Global Saw Palmetto Supplements Market Size, Share and Report Analysis By Nature (Organic, Conventional), By Form (Capsules/Softgels, Tablets, Powders, Gummies, Liquid Extracts), By End Use (Men, Women), By Sales Channel (Supermarkets/Hypermarkets, Pharmacies and Drugstores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175661

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

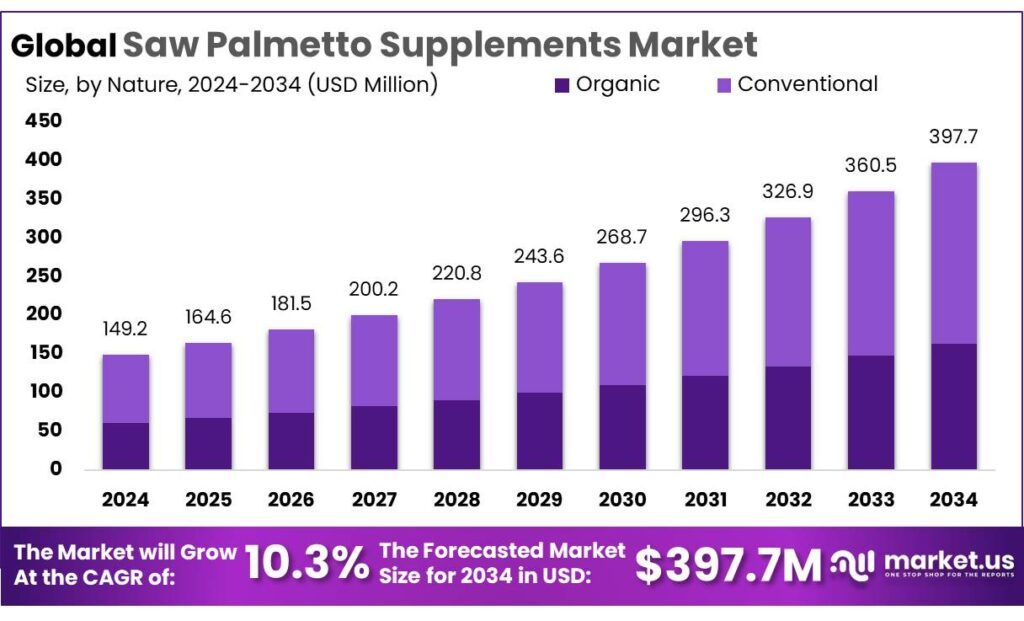

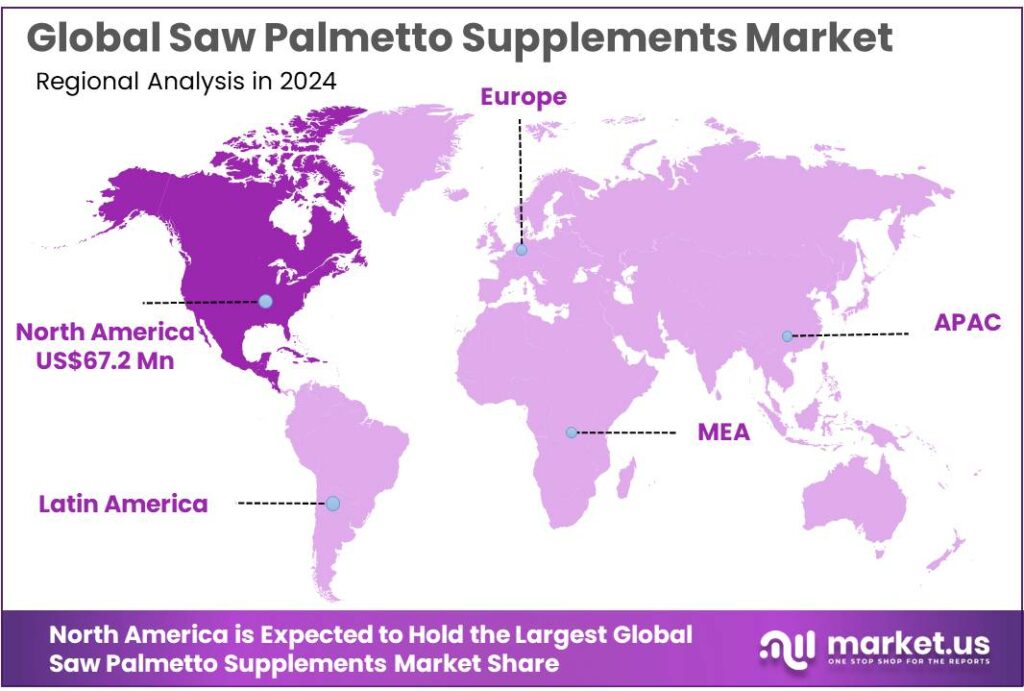

Global Saw Palmetto Supplements Market size is expected to be worth around USD 397.7 Million by 2034, from USD 149.2 Million in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 45.1% share, holding USD 67.2 Million in revenue.

Saw palmetto supplements sit inside the broader “botanical” corner of the dietary supplement industry, positioned mainly around men’s urinary comfort and prostate wellness, with secondary marketing around hair health.

- In the U.S., this category benefits from a large, habitual supplement consumer base: 57.6% of adults reported using at least one dietary supplement in the past 30 days. At the same time, the clinical narrative is nuanced—NIH’s NCCIH notes that a 2023 review of 27 studies found saw palmetto, when used alone, provides “little or no benefit” for BPH symptoms, shaping how responsibly brands communicate benefits and substantiation.

From an industry scenario perspective, saw palmetto competes for shelf space and search visibility in a fast-moving herbal marketplace where consumer demand clusters around condition-specific solutions. The American Botanical Council’s Herb Market Report shows total U.S. retail sales of herbal supplements at USD 12.551 billion in 2023. Within that mainstream channel ranking, saw palmetto recorded USD 26,149,194 in 2024 sales, with a –11.4% year-over-year change, indicating a category that is sizable but sensitive to pricing, messaging, and substitution by newer “prostate blends.”

Key driving factors are largely demographic and behavior-led. On the demand side, prostate enlargement becomes more common with age; NIDDK estimates BPH affects 5%–6% of men aged 40–64 and 29%–33% of men aged 65+. On the purchasing side, industry survey work from CRN continues to show high penetration of supplement use in the U.S.; in 2024, CRN reported 75% of Americans use dietary supplements.

Government and trusted institutional frameworks also shape how the category grows. In the U.S., manufacturers are expected to follow dietary supplement current Good Manufacturing Practices (cGMPs) under 21 CFR Part 111, which sets expectations for quality control across manufacturing, packaging, labeling, and holding. On the post-market side, FDA reporting infrastructure and public data releases reinforce the need for robust quality and surveillance: from January 1, 2004 through September 30, 2016, FDA received 56,574 adverse event reports across foods, supplements, and cosmetics, including 25,412 reports tied to dietary supplements.

Key Takeaways

- Saw Palmetto Supplements Market size is expected to be worth around USD 397.7 Million by 2034, from USD 149.2 Million in 2024, growing at a CAGR of 10.3%.

- Conventional saw palmetto supplements held a dominant market position, capturing more than a 59.2% share.

- Capsules/Softgels held a dominant market position, capturing more than a 54.7% share in the Saw Palmetto Supplements Market.

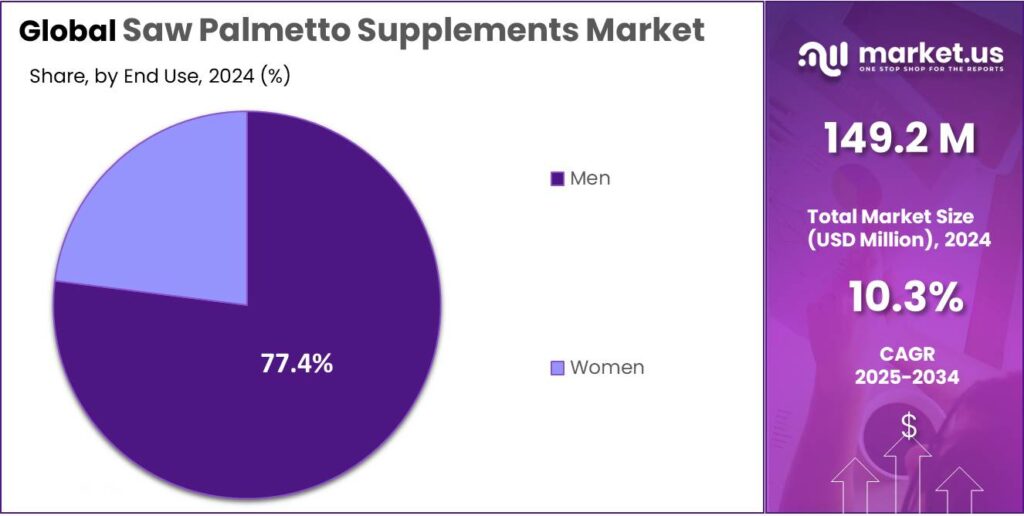

- Men segment held a dominant market position, capturing more than a 77.4% share in the Saw Palmetto Supplements Market.

- Pharmacies and Drugstores held a dominant market position, capturing more than a 39.9% share.

- North America leads the Saw Palmetto Supplements Market, with the region holding a dominant 45.1% share and reaching USD 67.2 Mn.

By Nature Analysis

Conventional Saw Palmetto Supplements Lead the Market with a Strong 59.2% Share

In 2024, Conventional saw palmetto supplements held a dominant market position, capturing more than a 59.2% share. This leadership reflects the continued consumer trust in traditional extraction and processing methods, which remain widely accessible and cost-effective for both manufacturers and end users. Conventional formats have long been the backbone of this category, largely because they offer stable supply chains and familiar formulations that retailers prefer for high-turnover men’s health products. Their dominance in 2024 also aligns with broader dietary supplement purchasing habits, as mainstream consumers often choose products perceived as reliable and tested over newer premium alternatives.

By Form Analysis

Capsules/Softgels dominate with a strong 54.7% share due to convenience and user preference

In 2024, Capsules/Softgels held a dominant market position, capturing more than a 54.7% share in the Saw Palmetto Supplements Market. This leadership is largely driven by the convenience these formats offer—easy swallowing, accurate dosing, and better portability compared to powders or liquids. Consumers looking for prostate and urinary health solutions often prefer forms that fit smoothly into daily routines, and capsules or softgels meet this expectation. Their longer shelf life and ability to protect the active compounds from oxidation also make them a trusted choice among supplement users. These benefits collectively supported strong retail visibility and repeat purchases throughout 2024.

By End Use Analysis

Men dominate the market with a strong 77.4% share driven by rising prostate and urinary health needs

In 2024, the Men segment held a dominant market position, capturing more than a 77.4% share in the Saw Palmetto Supplements Market. This clear lead comes from the supplement’s long-established association with male prostate health, especially for individuals experiencing urinary discomfort or age-related prostate enlargement. As men above 40 increasingly look for natural solutions to support long-term wellness, saw palmetto has remained one of the most recognized and widely adopted options. The segment’s strong share in 2024 also reflects growing awareness around early prostate care and the ease of accessing these supplements through pharmacies, online stores, and wellness outlets.

By Sales Channel Analysis

Pharmacies and Drugstores lead the market with a solid 39.9% share driven by consumer trust and accessibility

In 2024, Pharmacies and Drugstores held a dominant market position, capturing more than a 39.9% share in the Saw Palmetto Supplements Market. Their strong performance is rooted in the trust consumers place in pharmacy-based purchasing, especially for products linked to men’s prostate and urinary health. Shoppers often rely on pharmacists for quick guidance, making these outlets a preferred choice for first-time buyers or individuals seeking reassurance about safety and dosing. The ability to access well-known brands, quality-assured products, and regulated retail environments supported steady footfall throughout 2024, reinforcing the segment’s leadership.

Key Market Segments

By Nature

- Organic

- Conventional

By Form

- Capsules/Softgels

- Tablets

- Powders

- Gummies

- Liquid Extracts

By End Use

- Men

- Women

By Sales Channel

- Supermarkets/Hypermarkets

- Pharmacies and Drugstores

- Online Retail

- Others

Emerging Trends

Third-party verification and stricter quality proof are becoming the “new normal” for Saw Palmetto supplements

One of the latest trends shaping saw palmetto supplements is a clear move toward stronger quality proof, driven especially by e-commerce and stricter retail gatekeeping. In 2024, large online marketplaces began pushing sellers to show independent verification before products stay listed. Amazon, for example, updated its dietary supplement policy so that, effective April 2, 2024, dietary supplement products need to be verified through a third-party Testing, Inspection, and Certification (TIC) organization.

This shift is happening in a supplement world that is already crowded and confusing for shoppers. The NIH Office of Dietary Supplements has stated there are more than 80,000 dietary supplement products in the market. With so many options, brands can no longer rely on a familiar ingredient name alone. What increasingly wins trust is proof: consistent ingredient identity testing, clean specifications, and documentation that the product matches its label.

Safety monitoring also plays into why verification is rising. FDA has reported that from January 1, 2004 through September 30, 2016, it received 56,574 adverse event reports across foods, dietary supplements, and cosmetics, including 25,412 reports for dietary supplements. Even though this data is not specific to saw palmetto, it affects how the entire supplement aisle is viewed: platforms and retailers prefer products that can demonstrate oversight, and consumers feel better when a brand is transparent about quality practices.

Demand conditions add fuel to this trend. The user base for men’s health supplements continues to expand as populations age. WHO notes that by 2030, 1 in 6 people in the world will be aged 60+, rising from 1.0 billion (2020) to 1.4 billion (2030), and reaching 2.1 billion by 2050. In parallel, supplement use is already common in the age groups most likely to shop for prostate and urinary wellness products. In the U.S., CDC data shows 57.6% of adults used a dietary supplement in the past 30 days (2017–2018), and among men, use rose to 67.3% in those aged 60+.

Drivers

Aging men and rising urinary-health needs are pushing Saw Palmetto demand as supplement use climbs with age

One major driving factor for saw palmetto supplements is the steady rise in age-related urinary and prostate concerns—especially among older men—paired with a clear habit of using supplements as part of everyday health routines. The World Health Organization (WHO) expects global aging to accelerate: by 2030, 1 in 6 people worldwide will be aged 60+, with the 60+ population increasing from 1.0 billion (2020) to 1.4 billion (2030), and reaching 2.1 billion by 2050.

From a healthcare standpoint, benign prostatic hyperplasia (BPH), often described as an enlarged prostate, is a common contributor to urinary symptoms in older men. The U.S. National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) estimates BPH affects about 5%–6% of men aged 40–64, and 29%–33% of men aged 65+. This matters commercially because saw palmetto is widely recognized by consumers as part of the prostate-health conversation, even when people are not ready to start prescription therapy or want a “try-first” option.

The supplement industry’s own usage patterns reinforce why this demand keeps showing up. CDC survey data (NHANES) found that during 2017–2018, 57.6% of U.S. adults used a dietary supplement in the prior 30 days, and supplement use rises sharply with age. Among men specifically, use increased to 67.3% in those aged 60+.

Government and trusted health sources also shape how this category grows, mainly by pushing a more quality-focused supplement marketplace. In the U.S., dietary supplement manufacturers must follow current good manufacturing practice rules under 21 CFR Part 111, which set expectations for how supplements are manufactured, packaged, labeled, and held.

Restraints

Limited Clinical Evidence and Regulatory Hurdles Slow Saw Palmetto Supplement Growth

A significant restraining factor for the saw palmetto supplements market is the limited and mixed clinical evidence regarding its effectiveness, which creates uncertainty for consumers, healthcare professionals, and regulators alike. Many people turn to saw palmetto hoping for support with prostate and urinary comfort, but when they look for solid scientific proof, they often encounter studies that do not show consistent benefits.

For example, the U.S. National Center for Complementary and Integrative Health (NCCIH) reports that, after reviewing multiple clinical trials, saw palmetto alone shows little or no benefit in relieving symptoms of benign prostatic hyperplasia (BPH). This type of evidence—even though it does not imply harm—weakens consumer confidence, especially for those who expect clear, measurable results from daily supplements. When a trusted government-linked source highlights uncertainty, many shoppers pause or choose other products with stronger backing.

Regulatory reporting also highlights challenges for the broader supplement category, influencing how consumers view saw palmetto specifically. Between January 1, 2004 and September 30, 2016, the FDA received a total of 56,574 adverse event reports related to foods, dietary supplements, and cosmetics, including 25,412 associated with dietary supplements alone. While saw palmetto is not singled out in that data, the fact that supplements make up a large portion of adverse reports makes some consumers wary about products without clear clinical support.

Opportunity

Quality-led products can unlock growth as older consumers and supplement users keep rising

One major growth opportunity for saw palmetto supplements is quality-led premiumization—brands that prove purity, consistency, and label accuracy can win trust in a crowded category and convert cautious shoppers into repeat buyers. The market is already operating in a world where supplements are normal behavior, not a niche. In the U.S., CDC data shows that during 2017–2018, 57.6% of adults used a dietary supplement in the previous 30 days, and usage climbed to 67.3% among men aged 60+.

The opportunity becomes clearer when looking at how crowded the supplement shelf has become. NIH’s Office of Dietary Supplements (ODS) notes that “more than 80,000” dietary supplement products exist (and newer NIH planning documents discuss a market with more than 100,000 products). In a space with that much choice, growth rarely comes from “another saw palmetto bottle.” It comes from being the brand a buyer trusts when they compare labels.

Demographics add another strong tailwind to this opportunity. WHO projects that by 2030, 1 in 6 people globally will be aged 60+, rising from 1.0 billion (2020) to 1.4 billion (2030), and reaching 2.1 billion by 2050. At the same time, WHO’s UN Decade of Healthy Ageing (2021–2030) keeps global attention on aging well—staying active, independent, and comfortable in daily life.

Regional Insights

North America dominates the Saw Palmetto Supplements Market with a share of 45.1%, valued at USD 67.2 Mn

North America leads the Saw Palmetto Supplements Market, with the region holding a dominant 45.1% share and reaching USD 67.2 Mn. This strength is closely linked to two realities in the U.S. and Canada: men’s prostate/urinary concerns rise with age, and supplement use is already a normal part of daily health routines. In the United States, CDC data shows that in 2017–2018, 57.6% of adults used at least one dietary supplement in the past 30 days, and usage climbed with age—among men aged 60+, it reached 67.3%.

On the supply and compliance side, North America’s established regulatory framework also supports organized growth. U.S. dietary supplement firms are required to follow current good manufacturing practice rules under 21 CFR Part 111, which strengthens expectations around quality systems and documentation. In Canada, population aging adds another tailwind—Statistics Canada reported 18.9% of Canadians were aged 65+ as of July 1, 2024, reinforcing long-term demand for healthy aging products in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NOW Foods, active since 1968, runs one of the largest supplement manufacturing facilities in the U.S., producing 2,000+ products across categories. Its GMP-certified operations support high-volume output exceeding millions of bottles annually. Competitive pricing, combined with distribution in 60+ countries and strong e-commerce performance, reinforces its position in the saw palmetto supplements market.

Solgar Inc., established in 1947, maintains premium positioning with distribution in 50+ countries and a portfolio of 450+ formulations. Its saw palmetto products benefit from the brand’s clean-label and gold-standard manufacturing approach. Solgar’s retail reach spans 20,000+ specialty stores, helping it attract consumers seeking high-purity botanical extracts for men’s health support.

Puritan’s Pride, part of The Bountiful Company group, manages a strong direct-to-consumer model serving millions of customers annually. The brand offers 1,500+ SKUs, including saw palmetto softgels and blends. Its ability to run large promotional cycles and ship nationwide from multiple U.S. fulfillment centers supports consistent demand and competitive pricing in the men’s health supplement category.

Top Key Players Outlook

- Nature’s Bounty Co.

- Pharmavite LLC

- Solaray

- NOW Foods

- Solgar Inc.

- Puritan’s Pride

- Life Extension

- Zhou Nutrition

- Gaia Herbs

- Pure Encapsulations

Recent Industry Developments

In 2024, Nature’s Bounty Co. stayed active in the saw palmetto supplements space with a straightforward, high-volume core item: Saw Palmetto 450 mg in a 250-capsule bottle, positioned for “prostate and urinary health” and designed for routine use.

In 2024, NOW Foods continued to be a visible player in the saw palmetto supplements sector by offering multiple formulations such as Saw Palmetto Extract 160 mg in 120-softgel and 240-softgel bottles, as well as Saw Palmetto Extract 320 mg veggie softgels that combine saw palmetto with pumpkin seed oil for broader men’s health support.

Report Scope

Report Features Description Market Value (2024) USD 149.2 Mn Forecast Revenue (2034) USD 397.7 Mn CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Form (Capsules/Softgels, Tablets, Powders, Gummies, Liquid Extracts), By End Use (Men, Women), By Sales Channel (Supermarkets/Hypermarkets, Pharmacies and Drugstores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nature’s Bounty Co., Pharmavite LLC, Solaray, NOW Foods, Solgar Inc., Puritan’s Pride, Life Extension, Zhou Nutrition, Gaia Herbs, Pure Encapsulations Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Saw Palmetto Supplements MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Saw Palmetto Supplements MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Nature's Bounty Co.

- Pharmavite LLC

- Solaray

- NOW Foods

- Solgar Inc.

- Puritan's Pride

- Life Extension

- Zhou Nutrition

- Gaia Herbs

- Pure Encapsulations