Global SLAM LiDAR Mapping Systems Market Size, Share Report Analysis By System Type (2D SLAM Systems, 3D SLAM Systems), By Component (Hardware, Software, Services), By Application (Navigation & Path Planning, 3D Mapping & Modeling, Inspection & Surveying, Augmented Reality (AR) & Virtual Reality (VR), Others), By End-Use Industry (Robotics & Automation, Automotive & Transportation, Construction & Engineering, Mining & Agriculture, Consumer Electronics, Defense & Security, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170142

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Increasing Adoption Technologies

- Investment and Business Benefits

- China Market Size

- System Type Analysis

- Component Analysis

- Application Analysis

- End-Use Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

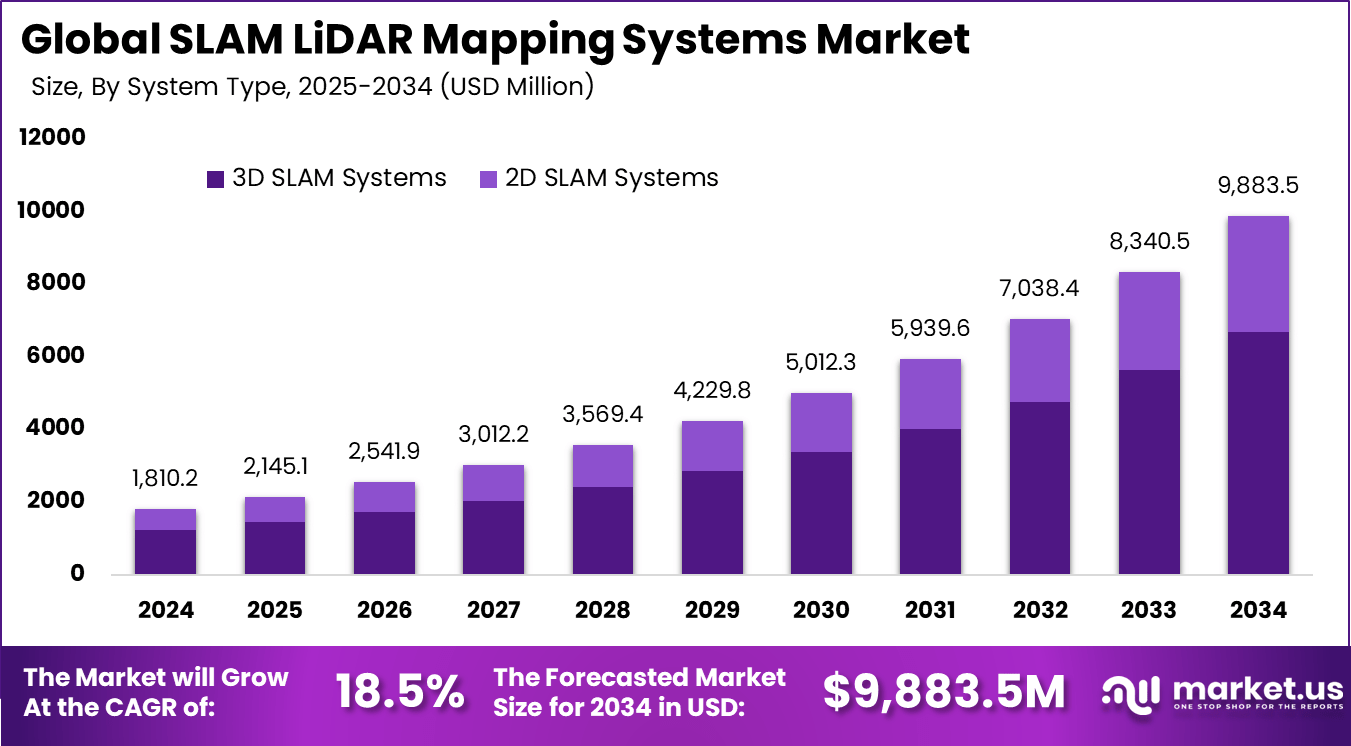

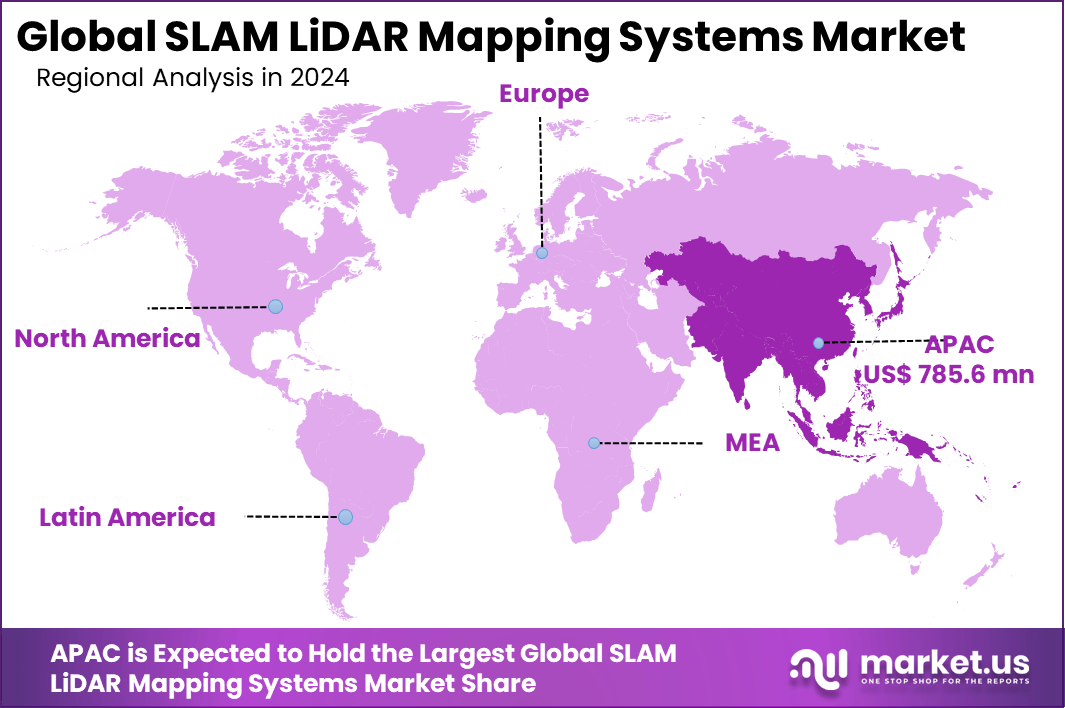

The Global SLAM LiDAR Mapping Systems Market size is expected to be worth around USD 9,883.5 million by 2034, from USD 1,810.2 million in 2024, growing at a CAGR of 18.5% during the forecast period from 2025 to 2034. Asia Pacific held a dominant market position, capturing more than a 43.4% share, holding USD 785.6 million in revenue.

The SLAM LiDAR Mapping Systems market refers to the sector of spatial sensing and navigation technologies that integrate Simultaneous Localization and Mapping (SLAM) algorithms with LiDAR (Light Detection and Ranging) sensors to generate real-time maps and location data for machines operating in complex or unknown environments.

SLAM defines the computational process by which an autonomous system concurrently builds a map of its surroundings and identifies its position within that environment, while LiDAR delivers high-precision distance measurements using laser pulses. This combined capability is essential for advanced robotics, autonomous vehicles, drones, surveying equipment, and industrial automation systems.

Top driving factors for SLAM LiDAR adoption start with the need for fast and accurate spatial data in both indoor and outdoor settings. Many teams report that mobile LiDAR scans can cut field time by more than half compared with traditional manual surveying. At the same time, real-time mapping reduces the gap between data capture and decision-making. Operators use a single pass to collect geometry that feeds into design models, safety checks, and maintenance planning.

The market for SLAM LiDAR mapping systems is driven by growing demand for precise, real-time 3D mapping and navigation across robotics, autonomous vehicles, drones, and industrial automation. Companies need reliable operation in GPS-denied and cluttered environments such as warehouses, mines, construction sites, and dense urban areas, where SLAM LiDAR delivers high accuracy and stable localization.

For instance, in October 2025, Topcon Positioning Systems showcased the CR-S2 scanner family at INTERGEO 2025, blending SLAM navigation with RTK corrections and upgraded Collage software. It unifies GNSS, total stations, and LiDAR for seamless surveying ecosystems, making complex site captures faster and more precise for construction pros across the Asia Pacific.

Key Takeaway

- 3D SLAM systems led with 67.6% in 2024, showing strong demand for high-precision spatial mapping used in autonomous navigation.

- Hardware accounted for 53.4%, reflecting continued reliance on advanced LiDAR units and sensing components to support real-time mapping.

- Navigation and path planning captured 42.1%, confirming its central role in autonomous mobility, route optimization, and obstacle avoidance.

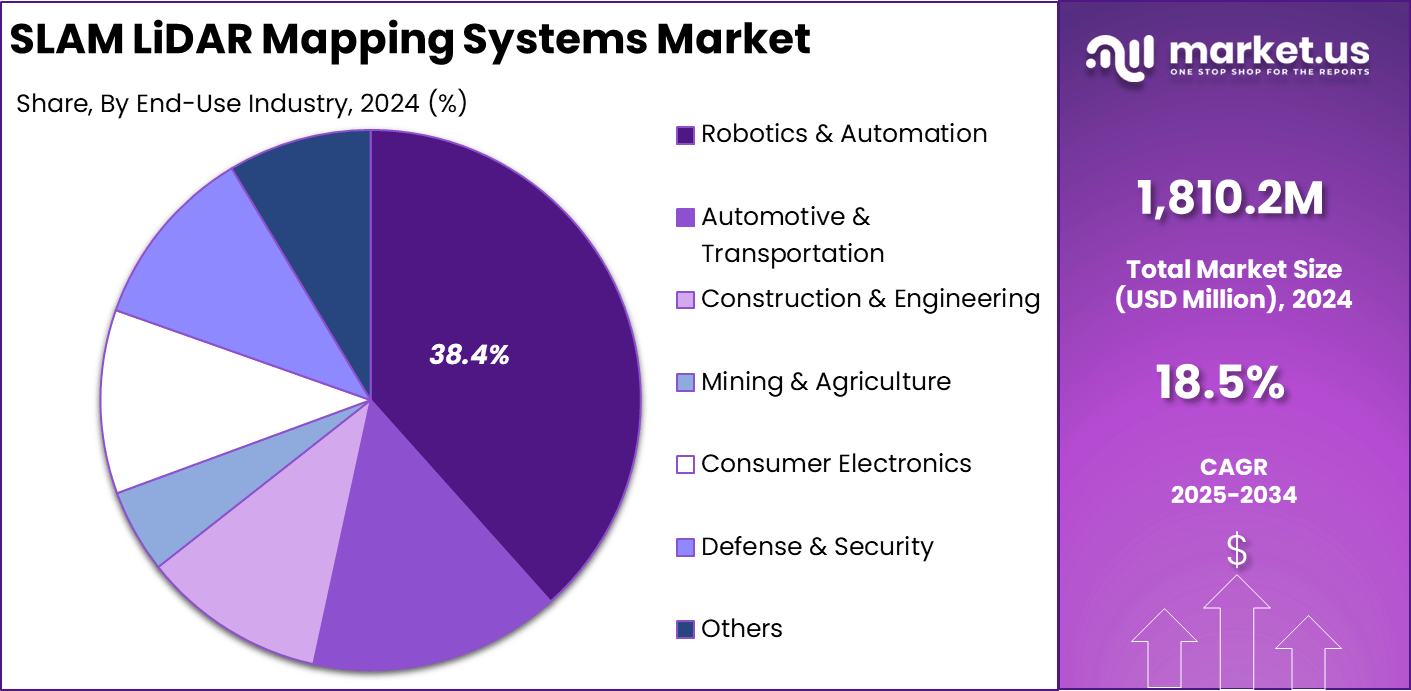

- Robotics and automation held 38.4%, driven by rapid expansion of autonomous robots across manufacturing, logistics, and industrial operations.

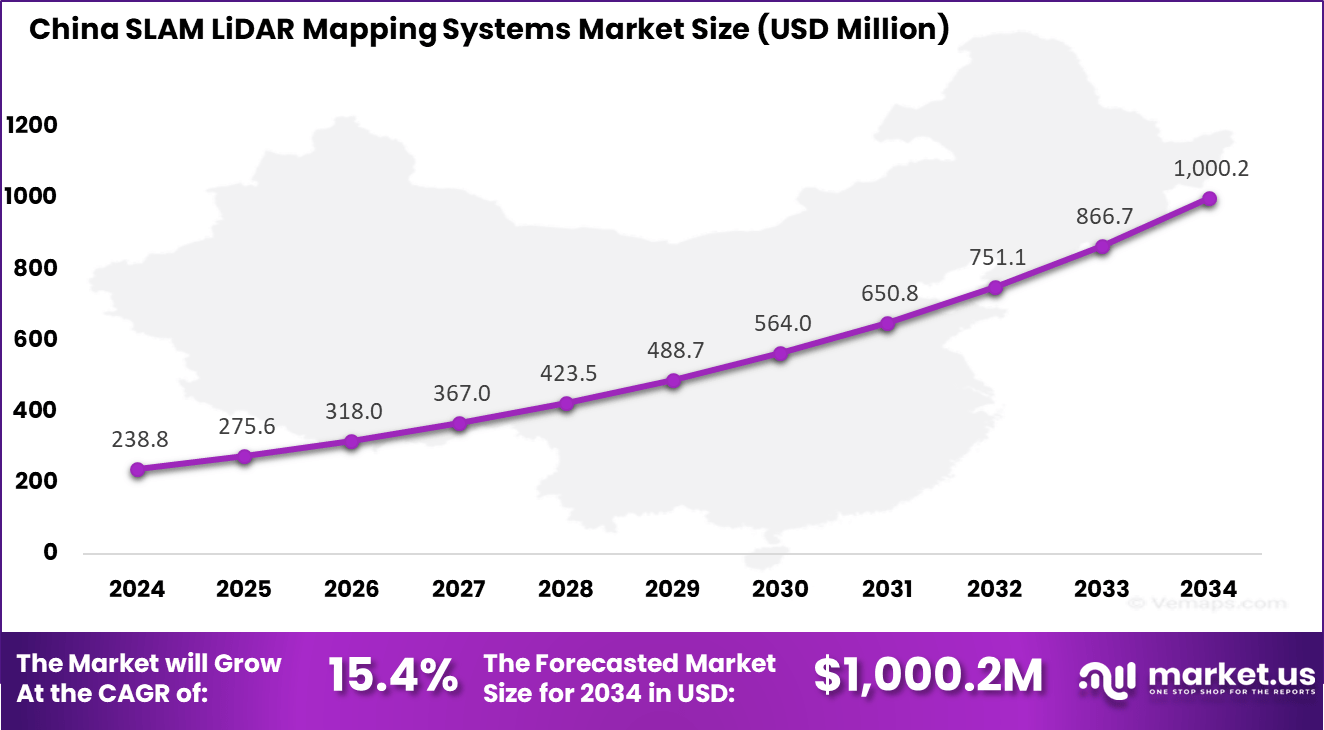

- China’s market reached USD 238.8 million in 2024 with a solid 15.4% CAGR, supported by strong robotics manufacturing and smart infrastructure projects.

- Asia Pacific dominated with more than 43.4%, backed by heavy investment in autonomous systems, LiDAR innovation, and large-scale industrial automation.

Increasing Adoption Technologies

Adoption of these systems is supported by rapid improvements in SLAM algorithms, sensor fusion techniques, and processing hardware. Current LiDAR sensors are more resilient to environmental noise, and they can capture dense point clouds that enable detailed mapping in three dimensions. Integration with artificial intelligence and machine learning further enhances system accuracy and adaptability.

Edge computing and real-time data processing architectures reduce latency during mapping tasks, ensuring that autonomous systems can respond promptly in dynamic situations. Organizations adopt SLAM LiDAR mapping systems primarily for their ability to deliver accurate position and environmental data without relying on external infrastructure such as GPS.

This independent navigation and mapping capability is critical for robots and vehicles that must operate in indoor, subterranean, or urban canyon environments where satellite signals may be unreliable. The precision of LiDAR sensing in combination with SLAM algorithms enhances situational awareness and supports autonomous decision-making in complex, real-world applications.

Investment and Business Benefits

Investment opportunities in this market are concentrated around enhancing sensor performance, developing efficient SLAM algorithm frameworks, and creating integrated software platforms that simplify deployment across different hardware types. Providers focusing on scalable solutions that can be adapted for specialized applications such as precision agriculture, automated mining vehicles, and infrastructure inspection may attract funding.

Increased interest from industries seeking to leverage automation for efficiency gains presents a favorable environment for investments in system integration services and long-term support models. From a business standpoint, SLAM LiDAR mapping systems enable improved operational efficiency and reduced error rates in automated tasks. Companies adopting these systems can reduce manual survey costs, accelerate project timelines, and support autonomous fleets with reliable navigation data.

Enhanced mapping capabilities also reduce risks associated with unknown terrain and cluttered environments by providing accurate spatial references that support safety and compliance. These benefits contribute to stronger competitive positioning among firms adopting advanced sensing technology.

China Market Size

The market for SLAM LiDAR Mapping Systems within China is growing tremendously and is currently valued at USD 238.8 million, the market has a projected CAGR of 15.4%. The market is growing due to rapid advances in autonomous vehicles and smart city projects that demand precise real-time mapping.

Factories push for robotics to handle complex logistics without human input, cutting costs and errors. Government support for tech self-reliance speeds adoption, while local sensor makers scale production to meet rising needs in drones and delivery bots. This blend of policy and industry drive keeps momentum strong.

For instance, in November 2025, Hesai Technology, headquartered in Shanghai, China, secured exclusive LiDAR design wins for Li Auto’s new-generation assisted driving platform, reinforcing China’s leadership in SLAM LiDAR mapping systems for autonomous vehicles. This partnership leverages Hesai’s advanced automotive-grade LiDAR sensors, enabling precise 3D mapping and real-time localization critical for ADAS and higher autonomy levels.

In 2024, Asia Pacific held a dominant market position in the Global SLAM LiDAR Mapping Systems Market, capturing more than a 43.4% share, holding USD 785.6 million in revenue. This dominance is due to booming robotics in factories and warehouses across the region, where precise mapping cuts downtime and boosts efficiency.

Smart city builds, and autonomous vehicle tests ramp up demand for real-time navigation tools. Local tech firms innovate fast, backed by government funds for automation. Heavy manufacturing hubs like China and Japan lead the charge, drawing global players to supply advanced sensors.

System Type Analysis

In 2024, 3D SLAM systems lead with a strong 67.6% share, reflecting their importance in high precision mapping and real time spatial understanding. These systems capture depth information and generate detailed 3D maps, which are essential for autonomous vehicles, drones, and advanced robotics.

The demand for 3D SLAM systems is rising as industries require accurate positioning in complex environments. Their ability to support dynamic decision making and real time navigation makes them a preferred choice for developers of intelligent mobility and automation systems.

For Instance, in May 2025, GeoSLAM introduced an upgraded handheld LiDAR mapper that uses 3D SLAM for both indoor and outdoor scans, targeting construction and surveying users who need quick walk‑and‑scan workflows. This kind of mobile 3D SLAM solution underpins wider adoption of 3D systems in field mapping, fitting well with their strong weight in the market.

Component Analysis

In 2024, Hardware accounts for 53.4%, showing that sensors, LiDAR units, processors, and onboard computing modules form the core of SLAM mapping systems. High quality hardware improves scanning accuracy, detection range, and environmental adaptability.

Growth in this segment is supported by continuous advancements in sensor technology and increasing use of compact LiDAR devices. Reliable hardware is essential for achieving stable mapping performance across indoor and outdoor applications.

For instance, in July 2024, FARO’s integration of GeoSLAM mobile mapping into its portfolio strengthened its hardware‑plus‑SLAM offering for reality capture and digital twin workflows. Combining robust scanners with SLAM processing reflects how hardware platforms remain central within the component split.

Application Analysis

In 2024, Navigation and path planning hold 42.1%, confirming this as the primary application for SLAM LiDAR systems. These tools help machines understand their surroundings, predict obstacle positions, and generate safe movement paths.

Industries adopt SLAM-based navigation to improve automation efficiency, reduce collision risks, and enhance overall operational accuracy. This segment continues to expand with the rise of autonomous robots, smart vehicles, and automated industrial systems.

For Instance, in October 2025, Trimble Inc. rolled out software with LiDAR QC tools for path planning and SLAM boresight tweaks. It plans routes around obstacles in complex sites like farms or buildings. Field teams adjust on the fly for smooth navigation. This makes autonomous moves safer and quicker.

End-Use Industry Analysis

In 2024, Robotics and automation represent 38.4%, making them the largest end-use industry for SLAM LiDAR mapping systems. Robots depend on SLAM technology to operate safely in dynamic environments and perform complex tasks without human direction.

The strong share of this segment is supported by increased use of service robots, warehouse automation, and inspection systems. SLAM LiDAR improves robot perception, movement stability, and decision making across multiple operational settings.

For Instance, in October 2025, Topcon Positioning Systems debuted the CR-S2 scanner, mixing SLAM with RTK for robot automation. It maps factories or mines without GNSS signals. Robots handle goods faster with live updates. Automation lines run non-stop with fewer mix-ups.

Emerging Trends

Emerging trends within this market reflect a clear shift toward high-accuracy and real-time 3D mapping capabilities. Adoption of 3D SLAM techniques is expanding as systems require detailed spatial awareness to operate reliably in complex and dynamic environments.

Integration of advanced sensor fusion algorithms that combine LiDAR with other modalities such as inertial measurement units and visual sensors is becoming more common, improving mapping accuracy and environmental perception.

The increasing use of LiDAR-based SLAM in unmanned aerial vehicles, autonomous ground vehicles and robotics underscores a move toward broader cross-industry deployment. Regional variation is observed in where this technology is being adopted most rapidly, with developed automation markets driving early uptake.

Growth Factors

Growth factors for this market derive from the increasing demand for autonomous navigation and precise mapping solutions across multiple sectors. The need for systems that can map environments in real time without reliance on pre-existing infrastructure has driven investment in LiDAR-enhanced SLAM solutions.

Advances in sensor hardware have resulted in smaller, more energy-efficient LiDAR units with greater range and resolution, making them suitable for a wider range of platforms including drones and mobile robots. Software improvements in SLAM algorithms have also reduced computational requirements while improving robustness in challenging environments.

Key Market Segments

By System Type

- 2D SLAM Systems

- 3D SLAM Systems

By Component

- Hardware

- Software

- Services

By Application

- Navigation & Path Planning

- 3D Mapping & Modeling

- Inspection & Surveying

- Augmented Reality (AR) & Virtual Reality (VR)

- Others

By End-Use Industry

- Robotics & Automation

- Automotive & Transportation

- Construction & Engineering

- Mining & Agriculture

- Consumer Electronics

- Defense & Security

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand in Autonomous Systems

Demand for SLAM LiDAR mapping systems is rising as industries increase adoption of automation and autonomous technologies. These systems enable robots and autonomous vehicles to map surroundings and navigate without GPS, which is critical in enclosed and dynamic settings such as warehouses, cities, and industrial sites where accuracy and safety are essential.

SLAM LiDAR solutions also support Industry 4.0 by improving material handling, inspection, and asset tracking across manufacturing, construction, agriculture, and logistics. As automation expands across sectors, the need for reliable and intelligent navigation systems continues to grow steadily.

For instance, in October 2025, Trimble rolled out new features in its Unity software at Innovate 2025. The updates focus on AI-driven mapping for asset tracking in factories. This helps robots navigate warehouses better, cutting downtime. Users report faster setup for automated lines. Demand surges as firms automate more.

Restraint

High Setup Costs

High upfront costs remain a major barrier to wider adoption of SLAM LiDAR mapping systems, as advanced sensors and high performance processing units are expensive to manufacture and integrate. This cost pressure is especially challenging for small and mid sized enterprises, while semiconductor shortages further increase prices and limit scalability in emerging markets.

Operational costs also remain high due to the need for skilled professionals to deploy, calibrate, and maintain these systems. Ongoing training and technical support raise the total cost of ownership, slowing adoption until more affordable and simplified LiDAR solutions become widely available.

For instance, in December 2025, FARO upgraded its Focus scanner and Orbis Premium SLAM device alongside Zone software. High-end kits target forensics but carry premium tags. Small survey teams hesitate due to setup costs. Training for full features adds budget strain. Cheaper rivals slow market share.

Opportunities

Smart City Projects

Smart city initiatives are creating strong opportunities for SLAM LiDAR systems as governments and urban planners seek accurate mapping tools for infrastructure monitoring and public safety. Deployment through drones and autonomous vehicles supports inspection of roads, utilities, and construction sites with limited human involvement, aligning with rising investment in digital urban infrastructure.

The integration of SLAM LiDAR with AI and cloud platforms further expands its value by enabling shared data for traffic control, infrastructure planning, and emergency response. Similar benefits extend to precision agriculture and mining, where real time mapping improves resource management and operational safety, widening adoption beyond city environments.

For instance, in April 2025, Quanergy linked its 3D LiDAR with Hanwha Vision at ISC West. Smart city perimeters gain real-time intrusion alerts. Drones map traffic flows without GPS gaps. Urban projects fund these pilots fast. Asia deals hint at big expansion.

Challenges

Rules and Data Safety

Regulatory and data privacy issues continue to challenge the SLAM LiDAR industry, as the use of drones, autonomous vehicles, and robotic systems often requires strict government approvals. The collection of detailed spatial data in public areas raises privacy concerns, increasing legal and compliance costs and slowing commercial deployment.

SLAM LiDAR systems also face technical limitations in dynamic environments where moving objects, changing light, or adverse weather can affect accuracy. Although ongoing improvements in algorithms are enhancing reliability, maintaining consistent performance in all conditions remains difficult, which may limit adoption until clearer regulations and stronger safeguards are in place.

For instance, in January 2025, Leica pushed BLK2FLY firmware for indoor GNSS-free scans in early 2025. Visual SLAM handles tight spots but faces drone regs in public areas. Privacy rules slow tests near crowds. Weather tests add compliance hurdles. Rollout waits on safety approvals.

Key Players Analysis

Velodyne Lidar, Leica Geosystems, Trimble, and FARO Technologies lead the SLAM LiDAR mapping systems market with high-precision sensors and real-time mapping software used in robotics, surveying, and autonomous navigation. Their systems support accurate point cloud generation, fast localization, and stable performance across indoor and outdoor environments. These companies focus on reliability, spatial accuracy, and integration with advanced perception platforms.

SICK, Quanergy Systems, RIEGL, Topcon Positioning Systems, Ouster, and LeddarTech strengthen the market with LiDAR units optimized for mobile mapping, industrial automation, and infrastructure inspection. Their solutions offer improved range, low latency, and robust environmental resistance. These providers emphasize scalability, modular design, and compatibility with SLAM frameworks.

GeoSLAM, Hesai Technology, Innoviz Technologies, Cepton Technologies, and other participants broaden the landscape with compact, cost-efficient, and AI-enhanced SLAM LiDAR systems. Their technologies support handheld, drone-based, and vehicle-mounted mapping workflows. These companies focus on portability, real-time processing, and flexible deployment.

Top Key Players in the Market

- Velodyne Lidar

- Leica Geosystems

- Trimble Inc.

- FARO Technologies

- SICK AG

- Quanergy Systems

- RIEGL Laser Measurement Systems

- Topcon Positioning Systems

- Ouster Inc.

- LeddarTech

- GeoSLAM

- Hesai Technology

- Innoviz Technologies

- Cepton Technologies

- Others

Recent Developments

- In October 2025, Trimble rolled out its next-gen POSPac Complete software, packing SLAM-powered LiDAR QC tools that handle boresight calibration and trajectory tweaks with auto ground control detection. This upgrade slashes processing time and supports RIEGL formats, making mobile mapping workflows smoother for surveyors hitting tough terrains. Field teams I’ve talked to say it’s a game-changer for ditching base stations entirely.

- In September 2025, RIEGL unveiled fresh LiDAR tech at INTERGEO Frankfurt, spotlighting the RiLOC-F system that fuses high-res scanning with IMU/GNSS for seamless UAV mapping. It cranks out geo-referenced point clouds fast, ideal for pros balancing speed and pinpoint accuracy in complex surveys. Early users note it cuts fieldwork by hours.

Report Scope

Report Features Description Market Value (2024) USD 1, 810.2 Mn Forecast Revenue (2034) USD 9, 883.5 Mn CAGR(2025-2034) 18.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By System Type (2D SLAM Systems, 3D SLAM Systems), By Component (Hardware, Software, Services), By Application (Navigation & Path Planning, 3D Mapping & Modeling, Inspection & Surveying, Augmented Reality (AR) & Virtual Reality (VR), Others), By End-Use Industry (Robotics & Automation, Automotive & Transportation, Construction & Engineering, Mining & Agriculture, Consumer Electronics, Defense & Security, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Velodyne Lidar, Leica Geosystems, Trimble Inc., FARO Technologies, SICK AG, Quanergy Systems, RIEGL Laser Measurement Systems, Topcon Positioning Systems, Ouster Inc., LeddarTech, GeoSLAM, Hesai Technology, Innoviz Technologies, Cepton Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  SLAM LiDAR Mapping Systems MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

SLAM LiDAR Mapping Systems MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Velodyne Lidar

- Leica Geosystems

- Trimble Inc.

- FARO Technologies

- SICK AG

- Quanergy Systems

- RIEGL Laser Measurement Systems

- Topcon Positioning Systems

- Ouster Inc.

- LeddarTech

- GeoSLAM

- Hesai Technology

- Innoviz Technologies

- Cepton Technologies

- Others