Global Salon Services Market Size, Share, Growth Analysis By Service Type (Hair Care, Nail Care, Skin Care), By Salon Type (Franchise Outlets, Independent Salons), By End-user (Women, Men), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172916

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

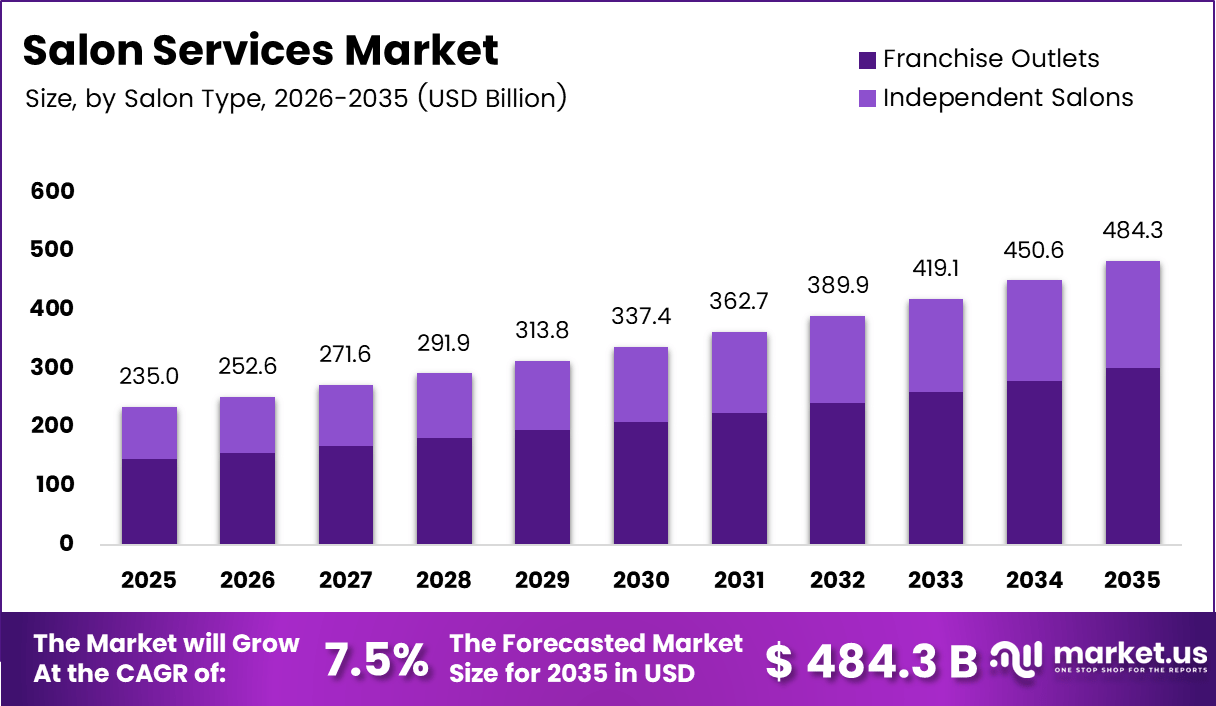

The Global Salon Services Market size is expected to be worth around USD 484.3 billion by 2035, from USD 235.0 billion in 2025, growing at a CAGR of 7.5% during the forecast period from 2026 to 2035.

The Salon Services Market refers to professional beauty and organic personal care services delivered through organized and independent salons. These services include hair, skin, nail, and wellness treatments designed for appearance enhancement and self care. From a market research perspective, this market connects consumer lifestyle spending with service driven recurring revenue models across urban and semi urban regions.

salon services operate as experience based businesses rather than product led enterprises. Consequently, repeat visits, personalization, and service consistency directly influence revenue stability. Moreover, rising awareness around grooming, wellness, and self expression continues strengthening demand across gender and age groups, supporting long term market resilience.

Growth in the Salon Services Market remains closely linked to changing consumer behavior and income patterns. As disposable incomes improve, consumers increasingly prioritize professional services over home alternatives. Additionally, the rise of working professionals and urban lifestyles supports frequent salon visits, while premium and specialized services help operators improve average ticket values.

Opportunities within the market emerge from technology adoption and service innovation. Digital booking platforms, CRM systems, and membership programs improve customer retention and operational efficiency. Furthermore, expansion into tier two and tier three cities creates new demand pockets, while wellness focused services open cross selling opportunities within existing salon footprints.

Government involvement indirectly supports market expansion through entrepreneurship programs, skill development initiatives, and MSME financing schemes. Regulatory frameworks emphasize hygiene, safety standards, and professional licensing, which improves consumer trust. As a result, organized salons gain credibility, while compliance driven structures encourage long term investment and formal market growth.

According to industry survey, services contribute nearly 92% of a salon’s income, highlighting the revenue dominance of service offerings over retail sales. Furthermore, studies show average salon profit margins around 8.2%, exceding the general business average of 7.7%, according to small business performance reports, indicating healthy operational viability.

However, profitability varies widely across operators. Research indicates some salons earn margins as low as 2%, while top performers achieve up to 17%. Industry experts note that achieving 10% or higher margins remains feasible through overhead control, pricing optimization, and targeted local marketing strategies rather than aggressive expansion.

Loyalty programs represent a high impact growth lever within the Salon Services Market. According studies, salons recover approximately 56% to 77% of loyalty program investments within one year. Consequently, structured rewards, prepaid packages, and subscription services enhance cash flow predictability while strengthening long term customer relationships.

Key Takeaways

- The Global Salon Services Market is projected to reach USD 484.3 billion by 2035, expanding from USD 235.0 billion in 2025 at a CAGR of 7.5%.

- By service type, Hair Care is the leading segment, accounting for a dominant share of 49.2% of total market demand.

- By salon type, Franchise Outlets represent the largest segment with a market share of 62.1%, reflecting organized market growth.

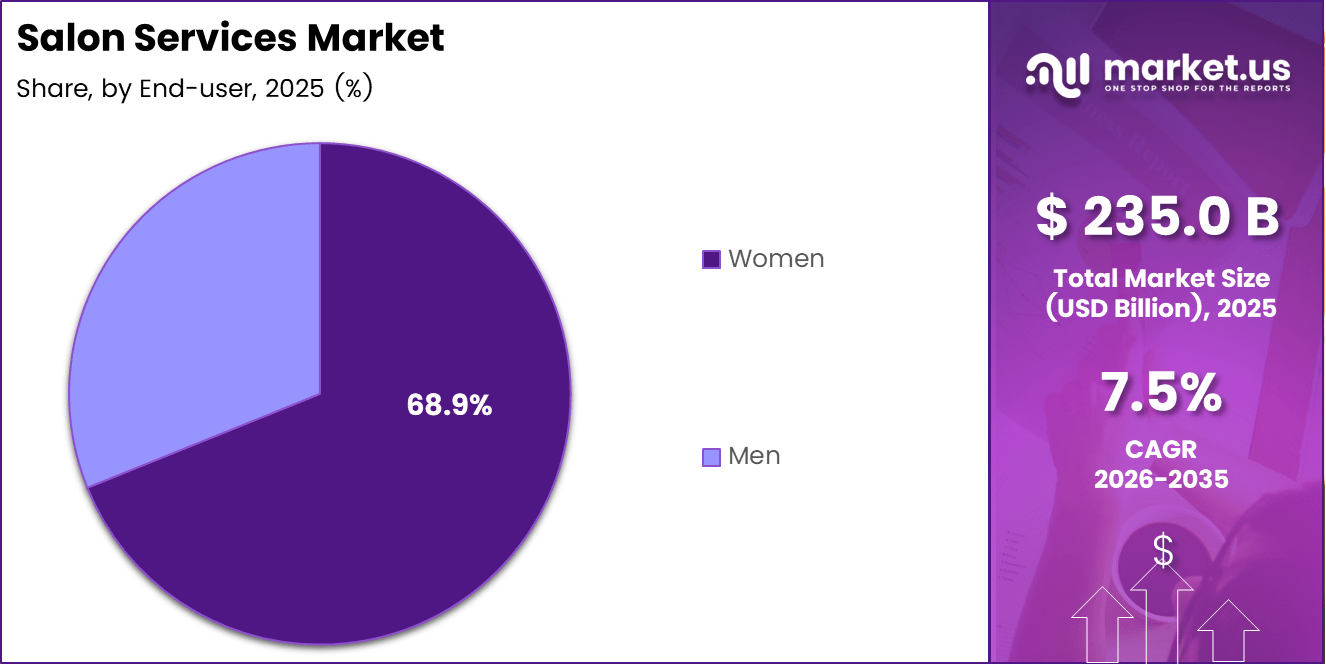

- By end user, Women dominate the Salon Services Market, contributing 68.9% of overall consumption.

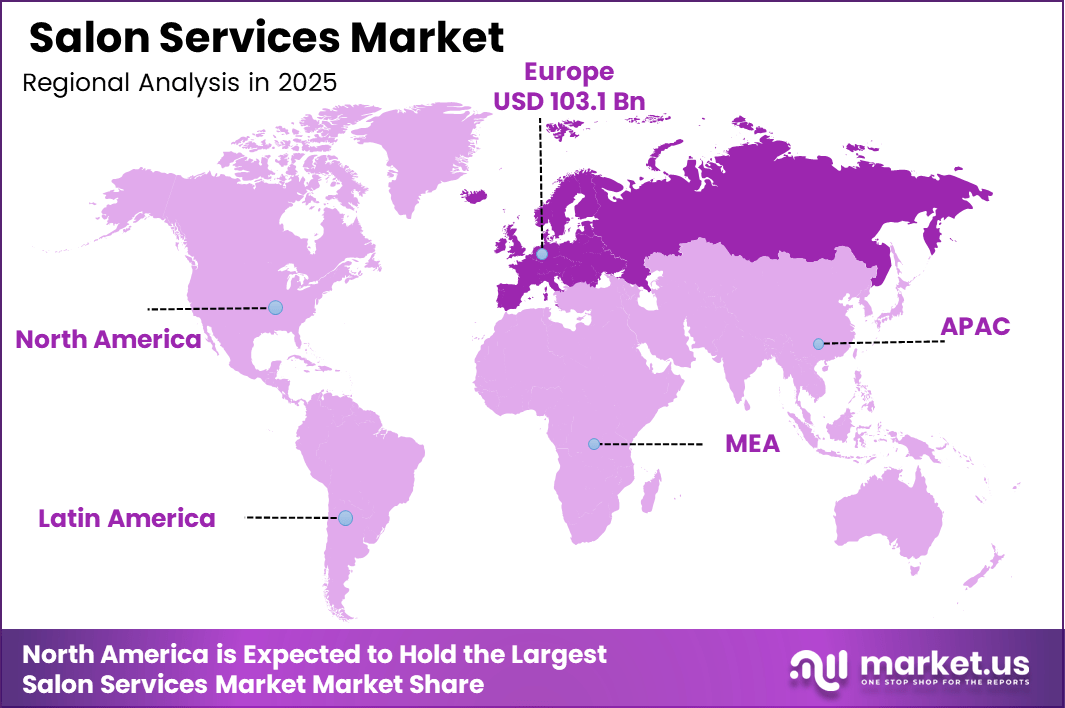

- By region, Europe leads the global market with a 43.9% share, valued at USD 103.1 billion.

By Service Type Analysis

Hair Care dominates with 49.2% due to its high service frequency and consistent consumer demand.

In 2025, Hair Care held a dominant market position in the By Service Type Analysis segment of the Salon Services Market, with a 49.2% share. Hair related services remain essential across demographics, driven by regular grooming needs and style maintenance. Consequently, repeat visits and bundled treatments support steady revenue generation for salons.

Nail Care maintained a stable position within the By Service Type Analysis segment of the Salon Services Market. Nail care services benefit from growing interest in personal aesthetics and seasonal fashion trends. Moreover, express treatments and add on services improve customer retention while supporting incremental revenue growth for service providers.

Skin Care continued expanding within the By Service Type Analysis segment of the Salon Services Market. Skin focused services gain traction from rising awareness around wellness and preventive care. Additionally, customized facials and non invasive treatments enhance perceived value, encouraging consumers to opt for professional salon solutions.

By Salon Type Analysis

Franchise Outlets dominate with 62.1% due to standardized operations and strong brand trust.

In 2025, Franchise Outlets held a dominant market position in the By Salon Type Analysis segment of the Salon Services Market, with a 62.1% share. Franchised salons benefit from structured processes, centralized marketing, and consistent service quality. As a result, they attract repeat customers and investor interest across urban locations.

Independent Salons retained relevance within the By Salon Type Analysis segment of the Salon Services Market. These salons emphasize personalized services and local customer relationships. Furthermore, flexible pricing and creative offerings allow independent operators to compete effectively in niche and community driven markets.

By End-user Analysis

Women dominate with 68.9% driven by higher service adoption and broader treatment preferences.

In 2025, Women held a dominant market position in the By End-user Analysis segment of the Salon Services Market, with a 68.9% share. Female consumers engage more frequently across hair, skin, and nail services. Consequently, recurring visits and premium treatments significantly contribute to overall market revenue.

In 2025, Men represented a growing segment within the By End-user Analysis segment of the Salon Services Market. Men grooming services as lifestyle norms evolve. Moreover, demand for specialized hair and beard services supports gradual expansion of male focused salon offerings.

Key Market Segments

By Service Type

- Hair Care

- Nail Care

- Skin Care

By Salon Type

- Franchise Outlets

- Independent Salons

By End-user

- Women

- Men

Drivers

Rising Consumer Spending on Personal Grooming and Wellness Experiences Drives Market Growth

Rising consumer spending on personal grooming and wellness continues driving the Salon Services Market forward. Consumers increasingly view salon visits as part of regular self care rather than occasional luxury. As a result, consistent demand supports stable revenue generation for service providers across urban and semi urban areas.

Moreover, a growing preference for professional treatments over at home solutions strengthens market expansion. Consumers trust trained professionals for quality results, safety, and personalized care. Consequently, salons benefit from higher visit frequency and increased spending per appointment across multiple service categories.

Increasing urbanization also supports higher salon density and footfall. Expanding cities create concentrated consumer bases with busy lifestyles that favor convenient professional services. Additionally, premium and specialized offerings help salons differentiate, improve margins, and attract customers seeking advanced or customized treatments.

Restraints

High Operational Costs Related to Skilled Labor and Rental Spaces Limit Market Expansion

High operational costs remain a major restraint in the Salon Services Market. Skilled labor demands competitive wages, while urban rental spaces significantly increase fixed expenses. As a result, profitability pressures persist, especially for small and independent salon operators.

Workforce shortages and high stylist attrition rates further challenge service continuity. Frequent staff turnover increases training costs and disrupts customer relationships. Consequently, salons struggle to maintain consistent service quality and long term client loyalty.

Additionally, price sensitivity during economic slowdowns affects discretionary spending. Regulatory compliance related to hygiene and safety also adds cost burdens. While necessary, these requirements increase operational complexity, particularly for smaller salons with limited financial flexibility.

Growth Factors

Expansion of Subscription Based and Membership Salon Service Models Creates New Opportunities

Subscription based and membership models present strong growth opportunities in the Salon Services Market. These models improve revenue predictability while encouraging repeat visits. As a result, salons benefit from improved cash flow and stronger customer retention.

Rising demand for organic, vegan, and clean beauty treatments also opens new revenue streams. Consumers increasingly prioritize health conscious and sustainable options. Consequently, salons that adopt clean beauty services gain differentiation and attract premium focused clientele.

Untapped potential in tier two and tier three cities further supports expansion. Growing urban migration and rising disposable incomes in these regions create demand for organized salon services, offering long term growth prospects beyond saturated metro markets.

Emerging Trends

Rising Popularity of Gender Neutral and Inclusive Salon Services Shapes Market Trends

Gender neutral and inclusive services increasingly influence salon service offerings. Consumers seek welcoming environments that cater to diverse identities and preferences. As a result, salons adapt service menus and branding to reflect inclusivity and broader appeal.

The growth of express and quick service formats also reshapes the market. Busy consumers prefer time efficient treatments without compromising quality. Consequently, salons introduce shorter service options to increase customer throughput and accessibility.

Additionally, collaborations with beauty product brands and adoption of digital consultations gain momentum. AI driven style recommendations and virtual consultations improve personalization, enhance customer engagement, and modernize the overall salon service experience.

Regional Analysis

Europe Dominates the Salon Services Market with a Market Share of 43.9%, Valued at USD 103.1 Billion

Europe held the leading position in the Salon Services Market, accounting for a dominant 43.9% share, with the market valued at USD 103.1 billion. High consumer spending on grooming, strong presence of organized salons, and well established beauty culture continue supporting market leadership across major European countries.

Additionally, stringent hygiene regulations and high service quality expectations strengthen consumer trust. Premium and wellness focused salon services further enhance revenue potential, while consistent urban demand supports stable footfall across metropolitan and semi urban locations.

North America Salon Services Market Trends

North America represents a mature and stable market for salon services. High awareness of personal grooming, regular service adoption, and strong preference for professional treatments support steady demand. Technology driven booking systems and loyalty programs also enhance customer retention across the region.

Moreover, rising interest in wellness oriented services and premium experiences continues shaping service offerings. Urban concentration and high disposable income levels further contribute to consistent market performance across major cities.

Asia Pacific Salon Services Market Trends

Asia Pacific shows strong growth momentum in the Salon Services Market due to rapid urbanization and expanding middle class populations. Increasing exposure to global beauty trends drives demand for professional grooming services across urban centers.

Furthermore, rising disposable incomes and growing youth populations support frequent salon visits. Organized salon formats continue expanding, particularly in tier two and tier three cities, enhancing regional market potential.

Middle East and Africa Salon Services Market Trends

The Middle East and Africa region demonstrates gradual growth supported by increasing beauty awareness and urban lifestyle adoption. Demand remains concentrated in metropolitan areas, driven by rising disposable incomes and social grooming trends.

Additionally, premium grooming services and wellness focused treatments gain traction, while improving retail infrastructure supports the gradual expansion of organized salon services across select markets.

Latin America Salon Services Market Trends

Latin America continues to exhibit steady demand for salon services, supported by strong beauty consciousness and cultural emphasis on personal appearance. Urban consumers increasingly prefer professional grooming over at home solutions.

Moreover, improving economic stability and growing young populations encourage regular salon visits. Expansion of organized salons and affordable service formats further supports regional market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Salon Services Company Insights

The global Salon Services Market in 2025 reflects a shift toward scale, consistency, and experience driven service delivery. Leading players focus on operational efficiency, brand trust, and repeat customer models to sustain growth. The following companies illustrate how structured strategies and service specialization shape competitive positioning.

Great Clips, Inc. continues to strengthen its market position through a high volume, standardized service model focused on accessibility and convenience. Its emphasis on operational simplicity and efficient throughput supports strong unit economics. As a result, the brand remains well positioned to capture repeat driven demand across diverse geographies.

Regis Corporation maintains relevance by operating across multiple salon formats that address varying consumer price points and preferences. Portfolio diversification allows the company to balance mass market services with higher value offerings. Consequently, this structure supports resilience against demand fluctuations while enabling localized market responsiveness.

Dessange International differentiates itself through premium positioning and strong alignment with luxury beauty and fashion sensibilities. The brand’s focus on high end hair and beauty experiences supports higher average service values. Moreover, its emphasis on professional expertise reinforces brand credibility within the premium salon segment.

Ulta Beauty, Inc. benefits from integrating salon services within a broader beauty ecosystem. This model encourages cross engagement between services and product discovery, enhancing customer lifetime value. As a result, its salon operations act as both a revenue driver and a strategic engagement channel within the overall business model.

Overall, these players demonstrate how scale, brand clarity, and service integration shape leadership in the Salon Services Market. Their strategies highlight the importance of operational discipline, customer experience, and repeat driven revenue in sustaining long term competitive advantage.

Top Key Players in the Market

- Great Clips, Inc.

- Regis Corporation

- Dessange International

- Ulta Beauty, Inc.

- The Lounge Hair Salon

- Drybar

- The Leading Salons of the World, LLC.

- Snip-its

Recent Developments

- In December 2024, Salon Republic completed the acquisition of Mosaic Salons + Spas in Seattle, Washington, strengthening its footprint in the Pacific Northwest and accelerating its strategic expansion across the West Coast, while reinforcing its company-owned salon studio platform.

- In April 2025, Modern Beauty Supplies announced the acquisition of ESP Salon Sales, enhancing its national distribution capabilities and deepening support for salon professionals across Canada, building on its recognition as a Canada’s Best Managed Companies Gold Standard winner.

Report Scope

Report Features Description Market Value (2025) USD 235.0 billion Forecast Revenue (2035) USD 484.3 billion CAGR (2026-2035) 7.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Hair Care, Nail Care, Skin Care), By Salon Type (Franchise Outlets, Independent Salons), By End-user (Women, Men) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Great Clips, Inc., Regis Corporation, Dessange International, Ulta Beauty, Inc., The Lounge Hair Salon, Drybar, The Leading Salons of the World, LLC., Snip-its Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Great Clips, Inc.

- Regis Corporation

- Dessange International

- Ulta Beauty, Inc.

- The Lounge Hair Salon

- Drybar

- The Leading Salons of the World, LLC.

- Snip-its