Global Self-service BI Market Size, Share Analysis Report By Type (Software, Services), By Application (Predictive Asset Maintenance, Fraud and Security Management, Sales and Marketing Management, Risk and Compliance Management, Supply Chain Management and Procurement, Operations Management, Customer Engagement and Analysis), By Deployment Model (On-Demand, On-Premises), By End-User Industry (Healthcare, Manufacturing, BFSI, Retail and E-commerce, Telecommunications, Media and Entertainment, Transportation and Logistics, Energy and Utilities, Government and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152530

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

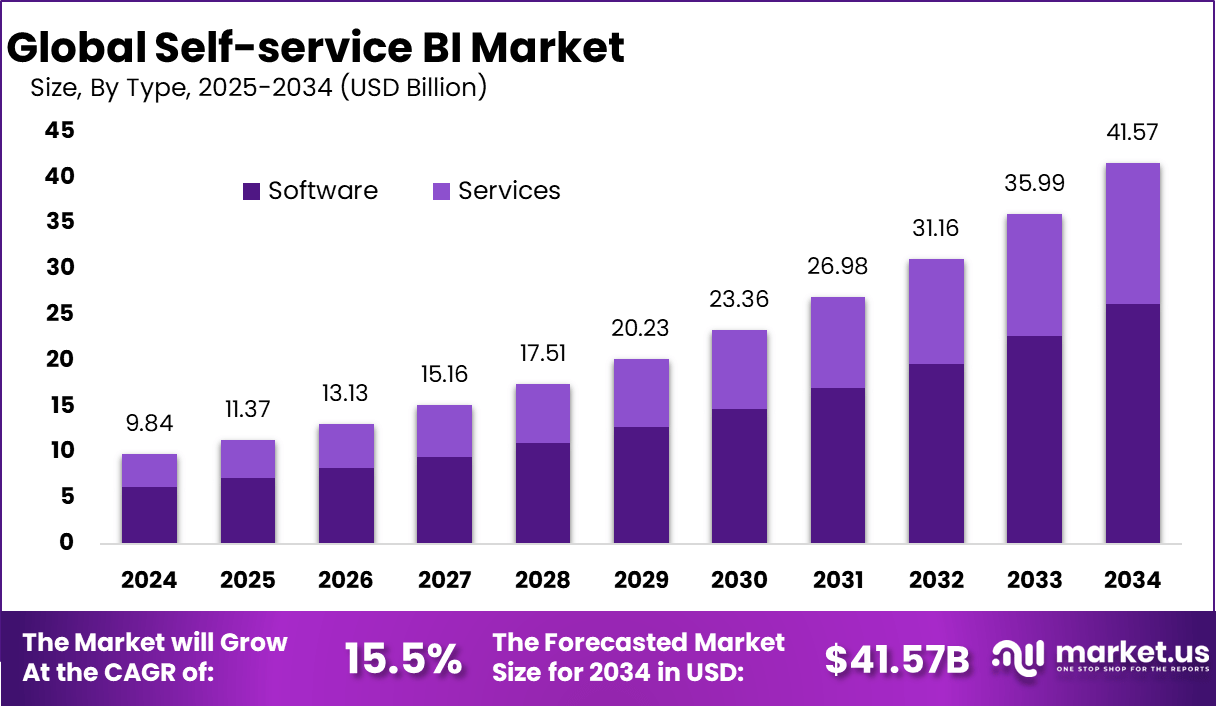

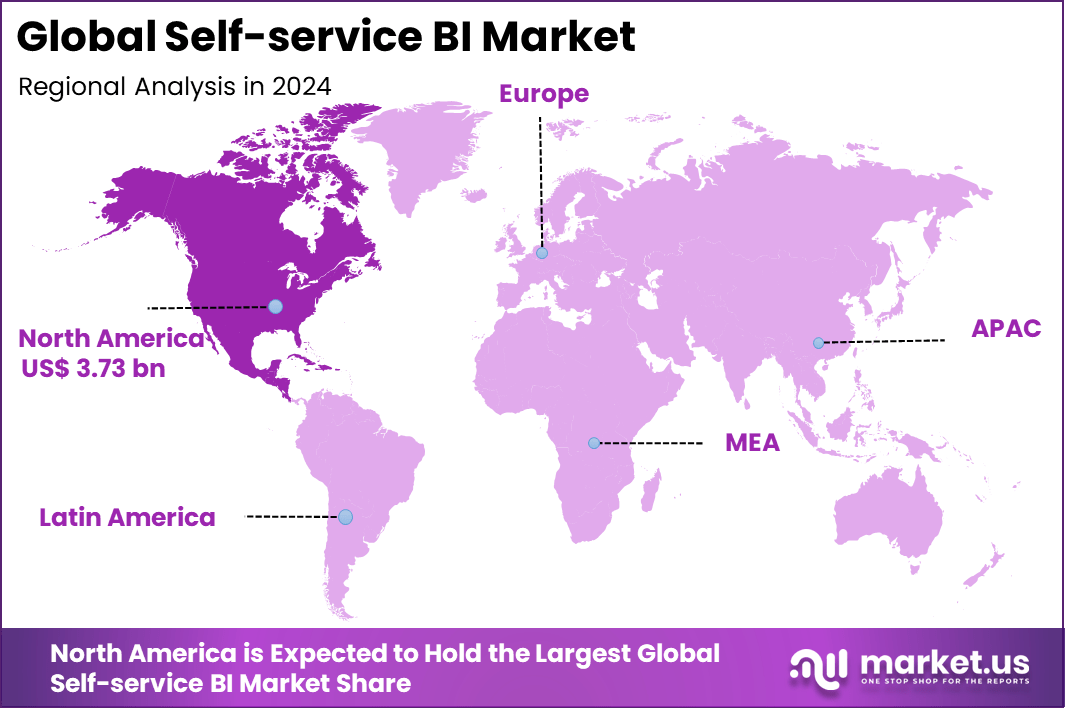

The Global Self-service BI Market size is expected to be worth around USD 41.57 billion by 2034, from USD 9.84 billion in 2024, growing at a CAGR of 15.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 3.73 billion in revenue.

The self-service BI market has been expanding as organizations pursue the empowerment of business users. Increasing demand for real-time data analysis and decentralization of decision-making has prompted companies to adopt solutions that allow visualization, dashboarding, and insights without reliance on IT teams. As data grows and cloud access improves, these solutions enable agility and quicker response.

According to the findings from Market.us, the global business intelligence market is projected to reach approximately USD 26.5 billion by 2033, rising from USD 5.9 billion in 2023, at a compound annual growth rate of 16.2% over the forecast period from 2024 to 2033.

Top driving factors include the need for speed in insight generation, reduction in reporting backlogs, and support for data democratization across departments. Tools with intuitive drag-and-drop interfaces, supported by AI and machine-learning enhancements, have extended usage to marketing, finance, and operations professionals. The shift from structured to unstructured data and the resulting complexities have further escalated demand.

For instance, in January 2025, MicroStrategy announced the release of a new version of its Auto AI Business Intelligence Bot. This updated version enhances the self-service BI experience by offering features such as paginated reporting, interactive dashboards, and advanced AI-driven analytics. The new capabilities help users generate insights and automate tasks, making decisions faster and using data more efficiently.

Scope and Forecast

Report Features Description Market Value (2024) USD 9.84 Bn Forecast Revenue (2034) USD 41.57 Bn CAGR (2025-2034) 15.5% Largest market in 2024 North America [38% market share] Key Insight Summary

- The market is expected to grow from USD 9.84 billion in 2024 to approximately USD 41.57 billion by 2034, registering a strong CAGR of 15.5%, driven by growing demand for democratized data access and agile decision-making.

- North America led the global market in 2024, capturing over 38% share and generating around USD 3.73 billion in revenue, supported by advanced analytics adoption and strong presence of BI solution providers.

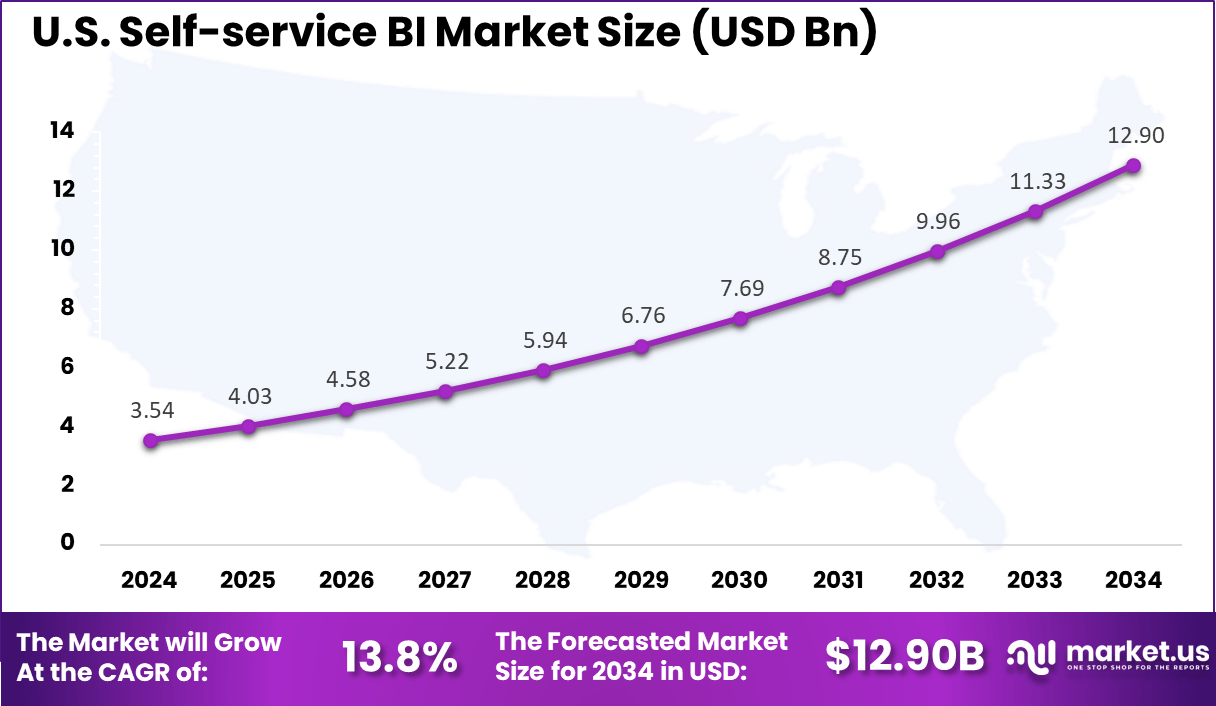

- The U.S. market accounted for USD 3.54 billion, with an expected CAGR of 13.8%, reflecting steady enterprise investments in empowering business users with intuitive analytics tools.

- By type, Software solutions dominated with a 63% share, as organizations prioritized feature-rich, scalable BI platforms over standalone services.

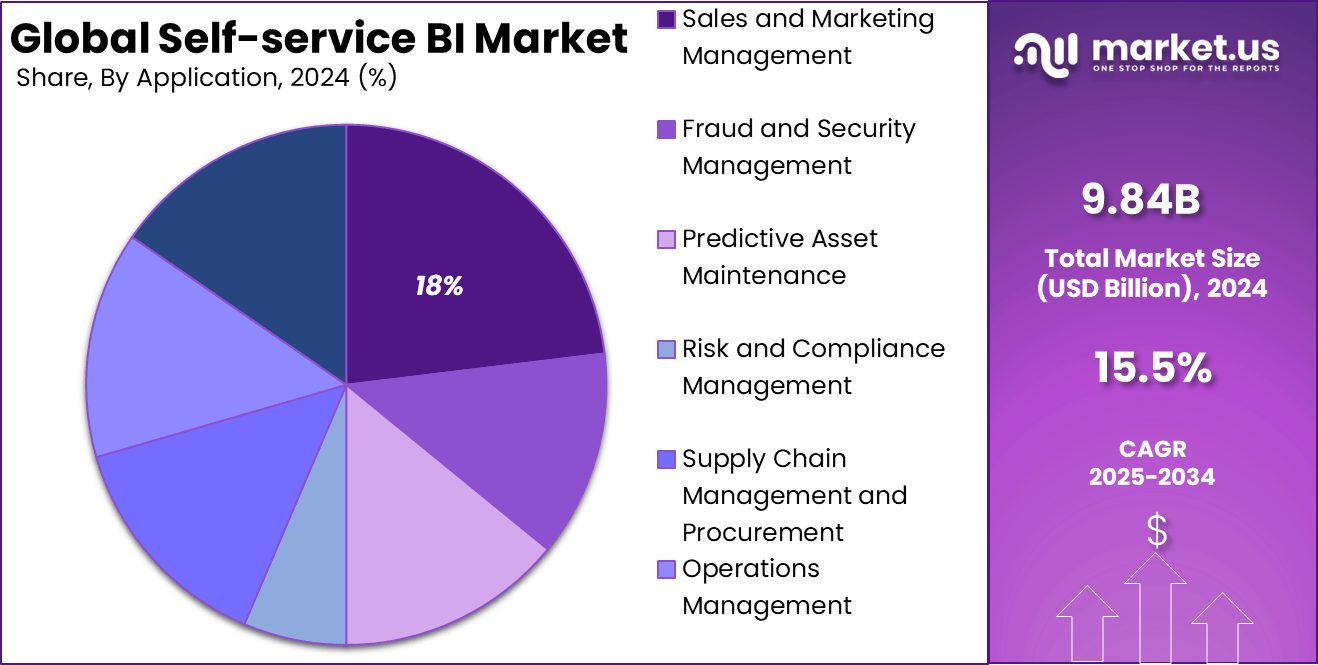

- In application areas, Sales and Marketing Management led with 18% share, reflecting the need for actionable customer insights, campaign optimization, and revenue forecasting.

- By deployment model, On-Demand (Cloud) solutions held the largest share at 68%, favored for their flexibility, lower upfront costs, and ease of integration across distributed teams.

- Among end-user industries, BFSI was the largest segment at 17%, driven by high volumes of financial data and the sector’s focus on risk management, compliance, and customer analytics.

Analysts’ Viewpoint

Adoption of enabling technologies is rising. Cloud computing has been instrumental in delivering scalable, cost-effective platforms, with embedded AI and natural language processing features making tools more accessible to non-technical users. Integration of machine learning helps provide predictive analytics, while visualization engines and smart dashboards ensure usability and intent-driven insights.

Organizations adopt self-service BI primarily to reduce dependency on IT, accelerate decision cycles, and promote a culture of data literacy. Cost efficiency is achieved through minimized reporting overhead and improved operational productivity. User empowerment and reduced analytical bottlenecks encourage innovation across teams, while freeing up technical staff for strategic initiatives.

Investment opportunities are evident in tools and services that support governance, training, and integration. As data governance remains a challenge, businesses are funding solutions that balance user autonomy with oversight. Vendors offering AI-driven insights, low-code/no-code experiences, and hybrid cloud/on-prem deployment models are positioned to gain investor attention.

U.S. Self-Service BI Market Size

The market for Self-service BI within the U.S. is growing tremendously and is currently valued at USD 3.54 billion, the market has a projected CAGR of 13.8%. This market is growing significantly due to the increasing demand for real-time, data-driven decision-making across industries.

Enterprises are seeking increased agility and faster insights, while self-service BI tools empower non-technical individuals to investigate and analyze data without relying on IT. Moreover, the growth of cloud computing, artificial intelligence, and machine learning has made these tools more efficient and user-friendly.

For instance, in September 2024, Zenlytic raised $9M to enhance its AI-powered self-service business intelligence platform, aimed at enabling organizations to leverage data analysis without the need for dedicated data analysts. This development underscores the growing demand for self-service BI solutions, particularly in the U.S.

In 2024, North America held a dominant market position in the Global Self-service BI Market, capturing more than a 38% share, holding USD 3.73 billion in revenue. North America remains the top player in worldwide self-service BI due to a strong base of technology-focused businesses in finance, healthcare, and technology that are eagerly accepting new eras of advanced BI solutions.

The focus of these industries is on data-driven strategies, with advanced analytics being a major investment to keep up with the competition. The region also benefits from a culture of innovation, a high density of top BI vendors, and substantial investments in cloud computing and AI, all contributing to the rapid adoption and success of self-service BI platforms.

For instance, in June 2024, Prospect utilized Amazon QuickSight’s self-service business intelligence tools to empower its clients, showcasing the growing adoption of self-service BI solutions in North America. This move reflects the region’s increasing reliance on data-driven decision-making tools to enhance efficiency and streamline operations.

Type Analysis

In 2024, Software segment held a dominant market position, capturing a 63% share of the Global Self-service BI Market. This dominance is attributed to the increasing demand for simple and user-friendly BI tools that enable business users to analyze and visualize data on their own.

The combination of data integration, real-time analytics, and customizable dashboards in software solutions is a popular choice for organizations seeking to streamline decision-making. Also, advancements in AI, machine learning, and cloud computing have significantly enhanced the productivity and flexibility of self-service BI software.

For Instance, In May 2025, Yellowfin launched its AI-powered Natural Language Query (AI-NLQ) feature in version 9.15, enabling users to query data using natural language. This upgrade enhances self-service BI by making insights more accessible to non-technical users, supporting faster decision-making and improving overall business efficiency.

Application Analysis

In 2024, Sales and Marketing Management segment held a dominant market position, capturing an 18% share of the Global Self-service BI Market. The demand in this sector has been driven mainly by the increasing need for real-time, data-driven insights to optimize marketing campaigns, customer segmentation, and sales strategies.

Self-service BI tools enable marketing and sales teams to independently analyze customer behavior, track key performance indicators, and make agile decisions, thus improving campaign effectiveness, driving revenue growth, and enhancing customer engagement.

For instance, in September 2024, Zoho launched an AI-powered, highly extensible version of Zoho Analytics, aimed at democratizing self-service BI for businesses of all sizes. The enhanced solution is particularly beneficial for the Sales and Marketing Management sector, enabling teams to independently analyze and derive insights from customer data.

Deployment Model Analysis

In 2024, On-Demand (Cloud) segment held a dominant market position, capturing a 68% share of the Global Self-service BI Market. This dominance is driven by the growing adoption of cloud-based solutions, valued for their scalability, flexibility, and cost-efficiency.

Cloud BI tools enable seamless data integration, real-time access, and faster decision-making from any location. They also reduce infrastructure needs with remote access and automatic updates. The ability to handle large datasets and support real-time analytics further fuels the rise of cloud-based BI solutions.

For Instance, in June 2023, Sigma Computing was named Snowflake’s Business Intelligence Partner of the Year, a recognition that highlights the growing importance of cloud-based self-service BI solutions. Sigma’s On-Demand (Cloud) deployment model enables businesses, particularly in Marketing Management, to leverage real-time data for more agile decision-making.

End-User Industry Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 17% share of the Global Self-service BI Market. This dominance is driven by the BFSI sector’s emphasis on using self-service BI tools to analyze large volumes of financial data, detect fraud, manage risk, and ensure compliance.

Financial institutions are adopting these solutions to empower their staff with data-driven insights, enhance operations, and refine customer analytics. The presence of specialized BI platforms in the market enhances adoption, further solidifying BFSI’s position as an industry leader in self-service business intelligence.

For Instance, in July 2024, Axis Bank enhanced its business intelligence capabilities with the help of Amazon QuickSight, enabling the organization to leverage modern, self-service BI tools. This integration empowers Axis Bank’s teams to independently analyze data, gain real-time insights, and make faster, data-driven decisions.

Emerging Trend

Shift Toward Embedded and Augmented Analytics

Self-service BI is witnessing a major transformation through the rise of embedded analytics. These solutions allow users to interact with data insights directly within their everyday tools or enterprise applications. This integration eliminates the need to switch platforms, thereby improving decision-making speed and user engagement. Organizations are increasingly embedding dashboards in portals and CRM systems, making analytics part of business processes rather than a separate activity.

In parallel, augmented analytics is growing as a complementary trend. It incorporates machine learning and natural language processing to make self-service BI more intuitive. Non-technical users can now ask questions in plain language and receive auto-generated visualizations or summaries. This evolution is reducing the barrier to entry and expanding BI usage to operational teams, marketers, and field staff who previously lacked access to actionable data.

Driver

Demand for Faster Insights and Decentralized Access

A key driver of market expansion is the growing need for immediate, on-demand insights. Traditional BI methods often involve long waits for reports from IT departments. In contrast, self-service BI empowers business users to create their own dashboards and explore data independently. This autonomy not only shortens decision cycles but also improves organizational agility in fast-changing environments.

Another contributing factor is the explosion of enterprise data from digital tools, social media, and IoT systems. Business users want to analyze this data in real time without relying on centralized IT teams. Self-service BI platforms are designed to accommodate this shift by offering easy-to-use interfaces and data connectors, enabling users across departments to work with data at their own pace.

For instance, in June 2023, IBM emphasized the increased demand for data-driven decision-making through AI-powered self-service business intelligence (BI) solutions. These tools enable organizations to harness advanced analytics, empowering employees at all levels to independently explore data, generate insights, and make informed decisions.

Restraint

Data Governance and Compliance Risks

One of the biggest restraints for the self-service BI market is the challenge of maintaining data governance. When users from different departments access and analyze data independently, discrepancies often arise due to inconsistent metrics, definitions, or data sources. This inconsistency can lead to flawed business decisions and loss of trust in analytics platforms.

Additionally, compliance with data protection laws such as GDPR or HIPAA is becoming increasingly complex. Self-service BI expands access to sensitive data, which must be handled according to strict privacy regulations. Without well-defined policies and access controls, organizations risk regulatory violations that can lead to reputational damage and financial penalties.

For instance, in April 2025, India’s Draft Digital Personal Data Protection Rules underscored the need for stringent data protection laws as businesses increasingly use self-service BI tools in marketing management. These laws aim to ensure data security and compliance while empowering marketing teams to analyze customer data and make informed, data-driven decisions, highlighting the importance of safeguarding sensitive information.

Opportunity

Automated Data Preparation and Low-Code Tools

An emerging opportunity is the development of smart data preparation features within self-service BI tools. Many platforms now include auto-join suggestions, transformation templates, and anomaly detection, making it easier for users to clean and prepare data without deep technical skills. This automation reduces dependency on data engineers and accelerates the time it takes to move from raw data to actionable insights.

In addition, the growing adoption of low-code and no-code BI tools is opening the market to non-developers. Business users can now build custom reports, interactive dashboards, and even basic predictive models with little to no programming. As organizations look to empower a broader workforce with data capabilities, these platforms are enabling scalable self-service models across industries.

For instance, in June 2024, Databricks launched an AI-powered business intelligence product, marking a significant advancement in the self-service BI market. The integration of AI capabilities into self-service BI tools enhances users’ ability to analyze large datasets, derive actionable insights, and make faster, data-driven decisions without the need for specialized technical expertise.

Challenge

Shadow BI and Agile Governance Misalignment

The widespread use of self-service tools has also given rise to the challenge of shadow BI. When departments or individuals use unauthorized tools or datasets, it becomes difficult for IT teams to maintain consistency, monitor performance, or enforce security. This lack of oversight increases operational risks and creates redundant or conflicting analyses across teams.

Another major challenge is aligning agile BI development with enterprise governance frameworks. While business teams push for faster rollouts, IT departments are required to ensure data quality, security, and compliance. Without a unified strategy that balances speed and control, many organizations struggle to scale self-service BI without introducing long-term complexity and risk.

Key Market Segments

By Type

- Software

- Services

- Managed Services

- Professional Services

- Deployment and Integration

- Support and Maintenance

- Consulting Services

By Application

- Predictive Asset Maintenance

- Fraud and Security Management

- Sales and Marketing Management

- Risk and Compliance Management

- Supply Chain Management and Procurement

- Operations Management

- Customer Engagement and Analysis

By Deployment Model

- On-Demand

- On-Premises

By End-User Industry

- Healthcare

- Manufacturing

- BFSI

- Retail and E-commerce

- Telecommunications

- Media and Entertainment

- Transportation and Logistics

- Energy and Utilities

- Government and Defense

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

IBM, Oracle, and Microsoft lead the self-service BI market with advanced, AI-enabled platforms that simplify analytics for all users. SAP and SAS strengthen their positions by offering predictive analytics and seamless data integration. These companies focus on empowering agile decisions through user-friendly and scalable solutions tailored for diverse enterprise needs.

Tableau, Qlik, and MicroStrategy stand out with intuitive dashboards and real-time analytics, appealing to mid-sized businesses. Tibco and ZOHO target cost-conscious firms with flexible, customizable BI tools. Their strategies emphasize cloud-native deployment and accessibility for wider adoption.

Dataphine, Looker, and other emerging players focus on niche applications like healthcare and retail analytics. By embedding machine learning and natural language features, they expand BI access to non-technical users. Their innovation and specialization drive competition and meet rising demand for democratized insights.

Top Key Players in the Market

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute

- Tableau Software

- Qlik Technologies, Inc.

- Microstrategy, Inc.

- Tibco Software

- ZOHO Corporation

- Dataphine

- Looker

- Other Key Players

Recent Developments

- In May 2025, SAS introduced new AI models at the SAS Innovate conference, designed to enhance self-service business intelligence (BI) solutions. These advanced models aim to optimize analytics, automate decision-making, and provide deeper insights into complex data sets.

- In April 2024, Tableau introduced advanced generative AI features, such as natural language-based metric exploration and deeper integration with Databricks. Its insight tool, Pulse, now includes Pulse Q&A for querying metrics in natural language, while Einstein Copilot enhances data transformation and catalog integration through AI.

- In June 2024, Microsoft Power BI improved integration by enabling Oracle Database connectivity with Microsoft Entra ID Single Sign-On (SSO) tokens. This eliminates the need for data migration, streamlines centralized access management, and strengthens security using Azure AD tokens.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Software, Services), By Application (Predictive Asset Maintenance, Fraud and Security Management, Sales and Marketing Management, Risk and Compliance Management, Supply Chain Management and Procurement, Operations Management, Customer Engagement and Analysis), By Deployment Model (On-Demand, On-Premises), By End-User Industry (Healthcare, Manufacturing, BFSI, Retail and E-commerce, Telecommunications, Media and Entertainment, Transportation and Logistics, Energy and Utilities, Government and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, SAS Institute, Tableau Software, Qlik Technologies, Inc., Microstrategy, Inc., Tibco Software, ZOHO Corporation, Dataphine, Looker, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute

- Tableau Software

- Qlik Technologies, Inc.

- Microstrategy, Inc.

- Tibco Software

- ZOHO Corporation

- Dataphine

- Looker

- Other Key Players