Global Satellite Texting Market Size, Share, Industry Analysis Report By Service Type (One-Way Messaging, Two-Way Messaging, Integrated Smartphone Services, Others), By Device Type (Dedicated Satellite Messengers, Satellite Adapters & Accessories, Smartphones with Satellite Connectivity, Others), By Pricing Model (Subscription-Based, Pay-As-You-Go, Bundled Services), By End-User (Individual Consumers, Enterprise & Business, Government & Public Sector), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167913

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Consumer Statistics

- Performance and Security Statistics

- User Adoption and Trends

- Role of Generative AI

- Investment and Business Benefits

- U.S. Satellite Texting Market Size

- Service Type Analysis

- Device Type Analysis

- Pricing Model Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

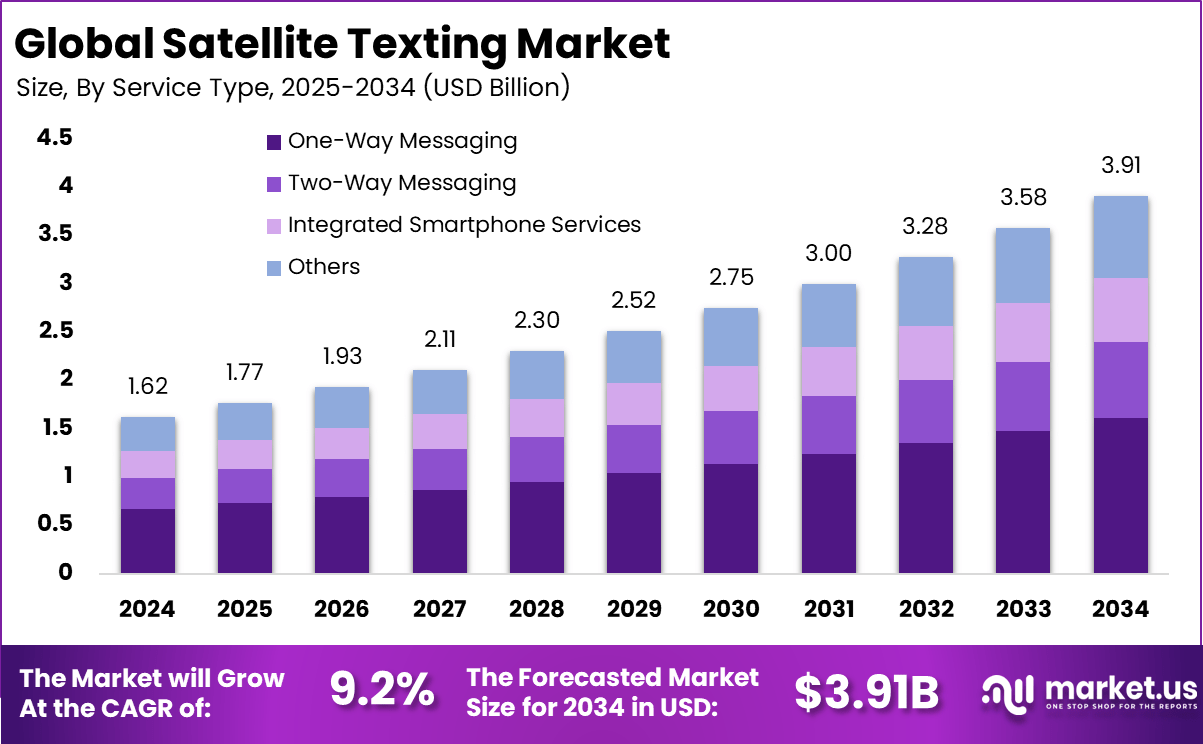

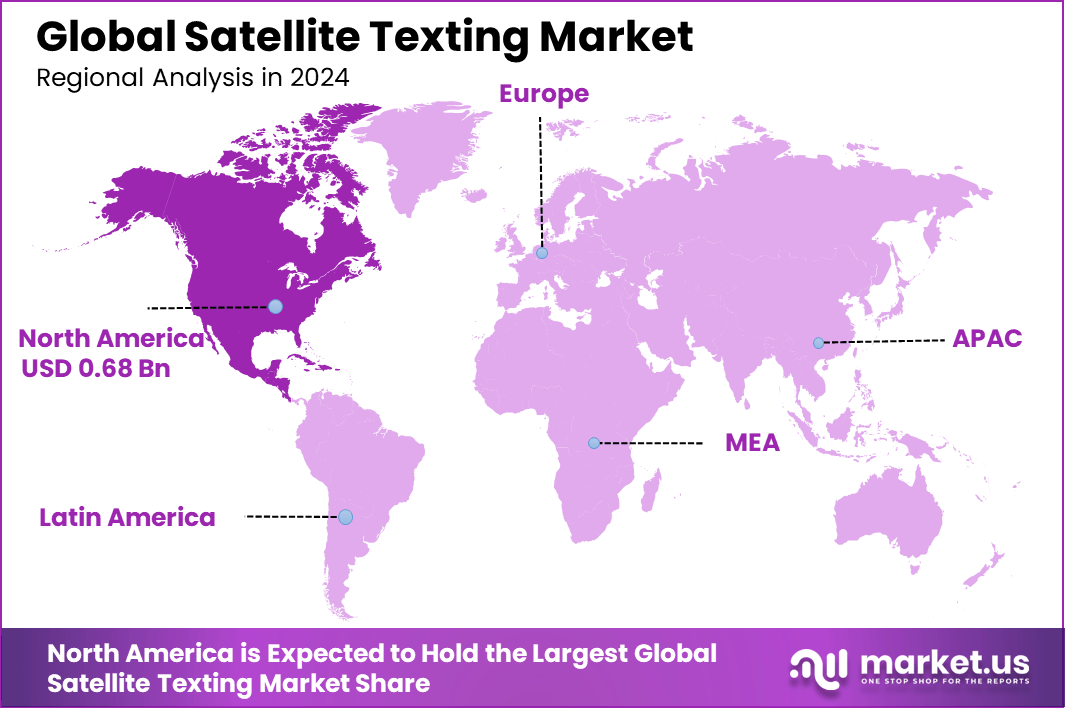

The Global Satellite Texting Market size is expected to be worth around USD 3.91 billion by 2034, from USD 1.62 billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.3% share, holding USD 0.68 billion in revenue.

The satellite texting market is driven primarily by the increasing demand for dependable communication solutions in remote locations such as wilderness, oceans, or disaster zones, where traditional cellular networks cannot reach. The rise in outdoor adventure activities and maritime uses also fuels demand. Additionally, advancements in satellite constellations that lower costs and improve connectivity quality have made satellite texting more accessible.

There is strong demand for satellite texting across various sectors. Individuals in remote or rugged environments require reliable messaging for safety and coordination. Commercial sectors like logistics, energy, and maritime rely on satellite texting for operational communication beyond cellular network reach. Governments and defense agencies demand resilient communication tools for border security and disaster response.

For instance, in January 2025, Thuraya Telecommunications launched the Thuraya One, the world’s first 5G-enabled satellite smartphone with seamless cellular-to-satellite transition capabilities. Additionally, the Thuraya-4 NGS satellite was launched to expand coverage and improve capacity for messaging and data services.

Investment opportunities include funding satellite network expansions, especially LEO constellations, which promise lower costs and better performance. Development of satellite-to-phone texting technologies is a high-growth area due to consumer convenience. IoT-focused satellite communication platforms attract capital for industrial applications. Regional expansions in underserved markets such as Asia-Pacific and parts of Africa present lucrative prospects.

Key Takeaway

- In 2024, the one way messaging segment held the leading position in the Global Satellite Texting Market by capturing a 41.3% share.

- In 2024, the dedicated satellite messengers segment secured a dominant 39.6% share within the Global Satellite Texting Market.

- In 2024, the pay as you go segment achieved the highest contribution in its category with a 49.5% share of the Global Satellite Texting Market.

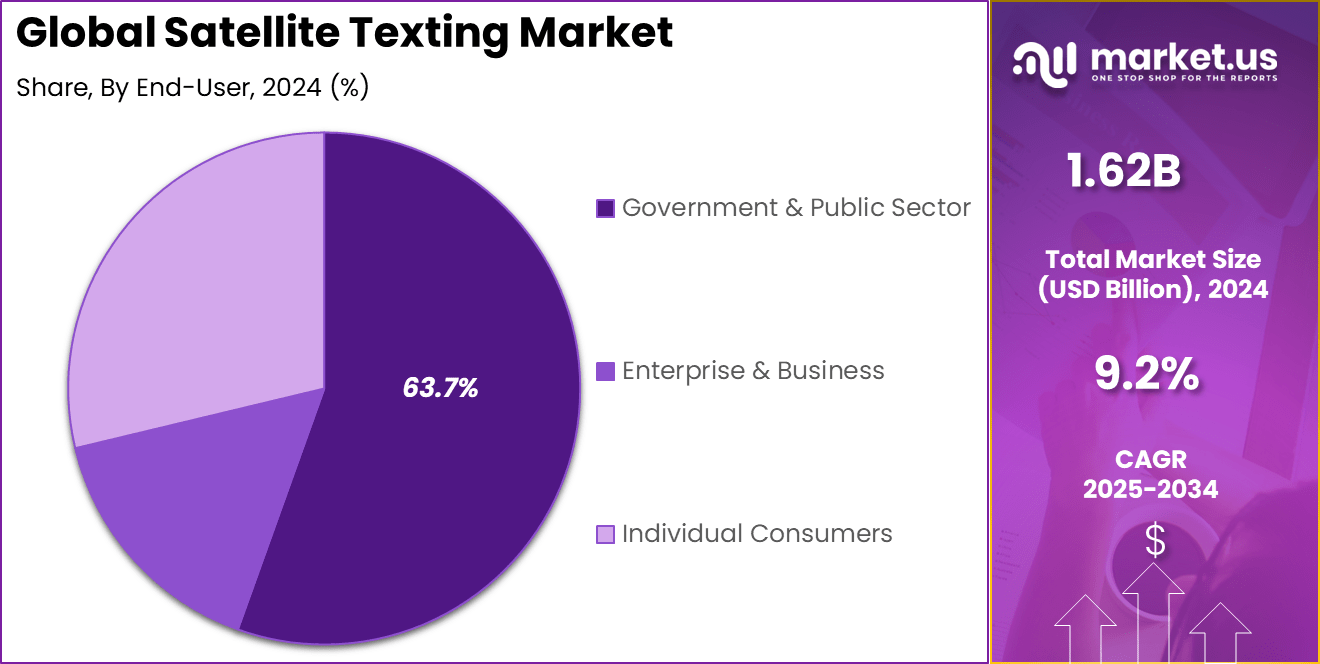

- In 2024, the government and public sector segment led the end user landscape by holding a strong 63.7% share in the Global Satellite Texting Market.

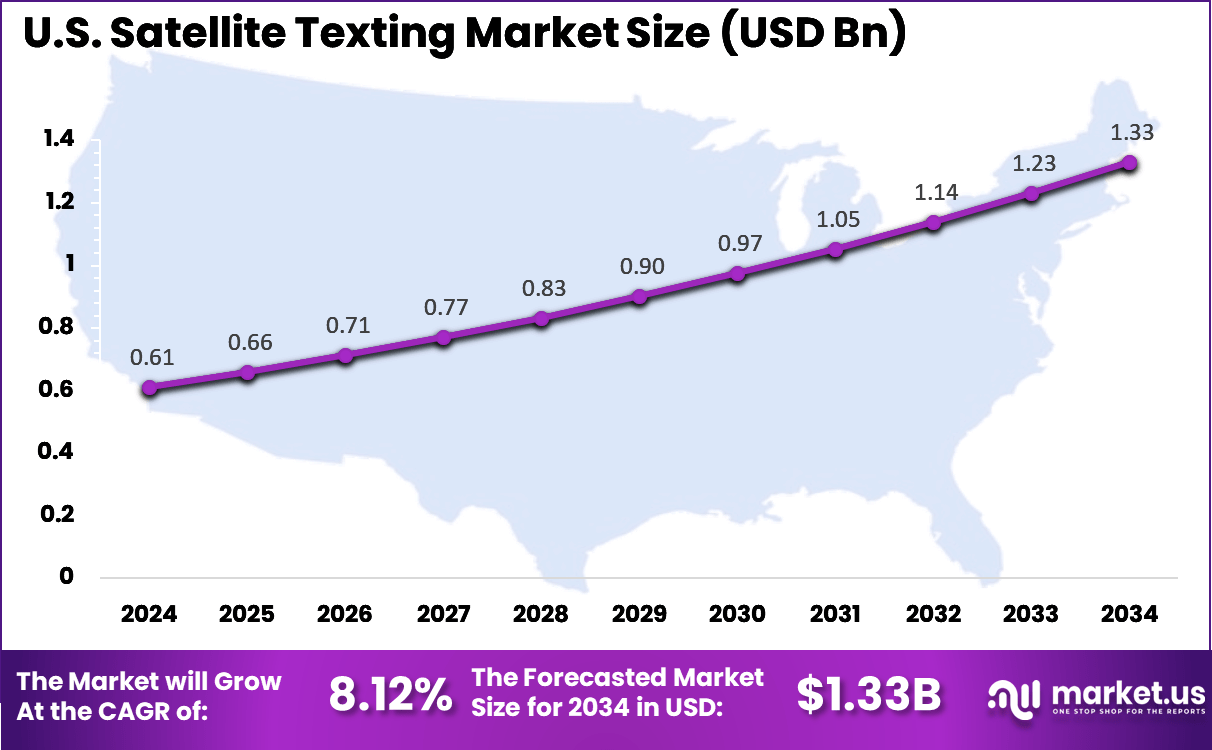

- The US Satellite Texting Market reached USD 0.61 Billion in 2024, supported by a stable 8.12% CAGR.

- In 2024, North America maintained dominance in the Global Satellite Texting Market by accounting for 42.3% of the total share.

Consumer Statistics

- 36% of postpaid mobile customers are willing to pay at least $1 per month for satellite connectivity.

- 32% of surveyed users are willing to pay $5 per month for the service.

- Around 20% of interested consumers would switch mobile providers to gain satellite communication features.

- A fall 2024 survey shows 10% of frequent travelers already use satellite-enabled smartphones.

- Another 31% of experienced travelers plan to purchase a satellite-capable device.

- During a testing period, T-Mobile users accounted for 60% of all Starlink satellite connections, rising to 70.8% for active devices.

- For travelers, the main appeal is emergency support, with 49% valuing the ability to call for help outside cellular coverage.

Performance and Security Statistics

- Approximately 50% of satellite-transmitted data is unencrypted, including calls, texts, and operational information.

- Only 20% of satellite transponders have encryption enabled for downlink protection.

- Just 6% of systems consistently use IPsec for secure network-layer encryption.

- Satellite texting can take 30 seconds to send under ideal sky conditions.

- Message delivery can exceed one minute when under light or medium foliage.

- Performance drops significantly in dense forests, rocky valleys, and heavy urban obstruction.

User Adoption and Trends

- T-Mobile’s SpaceX-powered satellite service beta (Feb 2025) saw 2 million signups and 30,000 daily active users, indicating strong early demand.

- Established players continue to dominate, holding 82% of the satellite messenger market in 2022, while startups accounted for 18%.

- The satellite messenger ecosystem is expanding as more companies enter the market and diversify offerings.

- Iridium reported a 14% revenue increase in its commercial IoT division and now serves around 2 million subscribers, with an ARPU of $7.79.

Role of Generative AI

Generative AI is playing an increasing role in satellite texting by enhancing the personalization and efficiency of communication. It is estimated that generative AI could automate up to 50% of customer care interactions, boosting performance by 30 to 45%. This automation creates faster response times and allows satellite messaging services to better handle communication in remote regions where traditional networks fall short.

Moreover, generative AI contributes to product personalization and improved sales effectiveness, potentially increasing revenues by 3 to 5% through smarter, automated messaging strategies. The impact of generative AI on satellite texting extends beyond automation; it helps overcome the challenge of managing unstructured and inconsistent data from messaging platforms.

Investment and Business Benefits

Investment opportunities in satellite texting are attracting global attention as the market expands with new satellite deployments and service models. There is strong potential for growth in regions with limited terrestrial infrastructure and increasing demand for reliable communication during emergencies.

Telecom providers and technology firms continue to invest in satellite network expansions, collaborative partnerships, and innovative services to capture new customer segments. Business benefits from satellite texting technology include operational resilience, enhanced customer safety, and access to untapped markets.

Companies operating in remote industries such as oil and gas, shipping, and outdoor tourism gain reliable communication capabilities that contribute to efficiency and risk management. Additionally, the technology spreads digital inclusion by bridging connectivity gaps in underserved areas.

U.S. Satellite Texting Market Size

The market for Satellite Texting within the U.S. is growing tremendously and is currently valued at USD 0.61 billion, the market has a projected CAGR of 8.12%. The growth is driven by increasing demand for seamless communication in remote and underserved areas where traditional cellular networks are limited. Rising adoption of satellite-enabled mobile devices and the need for reliable emergency communication services play key roles.

Furthermore, advancements in satellite and 5G technology integration are improving connectivity speed, coverage, and affordability. Government initiatives and partnerships with telecom providers also support market expansion as more users seek continuous access to mobile communication across diverse environments.

For instance, in March 2025, ORBCOMM announced OGx service enhancements providing faster and larger satellite messages at a lower cost, enabling expanded IoT applications. This upgrade positions ORBCOMM to better serve industries like agriculture and transportation with improved satellite IoT communication across North America.

In 2024, North America held a dominant market position in the Global Satellite Texting Market, capturing more than a 42.3% share, holding USD 0.68 billion in revenue. This leadership stems from the region’s mature satellite infrastructure and significant investments from both government and private sectors. The U.S. government’s substantial funding for satellite communications, alongside initiatives to improve connectivity in remote and rural areas, has accelerated market adoption.

Additionally, partnerships between satellite operators and major telecom providers have expanded services, especially for emergency messaging and coverage in underserved regions. The combination of advanced technology deployment, consumer demand for reliable communication, and regulatory support solidifies North America’s dominant position in this market.

For instance, in June 2025, Iridium Communications introduced the Iridium Chat app, offering global satellite messaging that integrates with its Iridium GO! exec device. This move enhances off-grid communication for U.S. government agencies and remote users, reinforcing Iridium’s leadership in satellite messaging services across North America.

Service Type Analysis

In 2024, The One-Way Messaging segment held a dominant market position, capturing a 41.3% share of the Global Satellite Texting Market. This type of service primarily supports scenarios where messages are transmitted in a single direction, typically from a central source to a user, which suits applications such as alerts, notifications, and broadcast messaging.

These services are favored for their simplicity and reliability in delivering information to remote or hard-to-reach locations where two-way communication might not be required or feasible. This segment continues to maintain strong relevance due to its efficiency and lower cost compared to two-way messaging options. Despite the growth in interactive communication technologies, one-way messaging retains prominence for specific use cases such as emergency notifications, weather alerts, and asset tracking.

For Instance, in January 2024, SpaceX’s Starlink successfully sent and received text messages via its Direct to Cell satellites, overcoming major technical challenges to connect unmodified cell phones directly to satellites. This breakthrough demonstrates significant advancement in one-way messaging services that enable communication in remote areas without traditional cell towers.

Device Type Analysis

In 2024, the Dedicated Satellite Messengers segment held a dominant market position, capturing a 39.6% share of the Global Satellite Texting Market. These devices are purpose-built for satellite communication, offering users features specialized for reliable text messaging in remote and unconnected areas. Their dedicated nature ensures consistent functionality without dependency on other devices, making them essential for outdoor enthusiasts, first responders, and professionals working in inaccessible environments.

These devices emphasize portability, durability, and ease of use while delivering a dependable messaging experience even in extreme conditions. Innovation in this segment focuses on improving battery life, connectivity range, and device integration with GPS and other safety features. The substantial share held by dedicated messengers highlights ongoing demand for reliable communication tools specifically designed for satellite networks.

For instance, in June 2025, Iridium Communications launched the Iridium Chat app for its Iridium GO! exec device, providing unlimited global messaging along with compressed image sharing and location updates. This app enhancement supports dedicated satellite messengers and improves communication for off-grid users such as government workers and responders.

Pricing Model Analysis

In 2024, The Pay-As-You-Go segment held a dominant market position, capturing a 49.5% share of the Global Satellite Texting Market. This model appeals to occasional users or those needing satellite texting services without committing to fixed monthly or annual contracts. It allows for cost control and adaptability, especially for users with intermittent communication needs.

This pricing approach is common among individuals and organizations that deploy satellite messaging sporadically or during specific projects and expeditions. It’s nearly half market share underscores the importance of affordability and convenience in driving service adoption. Providers leverage this model to attract a broader customer base by aligning costs directly with actual usage.

For Instance, in November 2024, Globalstar announced a $1.5 billion investment in its C-3 third-generation mobile satellite system, expanding its global MSS capabilities with more satellites and ground stations for improved, cost-effective satellite messaging service. This expansion supports flexible pricing models catering to users needing scalable, usage-based payment options.

End-User Analysis

In 2024, The Government & Public Sector segment held a dominant market position, capturing a 63.7% share of the Global Satellite Texting Market. This reflects the critical importance of satellite communication services for official operations that require secure, reliable messaging in remote or infrastructure-limited environments. Government agencies utilize these services extensively for emergency management, border security, disaster response, and remote area connectivity.

The substantial share underscores how satellite texting is integral to public safety, national security, and regulatory communications. The government’s heavy reliance on satellite texting further encourages ongoing technological advancement and market demand, ensuring steady investment in satellite communication infrastructure.

For Instance, in March 2025, Lynk Global formed a strategic partnership with SES to enhance its direct-to-device satellite messaging network targeting government and mission-critical communications. This collaboration strengthens service offerings, particularly adopted by government users for secure and reliable satellite texting.

Emerging trends

One major trend in satellite texting is the miniaturization of satellite technology, which allows for the deployment of smaller, more cost-effective satellites. This trend supports entry by startups and increases the diversity and competitiveness of messaging services.

The important trend is the integration of satellite texting with Internet of Things (IoT) devices, enabling real-time data exchange and better connectivity in remote or underserved areas, benefiting sectors like agriculture and logistics. Improved global connectivity continues to advance, driven by expanded satellite networks reaching remote regions.

Another emerging focus is on security and resilience, with efforts centered on enhancing encryption and data integrity to protect communications from cyber threats. Collaborative ventures that bring together governments, private companies, and academia also propel innovation, accelerating advancements in satellite texting technologies and applications.

Growth Factors

The growth of satellite texting is fueled by increasing demand for reliable communication in areas lacking cellular services. This demand comes from individuals engaged in outdoor activities and industries operating in remote or hazardous locations. Safety and security concerns also drive adoption, as satellite messaging can deliver emergency alerts and location signals when other methods fail.

Satellite texting services are becoming essential tools for improving safety, enabling quick access to help, and maintaining connections in isolated environments. Technological advancements, increasing investments, and the expansion of satellite networks are other key growth factors.

The rise of two-way communication features, real-time tracking, and weather updates enhances the functionality of satellite texting services, broadening their appeal. Greater adoption of satellite connectivity for IoT and M2M communications further contributes to the expanding satellite texting market.

Key Market Segments

By Service Type

- One-Way Messaging

- Two-Way Messaging

- Integrated Smartphone Services

- Others

By Device Type

- Dedicated Satellite Messengers

- Satellite Adapters & Accessories

- Smartphones with Satellite Connectivity

- Others

By Pricing Model

- Subscription-Based

- Pay-As-You-Go

- Bundled Services

By End-User

- Individual Consumers

- Enterprise & Business

- Government & Public Sector

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing demand for reliable communication in remote areas

The satellite texting market is driven by the increasing need for dependable communication in regions where traditional networks are limited or unavailable. Activities such as outdoor adventures, maritime navigation, and disaster response require constant connectivity for safety and coordination. Users in remote locations rely on satellite texting devices to stay connected when cellular signals are absent, pushing market growth.

Advancements in satellite technology also contribute to growth by improving coverage and device functionality. Low Earth Orbit (LEO) satellites enhance global reach and reduce communication delays, making satellite texting more accessible. Continuous innovation extends battery life and integrates features like GPS, boosting user appeal. These trends create favorable conditions for industry expansion as more sectors recognize the value of satellite texting solutions.

For instance, In January 2024, SpaceX’s Starlink sent and received its first text messages through its new Direct to Cell satellites that connect standard phones directly to space-based signals. This advancement shows rising demand for dependable communication in rural and remote areas where traditional networks are limited. The technology supports smoother satellite handoffs and helps overcome the technical challenges of linking regular phones to satellites.

Restraint

High cost of satellite infrastructure

One significant constraint on the satellite texting market is the high expense associated with developing and maintaining satellite networks. Deploying satellites, especially large constellations in LEO, requires substantial investment in manufacturing, launch services, and ground control infrastructure. These costs create barriers for new entrants and limit competition, constraining market growth by keeping prices higher.

Moreover, operating satellites involves ongoing expenses such as maintenance, upgrades, and regulatory compliance. These financial demands can delay service expansion and increase operating costs for providers, which may be passed on to users. The high upfront and recurring costs in satellite infrastructure can slow adoption in price-sensitive markets, especially developing regions with limited purchasing power.

For instance, in November 2025, Globalstar announced delays in the delivery of new satellites due to setbacks faced by its contractor, pushing planned launches to the following year. This reflects the high costs and complexity involved in satellite infrastructure development, including manufacturing and launch delays that raise overall expenses and affect service rollout timelines. Such costly infrastructure hurdles pose challenges for market growth and competitive pricing.

Opportunities

Expansion into emerging and rural markets

The satellite texting market holds considerable opportunity in underserved areas with poor or no cellular coverage, such as rural and remote regions in emerging economies. These areas often face challenges due to difficult geography or a lack of telecommunications infrastructure. Satellite texting offers a reliable communication alternative, enabling connectivity for residents, businesses, and emergency responders in these locations.

Growing government initiatives aimed at improving digital inclusion also fuel demand. By providing cost-effective satellite texting solutions, companies can serve millions of users who lack reliable communication options. Furthermore, combining satellite texting with technologies like IoT and cloud platforms opens avenues for new applications and services, expanding market potential. Strategic partnerships and localized approaches will be key to capitalizing on this growth segment.

For instance, in November 2025, Lynk Global partnered with Smart Communications to enable satellite SMS services that allow users to send and receive texts even without traditional phone signals. This initiative targets underserved and remote populations, providing an opportunity to extend connectivity to rural and difficult-to-reach areas. The partnership showcases how satellite texting can be expanded into emerging markets to improve communication accessibility.

Challenges

Regulatory complexities and spectrum allocation

The satellite texting market faces challenges related to regulatory environments and spectrum management. Operating satellites requires compliance with international space laws and coordination of radio frequencies to avoid interference. Obtaining regulatory approvals for launch, operation, and spectrum use can be time-consuming and costly for market players.

Spectrum allocation issues are especially critical because satellites rely on limited frequency bands to communicate. Competing demands for spectrum from terrestrial and other satellite services create complexities that may delay new deployments or limit service capabilities. These regulatory hurdles increase operational risks and costs, hindering rapid market expansion and innovation.

For instance, in October 2025, SpaceX reportedly cut off Starlink services to over 2,500 devices used by scam operations in Myanmar, highlighting challenges related to regulatory oversight and misuse prevention. Navigating such regulatory and ethical issues is complex, as providers must balance service availability with legal and social responsibilities. These challenges can impact satellite texting operations and require robust governance frameworks.

Key Players Analysis

The market is influenced by established satellite operators and emerging innovators focused on global messaging coverage. SpaceX, Globalstar, and Iridium strengthen satellite texting capability with wide-area networks that support reliable communication in remote locations. Garmin and ORBCOMM enhance device integration for outdoor, maritime, and enterprise users. Their solutions support safety, tracking, and two-way messaging. Thuraya and SPOT extend regional and global reach through compact devices and service bundles.

Lynk Global and AST SpaceMobile drive new momentum through direct-to-device connectivity. Their platforms target mass-market adoption by enabling satellite texting on standard smartphones. Huawei and Somewear Labs expand hardware and software solutions for emergency alerts and adventure travel. Zoleo improves user convenience with cross-network routing. Bullitt Group develops rugged devices with satellite messaging functions that support field workers and consumers.

The competitive landscape expands as stakeholders invest in low-Earth-orbit networks, hybrid architectures, and advanced antennas. Partnerships with telecom operators improve service availability and user adoption. Defense players, including BAE Systems, strengthen secure communication offerings. Innovation across device design, network resilience, and cross-platform apps supports steady market growth. The presence of diverse vendors keeps the market dynamic and accelerates global connectivity.

Top Key Players in the Market

- SpaceX (Starlink)

- Globalstar

- Iridium Communications

- Garmin

- ORBCOMM

- Thuraya Telecommunications

- SPOT (Globalstar)

- Lynk Global

- AST SpaceMobile

- Huawei

- Somewear Labs

- Zoleo

- Bullitt Group

- BAE Systems

- Others

Recent Developments

- In July 2025, Starlink by SpaceX launched its direct-to-cell satellite texting service in the U.S., allowing text messaging from anywhere using existing 4G LTE mobile devices without requiring specialized hardware. The service supports all major carriers and is priced at $10 per month for some, with free access for defined T-Mobile plans.

- In November 2025, Globalstar announced its ongoing expansion with a contract to launch 26 additional satellites in 2025 to enhance its direct satellite-to-device (D2D) capacity, building upon its 24 low-Earth orbit satellites currently providing satellite connection services. There is ongoing speculation about a potential sale of the company amidst these expansions, reflecting possible strategic shifts.

Report Scope

Report Features Description Market Value (2024) USD 1.62 Bn Forecast Revenue (2034) USD 3.91 Bn CAGR(2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (One-Way Messaging, Two-Way Messaging, Integrated Smartphone Services, Others), By Device Type (Dedicated Satellite Messengers, Satellite Adapters & Accessories, Smartphones with Satellite Connectivity, Others), By Pricing Model (Subscription-Based, Pay-As-You-Go, Bundled Services), By End-User (Individual Consumers, Enterprise & Business, Government & Public Sector) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SpaceX (Starlink), Globalstar, Iridium Communications, Garmin, ORBCOMM, Thuraya Telecommunications, SPOT (Globalstar), Lynk Global, AST SpaceMobile, Huawei, Somewear Labs, Zoleo, Bullitt Group, BAE Systems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SpaceX (Starlink)

- Globalstar

- Iridium Communications

- Garmin

- ORBCOMM

- Thuraya Telecommunications

- SPOT (Globalstar)

- Lynk Global

- AST SpaceMobile

- Huawei

- Somewear Labs

- Zoleo

- Bullitt Group

- BAE Systems

- Others