Global Silver Wound Dressing Market By Product Type (Silver Bandages, Silver Foam Dressings, Silver Plated Nylon Fiber Dressings, Silver Hydrogel and Hydrofiber Dressings and Silver Alginate Dressings), By Type (Traditional and Advanced), By Application (Acute Wounds and Chronic Wounds), By Age Group (Pediatric, Adult and Geriatric), By End-User (Hospitals, Clinics and Wound Care Centers, Home Healthcare and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174667

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

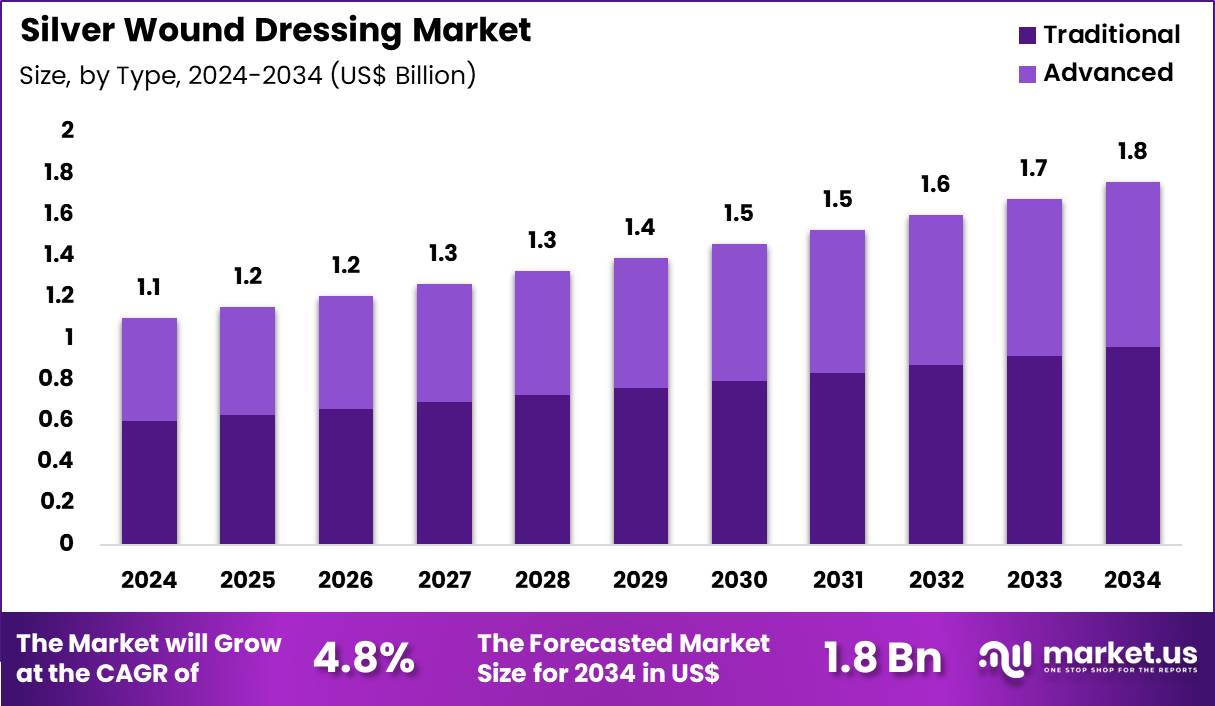

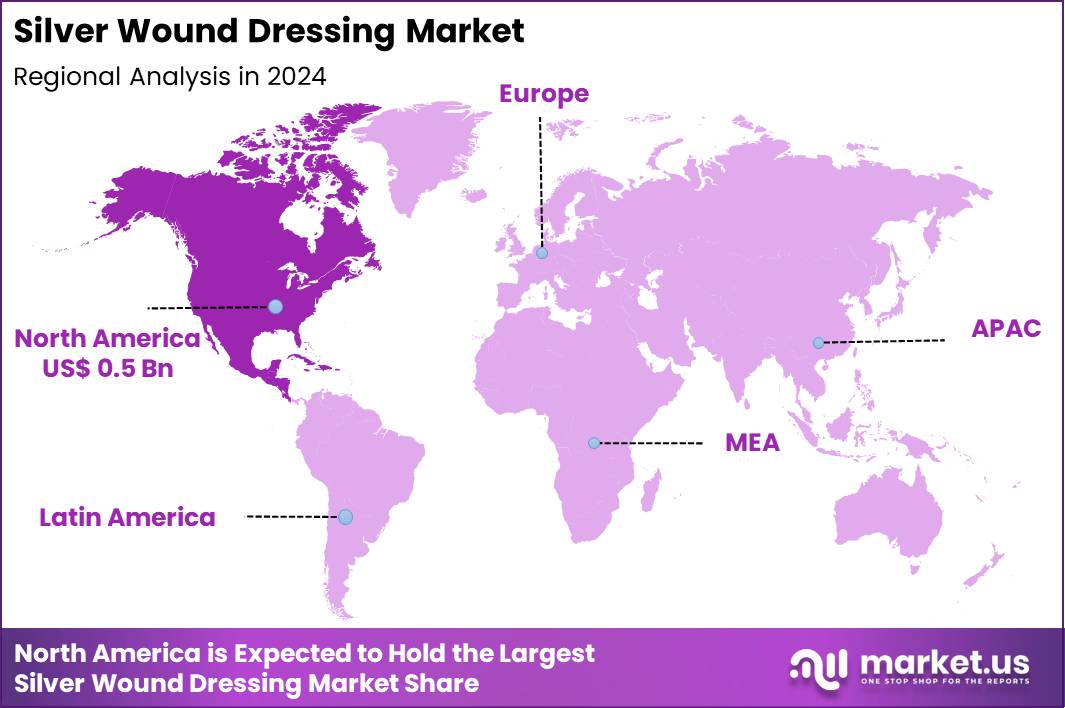

The Global Silver Wound Dressing Market size is expected to be worth around US$ 1.8 Billion by 2034 from US$ 1.1 Billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 47.2% share with a revenue of US$ 0.5 Billion.

Increasing prevalence of chronic wounds, particularly among diabetic and elderly populations, drives demand for silver wound dressings that combine antimicrobial action with effective exudate management. Wound care specialists increasingly apply silver-impregnated hydrofiber dressings to venous leg ulcers, where sustained silver ion release combats bacterial colonization while the absorbent core promotes moist healing and reduces dressing change frequency.

These products support treatment of diabetic foot ulcers by controlling bioburden in neuropathic wounds, preventing progression to osteomyelitis and facilitating granulation tissue formation. Clinicians utilize silver foam dressings for pressure injuries in long-term care settings, leveraging their cushioning properties and antimicrobial barrier to accelerate epithelialization in stage II and III ulcers.

Silver alginate dressings address moderately to heavily exuding burns and surgical wounds, providing rapid fluid absorption and sustained antimicrobial protection during the inflammatory phase. In May 2024, Convatec released findings from a multinational randomized controlled trial demonstrating strong clinical performance of its AQUACEL Ag+ Extra dressing in venous leg ulcer treatment.

The study showed significantly higher healing outcomes compared with standard care, reinforcing the role of advanced antimicrobial dressings in accelerating wound closure and improving clinical results in chronic wound management.

Manufacturers pursue opportunities to develop next-generation silver dressings with enhanced release kinetics, enabling longer wear times and reduced caregiver burden in outpatient chronic wound therapy. Developers advance combination technologies that integrate silver with anti-inflammatory agents or growth factors, expanding applications in stalled wounds requiring multimodal intervention.

These innovations facilitate use in post-surgical sites prone to infection, where silver dressings minimize biofilm formation and support faster return to function. Opportunities emerge in silver nanoparticle formulations that optimize cytotoxicity while maintaining broad-spectrum efficacy against resistant pathogens. Companies invest in conformable, low-adherent silver dressings that improve patient comfort during frequent changes in pediatric and fragile skin cases.

Firms explore sustainable silver delivery systems that reduce environmental impact without compromising antimicrobial performance, aligning with healthcare sustainability goals. Recent trends emphasize evidence-based protocols that position silver dressings as first-line options in infected or high-risk chronic wounds, driving adoption across diverse clinical settings.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.1 Billion, with a CAGR of 4.8%, and is expected to reach US$ 1.8 Billion by the year 2034.

- The product type segment is divided into silver bandages, silver foam dressings, silver plated nylon fiber dressings, silver hydrogel and hydrofiber dressings and silver alginate dressings, with silver bandages taking the lead with a market share of 36.8%.

- Considering type, the market is divided into traditional and advanced. Among these, traditional held a significant share of 54.6%.

- Furthermore, concerning the application segment, the market is segregated into acute wounds and chronic wounds. The acute wounds sector stands out as the dominant player, holding the largest revenue share of 58.3% in the market.

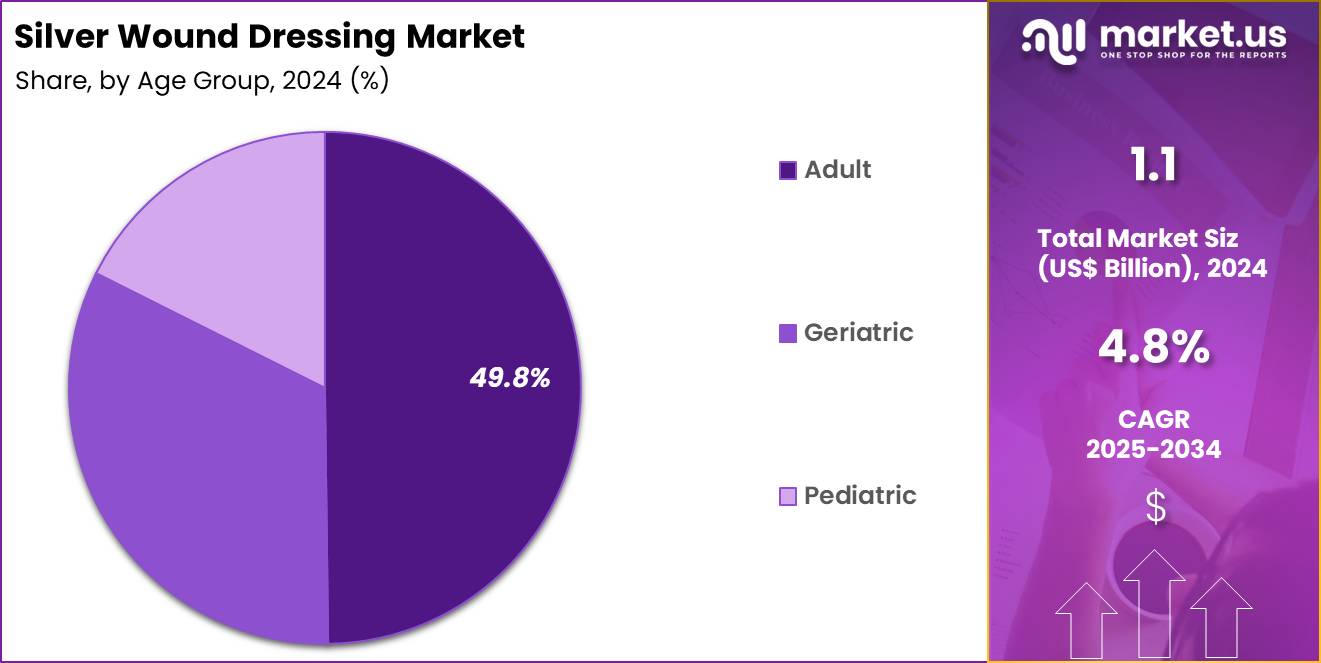

- The age group segment is segregated into pediatric, adult and geriatric, with the adult segment leading the market, holding a revenue share of 49.8%.

- The end-user segment is divided into hospitals, clinics and wound care centers, home healthcare and others, with hospitals taking the lead with a market share of 44.9%.

- North America led the market by securing a market share of 47.2%.

Product Type Analysis

Silver bandages accounted for 36.8% of growth within the product type category and represent the most widely used format in the Silver Wound Dressing market. Clinicians prefer silver bandages due to ease of application and broad antimicrobial coverage. Acute care settings rely on bandages for rapid wound protection and infection prevention.

Cost-effectiveness supports high-volume usage across hospitals. Familiarity among healthcare professionals accelerates adoption in routine wound management. Silver bandages suit a wide range of wound sizes and locations. Immediate availability supports emergency and trauma care needs. Reduced training requirements improve workflow efficiency.

Manufacturers offer varied sizes to address diverse clinical scenarios. Bandages support short-term wound management protocols effectively. Antimicrobial action reduces bacterial load during early healing phases. High turnover rates increase repeat purchasing. Standardized treatment pathways often start with bandage-based solutions.

Accessibility across care settings strengthens demand. Silver bandages integrate well into first-aid and postoperative care. Procurement teams favor dependable and scalable products. Packaging improvements extend shelf life and usability. Global trauma and surgical volumes increase consumption. Infection control priorities strengthen reliance on silver bandages. The segment is projected to remain dominant due to versatility, affordability, and clinical familiarity.

Type Analysis

Traditional dressings represented 54.6% of growth within the type category and remain the preferred option in the Silver Wound Dressing market. Many healthcare facilities continue to rely on conventional wound care protocols. Traditional silver dressings offer straightforward antimicrobial protection without complex handling. Lower cost compared to advanced dressings supports widespread use. Resource-limited settings favor traditional solutions for routine care.

Clinical staff maintain strong familiarity with traditional dressing techniques. Acute care protocols frequently recommend conventional dressings for initial treatment. Simpler reimbursement structures support adoption. Traditional products support high patient throughput environments. Manufacturing scale improves supply consistency. Traditional dressings integrate easily into existing formularies.

Minimal equipment requirements reduce operational burden. Short treatment durations suit traditional product usage. Infection prevention during early wound stages drives demand. Emergency departments prioritize rapid application methods.

Consistent performance strengthens clinician confidence. Training programs emphasize traditional wound care approaches. Global healthcare expansion increases demand for basic dressings. Traditional products remain essential for baseline wound management. The segment is anticipated to retain leadership due to cost sensitivity and established clinical practice.

Application Analysis

Acute wounds captured 58.3% of growth within the application category and stand as the primary driver of demand in the Silver Wound Dressing market. Rising surgical procedures increase postoperative wound management needs. Trauma cases generate immediate demand for antimicrobial dressings. Emergency departments rely on silver dressings to reduce infection risk. Acute wounds benefit from short-term antimicrobial protection.

Rapid intervention improves healing outcomes. Increased road accidents and workplace injuries contribute to volume growth. Surgical site infection prevention strengthens adoption. Burn care units frequently use silver-based solutions. Acute wound treatment emphasizes fast healing and infection control. Hospital protocols prioritize silver dressings during early wound phases.

Short hospital stays increase dressing change frequency. Sports injuries increase outpatient acute wound cases. Seasonal injury patterns support steady demand. Military and disaster response scenarios increase usage. Clinicians prefer proven antimicrobial solutions for acute care. Faster recovery supports healthcare efficiency goals. Acute wound prevalence remains high across age groups. The segment is expected to remain dominant due to procedural volumes and emergency care reliance.

Age Group Analysis

Adult represented 49.8% of growth within the age group category and dominate consumption in the Silver Wound Dressing market. Adults experience higher rates of surgical procedures and traumatic injuries. Workplace accidents contribute to wound incidence. Lifestyle-related injuries increase demand for effective wound care.

Adults frequently undergo elective and emergency surgeries. Faster recovery expectations drive use of antimicrobial dressings. Adults often seek early treatment to minimize downtime. Sports and recreational injuries increase acute wound cases. Adults show higher outpatient wound care utilization. Hospitals manage a large adult patient base daily.

Occupational hazards support continuous demand. Cosmetic and dermatological procedures add to wound care needs. Adults prefer solutions that reduce infection risk and scarring. Awareness of wound infection consequences supports compliance. Urbanization increases injury exposure. Adults access healthcare services more frequently than pediatric groups.

Treatment guidelines often target adult populations first. Adult-focused healthcare infrastructure supports higher usage. The segment is projected to remain dominant due to activity levels and healthcare utilization patterns.

End-User Analysis

Hospitals accounted for 44.9% of growth within the end-user category and remain the largest point of use in the Silver Wound Dressing market. Hospitals manage high volumes of surgical and trauma patients. Inpatient care requires stringent infection control measures. Surgical wards rely on silver dressings for postoperative management. Emergency departments generate continuous demand for acute wound treatment. Centralized procurement supports consistent supply.

Hospitals maintain standardized wound care protocols. Multidisciplinary teams emphasize antimicrobial protection. Teaching hospitals influence broader clinical adoption. High patient turnover increases dressing consumption rates. Burn units contribute significantly to usage volumes. Infection prevention committees support silver-based solutions. Hospitals manage complex wounds requiring monitored care.

Regulatory standards reinforce antimicrobial dressing use. Postoperative follow-up often begins in hospitals. Expansion of hospital infrastructure increases demand. Advanced surgical capabilities increase wound care needs. Referral networks concentrate severe cases in hospitals. Hospitals prioritize patient safety and outcome optimization. The segment is expected to retain dominance due to patient concentration and procedural intensity.

Key Market Segments

By Product Type

- Silver bandages

- Silver foam dressings

- Silver plated nylon fiber dressings

- Silver hydrogel and hydrofiber dressings

- Silver alginate dressings

By Type

- Traditional

- Advanced

By Application

- Acute wounds

- Chronic wounds

By Age Group

- Pediatric

- Adult

- Geriatric

By End-User

- Hospitals

- Clinics and wound care centers

- Home healthcare

- Others

Drivers

The rising prevalence of chronic conditions is driving the market

The escalating incidence of chronic diseases like diabetes and cancer is the primary driver for the silver wound dressing market. In 2024, the National Cancer Institute estimated that 2,001,140 new cancer cases were recorded in the US, many of which require surgical interventions that necessitate antimicrobial care.

Silver dressings are increasingly utilized in these scenarios because their broad-spectrum properties effectively manage bioburden in wounds susceptible to bacterial colonization. Key market players have reported growth to meet this demand; for instance, Convatec reported that its advanced wound care segment grew by 7.4% in 2024. Smith & Nephew also demonstrated momentum, with its Advanced Wound Management division delivering 5.1% underlying revenue growth for the full year 2024.

The shift toward outpatient and home care settings further accelerates adoption, as these dressings allow for longer wear times. Government data from the CDC in 2024 highlights that chronic diseases remain leading causes of disability, reinforcing the long-term necessity for infection-control products.

As surgical volumes increase alongside an aging population, the reliance on silver ions to prevent post-operative complications continues to solidify. Consequently, the integration of silver into standard protocols for chronic wound care is a critical factor sustaining market expansion.

Restraints

Stringent regulatory frameworks and clinical safety concerns are restraining the market

The silver wound dressing market faces significant restraints due to rigorous regulatory requirements and growing clinical concerns regarding cytotoxicity. In regions like the US and the European Union, the implementation of updated FDA guidelines has increased the time-to-market for innovative products. Clinicians in some jurisdictions remain hesitant to utilize silver-based dressings for prolonged periods due to potential impacts on tissue regeneration.

Furthermore, high production costs often lead to premium pricing that exceeds the reimbursement limits of publicly funded healthcare systems. For example, Medicare Administrative Contractors in the US recently delayed Local Coverage Determinations (LCDs) that impact specialized wound products. Convatec has noted that these regulatory shifts are expected to reduce their specific category revenue by approximately US$ 50 million in 2025.

Environmental concerns regarding the disposal of silver nanoparticles also present a growing challenge for manufacturers. Regulatory authorities continue to refine safety profiles, which can lead to stricter labeling for antimicrobial products. These factors collectively contribute to a more cautious adoption curve in price-sensitive markets.

Additionally, the lack of aligned international standards for antimicrobial efficacy testing creates hurdles for global expansion. Despite the efficacy of silver, these economic and safety-related barriers represent a substantial check on the speed of market penetration.

Opportunities

Combating antimicrobial resistance (AMR) is creating growth opportunities

The global threat of antimicrobial resistance (AMR) provides a significant opportunity for silver wound dressings as a non-antibiotic alternative for managing localized infections. Silver nanoparticles have demonstrated efficacy against multidrug-resistant bacteria, as highlighted in research published in Frontiers in Pharmacology in 2024. Because silver ions attack multiple sites within a bacterial cell, the risk of pathogens developing resistance is considerably lower compared to traditional antibiotics.

This has led to a surge in R&D spending, with major manufacturers investing in biocompatible silver therapies to address persistent infections. Governments are increasingly fast-tracking approvals for products that reduce the reliance on systemic antibiotics in wound management. For instance, the FDA 510(k) clearance process for combination products illustrates a move toward multifaceted treatment options.

The rising focus on “green synthesis” of silver nanoparticles also opens doors for sustainable product lines that appeal to modern healthcare systems. As providers seek evidence-based solutions to reduce healthcare-associated infections (HAIs), silver dressings are positioned as a vital component of infection stewardship.

This strategic alignment with global health priorities ensures a robust pipeline for future silver-infused medical technologies. Finally, the expansion of healthcare infrastructure in emerging economies provides a fertile ground for silver-based dressings as they transition toward advanced care.

Impact of Macroeconomic / Geopolitical Factors

Global economic advancements propel investments in wound care solutions, elevating the silver wound dressing market through heightened demand for antimicrobial treatments amid rising chronic disease prevalence in aging populations. Executives capitalize on stable fiscal policies to expand product lines, which supports robust adoption in hospitals treating diabetic ulcers and surgical wounds.

Regrettably, pervasive worldwide inflation surges raw material and energy expenditures, compelling manufacturers to recalibrate strategies in cost-conscious environments. Escalating geopolitical frictions in silver-mining regions fracture supply chains for essential metals, obliging suppliers to endure procurement uncertainties across international operations.

Innovators respond by cultivating alternative sourcing partnerships in stable territories, which enhances logistical resilience and facilitates collaborative efficiencies. Current US tariffs on imported medical supplies, ranging from 10% to 50% for devices from key exporters like China, magnify financial burdens for firms dependent on overseas components.

Native enterprises embrace this policy by amplifying U.S.-focused production facilities, which spurs technological progress and aligns with national healthcare goals. Continuous refinements in nanosilver formulations invariably strengthen the sector’s momentum, promising amplified infection control and prosperous market trajectories globally.

Latest Trends

The integration of silver with analgesics for pain management is a recent trend

A prominent trend in late 2024 and early 2025 is the development of hybrid silver dressings that combine antimicrobial protection with active pain management. In October 2024, the FDA granted 510(k) clearance (K211943) for Microlyte Ag/Lidocaine, the first antimicrobial wound dressing to integrate silver with the local anesthetic lidocaine. This innovation addresses two of the most critical challenges in wound care: preventing infection and managing the intense pain associated with chronic ulcers.

The dressing is designed to provide localized relief while the metallic silver maintains a sterile environment. This dual-action approach is gaining traction as clinicians seek ways to reduce the use of systemic opioids in post-operative care. Strategic partnerships are also characterizing this trend, such as the October 2024 collaboration between Mölnlycke Health Care and Transdiagen to innovate wound care through precision medicine.

Such alliances aim to create “smart” dressings that can monitor the wound environment while delivering controlled doses of silver ions. The focus has shifted from simple barrier protection to “active” dressings that facilitate faster tissue regeneration and improved patient comfort.

Furthermore, the industry is seeing a move toward sustainable, biodegradable polymers as carriers for silver to minimize environmental impact. This evolution reflects a broader market shift toward personalized and multifunctional medical devices that improve the overall quality of life for patients.

Regional Analysis

North America is leading the Silver Wound Dressing Market

North America accounted for 47.2% of the overall market in 2024, and the Silver Wound Dressing market expanded as hospitals and outpatient clinics intensified management of chronic and infected wounds. High incidence of surgical wounds, pressure ulcers, and traumatic injuries increased reliance on antimicrobial dressings that reduce infection risk and support faster healing.

Clinicians favored silver-based solutions due to their broad-spectrum antimicrobial properties and compatibility with advanced wound-care protocols. Growth in home healthcare further supported adoption for long-term wound management outside hospital settings. Technological improvements enhanced moisture balance and patient comfort, improving treatment adherence.

The American Burn Association reported approximately 398,000 burn injuries requiring medical treatment in the United States in 2022, reinforcing demand for advanced antimicrobial dressings. Strong reimbursement coverage for advanced wound care supported wider clinical use. These factors collectively drove solid market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness robust growth during the forecast period as the Silver Wound Dressing market benefits from rising trauma cases, surgical volumes, and chronic wound prevalence. Expanding healthcare infrastructure improves access to advanced wound-care products across hospitals and community clinics.

Increasing awareness of infection prevention encourages clinicians to adopt antimicrobial dressings in routine practice. Government investments in wound-care management and aging population support higher demand for long-term treatment solutions. Local manufacturers expand production of cost-effective silver-based dressings, improving regional affordability.

The World Health Organization estimates that around 11 million people worldwide seek medical care for burns each year, with a significant share occurring in Asia Pacific, highlighting substantial clinical need. Growth in homecare services further supports utilization. These dynamics position the region for sustained and accelerating market expansion

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Silver Wound Dressing market drive growth by refining antimicrobial efficacy while balancing moisture control, comfort, and extended wear time for complex and chronic wounds. Companies expand adoption through clinical evidence that demonstrates infection reduction and faster healing outcomes in burns, ulcers, and post-surgical care.

Commercial strategies emphasize formulary inclusion, clinician education, and protocol alignment within hospitals, wound clinics, and homecare settings. Innovation priorities focus on controlled silver release, advanced substrates, and combination technologies that optimize healing without increasing cytotoxicity risk.

Market expansion targets regions with rising chronic disease prevalence and growing demand for advanced wound management solutions. Mölnlycke Health Care operates as a leading participant with a strong wound care portfolio, global manufacturing capabilities, and deep clinical partnerships that support consistent adoption of advanced antimicrobial dressings.

Top Key Players

- Smith & Nephew plc

- 3M Company

- Mölnlycke Health Care AB

- Coloplast A/S

- Derma Sciences (Integra LifeSciences)

- ConvaTec Group plc

- Baxter International Inc.

- Medline Industries, Inc.

- Hollister Incorporated

- Beiersdorf AG

Recent Developments

- In October 2024, Mölnlycke Health Care entered into a collaborative research effort with Transdiagen to apply Transdiagen’s proprietary wound related gene signatures to chronic wound research. The collaboration focuses on improving biological insight into wound healing processes, supporting the development of more targeted and effective wound care solutions for hard to heal conditions.

- In September 2024, Solventum, formerly part of 3M, introduced the V.A.C. Peel and Place Dressing as a new evolution of its negative pressure wound therapy portfolio. The dressing integrates the drape and dressing into a single unit, allowing clinicians to complete application in less than two minutes. Designed for wear periods of up to seven days, the product reduces application complexity, limits training requirements, and improves patient comfort through a non adherent contact layer that minimizes pain during removal.

Report Scope

Report Features Description Market Value (2024) US$ 1.1 Billion Forecast Revenue (2034) US$ 1.8 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Silver Bandages, Silver Foam Dressings, Silver Plated Nylon Fiber Dressings, Silver Hydrogel and Hydrofiber Dressings and Silver Alginate Dressings), By Type (Traditional and Advanced), By Application (Acute Wounds and Chronic Wounds), By Age Group (Pediatric, Adult and Geriatric), By End-User (Hospitals, Clinics and Wound Care Centers, Home Healthcare and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smith & Nephew plc, 3M Company, Mölnlycke Health Care AB, Coloplast A/S, Derma Sciences (Integra LifeSciences), ConvaTec Group plc, Baxter International Inc., Medline Industries, Inc., Hollister Incorporated, Beiersdorf AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Silver Wound Dressing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Silver Wound Dressing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Smith & Nephew plc

- 3M Company

- Mölnlycke Health Care AB

- Coloplast A/S

- Derma Sciences (Integra LifeSciences)

- ConvaTec Group plc

- Baxter International Inc.

- Medline Industries, Inc.

- Hollister Incorporated

- Beiersdorf AG