Global Semiconductor Inspection Machines Market Size, Share Analysis Report By Type (Wafer Inspection Machine, Mask Inspection Machine), By Technology (Optical, E-beam), By End-User (Integrated Device Manufacturers (IDM), Foundry, OSATs, R&D Centers), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138545

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

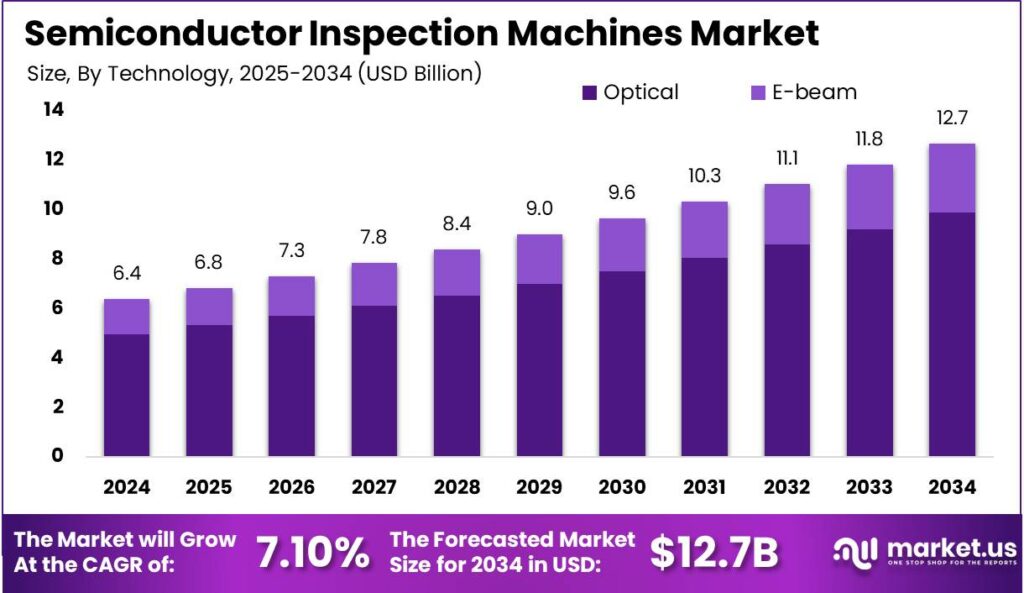

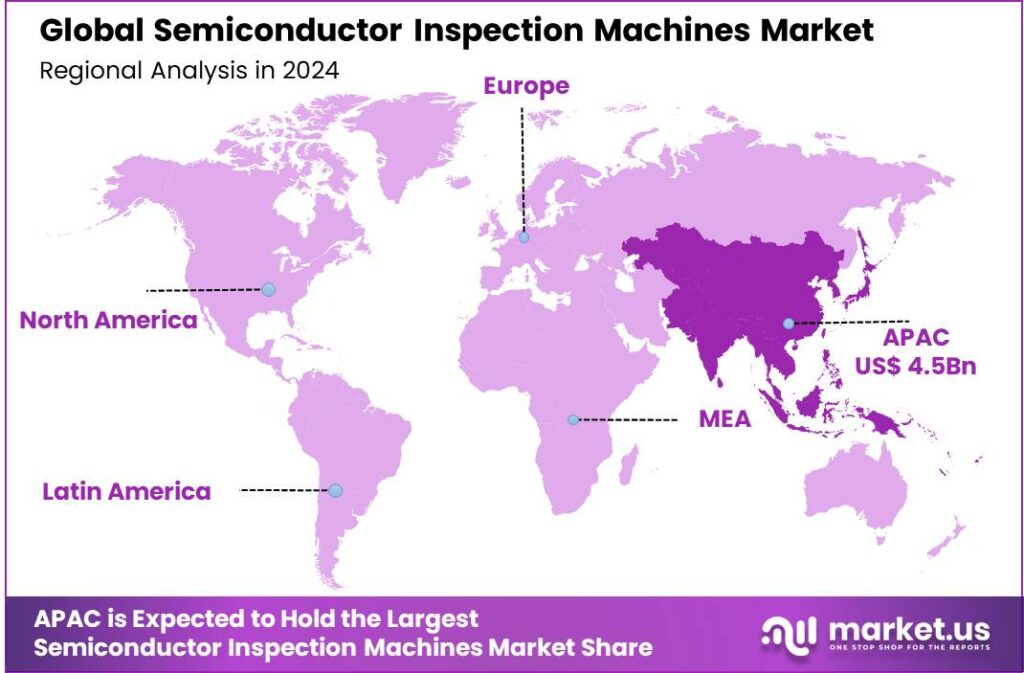

The Global Semiconductor Inspection Machines Market size is expected to be worth around USD 12.7 Billion By 2034, from USD 6.39 Billion in 2024, growing at a CAGR of 7.10% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region dominated this market, accounting for over 71.3% of the market share and generating a revenue of USD 4.5 billion.

Semiconductor inspection machines are advanced systems designed to examine and ensure the quality of semiconductor components during manufacturing. Semiconductor inspection machines are vital in detecting defects during chip production. Using techniques like optical, X-ray, electron microscopy, and laser scanning, they identify issues such as particle contamination, structural flaws, and material property variations.

The market for semiconductor inspection machines is driven by the growing complexity of semiconductor devices and the need for higher precision in manufacturing. As devices become smaller and circuits more intricate, the demand for sophisticated inspection technologies that can detect even the smallest anomalies has increased significantly. The market is also propelled by the expanding production capacities of semiconductor manufacturers worldwide, aiming to meet the increasing demand for electronics.

The growth of the semiconductor inspection machines market is driven by advancements in semiconductor technology, including smaller, more complex chips that require sophisticated inspection tools. As industries like electronics, automotive, and telecommunications demand higher precision, the rise of AI and machine learning in manufacturing also increases the need for advanced systems to detect subtle defects.

Key drivers of the semiconductor inspection machines market include technological advancements in semiconductor manufacturing, such as the shift towards smaller node sizes and 3D structures, which require more stringent quality checks. Additionally, the rising demand for consumer electronics, IoT devices, and electric vehicles, which all require high-quality semiconductor components, further stimulates market growth.

Recent trends in the semiconductor inspection market involve the integration of artificial intelligence and machine learning technologies. These advancements enhance the machines’ capability to analyze and interpret complex data more efficiently, leading to improved detection rates and faster processing times. There is also a shift towards more automated and non-invasive inspection methods that help reduce production downtime and improve throughput.

Demand in the semiconductor inspection machines market is high, particularly in regions with robust semiconductor manufacturing sectors such as Asia-Pacific, North America, and Europe. The demand is primarily driven by the need to enhance yield management and reduce production costs by minimizing the incidence of defects.

Key Takeaways

- The Global Semiconductor Inspection Machines Market size is projected to reach USD 12.7 billion by 2034, up from USD 6.39 billion in 2024, growing at a CAGR of 7.10% from 2025 to 2034.

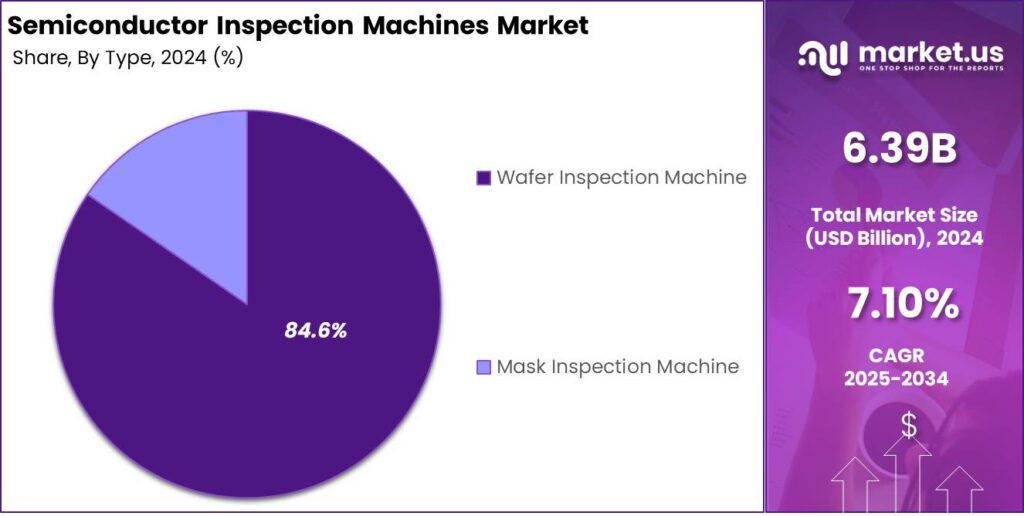

- In 2024, the Wafer Inspection Machine segment held a dominant market position, capturing more than 84.6% of the overall market share.

- The Optical segment was also a leader in the semiconductor inspection machines market in 2024, holding more than 77.9% of the market share.

- The Foundry segment dominated the semiconductor inspection machines market in 2024, with over 52.3% of the total market share.

- In 2024, the Asia-Pacific region held a dominant position in the global semiconductor inspection machines market, with a market share of over 71.3% and a revenue of USD 4.5 billion.

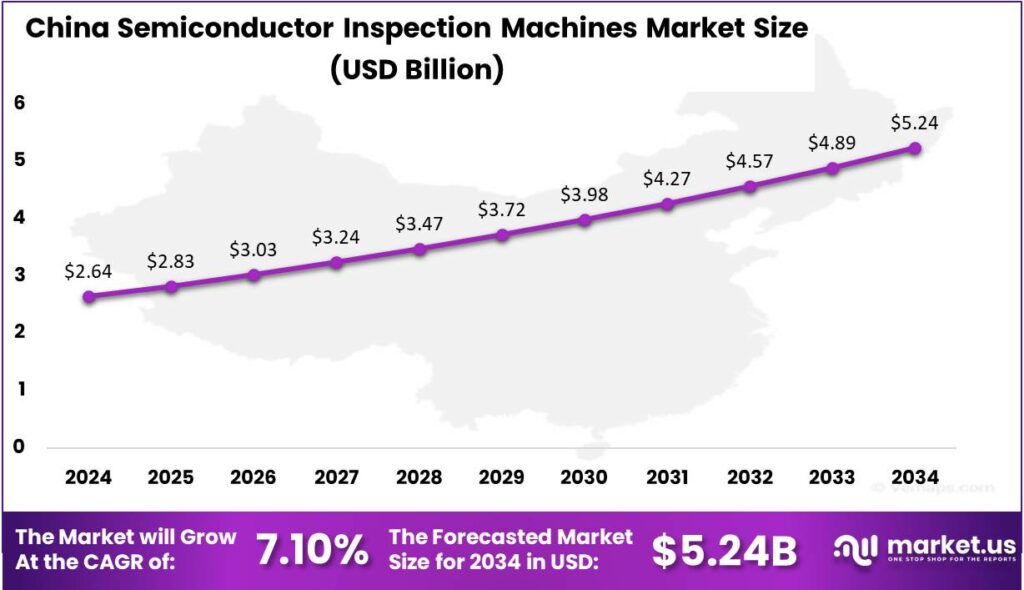

- The China semiconductor inspection machines market is expected to reach a valuation of USD 2.64 billion by 2024, with a projected growth rate of 7.10% CAGR during the forecast period.

China Market Size and Growth

The China semiconductor inspection machines market is projected to reach a valuation of USD 2.64 billion by 2024. This market is anticipated to grow at a robust compound annual growth rate (CAGR) of 7.10% over the forecast period.

The continued advancements in semiconductor technology, along with increasing demand for high-performance and precision inspection systems, are key factors driving this growth. As China strengthens its position in semiconductor manufacturing and technology, the demand for specialized equipment, such as inspection machines, continues to rise.

The market growth is driven by the increasing complexity of semiconductor chips, requiring advanced inspection tools for quality control and efficient production. These machines are essential for detecting defects at various stages, ensuring the reliability and functionality of the final product.

Furthermore, China’s expanding focus on building a self-sufficient semiconductor industry amid global supply chain disruptions is likely to create additional opportunities for market expansion.Technological innovation, higher production volumes, and government support for domestic manufacturing are expected to drive strong growth in the semiconductor inspection machine market.

In 2024, Asia-Pacific held a dominant position in the global semiconductor inspection machines market, capturing more than 71.3% of the market share with a revenue of USD 4.5 billion. This dominance can be attributed to the region’s robust semiconductor manufacturing industry, particularly in countries like China, South Korea, Japan, and Taiwan.

Countries like Taiwan, South Korea, and China, home to major foundries like TSMC, Samsung, and SMIC, drive strong demand for advanced inspection systems. Their focus on innovation and large-scale semiconductor production has increased the need for precision and quality control in manufacturing.

The rapid advancement of semiconductors in Asia-Pacific, driven by AI, 5G, and IoT, is fueling demand for high-performance inspection systems. These machines are vital for detecting tiny defects in chips, ensuring the quality of cutting-edge technology. The growing demand for next-gen devices and the adoption of automation in production are further boosting the market for inspection equipment in the region.

Government support and initiatives in Asia-Pacific, like China’s push for a self-reliant supply chain, are driving demand for semiconductor inspection systems. Competitive manufacturing costs and a skilled labor force make the region a key hub for semiconductor production, boosting the need for advanced inspection technologies.

Type Analysis

In 2024, the Wafer Inspection Machine segment held a dominant market position, capturing more than 84.6% of the overall market share. This dominance is largely driven by the critical role wafer inspection plays in the semiconductor manufacturing process.

Wafers, the foundation of semiconductor devices, need thorough inspection to detect even the smallest defects that could affect performance. As manufacturers advance miniaturization, the demand for advanced wafer inspection systems has grown to ensure chips meet the high standards required for modern electronics.

The increasing complexity of semiconductor designs, with smaller nodes and intricate circuits, drives the demand for advanced wafer inspection machines. These systems offer high resolution, sensitivity, and faster throughput, helping manufacturers identify defects early and meet the rapid production timelines of the semiconductor industry.

The growing use of semiconductor devices in industries like consumer electronics, automotive, telecommunications, and industrial automation has boosted the demand for wafer inspection systems. Reducing defect rates and improving yields in wafer production is key to enhancing manufacturing efficiency and profitability.

Technology Analysis

In 2024, the optical segment held a dominant market position in the semiconductor inspection machines market, capturing more than a 77.9% share. This leadership can be attributed to the widespread adoption of optical inspection technology in semiconductor manufacturing.

Optical inspection machines use advanced imaging techniques, like high-resolution cameras and specialized light sources, to detect surface defects in semiconductor wafers with high accuracy. Their ability to perform rapid, non-destructive inspections without complex sample preparation makes them ideal for high-volume production environments.

One of the main reasons optical inspection is leading the market is its efficiency in inspecting large-scale semiconductor production. The speed and precision of optical systems allow for high throughput, which is crucial in semiconductor fabs that aim to meet the increasing demand for chips in sectors like consumer electronics, automotive, and telecommunications.

Optical inspection systems are versatile, capable of inspecting wafers, photomasks, and packaged chips, which reduces costs and simplifies quality control. As chip miniaturization advances, optical technologies have evolved to keep up with smaller components, maintaining their dominance in the market.

End-User Analysis

In 2024, the Foundry segment held a dominant position in the semiconductor inspection machines market, capturing more than 52.3% of the total market share. This dominance is largely due to the increasing demand for semiconductor chips driven by advancements in technologies such as 5G, artificial intelligence (AI), and the Internet of Things (IoT).

Foundries, which are specialized facilities that focus on manufacturing semiconductors for various design companies, require precise and reliable inspection systems to ensure the quality of chips during production. The high volume of production and the need for stringent quality control make inspection machines indispensable in this segment.

The growth of the semiconductor foundry business, especially in Asia-Pacific, has driven demand for advanced inspection systems. As manufacturing becomes more complex with smaller nodes and higher performance needs, foundries rely on sophisticated machines to detect tiny defects, ensuring chips meet strict quality standards before reaching OEMs and other customers.

The shift toward advanced packaging techniques like 3D and system-in-package (SiP) has increased the need for precise inspection equipment in foundries. As heterogeneous integration and multi-chip systems rise, foundries require advanced inspection technologies to ensure production efficiency and chip quality, driving market demand.

Key Market Segments

By Type

- Wafer Inspection Machine

- Mask Inspection Machine

By Technology

- Optical

- E-beam

By End-User

- Integrated Device Manufacturers (IDM)

- Foundry

- OSATs

- R&D Centers

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Advanced Semiconductor Devices

The demand for semiconductor inspection machines is being driven by the rapid advancements in semiconductor technology, particularly with the rise of smaller, more powerful chips. As the industry pushes towards the fabrication of chips with smaller nodes, the need for highly accurate inspection systems has grown significantly.

These systems play a crucial role in identifying minute defects during the manufacturing process, which is critical as even tiny imperfections can lead to significant performance issues. The trend toward 5G, AI, IoT, and autonomous vehicles, which all require advanced semiconductor components, further intensifies this demand. The growing reliance on semiconductors in various industries is prompting manufacturers to invest in more advanced inspection machinery to ensure high-quality production.

Restraint

High Initial Cost of Inspection Machines

Despite their importance, the adoption of semiconductor inspection machines is restrained by their high initial cost. These machines often involve sophisticated technology and precision, resulting in a significant capital investment for manufacturers. Smaller companies or startups might struggle to afford such equipment, especially when market conditions are uncertain.

As semiconductor production ramps up to meet demand, companies need to balance their budgets, sometimes limiting their capacity to invest in high-end inspection systems. Furthermore, maintaining and calibrating these machines can add additional costs, which can further discourage adoption. These financial barriers present a challenge for smaller enterprises aiming to stay competitive in the market.

Opportunity

Growth in Emerging Markets

An exciting opportunity in the semiconductor inspection machine market lies in the expansion of semiconductor manufacturing in emerging markets. Countries in Asia, such as India and Vietnam, are starting to invest more in local semiconductor production capabilities. As the demand for consumer electronics, automotive systems, and mobile devices grows in these regions, there is a significant need for high-precision manufacturing equipment, including inspection machines.

Emerging markets are expected to play a crucial role in the global semiconductor ecosystem, and this presents a great opportunity for inspection machine manufacturers to expand their footprint in these regions. The growing middle class in these countries also fuels the demand for more consumer electronics, further enhancing this opportunity.

Challenge

Shortage of Skilled Labor

One of the ongoing challenges in the semiconductor industry is the shortage of skilled labor capable of operating and maintaining advanced inspection machines. These machines require highly trained technicians who can ensure optimal operation and address complex technical issues when they arise.

However, there is a global shortage of individuals with the required expertise in semiconductor manufacturing technologies. This gap in skilled workers is making it difficult for companies to scale their operations effectively, as they not only need to invest in high-end equipment but also in the training and recruitment of talent. This talent shortage is stalling growth in certain regions, as companies are often forced to delay or limit their production capabilities until the necessary workforce is available.

Emerging Trends

One of the most prominent emerging trends is the integration of artificial intelligence (AI) and machine learning (ML) algorithms into inspection systems. These technologies enable machines to automatically detect defects, classify them, and even predict potential failures, improving both efficiency and accuracy.

Another important trend is the development of high-throughput inspection machines. These machines are designed to inspect a larger number of wafers in a shorter amount of time without compromising quality. This is essential as the demand for semiconductors grows, and manufacturers strive to meet production targets while maintaining high-quality standards.

As sustainability becomes increasingly important, semiconductor inspection machines are being designed for greater energy efficiency, reducing power consumption and minimizing environmental impact. Additionally, the trend toward more compact and portable systems is helping manufacturers save space and boost facility efficiency.

Business Benefits

Semiconductor inspection machines offer numerous benefits to businesses, especially those in the semiconductor manufacturing space. These machines significantly enhance product quality. By identifying defects early in the production process, businesses can prevent the costly consequences of defective semiconductors reaching the market.

Moreover, the integration of AI and ML in inspection machines contributes to increased operational efficiency. These systems can perform inspections autonomously, reducing the need for manual labor and the associated human errors.

Another significant business benefit is cost reduction. While the initial investment in advanced inspection machines can be high, the long-term savings are substantial. By catching defects early in the manufacturing process, businesses avoid the costs associated with rework, waste, and warranty claims.

Key Player Analysis

As the demand for faster, more efficient semiconductors grows, key players in the inspection machine market play a vital role in meeting these needs.

- Thermo Fisher Scientific Inc. is a major player in the semiconductor inspection market, known for its advanced technologies in material characterization and analysis. The company provides cutting-edge electron microscopy systems that help semiconductor manufacturers inspect materials at the atomic level.

- ASML Holdings N.V. is a key leader in the semiconductor inspection market, primarily recognized for its advanced photolithography equipment. As one of the only companies capable of manufacturing extreme ultraviolet (EUV) lithography machines, ASML has revolutionized semiconductor production, allowing for smaller and more powerful chips.

- Applied Materials, Inc. is another top player that has significantly contributed to the semiconductor inspection sector. The company specializes in providing materials engineering solutions used in the production of semiconductor devices. Their inspection tools, including metrology and defect inspection systems, are crucial for ensuring that semiconductors meet strict quality standards.

Top Key Players in the Market

- Thermo Fisher Scientific Inc.

- ASML Holdings N.V.

- Applied Materials, Inc.

- Nikon Corporation

- Lasertec Corporation

- Hitachi High-Tech Corporation

- Onto Innovation Inc.

- Toray Industries, Inc.

- KLA Corporation

- C&D Semiconductor Services Inc.

- Other Major Players

Top Opportunities Awaiting for Players

- Rise in Demand for Advanced Semiconductor Devices: As industries like AI, 5G, and automotive push the need for more advanced semiconductors, the demand for high-precision inspection machines is increasing. Companies can capitalize on this growth by developing more advanced, accurate inspection technologies to meet evolving standards.

- Growth in Semiconductor Production in Emerging Markets: Regions like Asia-Pacific are seeing a surge in semiconductor manufacturing. This presents an opportunity for inspection machine suppliers to expand their footprint and tap into the growing number of manufacturing plants in these areas.

- Integration of AI and Automation: Semiconductor manufacturers are increasingly integrating AI and automation to improve production efficiency. Inspection machines equipped with AI-driven analytics can offer smarter defect detection and reduce human error, making them highly attractive to customers.

- Miniaturization of Semiconductor Devices: As semiconductors become smaller and more complex, inspection machines that can handle fine details at nanoscale levels are in high demand. Companies that innovate to offer scalable solutions for these tiny components will stand out in the market.

- Sustainability Initiatives: There’s growing pressure for the semiconductor industry to adopt sustainable practices. Inspection machines that reduce waste, use less energy, or support eco-friendly production processes can align with industry-wide goals, giving suppliers an edge in an increasingly green-focused market.

Recent Developments

- In January 2024, In a strategic move to strengthen its engineering and R&D expertise, Infosys has revealed plans to acquire InSemi, a company renowned for its semiconductor design and embedded services. This acquisition is set to enhance Infosys’ capabilities in cutting-edge industries, particularly in the 5G chipset and AI chip sectors.

- In July 2024, Merck completed the acquisition of Unity-SC, a French company specializing in semiconductor wafer inspection equipment. This acquisition enhances Merck’s capabilities in metrology and inspection instrumentation.

Report Scope

Report Features Description Market Value (2024) USD 6.39 Bn Forecast Revenue (2034) USD 12.7 Bn CAGR (2025-2034) 7.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Wafer Inspection Machine, Mask Inspection Machine), By Technology (Optical, E-beam), By End-User (Integrated Device Manufacturers (IDM), Foundry, OSATs, R&D Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., ASML Holdings N.V., Applied Materials, Inc., Nikon Corporation, Lasertec Corporation, Hitachi High-Tech Corporation, Onto Innovation Inc., Toray Industries, Inc., KLA Corporation, C&D Semiconductor Services Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Semiconductor Inspection Machines MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Inspection Machines MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- ASML Holdings N.V.

- Applied Materials, Inc.

- Nikon Corporation

- Lasertec Corporation

- Hitachi High-Tech Corporation

- Onto Innovation Inc.

- Toray Industries, Inc.

- KLA Corporation

- C&D Semiconductor Services Inc.

- Other Major Players