Global IT Asset Disposition Market Size, Share, Statistics Analysis Report By Asset Type (Computers/Laptops, Smartphones and Tablets, Peripherals, Storage Devices, Servers), By End-Use Industry (BFSI,IT & Telecom, Government & Public Sector, Healthcare, Energy and Utilities, Media and Entertainment, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133706

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

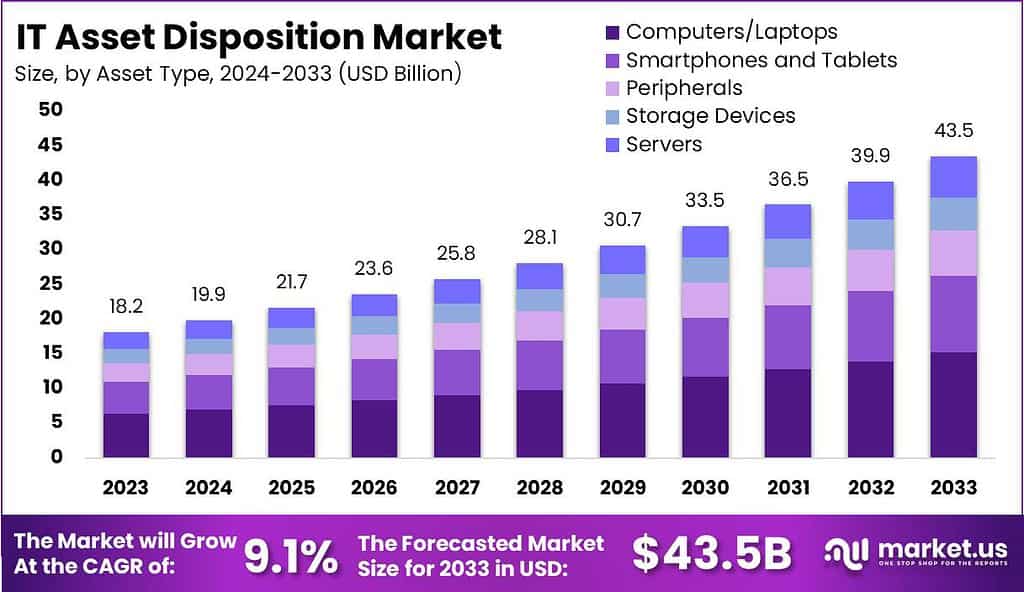

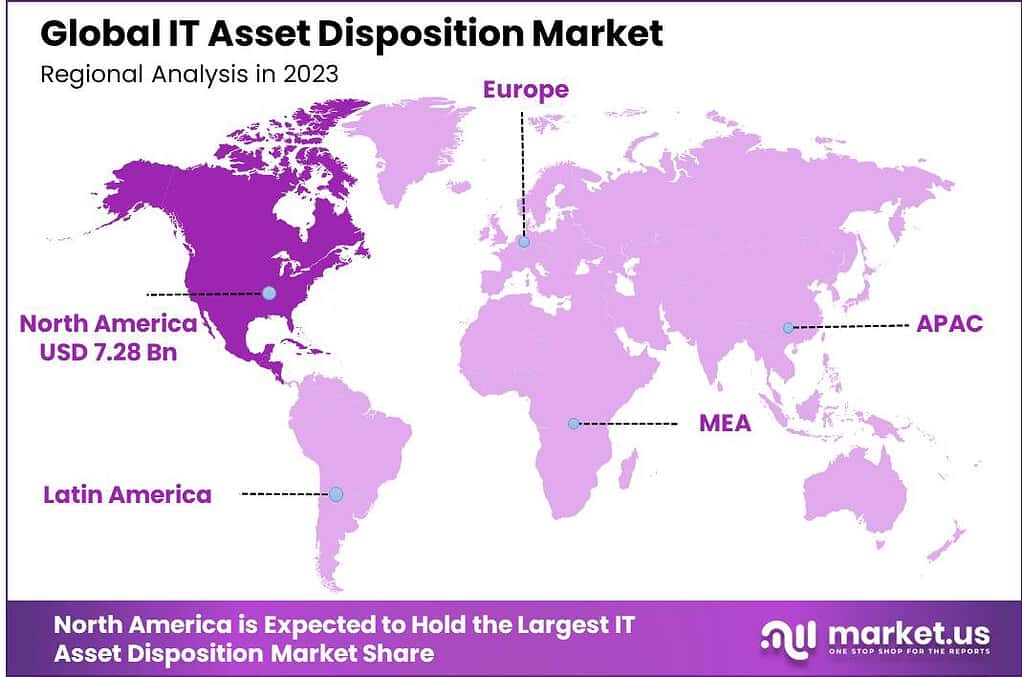

The Global IT Asset Disposition Market size is expected to be worth around USD 43.5 Billion By 2033, from USD 18.2 Billion in 2023, growing at a CAGR of 9.10% during the forecast period from 2024 to 2033. In 2023, North America captured over 40.0% of the IT Asset Disposition (ITAD) market, generating USD 7.28 billion in revenues, securing a dominant position.

IT Asset Disposition, commonly known as ITAD, involves the systematic approach to managing the disposal of obsolete or surplus IT equipment in a secure and environmentally responsible manner. This process encompasses several steps to ensure the secure erasure of data, the recycling or repurposing of parts, and compliance with various legal and environmental standards. ITAD’s relevance has grown with increasing concerns over data security and environmental impacts associated with discarded electronic waste.

The ITAD market is a dynamic sector driven by the rapid pace of technological change and the consequent turnover of IT equipment. As businesses continually update their IT infrastructures, the need to dispose of outdated assets in a secure and responsible way has become imperative. This market includes services such as data destruction, recycling, and the resale or refurbishment of IT assets. It serves not just to mitigate risk and comply with regulations but also offers opportunities for cost recovery through the resale of valuable components.

The growth of the ITAD market is primarily fueled by the increasing volume of e-waste and the stringent data privacy regulations across various industries. The expansion of the digital economy has led to a surge in data breaches, emphasizing the need for secure data destruction services. Additionally, environmental regulations require proper e-waste disposal, which further drives demand for professional ITAD services.

There is a robust demand in the ITAD market for services that ensure comprehensive data security and compliance with environmental regulations. Opportunities in the market are expanding, particularly in areas involving the refurbishment and resale of IT assets, which provide additional revenue streams while supporting sustainability goals. As companies become more environmentally conscious, the demand for certified ITAD providers who can guarantee eco-friendly disposal practices is increasing.

The recent report from the Global E-waste Monitor reveals significant findings about the escalating issue of electronic waste. In 2022, a staggering 62 million tonnes of e-waste were generated globally – an 82% increase from 2010. This rapid growth in e-waste is projected to continue, with expectations to reach 82 million tonnes by 2030.

Despite this surge, only a fraction of e-waste is being responsibly recycled. In 2022, just 22.3% of e-waste was documented as properly collected and recycled, highlighting a critical gap in e-waste management efforts. This inefficiency leads to substantial economic losses, with billions of dollars’ worth of recoverable resources squandered annually due to insufficient recycling practices.

For instance, In June 2024, Shanghai took a significant step forward in shaping the digital economy landscape by launching the Shanghai Data Exchange. This pioneering marketplace is set to transform China’s approach to data assets, offering an organized platform for their disclosure, trading, valuation, registration, and disposal. The launch is a testament to China’s commitment to advancing its digital infrastructure and has already attracted partnerships with over twenty financial institutions.

Technological advancements play a crucial role in shaping the ITAD industry. Innovations in data destruction technologies and asset tracking systems enhance the efficiency and security of ITAD services. Moreover, advancements in logistics and inventory management systems enable ITAD providers to offer more effective and transparent services to their clients, ensuring that all processes – from collection to final disposal – are handled with utmost security and compliance.

Key Takeaways

- The Global IT Asset Disposition Market size is expected to reach USD 43.5 Billion by 2033, up from USD 18.2 Billion in 2023, growing at a CAGR of 9.10% during the forecast period from 2024 to 2033.

- In 2023, the Computers/Laptops segment dominated the IT Asset Disposition market, capturing more than 35% of the market share.

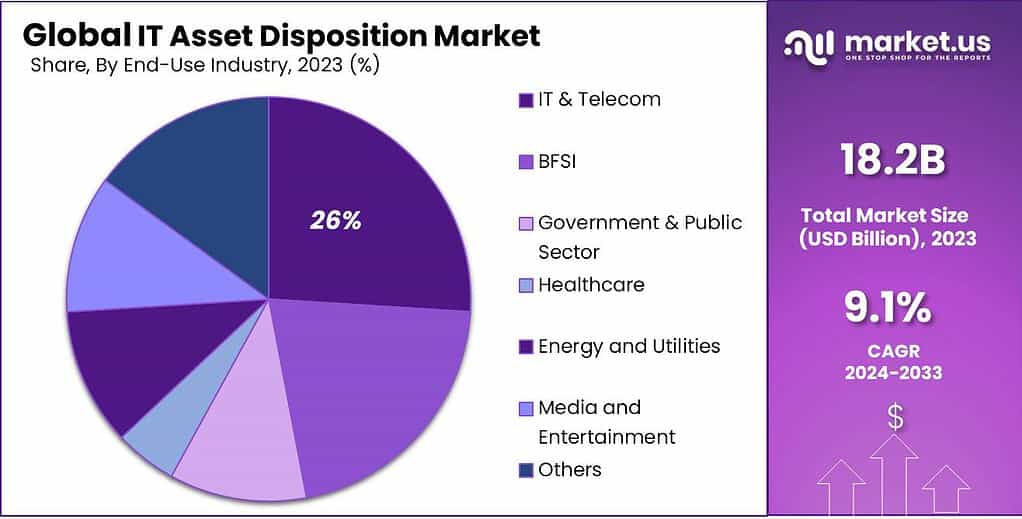

- The IT & Telecom segment also held a dominant position in 2023, accounting for over 26% of the market share in the ITAD market.

- North America led the IT Asset Disposition market in 2023, holding more than 40% of the market share with revenues reaching USD 7.28 billion. This dominance is driven by the region’s strong regulatory framework on data security and environmental protection.

Asset Type Analysis

In 2023, the Computers/Laptops segment held a dominant market position in the IT Asset Disposition market, capturing more than a 35% share. This prominence is largely attributed to the ongoing need for businesses to update their computing infrastructure to keep pace with technological advancements.

As companies aim to maintain competitive edge and enhance operational efficiency, the rapid turnover rate of computers and laptops necessitates robust IT asset disposition strategies to manage the lifecycle of these devices efficiently.

This segment’s leadership is further bolstered by the substantial volume of data these devices hold, which raises significant concerns regarding data security. With stringent regulations in place, companies are compelled to ensure that data on decommissioned computers and laptops is securely erased before disposal or recycling.

Moreover, the environmental impact of disposing of computers and laptops, which contain hazardous materials such as lead and mercury, has become a critical consideration for businesses. The push towards sustainability has encouraged companies to seek environmentally responsible disposal methods, supporting the growth of the ITAD services market within this asset category.

End-Use Industry Analysis

In 2023, the IT & Telecom segment held a dominant market position in the IT Asset Disposition (ITAD) market, capturing more than a 26% share. This leadership can be attributed primarily to the rapid technological advancements and frequent updates in IT equipment and infrastructure.

The nature of the IT & Telecom industry, which revolves around data centers, network equipment, and extensive computing infrastructure, creates a significant need for ITAD services. As these components become outdated, they must be managed to ensure data security and regulatory compliance, further driving demand for ITAD solutions.

Additionally, sustainability goals within the IT & Telecom sector have become increasingly stringent. Companies are under pressure not only from regulators but also from consumers and business partners to demonstrate environmental responsibility. ITAD services enable these companies to manage e-waste more effectively and sustainably.

Key Market Segments

By Asset Type

- Computers/Laptops

- Smartphones and Tablets

- Peripherals

- Storage Devices

- Servers

By End-Use Industry

- BFSI

- IT & Telecom

- Government & Public Sector

- Healthcare

- Energy and Utilities

- Media and Entertainment

- Others

Driver

Embracing Circular Economy Principles in IT Asset Management

The adoption of circular economy principles within IT asset management is significantly propelling the IT Asset Disposition (ITAD) market forward. Organizations are increasingly focusing on extending the lifecycles of their IT assets through refurbishment, reuse, and recycling practices.

This shift not only mitigates environmental damage but also delivers economic advantages by optimizing the use of existing resources. Such strategies help reduce waste, cut down on procurement expenses, and bolster corporate sustainability profiles, thereby driving a higher demand for ITAD services that support the effective management of IT equipment at the end of its life.

Restraint

Data Security Concerns in IT Asset Disposal

Despite the advantages of ITAD services, data security concerns pose a significant restraint. Organizations are apprehensive about the potential risks associated with data breaches during the disposal process. Ensuring that all sensitive information is thoroughly and irreversibly removed from devices is paramount.

The fear of residual data leading to unauthorized access or identity theft makes some companies hesitant to engage third-party ITAD providers. This apprehension underscores the need for ITAD services to implement robust data sanitization protocols and provide verifiable proof of data destruction to build trust and encourage broader adoption.

Opportunity

Growth in Cloud Computing and Data Center Consolidation

The rapid expansion of cloud computing and the trend toward data center consolidation present substantial opportunities for the ITAD market. As organizations migrate to cloud-based solutions, they often decommission on-premises hardware, creating a surge in demand for ITAD services to manage the disposition of obsolete equipment.

Additionally, consolidating data centers leads to the retirement of redundant assets, further driving the need for efficient IT asset disposition. ITAD providers can capitalize on this trend by offering specialized services tailored to the unique requirements of cloud migration and data center optimization projects.

Challenge

Navigating Diverse Regulatory Compliance Requirements

A significant challenge in the ITAD industry is navigating the complex landscape of regulatory compliance. Different regions and countries have varying laws and standards regarding electronic waste disposal, data protection, and environmental sustainability. ITAD providers must stay abreast of these regulations to ensure their practices are compliant, which can be resource-intensive and complex.

Non-compliance can result in legal penalties and damage to an organization’s reputation. Therefore, developing a comprehensive understanding of global and local regulations and implementing adaptable processes is crucial for ITAD companies to operate effectively across multiple jurisdictions.

Emerging Trends

The landscape of IT Asset Disposition (ITAD) is evolving rapidly, influenced by several key trends. A significant shift is the growing emphasis on sustainable practices. Organizations are increasingly prioritizing eco-friendly disposal methods to minimize environmental impact.

Additionally, the rise of remote work has introduced complexities in asset management. Companies now need to securely handle and dispose of IT assets distributed across various locations, ensuring data security and compliance with regulations.

Another notable trend is the integration of data erasure protocols. With heightened awareness of data breaches, businesses are adopting stringent data destruction methods to protect sensitive information before disposing of hardware. This approach not only safeguards against potential security threats but also aligns with legal requirements for data protection.

Business Benefits

Implementing effective IT Asset Disposition strategies offers numerous advantages for businesses. It ensures compliance with environmental regulations, helping companies avoid potential fines and legal issues associated with improper e-waste disposal. By adhering to these standards, businesses demonstrate corporate responsibility and enhance their reputation among stakeholders.

Secure data destruction during the disposition process protects against data breaches, safeguarding sensitive information and maintaining customer trust. This proactive approach to data security can prevent costly incidents and preserve the company’s integrity.

Additionally, refurbishing and reselling usable IT equipment can generate additional revenue streams. This practice not only offsets the costs of new technology investments but also promotes a circular economy by reducing waste.

Regional Analysis

In 2023, North America held a dominant position in the IT Asset Disposition (ITAD) market, capturing more than a 40.0% share with revenues amounting to USD 7.28 billion. This leadership is primarily driven by the region’s robust regulatory framework concerning data security and environmental protection.

In the United States and Canada, stringent regulations require businesses to responsibly dispose of IT assets, ensuring data privacy and reducing environmental impact, which significantly boosts the demand for professional ITAD services.

Another key factor contributing to North America’s market dominance is the high rate of technological adoption and the resultant rapid turnover of IT equipment in corporate sectors. Organizations in this region frequently update their IT infrastructure to keep pace with advancing technologies, leading to a continual need for efficient asset disposition services.

Additionally, the presence of major ITAD service providers in North America, coupled with their advanced logistical and processing capabilities, supports the growth of this market. These companies offer comprehensive ITAD services, including secure data destruction, environmentally sound recycling, and value recovery through the resale of refurbished devices, aligning with the circular economy model favored in the region.

Furthermore, the increasing societal awareness and corporate responsibility towards reducing electronic waste contribute to the growth of the ITAD market in North America. Businesses are actively adopting sustainable practices, which not only helps in enhancing their brand image but also complies with regional environmental standards, driving the demand for ITAD services.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The IT Asset Disposition (ITAD) market features several prominent players which stand out due to their significant market presence and comprehensive service offerings.

Apto Solutions Inc. has established itself as a leader in the ITAD sector with its robust approach to managing the lifecycle of IT assets. Specializing in environmentally responsible recycling and secure data destruction, Apto Solutions tailors its services to meet the stringent compliance standards required by businesses across various industries.

CompuCom Systems, Inc. is recognized for its integrated IT solutions that extend to IT asset disposition. The company provides a seamless service that includes secure data wiping, asset recovery, and responsible recycling. CompuCom’s strength lies in its ability to offer end-to-end IT services, from deployment to disposition, thereby simplifying the IT lifecycle management for its clients.

Dell Inc., a renowned name in the technology sector, also excels in the IT asset disposition arena through its extensive recycling and recovery services. Dell’s ITAD services are part of its broader environmental policy, which focuses on sustainability and the reduction of e-waste.

Top Key Players in the Market

- Apto Solutions Inc.

- CompuCom Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Ingram Micro Services

- Iron Mountain

- ITRenew

- LifeSpan International Inc.

- Sims Lifecycle Services, Inc.

- Other Key Players

Recent Developments

- In January 2024, Iron Mountain, a leader in information management, expanded its ITAD services by acquiring Regency Technologies. This strategic move enhanced Iron Mountain’s logistics network and bolstered its information security offerings in IT Asset Lifecycle Management.

- In March 2024, TES, a subsidiary of South Korea’s SK Group, has launched an IT asset disposition (ITAD) facility in Fredericksburg, Virginia. This new site aims to extend the life of tech assets and data center equipment, prevent valuable materials from ending up in landfills, and support the region’s booming data center industry.

Report Scope

Report Features Description Market Value (2023) USD 18.2 Bn Forecast Revenue (2033) USD 43.5 Bn CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Asset Type (Computers/Laptops, Smartphones and Tablets, Peripherals, Storage Devices, Servers), By End-Use Industry (BFSI,IT & Telecom, Government & Public Sector, Healthcare, Energy and Utilities, Media and Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apto Solutions Inc., CompuCom Systems, Inc., Dell Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Ingram Micro Services, Iron Mountain, ITRenew, LifeSpan International Inc., Sims Lifecycle Services, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IT Asset Disposition MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

IT Asset Disposition MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Apto Solutions Inc.

- CompuCom Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Ingram Micro Services

- Iron Mountain

- ITRenew

- LifeSpan International Inc.

- Sims Lifecycle Services, Inc.

- Other Key Players