Global Silicon Carbide (SiC) Heat Exchangers Market By Material Type (Silicon Carbide, Metal-Silicon Carbide Composites), By Heat Transfer Type (Convection Heat Transfer, Conduction Heat Transfer, Radiation Heat Transfer), By Design Type (Shell and Tube Heat Exchanger, Plate Heat Exchanger, Air Cooled Heat Exchanger, Others), By End-Use (Chemical Processing, Oil and Gas, Pharmaceutical, Food and Beverage, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149668

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

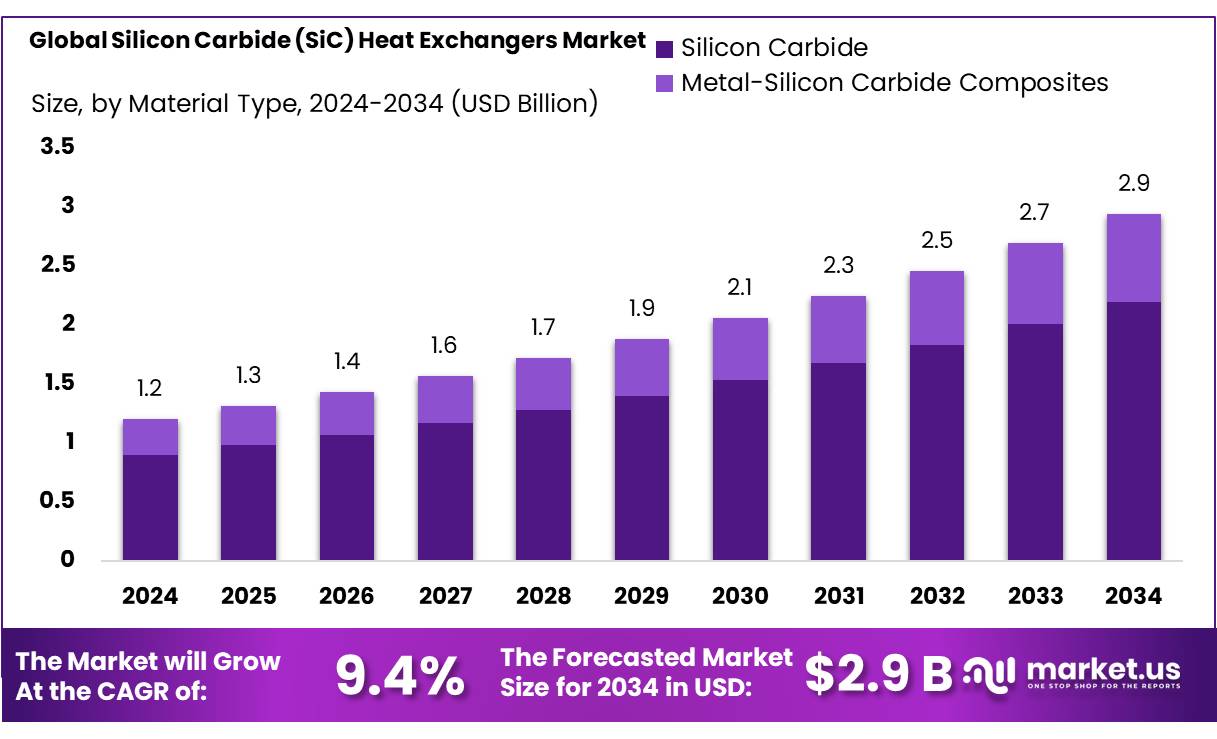

The Global Silicon Carbide (SiC) Heat Exchangers Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 9.4% during the forecast period from 2025 to 2034.

Silicon Carbide (SiC) heat exchangers are emerging as a transformative solution in industrial thermal management, particularly in sectors demanding high durability and efficiency. SiC’s exceptional thermal conductivity, corrosion resistance, and mechanical strength make it ideal for harsh environments, including chemical processing, power generation, and food and beverage industries. These properties enable SiC heat exchangers to operate effectively at temperatures exceeding 1000°C, outperforming traditional materials like stainless steel and copper.

Government initiatives are playing a pivotal role in this growth trajectory. In the United States, the Department of Energy has allocated $1.47 million to the University of Maryland for developing high-performance, cost-effective polymer composite heat exchangers aimed at energy recovery applications . Such funding underscores the government’s commitment to advancing energy-efficient technologies. In India, government policies promoting energy efficiency and sustainability are driving the adoption of SiC heat exchangers in sectors like chemical processing and wastewater treatment.

Technological advancements are further propelling the market. Innovations in SiC materials have led to the development of heat exchangers capable of operating at temperatures up to 1,250°C, making them suitable for applications in fossil energy and other high-temperature processes . These advancements not only improve performance but also extend the lifespan of the equipment, offering long-term cost savings.

For instance, the United States–India Initiative on Critical and Emerging Technology (iCET) aims to enhance cooperation in developing advanced technologies, including SiC-based systems. Under this initiative, a semiconductor fabrication plant focusing on SiC chips is being established in India, with a projected investment of $500 million and a 50% capital expenditure subsidy from the India Semiconductor Mission. Such developments are expected to bolster the domestic manufacturing of SiC components, including heat exchangers.

Key Takeaways

- Silicon Carbide (SiC) Heat Exchangers Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 9.4%.

- Silicon Carbide (SiC) held a dominant market position in the global heat exchangers market, capturing more than a 74.5% share.

- Convection Heat Transfer held a dominant market position in the Silicon Carbide (SiC) heat exchangers market, capturing more than a 56.3% share.

- Shell & Tube Heat Exchanger held a dominant market position in the Silicon Carbide (SiC) Heat Exchangers Market, capturing more than a 67.8% share.

- Road and Highway Marking held a dominant market position in the Silicon Carbide (SiC) Heat Exchangers Market, capturing more than a 38.6% share.

By Material Type

Silicon Carbide commands 74.5% share in 2024, driven by its exceptional thermal and chemical resilience.

In 2024, Silicon Carbide (SiC) held a dominant market position in the global heat exchangers market, capturing more than a 74.5% share. This stronghold is primarily due to SiC’s outstanding thermal conductivity, corrosion resistance, and mechanical strength, making it the material of choice for demanding applications in chemical processing, power generation, and other high-temperature industries.

SiC heat exchangers are particularly valued in environments where traditional materials like stainless steel or graphite may fail. Their ability to withstand extreme temperatures and aggressive chemicals without degradation ensures longer service life and reduced maintenance costs. This durability translates into operational efficiency and cost savings for industries that rely on continuous and reliable heat exchange processes.

By Heat Transfer Type

Convection Heat Transfer leads with 56.3% share in 2024, favored for its efficient thermal exchange in dynamic systems.

In 2024, Convection Heat Transfer held a dominant market position in the Silicon Carbide (SiC) heat exchangers market, capturing more than a 56.3% share. This dominance is primarily driven by the widespread use of convection-based systems across multiple industries, including chemical processing, energy, and semiconductors, where efficient and consistent heat dissipation is essential. Convection heat transfer, especially when paired with SiC materials, enables high-performance thermal management in systems exposed to aggressive fluids and elevated temperatures.

By Design Type

Shell & Tube Heat Exchanger dominates with 67.8% share in 2024, owing to its reliability in high-pressure and corrosive environments.

In 2024, Shell & Tube Heat Exchanger held a dominant market position in the Silicon Carbide (SiC) Heat Exchangers Market, capturing more than a 67.8% share. This design type continues to lead due to its proven efficiency in handling high-pressure operations and its adaptability across a broad range of industrial applications. Industries such as chemicals, petrochemicals, and pharmaceuticals favor shell and tube configurations because they can withstand extreme operating conditions while offering easy maintenance and scalability.

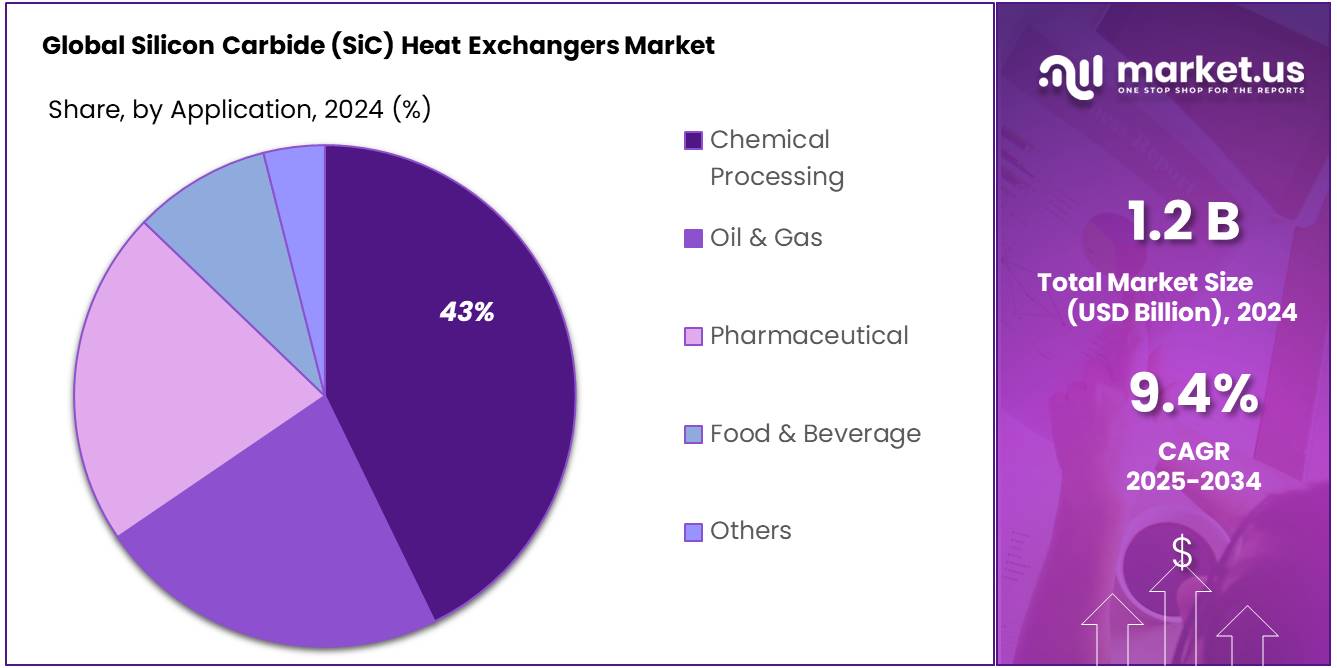

By End-Use

Road and Highway Marking leads with 38.6% share in 2024, driven by high-temperature demands in asphalt processing and marking applications.

In 2024, Road and Highway Marking held a dominant market position in the Silicon Carbide (SiC) Heat Exchangers Market, capturing more than a 38.6% share. This strong position is largely due to the increasing reliance on SiC heat exchangers for handling the extreme temperatures and corrosive environments involved in asphalt mixing and thermoplastic road marking production. The heat exchanger systems in these applications must withstand not only high heat but also abrasive particulate matter and reactive chemicals — conditions where traditional metal-based systems fall short.

Key Market Segments

By Material Type

- Silicon Carbide

- Metal-Silicon Carbide Composites

By Heat Transfer Type

- Convection Heat Transfer

- Conduction Heat Transfer

- Radiation Heat Transfer

By Design Type

- Shell & Tube Heat Exchanger

- Plate Heat Exchanger

- Air Cooled Heat Exchanger

- Others

By End-Use

- Chemical Processing

- Oil & Gas

- Pharmaceutical

- Food & Beverage

- Others

Drivers

Government Support for Clean Energy and Industrial Efficiency Fuels SiC Heat Exchanger Market

In 2024, the Silicon Carbide (SiC) heat exchanger market is experiencing significant growth, largely driven by global initiatives aimed at enhancing energy efficiency and reducing industrial emissions. Governments worldwide are investing in advanced technologies to meet stringent environmental regulations and sustainability goals.

For instance, the U.S. Department of Energy has been actively promoting energy-efficient technologies across various industries. Their Industrial Assessment Centers (IACs) program provides small and medium-sized manufacturers with assessments to improve energy efficiency, which includes recommendations for advanced heat exchanger systems. These efforts are part of a broader strategy to reduce industrial energy consumption and greenhouse gas emissions.

In Europe, the European Union’s Green Deal aims to make the continent climate-neutral by 2050. This ambitious plan includes significant investments in clean technologies and infrastructure, encouraging industries to adopt energy-efficient equipment like SiC heat exchangers. The EU has allocated over €1 trillion in sustainable investments over the next decade, providing a substantial boost to markets aligned with these goals.

These global initiatives underscore the growing importance of energy-efficient technologies in achieving environmental objectives. As industries seek to comply with regulations and reduce operational costs, the demand for durable and efficient solutions like SiC heat exchangers is expected to rise, propelling market growth in the coming years.

Restraints

High Manufacturing Costs Limit Adoption of SiC Heat Exchangers

In 2024, the Silicon Carbide (SiC) heat exchanger market faces a significant challenge: high manufacturing costs. SiC heat exchangers offer exceptional thermal conductivity and corrosion resistance, making them ideal for demanding industrial applications. However, producing these advanced systems is expensive, primarily due to the complex manufacturing processes and the cost of raw materials.

The production of SiC involves intricate procedures like the Acheson process, which requires high temperatures and energy consumption. Additionally, the raw materials, such as silica and coke, must meet stringent purity standards, further increasing costs. These factors contribute to the overall expense of SiC heat exchangers, making them less accessible to small and medium-sized enterprises (SMEs) that may opt for more affordable alternatives like stainless steel or graphite-based systems.

According to industry analyses, the high initial cost of SiC materials and the complex manufacturing processes involved in producing SiC heat exchangers remain significant barriers to market growth. This financial hurdle can deter potential adopters, especially in cost-sensitive sectors. Moreover, the lack of standardized manufacturing processes for SiC heat exchangers can lead to inconsistencies in product quality, further hindering widespread adoption.

To address these challenges, industry stakeholders are exploring ways to streamline production and reduce costs. Advancements in manufacturing technologies and increased economies of scale could potentially lower the price point of SiC heat exchangers, making them more competitive with traditional materials. Additionally, government initiatives aimed at promoting energy-efficient and sustainable technologies may provide financial incentives or subsidies to offset the high upfront costs associated with SiC heat exchangers.

Opportunity

Expanding Renewable Energy Infrastructure Drives Demand for SiC Heat Exchangers

In 2024, the global shift towards renewable energy sources is creating significant growth opportunities for the Silicon Carbide (SiC) heat exchangers market. As industries and governments aim to reduce carbon emissions and enhance energy efficiency, the need for advanced heat transfer solutions becomes paramount.

SiC heat exchangers are particularly well-suited for renewable energy applications due to their exceptional thermal conductivity, corrosion resistance, and ability to withstand extreme temperatures. These properties make them ideal for use in concentrated solar power (CSP) plants, geothermal energy systems, and biomass energy facilities, where efficient heat exchange is critical for optimal performance.

The U.S. Department of Energy has recognized the importance of advanced heat exchanger technologies in achieving energy efficiency goals. Through initiatives like the Industrial Assessment Centers (IACs) program, the DOE provides assessments and recommendations to small and medium-sized manufacturers to improve energy efficiency, which includes the adoption of advanced heat exchanger systems.

Moreover, the European Union’s Green Deal, aiming for climate neutrality by 2050, allocates substantial investments in clean technologies and infrastructure. This includes encouraging industries to adopt energy-efficient equipment like SiC heat exchangers.

In the Asia-Pacific region, countries like China and India are investing heavily in renewable energy projects. China’s 14th Five-Year Plan emphasizes green development and the adoption of advanced manufacturing technologies, while India’s National Action Plan on Climate Change promotes energy efficiency in industrial processes.

Trends

Integration of AI and Automation Enhances SiC Heat Exchanger Production

In 2024, a significant trend shaping the Silicon Carbide (SiC) heat exchangers market is the adoption of artificial intelligence (AI) and automation in manufacturing processes. This shift is driven by the need for improved efficiency, precision, and scalability in producing high-performance heat exchangers.

AI-driven automation systems are revolutionizing the production of SiC heat exchangers by streamlining operations, reducing human error, and enhancing product quality. These systems enable real-time monitoring and control of manufacturing parameters, ensuring consistent quality and performance of the heat exchangers. The integration of AI also facilitates predictive maintenance, minimizing downtime and extending the lifespan of equipment.

Government initiatives are also supporting this technological advancement. For instance, the U.S. Department of Energy’s Industrial Assessment Centers (IACs) program provides small and medium-sized manufacturers with assessments to improve energy efficiency, which includes recommendations for advanced heat exchanger systems.

The integration of AI and automation in SiC heat exchanger production not only enhances manufacturing efficiency but also aligns with global efforts to promote sustainable and energy-efficient technologies. As industries continue to seek innovative solutions to meet environmental regulations and operational demands, the adoption of AI-driven manufacturing processes is expected to play a pivotal role in the growth of the SiC heat exchangers market.

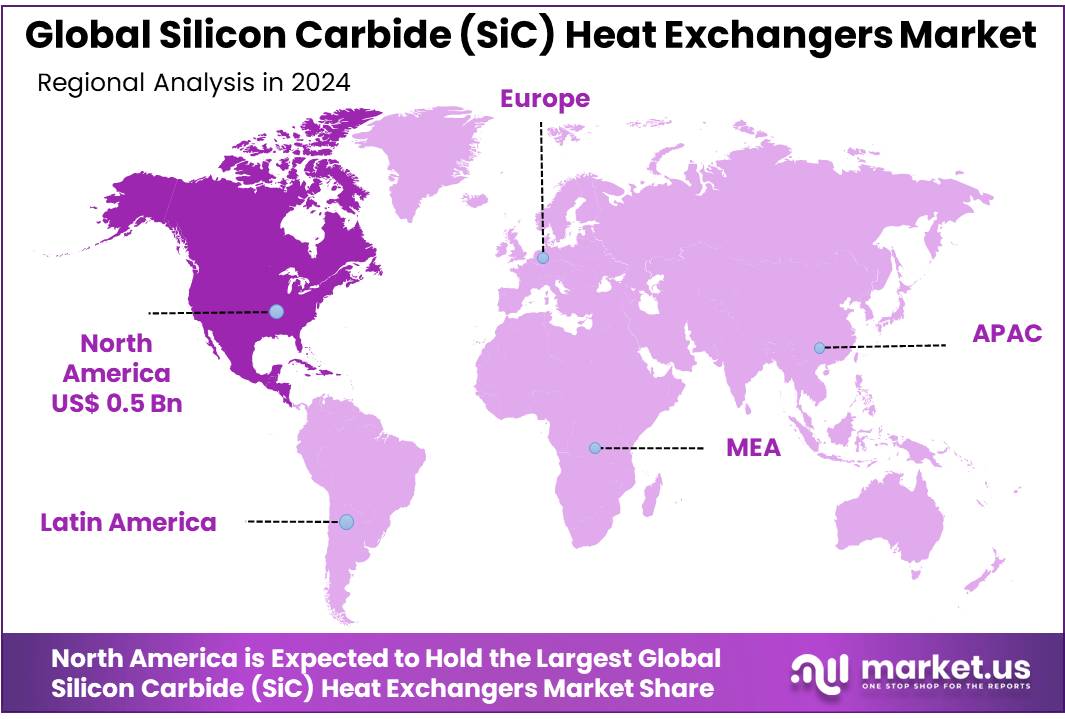

Regional Analysis

North America Leads SiC Heat Exchangers Market with 45.7% Share, Valued at $0.5 Billion in 2024

In 2024, North America emerged as the dominant region in the global Silicon Carbide (SiC) heat exchangers market, capturing a substantial 45.7% share, equivalent to a market valuation of approximately $ 0.5 billion. This leadership is primarily driven by the region’s robust industrial infrastructure and the increasing demand for high-performance heat exchangers in sectors such as chemical processing, power generation, and oil & gas.

Government initiatives further bolster this market expansion. The U.S. Department of Energy’s Industrial Assessment Centers (IACs) program provides small and medium-sized manufacturers with assessments to improve energy efficiency, which includes recommendations for advanced heat exchanger systems . Such programs encourage the adoption of energy-efficient technologies like SiC heat exchangers.

North American SiC heat exchangers market is poised for continued growth. The region’s commitment to industrial innovation, coupled with supportive government policies, positions it to maintain its leading role in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SGL Carbon is a leading global manufacturer of carbon-based products, including high-performance silicon carbide heat exchangers. The company serves key industries such as chemicals, semiconductors, and energy. Its Diabon® SiC products are recognized for superior corrosion resistance and durability in aggressive media. In 2024, SGL focused on expanding its production capacity in Europe and North America, supporting the rising demand for SiC equipment in chemical processing and environmental technologies.

GAB Neumann specializes in corrosion-resistant process equipment, including SiC heat exchangers used extensively in chemical and pharmaceutical industries. Known for custom-engineered solutions, the company offers blocks, plates, and shell-and-tube SiC exchangers. In 2024, it strengthened its presence in Asia-Pacific by introducing energy-efficient designs suited for emerging industrial setups. Its commitment to precision manufacturing and modular design positions it as a reliable partner for process optimization.

Sigma Roto Lining LLP, based in India, has gained recognition for its corrosion-resistant equipment, including SiC heat exchangers designed for extreme industrial conditions. The company caters to sectors like fertilizers, pharmaceuticals, and water treatment. In 2024, Sigma expanded its export reach across Southeast Asia and the Middle East, leveraging cost-effective production with international quality standards. Their customized SiC solutions are widely used for their operational reliability and lifespan.

Top Key Players in the Market

- SGL Carbon

- GAB Neumann

- Sigma Roto Lining LLP

- Saint-Gobain Ceramics

- MERSEN

- Corrox Remedies

- THALETEC GmbH

- 3V Tech

- De Dietrich

- Wuxi Qianqiao Chemical

- corrox Remedies

- Nantong Xingqiu

- Shandong Himile

Recent Developments

In 2025, Akvo plans to expand its manufacturing capabilities by establishing a new facility in Howrah district, with an investment of approximately ₹40 crore. This expansion aims to produce household models of AWGs with a daily capacity of about 40 liters, broadening the company’s reach to individual consumers and small communities.

In 2024 Saint-Gobain’s Performance Ceramics & Refractories division, responsible for these innovations, contributed to the group’s High Performance Solutions segment, which reported sales of €9.84 billion.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 2.9 Bn CAGR (2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Silicon Carbide, Metal-Silicon Carbide Composites), By Heat Transfer Type (Convection Heat Transfer, Conduction Heat Transfer, Radiation Heat Transfer), By Design Type (Shell and Tube Heat Exchanger, Plate Heat Exchanger, Air Cooled Heat Exchanger, Others), By End-Use (Chemical Processing, Oil and Gas, Pharmaceutical, Food and Beverage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SGL Carbon, GAB Neumann, Sigma Roto Lining LLP, Saint-Gobain Ceramics, MERSEN, Corrox Remedies, THALETEC GmbH, 3V Tech, De Dietrich, Wuxi Qianqiao Chemical, corrox Remedies, Nantong Xingqiu, Shandong Himile Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Silicon Carbide (SiC) Heat Exchangers MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Silicon Carbide (SiC) Heat Exchangers MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SGL Carbon

- GAB Neumann

- Sigma Roto Lining LLP

- Saint-Gobain Ceramics

- MERSEN

- Corrox Remedies

- THALETEC GmbH

- 3V Tech

- De Dietrich

- Wuxi Qianqiao Chemical

- corrox Remedies

- Nantong Xingqiu

- Shandong Himile