Global Shopify Merchant Insurance Market Size, Share and Analysis Report By Coverage Type (Product Liability Insurance, General Liability Insurance, Professional Liability (E&O) Insurance, Cyber Liability & Data Breach Insurance, Others), By Business Revenue/Size, (Micro-Merchants, Small Merchants, Medium Merchants), By Product Category (Apparel & Fashion, Health, Beauty & Wellness, Home & Garden, Electronics & Gadgets, Food & Beverage), By Policy Duration (Annual Policies, Monthly/Subscription Policies), By Sales Channel (Embedded/App-Based, Brokers & Independent Agents, Direct from Carrier), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 173581

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Coverage Type

- By Business Revenue and Size

- By Product Category

- By Policy Duration

- By Sales Channel

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

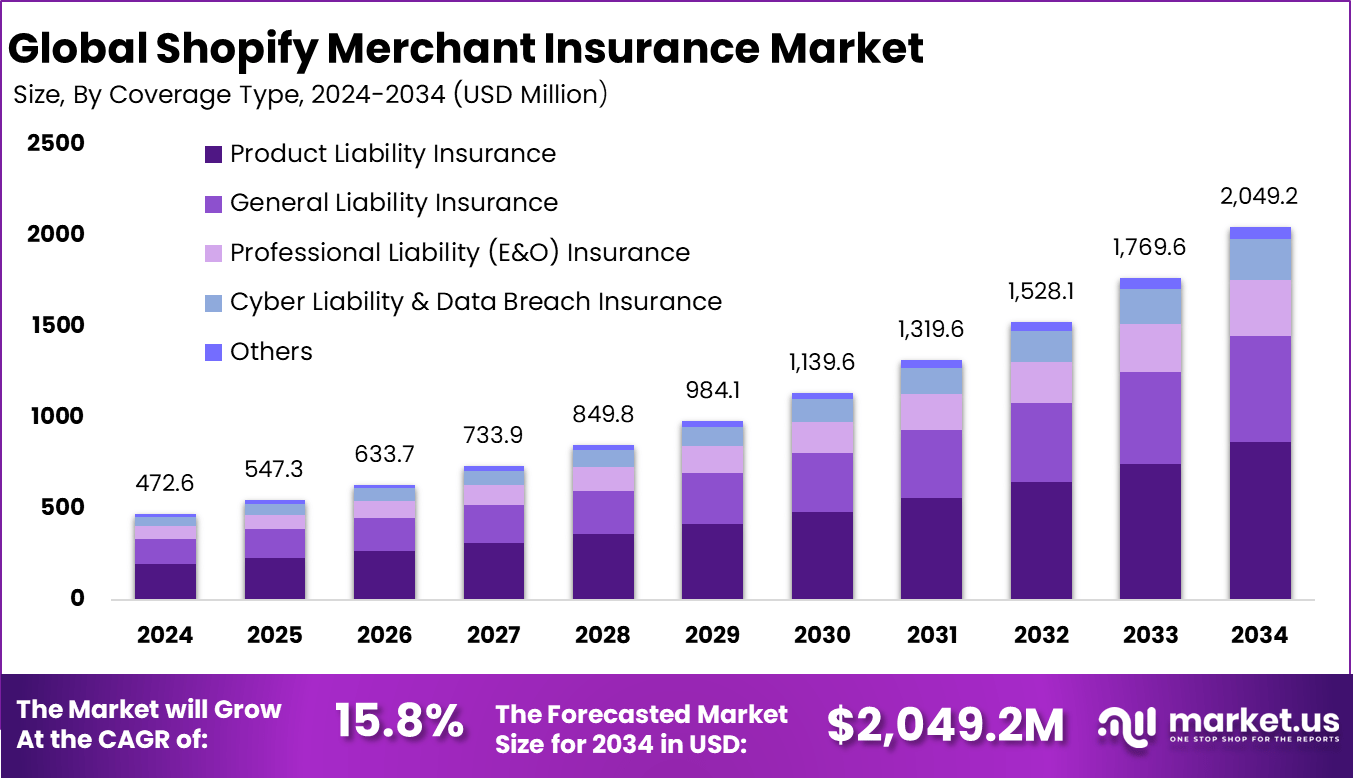

The Global Shopify Merchant Insurance Market size is expected to be worth around USD 2,049.2 million by 2034, from USD 472.6 million in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.6% share, holding USD 168.2 million in revenue.

The Shopify merchant insurance market refers to insurance products designed to protect online sellers operating on the Shopify platform from business related risks. These insurance solutions typically cover areas such as general liability, product liability, inventory protection, cyber risk, and shipping related losses. The market serves small and medium sized merchants, direct to consumer brands, and growing ecommerce businesses that rely on Shopify for sales operations.

Insurance is positioned as a risk management layer that supports stable and compliant digital commerce. Rising cyber threats drive merchants to buy insurance, as 68% of retailers suffer downtime from attacks and 45% lose sales right away. Product defects lead to more lawsuits, with online sales booming, while supply chain issues and theft hit hard, too. Merchants see coverage as key to staying afloat when unexpected problems arise.

The market for Shopify Merchant Insurance is driven by the steady rise in online selling through platforms like Shopify. More merchants join daily, handling bigger shipments and facing daily risks like lost packages or damaged goods. This growth makes coverage a must for steady operations, especially during peak seasons when volumes spike. Sellers seek protection to keep customer trust high and avoid unexpected hits to their bottom line. Real worries over these common issues push wider adoption of tailored insurance plans.

Demand for Shopify insurance rises as merchants manage tons of customer data and shipments each day, raising trouble. 20% of ecommerce returns stem from shipping damage, hurting profits and buyer trust fast. Busy stores face more claims for injuries or lost packages, with 0.06% of European shipments vanishing last year. Global sales mean varied risks, from defects to delays. Merchants want coverage that matches their scale without hassle. As orders grow, so does the need to shield against common pitfalls like returns and theft.

For instance, in December 2025, Chubb featured prominently in Shopify’s 2026 cyber guide with ForeFront Portfolio, offering flexible management liability amid rising $4M+ breach costs. New Jersey’s powerhouse delivers scalable protection for product risks and hacks, underscoring U.S. firms’ grip on the merchant insurance space through reliable, no-fuss options.

Key Takeaway

- In 2024, product liability insurance emerged as the leading coverage type, capturing a 42.3% share. This dominance reflected rising exposure to customer claims, returns, and cross border sales risks among online merchants.

- Small merchants represented the largest insured group with a 58.7% share, indicating strong demand for affordable and simplified insurance solutions among early stage and growing ecommerce businesses.

- The apparel and fashion segment held a dominant 34.9% share, supported by high order volumes, frequent returns, and greater liability exposure linked to sizing, materials, and product compliance.

- Annual policies accounted for 71.5% of adoption, showing clear preference for predictable coverage terms, cost stability, and uninterrupted protection throughout the business cycle.

- The embedded and app based distribution model captured 47.8% share, highlighting the shift toward seamless, in platform insurance purchasing integrated directly into merchant workflows.

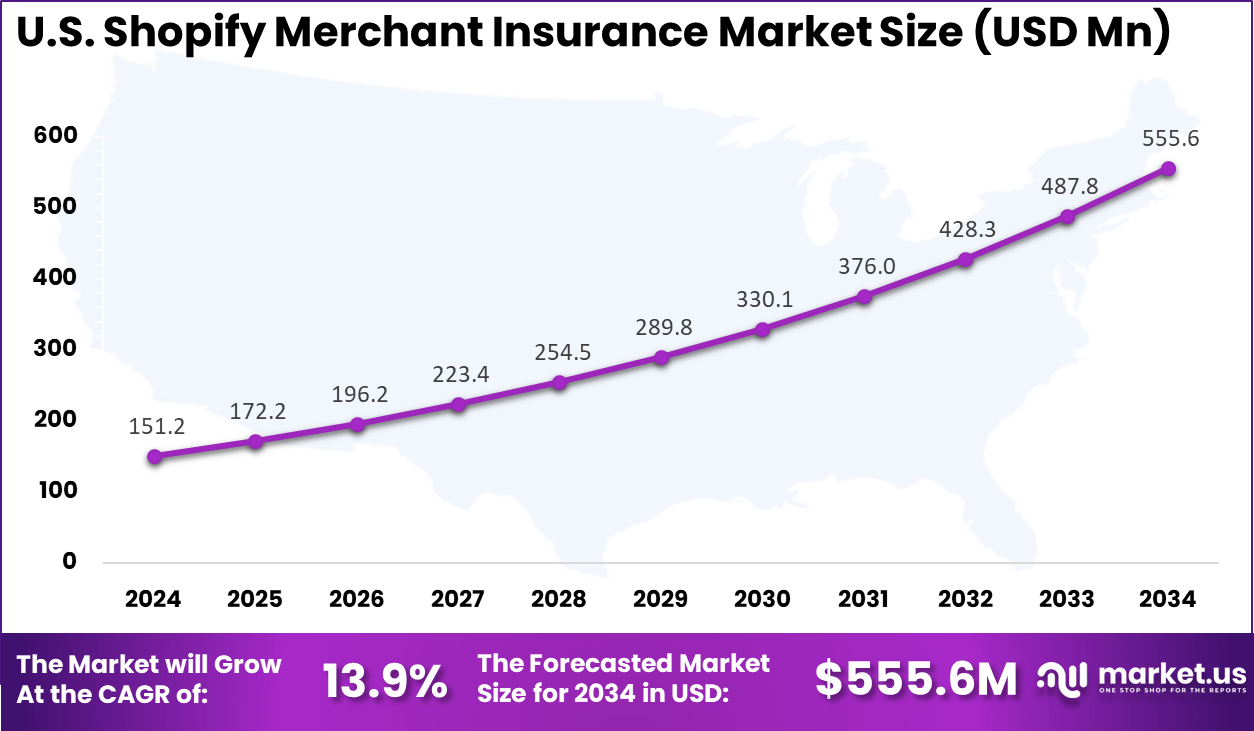

- The United States remained a core market in 2024, supported by a large base of active merchants and higher awareness of ecommerce related risks.

- North America led the global market with more than a 35.6% share, driven by mature digital commerce ecosystems, strong regulatory compliance needs, and widespread adoption of embedded insurance models.

Key Insights Summary

Key Insurance and Risk Statistics

- Cyber risk costs remained a major financial exposure for small businesses, as average cyber claims were around USD 205,000. When business interruption occurred, losses increased sharply to nearly USD 1 million, highlighting the financial impact of operational shutdowns.

- Package delivery risks continued to affect retailers, with about 1 in 10 shipped packages in the U.S. arriving damaged. In addition, nearly 1 in 3 Americans experienced package theft, reinforcing the importance of shipping and parcel insurance.

- Small business insurance adoption showed moderate coverage levels, as 65% of small businesses carried liability insurance, 39% held property insurance, and 32% maintained professional liability coverage.

Merchant Insurance Adoption and Costs

- Among small and midsize merchants, 65% adopted general liability insurance, while 39% invested in property insurance to protect physical and digital assets.

- Average monthly insurance costs remained manageable for most merchants. General liability averaged about USD 42, business owner policies ranged between USD 57 and USD 95, cyber liability averaged USD 140, and professional liability stood near USD 61.

Shipping and Parcel Insurance Insights

- Shipping performance played a critical role in customer loyalty, as 40% of shoppers avoided returning to retailers after a poor delivery experience.

- Damage and theft rates stayed elevated, with 1 in 10 packages damaged and nearly 1 in 3 consumers reporting theft incidents.

- Insurance coverage options supported risk mitigation, with qualifying merchants receiving up to USD 200 in included shipping insurance. Standard premium rates averaged USD 0.89 per USD 100 of coverage for domestic shipments and USD 1.29 per USD 100 for international shipments.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of e commerce merchants Rapid increase in Shopify based businesses ~4.2% North America, Europe Short Term Rising liability exposure Product returns, recalls, and customer claims ~3.6% Global Short Term Platform embedded insurance Seamless policy purchase within merchant tools ~3.1% North America Mid Term Regulatory compliance needs Mandatory insurance requirements ~2.6% Europe, North America Mid Term Cross border selling Higher risk exposure in international markets ~2.3% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Claims volatility Sudden spikes in product liability claims ~3.4% Global Short Term Pricing pressure Competitive premiums limiting margins ~2.9% Global Mid Term Fraudulent claims False or inflated merchant claims ~2.3% Global Short Term Regulatory changes Shifts in insurance compliance rules ~1.9% Europe, North America Mid Term Platform dependency Reliance on Shopify ecosystem policies ~1.4% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Low insurance awareness Merchants underestimate risk exposure ~3.7% Emerging Markets Short Term Premium affordability Cost sensitivity among small sellers ~3.2% Global Short to Mid Term Coverage complexity Difficulty understanding policy terms ~2.6% Global Mid Term Limited customization Standardized policies not fitting all sellers ~2.1% Global Long Term Claims processing delays Slow resolution discourages adoption ~1.6% Global Long Term By Coverage Type

Product liability insurance accounts for 42.3%, making it the leading coverage type for Shopify merchants. This coverage protects sellers against claims related to defective or unsafe products. Online merchants face higher exposure due to wide customer reach. Insurance coverage helps manage legal and compensation risks. Trust and compliance are important considerations.

The dominance of product liability coverage is driven by regulatory and customer protection requirements. Merchants selling physical goods prioritize protection against claims. Platforms encourage responsible selling practices. Insurance supports business continuity in case of disputes. This sustains strong demand for liability coverage.

By Business Revenue and Size

Small merchants represent 58.7%, highlighting their strong presence on the Shopify platform. These businesses often operate with limited financial buffers. Insurance helps protect against unexpected losses. Affordable coverage options support adoption. Risk management becomes essential for small sellers.

Adoption among small merchants is driven by platform accessibility. Shopify enables easy entry into online commerce. Insurance products designed for small businesses improve confidence. Coverage supports long-term sustainability. This keeps small merchants as the primary insured group.

By Product Category

Apparel and fashion account for 34.9%, making it the leading product category. Fashion merchants handle frequent transactions and returns. Product-related disputes can arise from quality or fit issues. Insurance helps manage these operational risks. High sales volume increases exposure.

Growth in this category is driven by online fashion demand. Shopify supports a large number of apparel sellers. Insurance coverage supports brand protection. Merchants value policies that align with their product risks. This sustains strong adoption in fashion retail.

By Policy Duration

Annual policies account for 71.5%, reflecting preference for long-term coverage. Year-long policies provide continuous protection. Merchants prefer predictable renewal cycles. Annual plans align with business planning. Consistency in coverage reduces risk gaps.

The dominance of annual policies is driven by convenience and cost efficiency. Merchants avoid frequent policy changes. Insurers offer stable terms for annual coverage. Long-term protection improves confidence. This keeps annual policies widely adopted.

By Sales Channel

Embedded and app-based channels represent 47.8%, highlighting the importance of platform-integrated insurance. Merchants can access insurance directly through Shopify apps. Embedded access simplifies purchase and management. Seamless integration improves adoption rates. Convenience remains a key driver.

Growth in this channel is driven by ease of onboarding. Merchants prefer insurance within existing workflows. App-based solutions reduce administrative effort. Integration improves visibility and control. This supports continued growth of embedded insurance.

By Region

North America accounts for 35.6%, supported by strong e-commerce activity. Shopify adoption remains high across the region. Insurance awareness among merchants is growing. Regulatory clarity supports insurance uptake. The region remains a key market.

For instance, in December 2025, The Hartford bolstered its Shopify-specific insurance offerings through its ICON platform, simplifying cyber liability quotes for merchants facing data breaches and e-commerce risks. This demonstrates North American leadership in comprehensive Shopify merchant coverage, including general liability and product protection, with average policies at $805 annually.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn, 2024) Adoption Maturity North America High Shopify merchant density 35.6% USD 168.3 Mn Advanced Europe Cross border e commerce growth 28.4% USD 134.3 Mn Advanced Asia Pacific Rapid SME digitalization 23.1% USD 109.2 Mn Developing Latin America Marketplace driven retail expansion 7.4% USD 35.0 Mn Developing Middle East and Africa Early stage e commerce adoption 5.5% USD 26.0 Mn Early The United States reached USD 151.2 Million with a CAGR of 13.9%, reflecting steady growth. Expansion is driven by small business participation. Embedded insurance adoption continues to rise. Merchants focus on risk protection. Market growth remains consistent.

For instance, in October 2025, Next Insurance, Inc. launched NEXT Pro+, delivering broader coverage including cyber insurance up to $250K and EPLI limits for professional services, with smarter AI-driven pricing for e-commerce merchants on platforms like Shopify. This innovation reinforces U.S. leadership in tailored small business insurance.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Small and medium merchants Very High ~58.7% Risk protection and platform trust Embedded policy purchase Large Shopify brands High ~22% Brand and liability protection Customized coverage Insurance providers High ~11% New digital distribution Platform partnerships Brokers and intermediaries Moderate ~6% SME insurance access Referral based Logistics partners Low to Moderate ~2% Shipment risk mitigation Bundled offerings Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Embedded insurance APIs In platform policy issuance ~4.1% Growing Digital underwriting engines Fast risk assessment ~3.3% Growing Claims automation tools Faster claim resolution ~2.7% Developing Data analytics Merchant risk profiling ~2.1% Developing AI fraud detection Claim validation and prevention ~1.6% Developing Emerging Trends

In the Shopify merchant insurance market, one trend is the increasing tailoring of coverage options to specific online retail needs. Merchants using e-commerce platforms are seeking policies that reflect risks unique to digital storefronts, such as cyber incidents, package loss, or online payment disputes. Insurers are responding with options that align more closely with the operational profiles of web based sellers.

Another trend is the growth of integrated insurance offerings within the merchant platform ecosystem itself. Some services allow Shopify store owners to explore insurance options directly through partner marketplaces or embedded interfaces. This integration simplifies access and encourages merchants to consider insurance early in their business development.

Growth Factors

A key growth factor in the Shopify merchant insurance market is the expanding number of small and medium sized businesses (SMBs) embracing online retail. As more entrepreneurs launch digital storefronts, the pool of businesses seeking protection against theft, liability, cyber threats, or business interruption grows. This broadening user base supports increased demand for merchant-oriented risk solutions.

Another factor supporting growth is the recognition of operational vulnerabilities inherent in online commerce. Merchants increasingly acknowledge that risks such as chargebacks, fulfillment errors, and data exposure can have financial impact. Insurance solutions that address these vulnerabilities help store owners manage exposures in ways that extend beyond traditional product liability.

Opportunity

An opportunity in the Shopify merchant insurance market exists in the development of modular, scalable insurance products that grow with the business. Products designed to start with basic protection and allow easy upgrades can support merchants as they transition from early stage to mature operations. This scalability helps reduce upfront cost concerns while providing a growth path.

Another opportunity lies in education and advisory services tailored to e-commerce risks. Merchants who better understand how specific risks relate to their operations and how coverage responds to real scenarios are more likely to invest in insurance. Clear, practical guidance can improve confidence in purchasing decisions and support long term retention.

Challenge

One challenge for this market is ensuring clarity and transparency in policy terms. Online merchants may struggle to interpret legal language or understand exclusions that apply to their business activities. Policies that are not presented in approachable terms can lead to misunderstandings about coverage and reduce confidence in risk protection.

Another challenge involves balancing comprehensive coverage with affordability. Robust insurance solutions that address cyber exposure, product liability, and operational interruptions can be priced higher. Designing offerings that provide meaningful protection while remaining accessible to SMB merchants continues to be an important consideration for insurers.

Key Market Segments

By Coverage Type

- Product Liability Insurance

- General Liability Insurance

- Professional Liability (E&O) Insurance

- Cyber Liability & Data Breach Insurance

- Others

By Business Revenue/Size

- Micro-Merchants (<$250K revenue)

- Small Merchants ($250K – $5M revenue)

- Medium Merchants ($5M – $20M revenue)

By Product Category

- Apparel & Fashion

- Health, Beauty & Wellness

- Home & Garden

- Electronics & Gadgets

- Food & Beverage

By Policy Duration

- Annual Policies

- Monthly/Subscription Policies

By Sales Channel

- Embedded/App-Based

- Brokers & Independent Agents

- Direct from Carrier

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Next Insurance, Inc., The Hartford Financial Services Group, Inc., and Chubb, Ltd. lead the Shopify merchant insurance market by offering tailored coverage for online sellers, including general liability, product liability, and cyber risk protection. Their policies are designed to align with ecommerce operations and platform requirements. These insurers focus on fast digital onboarding, flexible coverage limits, and strong claims support. Growing adoption of Shopify by small and mid sized businesses reinforces their leadership.

Hiscox, Ltd., Berkshire Hathaway GUARD Insurance Companies, biBERK Insurance Services, Simply Business, Ltd., and CoverWallet, Inc. strengthen the market with digital first insurance distribution and customizable ecommerce policies. Their offerings help merchants manage risks related to inventory, shipping, and third party claims. These providers emphasize affordability and ease of policy management. Rising regulatory and platform compliance needs support wider adoption.

Thimble Insurance Agency, Inc., Travelers Companies, Inc., Liberty Mutual Insurance Company, Coterie Insurance, and Pie Insurance Holdings, Inc. expand the landscape with short term, on demand, and niche insurance products for Shopify merchants. Their solutions target micro sellers and fast growing online brands. These companies focus on flexibility and rapid issuance. Continued growth of ecommerce entrepreneurship drives steady expansion of the Shopify merchant insurance market.

Top Key Players in the Market

- Next Insurance, Inc.

- The Hartford Financial Services Group, Inc.

- Chubb, Ltd.

- Hiscox, Ltd.

- Berkshire Hathaway GUARD Insurance Companies

- biBERK Insurance Services (a Berkshire Hathaway company)

- Simply Business, Ltd.

- CoverWallet, Inc. (an Aon company)

- Thimble Insurance Agency, Inc.

- Travelers Companies, Inc.

- Markel Corporation

- Liberty Mutual Insurance Company

- Coterie Insurance

- Acuity Insurance

- Pie Insurance Holdings, Inc.

- Others

Recent Developments

- Next Insurance rolled out NEXT Pro+ in October, 2025, a new product line with broader coverage options like cyber insurance up to $250K and employment practices liability, aimed at professional services firms including e-commerce sellers on platforms like Shopify.

- Hiscox sealed a key acquisition in August, 2025, buying Corix Insurance Services and Vouch Insurance from Vouch Inc., boosting its tech for small business policies that fit Shopify merchants in tech and professional services.

Report Scope

Report Features Description Market Value (2025) USD 472.6 Mn Forecast Revenue (2035) USD 2,049.2 Mn CAGR(2025-2035) 15.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Product Liability Insurance, General Liability Insurance, Professional Liability (E&O) Insurance, Cyber Liability & Data Breach Insurance, Others), By Business Revenue/Size, (Micro-Merchants (<$250K revenue), Small Merchants ($250K – $5M revenue), Medium Merchants ($5M – $20M revenue), By Product Category (Apparel & Fashion, Health, Beauty & Wellness, Home & Garden, Electronics & Gadgets, Food & Beverage), By Policy Duration (Annual Policies, Monthly/Subscription Policies), By Sales Channel (Embedded/App-Based, Brokers & Independent Agents, Direct from Carrier) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Next Insurance, Inc., The Hartford Financial Services Group, Inc., Chubb, Ltd., Hiscox, Ltd., Berkshire Hathaway GUARD Insurance Companies, biBERK Insurance Services (a Berkshire Hathaway company), Simply Business, Ltd., CoverWallet, Inc. (an Aon company), Thimble Insurance Agency, Inc., Travelers Companies, Inc., Markel Corporation, Liberty Mutual Insurance Company, Coterie Insurance, Acuity Insurance, Pie Insurance Holdings, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Shopify Merchant Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Shopify Merchant Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Next Insurance, Inc.

- The Hartford Financial Services Group, Inc.

- Chubb, Ltd.

- Hiscox, Ltd.

- Berkshire Hathaway GUARD Insurance Companies

- biBERK Insurance Services (a Berkshire Hathaway company)

- Simply Business, Ltd.

- CoverWallet, Inc. (an Aon company)

- Thimble Insurance Agency, Inc.

- Travelers Companies, Inc.

- Markel Corporation

- Liberty Mutual Insurance Company

- Coterie Insurance

- Acuity Insurance

- Pie Insurance Holdings, Inc.

- Others