Global Skateboard Footwear & Apparel Market Size, Share, Growth Analysis Product Type (Skate Shoes [Slip-on Skate Shoes, Old Skool & Authentic Shoes, Others], T-Shirts [T- Shirts, Tank Tops, Jerseys] & Tops, Hoodies & Sweatshirts, Bottoms [Pants & Sweatpants, Shorts]), Consumer Orientation (Men, Women, Unisex, Kids), Distribution Channel (Specialty Stores, Direct Sales/Exclusive Stores, Sports Merchandise, Departmental Stores, Online Retailers, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176737

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

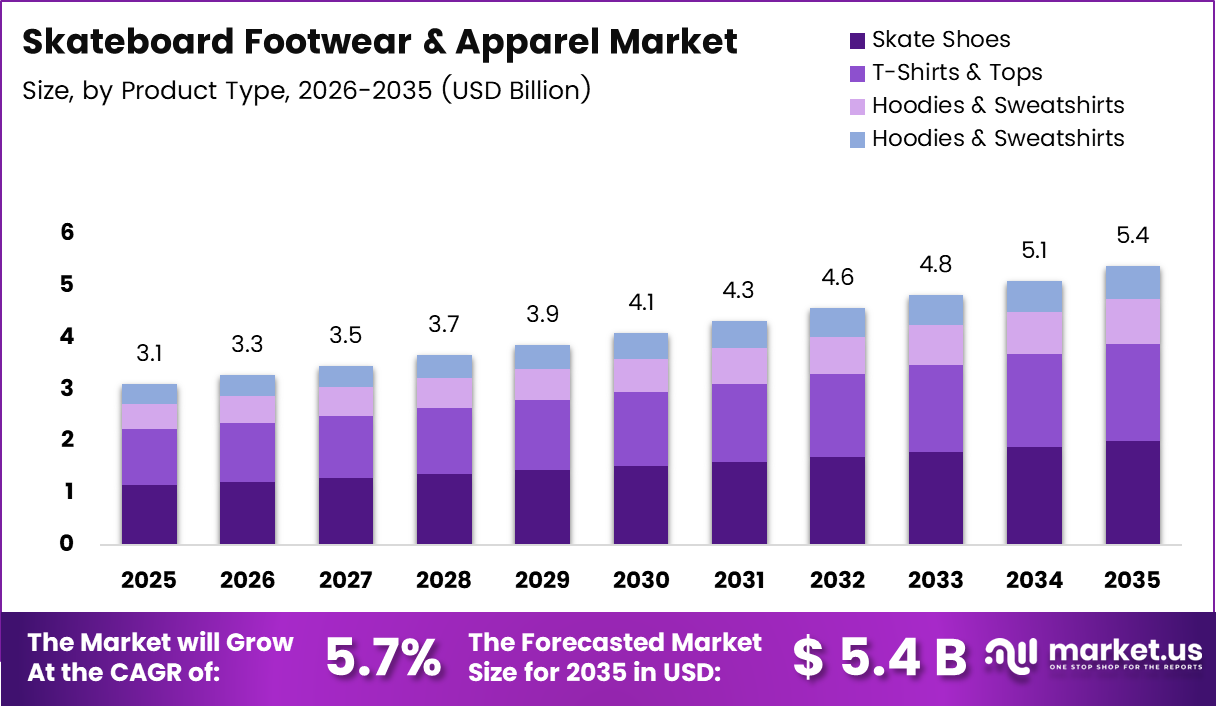

Global Skateboard Footwear & Apparel Market size is expected to be worth around USD 5.4 Billion by 2035 from USD 3.1 Billion in 2025, growing at a CAGR of 5.7% during the forecast period 2026 to 2035.

The skateboard footwear and apparel market encompasses specialized clothing and shoes designed for skateboarding activities. This includes skate shoes with enhanced grip and durability, graphic t-shirts, hoodies & Sweatshirt, and performance bottoms. These products blend functionality with streetwear aesthetics, appealing to both active skaters and fashion-conscious consumers.

Skateboarding has evolved from a niche sport into a global lifestyle phenomenon. Consequently, demand for authentic skate brands has surged across urban youth demographics. The market caters to performance needs while simultaneously driving mainstream fashion trends through collaborations with high-end labels and streetwear influencers.

Market growth is propelled by increasing youth participation in skateboarding as both sport and lifestyle. Moreover, the inclusion of skateboarding in international sporting events has elevated its profile globally. Urban development projects focusing on skate parks have created dedicated spaces that encourage community engagement and skill development.

The industry benefits from strong endorsements by professional skateboarders and social media influencers. Additionally, streetwear culture’s integration into mainstream fashion has expanded the consumer base beyond traditional skaters. E-commerce platforms enable direct-to-consumer sales, reducing distribution barriers and enhancing brand accessibility for emerging labels.

However, the market faces challenges from price-sensitive teen consumers with limited disposable income. Furthermore, competition from counterfeit products and unorganized local brands undermines premium pricing strategies. Nevertheless, innovation in sustainable materials and women-specific product lines presents significant expansion opportunities for established brands.

According to 2Hex Sports Manufacturer, the cost for each pair of skate shoes ranges between $14 to $30, with bulk orders requiring minimum investments of $20,000. This pricing structure influences retail positioning and profit margins across the supply chain, particularly for small-to-medium enterprises entering the market.

According to VF Corporation’s announcement in November 2025, the sale of the Dickies brand to Bluestar Alliance for $600 million reflects ongoing portfolio optimization among major apparel corporations. Additionally, the Nidecker Group’s acquisition of iconic skate brands from Sole Technology in February 2025 demonstrates continued industry consolidation and strategic repositioning efforts.

Key Takeaways

- The global Skateboard Footwear & Apparel Market is projected to grow from USD 3.1 Billion in 2025 to USD 5.4 Billion by 2035 at a CAGR of 5.7%.

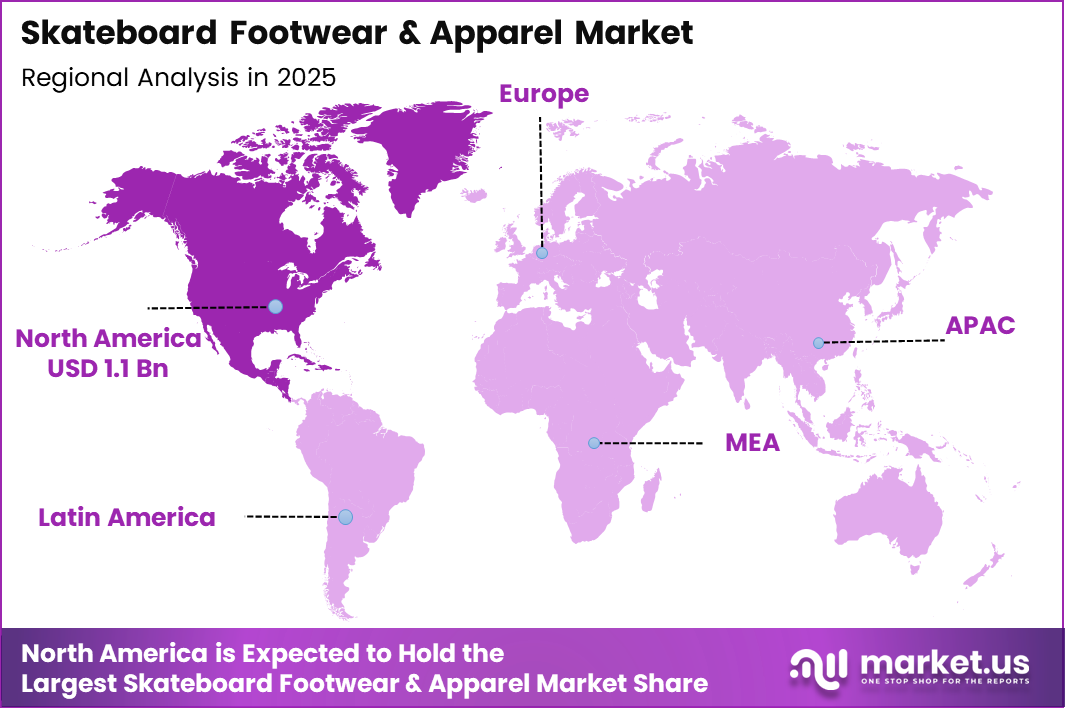

- North America dominates the market with a 36.2% share, valued at USD 1.1 Billion in 2025.

- Skate Shoes lead the Product Type segment with 37.1% market share in 2025.

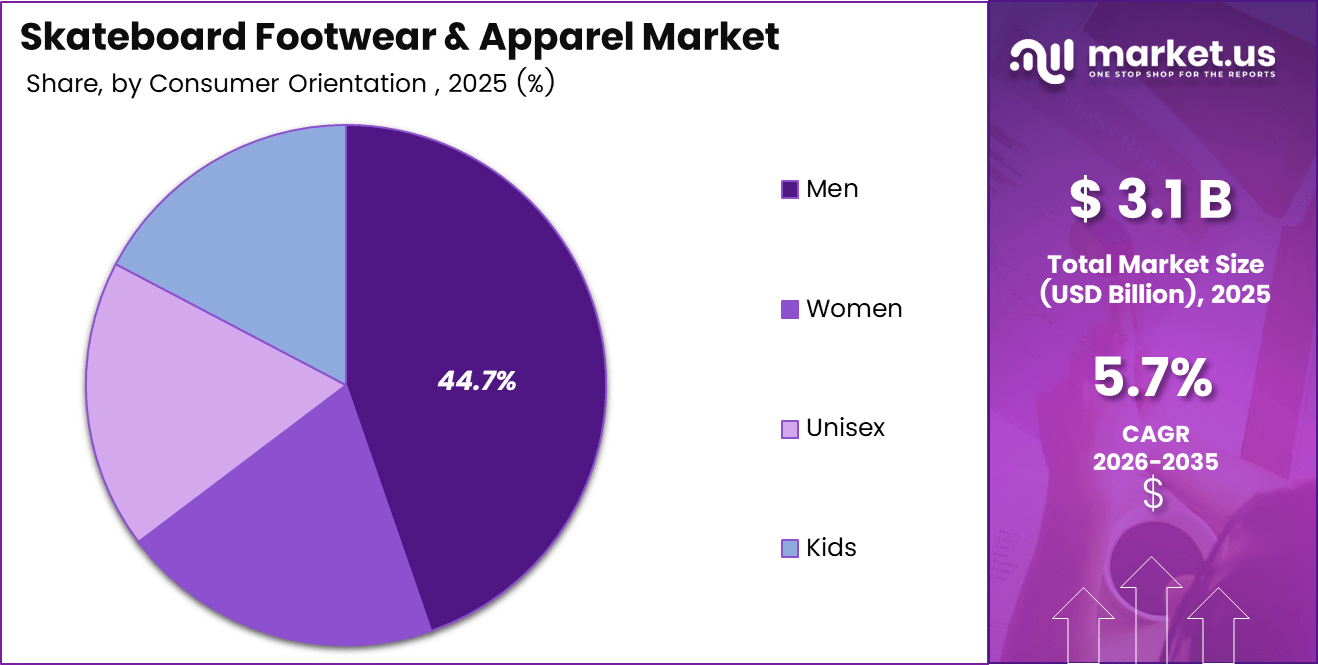

- Men’s segment holds the largest Consumer Orientation share at 44.7% in 2025.

- Specialty Stores dominate the Distribution Channel segment with 37.3% market share in 2025.

- Rising youth participation and streetwear culture influence drive market expansion through 2035.

- E-commerce growth and sustainable material innovation create new opportunities for brands globally.

Product Type Analysis

Skate Shoes dominate with 37.1% due to their essential role in skateboarding performance and safety.

In 2025, ‘Skate Shoes’ held a dominant market position in the ‘Product Type’ segment of Skateboard Footwear & Apparel Market, with a 37.1% share. These specialized shoes feature reinforced toe caps, grippy rubber soles, and padded collars that enhance board control and impact protection. Their dual appeal as performance gear and streetwear staples drives consistent demand across skater and fashion consumer segments.

Slip-on Skate Shoes offer convenience and classic aesthetics favored by casual skaters and lifestyle consumers. Additionally, these designs provide easier wear while maintaining essential grip features. Old Skool & Authentic Shoes represent iconic silhouettes with heritage appeal that transcend skateboarding into mainstream fashion. Moreover, their timeless designs enable cross-generational consumer engagement and brand loyalty.

T-Shirts & Tops serve as canvas for brand graphics and skate culture expression through bold designs. These apparel items include standard T-Shirts, breathable Tank Tops for warm-weather skating, and numbered Jerseys that emulate competitive sports aesthetics. Consequently, they form the foundational wardrobe layer for skate enthusiasts and streetwear fans alike.

Hoodies & Sweatshirts provide essential layering options while displaying brand identity through oversized fits and graphic prints. Furthermore, these garments bridge seasonal transitions and appeal to both active skaters requiring warmth and style-conscious consumers. Bottoms encompass durable Pants & Sweatpants designed for mobility and Shorts optimized for summer skating sessions and casual wear scenarios.

Consumer Orientation Analysis

Men dominate with 44.7% due to traditional male predominance in skateboarding participation and culture.

In 2025, ‘Men’ held a dominant market position in the ‘Consumer Orientation’ segment of Skateboard Footwear & Apparel Market, with a 44.7% share. Male consumers historically constitute the core skateboarding demographic, driving higher purchase frequency and brand loyalty. However, this segment faces increasing competition as brands expand into underserved consumer groups through targeted product development.

Women represent a rapidly growing segment as female skateboarding participation increases globally. Moreover, brands now develop women-specific fits, designs, and marketing campaigns that address previously ignored preferences. This demographic shift creates substantial growth opportunities as skateboarding becomes more inclusive and diverse across gender lines.

Unisex offerings appeal to consumers seeking versatile, gender-neutral designs that align with contemporary fashion sensibilities. Additionally, unisex products reduce inventory complexity while maximizing market reach. Kids segment focuses on introducing younger generations to skateboarding through affordable, durable products that withstand active play and frequent growth-related replacements.

Distribution Channel Analysis

Specialty Stores dominate with 37.3% due to expert guidance and curated skateboarding product selections.

In 2025, ‘Specialty Stores’ held a dominant market position in the ‘Distribution Channel’ segment of Skateboard Footwear & Apparel Market, with a 37.3% share. These dedicated skate shops provide knowledgeable staff, authentic brand experiences, and community connections valued by serious skaters. Consequently, they maintain competitive advantages despite e-commerce growth through personalized service and local engagement.

Direct Sales/Exclusive Stores enable brands to control customer experience, maintain premium positioning, and capture higher margins. Furthermore, flagship locations serve as brand showcases and marketing tools in key urban markets. Sports Merchandise retailers offer broader product assortments alongside skateboarding items, attracting casual consumers exploring action sports equipment and apparel.

Departmental Stores provide mainstream accessibility and convenience for consumers purchasing skate-inspired fashion without specialized knowledge requirements. Additionally, these channels expand brand visibility beyond core skater demographics. Online Retailers facilitate global reach, competitive pricing, and convenience, particularly appealing to younger digital-native consumers seeking product variety and exclusive online releases.

Key Market Segments

By Product Type

- Skate Shoes

- Slip-on Skate Shoes

- Old Skool & Authentic Shoes

- Others

- T-Shirts & Tops

- T-Shirts

- Tank Tops

- Jerseys

- Hoodies & Sweatshirts

- Bottoms

- Pants & Sweatpants

- Shorts

By Consumer Orientation

- Men

- Women

- Unisex

- Kids

By Distribution Channel

- Specialty Stores

- Direct Sales/Exclusive Stores

- Sports Merchandise

- Departmental Stores

- Online Retailers

- Others

Drivers

Rising Global Youth Participation and Streetwear Influence Drive Skateboard Footwear & Apparel Market Growth

Skateboarding has transitioned from underground subculture to mainstream lifestyle sport embraced by youth globally. Moreover, its inclusion in international sporting events has legitimized the activity, encouraging participation across diverse demographics. Urban communities increasingly view skateboarding as accessible recreation requiring minimal equipment, thereby expanding the potential consumer base for related footwear and apparel products.

Streetwear culture’s dominance in contemporary fashion elevates skateboard brands to premium status beyond their functional origins. Consequently, collaborations between skate labels and high-fashion houses blur traditional market boundaries, attracting consumers who never skateboard. This cultural crossover significantly expands addressable markets while enhancing brand prestige and pricing power across product categories.

Professional skateboarders and social media influencers drive authentic brand engagement through visible endorsements and content creation. Additionally, expansion of urban skate parks and community facilities provides dedicated spaces that normalize skateboarding as healthy recreation. Therefore, these factors collectively reinforce product demand while building long-term brand loyalty among younger consumer generations.

Restraints

Price Sensitivity and Counterfeit Competition Limit Skateboard Footwear & Apparel Market Expansion

Core skateboarding demographics predominantly comprise teenagers and young adults with limited disposable income and purchasing power. Consequently, premium-priced authentic products often remain inaccessible, forcing price-conscious consumers toward budget alternatives. This affordability challenge restricts market penetration among the most engaged consumer segments, limiting volume growth despite strong brand awareness and cultural relevance.

Intense competition from counterfeit products undermines authentic brands by offering visually similar items at significantly lower price points. Moreover, unorganized local brands replicate popular designs without licensing costs or quality standards, fragmenting market share. These unauthorized products particularly impact emerging markets where enforcement mechanisms remain weak and consumer price sensitivity peaks.

Brand dilution through counterfeiting erodes premium positioning carefully cultivated through athlete sponsorships and marketing investments. Additionally, quality inconsistencies in fake products damage category perception when consumers experience poor performance or durability. Therefore, these challenges necessitate increased investment in authentication technologies, legal enforcement, and consumer education programs that strain profitability margins.

Growth Factors

Sustainability Innovation and Market Diversification Accelerate Skateboard Footwear & Apparel Growth Opportunities

Increasing consumer awareness regarding environmental impact drives demand for sustainable and eco-friendly skateboard apparel materials. Consequently, brands investing in recycled fabrics, organic cotton, and responsible manufacturing processes differentiate themselves competitively. Moreover, younger consumers particularly value environmental commitments, making sustainability initiatives strategic imperatives rather than optional marketing tactics for future growth.

Growth of women-specific skateboarding footwear and apparel lines addresses historically underserved demographics experiencing rapid participation increases. Additionally, female-focused designs considering different fit preferences and aesthetic sensibilities expand total addressable markets. This segment diversification reduces dependence on traditional male consumers while capturing emerging opportunities in inclusive skateboarding culture.

Expansion of e-commerce and direct-to-consumer channels enables brands to bypass traditional retail margins and build direct customer relationships. Furthermore, digital platforms facilitate limited-edition releases and collaborative collections that generate excitement and urgency. Rising skateboarding popularity in emerging markets and tier-2 cities creates geographic expansion opportunities beyond saturated developed markets, particularly across Asia-Pacific regions.

Emerging Trends

Digital Innovation and Fashion Integration Reshape Skateboard Footwear & Apparel Market Landscape

Integration of skate footwear with casual and athleisure fashion blurs traditional product category boundaries and expands usage occasions. Consequently, consumers purchase skate shoes for everyday wear rather than exclusively for skateboarding activities. This trend significantly enlarges market potential while elevating skate brands into mainstream fashion conversations alongside established athletic and lifestyle labels.

Limited-edition drops and collaborative collections with fashion labels create scarcity-driven demand and cultural relevance beyond core skating communities. Moreover, strategic partnerships with streetwear brands, artists, and designers generate media attention and social media engagement. These exclusive releases command premium pricing while building brand desirability through carefully managed supply constraints and storytelling.

Growing preference for durable, performance-enhanced skate shoes reflects consumer sophistication and willingness to invest in quality products. Additionally, technological innovations in cushioning, board feel, and abrasion resistance justify premium positioning despite price sensitivity. Increased use of digital marketing and social media skate communities enables authentic brand storytelling, user-generated content amplification, and direct consumer engagement.

Regional Analysis

North America Dominates the Skateboard Footwear & Apparel Market with a Market Share of 36.2%, Valued at USD 1.1 Billion

North America leads the global market due to skateboarding’s deep cultural roots in California and established infrastructure across the region. The United States particularly drives demand through extensive skate park networks, professional competitions, and influential skate brands headquartered domestically. Moreover, strong streetwear culture integration and high consumer spending power sustain premium product adoption rates across diverse age demographics.

Europe Skateboard Footwear & Apparel Market Trends

Europe demonstrates steady growth driven by urban youth culture in major cities and increasing skateboarding acceptance as mainstream recreation. Germany, the UK, and France lead regional consumption through developed retail infrastructure and active skate communities. Additionally, sustainability consciousness among European consumers favors brands emphasizing eco-friendly materials and ethical manufacturing practices throughout supply chains.

Asia Pacific Skateboard Footwear & Apparel Market Trends

Asia Pacific represents the fastest-growing regional market as skateboarding gains popularity across China, Japan, and emerging Southeast Asian nations. Rising urbanization, youth population growth, and increasing disposable incomes create favorable demographic conditions. Furthermore, government investments in sports infrastructure and skateboarding’s Olympic inclusion accelerate participation rates and mainstream acceptance across the region.

Latin America Skateboard Footwear & Apparel Market Trends

Latin America shows promising growth potential despite economic challenges, particularly in Brazil and Mexico where skateboarding enjoys grassroots popularity. Urban youth increasingly embrace skate culture as self-expression and recreation amid limited entertainment options. However, price sensitivity and counterfeit competition remain significant barriers requiring strategic localization and affordable product tier development.

Middle East & Africa Skateboard Footwear & Apparel Market Trends

Middle East & Africa exhibits nascent but growing interest in skateboarding, concentrated in urban centers and expatriate communities. GCC countries demonstrate higher purchasing power and willingness to adopt Western youth culture trends. Nevertheless, limited skate park infrastructure and cultural barriers slow mainstream adoption compared to established markets globally.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Volcom, LLC maintains strong market presence through authentic skate heritage and lifestyle brand positioning that resonates with action sports enthusiasts. The company leverages professional athlete sponsorships and innovative product designs that blend performance functionality with contemporary streetwear aesthetics. Moreover, Volcom’s integration within broader apparel corporations provides distribution advantages while maintaining credible skate culture connections.

Element differentiates through environmental sustainability commitments and nature-inspired designs that appeal to eco-conscious younger consumers. The brand’s focus on renewable materials and responsible manufacturing processes aligns with emerging consumer values regarding corporate social responsibility. Additionally, Element’s skateboard deck innovations complement its apparel offerings, creating comprehensive brand ecosystems that enhance customer loyalty.

NHS Inc. represents authentic skateboarding industry roots through ownership of heritage brands and manufacturing operations spanning multiple decades. The company’s portfolio encompasses specialized skate footwear, protective equipment, and accessories that serve core skateboarding communities. Furthermore, NHS maintains independent ownership structure that enables long-term strategic planning without external shareholder pressures.

High Speed Productions Inc. operates through direct-to-consumer e-commerce platforms and retail stores serving skateboarding enthusiasts with curated product selections. The company emphasizes community engagement through skate events, team sponsorships, and content creation that builds authentic relationships. Moreover, High Speed’s retail expertise provides valuable consumer insights that inform product development and merchandising strategies.

Key players

- Volcom, LLC

- Element

- NHS Inc.

- High Speed Productions Inc.

- CCS

- Tactics

- HUF Worldwide

- Diamond Supply Co.

- Primitive Skateboarding

- Stüssy

Recent Developments

- February 2025 – The Nidecker Group successfully acquired iconic skate brands from Sole Technology, expanding its action sports portfolio and strengthening market positioning. This strategic consolidation enables operational synergies and enhanced distribution capabilities across multiple skateboarding product categories globally.

- November 2025 – VF Corporation completed the sale of the Dickies brand to Bluestar Alliance LLC for USD 600 million in cash, reflecting ongoing portfolio optimization strategies. This divestiture allows VF to focus resources on core brands while Bluestar gains an established workwear label with crossover appeal.

Report Scope

Report Features Description Market Value (2025) USD 3.1 Billion Forecast Revenue (2035) USD 5.4 Billion CAGR (2026-2035) 5.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Skate Shoes [Slip-on Skate Shoes, Old Skool & Authentic, Others Shoes], T-Shirts & Tops [T- Shirts, Tank Tops, Jerseys], Hoodies & Sweatshirts, Bottoms [Pants & Sweatpants, Shorts]), Consumer Orientation (Men, Women, Unisex, Kids), Distribution Channel (Specialty Stores, Direct Sales/Exclusive Stores, Sports Merchandise, Departmental Stores, Online Retailers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Volcom LLC, Element, NHS Inc., High Speed Productions Inc., CCS, Tactics, HUF Worldwide, Diamond Supply Co., Primitive Skateboarding, Stüssy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Skateboard Footwear & Apparel MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Skateboard Footwear & Apparel MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Volcom, LLC

- Element

- NHS Inc.

- High Speed Productions Inc.

- CCS

- Tactics

- HUF Worldwide

- Diamond Supply Co.

- Primitive Skateboarding

- Stüssy