Global Skin Packaging Market By Material (Plastics, Paper and Paperboard, Others), By Application (Industrial Goods, Medical Devices, Processed Food, Cheese, Durable Consumer Goods, Food, Meat, Fish and Seafood), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 131997

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

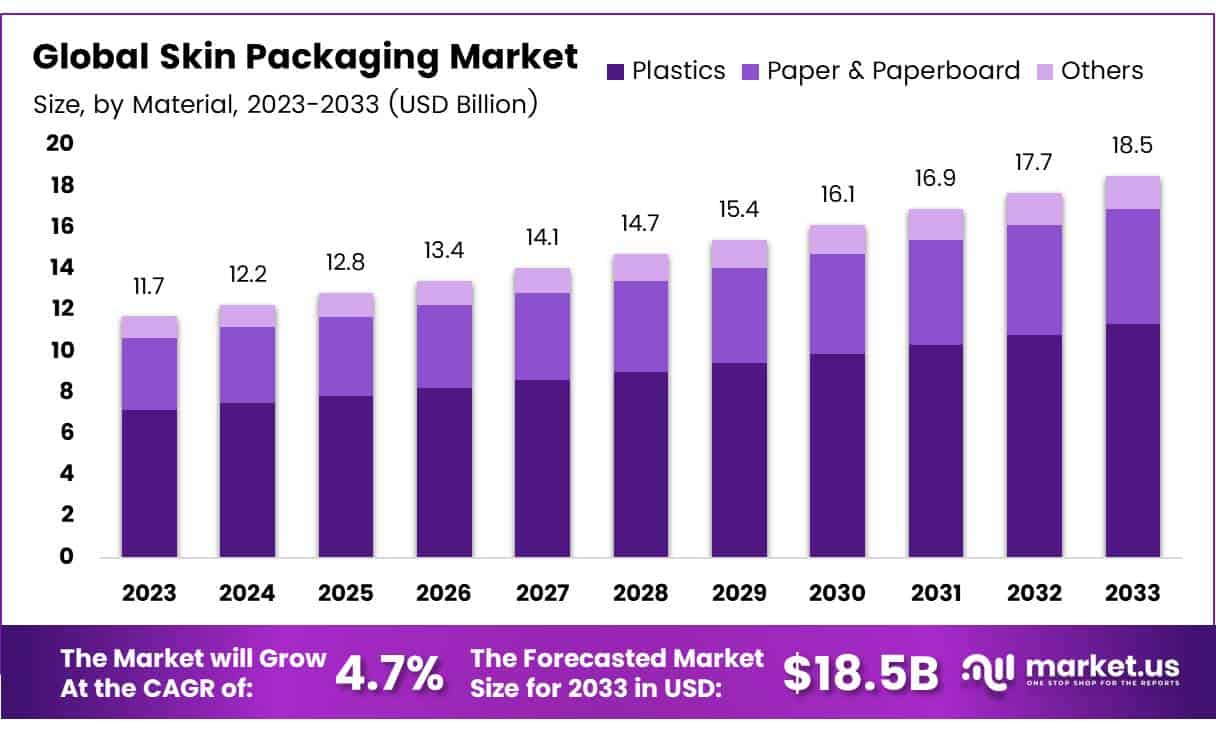

The Global Skin Packaging Market size is expected to be worth around USD 18.5 Billion by 2033, from USD 11.7 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

Skin packaging is a type of packaging technology that tightly wraps a product in a thin, transparent film sealed to a supportive backing like paperboard or a tray. This method involves heating the film and using a vacuum to mold it closely around the product. This packaging is especially useful for perishable items like meats and ready-to-eat meals, as it helps maintain freshness and visual appeal.

The skin packaging market is rapidly growing, driven by changing consumer preferences and advances in technology. This market includes various materials, equipment, and services used to create skin packaging solutions.

It prioritizes sustainability, efficiency, and safety, serving industries such as food and beverages, pharmaceuticals, and consumer electronics. The push for durable, lightweight packaging that extends product shelf life offers considerable opportunities for manufacturers and suppliers.

Globally, the demand for eco-friendly and effective packaging is increasing. Innovations in recyclable and biodegradable materials meet consumer and regulatory demands for environmental responsibility.

Furthermore, developments in technology that improve the attractiveness and freshness of packaged goods are opening new growth opportunities. These innovations also enhance logistical efficiency by reducing packaging size and weight, which cuts transportation costs and emissions.

Government policies and investments significantly influence the skin packaging sector. Regulations on food safety and packaging standards are critical, especially in the food industry. Additionally, government incentives, such as subsidies and tax rebates for adopting sustainable packaging technologies, are reshaping market trends and competitive strategies.

Initiatives aimed at reducing plastic waste are driving companies to invest in new, compliant materials, affecting the overall market dynamics.

According to industry sources like express plas pack, vacuum skin packaging can notably reduce transportation needs, with the potential to decrease truckloads by an average of 12% annually. This reduction is significant, reflecting not only on cost savings in logistics but also on the environmental impact by lowering CO2 emissions associated with transportation.

Such data underscores the role of skin packaging in enhancing supply chain efficiency and sustainability, which are key considerations for companies aiming to optimize their operational footprints.

Further emphasizing the technological efficiency of skin packaging, WH reports highlight that vacuum skin packaging possesses excellent optical properties and is capable of extending the shelf life of fresh products like meat for up to three weeks.

By significantly reducing food wastage—from 12% to 3% for beef sirloin steak, for instance—this technology plays a crucial role in addressing global food security challenges.

Additionally, kapag points out that flat skin packaging for fresh foods can reduce the plastic usage in overall packaging by up to 75%. These advancements not only meet consumer demands for quality and sustainability but also align with global environmental goals by minimizing waste and resource consumption.

Key Takeaways

- The global skin packaging market is expected to grow from USD 11.7 billion in 2023 to USD 18.5 billion by 2033, with a CAGR of 4.7%.

- Plastics accounted for 61.2% of the skin packaging market in 2023, preferred for their durability and cost-effectiveness.

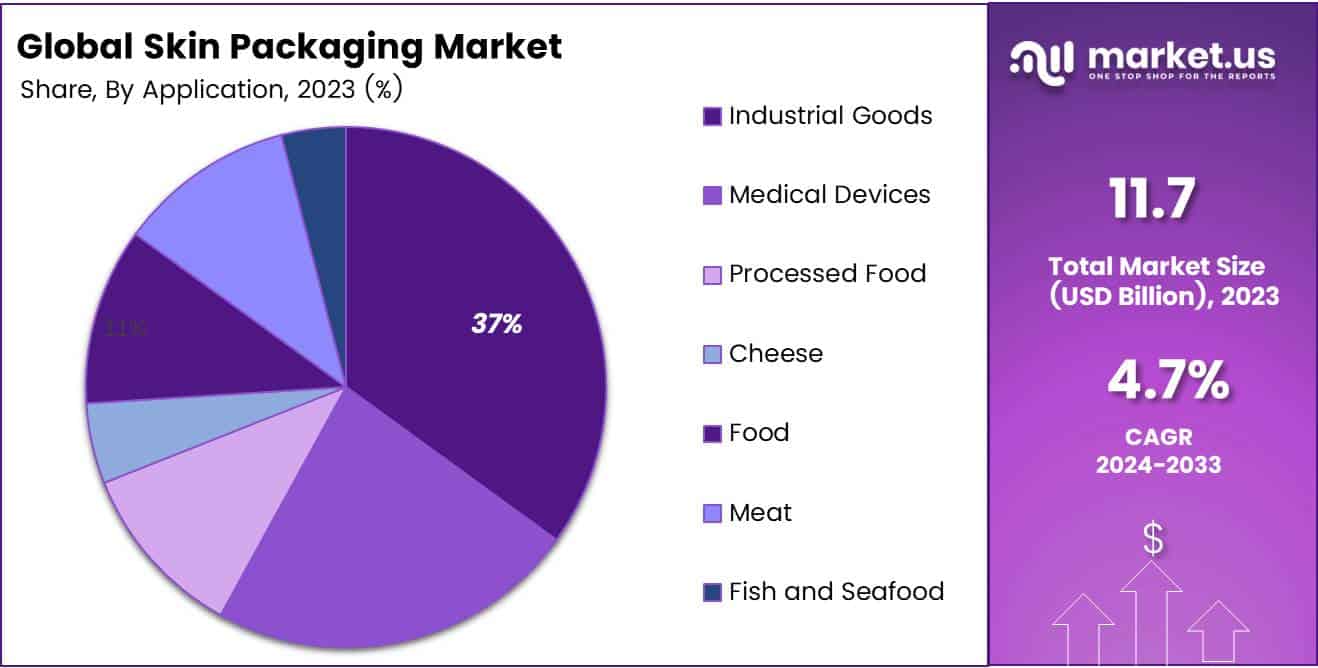

- Industrial goods led the application segment with a 37% share in 2023, due to the protective benefits of skin packaging.

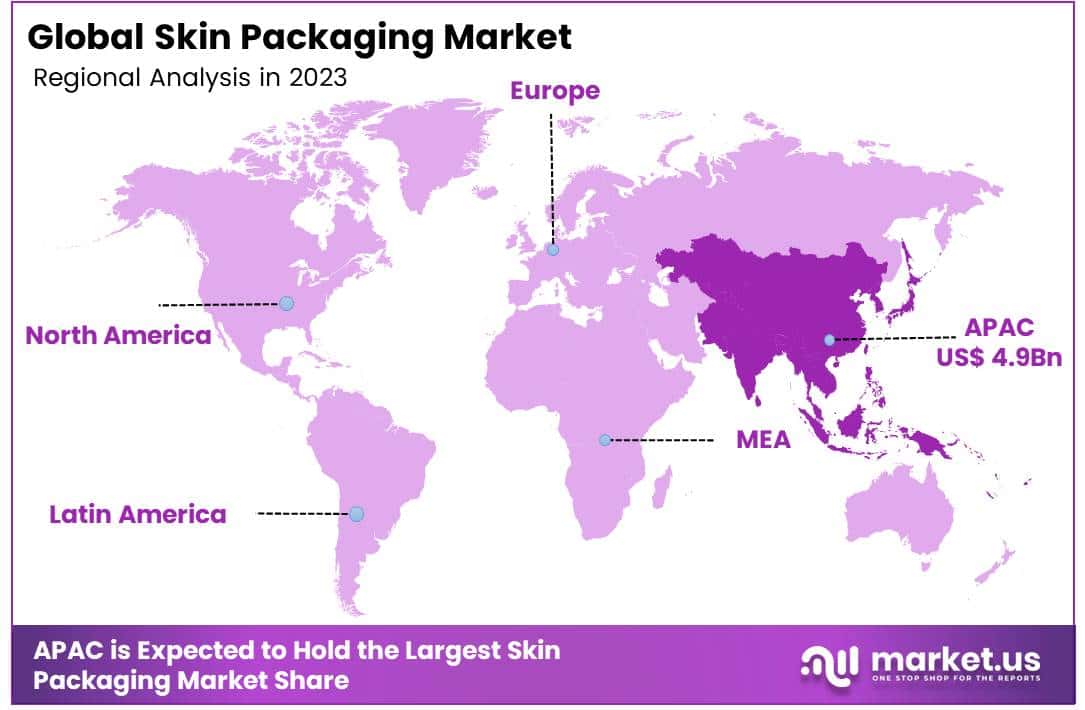

- Asia Pacific held a 42% market share in 2023, driven by robust manufacturing and rising consumer demand.

- Increasing demand for fresh and processed foods is driving market growth, as skin packaging helps extend shelf life and reduce spoilage.

- Expansion into emerging markets presents growth opportunities, driven by rising incomes and evolving consumer preferences.

Material Analysis

Plastic Dominates Skin Packaging Market with 61.2% Share in 2023

In 2023, Plastics held a dominant market position in the By Material Analysis segment of the Skin Packaging Market, accounting for a significant 61.2% share. This dominance is largely attributed to plastic’s versatility, durability, and cost-effectiveness, which make it the preferred choice for skin packaging applications across various industries, including food, electronics, and pharmaceuticals.

Plastic materials provide superior clarity and strength, essential for product visibility and protection, particularly in retail packaging.

Paper and Paperboard materials followed with a moderate share, reflecting an increased consumer and industry shift toward sustainable alternatives. With environmental concerns on the rise, paper-based packaging is gaining traction, especially among brands focused on reducing plastic use.

However, challenges persist with moisture resistance and durability in comparison to plastics, which limits paper’s dominance in segments where product protection is critical.

The Others category, encompassing materials like biodegradable films and composites, held a smaller share, indicating niche usage primarily in environmentally conscious markets. While growing, the adoption rate of these alternatives remains lower due to higher costs and limited applications.

Overall, plastic remains the cornerstone of the Skin Packaging Market, though shifting consumer demands could impact this trend in the coming years.

Application Analysis

Skin Packaging Market: Industrial Goods Lead with 37% Share

In 2023, Industrial Goods held a dominant market position in the By Application Analysis segment of the Skin Packaging Market, with a 37% share. This segment’s prominence is primarily due to the critical role that skin packaging plays in protecting industrial components from environmental factors and handling damage.

Skin packaging’s ability to tightly enclose products with a second-skin plastic film significantly reduces the risk of corrosion and enhances shelf presence, a vital factor in industrial applications. Following closely, the Medical Devices segment leverages skin packaging to maintain sterility and ensure safe transport, reflecting stringent healthcare standards.

Processed Food and Cheese segments also utilize skin packaging extensively to prolong shelf life and preserve flavor, with visual appeal boosting consumer trust. Durable Consumer Goods benefit similarly, with packaging that offers a clear view of the product, enhancing consumer confidence in the purchase.

The segments for Food, Meat, Fish, and Seafood emphasize the method’s ability to maintain product freshness and extend shelf life, crucial for perishable goods. Each application area underlines the adaptability of skin packaging to various market needs, affirming its integral role in safeguarding product integrity and enhancing marketability across diverse industries.

Key Market Segments

By Material

- Plastics

- Paper & Paperboard

- Others

By Application

- Industrial Goods

- Medical Devices

- Processed Food

- Cheese

- Durable Consumer Goods

- Food

- Meat

- Fish and Seafood

Drivers

Rising Demand for Food Drives Packaging Innovations

The skin packaging market is experiencing substantial growth primarily driven by an escalating demand for fresh and processed food products. This demand is not only boosting the consumption of these goods but also necessitating more effective packaging solutions that extend product shelf life and minimize spoilage.

Skin packaging, known for its ability to tightly encase products with a second-skin film, significantly enhances the product’s protection against external contaminants. This characteristic is especially crucial for perishable items, as it maintains their freshness and quality for longer periods, thereby reducing food waste and ensuring customer satisfaction.

Additionally, the continued expansion of the retail and e-commerce sectors has further amplified the need for skin packaging. As these sectors evolve, they demand not only functional but also visually appealing packaging solutions that can attract consumers while providing optimal product visibility and protection.

The adaptability of skin packaging to accommodate various product shapes and sizes, coupled with its clear visibility, makes it highly attractive in physical stores and online platforms where product presentation and safety are paramount. This convergence of functionality and aesthetic appeal in skin packaging is setting a new standard in the packaging industry, catering effectively to the dynamic needs of food distribution channels across the globe.

Restraints

Restraints on the Skin Packaging Market: Environmental Concerns

Despite the various advantages it offers, the skin packaging market faces significant restraints that could hinder its growth. Foremost among these is the environmental concern associated with the use of plastics.

Although skin packaging often utilizes less plastic compared to other methods, the core material is still predominantly plastic, which poses a disposal and recycling challenge. This factor is particularly impactful as consumer awareness and regulatory pressures increase regarding environmental sustainability.

Many consumers and businesses are shifting towards greener alternatives, which could decrease the demand for traditional skin packaging solutions. Additionally, the skin packaging market faces stiff competition from other packaging technologies like vacuum packaging and modified atmosphere packaging.

These alternatives not only match the benefits of skin packaging—such as product longevity and tamper evidence—but also often come with enhanced features that cater to specific industry needs, further intensifying the competition. This scenario compels manufacturers in the skin packaging sector to innovate and potentially integrate more sustainable materials and processes to maintain market share and appeal to an increasingly eco-conscious consumer base.

Growth Factors

Emerging Markets Drive Skin Packaging Growth

The opportunities for growth in the Skin Packaging Market are substantial and diverse. The foremost opportunity lies in the expansion into emerging markets, where rising disposable incomes and evolving consumer lifestyles are fueling demand, particularly in the food sector. This shift offers significant prospects for skin packaging solutions, known for their ability to preserve product integrity and extend shelf life.

Additionally, there is an increasing trend towards premium packaging, driven by brands striving to stand out in a competitive marketplace. The aesthetic and protective qualities of skin packaging make it ideal for this high-value segment, appealing to consumer preferences for both luxury and sustainability. Moreover, the pharmaceutical industry’s growing need for secure, tamper-evident packaging underscores another pivotal growth avenue.

Skin packaging’s ability to conform tightly to product shapes makes it an excellent choice for pharmaceuticals, ensuring product safety and consumer trust. Each of these opportunities highlights the adaptive and versatile nature of skin packaging technologies, poised to meet diverse industry needs while expanding its market footprint.

Emerging Trends

Shift Toward Minimalistic Packaging

In the evolving landscape of the Skin Packaging Market, three predominant trends are shaping demand and industry practices. Foremost is the shift toward minimalistic packaging, where businesses are increasingly adopting skin packaging due to its efficient use of materials, addressing consumer and regulatory calls for sustainability.

This trend is complemented by heightened concerns over hygiene and safety, particularly in the post-COVID-19 era. Packaging solutions that offer secure sealing and minimize contamination risks, such as skin packaging, are witnessing a surge in demand across multiple sectors.

Additionally, the rise of Vacuum Skin Packaging (VSP) is notable, especially in food applications where its superior oxygen barrier properties enhance product shelf-life and quality, thus aligning with consumer preferences for freshness and extended usability. These factors collectively drive the adoption of skin packaging solutions, marking a significant shift in packaging standards and consumer expectations.

Regional Analysis

Asia Pacific Dominates with 42% Share and USD 4.9 Billion in Value

The Skin Packaging Market is characterized by diverse regional dynamics, with Asia Pacific taking the lead with a commanding 42% market share, valued at USD 4.9 billion. This dominance is attributed to the robust manufacturing sector in countries like China and India, coupled with increasing consumer demand for packaged goods due to rising urbanization and income levels.

Regional Mentions:

North America follows, leveraging advanced packaging technologies and high consumer awareness regarding sustainable packaging options. The market here is driven by stringent food safety regulations that favor skin packaging for its ability to extend product shelf life.

Europe’s market is propelled by a preference for convenience foods and high meat consumption, which require reliable packaging solutions to ensure freshness and compliance with EU food safety standards. The region’s focus on recyclable and eco-friendly packaging materials is influencing market trends significantly.

Latin America and the Middle East & Africa, though smaller in comparison, are emerging as potential growth areas. Latin America benefits from increasing processed food consumption and a growing retail sector, which are creating more opportunities for skin packaging solutions. Meanwhile, the Middle East & Africa is experiencing gradual growth due to urbanization and an expanding retail infrastructure, although the market is still nascent.

Collectively, these regional markets contribute to a global industry landscape where technological advancements and shifting consumer preferences towards convenience and sustainability drive growth. Asia Pacific’s lead is expected to expand further, fueled by ongoing industrial activities and an expanding middle class that demands higher-quality packaged products.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Skin Packaging Market is witnessing substantial contributions from key players, among which PROAMPAC, MULTIVAC, and Amcor plc stand out due to their innovative approaches and expansive geographical footprints.

PROAMPAC has enhanced its market position through the adoption of sustainable materials and advanced technology in skin packaging solutions, aligning with the global shift towards sustainability. This strategy not only meets the increasing regulatory demands but also caters to the consumer preference for eco-friendly packaging.

MULTIVAC continues to excel by leveraging its robust R&D capabilities to develop highly efficient and customizable skin packaging machines. Their focus on automation and integration with IoT has allowed them to offer superior operational efficiency and real-time data monitoring, which are critical for maintaining high standards in packaging processes.

Amcor plc, with its global presence and strong focus on innovation, remains a leader in the space, driving advancements in barrier properties and material science to extend shelf life and enhance product appeal. Their commitment to R&D and collaboration with food and healthcare sectors to provide tailored packaging solutions further strengthens their market dominance.

Additionally, companies like Sealed Air and Klöckner Pentaplast are making significant strides by focusing on recyclable and reduced-material packaging options, thereby supporting the circular economy. These initiatives are not only environmentally significant but also economically beneficial, as they meet both regulatory frameworks and consumer expectations for sustainability.

Top Key Players in the Market

- PROAMPAC

- MULTIVAC

- Klöckner Pentaplast

- FLEXOPACK S.A.

- WINPAK LTD.

- PLASTOPIL

- Shanying International Holding Co., Ltd.

- Coveris.

- Sealed Air

- Amcor plc

Recent Developments

- In March 2024, Coveris announced the expansion of its barrier films capabilities to enhance its production of vacuum skin packaging (VSP). This development aims to strengthen the company’s position in high-performance food packaging, particularly in the fresh meat, poultry, and seafood sectors.

- In January 2023, SOLIDUS committed €11 million to advance its sustainable retail packaging solutions, with a focus on eco-friendly materials and production processes. This investment supports the company’s broader strategy to meet the growing demand for sustainable packaging in retail sectors, driven by regulatory changes and consumer preference for environmentally responsible products.

- In September 2024, Cara Partners declared that it would invest €130 million in its Cork, Ireland facility to expand its production capabilities. This investment will bolster the company’s manufacturing infrastructure, facilitating increased output and the development of innovative products.

- In May 2023, Skin Pharm, a skincare company, secured $15 million in funding from Prelude Growth Partners. This investment will support Skin Pharm’s expansion plans, including new product development, enhancement of its digital sales platform, and potential opening of new retail locations.

Report Scope

Report Features Description Market Value (2023) USD 11.7 Billion Forecast Revenue (2033) USD 18.5 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastics, Paper & Paperboard, Others), By Application (Industrial Goods, Medical Devices, Processed Food, Cheese, Durable Consumer Goods, Food, Meat, Fish and Seafood) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PROAMPAC, MULTIVAC, Klöckner Pentaplast, FLEXOPACK S.A., WINPAK LTD., PLASTOPIL, Shanying International Holding Co., Ltd., Coveris., Sealed Air, Amcor plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PROAMPAC

- MULTIVAC

- Klöckner Pentaplast

- FLEXOPACK S.A.

- WINPAK LTD.

- PLASTOPIL

- Shanying International Holding Co., Ltd.

- Coveris.

- Sealed Air

- Amcor plc