Global Semi-Trailer Dealership Market Size, Share, Growth Analysis By Product Type (New Semi-Trailers, Used Semi-Trailers), By Application (Freight Transportation, Logistics Services, Construction and Heavy Haul, Specialized Transport), By End-Use (Fleet Operators, Owner-Operators, Leasing Companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170478

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

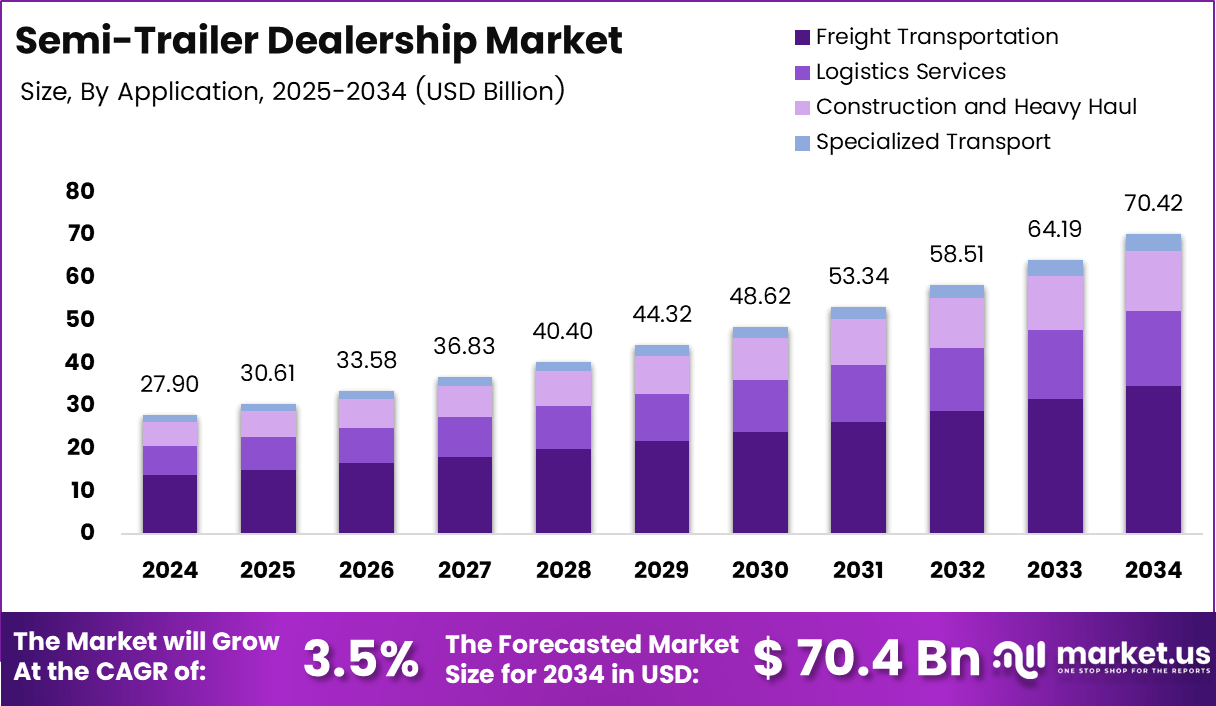

The Global Semi-Trailer Dealership Market size is expected to be worth around USD 70.4 billion by 2034, from USD 27.9 billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

The semi trailer dealership market refers to authorized and independent businesses involved in selling, leasing, financing, and servicing semi-trailers for freight and logistics operations. These dealerships act as critical intermediaries between manufacturers and fleet operators, supporting asset acquisition, lifecycle management, and regulatory compliance across regional and long-haul transport networks.

From an analyst’s viewpoint, the market is expanding steadily as freight volumes rise and fleet renewal cycles shorten. Increasing e-commerce penetration, infrastructure upgrades, and cross-border trade activity are encouraging logistics operators to modernize trailer fleets. As a result, dealerships increasingly combine sales with financing, maintenance contracts, and digital fleet advisory services to drive recurring revenue.

In terms of growth dynamics, the shift toward efficiency-focused transportation is reshaping dealership demand patterns. Fleet owners are prioritizing trailers that improve fuel efficiency, payload optimization, and operational uptime. Consequently, dealerships offering technical guidance, telematics integration support, and aftermarket service capabilities are better positioned to capture long-term customer relationships and higher margins.

Government investment and regulation continue to influence dealership strategies. Public spending on highways, logistics parks, and intermodal corridors supports sustained trailer demand. Meanwhile, emissions regulations and fuel efficiency mandates are accelerating interest in advanced trailer technologies. Therefore, dealerships increasingly align portfolios with sustainability-compliant assets to support fleet decarbonization goals.

Opportunities are also emerging from the transition toward electric and hybrid logistics ecosystems. According to BMW Group pilot logistics trials, e-trailers demonstrated measurable efficiency gains during real-world operations. These developments create new revenue streams for dealerships through specialized sales, charging infrastructure coordination, and technical training services tailored to next-generation trailers.

According to BMW Group logistics testing, up to 250 kilometres per day were covered on motorways with synchronized tractor-trailer data collection. The trials showed an average diesel consumption reduction of 46.59 percent during long-distance operations with loads exceeding 16 tonnes. This performance reinforces the value proposition of efficiency-focused trailers for commercial fleets.

In additional trials, BMW Group reported energy modules transported over 450 kilometres resulted in diesel savings of more than 48 percent compared with conventional trailers. The e-trailer battery, charged using 100 percent green energy, enabled an estimated CO2 reduction of around 120 tonnes annually per unit. These outcomes highlight the commercial relevance of advanced trailers within dealership portfolios.

Overall, the semi-trailer dealership market is evolving from transactional sales toward solution-oriented mobility enablement. As sustainability targets, digital logistics, and cost efficiency priorities converge, dealerships positioned as advisory partners are expected to remain central to future freight transportation ecosystems.

Key Takeaways

- The global Semi-Trailer Dealership Market is projected to grow from USD 27.9 billion in 2024 to USD 70.4 billion by 2034, registering a CAGR of 3.5%.

- By product type, New Semi-Trailers dominated the market in 2024 with a share of 67.2%, driven by fleet modernization and regulatory compliance needs.

- By application, Freight Transportation accounted for the largest share of 49.4% in 2024, supported by steady long-haul and cross-border cargo movement.

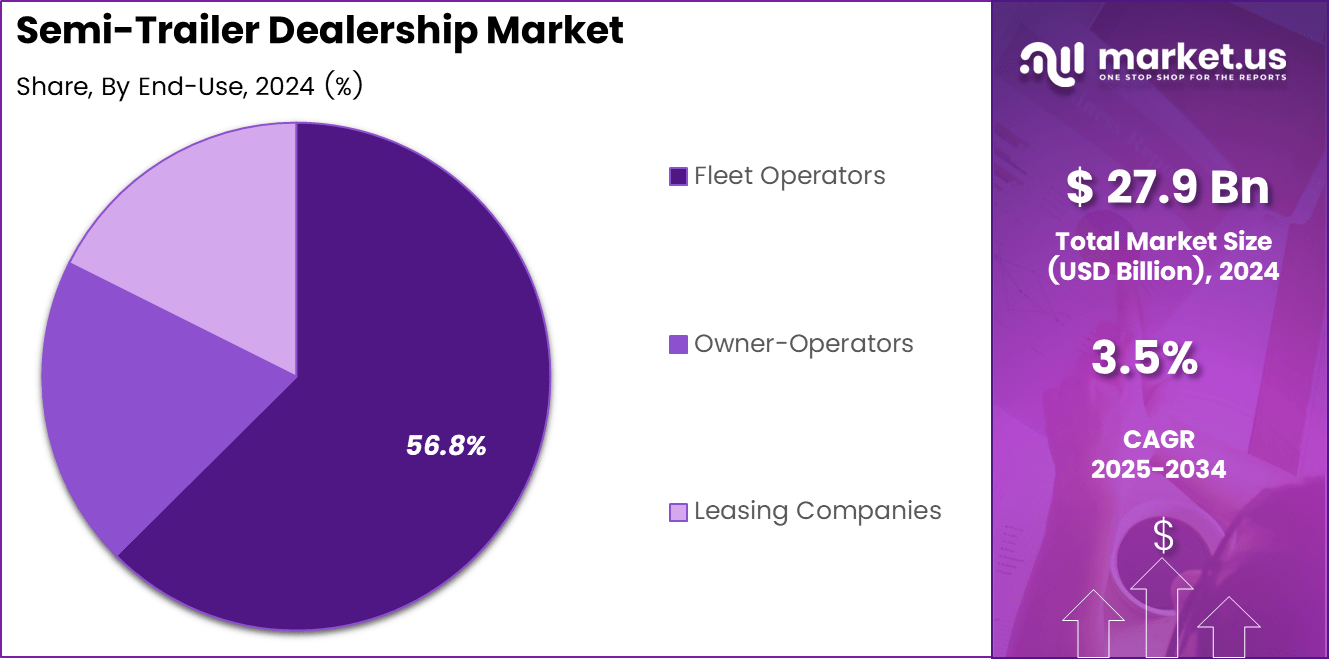

- By end-use, Fleet Operators led the market with a dominant share of 56.8% in 2024, reflecting bulk procurement and structured replacement cycles.

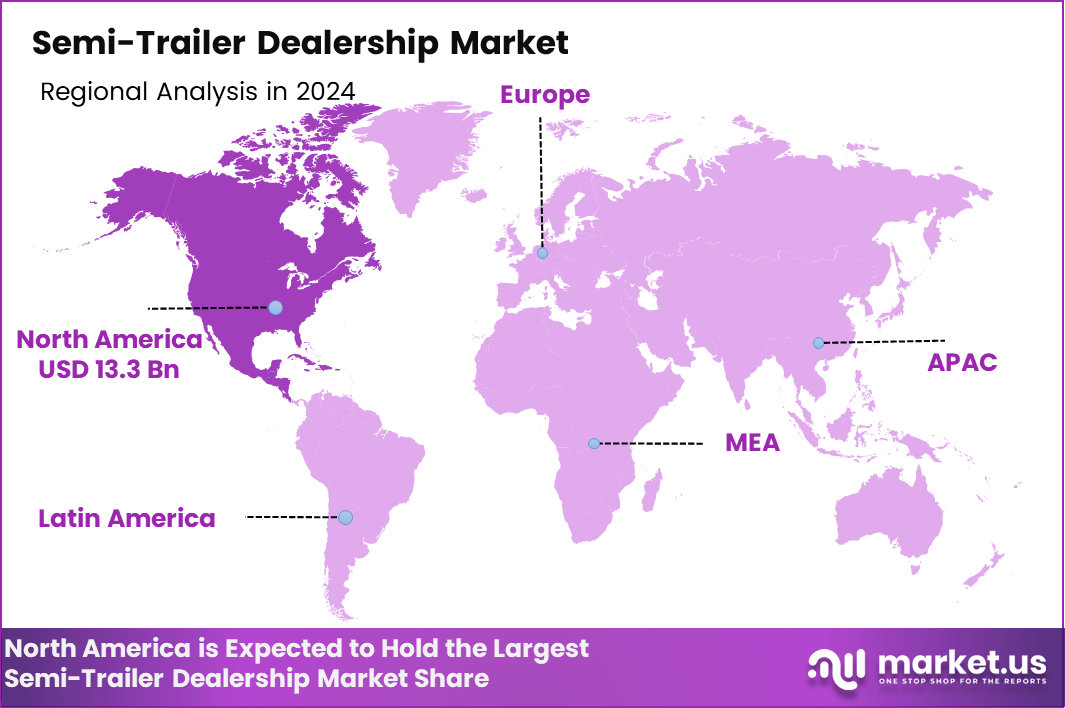

- Regionally, North America emerged as the leading market with a share of 47.9% in 2024, valued at USD 13.3 billion.

By Product Type Analysis

New Semi-Trailers dominate with 67.2% due to higher demand for compliant, fuel-efficient, and technology-integrated trailer assets.

In 2024, New Semi-Trailers held a dominant market position in the By Product Type Analysis segment of the Semi-Trailer Dealership Market, with a 67.2% share. This dominance is supported by rising fleet modernization efforts. Moreover, stricter safety and emission regulations encourage buyers to prefer factory-built trailers with advanced braking, telematics readiness, and warranty coverage.

Used Semi-Trailers represented the remaining share in the by-product type segment, supported by budget-sensitive buyers. However, demand remains selective due to concerns around maintenance history and regulatory compliance. Still, dealerships benefit from faster inventory turnover and price flexibility, especially among small operators seeking short-term capacity additions.

By Application Analysis

Freight Transportation dominates with 49.4% driven by consistent cargo movement across domestic and cross-border trade routes.

In 2024, Freight Transportation held a dominant market position in the By Application Analysis segment of the Semi-Trailer Dealership Market, with a 49.4% share. This leadership is reinforced by sustained demand from retail, manufacturing, and industrial distribution. Consequently, dealerships focus on high-volume trailer configurations optimized for long-haul efficiency.

Logistics Services accounted for a significant portion, supported by third-party logistics providers expanding regional hubs. As e-commerce penetration grows, dealerships increasingly supply standardized trailers suited for hub-and-spoke distribution models, improving utilization rates.

Construction and Heavy Haul applications contribute steadily due to infrastructure activity. Demand centers on reinforced trailers designed for oversized loads, creating specialized sales opportunities for dealerships.

Specialized Transport remains niche, serving temperature-controlled and hazardous goods movements. Although lower in volume, it supports higher margins through customization and compliance-driven demand.

By End-Use Analysis

Fleet Operators dominate with 56.8% reflecting bulk procurement and long-term replacement cycles.

In 2024, Fleet Operators held a dominant market position in the By End-Use Analysis segment of the Semi-Trailer Dealership Market, with a 56.8% share. Large operators prioritize dealership partnerships offering financing, service contracts, and volume discounts, strengthening repeat purchase behavior.

Owner-Operators form a steady demand base, driven by independent freight activity. However, purchasing decisions remain price-sensitive, favoring flexible payment options and trade-in programs offered by dealerships.

Leasing Companies represent an important institutional segment. Their focus on asset lifecycle management increases dealership demand for standardized, durable trailers that retain residual value over extended lease periods.

Key Market Segments

By Product Type

- New Semi-Trailers

- Used Semi-Trailers

By Application

- Freight Transportation

- Logistics Services

- Construction and Heavy Haul

- Specialized Transport

By End-Use

- Fleet Operators

- Owner-Operators

- Leasing Companies

Drivers

Expansion of Long Haul Freight Transportation Drives Market Growth

The expansion of long-haul freight transportation is a key driver supporting the semi-trailer dealership market. The rising movement of industrial goods, consumer products, and raw materials across regions increases the need for reliable trailer fleets. As supply chains become more interconnected, logistics companies depend on semi-trailers to support consistent and large-volume cargo movement.

Fleet modernization initiatives further strengthen dealership demand. Logistics and transportation service providers are actively replacing older trailers to improve safety, fuel efficiency, and regulatory compliance. This shift encourages dealerships to stock newer models and provide value-added advisory support to fleet owners.

The growing need for specialized semi-trailers also contributes to market growth. Temperature-controlled trailers for food and pharmaceuticals, and certified units for hazardous cargo, are increasingly required. Dealerships benefit by offering customized solutions and application-specific guidance.

Infrastructure and highway development improve freight efficiency and trailer utilization. Better road connectivity reduces transit time and vehicle wear, encouraging operators to invest in additional trailers. As freight routes expand, dealerships see higher inquiry levels and repeat purchases.

Restraints

High Upfront Capital Requirement Limits Market Expansion

High upfront capital requirements act as a major restraint for semi-trailer dealerships. Maintaining a wide inventory demands significant investment, often supported through floor financing. This increases financial risk, especially during periods of slow sales or delayed inventory turnover.

The market is also exposed to cyclical downturns in freight volumes. Economic slowdowns reduce cargo movement and postpone fleet expansion decisions. During such phases, dealerships experience lower footfall and extended sales cycles, affecting overall profitability.

Dependence on OEM coating production schedules adds another challenge. Delays in manufacturing or component shortages disrupt dealership supply planning. Limited control over production timelines makes it difficult to meet customer delivery expectations consistently.

Supply chain instability further impacts dealership operations. Fluctuations in steel prices, logistics disruptions, or regulatory changes can affect trailer availability. These factors create uncertainty in pricing and inventory management, restraining short-term market performance.

Growth Factors

Increasing Adoption of Leasing Models Creates New Opportunities

The rising adoption of leasing and rental-based semi-trailer ownership models presents strong growth opportunities. Many fleet operators prefer flexible access to trailers without heavy upfront investment. Dealerships that offer leasing options can attract small and mid-sized logistics companies.

Leasing models also support seasonal freight demand. Customers can scale trailer usage during peak periods and reduce exposure during slow phases. This flexibility strengthens long-term dealership customer relationships and recurring revenue streams.

Aftermarket services offer another promising opportunity area. Demand for maintenance, refurbishment, and resale services is rising as operators focus on extending trailer life cycles. Dealerships with service capabilities gain a competitive advantage.

Used trailer resale programs further support growth. By refurbishing and certifying used units, dealerships can serve cost-sensitive buyers while improving inventory turnover. This approach enhances margins and broadens the customer base.

Emerging Trends

Growing Preference for Lightweight Trailers Shapes Market Trends

Lightweight trailers are gaining preference as operators seek better fuel efficiency and higher payload capacity. This trend influences dealership portfolios toward advanced materials and modern designs. Fuel savings and operational efficiency make lightweight options attractive to fleet owners.

Integration of telematics and smart tracking systems is another key trend. Real-time monitoring of trailer location, load status, and maintenance needs improves fleet management. Dealerships increasingly highlight digital features during sales discussions.

The shift toward multi-axle and high-capacity trailers supports optimized freight economics. These trailers reduce trips per shipment and improve cost efficiency. Dealerships benefit by offering configuration guidance based on cargo requirements.

Sustainability is also shaping purchasing behavior. Recyclable materials and aerodynamic designs help reduce emissions and operating costs. Dealerships aligning with sustainable trailer offerings are better positioned to meet evolving customer and regulatory expectations.

Regional Analysis

North America Dominates the Semi-Trailer Dealership Market with a Market Share of 47.9%, Valued at USD 13.3 billion

North America leads the semi-trailer dealership market due to its well-established freight transportation network and high dependence on road logistics. In 2024, the region accounted for 47.9% of the global market, with a valuation of USD 13.3 billion, supported by strong replacement demand and continuous fleet modernization. The presence of large-scale logistics operators and long-haul freight routes sustains steady dealership activity. Additionally, regulatory focus on vehicle safety and efficiency encourages regular trailer upgrades across commercial fleets.

Europe Semi-Trailer Dealership Market Trends

Europe represents a mature yet steadily evolving semi-trailer dealership market, driven by cross-border trade and harmonized transport regulations. Demand remains stable due to consistent freight movement across EU economies and a growing emphasis on sustainable and compliant trailer configurations. Infrastructure investments and emission-related transport policies further influence replacement cycles and dealership volumes across the region.

Asia Pacific Semi-Trailer Dealership Market Trends

Asia Pacific is emerging as a high-growth region for semi-trailer dealerships, supported by expanding manufacturing output and rising domestic logistics demand. Rapid highway development and increasing adoption of organized freight services enhance trailer utilization. Moreover, growth in e-commerce and industrial distribution networks strengthens long-term dealership opportunities across developing economies.

Middle East and Africa Semi-Trailer Dealership Market Trends

The Middle East and Africa market is shaped by infrastructure expansion, mining activity, and energy-related logistics. Demand for heavy-duty and specialized trailers supports dealership growth, particularly along trade corridors and port-linked transport routes. While market penetration remains moderate, gradual improvements in road connectivity sustain future potential.

Latin America Semi-Trailer Dealership Market Trends

Latin America shows moderate growth in the semi-trailer dealership market, driven by agricultural exports and regional trade movement. Economic recovery efforts and logistics modernization initiatives contribute to replacement demand. However, market performance remains influenced by freight cycles and infrastructure investment consistency across major economies.

U.S. Semi-Trailer Dealership Market Trends

The U.S. market remains a key contributor within North America, supported by high freight intensity and extensive interstate highway usage. Strong demand for both new and used semi-trailers reflects active fleet renewal strategies. Additionally, the rising adoption of advanced trailer technologies supports sustained dealership engagement nationwide.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Semi-Trailer Dealership Company Insights

In 2024, these four key players collectively underscore the dynamic nature of the semi-trailer dealership market, where service differentiation, network scale, and technology adoption define competitive advantage.

Penske Truck Leasing continues to leverage its extensive network and integrated services to strengthen its foothold in the global semi-trailer dealership market in 2024. With a focus on operational efficiency and customer service excellence, the company remains a preferred partner for fleet operators seeking reliable, full-service solutions that extend beyond traditional sales.

Rush Enterprises, Inc. sustains its competitive position by emphasizing strategic expansion and a diversified portfolio of commercial vehicles and services. Its commitment to enhancing dealership capabilities through technology integration and value-added offerings has bolstered customer retention and driven steady market relevance.

Ryder System, Inc. differentiates itself through a robust blend of leasing, rental, and maintenance services that complement its dealership operations. By aligning its semi-trailer sales with comprehensive fleet management solutions, Ryder addresses evolving client demands for flexibility, cost predictability, and end-to-end support.

TEC Equipment, Inc. remains a significant player through its deep industry expertise and customer-centric approach to semi-trailer sales and support. The company’s dedication to tailored solutions and strong after-sales service has reinforced its reputation among regional and national fleet customers.

Top Key Players in the Market

- Penske Truck Leasing

- Rush Enterprises, Inc.

- Ryder System, Inc.

- TEC Equipment, Inc.

- Velocity Vehicle Group

- TransWest Truck Trailer RV

- Arrow Truck Sales

- Idealease, Inc.

- MHC Kenworth

- Premier Truck Group

Recent Developments

- In Jun, 2024, Premier Truck Group, a Penske Automotive Group company, announced the acquisition of River States Truck and Trailer, Inc. (RSTT) headquartered in La Crosse, Wisconsin. The acquisition is expected to add approximately $200 million in estimated annualized revenue, strengthening Premier Truck Group’s medium duty and heavy duty commercial truck dealership network.

- In Mar 2025, GT Trailers, a high volume trailer producer based in Poland’s Opole region, signed an agreement with Schmitz Cargobull AG for the acquisition of a 48% stake in the business. The partnership expands Schmitz Cargobull’s manufacturing footprint and reinforces its leadership in the European semi trailer and trailer market.

Report Scope

Report Features Description Market Value (2024) USD 27.9 billion Forecast Revenue (2034) USD 70.4 billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (New Semi-Trailers, Used Semi-Trailers), By Application (Freight Transportation, Logistics Services, Construction and Heavy Haul, Specialized Transport), By End-Use (Fleet Operators, Owner-Operators, Leasing Companies) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Penske Truck Leasing, Rush Enterprises, Inc., Ryder System, Inc., TEC Equipment, Inc., Velocity Vehicle Group, TransWest Truck Trailer RV, Arrow Truck Sales, Idealease, Inc., MHC Kenworth, Premier Truck Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Semi-Trailer Dealership MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Semi-Trailer Dealership MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Penske Truck Leasing

- Rush Enterprises, Inc.

- Ryder System, Inc.

- TEC Equipment, Inc.

- Velocity Vehicle Group

- TransWest Truck Trailer RV

- Arrow Truck Sales

- Idealease, Inc.

- MHC Kenworth

- Premier Truck Group