Global Sanitary Diaphragm Pump Market Size, Share, Growth Analysis By Technology (Air-Operated Double Diaphragm (AODD), Electric Diaphragm Pumps, Metering Diaphragm Pumps, Others), By Actuation Method (Pneumatic, Electric, Mechanical, Hydraulic), By Pump Configuration (Double Diaphragm, Single Diaphragm, Multi Chamber, Cartridge Design), By Flow Rate Range (Medium Flow, Low Flow, High Flow), By End Use Industry (Food & Beverage, Pharmaceutical & Biotechnology, Personal Care & Cosmetics, Household & Industrial Cleaning, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175338

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Technology Analysis

- Actuation Method Analysis

- Pump Configuration Analysis

- Flow Rate Range Analysis

- End Use Industry Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Company Insights

- Recent Developments

- Report Scope

Report Overview

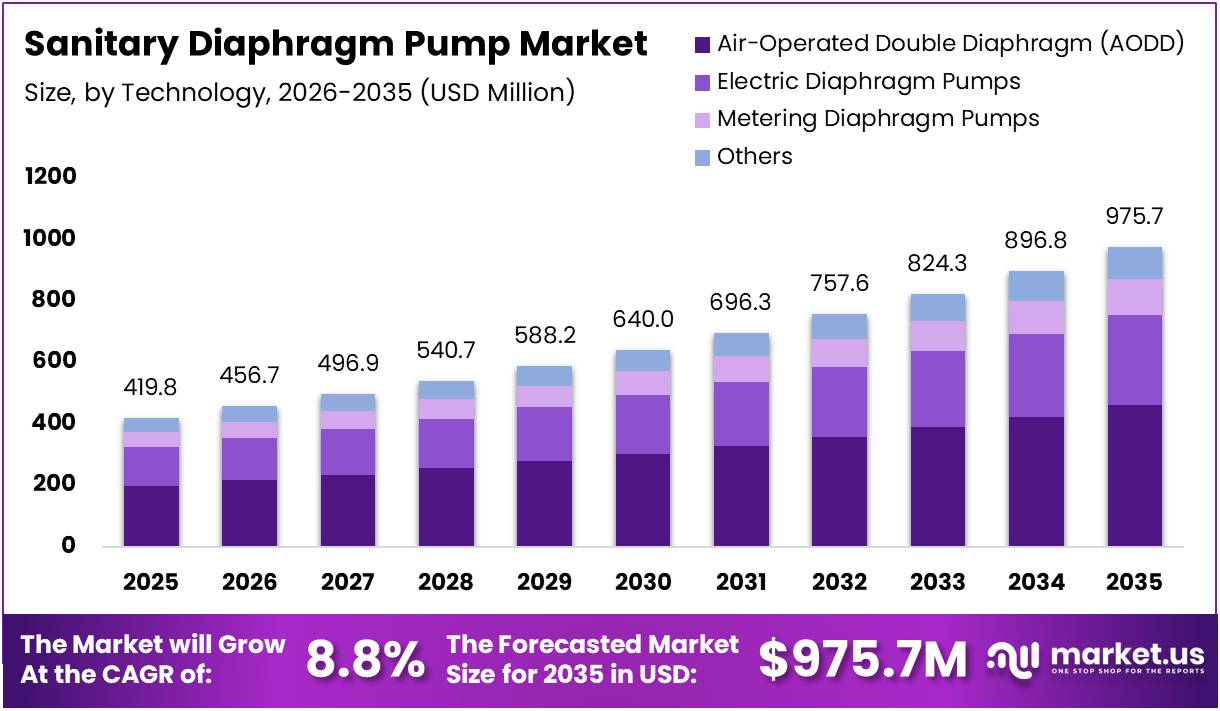

The Global Sanitary Diaphragm Pump Market size is expected to be worth around USD 975.7 Million by 2035 from USD 419.8 Million in 2025, growing at a CAGR of 8.8% during the forecast period 2026 to 2035.

Sanitary diaphragm pumps are specialized positive displacement pumps designed for hygienic fluid transfer in contamination-sensitive industries. These pumps utilize flexible diaphragms to move liquids without direct contact between moving parts and the product. This design ensures sterility and prevents cross-contamination during processing operations.

The market encompasses air-operated, electric, and mechanically driven pump configurations. These systems serve critical applications in pharmaceutical manufacturing, food processing, and biotechnology production. Moreover, they provide gentle handling of sensitive fluids while maintaining strict hygiene standards throughout operation.

Growing regulatory demands for contamination-free processing drive market expansion significantly. Industries increasingly prioritize equipment that meets stringent sanitary standards and validates cleanability. Consequently, manufacturers invest heavily in advanced diaphragm pump technologies that ensure product purity and operational reliability.

Pharmaceutical and biopharmaceutical sectors represent major growth drivers for sanitary diaphragm pumps. These industries require precise, sterile fluid handling for drug formulation and vaccine production. Additionally, rising biologics manufacturing and cell therapy development create substantial demand for hygienic pumping solutions.

Food and beverage processing facilities increasingly adopt sanitary diaphragm pumps for product transfer. These pumps handle viscous products, dairy ingredients, and beverage concentrates without compromising quality. Therefore, dairy processors and beverage manufacturers prioritize investments in hygienic equipment upgrades.

According to Tapflo, sanitary diaphragm pumps are designed to support high-throughput hygienic processes, with most models operating in the 500-950 l/min range depending on pump size and operating conditions. Standard 3-inch sanitary configurations can achieve peak flow rates approaching 900-980 l/min. Furthermore, standard stainless steel bodies can withstand temperatures up to 110°C (230°F), while plastic housing variants typically limit operation to 70°C-100°C.

Diaphragm pumps demonstrate high efficiency with the right parts and maintenance protocols. The diaphragm pump’s design naturally provides operational advantages in hygienic applications. Subsequently, industries recognize these efficiency benefits when selecting equipment for sanitary fluid transfer operations.

Key Takeaways

- Global Sanitary Diaphragm Pump Market valued at USD 419.8 Million in 2025, projected to reach USD 975.7 Million by 2035

- Market expected to grow at a CAGR of 8.8% during the forecast period 2026-2035

- Air-Operated Double Diaphragm (AODD) segment holds 47.2% market share in technology segment

- Pneumatic actuation method dominates with 49.1% market share

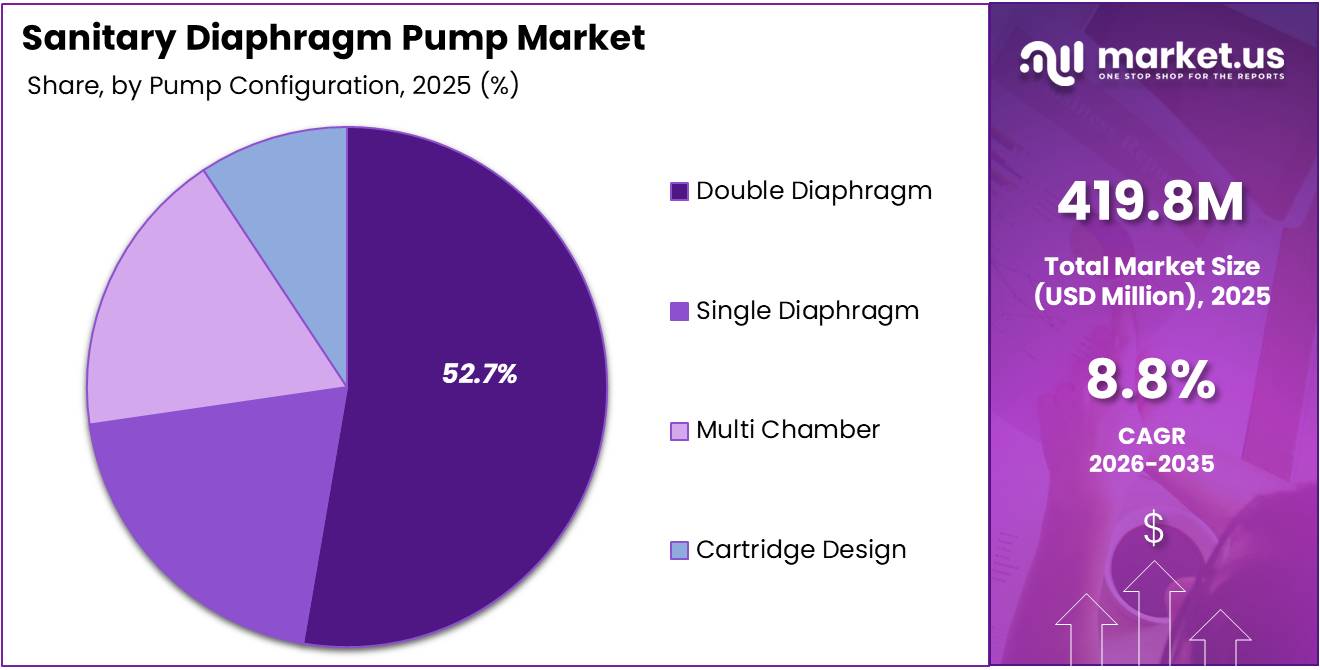

- Double Diaphragm pump configuration leads with 52.7% market share

- Medium Flow range segment accounts for 46.5% of the market

- Food & Beverage industry represents 38.1% of end-use applications

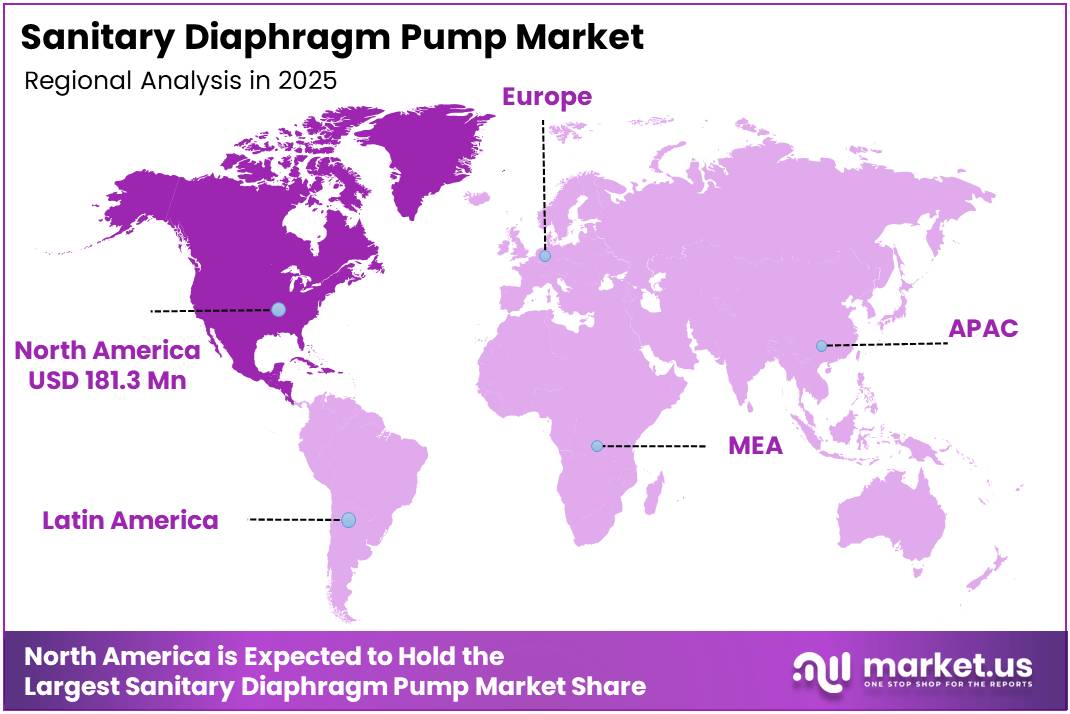

- North America dominates with 43.20% market share, valued at USD 181.3 Million

Technology Analysis

Air-Operated Double Diaphragm (AODD) dominates with 47.2% due to operational simplicity and intrinsic safety in hazardous environments.

In 2025, Air-Operated Double Diaphragm (AODD) held a dominant market position in the By Technology segment of Sanitary Diaphragm Pump Market, with a 47.2% share. These pumps operate without electricity, eliminating spark risks in volatile processing areas. Moreover, their self-priming capability and ability to run dry without damage make them ideal for sanitary applications requiring frequent cleaning cycles.

Electric Diaphragm Pumps offer precise flow control and energy efficiency for automated hygienic processes. These systems integrate seamlessly with modern manufacturing execution systems for real-time monitoring. Additionally, electric variants provide consistent performance in cleanroom environments where compressed air availability is limited or contamination concerns exist.

Metering Diaphragm Pumps deliver accurate dosing capabilities essential for pharmaceutical formulation and chemical injection applications. These precision pumps ensure reproducible fluid transfer with minimal pulsation or variation. Consequently, industries requiring exact ingredient proportioning and regulatory compliance increasingly adopt metering diaphragm technologies.

Others include hydraulic and specialized diaphragm pump technologies serving niche sanitary applications. These variants address specific processing challenges in biotechnology and specialty chemical manufacturing. Therefore, customized pump solutions continue expanding market diversity beyond conventional technology categories.

Actuation Method Analysis

Pneumatic actuation dominates with 49.1% due to inherent safety, explosion-proof operation, and reliability in hygienic environments.

In 2025, Pneumatic held a dominant market position in the By Actuation Method segment of Sanitary Diaphragm Pump Market, with a 49.1% share. Pneumatic pumps operate using compressed air, eliminating electrical components that could compromise sanitary conditions. Furthermore, these systems provide variable flow control through simple air pressure adjustments without complex electronic controls.

Electric actuation methods provide precise speed control and integration with automated process systems in pharmaceutical facilities. These pumps offer energy efficiency and programmable operation for validated manufacturing protocols. Moreover, electric actuation eliminates compressed air requirements, reducing operational costs in facilities with limited pneumatic infrastructure.

Mechanical actuation employs direct drive mechanisms for consistent, reliable pumping in continuous processing operations. These systems deliver predictable performance with minimal maintenance requirements in food production environments. Additionally, mechanical actuation provides robust operation in applications requiring steady flow rates without sophisticated control systems.

Hydraulic actuation serves specialized high-pressure sanitary applications requiring precise force transmission and control. These pumps handle demanding processing conditions in pharmaceutical manufacturing and biotechnology production. Consequently, hydraulic variants address specific operational requirements where pneumatic and electric methods prove insufficient.

Pump Configuration Analysis

Double Diaphragm configuration dominates with 52.7% due to balanced operation, self-priming capability, and superior flow characteristics.

In 2025, Double Diaphragm held a dominant market position in the By Pump Configuration segment of Sanitary Diaphragm Pump Market, with a 52.7% share. This configuration utilizes two diaphragms operating in synchronized reciprocating motion for continuous fluid transfer. Moreover, the alternating chamber design minimizes pulsation and maintains steady flow in sanitary processing applications.

Single Diaphragm pumps offer simplified construction and lower initial investment for smaller-scale hygienic operations. These systems provide adequate performance for intermittent dosing and low-flow sanitary applications. Additionally, single diaphragm designs reduce maintenance complexity in facilities with limited technical resources or space constraints.

Multi Chamber configurations deliver enhanced flow smoothing and reduced pulsation for sensitive product handling requirements. These advanced designs incorporate multiple diaphragms working in coordinated sequences for superior performance. Consequently, pharmaceutical manufacturers increasingly specify multi-chamber pumps for critical sterile fluid transfer operations.

Cartridge Design pumps feature modular construction enabling rapid changeover and simplified cleaning validation in biopharmaceutical facilities. These innovative configurations support single-use processing strategies and minimize cross-contamination risks. Therefore, contract manufacturing organizations increasingly adopt cartridge designs for flexible, multi-product processing environments.

Flow Rate Range Analysis

Medium Flow dominates with 46.5% due to versatility across diverse sanitary processing applications and production scales.

In 2025, Medium Flow held a dominant market position in the By Flow Rate Range segment of Sanitary Diaphragm Pump Market, with a 46.5% share. Medium flow pumps typically operate between 100-500 liters per minute, addressing mainstream food, beverage, and pharmaceutical production requirements. Moreover, this range provides optimal balance between throughput capacity and gentle product handling characteristics.

Low Flow pumps serve precision dosing, sampling, and small-batch pharmaceutical manufacturing applications requiring careful product control. These systems deliver flow rates below 100 liters per minute with exceptional accuracy and repeatability. Additionally, low flow configurations support laboratory-scale operations and specialty chemical processing where product conservation is critical.

High Flow pumps address large-scale production facilities requiring rapid product transfer and high-volume processing capabilities. These systems exceed 500 liters per minute, supporting industrial dairy processing and bulk beverage manufacturing operations. Consequently, major food processors invest in high-flow sanitary diaphragm pumps for maximizing production efficiency while maintaining hygiene standards.

End Use Industry Analysis

Food & Beverage dominates with 38.1% due to stringent hygiene requirements and diverse product handling needs.

In 2025, Food & Beverage held a dominant market position in the By End Use Industry segment of Sanitary Diaphragm Pump Market, with a 38.1% share. This industry requires gentle handling of temperature-sensitive ingredients, viscous products, and particulate-laden fluids without compromising quality. Moreover, frequent cleaning cycles and strict regulatory compliance drive demand for sanitary diaphragm pump technologies.

Pharmaceutical & Biotechnology sectors prioritize contamination-free fluid transfer for drug formulation, vaccine production, and cell therapy manufacturing. These industries demand validated equipment meeting FDA and EMA guidelines for sterile processing. Additionally, growing biologics manufacturing and personalized medicine development create substantial opportunities for sanitary pumping solutions.

Personal Care & Cosmetics manufacturers require hygienic transfer of creams, lotions, and viscous formulations maintaining product integrity and consistency. These applications demand gentle pumping without phase separation or ingredient degradation. Consequently, premium cosmetics producers increasingly invest in sanitary diaphragm pumps for quality assurance.

Household & Industrial Cleaning industries utilize sanitary pumps for detergent formulation, surfactant blending, and chemical processing operations. These applications require chemical-resistant materials and reliable performance under demanding conditions. Others include water treatment, chemical processing, and specialty manufacturing sectors requiring hygienic fluid handling capabilities.

Key Market Segments

By Technology

- Air-Operated Double Diaphragm (AODD)

- Electric Diaphragm Pumps

- Metering Diaphragm Pumps

- Others

By Actuation Method

- Pneumatic

- Electric

- Mechanical

- Hydraulic

By Pump Configuration

- Double Diaphragm

- Single Diaphragm

- Multi Chamber

- Cartridge Design

By Flow Rate Range

- Medium Flow

- Low Flow

- High Flow

By End Use Industry

- Food & Beverage

- Pharmaceutical & Biotechnology

- Personal Care & Cosmetics

- Household & Industrial Cleaning

- Others

Drivers

Escalating Hygienic Process Compliance Requirements Drive Market Expansion

Regulatory agencies worldwide enforce increasingly stringent sanitary standards for food, beverage, and pharmaceutical manufacturing operations. These compliance requirements mandate contamination-free fluid transfer systems meeting EHEDG, 3-A, and FDA guidelines. Moreover, manufacturers face substantial penalties for hygiene violations, driving investment in certified sanitary pumping equipment.

Biopharmaceutical production facilities require validated contamination-free fluid transfer systems for maintaining product purity and patient safety. Rising adoption of single-use technologies and closed processing systems creates demand for specialized sanitary pumping solutions. Additionally, contract manufacturing organizations prioritize flexible equipment supporting multiple products without cross-contamination risks.

Industries handling sensitive and viscous media increasingly demand gentle, low-shear pumping technologies preserving product integrity and characteristics. Sanitary diaphragm pumps provide ideal solutions for transferring cell cultures, suspensions, and shear-sensitive formulations. Consequently, biotechnology and specialty chemical sectors expand adoption of diaphragm pumping technologies for critical processing applications.

Restraints

Performance Limitations and Maintenance Requirements Constrain Market Growth

Sanitary diaphragm pumps demonstrate performance constraints in high-pressure and continuous high-flow industrial applications requiring sustained operation. These pumps typically operate effectively up to moderate pressure ranges, limiting suitability for certain demanding processing conditions. Moreover, alternative pump technologies often provide superior performance for applications exceeding diaphragm pump operational capabilities.

Diaphragm components experience wear during normal operation, requiring periodic replacement to maintain pump performance and hygiene standards. Frequent diaphragm failures cause operational interruptions, production downtime, and increased maintenance costs for manufacturing facilities. Additionally, replacement procedures require skilled technicians and careful validation to ensure continued compliance with sanitary processing requirements.

Industries seeking uninterrupted processing operations face challenges with diaphragm pump maintenance schedules and component lifecycle limitations. These operational considerations influence equipment selection decisions favoring alternative pumping technologies in critical applications. Consequently, manufacturers must balance sanitary diaphragm pump benefits against maintenance frequency and operational reliability requirements.

Growth Factors

Expanding Biopharmaceutical Manufacturing Infrastructure Accelerates Market Development

Rapid scale-up of biologics, vaccines, and cell-based therapy manufacturing infrastructure creates substantial demand for hygienic pumping solutions. Global health initiatives and pandemic preparedness programs drive investment in vaccine production capacity worldwide. Moreover, personalized medicine advancement requires flexible manufacturing systems supporting diverse product portfolios with stringent contamination control.

Dairy and beverage processing facilities increasingly invest in hygienic process upgrades meeting modern food safety standards and consumer expectations. Aging infrastructure replacement and capacity expansion projects prioritize equipment meeting current sanitary design principles. Additionally, craft beverage producers and specialty food manufacturers adopt professional-grade sanitary pumping systems for quality assurance.

Contract manufacturing organizations require flexible sterile fluid handling systems supporting rapid changeover between different products and formulations. These facilities serve pharmaceutical, biotechnology, and specialty chemical clients demanding validated hygienic processing capabilities. Consequently, CMOs invest in versatile sanitary diaphragm pumps accommodating diverse client requirements while maintaining stringent contamination control standards.

Emerging Trends

Advanced Materials and Smart Technologies Transform Sanitary Pumping Systems

Integration of advanced elastomer materials significantly improves chemical resistance and durability in demanding sanitary processing environments. New diaphragm compounds withstand aggressive cleaning agents, extreme temperatures, and challenging process fluids more effectively. Moreover, enhanced material performance extends component lifecycle, reducing maintenance frequency and operational interruptions for manufacturers.

Compact, modular pump designs address space constraints in cleanroom environments and pharmaceutical manufacturing facilities requiring optimized layouts. Manufacturers develop lightweight, footprint-reduced pumps maintaining performance while enabling flexible installation configurations. Additionally, modular construction facilitates rapid maintenance, component replacement, and cleaning validation in regulated production environments.

Adoption of smart monitoring features enables predictive maintenance strategies, reducing unexpected failures and optimizing operational efficiency in hygienic pumping systems. Integrated sensors track diaphragm condition, cycle counts, and performance parameters for data-driven maintenance planning. Consequently, manufacturers leverage IoT connectivity and analytics for maximizing equipment uptime while ensuring continuous compliance with sanitary processing requirements.

Regional Analysis

North America Dominates the Sanitary Diaphragm Pump Market with a Market Share of 43.20%, Valued at USD 181.3 Million

North America leads the sanitary diaphragm pump market due to extensive pharmaceutical manufacturing infrastructure and stringent regulatory compliance requirements. The region hosts major biopharmaceutical companies, food processors, and beverage manufacturers prioritizing hygienic equipment investments. Moreover, FDA enforcement of Current Good Manufacturing Practices drives continuous equipment upgrades and modernization initiatives across sanitary processing industries.

Europe Sanitary Diaphragm Pump Market Trends

Europe demonstrates strong market growth driven by established pharmaceutical industry, dairy processing tradition, and rigorous EHEDG sanitary design standards. Countries like Germany, France, and Switzerland host major pharmaceutical manufacturers and food processing facilities. Additionally, European regulations mandate comprehensive equipment validation and cleaning verification, supporting sanitary diaphragm pump adoption.

Asia Pacific Sanitary Diaphragm Pump Market Trends

Asia Pacific represents the fastest-growing regional market with expanding pharmaceutical manufacturing capacity and rising food safety awareness. China and India attract substantial biopharmaceutical investment, building modern production facilities requiring hygienic processing equipment. Furthermore, growing middle-class populations drive demand for quality food and beverage products, necessitating sanitary processing infrastructure.

Latin America Sanitary Diaphragm Pump Market Trends

Latin America shows moderate growth with increasing pharmaceutical manufacturing and food processing industry modernization efforts. Brazil and Mexico lead regional development with growing domestic pharmaceutical production and beverage manufacturing sectors. Moreover, improving regulatory frameworks and quality standards gradually drive adoption of international-standard sanitary equipment.

Middle East & Africa Sanitary Diaphragm Pump Market Trends

Middle East and Africa demonstrate emerging market potential with growing pharmaceutical sector investment and food processing industry development. GCC countries invest heavily in healthcare infrastructure and local pharmaceutical manufacturing capabilities. Additionally, South Africa maintains established food and beverage processing industries adopting modern sanitary equipment standards.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

PSG operates as a leading global manufacturer of pumping solutions, offering comprehensive sanitary diaphragm pump portfolios serving pharmaceutical, food, and chemical industries. The company maintains strong market presence through diverse brands and extensive distribution networks across major manufacturing regions. Moreover, PSG continuously invests in product innovation and technical support services, strengthening customer relationships and market positioning in hygienic fluid handling applications.

Graco delivers advanced fluid handling equipment including sanitary diaphragm pumps for demanding industrial and hygienic processing applications worldwide. The company leverages extensive engineering expertise and manufacturing capabilities to develop innovative pumping solutions meeting evolving customer requirements. Additionally, Graco’s established reputation for quality and reliability supports strong market penetration in pharmaceutical manufacturing and food processing sectors.

Verderair specializes in air-operated double diaphragm pump technologies, providing hygienic solutions for pharmaceutical, biotechnology, and specialty chemical applications. The company focuses on delivering reliable, efficient pumping systems with minimal maintenance requirements and exceptional chemical compatibility. Furthermore, Verderair’s technical expertise in AODD technology enables customized solutions addressing specific customer challenges in sanitary fluid transfer operations.

Ingersoll Rand (ARO) manufactures comprehensive ranges of pneumatic diaphragm pumps serving diverse industrial and sanitary processing markets globally. The company combines proven pump technologies with responsive customer support and aftermarket services supporting operational efficiency. Consequently, ARO maintains significant market share through established distribution channels and reputation for dependable performance in critical pumping applications.

Key Players

- PSG

- Graco

- Verderair

- Ingersoll Rand (ARO)

- Yamada

- Tapflo

- Bürkert

- Alfa Laval

- AxFlow

- Sani-Matic

Recent Developments

- June 2025 – PSG acquired ipp Pump Products GmbH, a leading manufacturer of high-performance rotary lobe pumps and other processing equipment for hygienic and industrial applications. This strategic acquisition expands PSG’s product portfolio in sanitary processing solutions, strengthening its competitive position in pharmaceutical and food processing markets while enhancing technological capabilities for hygienic fluid handling systems.

Report Scope

Report Features Description Market Value (2025) USD 419.8 Million Forecast Revenue (2035) USD 975.7 Million CAGR (2026-2035) 8.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Air-Operated Double Diaphragm (AODD), Electric Diaphragm Pumps, Metering Diaphragm Pumps, Others), By Actuation Method (Pneumatic, Electric, Mechanical, Hydraulic), By Pump Configuration (Double Diaphragm, Single Diaphragm, Multi Chamber, Cartridge Design), By Flow Rate Range (Medium Flow, Low Flow, High Flow), By End Use Industry (Food & Beverage, Pharmaceutical & Biotechnology, Personal Care & Cosmetics, Household & Industrial Cleaning, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape PSG, Graco, Verderair, Ingersoll Rand (ARO), Yamada, Tapflo, Bürkert, Alfa Laval, AxFlow, Sani-Matic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sanitary Diaphragm Pump MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Sanitary Diaphragm Pump MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- PSG

- Graco

- Verderair

- Ingersoll Rand (ARO)

- Yamada

- Tapflo

- Bürkert

- Alfa Laval

- AxFlow

- Sani-Matic