Global Sharps Safety Market Analysis By Product Type (Injection Equipment, IV Insertion Equipment, Blood Collection Equipment, Safety Scalpels, Safety Lancets, Other Product Types), By Technology (Passive Safety, Retractable Safety), By End-Use (Hospitals, Home Care Settings, Specialty Clinics, Ambulatory Surgical Centers, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 68349

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

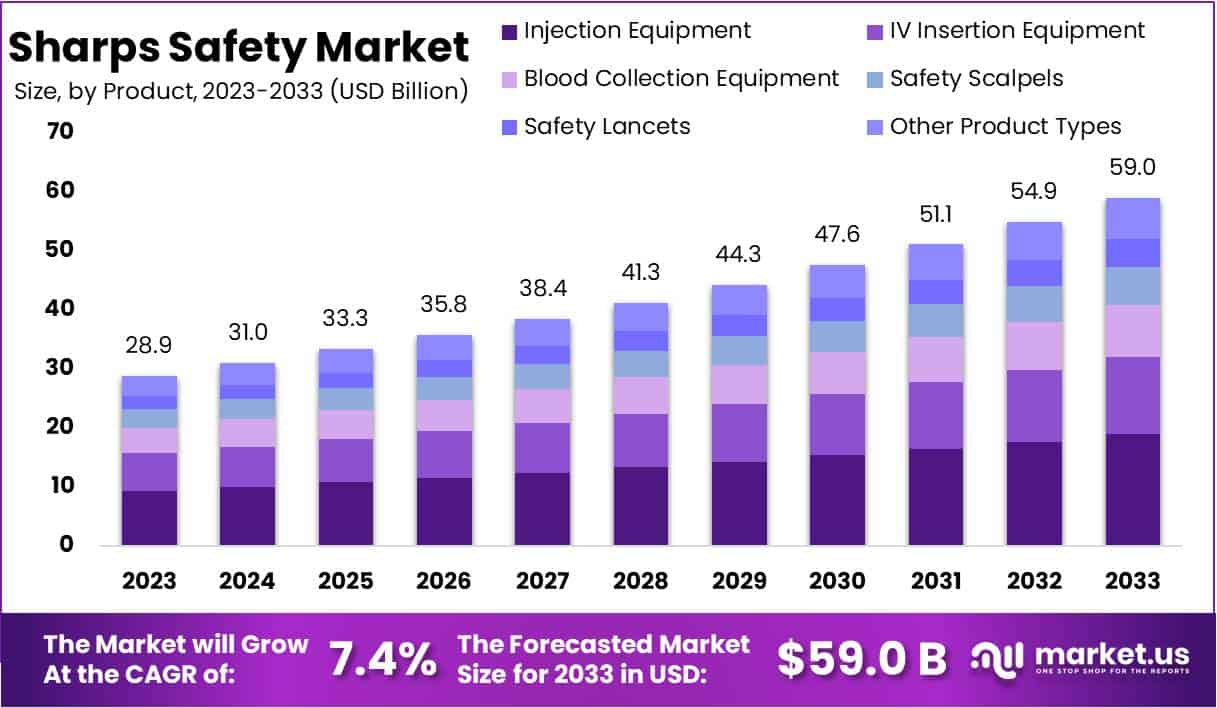

The Global Sharps Safety Market size is expected to be worth around USD 59 Billion by 2033, from USD 28.9 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

The Sharps Safety Market is primarily driven by the high demand from hospitals, clinics, and pharmaceutical companies, which are significant generators of medical waste. These healthcare institutions require advanced waste management systems to efficiently handle the vast amounts of sharps waste, such as needles and scalpels, produced daily. The U.S. Environmental Protection Agency highlights that improper disposal of sharps poses severe risks to public and environmental health. For instance, a study in Lagos, Nigeria, hospitals showed that they generate between 0.116 to 0.561 kg of medical waste per bed per day, underscoring the urgent need for effective sharps disposal systems.

Regulatory frameworks play a crucial role in shaping the market. In the U.S. and EU, stringent regulations by authorities like the FDA and the EMA enforce high standards for medical waste management and occupational safety. These regulations are vital for ensuring the safe disposal of medical sharps, thus preventing injuries and the spread of infections. Globally, about 16 billion injections are administered each year, according to the World Health Organization, emphasizing the extensive use of sharps and the potential hazards associated with their disposal. The FDA, recognizing the importance of safety, categorizes sharps disposal containers as class II devices that require premarket notification.

Trade dynamics also significantly influence the Sharps Safety Market. In 2022, Europe reported a medical devices trade surplus of 5.2 billion EUR, with strong exports to major markets like the U.S., China, Japan, and Mexico. The U.S. similarly noted significant medical device exports valued at $17.6 billion to the EU-28 in 2018. This robust trade in medical devices, including safety and diagnostic equipment, supports the growth of the Sharps Safety Market by ensuring a continuous supply of essential safety materials.

Government initiatives in regions like North America and Europe have strengthened healthcare safety protocols, particularly regarding sharps management. The UK’s Health and Safety Regulations 2013 and France’s measures integrating safety mechanisms in medical devices, which have reduced sharps injuries by two-thirds, are examples of such initiatives. The U.S. CDC estimates that adopting these safety measures could prevent over 80% of needlestick and sharps injuries annually.

The market is further supported by significant investments and strategic business activities. For example, the UK plans to invest over £20 billion in new hospital facilities by 2030, and Canada has committed $198.6 billion over ten years to enhance health services. Companies like Stericycle and Daniels Health are expanding through mergers and acquisitions, aiming to meet the growing demands for effective medical waste management solutions, thereby contributing to the market’s growth.

Key Takeaways

- Market Size and Growth: The Global Sharps Safety Market is expected to reach USD 59 Billion by 2033, growing at a CAGR of 7.4% from 2024 to 2033 (from USD 28.9 Billion in 2023).

- Product Type Analysis: In 2023, the Injection Equipment segment held over 32% market share, driven by extensive use of injectable medications and a focus on preventing needlestick injuries.

- Technology Analysis: In 2023, the Retractable Safety segment secured over 52% market share, driven by a focus on healthcare worker safety and stringent regulations mandating safety-engineered medical devices.

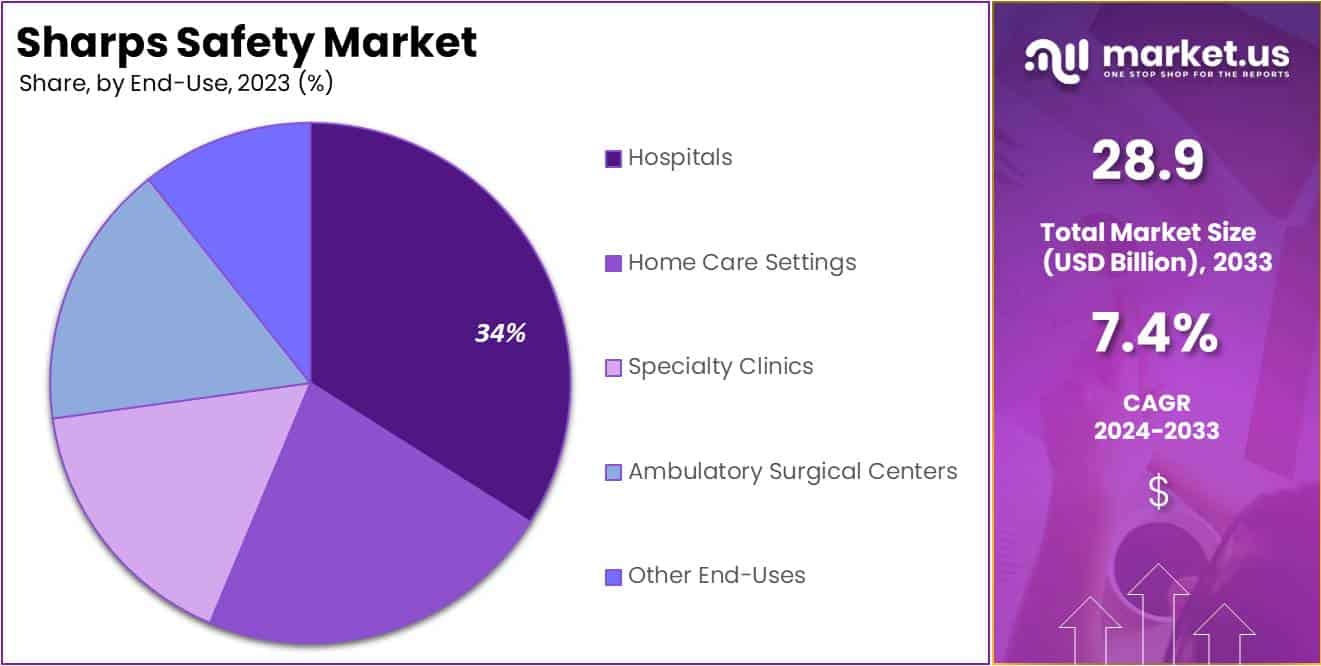

- End-Use Analysis: In 2023, the Hospitals segment held over 35% market share, due to the high number of invasive procedures and strict adherence to sharps safety protocols.

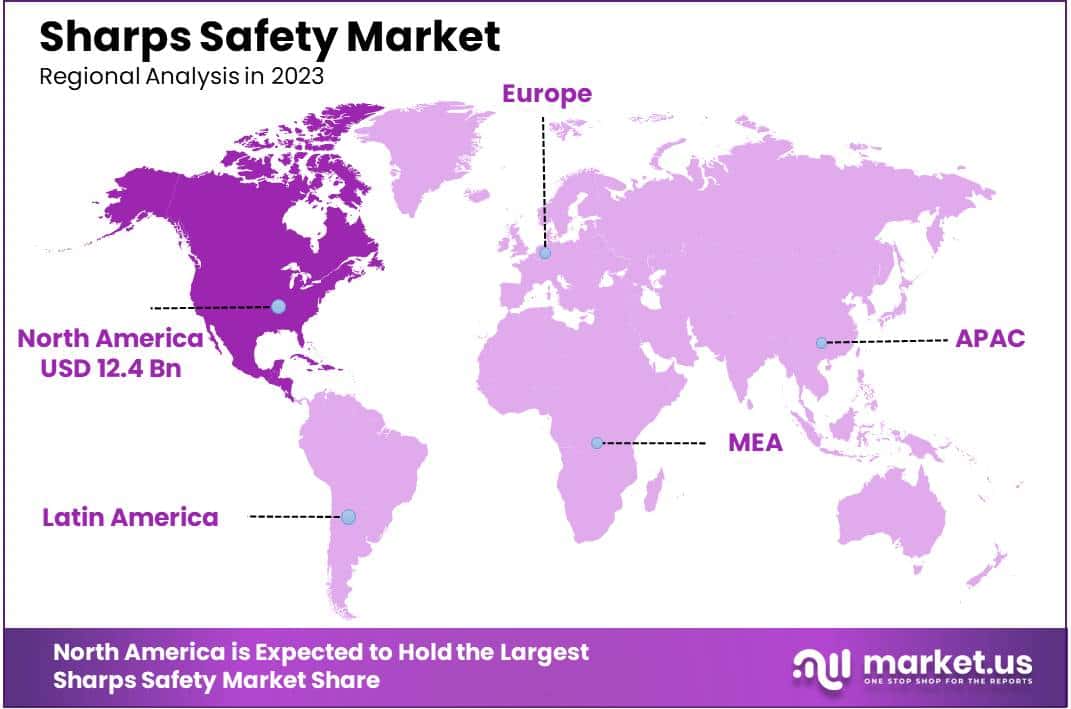

- Regional Analysis: In 2023, North America led the market with over 43.1% share, driven by stringent regulations and robust healthcare infrastructure.

Product Type Analysis

In 2023, the Injection Equipment segment secured a leading position in the Product Type Segment of the Sharps Safety Market, holding over 32% of the market share. This segment’s strong performance is largely due to the extensive use of injectable medications across medical practices and a heightened focus on preventing needlestick injuries among healthcare workers. Additionally, stringent regulations and increased awareness about occupational safety continue to drive the demand for safer injection equipment. The IV Insertion Equipment segment also maintained a substantial share of the market, fueled by the widespread application of intravenous therapies in medical facilities.

Furthermore, the Blood Collection Equipment segment accounted for a significant share, driven by frequent blood collection in diagnostic and therapeutic applications. Innovations in safety features, such as mechanisms to prevent needlestick injuries, are becoming standard in this segment. Similarly, the Safety Scalpels and Safety Lancets segments have experienced growth due to the rising adoption of safer tools for surgical procedures and blood sampling. The Other Product Types category, which includes various sharps disposal solutions and other safety products, enhances the market by providing comprehensive safety solutions in healthcare settings, thus ensuring compliance with health regulations and facilitating the proper disposal of sharp medical waste.

Technology Analysis

In 2023, the Retractable Safety segment secured a commanding position in the Technology Segment of the Sharps Safety Market, with a share exceeding 52%. This prominence is largely due to the increasing focus on the safety of healthcare workers and stringent regulations that mandate the adoption of safety-engineered medical devices. Retractable safety devices, which are specifically designed to reduce needlestick injuries, have become widely adopted in various healthcare environments. The drive towards enhancing safety mechanisms and usability in these devices aligns with healthcare providers’ needs, supporting continued market growth.

Additionally, the shift towards incorporating biodegradable materials and eco-friendly practices in the manufacturing of retractable sharps is creating new growth opportunities. This trend aligns with the global movement towards sustainable healthcare solutions, further driving the segment’s expansion. The competitive landscape in this segment is shaped by numerous key players investing in research and development to improve their product offerings. This ongoing innovation is essential for staying competitive and meeting the evolving demands of healthcare professionals. Projections indicate that the retractable safety segment will continue its upward trajectory, driven by advances in medical technology and heightened global healthcare standards.

End-Use Analysis

In 2023, the Hospitals segment secured a leading position in the Sharps Safety Market’s End-Use Segment, holding over 35% of the market share. This dominance is largely due to the extensive number of invasive procedures performed in hospitals, which necessitates strict adherence to sharps safety protocols to prevent needlestick injuries and other related hazards. The implementation of comprehensive sharps disposal systems and safety-engineered devices in these settings is driven by rigorous regulations aimed at safeguarding healthcare workers from infections and injuries.

Following hospitals, Home Care Settings emerged as a significant segment, reflecting the shift towards home-based medical care and the corresponding need for effective sharps management outside traditional clinical settings. As home treatments, including injections and infusions, become more prevalent, the demand for user-friendly sharps disposal products is expected to grow. Additionally, Specialty Clinics and Ambulatory Surgical Centers are increasingly adopting advanced safety devices to enhance the safety of both patients and healthcare personnel, spurred by heightened awareness of the consequences of sharps injuries.

Key Market Segments

Product Type

- Injection Equipment

- IV Insertion Equipment

- Blood Collection Equipment

- Safety Scalpels

- Safety Lancets

- Other Product Types

Technology

- Passive Safety

- Retractable Safety

End-Use

- Hospitals

- Home Care Settings

- Specialty Clinics

- Ambulatory Surgical Centers

- Other End-Uses

Drivers

Increasing Awareness of Healthcare Worker Safety

The increasing awareness of healthcare worker safety, particularly related to sharps injuries, has become a significant driver for the market of sharps safety devices. This heightened awareness is a response to the substantial risks that healthcare professionals face; approximately 600,000 to 800,000 needlestick and other sharps-related injuries are reported annually among healthcare workers in the U.S. alone. These incidents not only pose a risk of transmitting serious infections such as hepatitis B, hepatitis C, and HIV but also incur considerable direct and indirect costs averaging over $3,000 per injury.

The adoption of safety-engineered devices and the integration of comprehensive safety protocols are strongly encouraged by health organizations and regulatory bodies like the CDC and OSHA. Legislation such as the Needlestick Safety and Prevention Act has mandated enhancements to the Bloodborne Pathogens Standard, emphasizing the need for healthcare facilities to implement safer medical technologies. Moreover, the technology to prevent these injuries, including needle-free injection systems, has been identified as a pivotal element in reducing the prevalence of sharps injuries and their associated costs.

These developments reflect a broader commitment to improving workplace safety for healthcare workers, thereby driving the demand for advanced sharps safety solutions. The ongoing advocacy for healthcare worker safety and the implementation of regulatory measures ensure that this issue remains a priority, fostering an environment where the adoption of sharps safety devices is increasingly seen as both a necessary and standard practice in healthcare settings.

Restraints

High Cost of Safety-Engineered Devices

The high costs of safety-engineered sharps devices (SEDs) pose a significant restraint for market growth, particularly in developing and underdeveloped regions. These advanced devices are engineered to reduce the incidence of sharps injuries among healthcare workers. For example, one study showed that introducing safety-engineered needles in certain hospital settings could increase costs by 20% compared to traditional needles. Another financial analysis indicated that the average cost of a safety-engineered syringe is approximately 30% higher than a conventional syringe, which can significantly impact budget allocations in resource-limited healthcare systems.

Furthermore, the broader economic implications of adopting SEDs include not only the devices’ direct costs but also associated expenses such as training healthcare workers and adapting hospital protocols to integrate these new tools. Despite their higher initial cost, SEDs can reduce the long-term expenses related to managing needlestick injuries, which include direct medical costs and potential litigation. The balance between the initial investment and potential savings is crucial, especially where financial resources are scarce. Thus, the economic challenge posed by the high costs of SEDs underlines the need for strategies that consider both safety outcomes and financial feasibility in healthcare provisioning.

Opportunities

Rising Incidence of Needlestick Injuries

The rising incidence of needlestick injuries (NSIs) among healthcare workers provides a significant opportunity for growth in the sharps safety market. Each year, approximately 385,000 sharps-related injuries occur among healthcare workers in hospitals alone. Globally, the rate of NSIs can be as high as 83% among surgical residents, emphasizing the pervasive risk these incidents pose, especially in high-stress environments like operating rooms.

This alarming data underscores the urgent need for enhanced sharps safety protocols and innovative protective devices. As the market responds to these needs, there is a substantial opportunity for the development and adoption of new safety-engineered devices and comprehensive training programs aimed at reducing these injuries. The focus is not only on preventing the injuries but also on creating a safer working environment that can lead to better healthcare delivery. The substantial direct and indirect costs associated with managing NSIs-ranging from treatment and legalities to lost workforce hours-further highlight the potential financial savings and market demand for effective solutions in this area.

Trends

Integration of Safety Features in Medical Devices

The integration of advanced safety features in medical devices, such as retractable needles and shielded syringes, is a critical trend within the sharps safety market. This trend responds to the urgent need to reduce the substantial number of sharps-related injuries, which are estimated to affect up to 385,000 healthcare workers annually in the U.S. alone. The emphasis on safety is bolstered by initiatives from the U.S. Food and Drug Administration, which has seen a five-fold increase in the authorization of innovative medical devices since 2009 due to enhanced safety and technological advancements.

The continuous refinement of safety standards and practices is essential as the FDA reports that there are about 257,000 different types of medical devices in the U.S. market, developed by approximately 22,000 manufacturers globally. Despite the vast number of devices and manufacturers, the focus on safety has ensured that the incidents of new or increased known safety issues remain remarkably low, involving only a small fraction of technologies. This prioritization of safety not only protects healthcare providers but also ensures patient safety across the device lifecycle.

Regional Analysis

In 2023, North America maintained its leading position in the Sharps Safety Market, securing over 43.1% market share with a valuation of USD 12.4 billion. This dominance is primarily due to stringent healthcare safety regulations and a robust healthcare infrastructure. The region’s heightened awareness and strict adherence to protocols designed to prevent needlestick injuries significantly contribute to this leadership. Meanwhile, Europe holds a strong market presence, driven by rigorous healthcare policies and widespread adoption of advanced safety mechanisms across medical facilities. The proactive stance on reducing healthcare-associated infections further propels the demand for sharps safety devices in Europe.

The Asia-Pacific region is witnessing the fastest growth in the Sharps Safety Market, expected to rise at an impressive CAGR. Factors such as increased healthcare spending, burgeoning medical tourism, and the expansion of hospital networks in countries like China, India, and Japan are pivotal. Government initiatives aimed at elevating healthcare standards are also crucial for this growth. Conversely, Latin America and the Middle East & Africa are experiencing moderate growth, hindered by challenges related to healthcare accessibility and affordability. Despite these obstacles, investments in healthcare infrastructure and rising awareness about the safety of healthcare workers are gradually fostering market growth in these regions.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Cardinal Health Inc. is a major force in the Sharps Safety Market, renowned for its comprehensive array of safety-engineered devices aimed at minimizing needlestick injuries. This emphasis on innovation and safety is a core part of their strategy, helping to address the increasing demand for safer healthcare environments. Similarly, Smiths Group PLC enhances the market with its subsidiary, Smiths Medical, known for pioneering safety syringes and needles that play a crucial role in protecting healthcare workers.

Meanwhile, Medtronic PLC offers an extensive portfolio of sharps safety solutions that serve various medical applications, prioritizing effectiveness and security to improve healthcare outcomes. DeRoyal Industries Inc. focuses on creating customized protective equipment designed to safeguard healthcare personnel, blending functionality with cost-efficiency.

Terumo Corporation contributes through its reliable and innovative sharps safety devices, underscoring its commitment to ongoing research and development. Alongside these giants, numerous other key players deliver specialized products that further enrich the market, each adding unique value and enhancing the competitive landscape of the industry.

Market Key Players

- Cardinal Health Inc.

- Smiths Group PLC

- Medtronic PLC

- DeRoyal Industries Inc.

- Terumo Corporation

- Ansell Ltd.

- Becton Dickinson & Co.

- UltiMed Inc.

- Other Key Players.

Recent Developments

- April 2024: Medtronic, in collaboration with Cosmo Pharmaceuticals, unveiled the ColonPRO software for the GI Genius intelligent endoscopy system. This new software features an enhanced algorithm that improves polyp detection and reduces false positives by 9%.

- In March 2024: Smiths Group announced its half-year results, reporting a 3.9% organic revenue growth and a 16.5% increase in orders for the first half of fiscal year 2024. This strong performance was driven by growth in divisions like John Crane and Smiths Detection, with significant contracts secured globally for their next-generation CTiX platform and chemical detection technology.

- In February 2024: DeRoyal Industries initiated a Class I recall of certain Surgical Tracecarts containing the 16FR Urine Meter Foley due to sterility concerns. The recall affected 134 units distributed in the U.S. between August 2022 and September 2023 and was announced on February 14, 2024.

- In November 2023: Cardinal Health reported its first quarter fiscal 2024 results and raised its fiscal 2024 outlook. The company highlighted its Medical Improvement Plan, which aims to achieve at least $650 million in segment profit by FY26. This plan includes enhancements in the production and distribution of sharps safety products.

Report Scope

Report Features Description Market Value (2023) USD 28.9 Bn Forecast Revenue (2033) USD 59 Bn CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Injection Equipment, IV Insertion Equipment, Blood Collection Equipment, Safety Scalpels, Safety Lancets, Other Product Types), By Technology (Passive Safety, Retractable Safety), By End-Use (Hospitals, Home Care Settings, Specialty Clinics, Ambulatory Surgical Centers, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cardinal Health Inc., Smiths Group PLC, Medtronic PLC, DeRoyal Industries Inc., Terumo Corporation, Ansell Ltd., Becton Dickinson & Co., UltiMed Inc., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cardinal Health Inc.

- Smiths Group PLC

- Medtronic PLC

- DeRoyal Industries Inc.

- Terumo Corporation

- Ansell Ltd.

- Becton Dickinson & Co.

- UltiMed Inc.

- Other Key Players.