Global Shelf Stable Packaging Market Size, Share, Growth Analysis By Packaging Format (Flexible, Rigid), By Packaging Material (Plastic, Metal, Glass, Paper and Paperboard), By Product Type (Metal Cans, Bottles, Jars, Cartons, Pouches, Others), By Packaging Technology (Asceptic Food Packaging, Retort Food Packaging, Hot Fill Food Packaging, Others), By End User (Prepared Food, Sauce & Condiment, Processed Fruit & Vegetable, Juice, Meat Poultry and Seafood, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171649

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

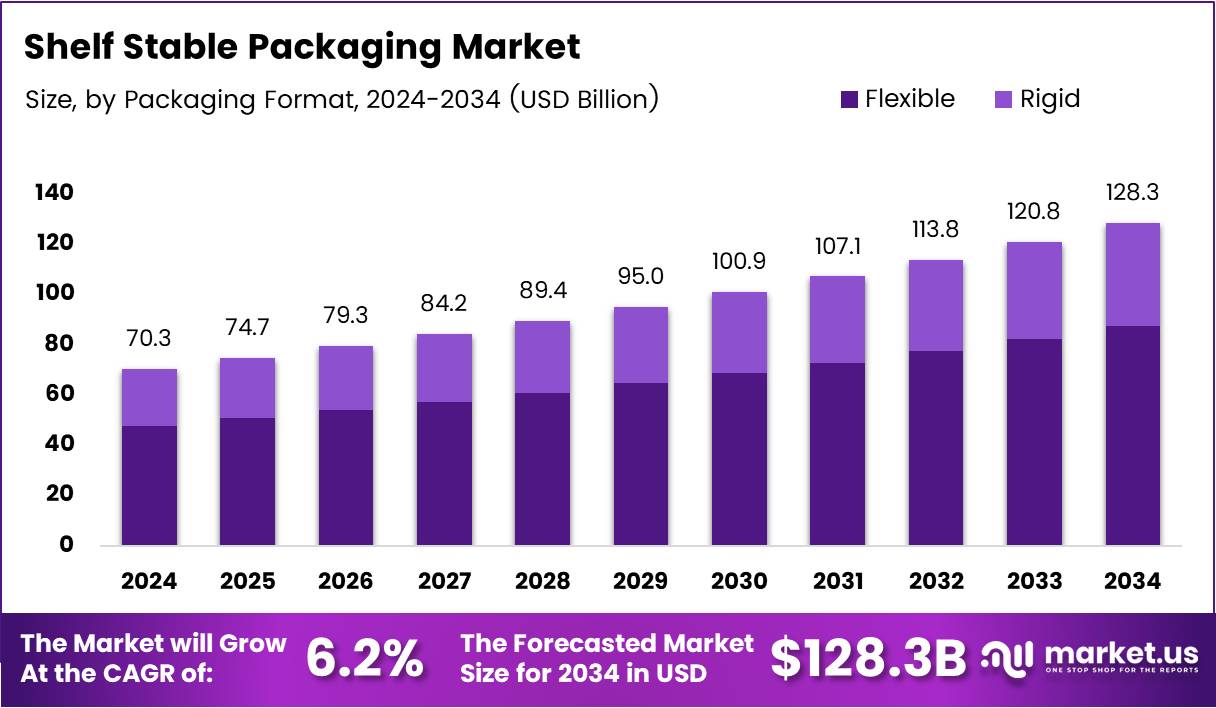

Global Shelf Stable Packaging Market size is expected to reach approximately USD 128.3 Billion by 2034 from USD 70.3 Billion in 2024, expanding at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Shelf stable packaging represents specialized containment solutions designed to preserve food products at ambient temperatures without refrigeration. These packaging systems utilize advanced barrier technologies and sterilization methods to prevent microbial growth and oxidation.

The shelf stable packaging market encompasses various formats including aseptic cartons, retort pouches, metal cans, and high-barrier flexible materials. These solutions serve multiple food categories ranging from ready-to-eat meals to beverages. Moreover, they enable efficient distribution across regions with limited cold-chain infrastructure.

Market growth accelerates driven by increasing consumer demand for convenient, long-lasting food products across urban populations. Modern lifestyles prioritize time-saving meal solutions that require minimal preparation and storage complexity. Additionally, expanding organized retail channels facilitate broader product accessibility.

Urbanization patterns significantly influence consumption behaviors toward shelf-stable food categories globally. Working professionals increasingly prefer ready-to-eat options that eliminate cooking time without compromising quality. Furthermore, rising disposable incomes support premium packaged food purchases.

Technological advancements continually improve packaging barrier properties, reducing material thickness while enhancing protection capabilities. Innovations in aseptic processing enable ambient storage of sensitive products previously requiring refrigeration. Subsequently, manufacturers achieve cost reductions through optimized operations.

Regulatory frameworks increasingly emphasize food safety standards, mandating robust barrier protection against contamination risks. Governments worldwide implement stringent quality certifications for shelf-stable food packaging materials. These compliance requirements drive adoption of advanced packaging technologies.

According to research from PMC, over 60% of U.S. households regularly purchase shelf-stable foods for convenience and reduced spoilage risk. Meanwhile, studies on ResearchGate demonstrate packaging innovations increase shelf life by 50% while reducing food waste by 40%.

Additionally, Save Food International reports that 45% of worldwide fruit and vegetable harvest losses stem from inadequate packaging solutions. Investment opportunities emerge particularly in emerging markets where cold-chain infrastructure remains underdeveloped. Sustainability initiatives further accelerate development of recyclable packaging alternatives.

Key Takeaways

- Global Shelf Stable Packaging Market valued at USD 70.3 Billion in 2024, projected to reach USD 128.3 Billion by 2034

- Market expanding at CAGR of 6.2% during forecast period 2025-2034

- Flexible packaging format dominates with 59.4% market share

- Plastic material segment leads with 51.5% market share

- Metal cans hold 27.8% share in product type segment

- Aseptic food packaging technology commands 41.2% market share

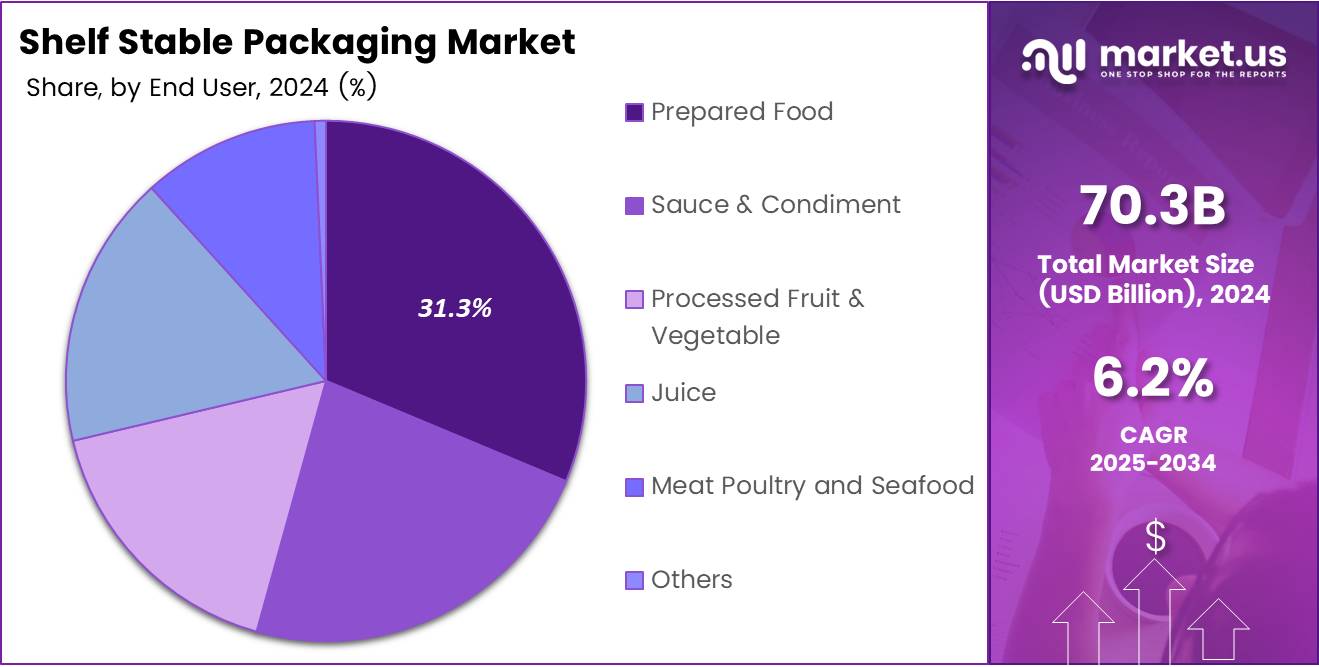

- Prepared food end-user segment captures 31.3% market share

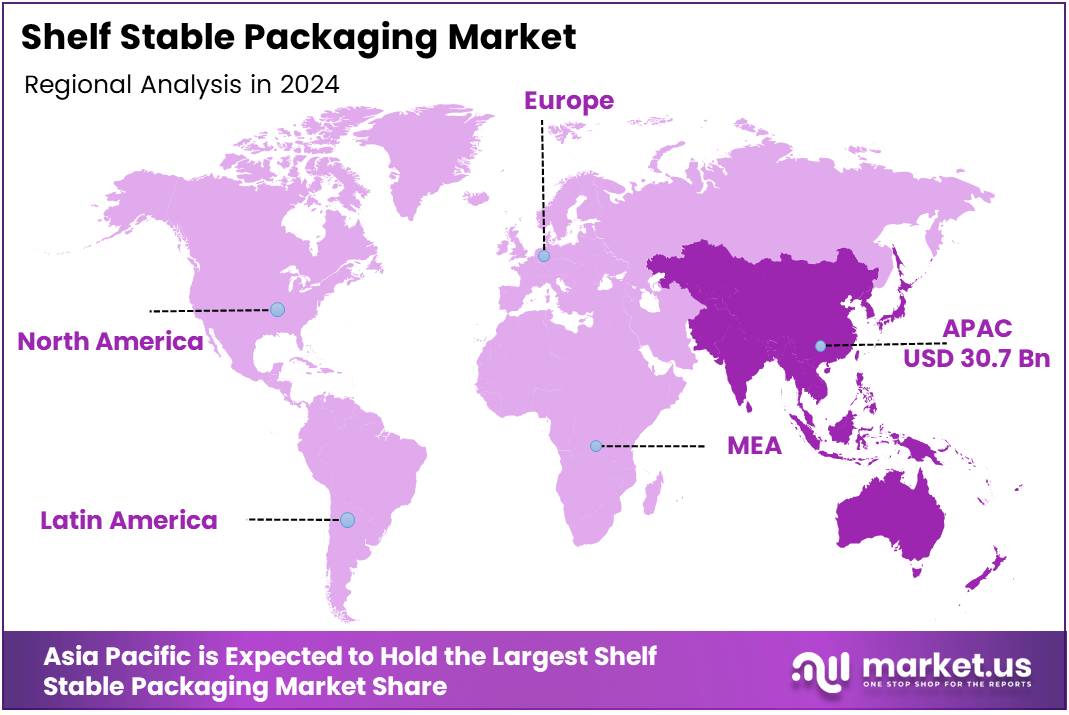

- Asia Pacific dominates regional market with 43.80% share, valued at USD 30.7 Billion

By Packaging Format

Flexible packaging dominates with 59.4% market share due to superior convenience and cost efficiency.

In 2024, Flexible packaging held a dominant market position in the By Packaging Format segment of Shelf Stable Packaging Market, with a 59.4% share. This format delivers exceptional versatility across multiple food categories including sauces, snacks, and ready-to-eat meals. Manufacturers prefer flexible materials for their lightweight properties that reduce transportation costs significantly.

Additionally, these packaging solutions offer excellent barrier protection against moisture, oxygen, and light contamination. Consumer convenience drives adoption through features like resealable closures and easy-open mechanisms. Furthermore, flexible formats enable innovative packaging designs that enhance shelf appeal and brand differentiation strategies.

Rigid packaging maintains substantial market presence through applications requiring superior structural integrity and premium positioning. Glass jars and metal containers provide unmatched protection for high-value products like gourmet sauces. These formats excel in maintaining product freshness over extended periods without compromising taste quality.

By Packaging Material

Plastic material dominates with 51.5% market share driven by versatility and barrier performance.

In 2024, Plastic held a dominant market position in the By Packaging Material segment of Shelf Stable Packaging Market, with a 51.5% share. Plastic polymers deliver exceptional flexibility in designing customized packaging solutions for diverse food applications. Advanced multi-layer plastic structures provide superior moisture and oxygen barriers essential for shelf stability.

Manufacturers leverage plastic’s moldability to create innovative packaging formats that optimize storage efficiency. Additionally, plastic materials offer significant cost advantages compared to traditional metal and glass alternatives. Processing versatility enables integration of features like transparency, printability, and resealable closures enhancing consumer experience.

Metal packaging maintains strong positioning particularly in beverage and canned food segments requiring maximum durability. Steel and aluminum containers provide complete light and oxygen barriers ensuring extended shelf life. These materials excel in withstanding high-temperature retort processing essential for sterilization procedures.

Glass material serves premium product segments where purity and non-reactivity remain critical selection criteria. Jars and bottles made from glass preserve authentic flavors without chemical interactions affecting taste profiles. Additionally, glass packaging communicates quality perception supporting premium pricing strategies effectively.

Paper and paperboard materials gain traction driven by environmental sustainability concerns and consumer preferences. Renewable fiber-based materials align with circular economy principles reducing plastic dependency. Innovations in barrier coating technologies expand paper applications into moisture-sensitive product categories previously limited to plastic formats.

By Product Type

Metal cans dominate with 27.8% market share through proven reliability in long-term preservation.

In 2024, Metal Cans held a dominant market position in the By Product Type segment of Shelf Stable Packaging Market, with a 27.8% share. Cans provide unmatched protection against light, oxygen, and physical damage throughout distribution and storage cycles. Food manufacturers trust metal cans for products requiring extended ambient shelf life exceeding multiple years.

Retort processing compatibility makes cans ideal for ready-to-eat meals, soups, and preserved vegetables. Additionally, stackable designs optimize warehouse space utilization and transportation efficiency. Consumer familiarity with canned goods supports consistent purchase patterns across demographic segments.

Bottles serve beverage and liquid food categories requiring transparency and premium presentation characteristics. Glass and plastic bottles enable visual product inspection building consumer confidence in quality. Ergonomic designs facilitate easy handling and controlled pouring reducing usage waste.

Jars cater to specialty food segments like jams, sauces, and pickles emphasizing product visibility and reusability. Wide-mouth openings simplify content access while supporting portion control through resealable lids. Premium positioning leverages jar aesthetics for gift-worthy packaging presentations.

Cartons dominate shelf-stable beverage markets through lightweight construction and space-efficient rectangular formats. Aseptic carton technology enables ambient storage of dairy alternatives and juices without preservatives. Renewable paperboard composition aligns with sustainability preferences among environmentally conscious consumers.

Pouches represent fastest-growing formats driven by convenience and material efficiency advantages. Stand-up pouches require minimal storage space while offering excellent barrier properties. Flexible pouch formats reduce packaging weight by up to 80% compared to rigid alternatives.

Others category encompasses specialized formats including trays, tubes, and composite containers serving niche applications. Innovation continues expanding format diversity addressing specific functional requirements across emerging food categories.

By Packaging Technology

Aseptic food packaging dominates with 41.2% market share enabling ambient storage without refrigeration.

In 2024, Aseptic Food Packaging held a dominant market position in the By Packaging Technology segment of Shelf Stable Packaging Market, with a 41.2% share. This technology sterilizes food and packaging separately before filling under sterile conditions maintaining nutritional integrity. Aseptic processing preserves heat-sensitive nutrients and natural flavors better than traditional thermal methods.

Manufacturers achieve extended shelf life ranging from six months to over one year without refrigeration requirements. Additionally, aseptic systems reduce energy consumption eliminating cold-chain logistics throughout distribution networks. Consumer acceptance grows for ambient-stable dairy, beverages, and liquid foods packaged aseptically.

Retort food packaging serves products requiring in-container sterilization through high-temperature pressure processing. Pouches and trays withstand retort conditions enabling shelf-stable ready meals and pet food applications. This technology maintains product safety standards while delivering convenience-focused portion sizes.

Hot fill food packaging utilizes elevated filling temperatures to sterilize containers and create vacuum seals. Acidic products like juices, sauces, and pickles benefit from hot fill methods preventing microbial contamination. Cost-effectiveness makes hot fill attractive for high-volume production operations.

Others category includes emerging technologies like high-pressure processing and modified atmosphere packaging expanding preservation options. These advanced methods address specific product sensitivities while minimizing thermal impact on quality attributes.

By End User

Prepared food dominates with 31.3% market share driven by convenience-oriented consumer lifestyles.

In 2024, Prepared Food held a dominant market position in the By End User segment of Shelf Stable Packaging Market, with a 31.3% share. Ready-to-eat meals packaged in shelf-stable formats address time-constrained consumer needs across urban populations. Products include pasta dishes, curries, rice bowls, and complete meal solutions requiring minimal preparation.

Manufacturers leverage advanced packaging technologies ensuring food safety without artificial preservatives. Additionally, portion-controlled packaging reduces food waste while supporting single-person households. E-commerce growth expands prepared food accessibility beyond traditional retail channels significantly.

Sauce and condiment categories benefit from shelf-stable packaging enabling global distribution without cold-chain limitations. Ketchup, mayonnaise, and cooking sauces maintain quality through barrier packaging protecting against oxidation. Squeezable bottles and pouches enhance usage convenience supporting repeated consumption occasions.

Processed fruit and vegetable segments utilize shelf-stable packaging extending seasonal availability year-round. Canned and pouched products preserve nutritional content while eliminating preparation complexity. Value-added products like fruit cups and vegetable medleys cater to health-conscious consumers seeking convenient nutrition.

Juice category adopts aseptic packaging technologies enabling ambient storage of natural beverages without refrigeration. Extended shelf life supports export opportunities and vending machine applications. Premium juice blends leverage packaging quality perceptions differentiating from refrigerated competitors.

Meat poultry and seafood applications employ retort packaging ensuring complete pathogen elimination through sterilization. Shelf-stable protein products serve emergency preparedness, outdoor recreation, and convenience-oriented meal solutions. Regulatory compliance remains critical given safety sensitivities in protein-based foods.

Others segment encompasses diverse applications including pet food, baby food, and institutional foodservice products. Specialized packaging requirements address unique nutritional, safety, and convenience criteria across these subcategories.

Key Market Segments

By Packaging Format

- Flexible

- Rigid

By Packaging Material

- Plastic

- Metal

- Glass

- Paper and Paperboard

By Product Type

- Metal Cans

- Bottles

- Jars

- Cartons

- Pouches

- Others

By Packaging Technology

- Aseptic Food Packaging

- Retort Food Packaging

- Hot Fill Food Packaging

- Others

By End User

- Prepared Food

- Sauce and Condiment

- Processed Fruit and Vegetable

- Juice

- Meat Poultry and Seafood

- Others

Drivers

Rising Global Demand for Long-Shelf-Life Processed and Ready-to-Eat Food Products Drives Market Expansion

Consumer lifestyle transformations accelerate demand for convenient food solutions requiring minimal preparation time across global markets. Working professionals increasingly prioritize ready-to-eat options that eliminate cooking while maintaining nutritional quality. Shelf-stable packaging enables ambient storage eliminating refrigeration dependency and reducing household energy consumption.

Urbanization concentrates populations in areas where space constraints limit refrigeration capacity making ambient-stable products particularly attractive. Expanding organized retail channels and e-commerce grocery platforms facilitate broader shelf-stable product accessibility. Modern trade formats dedicate substantial shelf space to ambient-stable categories supporting inventory depth.

Online grocery delivery services benefit from packaging formats withstanding temperature variations during last-mile logistics. Stringent food safety regulations mandate barrier-protected packaging solutions preventing contamination throughout distribution networks. Regulatory bodies worldwide implement comprehensive certification standards ensuring packaging integrity and material safety compliance.

Restraints

Environmental Concerns Over Multilayer and Non-Recyclable Packaging Materials Constrain Market Growth

Increasing environmental awareness pressures manufacturers to address sustainability challenges associated with complex packaging structures. Multi-layer flexible materials combining different polymers create significant recycling complications requiring specialized separation technologies. Consumer activism targets single-use packaging formats perceived as contributing to plastic pollution and landfill accumulation.

Regulatory initiatives increasingly restrict non-recyclable packaging materials through extended producer responsibility mandates and taxation schemes. High initial capital and processing costs for aseptic and retort packaging systems limit accessibility particularly for small enterprises. Advanced sterilization equipment requires substantial upfront investment exceeding capabilities of regional manufacturers.

Specialized technical expertise remains scarce increasing operational complexity and training costs. Additionally, stringent validation procedures for new packaging formats extend product development timelines impacting competitiveness. Energy-intensive sterilization processes contribute to operational expenses while raising carbon footprint concerns among sustainability-focused brands.

Growth Factors

Rapid Adoption of Shelf-Stable Packaging in Emerging Economies with Weak Cold-Chain Infrastructure Fuels Market Expansion

Emerging markets present substantial growth opportunities where refrigeration infrastructure remains underdeveloped across rural and semi-urban regions. Shelf-stable packaging enables food distribution reaching populations previously underserved due to cold-chain limitations. Growing middle-class populations in Asia, Africa, and Latin America increase purchasing power supporting packaged food consumption.

Additionally, extreme climate conditions in tropical regions accelerate spoilage risks making ambient-stable solutions particularly valuable. Rising demand for shelf-stable packaging in plant-based, functional, and nutraceutical foods expands addressable market segments. Health-conscious consumers seek convenient access to protein alternatives and fortified products without refrigeration dependencies.

Technological advancements in high-barrier, lightweight, and sustainable packaging materials improve performance while reducing environmental impact. Brands leverage smart packaging features integrating shelf-life monitoring and traceability capabilities enhancing consumer confidence. Pet food and animal nutrition segments increasingly adopt shelf-stable formats supporting premiumization and convenience trends.

Emerging Trends

Shift Toward Recyclable, Mono-Material, and Paper-Based Shelf-Stable Packaging Formats Transforms Industry Landscape

Sustainability imperatives drive industry transition toward packaging designs facilitating end-of-life recyclability and material recovery. Mono-material structures eliminating incompatible layer combinations enable mainstream recycling infrastructure processing without specialized equipment requirements. Paper-based alternatives gain prominence leveraging renewable fiber sources while achieving necessary barrier properties through advanced coating technologies.

Brands communicate environmental commitments through packaging material choices supporting corporate sustainability objectives and consumer expectations. Growing preference for aseptic cartons and retort pouches over traditional metal cans reflects evolving consumer convenience priorities. Lightweight flexible formats reduce transportation emissions while optimizing storage efficiency throughout supply chains.

Integration of smart packaging features enables real-time monitoring of product freshness and safety parameters. Digital technologies including QR codes and NFC tags connect consumers with product information, traceability data, and engagement content. Portion-controlled and single-serve packaging designs address individualized consumption patterns reducing food waste at household level.

Regional Analysis

Asia Pacific Dominates the Shelf Stable Packaging Market with a Market Share of 43.80%, Valued at USD 30.7 Billion

Asia Pacific commands the global shelf-stable packaging market with a dominant 43.80% share, valued at USD 30.7 Billion, driven by massive population base and accelerating urbanization rates. Rapid economic development increases disposable incomes supporting packaged food consumption across middle-class households. Limited cold-chain infrastructure particularly in rural areas makes shelf-stable solutions essential for food distribution networks.

Additionally, hot climates across Southeast Asian countries accelerate spoilage risks necessitating advanced preservation technologies. Growing e-commerce penetration expands packaged food accessibility beyond traditional retail channels supporting market expansion. Manufacturers increasingly invest in regional production facilities optimizing supply chain efficiency and market responsiveness.

North America Shelf Stable Packaging Market Trends

North America demonstrates mature market characteristics with established consumer preferences for convenient shelf-stable food products. Busy lifestyles drive consistent demand for ready-to-eat meals and ambient-stable beverages across demographics. Stringent food safety regulations maintain high packaging quality standards ensuring consumer confidence throughout distribution channels.

Sustainability initiatives accelerate adoption of recyclable and renewable packaging materials across major brands. Innovation investments focus on reducing packaging weight while enhancing barrier performance and shelf appeal. Premium product segments leverage advanced packaging technologies supporting brand differentiation strategies effectively.

Europe Shelf Stable Packaging Market Trends

Europe emphasizes environmental sustainability driving innovation in eco-friendly shelf-stable packaging solutions across the region. Circular economy policies mandate recyclable packaging designs reducing single-use plastic consumption throughout supply chains. Premium food culture supports quality-focused packaging investments maintaining product integrity and authentic taste profiles.

Organic and natural food segments increasingly adopt shelf-stable formats expanding market opportunities beyond conventional categories. Regulatory frameworks promote transparency requirements supporting traceability and ingredient disclosure through packaging communications. Cross-border trade benefits from standardized packaging specifications facilitating efficient distribution across European markets.

Middle East and Africa Shelf Stable Packaging Market Trends

Middle East and Africa exhibit strong growth potential driven by improving economic conditions and expanding retail infrastructure. Extreme temperatures necessitate robust packaging solutions ensuring product stability under harsh environmental conditions throughout distribution. Growing expatriate populations increase demand for international food products requiring extended shelf life capabilities.

Government investments in food security initiatives support packaging technology adoption enhancing domestic food processing capabilities. Religious dietary requirements drive demand for certified halal packaging solutions meeting strict compliance standards. Tourism industry growth supports portable, convenient packaging formats catering to on-the-go consumption occasions.

Latin America Shelf Stable Packaging Market Trends

Latin America experiences rising demand for shelf-stable products addressing infrastructure challenges in remote regions. Economic volatility encourages consumers toward cost-effective ambient-stable food options reducing refrigeration expenses significantly. Tourism industry growth drives demand for portable, convenient packaging formats supporting on-the-go consumption needs.

Local manufacturers increasingly adopt modern packaging technologies improving product quality and export competitiveness across international markets. Agricultural abundance supports value-added food processing investments leveraging shelf-stable packaging for extended distribution reach. Regional trade agreements facilitate cross-border commerce benefiting from standardized packaging specifications and quality certifications.

Key Shelf Stable Packaging Company Insights

The global shelf-stable packaging market landscape features established multinational corporations combining extensive production capabilities with continuous innovation investments.

Amcor PLC leads through comprehensive packaging solutions portfolio spanning flexible and rigid formats serving diverse food applications globally. Their strategic focus on sustainable packaging development positions them advantageously amid growing environmental consciousness supporting brand differentiation initiatives.

Tetra Pak dominates aseptic carton technology segment through proprietary processing equipment and packaging materials supporting ambient-stable dairy markets. Their integrated approach combining packaging supply with filling machinery creates strong customer relationships and recurring revenue streams. Innovation investments focus on renewable paperboard materials and barrier coating technologies enhancing sustainability profiles across product portfolios.

Sealed Air Corporation excels in protective and food packaging solutions leveraging material science expertise to develop high-barrier flexible formats. Their innovation pipeline addresses sustainability challenges while maintaining superior product protection characteristics throughout distribution networks. Advanced polymer technologies enable lightweight packaging designs reducing material consumption without compromising performance standards.

Mondi Group brings integrated paper and packaging capabilities supporting paper-based shelf-stable solutions aligned with circular economy principles. Their vertical integration from pulp production through packaging conversion ensures supply chain reliability and quality consistency. Sustainable forestry practices and renewable material sourcing strengthen environmental credentials appealing to eco-conscious brands.

Additional market participants including Reynolds Group, Silgan Holdings, DuPont, Printpack, PolyOne, and APAK contribute specialized capabilities across material science sectors. These companies invest in research partnerships and production automation enhancing operational efficiency and product quality standards. Strategic acquisitions consolidate market positions while expanding geographic reach and technology portfolios systematically.

Key Companies

- Mondi Group

- Silgan Holdings

- Reynolds Group

- Tetra Pak

- Printpack

- DuPont

- Sealed Air Corporation

- Amcor PLC

- PolyOne

- APAK

Recent Developments

- July 2025 – Bambrew secured USD 10.3 Million in funding to accelerate sustainable packaging innovation initiatives expanding global market presence. The investment supports development of environmentally friendly packaging alternatives addressing plastic pollution concerns across food industry applications effectively.

- August 2025 – USDA allocated funding for packaging innovations supporting the USD 143 Billion specialty crop export industry enhancing international competitiveness significantly. This initiative promotes advanced packaging technologies improving product shelf life and reducing post-harvest losses during global distribution operations.

- April 2024 – Saveggy raised EUR 1.76 Million for plastic-free edible cucumber packaging technology revolutionizing fresh produce preservation approaches. The innovation eliminates single-use plastic films through biodegradable coating solutions extending vegetable freshness naturally without environmental impact concerns.

- December 2025 – ICL Group announced acquisition of acidulant leader Bartek through two-phase transaction strengthening food ingredient capabilities comprehensively. This strategic move expands portfolio offerings supporting shelf-stable food preservation technologies and pH management solutions across diverse applications.

Report Scope

Report Features Description Market Value (2024) USD 70.3 Billion Forecast Revenue (2034) USD 128.3 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Format (Flexible, Rigid), By Packaging Material (Plastic, Metal, Glass, Paper and Paperboard), By Product Type (Metal Cans, Bottles, Jars, Cartons, Pouches, Others), By Packaging Technology (Asceptic Food Packaging, Retort Food Packaging, Hot Fill Food Packaging, Others), By End User (Prepared Food, Sauce & Condiment, Processed Fruit & Vegetable, Juice, Meat Poultry and Seafood, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mondi Group, Silgan Holdings, Reynolds Group, Tetra Pak, Printpack, DuPont, Sealed Air Corporation, Amcor PLC, PolyOne, APAK Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Shelf Stable Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Shelf Stable Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mondi Group

- Silgan Holdings

- Reynolds Group

- Tetra Pak

- Printpack

- DuPont

- Sealed Air Corporation

- Amcor PLC

- PolyOne

- APAK