Global Serverless Security Market Size, Share, Industry Analysis Report By Service (Function as a Service (FaaS), Backend as a Service (BaaS), By Security Type (Data Security, Network Security, Application Security, Perimeter Security, Others), By Deployment (Cloud, On-Premise), By Enterprise Size (SMEs, Large Enterprises), By Industry Vertical (BFSI, Healthcare, Retail and E-commerce, IT and Telecommunications, Government and Public Sector, Manufacturing, Energy and Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 156954

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Role of Generative AI

- Emerging Trends

- U.S. Serverless Security Market Size

- Service Analysis

- Security Type Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Top Use Cases

- Customer Insights

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

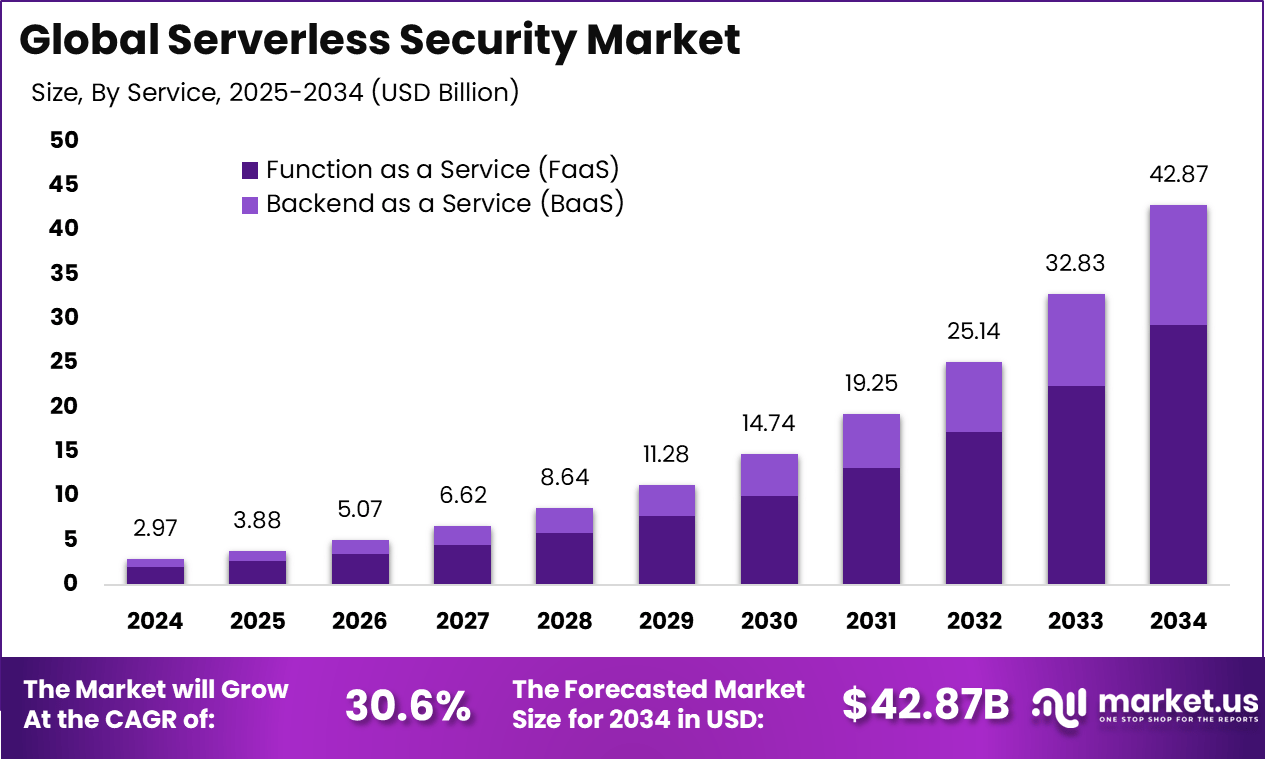

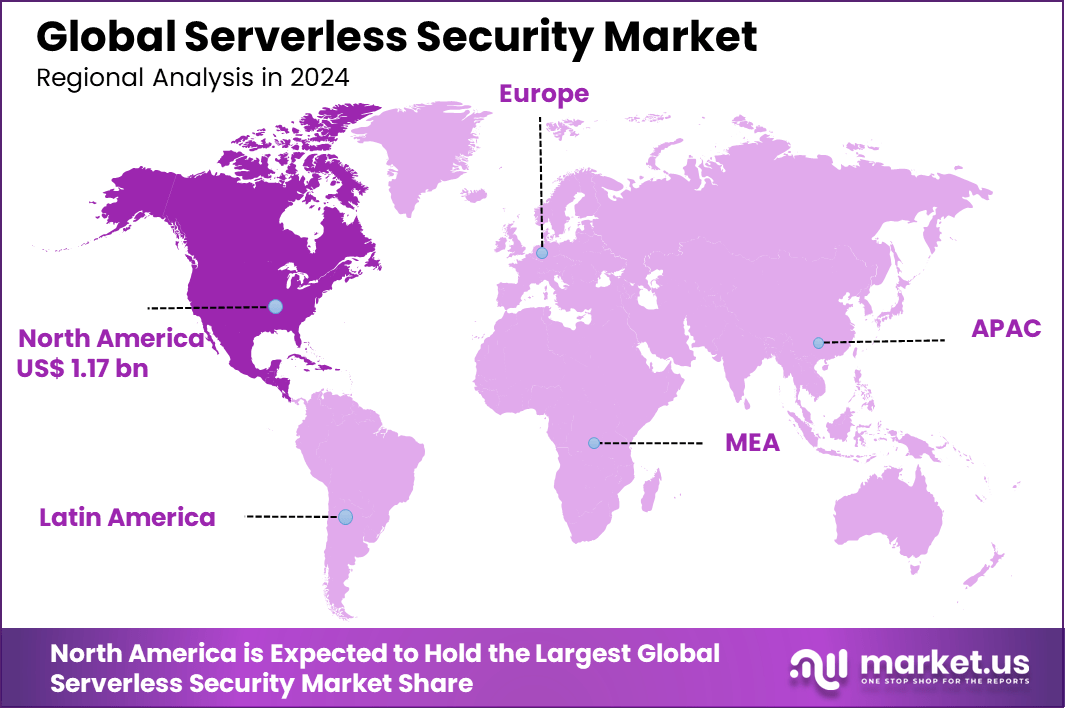

The Global Serverless Security Market size is expected to be worth around USD 42.87 billion by 2034, from USD 2.97 billion in 2024, growing at a CAGR of 30.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.4% share, holding USD 1.17 billion in revenue.

The serverless security market refers to solutions designed to protect applications and data hosted on serverless platforms, where infrastructure management is abstracted away. This segment has grown in importance as organizations shift to serverless computing models, which require tailored security strategies due to their dynamic, distributed nature.

According to O’Reilly’s 2019 survey, nearly 40% of organizations had adopted serverless architecture in some form. Since then, adoption has expanded rapidly, reaching over 75% by 2025. More than 70% of AWS users now rely on AWS Lambda, while Microsoft Azure and Google Cloud have also recorded strong growth in serverless usage.

The market is shaped by the increasing demand for protection of functions, APIs, and data in production environments running on cloud provider platforms. One fundamental driver is the rising adoption of serverless computing, which enables organizations to focus on code rather than infrastructure. As adoption rises, so does the need for security specific to ephemeral functions, runtime environments, and event-driven workflows.

For instance, in August 2025, AppZen enhanced its operational efficiency and data security by migrating to Amazon OpenSearch Serverless. The shift eliminated infrastructure management overhead, enabled automatic scaling, and improved performance for real-time document and data search workloads.

Key Takeaway

- In 2024, Function as a Service (FaaS) led the market with a 68.5% share.

- Data Security was the leading security focus, accounting for 20.2% share.

- The Cloud segment dominated with 82.4% share in 2024.

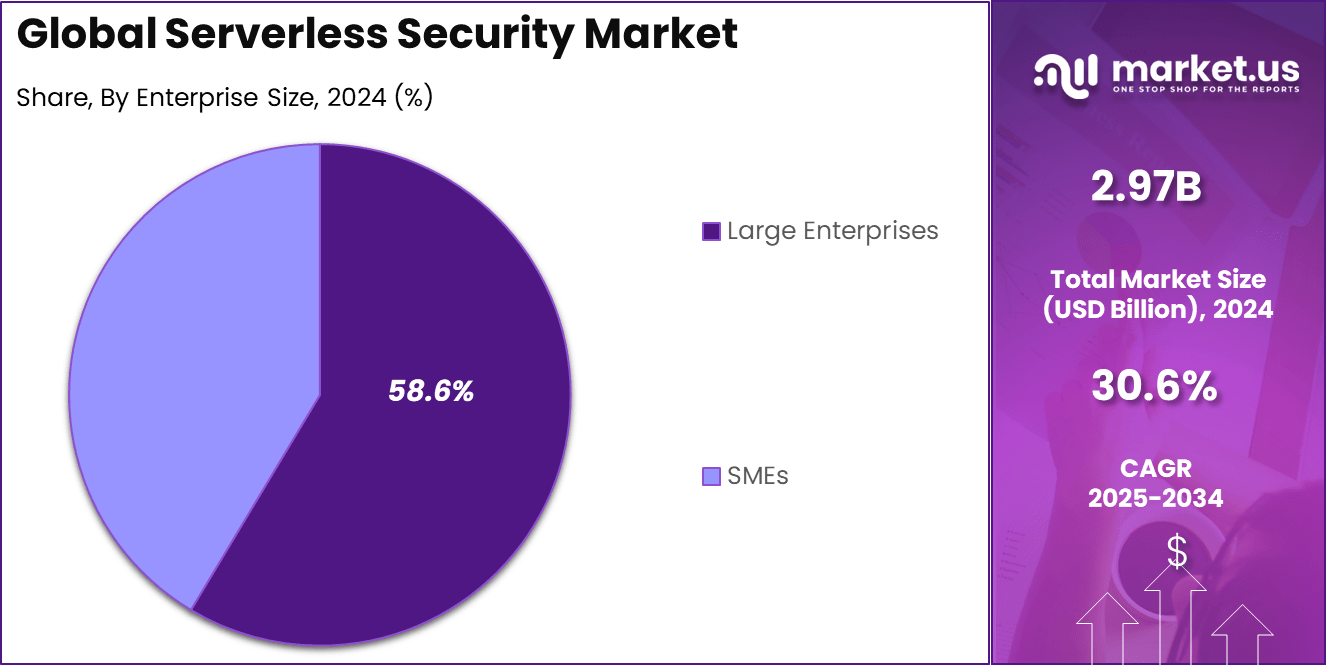

- Large Enterprises held the top position by enterprise size, securing 58.6% share.

- By industry, IT and Telecommunications led the market with 22.3% share.

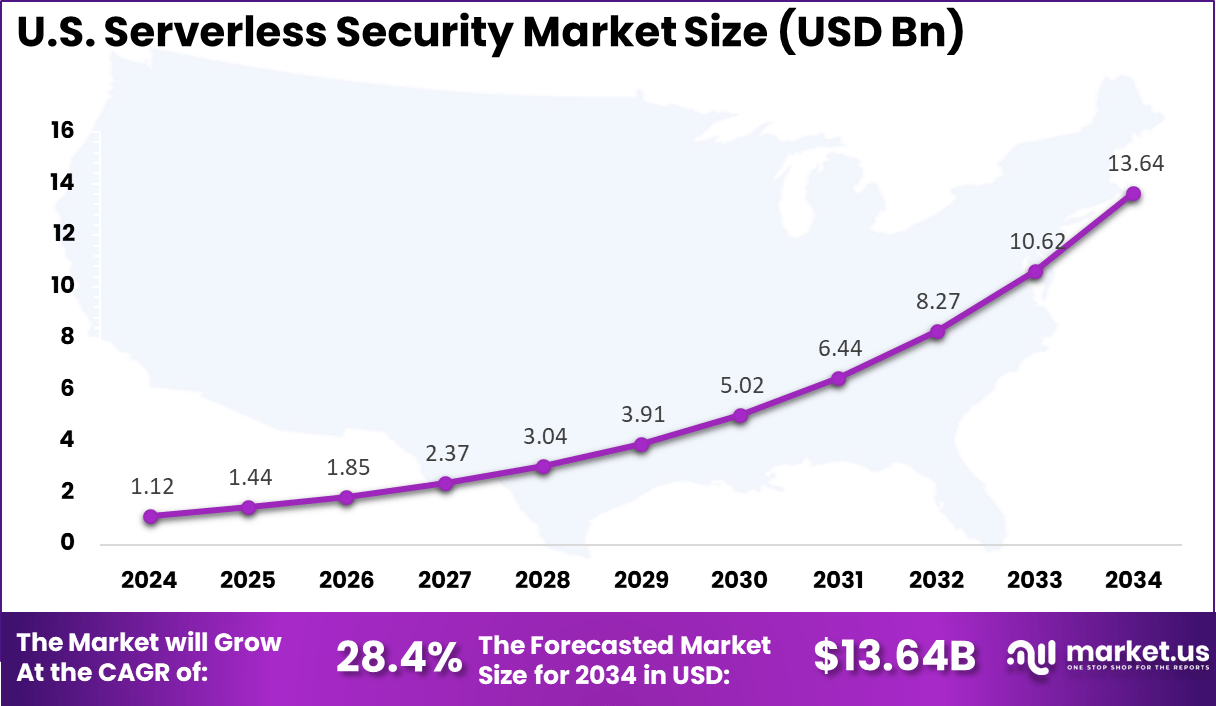

- The U.S. Serverless Security Market reached USD 1.12 Billion in 2024, growing at a strong 28.4% CAGR.

- North America was the leading regional market, capturing 39.4% share in 2024.

Analysts’ Viewpoint

Technologies driving increasing adoption of serverless security include artificial intelligence and machine learning, especially generative AI, which enhances threat detection and quick response capabilities. Identity and Access Management (IAM) tools integrated with serverless platforms enforce least privilege principles and help prevent unauthorized access. Automated vulnerability scanning, encryption protocols, and secure API gateways also form the technology backbone for strengthening serverless security.

Investment opportunities in the serverless security market lie in areas such as security monitoring, infrastructure protection, and integrated multi-cloud security platforms. With serverless adoption growing rapidly, investors see potential in startups developing innovative tools to close security blind spots and simplify management across diverse cloud environments.

The business benefits of deploying serverless security include reduced costs as companies pay only for used resources without maintaining idle servers. Serverless models accelerate innovation due to increased agility and faster development cycles, supported by secure environments that allow developers to focus on business logic. These advantages improve time-to-market for digital products and reduce complexity.

Role of Generative AI

Key Points Description Enhances threat detection Generative AI analyzes extensive datasets swiftly to identify security threats in serverless environments before they escalate. Automates response It enables automated security protocols and fast incident response to mitigate risks proactively. Improves accuracy AI reduces false positives and increases the precision of threat detection, optimizing security operations. Helps develop advanced protocols Generative AI aids in creating sophisticated and adaptive security measures tailored for serverless architectures. Integrates with security frameworks AI tools can seamlessly integrate with existing security systems to boost overall protection dynamically. Emerging Trends

Key Trends Description Increased enterprise adoption More enterprises are adopting serverless for event-driven apps and backend automation, increasing security demand. AI and ML integration Serverless environments are increasingly deploying AI/ML models for real-time anomaly detection and cybersecurity. Serverless DevOps (DevSecOps) CI/CD pipelines now incorporate serverless workflows with secure function execution and monitoring. Multi-cloud serverless strategies Organizations use multi-cloud and abstraction layers to avoid vendor lock-in while securing serverless across platforms. Expanding tools and frameworks Growth of frameworks like AWS SAM, Serverless Framework, and others improving developer experience and security. U.S. Serverless Security Market Size

The market for Serverless Security within the U.S. is growing tremendously and is currently valued at USD 1.12 billion, the market has a projected CAGR of 28.4%. The market is growing due to the rising adoption of cloud-native and serverless computing by businesses seeking greater scalability, agility, and cost-efficiency.

As organizations move away from traditional infrastructure, the need for security solutions tailored to dynamic, ephemeral serverless environments is increasing. Also, rapid innovation and strong investment from major cloud providers are accelerating product development and expanding the overall serverless security landscape.

For instance, in June 2025, AWS, headquartered in the U.S., showcased its leadership in serverless security by publishing a reference architecture integrating Amazon MSK Serverless, Amazon EMR Serverless, and IAM. The pipeline enables secure, scalable, and real-time data processing with built-in encryption and access controls.

In 2024, North America held a dominant market position in the Global Serverless Security Market, capturing more than a 39.4% share, holding USD 1.17 billion in revenue. This dominance is due to early adoption of cloud-native technologies, a strong footprint of major providers like AWS, Microsoft, and Google, and strict regulatory requirements fueling demand for advanced security tools.

The region also leveraged a mature cybersecurity landscape, significant enterprise IT investments, and a skilled talent pool. Additionally, the growing shift toward scalable, flexible serverless environments requiring robust protection further reinforced the growth of the market.

For instance, in August 2025, Vasion, a U.S. based leader in serverless automation, achieved “In Process” FedRAMP High status, advancing its cloud security posture for federal adoption. This milestone underscores the region’s leadership in secure serverless solutions, driven by stringent regulatory frameworks, robust cybersecurity ecosystems, and significant IT investments.

Service Analysis

The Function as a Service segment dominates the serverless security market with 68.5% share in 2024. FaaS enables organizations to deploy and scale individual functions without managing underlying servers, promoting agile development and operational efficiency. This model’s pay-per-use pricing and stateless execution align closely with the dynamic needs of modern applications, driving its widespread adoption.

Moreover, FaaS reduces infrastructure overhead and accelerates software delivery by allowing developers to focus solely on code logic. The security focus on FaaS is crucial because the ephemeral nature of functions requires specialized solutions for vulnerabilities such as unauthorized access, injection attacks, and insecure APIs to ensure safe execution environments.

For Instance, in February 2023, the Cloud Native Computing Foundation (CNCF) reported a notable rise in the adoption of Function-as-a-Service (FaaS) and serverless architectures. The survey highlighted that organizations increasingly rely on serverless computing for scalable, event-driven applications and microservices.

Security Type Analysis

In 2024, Data security holds a significant 20.2% of the serverless security market, reflecting the critical importance of protecting sensitive information in ephemeral and distributed serverless environments. Serverless applications often process large volumes of data across transient functions, creating unique challenges around data confidentiality, integrity, and compliance with regulations.

Organizations investing in data security solutions aim to mitigate risks of data leakage, unauthorized access, and breaches prompted by the lack of persistent infrastructure controls. Encryption, tokenization, and secure key management are among the core strategies to safeguard data both at rest and in transit within serverless ecosystems.

For instance, in June 2025, National Australia Bank (NAB) achieved regulatory approval to integrate serverless computing into its data environment and the adopt of serverless security within the financial sector. This approval process spanned 18 months, involving comprehensive third-party risk assessments, customer impact evaluations, and consultations with regulators.

Deployment Analysis

The cloud deployment segment leads with 82.4% market share in 2024, underscoring the inherent connection between serverless architectures and cloud platforms. Cloud providers offer scalable, flexible infrastructure that enables rapid deployment of serverless functions alongside integrated security tools.

The preference for cloud deployment is driven by benefits such as on-demand resource provisioning, global accessibility, and reduced capital expenditure on physical infrastructure. Additionally, cloud vendors continuously enhance security frameworks, including identity and access management, threat detection, and compliance monitoring, essential for securing serverless environments.

For Instance, in December 2024, Elastic launched Elastic Cloud Serverless, enabling optimized real-time search without infrastructure management. The solution allows organizations to scale workloads automatically while maintaining high performance and security. Removing operational overhead simplifies the deployment of cloud-native applications.

Enterprise Size Analysis

In 2024, Large enterprises constitute 58.6% of the serverless security market, reflecting their leadership in adopting advanced cloud-native technologies. These organizations leverage serverless computing to improve agility and reduce operational costs while ensuring comprehensive security against complex cyber threats.

Large enterprises typically face stringent compliance requirements and manage extensive digital assets, necessitating robust security solutions tailored to serverless environments. Their investment in serverless security also aligns with broader digital transformation strategies to optimize IT efficiency and risk management.

For Instance, in May 2025, AWS published best practices for securing Amazon S3 presigned URLs in serverless applications, targeting enterprise-scale deployments. The guidance helps large organizations manage access control, expiration policies, and encryption for ephemeral workloads, reducing the risk of unauthorized data exposure.

Industry Vertical Analysis

In 2024, the IT and telecommunications sector leads with a 22.3% share in the serverless security market. This industry heavily utilizes serverless computing to support rapid application development, real-time data processing, and scalable network services.

Due to the critical nature of data handled and the dynamic infrastructure in telecom and IT, security concerns such as identity management, threat detection, and data protection are paramount. Investments in serverless security help these sectors maintain service integrity, meet regulatory requirements, and protect customer data from sophisticated cyber threats.

For Instance, in June 2025, AWS published a reference architecture for building a secure serverless streaming data pipeline using Amazon MSK Serverless, Amazon EMR Serverless, and IAM. This solution enables IT organizations to process large-scale streaming workloads securely and at scale, leveraging encryption, fine-grained access control, and automated monitoring.

Key Market Segments

By Service

- Function as a Service (FaaS)

- Backend as a Service (BaaS)

By Security Type

- Data Security

- Network Security

- Application Security

- Perimeter Security

- Others

By Deployment

- Cloud

- On-Premise

By Enterprise Size

- SMEs

- Large Enterprises

By Industry Vertical

- BFSI

- Healthcare

- Retail and E-commerce

- IT and Telecommunications

- Government and Public Sector

- Manufacturing

- Energy and Utilities

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Adoption of Serverless Computing

One key driver of the serverless security market is the rapidly growing adoption of serverless computing across industries like finance, healthcare, and retail. Organizations are shifting to serverless architectures due to their scalability, flexibility, and cost-efficiency. This migration enables companies to streamline their operations and accelerate application development without needing to manage physical servers.

However, adopting serverless creates new security challenges, including function-level vulnerabilities and access management issues. This drives demand for specialized security solutions designed to guard serverless environments against evolving cyber threats while ensuring regulatory compliance.

For instance, in April 2025, Cloud Native Now showcased the growing synergy between Kubernetes and serverless computing in MLOps. Organizations are leveraging Kubernetes for scalable, automated model training and packaging while deploying inference tasks via serverless platforms such as AWS Lambda, Google Cloud Functions, and Azure Functions.

Restraint

Limited Visibility in Serverless Environments

A significant restraint for serverless security adoption is the challenge of limited visibility into what happens inside serverless environments. Unlike traditional server infrastructures, serverless computing abstracts away the underlying hardware and runtime environments, making it difficult for security teams to monitor network traffic and application behavior effectively.

This lack of transparency hinders real-time detection of vulnerabilities or suspicious activities, potentially leaving gaps for attackers to exploit. Security teams face difficulties in controlling and auditing these dynamic, ephemeral functions, which complicates threat detection and response.

For instance, in December 2024, CrowdStrike launched pre-deployment malware scanning for serverless functions, addressing a risk of malicious code hidden in third-party dependencies. Using ML-based detection, Falcon Cloud Security scans scripts and containers before runtime, highlighting the persistent threat posed by external libraries and frameworks.

Opportunities

Multi-Cloud and Hybrid Cloud Security Demand

The rising adoption of multi-cloud and hybrid cloud strategies presents a significant growth opportunity for the serverless security market. Companies increasingly distribute their workloads across multiple cloud providers (such as AWS, Azure, and Google Cloud) to avoid vendor lock-in, optimize costs, and enhance operational flexibility.

This increasing complexity creates a demand for security solutions that can provide unified, consistent protection across diverse cloud environments. Serverless security providers can capitalize on this by developing tools that integrate seamlessly with different platforms, offering real-time threat detection, automated incident response, and comprehensive compliance management.

For instance, in June 2025, Tech Mahindra partnered with Cisco to introduce managed services for Cisco Multicloud Defense, reinforcing enterprise security across hybrid and multi‑cloud environments via a unified SaaS control plane. This initiative aligns squarely with the opportunity inherent in multi‑cloud security frameworks, enabling scalable, cloud‑agnostic protection.

Challenges

Security Complexity of Third-Party Dependencies

A major challenge facing the serverless security market is managing the security risks introduced by third-party service dependencies. Serverless applications often rely heavily on external APIs, cloud functions, and managed services to extend functionality and improve performance.

However, organizations typically do not have direct control over the security posture of these third-party components, leading to potential vulnerabilities and unknown attack surfaces. This dependence can create blind spots in security monitoring and complicate vulnerability management efforts.

Moreover, third-party services themselves may have varying security standards, and ensuring these meet an organization’s requirements demands rigorous oversight. The dynamic nature of serverless applications, coupled with the external dependencies, increases the difficulty of maintaining a holistic security framework. Failure to properly manage these dependencies can lead to data breaches, unauthorized access, and service disruptions.

For instance, in October 2024, Network World highlighted a widening global cybersecurity skills gap. A survey by ISC² revealed that 90% of organizations report skills shortages across critical areas such as AI/ML (34%), cloud computing security (30%), and Zero Trust implementation (27%).

Top Use Cases

Top Use Cases Description Web and mobile backend security Secure APIs and backend processes powering SaaS, mobile apps, and eCommerce platforms. Real-time data processing Protect functions triggered by data uploads or streams, e.g., logs, images, videos. AI-powered chatbots Secure serverless deployments of chatbots with natural language processing capabilities. Scheduled jobs and automation Safeguard cron jobs, backups, and routine automation running on serverless platforms. IoT and edge computing Protect serverless functions processing sensor and edge device data with low latency needs. Customer Insights

Key Points Description High demand for visibility Customers expect deep monitoring and logging capabilities to track serverless activity for security. Need for fine-grained access control Users want precise role and permission management at the individual function level to limit exposure. Desire for automated security Automation in threat detection and response is seen as essential to reduce resource strain. Security complexity concerns Customers recognize the challenges of configuring secure serverless environments and seek guidance/tools. Preference for integrated solutions Organizations favor security solutions that integrate easily with existing cloud infrastructure and workflows. Key Players Analysis

In the serverless security market, major technology leaders such as Microsoft, Amazon Web Services, Google, and IBM play a central role. These companies have extensive cloud ecosystems, which allow them to embed security controls directly into their serverless offerings. Their solutions focus on access management, workload protection, and threat detection.

In March 2025, Google announced plans to acquire cybersecurity firm Wiz for USD 32 billion, marking one of the largest security deals in history. Specialized security providers including McAfee, Palo Alto Networks, Trend Micro, Fortinet, Check Point Software, and Zscaler are strengthening their presence. These players focus on advanced threat protection, cloud workload defense, and identity security.

Emerging innovators and niche providers such as Aqua Security, StackHawk, Cloudflare, Imperva, Signal Sciences, Rackspace, and Micro Focus are expanding their market relevance. These firms offer specialized tools for runtime protection, container security, and application monitoring tailored to serverless environments.

Top Key Players in the Market

- StackHawk

- Microsoft

- McAfee

- Palo Alto Networks

- Trend Micro

- Fortinet

- Check Point Software

- Cloudflare

- Zscaler

- IBM

- Amazon Web Services

- Imperva

- Aqua Security

- Signal Sciences

- Rackspace

- Micro Focus

- Other Key Players

Recent Developments

- In June 2025, StackHawk unveiled a new feature that automatically identifies high-risk APIs handling sensitive data (like PII or health information) across source code repositories, helping security teams prioritize testing across shadow, zombie, and ghost APIs.

- In March 2025, Alphabet announced its intent to acquire cloud-security unicorn Wiz for USD 32 billion, in a move to enhance Google Cloud’s end-to-end cloud security capabilities and compete more effectively with AWS and Azure.

Report Scope

Report Features Description Market Value (2024) USD 2.97 Bn Forecast Revenue (2034) USD 42.87 Bn CAGR(2025-2034) 30.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Service (Function as a Service (FaaS), Backend as a Service (BaaS), By Security Type (Data Security, Network Security, Application Security, Perimeter Security, Others), By Deployment (Cloud, On-Premise), By Enterprise Size (SMEs, Large Enterprises), By Industry Vertical (BFSI, Healthcare, Retail and E-commerce, IT and Telecommunications, Government and Public Sector, Manufacturing, Energy and Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape StackHawk, Microsoft, McAfee, Palo Alto Networks, Trend Micro, Fortinet, Check Point Software, Cloudflare, Zscaler, IBM, Amazon Web Services, Google, Imperva, Aqua Security, Signal Sciences, Rackspace, Micro Focus, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Serverless Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Serverless Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- StackHawk

- Microsoft

- McAfee

- Palo Alto Networks

- Trend Micro

- Fortinet

- Check Point Software

- Cloudflare

- Zscaler

- IBM

- Amazon Web Services

- Imperva

- Aqua Security

- Signal Sciences

- Rackspace

- Micro Focus

- Other Key Players