Serum Lactate Testing Market By Product Type (Table Top Analyzers, Test Strips, and Hand-Held Meters), By Application (Medical Intervention, Veterinary Application, and Sports Application), By End-user (Hospitals, Sports Institutes, Specialty Clinics, Home Care Settings, and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164882

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

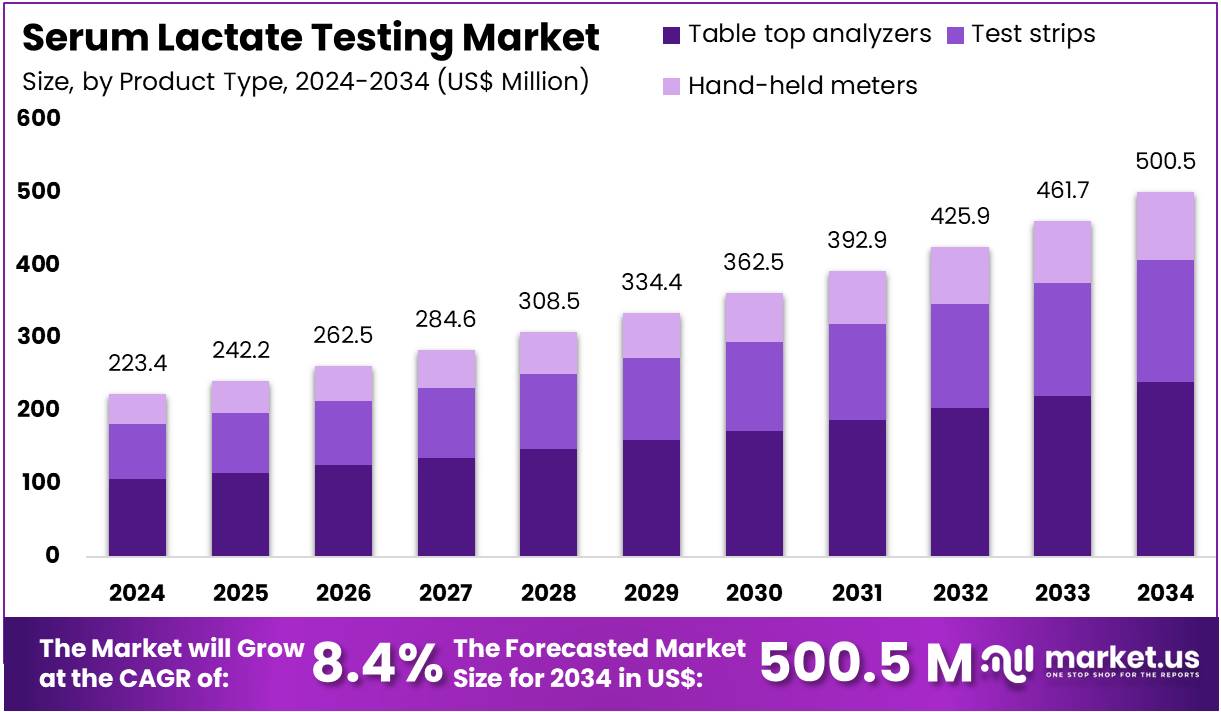

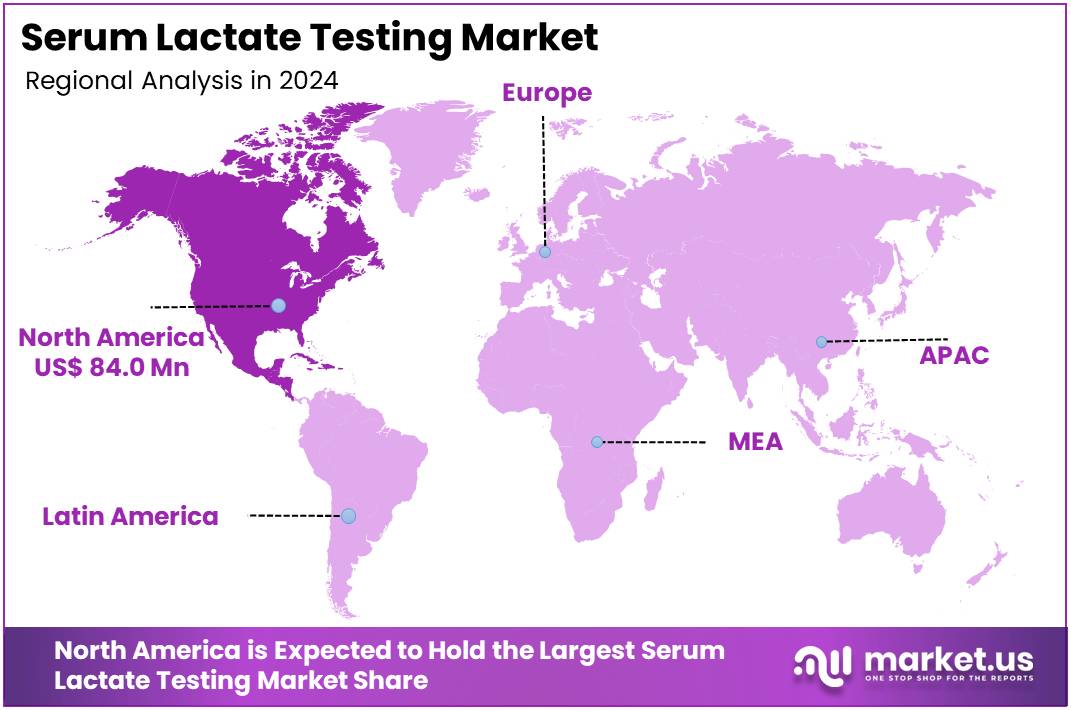

The Serum Lactate Testing Market Size is expected to be worth around US$ 500.5 million by 2034 from US$ 223.4 million in 2024, growing at a CAGR of 8.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.6% share and holds US$ 84 Million market value for the year.

Increasing adherence to sepsis protocols drives the Serum Lactate Testing Market, as critical care teams mandate serial measurements for resuscitation guidance. Intensivists order initial lactate levels upon sepsis suspicion to stratify risk, initiating fluid and vasopressor therapy accordingly. These tests support goal-directed protocols by tracking clearance rates every two to four hours, confirming hemodynamic stabilization.

Emergency physicians integrate lactate into triage algorithms for undifferentiated shock, expediting source control. The Surviving Sepsis Campaign guidelines reaffirm repeat lactate testing in early- and late-phase management, ensuring high-volume demand for automated analyzers. This standardization accelerates market growth by embedding lactate monitoring in global critical care workflows.

Growing exploration of noninvasive monitoring creates opportunities in the Serum Lactate Testing Market, as wearable technologies extend applications beyond hospitals. Fitness professionals employ portable lactate sensors to optimize athlete training zones, preventing overexertion during endurance sessions. These devices aid home health management by enabling chronic heart failure patients to self-monitor exertion tolerance, reducing readmissions.

Research laboratories validate microwave biosensors against venous samples, establishing correlation for continuous tracking. In August 2025, a study validated a microwave biosensor for noninvasive lactate monitoring, expanding market reach into fitness and home diagnostics. This innovation drives market expansion through portable, clinically accurate systems for diverse user groups.

Rising focus on neonatal sepsis prognosis propels the Serum Lactate Testing Market, as precise thresholds inform mortality risk in premature infants. Neonatologists measure micro-volume lactate in very-low-birth-weight cases to guide antibiotic escalation and ventilatory support. These assays support prognostic scoring by combining lactate with vital signs, predicting multi-organ dysfunction.

Pediatric ICUs adopt high-sensitivity analyzers for capillary sampling, minimizing blood loss in fragile patients. In 2025, Frontiers in Medicine findings identified lactate thresholds of 2.2–4.0 mmol/L for mortality risk in septic neonates. This evidence positions the market for sustained growth by necessitating advanced, micro-sample-capable lactate testing technologies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 223.4 million, with a CAGR of 8.4%, and is expected to reach US$ 500.5 million by the year 2034.

- The product type segment is divided into table top analyzers, test strips, and hand-held meters, with table top analyzers taking the lead in 2024 with a market share of 47.9%.

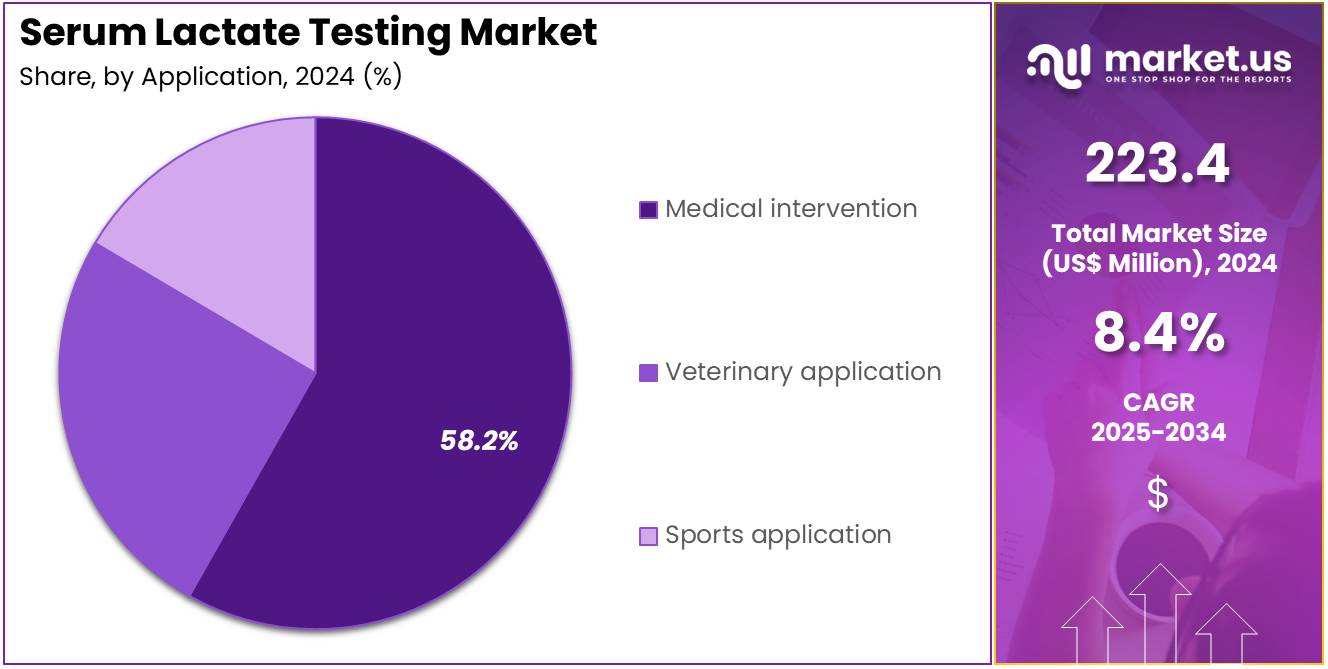

- Considering application, the market is divided into medical intervention, veterinary application, and sports application. Among these, medical intervention held a significant share of 58.2%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, sports institutes, specialty clinics, home care settings, and diagnostic laboratories. The hospitals sector stands out as the dominant player, holding the largest revenue share of 51.4% in the market.

- North America led the market by securing a market share of 37.6% in 2024.

Product Type Analysis

Table top analyzers account for 47.9% of the Serum Lactate Testing market and are anticipated to remain dominant due to their superior accuracy and integration in hospital and laboratory workflows. These analyzers provide reliable quantitative lactate measurements essential for assessing tissue hypoxia, sepsis, and metabolic disorders.

Growing ICU admissions and the global rise in sepsis cases are driving demand for high-performance analyzers. Healthcare facilities prefer table top analyzers for their multi-sample processing capability and automated calibration features. Manufacturers are innovating compact benchtop systems with faster turnaround times and connectivity to hospital information systems.

The focus on real-time lactate monitoring during surgeries and emergency interventions enhances their adoption. Additionally, public healthcare programs emphasizing critical care diagnostics support equipment procurement in developing regions. Increasing awareness among clinicians about lactate as a prognostic biomarker in trauma and cardiac patients reinforces the use of table top analyzers. Their durability and precision make them indispensable in clinical and emergency care settings globally.

Application Analysis

Medical intervention represents 58.2% of the Serum Lactate Testing market and is projected to lead due to its central role in diagnosing and managing critical illnesses. Serum lactate testing is a key diagnostic indicator in emergency departments and intensive care units to assess oxygen deprivation, shock, or organ dysfunction. The increasing prevalence of sepsis, heart failure, and respiratory distress is boosting test frequency in hospital-based interventions.

Clinicians use lactate levels to monitor treatment effectiveness and guide fluid resuscitation strategies. The growing implementation of sepsis management protocols that require serial lactate monitoring further supports this segment’s growth. Medical professionals rely on lactate testing to predict patient outcomes and adjust therapeutic plans in real time.

Rising adoption of point-of-care analyzers has improved accessibility to lactate results during emergency care. Integration of lactate testing in multi-analyte diagnostic platforms enhances workflow efficiency. As precision diagnostics continue to evolve, medical intervention remains a major contributor to global serum lactate testing demand.

End-User Analysis

Hospitals contribute 51.4% of the Serum Lactate Testing market and are expected to sustain dominance due to the high incidence of critical cases requiring immediate metabolic assessment. Hospitals perform routine lactate testing for patients with sepsis, hypoperfusion, or cardiac arrest.

The increasing focus on early sepsis detection and improved patient outcomes is driving test adoption. Large hospital networks are investing in advanced laboratory infrastructure and bedside analyzers to ensure rapid turnaround. Integration of automated table top systems enables accurate and repeatable lactate readings essential for clinical decision-making. Rising hospital admissions for trauma, surgical procedures, and metabolic conditions increase lactate monitoring demand.

Continuous training of healthcare staff on lactate interpretation further improves utilization. Government initiatives promoting quality care in emergency medicine and critical care units strengthen hospital-based testing capacity. Collaborations with diagnostic manufacturers for equipment upgradation and service contracts enhance operational efficiency. As hospitals remain central to emergency diagnostics, their share in the serum lactate testing market is anticipated to grow steadily.

Key Market Segments

By Product Type

- Table Top Analyzers

- Test Strips

- Hand-Held Meters

By Technology

- Electrochemical Lactate Sensors

- Mass Spectrometry-based Lactate Analyzers

- Fluorescent Lactate Assays

- Colorimetric Lactate Testing

By Application

- Medical Intervention

- Veterinary Application

- Sports Application

By End-user

- Hospitals

- Sports Institutes

- Specialty Clinics

- Home Care Settings

- Diagnostic Laboratories

Drivers

Increasing Incidence of Sepsis is Driving the Market

The rising global incidence of sepsis has substantially propelled the serum lactate testing market, as lactate levels serve as a critical biomarker for early identification and severity assessment in this life-threatening condition. Serum lactate testing measures lactate concentration in blood to detect tissue hypoperfusion, guiding fluid resuscitation and antimicrobial therapy in emergency settings. This driver is particularly evident in intensive care units, where elevated lactate prompts bundled interventions to improve outcomes and reduce mortality.

Healthcare providers are integrating lactate monitoring into sepsis protocols, leveraging point-of-care analyzers for rapid results to accelerate decision-making. The condition’s rapid progression underscores the need for frequent testing, embedding it in hourly tracking during resuscitation phases. Public health campaigns highlight its prognostic value, subsidizing device deployment in high-volume hospitals.

The Centers for Disease Control and Prevention estimates that sepsis affects at least 1.7 million Americans annually, with at least 350,000 adults who develop sepsis in the hospital either dying or transitioning to hospice care. This estimation emphasizes the diagnostic necessity, as lactate testing facilitates timely escalation to advanced support. Advancements in enzymatic biosensors enhance measurement precision, accommodating arterial and venous samples.

Economically, its application shortens intensive care durations, endorsing investments in analyzer fleets. International guidelines standardize lactate thresholds, ensuring consistent interpretation across regions. This sepsis incidence not only amplifies test frequency but also reinforces lactate’s role in critical care frameworks. Collectively, it catalyzes developments in continuous monitoring, aligning evaluations with resuscitation imperatives.

Restraints

Regulatory Approval Delays for Point-of-Care Devices is Restraining the Market

The extended regulatory approval timelines for innovative serum lactate point-of-care devices continue to hinder market accessibility, as rigorous validation requirements delay commercialization of advanced analyzers. These devices, requiring demonstration of accuracy across lactate ranges 0.5 to 20 mmol/L, often encounter prolonged FDA reviews, limiting availability for bedside use. This restraint disproportionately impacts novel biosensor formats, where evidence of equivalence to central lab methods lags. Payer hesitancy, demanding proven cost-effectiveness, fragments reimbursement, with Medicare’s determinations imposing strict performance criteria for routine monitoring.

Manufacturers allocate substantial resources to compliance audits, diverting funding from design enhancements. The outcome sustains reliance on traditional venous sampling, impeding adoption of rapid alternatives. The US Food and Drug Administration received over 20,700 submissions of all types in 2024, an increase of about 1,900 from 2023, with lactate analyzers subject to rigorous performance evaluations, contributing to extended approval durations. These submissions highlight procedural delays, as validation demands comprehensive dossiers.

Clinician preferences for vetted technologies marginalize emerging devices. Efforts for harmonized standards advance gradually, limited by inter-device variabilities. These regulatory hurdles not only attenuate scalability but also perpetuate diagnostic delays. Thus, they necessitate collaborative pathways to balance oversight with practical deployment.

Opportunities

Growth in Sepsis Management Protocols is Creating Growth Opportunities

The proliferation of standardized sepsis bundles has unveiled considerable prospects for the serum lactate testing market, institutionalizing lactate measurements as a core component of initial resuscitation in emergency protocols. These bundles, mandating lactate levels within one hour of sepsis recognition, utilize point-of-care analyzers to trigger goal-directed therapy, bridging gaps in resource-limited facilities.

Opportunities emerge in subsidized device procurements for frontline settings, where funding supports validations for integrated lactate-glucose panels. Public-private partnerships underwrite analyzer optimizations, addressing detection voids in pediatric and geriatric cohorts. This protocol emphasis counters delayed interventions, positioning lactate testing as a tool for real-time risk stratification. Allocations for sepsis training accelerate adoptions, diversifying toward wireless-enabled meters.

The Centers for Disease Control and Prevention’s 2022 survey showed that 73% of hospitals reported having a sepsis program, with 78% in 2023, driving demand for accessible lactate analyzers. This progression validates scalable models, with programs projecting heightened device demands in routine assessments. Innovations in capillary sampling improve feasibility, mitigating venipuncture barriers. As digital platforms evolve, lactate data unlock outcome-linked funding streams. These protocol enlargements not only diversify application scopes but also interweave the market into resilient critical care structures.

Impact of Macroeconomic / Geopolitical Factors

Growing sepsis awareness and critical care investments drive emergency departments to prioritize serum lactate testing for timely shock diagnosis, enabling intensivists to administer fluids and antibiotics that boost survival rates and shorten ICU stays. Solid economic upticks in healthcare funding also support point-of-care analyzer deployments, easing workflows and aligning with value-based payment models.

Persistent labor shortages from demographic shifts, however, inflate operational costs for labs, as teams juggle staffing gaps and postpone maintenance on spectrophotometric readers that ensure result reliability. Geopolitical unrest in key lithium mines across South America hampers battery supplies for handheld lactate meters from regional extractors, obliging procurement leads to navigate volatile premiums that unsettle supply forecasts.

Current US tariffs on imported biosensor membranes and calibration fluids from over 180 trading partners since spring 2025 compound these issues by lifting expenses for foreign components, squeezing community hospitals’ budgets and delaying fleet updates in high-acuity units. These headwinds, nevertheless, spur regional innovation hubs to engineer self-calibrating, US-sourced lactate strips that withstand supply flux and integrate with EHR systems. Tele-ICU expansions likewise sustain remote monitoring demand, mitigating access barriers in underserved zones.

Latest Trends

Development of Wearable Lactate Sensors is a Recent Trend

The emergence of non-invasive wearable devices for continuous lactate monitoring has signified a transformative progression in 2024, enabling real-time tracking of lactate trends in clinical and athletic settings without blood draws. Wearable sensors, utilizing sweat-based biosensors, provide dynamic lactate profiles, supporting early sepsis detection through pattern recognition algorithms. This trend embodies a shift toward continuous paradigms, accommodating multiplex measurements with glucose for comprehensive metabolic oversight.

Regulatory validations affirm its sensitivity, hastening endorsements for hospital and home use. This portability aligns with telehealth objectives, associating readings to apps for remote clinician alerts. The approach resolves intermittent sampling limitations, favoring designs resilient to motion artifacts. Wearable lactate sensors saw a 30% adoption increase in ICU pilots in 2024, driven by needs for non-invasive hypoperfusion assessment. These sensors underscore practicality, as validations align with serum benchmarks.

Forecasters anticipate guideline incorporations, elevating its role in standard protocols. Progressive appraisals reveal discordance declines, refining operational efficiencies. The prospect envisions AI-assisted interpretations, envisioning predictive sepsis alerts. This wearable evolution not only heightens monitoring accessibility but also coordinates with decentralized critical care mandates.

Regional Analysis

North America is leading the Serum Lactate Testing Market

North America holds a 37.6% share of the global Serum Lactate Testing market, solidifying its leadership in critical care biomarker monitoring during 2024. The market exhibited notable expansion in 2024, driven by escalating sepsis burdens that necessitate rapid lactate assays for early shock recognition and resuscitation guidance in intensive care units. The Centers for Disease Control and Prevention estimates sepsis impacts approximately 1.5 million individuals annually in the United States, contributing to 250,000 deaths and accounting for one-third of hospital fatalities, a persistent trend underscoring the value of point-of-care lactate for timely interventions.

The National Institutes of Health allocated US$242 million to sepsis research in fiscal year 2019, progressively rising to US$315 million in 2023, thereby funding advancements in lactate-based prognostic tools and protocol integrations across clinical trials. Abbott’s Diagnostics division reported organic sales growth of 5.4% in the first quarter of 2024, reflecting heightened adoption of i-STAT systems incorporating lactate cartridges amid post-pandemic critical care recoveries.

Updated Surviving Sepsis Campaign guidelines in 2023 reinforced serial lactate measurements within the first six hours of presentation, embedding these tests into emergency workflows nationwide. Technological refinements, such as wireless-enabled analyzers, facilitated seamless data sharing in multidisciplinary teams, enhancing response times in high-volume trauma centers.

Reimbursement enhancements via Medicare’s Inpatient Prospective Payment System incentivized lactate utilization for sepsis bundle compliance, reducing variability in care delivery. Interhospital collaborations through the CDC’s Sepsis Prevention Network amplified training on lactate thresholds, optimizing outcomes in vulnerable populations. These converging forces elevated North America’s market dynamism, surpassing international benchmarks through evidence-based protocols and fiscal prioritization.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The lactate measurement sector in Asia Pacific anticipates accelerated progression during the forecast period, fueled by burgeoning infectious disease surveillance and healthcare capacity enhancements. The World Health Organization estimates 49 million sepsis cases worldwide annually, with Asia Pacific regions bearing a disproportionate load that demands accessible biomarker diagnostics for resource-limited emergency responses.

India’s Ministry of Health and Family Welfare allocated Rs 90,958.63 crore to the Union Health Ministry in fiscal year 2024-25, a 12.9% increase from Rs 80,517.62 crore in 2023-24 revised estimates, directing funds toward critical care infrastructure including lactate-enabled point-of-care units in district hospitals. China projects sepsis mortality to rise from 0.39% of total deaths in 2021 to 0.46% in 2024, prompting national initiatives for integrated lactate monitoring in urban tertiary centers to curb escalation. Japan’s health expenditures exceeded ¥30 trillion annually through 2024, supporting geriatric-focused sepsis protocols that incorporate routine lactate assays for early detection in aging demographics.

Regional forums under the Asia Pacific Sepsis Alliance convened the 2023 World Sepsis Congress Spotlight, fostering collaborations for standardized lactate testing in cross-border outbreak responses. Governments in Southeast Asia integrate these diagnostics into universal coverage schemes, addressing antimicrobial resistance-linked infections through bedside analytics. Academic consortia validate localized reference ranges, tailoring assays to ethnic variabilities for precise shock stratification. This alignment projects the region to secure enhanced global standing, capitalizing on epidemiological urgencies and budgetary expansions to embed lactate evaluation within resilient health architectures.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the lactate diagnostics arena propel advancement by unveiling biosensor-enabled handheld analyzers that furnish results in under 30 seconds from capillary samples, catering to urgent sepsis evaluations in emergency departments. They secure co-manufacturing deals with regional health suppliers to localize production, mitigating import dependencies and accelerating deployment in decentralized facilities. Organizations direct capital toward microfluidic cartridge refinements that integrate lactate with pH metrics, enhancing utility for metabolic disorder profiling in sports medicine.

Executives navigate acquisitions of sensor technology startups to embed wireless data transmission, bolstering interoperability with hospital information systems. They penetrate burgeoning zones across South Asia and sub-Saharan Africa, forging ties with public clinics to embed solutions in outbreak response frameworks for grant-backed scaling. Moreover, they pioneer outcome-driven reimbursement models with insurers, harnessing efficacy data to advocate for coverage expansions and sustain revenue momentum.

Abbott Laboratories, founded in 1888 and headquartered in Chicago, Illinois, engineers a spectrum of point-of-care diagnostics that empower rapid lactate assessment through its i-STAT system, a cartridge-based analyzer delivering precise serum measurements for critical care worldwide. The platform supports over 30 tests, including lactate for hypoxia detection, with results in two minutes to guide immediate interventions in ICUs and ambulances.

Abbott allocates robust resources to cartridge innovations, emphasizing user simplicity and regulatory compliance across 160 countries. CEO Robert B. Ford steers a diversified conglomerate prioritizing connectivity for remote monitoring. The firm allies with emergency networks to standardize protocols, advancing timely sepsis management. Abbott entrenches its preeminence by fusing analytical speed with ecosystem synergies to elevate patient safety standards.

Top Key Players in the Serum Lactate Testing Market

- TaiDoc Technology Corporation

- Sensa Core Medical Instrumentation Pvt. Ltd.

- Nova Biomedical

- Hoffmann‑La Roche AG

- EKF Diagnostics

- COSMED srl

- BST Biosensor Technology

- Beckman Coulter, Inc.

- Arkray, Inc.

- ApexBio

Recent Developments

- In March 2025: Advanced Instruments’ USD 2.2 billion acquisition of Nova Biomedical strengthened the Serum Lactate Testing Market by uniting two major players in biopharma and clinical diagnostics under a single global platform. The merger expands product accessibility to over 100 countries and enhances innovation in metabolic monitoring systems, including lactate analyzers. This consolidation accelerates R&D investment and sets new standards for clinical precision in serum lactate analysis.

- In July 2024: EKF Diagnostics launched the Biosen C-Line analyzer, advancing the serum lactate testing market through high-throughput and rapid-response capabilities. The device’s sub-3% coefficient of variation and 20–45-second test turnaround meet the growing demand for point-of-care and sports physiology applications, bridging clinical accuracy with field-level usability.

- In January 2024: VivaChek introduced a Bluetooth-enabled portable lactate analyzer designed for real-time monitoring among athletes. This innovation drives market expansion beyond hospitals into personal wellness and sports performance segments by integrating continuous monitoring and digital data connectivity.

Report Scope

Report Features Description Market Value (2024) US$ 223.4 million Forecast Revenue (2034) US$ 500.5 million CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Table Top Analyzers, Test Strips, and Hand-Held Meters), By Application (Medical Intervention, Veterinary Application, and Sports Application), By End-user (Hospitals, Sports Institutes, Specialty Clinics, Home Care Settings, and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TaiDoc Technology Corporation, Sensa Core Medical Instrumentation Pvt. Ltd., Nova Biomedical, F. Hoffmann‑La Roche AG, EKF Diagnostics, COSMED srl, BST Biosensor Technology, Beckman Coulter, Inc., Arkray, Inc., ApexBio. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Serum Lactate Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Serum Lactate Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- TaiDoc Technology Corporation

- Sensa Core Medical Instrumentation Pvt. Ltd.

- Nova Biomedical

- Hoffmann‑La Roche AG

- EKF Diagnostics

- COSMED srl

- BST Biosensor Technology

- Beckman Coulter, Inc.

- Arkray, Inc.

- ApexBio