Global Sludge Dewatering Equipment Market Size, Share, Growth Analysis By Material (Stainless Steel, Carbon Steel, Fiber-reinforced Plastic), By Technology (Centrifuges, Screw Press, Rotator Disc Press, Belt Filter Press, Other Technologies), By Application (Municipal, Industrial [Pulp & Paper, Textile, Food & Beverage, Chemical, Others]), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175998

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

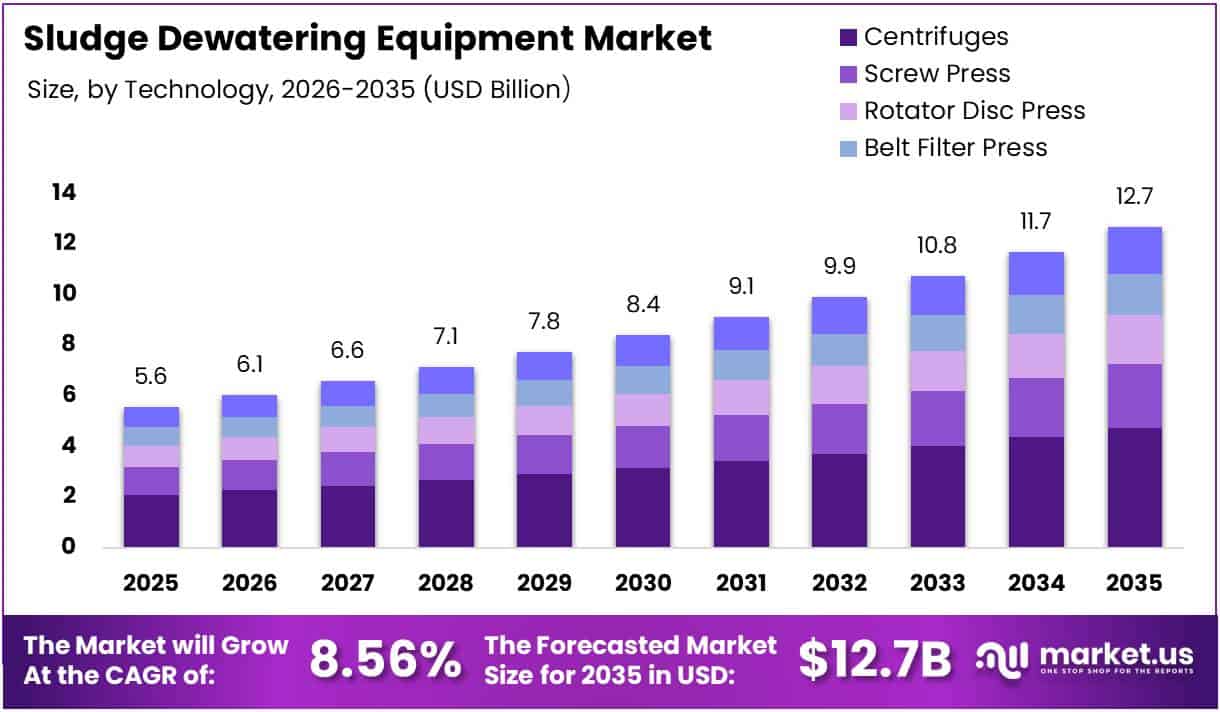

The Global Sludge Dewatering Equipment Market size is expected to be worth around USD 12.7 Billion by 2035 from USD 5.58 Billion in 2025, growing at a CAGR of 8.56% during the forecast period 2026 to 2035.

Sludge dewatering equipment removes water content from sludge generated during wastewater treatment processes. This technology transforms semi-solid waste into more manageable material for disposal or reuse. Moreover, it reduces transportation costs and minimizes environmental impact through efficient volume reduction.

The market encompasses various technologies including centrifuges, screw presses, belt filter presses, and rotary disc systems. These solutions serve municipal wastewater treatment plants and diverse industrial sectors. Additionally, equipment materials range from stainless steel to fiber-reinforced plastics, ensuring durability and chemical resistance.

Rapid urbanization worldwide drives substantial growth in municipal wastewater generation, necessitating advanced treatment infrastructure. Consequently, governments implement stricter environmental regulations requiring proper sludge management and disposal. Therefore, municipalities increasingly invest in modern dewatering equipment to meet compliance standards and operational efficiency goals.

Industrial applications across pulp and paper, textile, food and beverage, and chemical sectors expand significantly. These industries generate considerable sludge volumes requiring specialized dewatering solutions. Furthermore, sustainability initiatives and zero-liquid discharge practices accelerate technology adoption across manufacturing facilities globally.

According to ESMIL, sludge at inlet stages contains 8-16% dry solids with mineral content reaching up to 64%, presenting significant dewatering challenges. According to Nihao Water, sludge solids content after dewatering typically ranges from 15% to over 40%, depending on technology employed.

According to research, municipal treatment plants reduce water content from up to 99% initially to around 20-40% after dewatering. This substantial reduction makes transportation and disposal significantly easier. Subsequently, operational costs decrease while environmental compliance improves through efficient sludge handling processes.

Technological advancements focus on automation, IoT integration, and energy efficiency improvements. Market participants develop compact and mobile units for flexible deployment across various applications. Therefore, emerging economies present substantial growth opportunities as water treatment infrastructure expands rapidly to support industrial development.

Key Takeaways

- Global Sludge Dewatering Equipment Market valued at USD 5.58 Billion in 2025, projected to reach USD 12.7 Billion by 2035

- Market growing at CAGR of 8.56% during forecast period 2026-2035

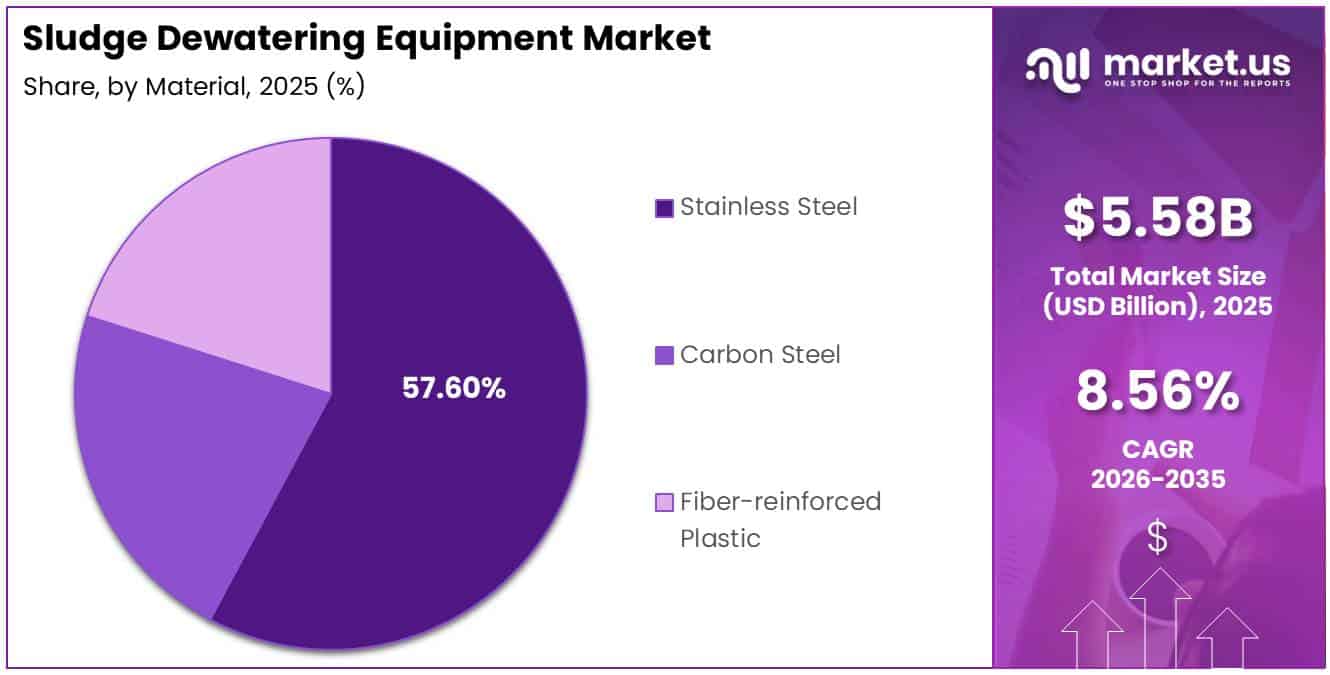

- Stainless Steel segment dominates By Material segment with 57.60% market share

- Centrifuges technology leads By Technology segment with 37.40% share

- Municipal application holds dominant position with 53.16% share in By Application segment

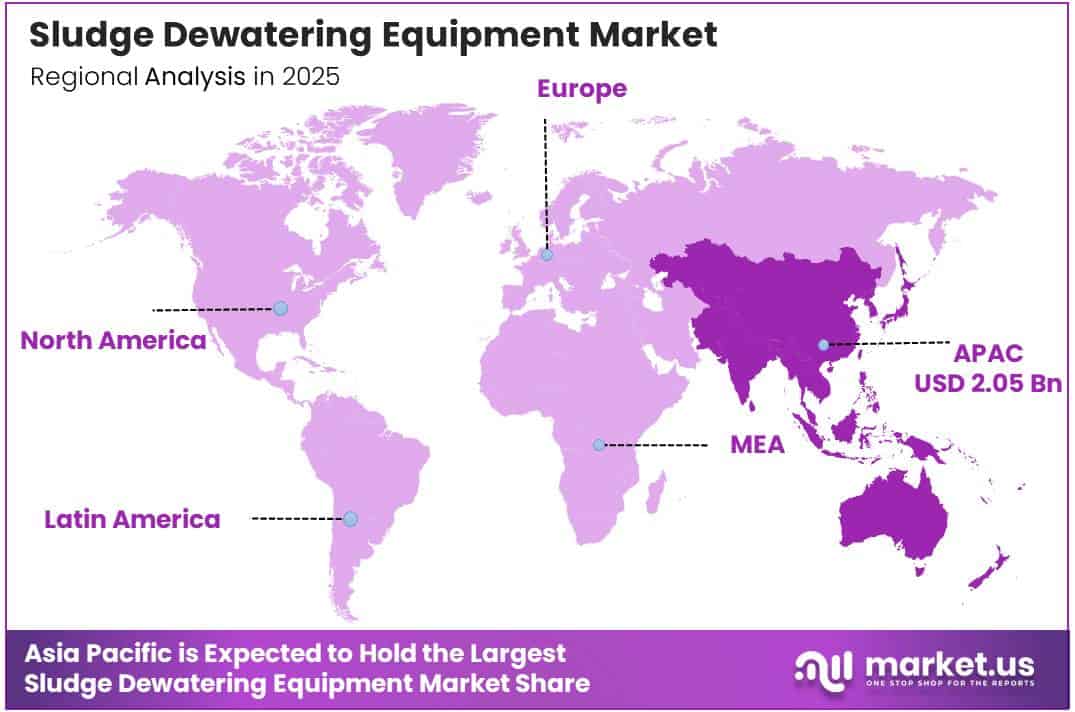

- Asia-Pacific region dominates global market with 36.85% share, valued at USD 2.05 Billion

Material Analysis

Stainless Steel dominates with 57.60% due to superior corrosion resistance and durability.

In 2025, Stainless Steel held a dominant market position in the By Material segment of Sludge Dewatering Equipment Market, with a 57.60% share. Stainless steel offers exceptional resistance to corrosive wastewater environments and chemical treatments. Moreover, its longevity reduces replacement costs and ensures consistent operational performance across municipal and industrial applications.

Carbon Steel provides cost-effective solutions for less demanding dewatering applications with moderate corrosion resistance requirements. This material suits budget-conscious installations where chemical exposure remains limited. However, carbon steel requires protective coatings and regular maintenance to prevent degradation in harsh wastewater treatment environments.

Fiber-reinforced Plastic delivers lightweight construction with excellent chemical resistance and reduced maintenance needs. This innovative material withstands aggressive chemicals while offering design flexibility for complex configurations. Additionally, FRP components resist corrosion naturally, eliminating coating requirements and extending equipment service life in challenging industrial applications.

Technology Analysis

Centrifuges dominate with 37.40% due to high dewatering efficiency and continuous operation capabilities.

In 2025, Centrifuges held a dominant market position in the By Technology segment of Sludge Dewatering Equipment Market, with a 37.40% share. Centrifugal force efficiently separates solids from liquids, achieving superior dry solids content. Furthermore, continuous operation maximizes throughput while automated controls minimize labor requirements across large-scale municipal facilities.

Screw Press technology provides gentle dewatering suitable for sensitive sludge types with lower polymer consumption. This method operates continuously with minimal noise and reduced energy consumption. Consequently, screw presses gain popularity in decentralized treatment facilities requiring compact footprints and simplified maintenance procedures.

Rotary Disc Press systems deliver high-capacity dewatering through rotating disc mechanisms that compress sludge effectively. These units handle varying sludge characteristics while maintaining consistent performance. Additionally, rotary disc technology offers efficient operation with reduced maintenance requirements and reliable long-term service.

Belt Filter Press technology uses gravity drainage and mechanical pressure across continuous belt systems, offering reliable dewatering for diverse applications. This proven method suits various sludge types while maintaining operational simplicity. Moreover, belt filter presses provide cost-effective solutions for medium to large-scale treatment facilities.

Other Technologies include innovative solutions such as thermal drying systems and electrodewatering methods. These emerging technologies address specific challenging sludge characteristics requiring specialized treatment approaches. Additionally, hybrid systems combine multiple dewatering principles to optimize efficiency and reduce operational costs.

Application Analysis

Municipal dominates with 53.16% due to extensive wastewater treatment infrastructure and regulatory requirements.

In 2025, Municipal held a dominant market position in the By Application segment of Sludge Dewatering Equipment Market, with a 53.16% share. Municipal wastewater treatment plants generate substantial sludge volumes requiring efficient dewatering solutions. Moreover, stringent environmental regulations mandate proper sludge handling, disposal, and potential beneficial reuse in agriculture.

Industrial applications span diverse sectors including Pulp and Paper, Textile, Food and Beverage, Chemical, and Others. These industries produce specialized sludge types with varying characteristics requiring customized dewatering approaches. Additionally, industrial facilities increasingly adopt zero-liquid discharge practices, driving demand for advanced dewatering technologies.

Key Market Segments

By Material

- Stainless Steel

- Carbon Steel

- Fiber-reinforced Plastic

By Technology

- Centrifuges

- Screw Press

- Rotator Disc Press

- Belt Filter Press

- Other Technologies

By Application

- Municipal

- Industrial

- Pulp & Paper

- Textile

- Food & Beverage

- Chemical

- Others

Drivers

Increasing Urbanization Leading to Higher Municipal Wastewater Generation

Rapid global urbanization concentrates populations in cities, significantly increasing municipal wastewater volumes requiring treatment infrastructure expansion. Growing urban centers establish new treatment facilities while upgrading existing plants to handle increased capacity demands. Consequently, municipalities invest substantially in modern sludge dewatering equipment to manage rising waste streams efficiently.

Developing economies experience accelerated urban migration, creating urgent needs for wastewater treatment infrastructure development. Governments prioritize sanitation projects to improve public health and environmental quality in rapidly expanding metropolitan areas. Therefore, demand for reliable dewatering equipment grows proportionally with urban population increases worldwide.

Stringent environmental regulations mandate proper wastewater treatment and sludge disposal across municipal operations. Regulatory frameworks require treatment plants to achieve specific dry solids content before sludge disposal or beneficial reuse. Additionally, industrial sectors face increasingly strict discharge standards, driving adoption of advanced dewatering technologies for compliance assurance.

Restraints

High Initial Investment Costs Limit Market Adoption

Advanced sludge dewatering equipment requires substantial capital expenditure for procurement and installation, challenging budget-constrained municipalities and smaller industrial facilities. Complex systems incorporating automation and advanced controls further increase upfront costs. Consequently, many organizations delay technology upgrades despite long-term operational benefits and efficiency gains.

Limited awareness and technical expertise in developing regions hinder effective technology implementation and operation. Many facilities lack trained personnel capable of optimizing dewatering processes and maintaining sophisticated equipment. Moreover, inadequate understanding of technology benefits prevents informed investment decisions among potential adopters.

Complex operational requirements of advanced dewatering systems necessitate specialized training and ongoing technical support. Equipment demands precise parameter control, regular maintenance, and careful polymer dosing for optimal performance. Therefore, facilities without adequate technical infrastructure struggle to achieve desired dewatering efficiency and equipment reliability.

Growth Factors

Technological Advancements Accelerate Market Expansion

Integration of IoT and automation transforms sludge dewatering operations through real-time monitoring and predictive maintenance capabilities. Smart sensors optimize polymer dosing, adjust operational parameters automatically, and minimize energy consumption significantly. Consequently, facilities achieve superior efficiency while reducing labor requirements and operational costs substantially.

Expansion of water treatment infrastructure in emerging economies creates substantial growth opportunities for equipment manufacturers. Governments invest heavily in wastewater treatment facilities to support industrial development and improve public health standards. Additionally, international funding agencies support infrastructure projects, accelerating technology adoption across developing regions.

Development of energy-efficient and low-maintenance dewatering equipment addresses operational cost concerns while enhancing environmental sustainability. Manufacturers innovate designs that minimize power consumption, reduce polymer usage, and extend maintenance intervals significantly. Therefore, total cost of ownership decreases, making advanced technologies accessible to broader market segments globally.

Emerging Trends

Digital Transformation Reshapes Market Landscape

Adoption of zero-liquid discharge practices in industrial facilities drives demand for high-efficiency dewatering solutions capable of maximum water recovery. Industries implement closed-loop systems to eliminate wastewater discharge, requiring equipment achieving extremely high dry solids content. Moreover, environmental sustainability commitments accelerate ZLD technology implementation across manufacturing sectors.

Increasing use of polymer-based and chemical-assisted dewatering methods enhances solid-liquid separation efficiency significantly. Advanced polymer formulations optimize flocculation while minimizing chemical consumption and associated costs. Additionally, automated dosing systems ensure precise chemical application, maximizing dewatering performance while reducing operational complexity.

Growing demand for compact and mobile dewatering units addresses space constraints and temporary application requirements effectively. Portable systems enable flexible deployment across multiple sites, supporting construction projects and emergency response situations. Furthermore, modular designs facilitate capacity expansion and equipment relocation as operational needs evolve.

Regional Analysis

Asia-Pacific Dominates the Sludge Dewatering Equipment Market with a Market Share of 36.85%, Valued at USD 2.05 Billion

Asia-Pacific leads the global market driven by rapid industrialization, urban population growth, and substantial wastewater infrastructure investments. Countries including China, India, and Japan implement large-scale municipal treatment projects requiring extensive dewatering equipment. Moreover, the region’s 36.85% market share valued at USD 2.05 Billion reflects strong demand across diverse industrial sectors and expanding environmental compliance requirements.

North America Sludge Dewatering Equipment Market Trends

North America maintains substantial market presence through infrastructure modernization and technology upgrades across aging municipal treatment facilities. The United States and Canada prioritize environmental protection, implementing stringent wastewater treatment standards driving equipment replacement cycles. Additionally, industrial sectors adopt advanced dewatering solutions supporting sustainability initiatives and operational efficiency improvements.

Europe Sludge Dewatering Equipment Market Trends

Europe demonstrates strong commitment to environmental sustainability through rigorous wastewater treatment regulations and circular economy initiatives. Germany, France, and the United Kingdom lead regional investments in advanced dewatering technologies supporting resource recovery efforts. Furthermore, European manufacturers innovate energy-efficient solutions meeting demanding environmental standards and performance requirements.

Latin America Sludge Dewatering Equipment Market Trends

Latin America experiences growing infrastructure development as Brazil, Mexico, and other nations expand wastewater treatment capacity. Regional governments invest in sanitation projects improving public health while addressing environmental concerns. However, economic constraints and technical expertise limitations moderate adoption rates compared to developed markets.

Middle East & Africa Sludge Dewatering Equipment Market Trends

Middle East and Africa regions develop water treatment infrastructure driven by water scarcity concerns and industrial expansion. GCC countries invest substantially in advanced technologies supporting sustainable development goals despite challenging climate conditions. Additionally, South African markets grow steadily as environmental awareness increases and regulatory frameworks strengthen.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Alfa Laval maintains leading market position through comprehensive dewatering solutions combining advanced centrifuge technology with extensive global service networks. The company delivers high-performance equipment for municipal and industrial applications, emphasizing energy efficiency and operational reliability. Moreover, Alfa Laval invests significantly in research and development, introducing innovative features that optimize dewatering processes while minimizing environmental impact through reduced energy consumption and chemical usage.

Andritz provides complete dewatering systems integrating mechanical separation technologies with automation and digital solutions for enhanced operational control. Their portfolio spans centrifuges, belt filter presses, and screw presses serving diverse industry sectors worldwide. Additionally, Andritz offers comprehensive aftermarket services including spare parts, maintenance programs, and performance optimization consulting that ensure long-term equipment reliability and maximum return on investment.

Veolia combines equipment manufacturing expertise with water treatment operation experience, delivering integrated solutions addressing complex sludge management challenges. The company emphasizes sustainable technologies that support circular economy principles through resource recovery and waste minimization. Furthermore, Veolia’s global presence enables localized support while leveraging international best practices, ensuring customers receive optimal technology solutions tailored to specific regional requirements and regulatory frameworks.

Evoqua Water Technologies specializes in comprehensive water treatment solutions including advanced dewatering equipment designed for challenging applications across municipal and industrial sectors. Their technology portfolio emphasizes automation, energy efficiency, and reduced operational complexity through intelligent control systems. Consequently, Evoqua enables customers to achieve superior dewatering performance while minimizing total cost of ownership through optimized chemical consumption and extended equipment service life.

Key players

- Alfa Laval

- Andritz

- Aqseptence Group

- Encon Evaporators

- Evoqua Water Technologies

- Flotrend

- Hiller Separation & Process

- Hitachi Zosen

- Huber

- Keppel Seghers

- Komline-Sanderson

- Kontek Ecology Systems

- Phoenix Process Equipment

- Sebright Products

- Veolia

- Others

Recent Developments

- October 2025 – Smith & Loveless Australia Pty. Ltd. announced the acquisition of CST Wastewater Solutions Pty. Ltd., expanding its wastewater treatment capabilities and strengthening market presence across Australian water infrastructure sector. This strategic acquisition enhances service offerings and broadens customer base throughout the region.

- June 2025 – Pelagia strengthened focus on sludge management through acquisition of Fjord Solutions, integrating advanced dewatering technologies into its operational portfolio. This development demonstrates increasing industry consolidation as companies pursue comprehensive water treatment solutions and expanded technological capabilities for competitive advantage.

Report Scope

Report Features Description Market Value (2025) USD 5.58 Billion Forecast Revenue (2035) USD 12.7 Billion CAGR (2026-2035) 8.56% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Stainless Steel, Carbon Steel, Fiber-reinforced Plastic), By Technology (Centrifuges, Screw Press, Rotator Disc Press, Belt Filter Press, Other Technologies), By Application (Municipal, Industrial – Pulp & Paper, Textile, Food & Beverage, Chemical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alfa Laval, Andritz, Aqseptence Group, Encon Evaporators, Evoqua Water Technologies, Flotrend, Hiller Separation & Process, Hitachi Zosen, Huber, Keppel Seghers, Komline-Sanderson, Kontek Ecology Systems, Phoenix Process Equipment, Sebright Products, Veolia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sludge Dewatering Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Sludge Dewatering Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Laval

- Andritz

- Aqseptence Group

- Encon Evaporators

- Evoqua Water Technologies

- Flotrend

- Hiller Separation & Process

- Hitachi Zosen

- Huber

- Keppel Seghers

- Komline-Sanderson

- Kontek Ecology Systems

- Phoenix Process Equipment

- Sebright Products

- Veolia

- Others