaders. Thales Group, reinforced by its acquisition of Gemalto, holds a dominant position with broad capabilities spanning defense, aerospace, digital identity, and security solutions. Their edge lies in advanced technological innovation, substantial R&D investment, and long-standing government relationships.

IDEMIA competes closely, specializing in identity and biometric solutions, and focuses on high-growth areas like eSIMs and automated border control, carving niches outside Thales’ main markets. Giesecke+Devrient (G+D) stands out with strong brand equity and proprietary currency and security technologies, competing with specialist currency producers and certification providers.

In the semiconductor segment, Infineon Technologies faces direct competition from NXP Semiconductors and STMicroelectronics, with all three vying for leadership in automotive, industrial, and IoT chip markets. Infineon and NXP are intensely competitive in automotive microcontrollers and sensors, targeting electric and autonomous vehicle applications. HID Global, known for secure identity solutions, faces rivals like Assa Abloy and Morphotrust, operating in sectors demanding high product quality and secure authentication technologies.

Smaller yet specialized firms such as CardLogix and Watchdata Technologies compete by focusing on niche biometric and blockchain-based identity and security solutions. CardLogix’s main competitors include biometric authentication and digital identity firms that emphasize fraud prevention and identity verification. Watchdata competes in blockchain infrastructure with players offering modular, data-centric tools for decentralized applications.

Top Key Players in the Market

- Thales Group (Gemalto NV)

- IDEMIA

- Giesecke+Devrient GmbH (G+D)

- Infineon Technologies AG

- NXP Semiconductors

- HID Global Corporation (Assa Abloy)

- CardLogix Corporation

- Watchdata Technologies

- CPI Card Group Inc.

- Valid S.A.

- Eastcompeace Technology Co., Ltd.

- Shanghai Huahong Integrated Circuit Co., Ltd.

- Athena Smartcard Solutions

- Bundesdruckerei GmbH

- SecuGen Corporation

- Identiv, Inc.

- NEC Corporation

- STMicroelectronics

- Samsung Electronics Co., Ltd.

- Atos SE

Recent Developments

- May, 2024, Thales Group (Gemalto) secured a major contract to provide smart card-based identification systems for national governments, enhancing citizen identification processes and security measures. The contract included AI-driven encryption and biometric authentication features.

- October, 2024, IDEMIA partnered with a government agency to implement contactless smart card solutions for secure access to public services, focusing on efficiency and safeguarding sensitive information.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Bn Forecast Revenue (2034) USD 10.1 Bn CAGR(2025-2034) 6.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Card Type (Contact-Based Smart Cards, Contactless Smart Cards, Dual-Interface Smart Cards, Hybrid Smart Cards), By Component (Hardware (Cards, Chips, Readers, Terminals), Software and Middleware (Operating Systems, Authentication Tools), Services (Consulting, Integration, Maintenance, Managed Services)), By Application (National ID Cards, E-Passports, Driver’s Licenses, Voter ID Cards, Healthcare and Social Security Cards, Subsidy/Welfare Distribution Cards, Border Control and Immigration, Others (Defense, Law Enforcement)), By Technology (Microprocessor Smart Cards, Memory Smart Cards, Biometric-Enabled Smart Cards, Optical/Other Advanced Cards) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thales Group (Gemalto NV), IDEMIA, Giesecke+Devrient GmbH (G+D), Infineon Technologies AG, NXP Semiconductors, HID Global Corporation (Assa Abloy), CardLogix Corporation, Watchdata Technologies, CPI Card Group Inc., Valid S.A., Eastcompeace Technology Co., Ltd., Shanghai Huahong Integrated Circuit Co., Ltd., Athena Smartcard Solutions, Bundesdruckerei GmbH, SecuGen Corporation, Identiv, Inc., NEC Corporation, STMicroelectronics, Samsung Electronics Co., Ltd., Atos SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Card in Government MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Card in Government MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thales Group (Gemalto NV)

- IDEMIA

- Giesecke+Devrient GmbH (G+D)

- Infineon Technologies AG

- NXP Semiconductors

- HID Global Corporation (Assa Abloy)

- CardLogix Corporation

- Watchdata Technologies

- CPI Card Group Inc.

- Valid S.A.

- Eastcompeace Technology Co., Ltd.

- Shanghai Huahong Integrated Circuit Co., Ltd.

- Athena Smartcard Solutions

- Bundesdruckerei GmbH

- SecuGen Corporation

- Identiv, Inc.

- NEC Corporation

- STMicroelectronics

- Samsung Electronics Co., Ltd.

- Atos SE