Global Self-Organizing Network (SON) Market Size, Share, Trends Analysis Report By Offering (Software, Services), By Network (RAN, Wi-Fi, Core Network, Backhaul), By Architecture (C-SON (Centralized), D-SON (Decentralized), H-SON (Hybrid)), By Network Technology (2G/3G, 4G/LTE, 5G), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 132857

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

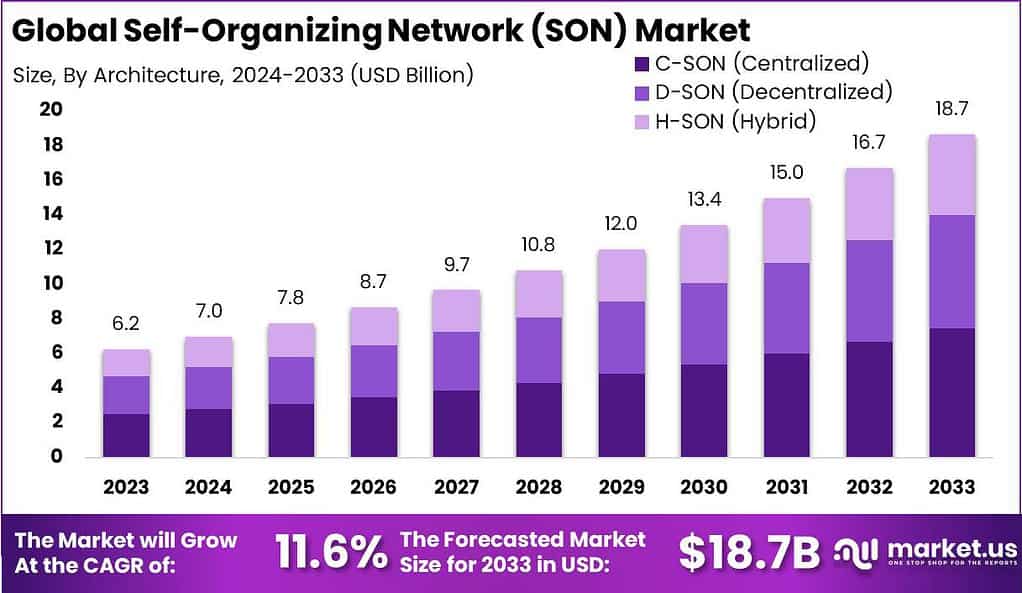

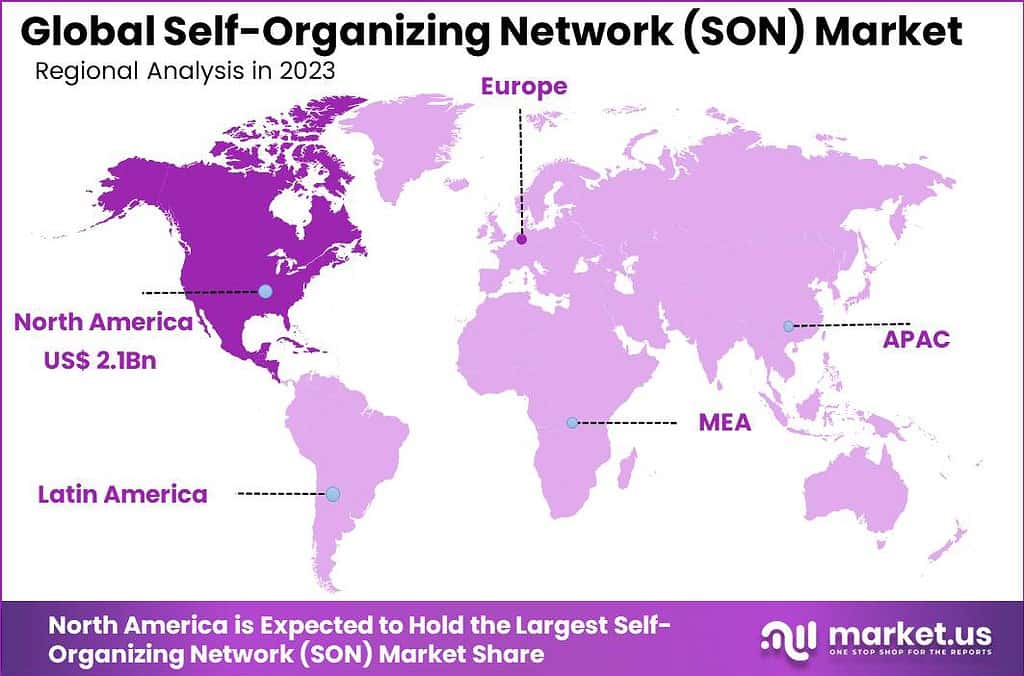

The Global Self-Organizing Network Market size is expected to be worth around USD 18.7 Billion By 2033, from USD 6.2 billion in 2023, growing at a CAGR of 11.6% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 34% share, holding USD 2.1 Billion revenue.

A Self-Organizing Network (SON) is an innovative automation technology primarily utilized in mobile radio access networks to simplify and accelerate their planning, configuration, management, optimization, and healing processes. These networks are designed to reduce human intervention by enabling a range of automated functions such as self-configuration, self-optimization, self-healing, and self-protection.

The market for Self-Organizing Networks is expanding, driven by the increasing complexity and scale of mobile networks and the need for efficient network management. SON technology is crucial for the deployment and operation of next-generation cellular networks, including 5G and beyond, where it enhances network performance, reduces operational costs, and improves service reliability.

The major driving factors for the adoption of SON technology include the need to manage growing network complexity and to reduce operational costs in telecommunications. As networks expand in size and complexity, the ability to automate tasks like configuration and optimization becomes critical.

Moreover, the increased focus on improving network quality and customer experience, coupled with the need for efficient resource management, propels the demand for SONs. These networks are particularly advantageous in dynamically managing network load and optimizing resource allocation in real-time. There is a substantial demand for SONs in the telecommunications industry, primarily due to the ongoing rollout of 5G networks and the anticipated future deployment of 6G.

The flexibility and efficiency provided by SONs make them integral to modern network operations, offering significant market opportunities for both technology providers and telecom operators. As the industry moves towards more automated and intelligent network solutions, the role of SONs is expected to grow, opening new avenues for innovation in network management and operational efficiencies.

Technological advancements in SON include the integration of artificial intelligence (AI) and machine learning (ML), which enhance the network’s ability to self-learn and adapt to changing environments and demands. These technologies enable SONs to predict potential network failures and automatically adjust to optimize performance.

Key Takeaways

- The global market for Self-Organizing Networks (SON) is on a notable upward trajectory, expected to expand from USD 6.2 billion in 2023 to an impressive USD 18.7 billion by 2033. This growth, projecting a CAGR of 11.6% from 2024 to 2033

- In 2023, North America led the charge in the SON market, commanding over a 34% market share, which translated to revenues of about USD 2.1 billion.

- Diving deeper into the components of the SON market, the Software segment proved to be particularly robust, securing more than 64% of the market share in 2023.

- From a technology perspective, the Radio Access Network (RAN) segment held sway over the market, with more than 45% of the market share in 2023.

- Moreover, the Centralized Self-Organizing Network (C-SON) segment also demonstrated significant market strength, capturing over 40% of the market share in 2023.

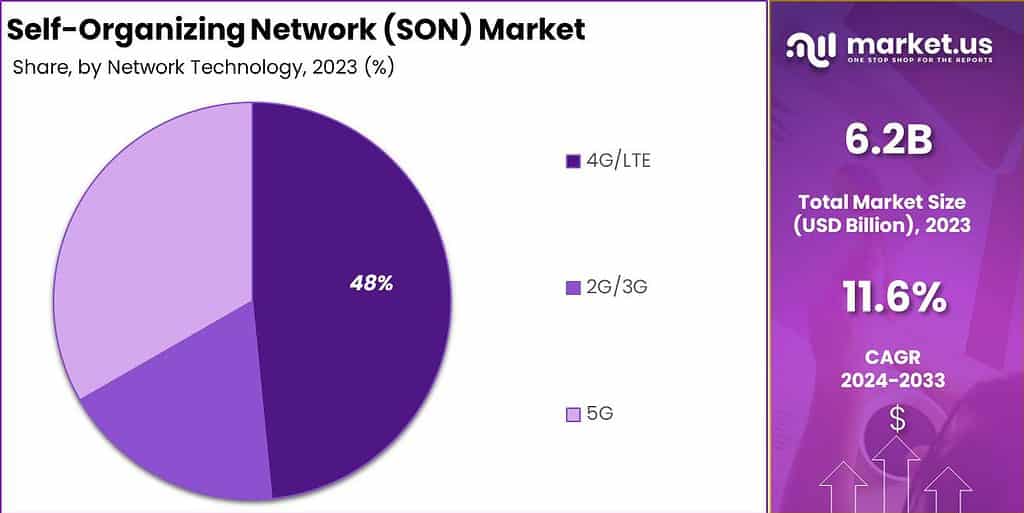

- Lastly, the 4G/LTE segment maintained its lead within the SON market, holding a dominant 48% market share.

North America SON Market Size

In 2023, North America held a dominant position in the Self-Organizing Network (SON) market, capturing more than a 34% share with revenues amounting to USD 2.1 billion. This leadership is primarily attributed to the advanced state of mobile network infrastructure in the region and the early adoption of emerging technologies such as 5G, which have significantly driven the demand for sophisticated network management solutions like SON.

The region’s dominance in the SON market is also bolstered by the presence of major telecommunications and technology firms that are continuously investing in network upgrades and automation to enhance service quality and operational efficiency. These companies are pioneering the implementation of AI and machine learning technologies within SON systems, further promoting North America’s leading position in the global market.

Moreover, regulatory support and substantial investments in research and development activities in countries like the United States and Canada have facilitated the rapid deployment of SON solutions. These factors are crucial in addressing the growing requirements for data-heavy applications, such as streaming services, cloud computing, and the Internet of Things (IoT), which demand highly reliable and efficient network management.

North America’s proactive approach to adopting new technologies and its robust digital infrastructure continue to make it a leading region in the global SON market. With ongoing advancements in network technology and increasing demand for automation and efficiency in network operations, North America is expected to maintain its leading position in the foreseeable future, driving innovation and growth in the SON market.

Offering Analysis

In 2023, the Software segment of the Self-Organizing Network (SON) market held a dominant position, capturing more than 64% of the market share. This significant portion is attributed to the essential role that software plays in the automation of network functions such as configuration, optimization, management, and healing in radio access networks (RANs).

Software solutions in this market are advanced enough to handle complex operations that traditionally required extensive manual oversight, thus reducing operational costs and improving network efficiency. The robust growth of the Software segment is driven by the increasing complexity of network infrastructures and the need for cost-efficient network management solutions.

As networks expand in terms of both size and capability, particularly with the rollout of 5G technologies, the demand for sophisticated software that can autonomously manage and optimize these networks has surged. This demand is further supported by the ongoing digital transformation in various industries, where connectivity requirements are becoming more complex and dynamic.

Moreover, the market landscape for SON software is evolving. It integrates cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML), which enhances its ability to predict and respond to network anomalies in real-time. These capabilities make SON software not only a tool for automation but also a critical component for ensuring network reliability and service quality across various telecommunications platforms.

This segment’s continued dominance is also bolstered by the strategic expansions and innovations by leading market players who focus on enhancing their SON software offerings to meet the growing demands of modern network environments. The integration of smart and adaptive algorithms within SON software allows for more efficient management of data traffic and network resources, highlighting its pivotal role in the evolving network ecosystem.

Overall, the SON software segment is expected to maintain its market lead, driven by continuous advancements in network technology and the growing necessity for efficient, automated network operations in the telecommunications sector.

Network Analysis

In 2023, the RAN (Radio Access Network) segment of the Self-Organizing Network (SON) market held a dominant market position, capturing more than a 45% share. This prominence is primarily due to the critical role RAN plays in the telecommunications infrastructure, particularly in supporting the increased traffic and the complex network operations required by modern wireless communication technologies, including 5G.

As the backbone of cellular communication, RANs are pivotal in managing and optimizing signal transmission and reception, which are essential for maintaining robust mobile connectivity and service quality. The substantial market share of the RAN segment is also bolstered by the ongoing global expansion of mobile network coverage and the upgrade of existing network infrastructures to support higher data rates and reduced latency.

These upgrades are necessary to accommodate the burgeoning volume of data traffic generated by smartphones, IoT devices, and other digital technologies that rely on robust wireless communication. As such, SON technologies are increasingly integral in RAN deployments to enhance operational efficiencies and network performance.

Furthermore, the drive towards more integrated and intelligent network management solutions has propelled the adoption of SON within the RAN segment. These solutions utilize AI and machine learning algorithms to automate key network operations, such as self-configuration, self-optimization, and self-healing, which are crucial for the dynamic management of network resources and ensuring uninterrupted service delivery.

Given these factors, the RAN segment’s dominance in the SON market is expected to persist as networks evolve towards more autonomous and self-managing frameworks. The continuous technological advancements and the increasing demand for high-speed, reliable mobile services underscore the RAN’s critical role in the global telecommunications landscape.

Architecture Analysis

In 2023, the C-SON (Centralized Self-Organizing Network) segment held a dominant market position, capturing more than a 40% share. This significant market share is largely attributed to the centralized nature of C-SON, which enables comprehensive management and optimization of network resources from a central point.

This central control is particularly beneficial in large-scale network environments where consistency and coordination across various network elements are crucial. Centralized architectures facilitate streamlined operations and better quality of service by allowing operators to deploy uniform policies and procedures across the entire network.

The preference for C-SON in complex network scenarios also stems from its efficiency in handling network traffic and resource allocation. By centralizing the decision-making process, C-SON can effectively manage and optimize network traffic flows, reduce operational complexities, and enhance overall network performance. This is essential for telecom operators who face increasing demands for high-speed data services and need to ensure network reliability and user satisfaction.

Moreover, C-SON architectures are increasingly being integrated with advanced technologies such as artificial intelligence and machine learning, which further enhance their capability to predict network anomalies and automatically adjust configurations to maintain optimal performance. This ability to rapidly respond to dynamic network conditions and ensure continuous service availability is a key factor driving the adoption of centralized SON solutions.

The ongoing evolution of network technologies and the growing complexity of wireless network management continue to underscore the importance of centralized control mechanisms. As networks grow in size and complexity, the role of C-SON is expected to become even more pivotal, ensuring it remains a dominant force in the SON market.

Network Technology Analysis

In 2023, the 4G/LTE segment held a dominant market position in the Self-Organizing Network (SON) market, capturing more than a 48% share. This dominance is attributed to the widespread global deployment of 4G networks and the critical need for efficient network management to support the high data traffic generated by mobile and IoT devices.

As the backbone of current mobile telecommunications, 4G/LTE networks require advanced management solutions like SON to optimize network performance and reliability, handle the increased load, and reduce operational costs. The 4G/LTE networks, being at the mature stage of their lifecycle, have extensive infrastructure globally, which necessitates sophisticated network management techniques to maximize efficiency and service quality.

SON technologies play a crucial role in automating complex processes such as capacity planning, coverage optimization, and spectrum management, which are vital for maintaining the performance of 4G networks. This automation is essential for telecom operators to ensure customer satisfaction and to reduce churn in competitive markets.

Furthermore, the ongoing enhancements in 4G technology, including carrier aggregation and advanced modulation techniques, continue to push the capabilities of 4G/LTE networks, driving further integration of SON solutions to manage these complexities. Despite the rollout of 5G, the extensive existing infrastructure of 4G and the slower rate of 5G adoption in certain regions ensure that 4G/LTE remains a significant focus for SON deployments.

Overall, the 4G/LTE segment’s prominence in the SON market is supported by the necessity for advanced network management solutions that can dynamically adapt to and optimize the network environment, ensuring robust and uninterrupted service delivery across diverse geographic and demographic landscapes. As such, 4G/LTE networks will continue to demand significant attention from SON solutions as they provide the critical infrastructure for most mobile communication and data services globally.

Key Market Segments

By Offering

- Software

- Services

By Network

- RAN

- Wi-Fi

- Core Network

- Backhaul

By Architecture

- C-SON (Centralized)

- D-SON (Decentralized)

- H-SON (Hybrid)

By Network Technology

- 2G/3G

- 4G/LTE

- 5G

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Accelerated Mobile Data Traffic

The surging volume of mobile data traffic is a primary driver for the Self-Organizing Network (SON) market. As mobile device usage expands globally, accompanied by increased smartphone penetration and the rising consumption of streaming services, there is a substantial growth in data traffic. This surge necessitates more robust and efficient network management systems.

SONs address this need by dynamically optimizing network resources, enhancing network coverage, and improving overall network efficiency, which is crucial in handling the expected increase from 130 exabytes per month in 2023 to approximately 403 exabytes by 2029. This growth represents a significant opportunity for SON technologies to enhance network capabilities without proportional increases in cost or complexity.

Restraint

High Initial Implementation Costs

A significant restraint for the SON market is the high initial cost associated with implementing these technologies. Deploying SON involves substantial upfront investments in new software and infrastructure modifications, which can be a deterrent, especially for smaller network operators or those in developing regions where budget constraints are tighter. The integration of SON systems with existing network infrastructures often requires extensive technical support and can lead to additional costs related to training and system upgrades.

Opportunity

Expansion in Emerging Markets

The increasing number of mobile subscribers in emerging markets presents a substantial opportunity for the expansion of SON. As these markets continue to develop, there is a growing need for efficient network management to support the rising number of users and the introduction of advanced mobile services.

The adoption of 4G and the gradual rollout of 5G technologies in these regions offer a fertile ground for SON implementations. Network operators in these areas are likely to invest in SON systems to improve their competitive edge, network performance, and customer satisfaction.

Challenge

Integration with Legacy Systems

A key challenge in the SON market is the complexity associated with integrating advanced SON systems with legacy network technologies. Many existing telecommunications infrastructures are based on older technology that may not seamlessly support the newer, more advanced functionalities of SON.

This integration issue can lead to operational disruptions and may require substantial time and financial resources to resolve, making it a significant hurdle for widespread SON adoption. Moreover, the ongoing need to adapt to regulatory changes and manage the security concerns associated with modern network technologies further complicates the integration process.

Growth Factors

The Self-Organizing Network (SON) market is experiencing significant growth due to several key factors. One major driver is the increasing complexity of network environments driven by the surge in connected devices and data traffic. As networks expand and evolve, the need for efficient management through automated systems like SON becomes crucial. This technology simplifies the management of network configurations and optimizes performance, which is essential in today’s data-driven landscape.

Additionally, the deployment of 5G networks is accelerating the growth of the SON market. The advanced capabilities of 5G necessitate more dynamic and intelligent network management solutions to handle increased data volumes and connectivity demands. SON systems are integral in managing these complexities, ensuring high network performance and reliability.

Another growth stimulator is the integration of Artificial Intelligence (AI) and Machine Learning (ML) with SON technologies. These integrations enhance the predictive capabilities of network systems, allowing for proactive adjustments and optimizations, which are vital for maintaining service continuity and customer satisfaction in real-time network scenarios.

Emerging Trends

Emerging trends in the SON market include the growing incorporation of AI and ML technologies, which significantly enhance the automation and efficiency of network operations. These technologies enable SON systems to predict network disruptions and automatically adjust configurations to mitigate issues before they impact users.

The adoption of virtualized network infrastructures and the transition to cloud-based architectures are also notable trends. These changes allow for more scalable and flexible network management solutions that can quickly adapt to changing network demands without the need for extensive physical infrastructure upgrades.

Business Benefits

Businesses that implement SON can enjoy numerous benefits, including reduced operational costs and enhanced network efficiency. SON technologies automate many routine tasks that were previously manually intensive, reducing labor costs and minimizing human errors. This automation also speeds up the deployment of network services, which can give businesses a competitive edge by enabling them to respond more quickly to market demands.

Furthermore, SON improves overall network performance and customer satisfaction by continuously optimizing network settings to provide the best possible service quality. This is particularly beneficial in today’s market, where users expect fast and reliable connectivity

Key Player Analysis

In the competitive landscape of the Self-Organizing Network (SON) market, key players like Ericsson, Cisco Systems, and Nokia distinguish themselves through strategic advancements and innovations. Ericsson leverages its technological prowess in 5G to enhance network automation, notably partnering with companies like Nestlé to transition industrial operations to more autonomous frameworks using private 5G networks. .

Cisco Systems, on the other hand, focuses on expanding its network capabilities through both acquisitions and organic growth. The launch of new capabilities in its AppDynamics Cloud platform highlights its strategy to offer more comprehensive and adaptable solutions, essential for managing modern, cloud-native applications. .

Nokia, with its strategic acquisitions, aims to broaden its technological capabilities and reinforce its market presence, especially in the growing sector of 5G networks. These acquisitions are part of Nokia’s broader strategy to deliver more efficient and scalable network solutions, meeting the increasing demand for enhanced network management and optimization technologies.

Top Key Players in the Market

- Cisco Systems, Inc.

- Telefonaktiebolaget Lm Ericsson

- Qualcomm Technologies Inc.

- Airspan Networks

- Innovile

- Corning Incorporated

- Hughes Systique Corporation

- Cellwize

- Airhop Communications

- ZTE Corporation

- Comarch SA

- Radisys

- VIAVI Solutions

- Infovista

- Other Key Players

Recent Developments

- In January 2024, Qualcomm completed the acquisition of Cellwize, a company specializing in mobile network automation and SON solutions, to bolster its 5G infrastructure capabilities.

- In March 2023, Cisco completed its acquisition of Acacia Communications to enhance its optical networking capabilities, which supports SON implementations by improving network efficiency and scalability.

- In June 2023, Ericsson announced an upgrade to its SON solution that integrates AI-driven automation to optimize network performance and reduce operational costs.

- In September 2023, Qualcomm unveiled its latest chipset designed for enhanced SON capabilities, aiming to improve data throughput and network reliability for 5G applications.

- In November 2023, Airspan entered a strategic partnership with ZTE to co-develop next-generation SON solutions that leverage both companies’ technologies for improved mobile connectivity.

Report Scope

Report Features Description Market Value (2023) USD 6.2 Bn Forecast Revenue (2033) USD 18.7 Bn CAGR (2024-2033) 11.6% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Software, Services), By Network (RAN, Wi-Fi, Core Network, Backhaul), By Architecture (C-SON (Centralized), D-SON (Decentralized), H-SON (Hybrid)), By Network Technology (2G/3G, 4G/LTE, 5G) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Cisco Systems Inc., Telefonaktiebolaget Lm Ericsson, Qualcomm Technologies Inc., Airspan Networks, Innovile, Corning Incorporated, Hughes Systique Corporation, Cellwize, Airhop Communications, ZTE Corporation, Comarch SA, Radisys, VIAVI Solutions, Infovista, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Self-Organizing Network MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Self-Organizing Network MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Telefonaktiebolaget Lm Ericsson

- Qualcomm Technologies Inc.

- Airspan Networks

- Innovile

- Corning Incorporated

- Hughes Systique Corporation

- Cellwize

- Airhop Communications

- ZTE Corporation

- Comarch SA

- Radisys

- VIAVI Solutions

- Infovista

- Other Key Players