Global Shipbroking Market Size, Share, Growth Analysis By Type (Dry Cargo Broking, Tanker Broking, Container Vessel Broking, Others), By Service (Chartering, Sales and Purchases, Offshore Services, Newbuilding Services, Salvage & Towage Services), By End-use (Oil and Gas, Manufacturing, Aerospace and Defense, Government, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173632

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

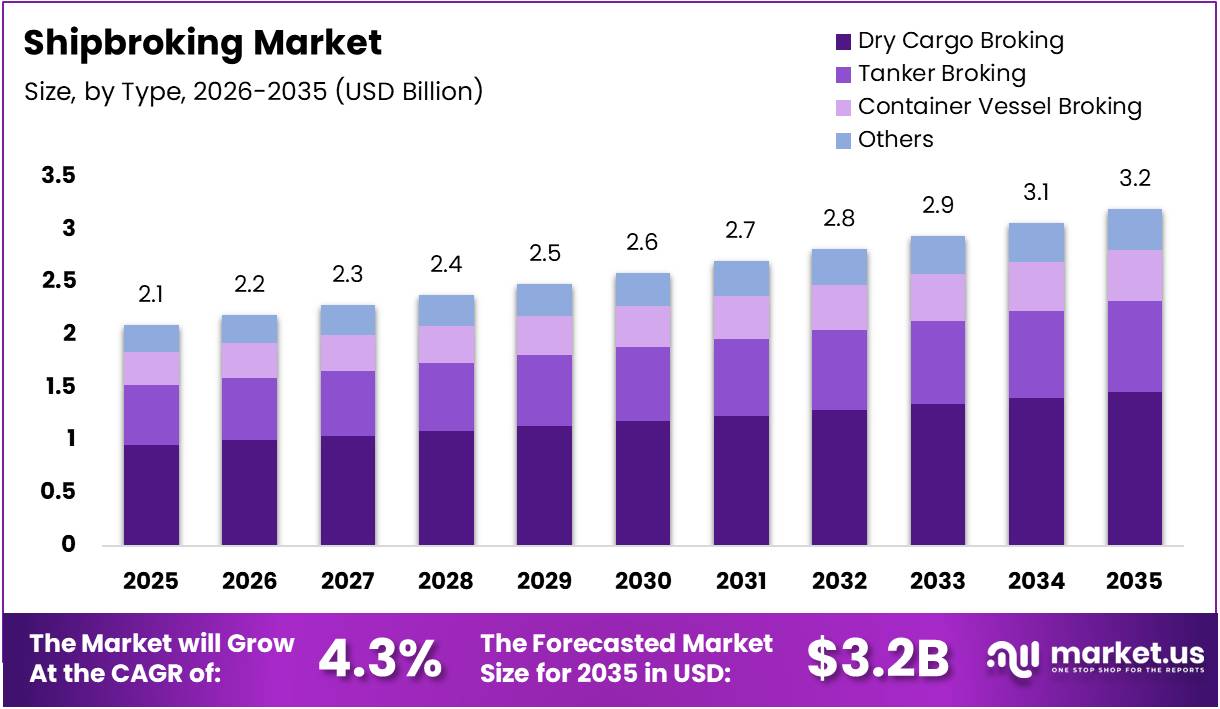

The Global Shipbroking Market size is expected to be worth around USD 3.2 Billion by 2035, from USD 2.1 Billion in 2025, growing at a CAGR of 4.3% during the forecast period from 2026 to 2035.

Shipbroking represents a specialized intermediary service connecting vessel owners with cargo shippers. Essentially, shipbrokers facilitate maritime transactions by negotiating charter agreements, managing logistics coordination, and ensuring optimal freight rates. This professional service encompasses various segments including dry bulk, tankers, containers, and specialized vessels.

The shipbroking industry demonstrates robust expansion driven by escalating global trade volumes. Consequently, maritime freight transactions have intensified, creating substantial opportunities for brokerage services. Digital transformation particularly reshapes traditional operations, enabling real-time cargo matching and transparent pricing mechanisms. Market participants increasingly adopt technology-driven solutions, thereby enhancing service delivery and competitive positioning across international shipping corridors.

Maritime commerce expansion directly propels shipbroking demand, especially across Asia-Pacific and Middle Eastern trade routes. Moreover, increasing vessel specialization creates niche brokerage opportunities in chemical carriers, LNG tankers, and offshore support vessels. The freight forwarding sector simultaneously witnesses consolidation, thereby amplifying demand for independent brokerage expertise.

International Maritime Organization regulations significantly influence shipbroking operations, particularly regarding environmental compliance standards. Furthermore, governments invest substantially in port infrastructure modernization, thereby facilitating smoother cargo movements. Emission reduction mandates reshape vessel selection criteria, consequently affecting brokerage advisory services.

The shipbroking landscape exhibits considerable fragmentation with shippers diversifying their capacity sources strategically. According to research, 48% of large shippers utilize 2-5 brokers simultaneously, while 38% engage 6 or more brokers for capacity procurement. This multi-broker approach reflects shippers’ risk mitigation strategies and their pursuit of competitive freight rates.

Key Takeaways

- The Global shipbroking market is projected to grow from USD 2.1 Billion in 2025 to USD 3.2 Billion by 2035, registering a 4.3% CAGR.

- By type, Dry Cargo Broking leads the market with a dominant share of 45.7%, reflecting its central role in global bulk commodity trade.

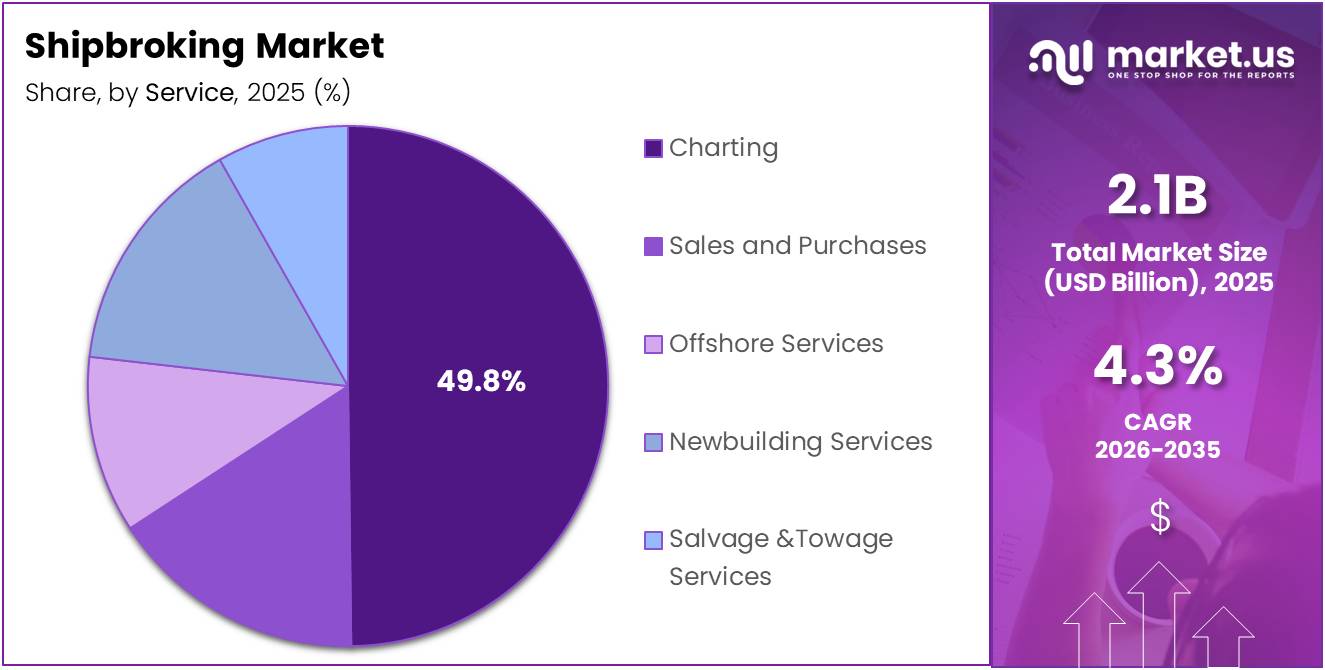

- By service, Chartering accounts for the largest share at 49.8%, underscoring its importance in vessel-capacity matching worldwide.

- By end-use, Oil and Gas remains the leading segment with a market share of 41.6%, driven by crude oil, LNG, and petroleum transport demand.

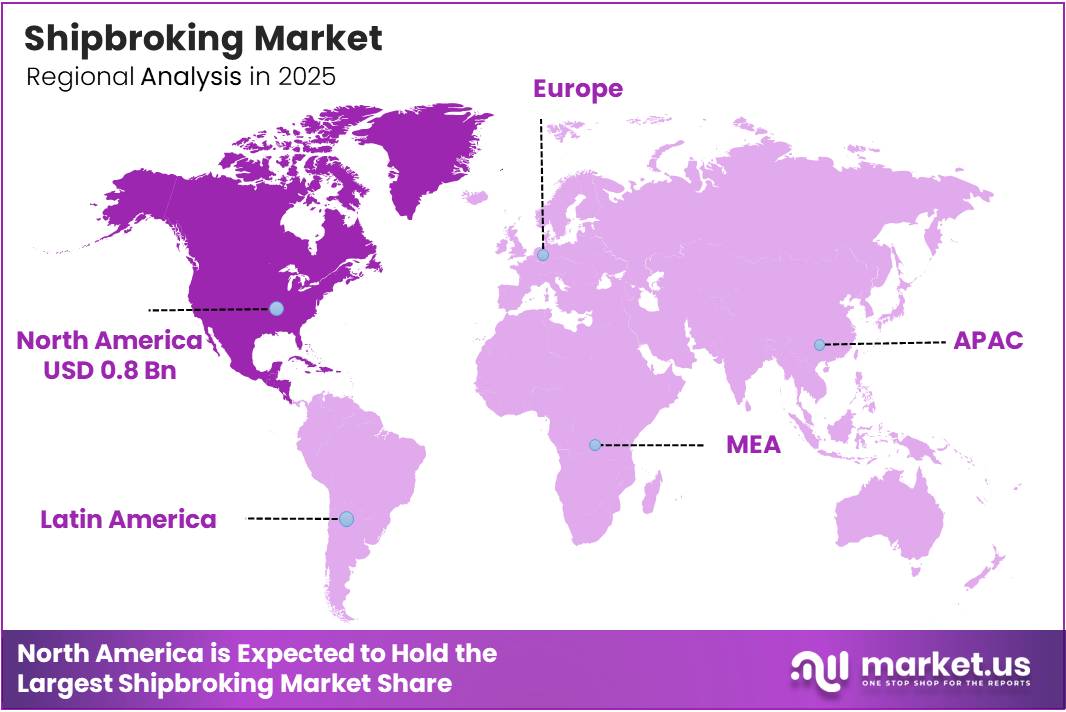

- North America dominates the market with 41.7% share, valued at USD 0.8 Billion, supported by strong energy and container trade activity.

Type Analysis

Dry Cargo Broking dominates with 45.7% due to its substantial share in global maritime trade and consistent commodity transportation demand.

In 2025, Dry Cargo Broking held a dominant market position in the By Type Analysis segment of Shipbroking Market, with a 45.7% share. This segment leads primarily because dry bulk commodities constitute the foundational element of international maritime commerce. Ships transporting coal, grain, iron ore, and raw materials require specialized brokerage services to match cargo owners with vessel operators efficiently. Infrastructure development in emerging markets drives continuous dry cargo movement across global trade routes.

Tanker Broking facilitates the transportation of crude oil, refined petroleum products, and chemicals across international waters. This segment experiences fluctuations based on global energy demand and geopolitical factors affecting maritime trade routes. Shipbrokers negotiate complex charter agreements while managing stringent regulatory compliance requirements.

Container Vessel Broking serves the containerized cargo sector, supporting global supply chains that transport manufactured goods and consumer products worldwide. This segment demands sophisticated market intelligence and real-time rate negotiations for optimal commercial outcomes. The growth of international trade and just-in-time logistics models enhances the value proposition of container vessel broking services substantially.

Others encompass specialized vessels including bulk carriers, multipurpose ships, and project cargo carriers addressing niche transportation requirements. These segments serve specific industry needs with customized vessel configurations. Innovation in specialized shipping continues expanding as unique cargo handling requirements evolve across diverse industries and maritime applications.

Service Analysis

Chartering dominates with 49.8% due to its fundamental role in connecting cargo owners with vessel capacity globally.

In 2025, Chartering held a dominant market position in the By Service Analysis segment of Shipbroking Market, with a 49.8% share. Chartering services form the operational backbone of maritime logistics, facilitating voyage charters, time charters, and bareboat charters worldwide. Shipbrokers negotiate complex terms that balance client requirements with prevailing market conditions and vessel availability. The expertise required in maritime law, insurance provisions, and operational specifications makes professional brokerage intervention essential.

Sales and Purchases services facilitate vessel transactions between buyers and sellers, requiring comprehensive market valuation expertise and technical inspection coordination. Brokers assess vessel conditions, negotiate pricing structures, and manage extensive documentation throughout acquisition processes. This segment experiences cyclical activity corresponding to fleet renewal strategies and prevailing economic conditions.

Offshore Services support the energy sector by brokering specialized vessels for exploration, production, and maintenance operations in challenging maritime environments. These services require understanding of technical vessel specifications and offshore operational requirements. The segment serves critical infrastructure development projects in deepwater exploration and renewable energy installations increasingly.

Newbuilding Services connect shipowners with shipyards for vessel construction projects, managing detailed specifications and delivery schedules. Brokers coordinate between multiple stakeholders throughout the lengthy construction process. Financial structuring and payment milestone management represent critical components of newbuilding brokerage services.

Salvage & Towage Services address emergency maritime situations and vessel repositioning needs across global waters. These services provide critical support during distress scenarios requiring immediate response capabilities. Planned vessel movements and repositioning operations also utilize salvage and towage expertise for safe maritime transit operations.

End-use Analysis

Oil and Gas dominates with 41.6% due to energy transportation constituting the largest commodity category in maritime trade.

In 2025, Oil and Gas held a dominant market position in the By End-use Analysis segment of Shipbroking Market, with a 41.6% share. The energy industry drives substantial shipbroking demand as crude oil tankers, LNG carriers, and petroleum product vessels require continuous brokerage services. International energy supply chains depend heavily on maritime transport for connecting producers, refiners, and consumers worldwide. Offshore exploration and production activities generate additional demand for specialized support vessels and floating infrastructure.

Manufacturing relies extensively on shipbroking services to transport raw materials and finished goods across global supply chains efficiently. This sector utilizes dry cargo vessels, container ships, and specialized carriers to maintain production continuity. Shipbrokers coordinate logistics for automotive components, steel products, machinery, and consumer goods ensuring timely deliveries.

Aerospace and Defense requires shipbroking expertise for transporting oversized equipment, military cargo, and sensitive materials under stringent security protocols. This segment demands specialized handling capabilities and confidential transaction management. Government contracts and international defense agreements drive consistent demand for secure maritime transportation services.

Government entities engage shipbrokers for official cargo movements, humanitarian aid shipments, and strategic reserve transportation across international waters. Public sector requirements include compliance with procurement regulations and transparent contracting processes. Emergency response capabilities and disaster relief operations necessitate rapid vessel mobilization through professional brokerage channels.

Others encompass agricultural products, construction materials, and project cargo requiring specialized handling and vessel configurations. These segments serve diverse industries with unique transportation requirements and cargo specifications. Emerging trade patterns and new commodity flows continue expanding the scope of shipbroking services across international maritime routes.

Key Market Segments

By Type

- Dry Cargo Broking

- Tanker Broking

- Container Vessel Broking

- Others

By Service

- Chartering

- Sales and Purchases

- Offshore Services

- Newbuilding Services

- Salvage & Towage Services

By End-use

- Oil and Gas

- Manufacturing

- Aerospace and Defense

- Government

- Others

Drivers

Expansion of Seaborne Trade Volumes Across Energy, Bulk, and Containerized Cargo Drives Market Growth

The shipbroking market is experiencing steady momentum as global seaborne trade continues to expand across multiple cargo segments. Energy commodities, including crude oil and petroleum products, remain major contributors to vessel demand, while dry bulk shipments of coal, iron ore, and grains sustain long-term chartering activity.

Fleet modernization efforts by shipowners are driving increased chartering activity as older vessels are replaced with fuel-efficient models. This transition requires professional brokerage services to match suitable tonnage with charterer requirements. Shipowners rely on brokers to negotiate favorable terms and secure optimal utilization rates for their upgraded fleets.

Specialized broking segments are gaining traction as LNG transport, offshore support, and project cargo movements become more complex. These niche areas demand brokers with technical expertise and market knowledge to handle unique contractual arrangements. The rise in cross-border commodity flows further underscores the need for professional chartering intermediaries who understand regional regulations, port conditions, and freight dynamics.

Restraints

High Earnings Volatility Driven by Cyclical Freight Rate Fluctuations Restrains Market Stability

The shipbroking market faces significant challenges due to the inherent volatility of freight rates, which are closely tied to global economic cycles. When trade volumes decline or vessel supply exceeds demand, charter rates can drop sharply, directly impacting broker commission income. This cyclical nature makes revenue forecasting difficult and creates periods of financial stress for brokerage firms, especially smaller independent operators.

Shipbrokers typically earn a percentage of charter hire or transaction value, meaning their income fluctuates with market conditions. During downturns, prolonged periods of weak freight markets reduce deal flow and force brokers to operate on tight margins. This earnings instability can lead to workforce reductions and discourage new entrants into the profession.

Additionally, the rise of digital chartering platforms poses a disintermediation risk to traditional brokers. Online marketplaces now allow shipowners and charterers to connect directly, bypassing intermediary services. These platforms offer transparency, speed, and lower transaction costs, appealing particularly to cost-sensitive clients. While brokers still provide valuable expertise and relationship management, the growing adoption of digital tools threatens to erode their market share and compress commission structures over time.

Growth Factors

Growing Demand for Advisory Services in Alternative Fuels and Green Vessel Chartering Creates Market Opportunities

The shipbroking industry is poised for expansion as environmental regulations drive demand for advisory services related to alternative fuels and green shipping. Charterers and shipowners increasingly seek brokers who can identify vessels compliant with emission standards and guide them through the transition to LNG, methanol, and ammonia-powered tonnage. This expertise adds significant value beyond traditional chartering functions.

Small and mid-sized shipowners are outsourcing more of their commercial management to specialized brokers. These operators often lack in-house teams to handle complex market analysis, contract negotiation, and fleet optimization. By partnering with professional brokers, they gain access to market intelligence and operational efficiency without maintaining large overhead costs.

Emerging maritime trade corridors in Africa, Southeast Asia, and Latin America present untapped opportunities for shipbroking services. As these regions develop their port infrastructure and increase commodity exports, demand for professional chartering intermediaries will grow. Asset valuation and sale-and-purchase advisory services are also gaining importance as fleet owners navigate market uncertainties and consolidation trends.

Emerging Trends

Accelerating Adoption of Digital Shipbroking and Data-Driven Chartering Tools Shapes Market Trends

The shipbroking market is undergoing digital transformation as technology adoption accelerates across the industry. Data-driven chartering tools now provide brokers with real-time freight analytics, historical rate trends, and predictive modeling capabilities. These platforms enhance decision-making speed and accuracy, allowing brokers to offer more competitive recommendations to clients while improving operational efficiency.

ESG-compliant chartering is becoming a major focus as environmental regulations tighten globally. Brokers are increasingly involved in structuring emission-linked contracts that tie charter rates to vessel performance and carbon intensity. This trend reflects growing pressure from cargo owners and financiers to reduce maritime emissions, creating new service lines for brokers with sustainability expertise.

Real-time market intelligence platforms are transforming how brokers access and share information. Instead of relying solely on personal networks and phone calls, modern brokers leverage centralized databases that aggregate vessel positions, fixture reports, and port congestion data. This transparency improves market efficiency but also intensifies competition among brokerage firms. End-to-end maritime transaction platforms are emerging as integrated solutions that handle everything from initial inquiry to post-fixture documentation.

Regional Analysis

North America Dominates the Shipbroking Market with a Market Share of 41.7%, Valued at USD 0.8 Billion.

North America maintains its leadership position in the global shipbroking market, commanding a market share of 41.7% with a valuation of USD 0.8 billion. The region’s dominance stems from robust maritime infrastructure, extensive trade networks, and the United States’ significant role in crude oil, LNG, and containerized cargo operations. The concentration of leading shipbroking firms and advanced port facilities further strengthens the region’s market position.

Europe Shipbroking Market Trends

Europe represents a significant market for shipbroking services, driven by its strategic location connecting major global trade routes and well-established shipping hubs in the UK, Norway, Greece, and Germany. The region benefits from sophisticated maritime operations, transparent regulatory frameworks, and a mature ecosystem supporting dry bulk, tanker, and container vessel brokerage activities.

Asia Pacific Shipbroking Market Trends

Asia Pacific is experiencing rapid growth in the shipbroking market, fueled by expanding seaborne trade volumes, rising industrialization, and increasing energy imports across key economies like China, Japan, and South Korea. The region’s prominence in shipbuilding, major port operations, and growing demand for commodities positioning it as a vital hub for maritime brokerage services.

Middle East and Africa Shipbroking Market Trends

The Middle East and Africa region demonstrates steady growth potential in shipbroking, primarily driven by substantial crude oil and petroleum product exports from Gulf nations and emerging trade corridors along Africa’s coastlines. Strategic investments in port infrastructure and the region’s critical role in global energy supply chains support the expansion of shipbroking activities.

Latin America Shipbroking Market Trends

Latin America’s shipbroking market is gradually developing, supported by growing agricultural commodity exports, particularly from Brazil and Argentina, alongside increasing energy trade activities. The region’s evolving port infrastructure, expanding mineral exports, and strengthening maritime connectivity with global markets present opportunities for shipbroking service providers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Shipbroking Company Insights

The global shipbroking market in 2025 continues to be shaped by established industry leaders who bring decades of expertise and extensive global networks to maritime commerce. These key players are instrumental in facilitating vessel chartering, sale and purchase transactions, and providing critical market intelligence that drives decision-making across the shipping industry.

Clarkson PLC remains the world’s largest shipbroker, leveraging its comprehensive service offerings and unparalleled market data capabilities to maintain its dominant position. The company’s integrated platform spans dry cargo, tankers, containers, and offshore segments, providing clients with end-to-end solutions in an increasingly complex maritime environment.

BRS Group continues to strengthen its position as a major independent shipbroking house, with particular strength in tanker and dry bulk markets. Their global presence and specialized teams enable them to deliver sophisticated brokerage services while maintaining strong relationships with shipowners and charterers worldwide.

Braemar Shipping Services PLC distinguishes itself through its diversified business model that combines shipbroking with technical and risk management services. This integrated approach allows them to offer value-added solutions beyond traditional brokerage, positioning them as strategic advisors in maritime transactions.

Fearnleys A/S maintains its reputation as one of the most respected independent shipbrokers, particularly noted for its expertise in the sale and purchase market and forward freight agreements. Their deep market knowledge and analytical capabilities make them a trusted partner for complex maritime transactions.

Top Key Players in the Market

- Aries Shipbroking (Asia) Pte Ltd

- BRS Group

- Braemar Shipping Services PLC

- Clarkson PLC

- Howe Robinson Partners

- Simpson Spence Young

- Fearnleys A/S

- Chowgule Brothers Pvt. Ltd

- Affinity (Shipping) LLP

Recent Developments

- In December 2025, SSY accelerated its global expansion strategy through the acquisition of Grieg Shipbrokers, a leading Scandinavian brokerage, strengthening its presence in the Nordic shipping markets and dry bulk brokerage operations.

- In December 2025, Vantage Corporation announced the acquisition of PJ Marine Singapore Pte. Ltd., PJ Marine Shanghai Co., Ltd., and Peijun Marine Consultant Co., Limited, enhancing its shipbroking and marine consultancy footprint across Southeast Asia and China.

- In December 2025, Ifchor-Galbraiths acquired Aries Shipping, a Brazilian shipbroker, to strengthen its market access and chartering activities across South America’s growing maritime trade corridors.

- In June 2024, FIS completed the acquisition of GR8 Chartering Hellas, expanding its dry bulk and tanker brokerage capabilities while reinforcing its operational presence in the Greek shipping market.

Report Scope

Report Features Description Market Value (2025) USD 2.1 Billion Forecast Revenue (2035) USD 3.2 Billion CAGR (2026-2035) 4.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dry Cargo Broking, Tanker Broking, Container Vessel Broking, Others), By Service (Chartering, Sales and Purchases, Offshore Services, Newbuilding Services, Salvage & Towage Services), By End-use (Oil and Gas, Manufacturing, Aerospace and Defense, Government, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aries Shipbroking (Asia) Pte Ltd, BRS Group, Braemar Shipping Services PLC, Clarkson PLC, Howe Robinson Partners, Simpson Spence Young, Fearnleys A/S, Chowgule Brothers Pvt. Ltd, Affinity (Shipping) LLP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aries Shipbroking (Asia) Pte Ltd

- BRS Group

- Braemar Shipping Services PLC

- Clarkson PLC

- Howe Robinson Partners

- Simpson Spence Young

- Fearnleys A/S

- Chowgule Brothers Pvt. Ltd

- Affinity (Shipping) LLP