RT-PCR Kits Market By Kit Type (Quantitative and Digital), By Application (Infectious diseases testing, Oncology testing, Human genetic testing, Blood screening, Forensic applications and Others), By End-User (Hospitals and diagnostic centres, Stand-alone diagnostic laboratories, Research laboratories, and Pharmaceutical & biotechnology companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167229

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

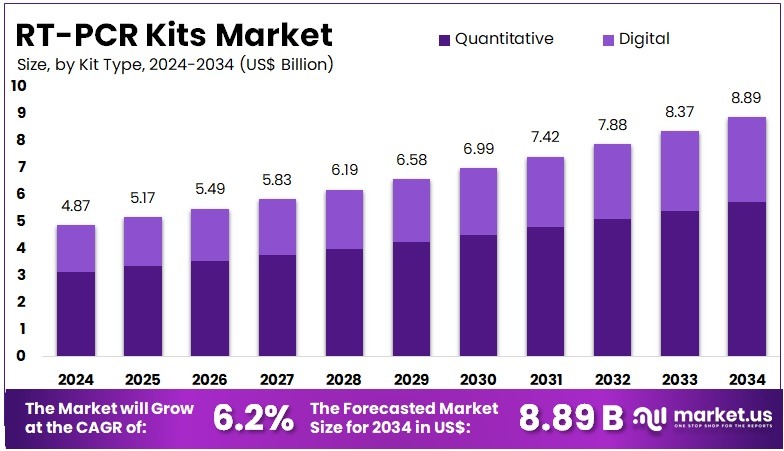

The RT-PCR Kits Market Size is expected to be worth around US$ 8.89 billion by 2034 from US$ 4.87 billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.20% share and holds US$ 2.01 Billion market value for the year.

The RT-PCR Kits Market represents a core segment of molecular diagnostics, driven by the growing need for sensitive and rapid detection of RNA-based pathogens and genetic markers. Reverse transcription polymerase chain reaction (RT-PCR) enables the conversion of RNA into complementary DNA followed by amplification, allowing laboratories, hospitals, and research facilities to identify viral loads, gene expression patterns, and mutation profiles with high precision.

The market expanded significantly during recent global health emergencies, as RT-PCR became the primary diagnostic method for detecting respiratory viruses. Manufacturers such as Thermo Fisher Scientific and Roche advanced high-throughput kits that supported large-scale screening programs in public and private laboratories.

Beyond infectious disease testing, RT-PCR kits are increasingly used in oncology for detecting cancer-related mutations, such as BCR-ABL in leukemia or KRAS mutations in colorectal cancer. Genetic testing applications also continue to rise, supported by expanding research activity in gene expression studies, pharmacogenomics, and personalized medicine. For example, research institutions use RT-PCR kits to quantify mRNA levels in targeted therapies development. The market benefits from ongoing improvements in kit sensitivity, automation, and multiplexing, which allow simultaneous detection of multiple targets in a single reaction.

In August 2024, Cipla Limited announced the commercial launch of its ‘RT-Direct’ multiplex COVID-19 RT-PCR test kit in India, developed in collaboration with Genes2Me Pvt. Ltd. The introduction of this product strengthens Cipla’s diagnostics portfolio by adding more advanced and innovative testing solutions. Cipla has taken on the responsibility for distributing the RT-Direct kits across India and has already begun supplying them to the market.

Key Takeaways

- In 2024, the market generated a revenue of US$ 87 billion, with a CAGR of 6.2%, and is expected to reach US$ 8.89 billion by the year 2034.

- The Kit Type segment is divided into Quantitative, and Digital, with Quantitative taking the lead in 2024 with a market share of 64.7%.

- The Application segment is divided into Infectious diseases testing, Oncology testing, Human genetic testing, Blood screening, Forensic applications, and Others, with Infectious diseases testing taking the lead in 2024 with a market share of 42.3%

- The End-User segment is divided into Hospitals and diagnostic centres, Stand-alone diagnostic laboratories, Research laboratories, and Pharmaceutical & biotechnology companies, with Hospitals and diagnostic centres taking the lead in 2024 with a market share of 48.3%.

- North America led the market by securing a market share of 41.20% in 2024.

Kit Type Analysis

Quantitative RT-PCR kits dominated the market with 64.7% market share due to their ability to simultaneously detect and quantify nucleic acids with high sensitivity. These kits are widely used in infectious disease testing, oncology diagnostics, viral load monitoring, and genetic research. Hospitals and national laboratories rely on them for accurate quantification of viral RNA — such as influenza, RSV, and other respiratory pathogens — enabling clinicians to track disease progression and treatment response.

Quantitative RT-PCR remains the standard for applications where viral load or gene-expression measurement is crucial. For example, oncology laboratories use qRT-PCR to quantify gene mutations such as BCR-ABL in leukemia or HER2 mRNA in breast cancer. Their wide compatibility with automated systems, high reproducibility, and strong regulatory backing support continued market dominance. In November 2023, Roche introduced the LightCycler PRO system, a next-generation qPCR/RT-PCR platform designed to enhance precision, workflow automation, and clinical applicability in molecular diagnostics.

Digital RT-PCR kits are gaining traction as demand increases for ultra-sensitive detection of low-abundance targets, rare mutations, and minimal residual disease (MRD). Unlike quantitative kits, digital PCR partitions samples into thousands of micro-droplets, enabling absolute quantification with higher precision.

Application Analysis

Infectious diseases testing represents the largest application segment accounting for 42.3% market share in 2024. RT-PCR is essential for detecting RNA viruses such as influenza, SARS-CoV-2, dengue, Zika, and hepatitis C, due to its unmatched sensitivity and specificity. Public health agencies depend on RT-PCR kits to support national surveillance programs, travel screening, and outbreak investigations. For example, many global reference laboratories adopted multiplex RT-PCR kits capable of detecting multiple respiratory pathogens in a single assay to improve turnaround time and resource efficiency.

RT-PCR also plays a pivotal role in cancer diagnostics by identifying gene mutations, gene fusions, and expression signatures. It supports targeted therapy selection, minimal residual disease monitoring, and tumor profiling.

Molecular labs routinely use RT-PCR to detect oncogenic drivers such as KRAS, EGFR, or BCR-ABL, supporting personalized treatment strategies. As companion diagnostics advance, oncology-focused RT-PCR applications continue to expand. In June 2021, Thermo Fisher Scientific released its CE-IVD-marked TaqPath COVID-19 2.0 RT-PCR test, designed with improved mutation resilience to ensure reliable detection across evolving viral variants.

End-User

Hospitals and diagnostic centres represent the largest end-user segment with 48.3% market share in 2024 due to their high test volumes and the clinical necessity of RT-PCR for infectious disease detection and oncology diagnostics. Emergency departments, ICU units, and infectious disease departments depend heavily on rapid RT-PCR for patient triaging, isolation decisions, and treatment planning.

Stand-alone and reference laboratories conduct high-throughput RT-PCR testing for nationwide screening, travel testing, corporate health programs, and specialized molecular panels. These laboratories often use automated, high-capacity RT-PCR systems to manage large sample flows efficiently.

Research institutions use RT-PCR kits extensively for gene-expression profiling, biomarker validation, CRISPR gene-editing verification, and experimental virology. Universities and R&D centers rely on RT-PCR as a cornerstone technique for molecular biology research and translational science projects.

Key Market Segments

By Kit Type

- Quantitative

- Digital

By Application

- Infectious diseases testing

- Oncology testing

- Human genetic testing

- Blood screening

- Forensic applications

- Others

By End-User

- Hospitals and diagnostic centres

- Stand-alone diagnostic laboratories

- Research laboratories

- Pharmaceutical & biotechnology companie

Drivers

Growing demand for rapid and accurate diagnostics

The increasing incidence of infectious diseases (including emerging viruses) and the growing requirement for fast, precise diagnostic results are major growth drivers for the RT-PCR kits market. For example, in 2022 the World Cancer Research Fund International estimated 19.9 billion new cancer cases globally, which influences demand for molecular diagnostic tools including RT-PCR kits for gene-specific diagnosis. In infectious disease testing, the ability of RT-PCR to convert RNA to complementary DNA and amplify target sequences enables early detection of pathogens and supports outbreak surveillance.

The COVID-19 pandemic has underscored this: RT-PCR became the gold standard for SARS-CoV-2 detection, driving kit adoption and infrastructure expansion. This rapid detection capacity, combined with rising awareness of molecular diagnostics and supportive public health initiatives, provides a strong momentum for the RT-PCR kits market. In October 2022, Roche Diagnostics received FDA clearance for its cobas SARS-CoV-2 qualitative RT-PCR test, strengthening clinical testing capabilities for COVID-19 across US hospitals and laboratories.

Restraints

Issues of sensitivity, false results and high cost

A major restraint in the RT-PCR kits market is the issue of analytical sensitivity. Low sensitivity can reduce test accuracy. It also increases the risk of false positives and false negatives. These errors often occur when complementary DNA synthesis is poor or when the target base pairs are limited. Such factors can weaken diagnostic reliability. The higher cost of RT-PCR kits in resource-limited settings further adds to the challenge. As a result, these limitations can slow overall market growth.

For example, if viral RNA load is low or sample collection is sub-optimal, RT-PCR results may yield false negatives. Moreover, sophisticated reagents, thermal-cycling instrumentation and consumables add cost, which may limit adoption in smaller laboratories or emerging markets. Some end-users may revert to simpler, cheaper methods (e.g., antigen tests) despite lower accuracy. The requirement for trained personnel, strict quality control and regulatory compliance also raises operational burden. Together, these constraints dampen the rate of adoption and expansion of RT-PCR kit volumes, especially in low-income regions or non-centralised settings.

Opportunities

Expansion into multiplex assays and emerging markets

An important opportunity for the RT-PCR kits market is the development of multiplex RT-PCR assays (detecting multiple targets in one run) and the growth in emerging-market adoption as healthcare infrastructure improves. For instance, a report on one-step RT-PCR kits states that advancements in multiplex RT-PCR testing allow detection of several pathogens within a single test and that “expansion of healthcare infrastructure in emerging markets like Asia Pacific, Latin America & Africa.

Multiplexing reduces cost per target, increases throughput and improves laboratory efficiency. Meanwhile, emerging markets are increasing diagnostic investment, building laboratory networks and adopting molecular diagnostics. These twin dynamics offer manufacturers of RT-PCR kits significant opportunity to broaden applications (e.g., infectious disease panels, oncology, gene expression), expand into new geographies and upgrade product portfolios.

For instance, in April 2022, during the 32nd European Congress of Clinical Microbiology & Infectious Diseases, Bruker Corporation announced new enhancements to its market-leading MALDI Biotyper® (MBT) platform and introduced a series of multiplex PCR infectious disease assays powered by its proprietary LiquidArray® technology.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the RT-PCR Kits Market by shaping consumer spending, supply chain stability, and access to diagnostic materials. Periods of economic slowdown typically shift household spending toward essential healthcare, which benefits at-home testing because it offers a lower-cost alternative to clinical diagnostics. However, inflation-driven increases in raw material and logistics costs can raise kit prices, affecting affordability in price-sensitive markets.

Geopolitical tensions also impact the sourcing of assay components, microfluidic cartridges, reagents, and lateral-flow materials, which are often manufactured across multiple countries. Disruptions in global trade routes or restrictions on chemical exports may slow production timelines and limit inventory availability for online and retail channels.

Public health policy changes in response to geopolitical events further influence demand. For example, global energy and food supply uncertainties increase consumer awareness of immunity, fatigue, and nutritional well-being, contributing to higher self-monitoring behavior. Shifts in labor markets, such as the rise of remote work, encourage more people to adopt home diagnostics rather than visiting clinics. At the same time, increased government scrutiny over cross-border data transfers and digital health privacy may affect how testing companies store and process user data.

Latest Trends

Shift toward decentralised and point-of-care RT-PCR testing

A key trend affecting the RT-PCR kits market is the move from central laboratories toward decentralised, near-patient or point-of-care (POC) molecular diagnostics. In this context, RT-PCR kits designed for rapid turnaround, portable instruments, simplified workflows and smaller sample sizes are gaining traction. This decentralisation enables hospitals, clinics or even mobile units to conduct molecular testing on-site rather than routing samples to central labs, thereby shortening time to result and improving patient management.

Furthermore, technological enhancements such as microfluidic cartridges, ready-to-use reagents and automated platforms support this trend. As healthcare systems emphasise faster diagnostics (especially in infectious disease outbreaks or remote settings), RT-PCR kits aligned with decentralised testing offer a compelling direction for growth.

Regional Analysis

North America is leading the RT-PCR Kits Market

North America is the largest region in the RT-PCR Kits Market with accounting for 41.2% market share due to its advanced healthcare infrastructure, extensive laboratory networks, and strong adoption of molecular diagnostics across clinical and research settings. The region benefits from high testing volumes in infectious diseases, oncology, and genetic screening, supported by federal agencies such as the CDC and FDA that routinely endorse RT-PCR as the preferred diagnostic method for RNA-based pathogen detection.

Hospitals and diagnostic chains in the US conduct large-scale RT-PCR testing for influenza, RSV, HIV, and emerging respiratory viruses, driving continuous kit consumption. Major manufacturers such as Thermo Fisher Scientific, Abbott, and Bio-Rad operate extensive production and distribution networks within the region, ensuring consistent supply and rapid kit innovation. The region’s biopharmaceutical ecosystem further accelerates demand, as RT-PCR is essential for gene-expression studies, biomarker validation, and therapeutic development. Strong research funding from NIH-backed institutions reinforces North America’s dominant position.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the RT-PCR Kits Market, driven by expanding healthcare investments, rising incidence of viral infections, and rapid adoption of molecular diagnostics in developing economies. Countries such as China, India, South Korea, and Japan are increasing laboratory capacity and integrating RT-PCR into national disease surveillance programs.

For example, public health laboratories across Southeast Asia use RT-PCR for dengue, Zika, and influenza monitoring, significantly increasing routine test volumes. Growing cancer incidence in China and Japan also accelerates oncology-focused RT-PCR assays for KRAS, EGFR, and BCR-ABL mutation analysis. The region’s biopharma expansion stimulates demand as biotechnology firms rely on RT-PCR for research, quality control, and clinical trials. Increasing availability of cost-efficient kits from regional manufacturers further boosts adoption in hospitals and reference labs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Thermo Fisher Scientific, QIAGEN, Merck KGaA, Takara Bio Inc., Promega Corporation, altona Diagnostics GmbH, Zymo Research Corporation, Roche Diagnostics, Bio-Rad Laboratories, Agilent Technologies, Abbott Laboratories, Seegene Inc., and Others.

Thermo Fisher Scientific, QIAGEN, and Merck KGaA are among the most influential players shaping the global RT-PCR Kits Market through advanced assay development, automated workflows, and extensive molecular biology portfolios. Thermo Fisher Scientific leads the market with its TaqPath RT-PCR kits, high-throughput QuantStudio platforms, and broad reagent ecosystem used in infectious disease diagnostics, oncology mutation detection, and gene-expression studies. Its kits are widely deployed in public health laboratories and pharmaceutical R&D pipelines due to strong regulatory approvals and global distribution.

QIAGEN contributes significantly through its widely adopted QIAamp sample-prep technologies and QuantiTect/NeuMoDx RT-PCR kits, which support centralized testing laboratories and decentralized settings requiring rapid results. The company’s strong presence in molecular workflows—from nucleic acid extraction to data analysis—positions it as a core RT-PCR solutions provider.

Merck KGaA strengthens the market through its high-quality reagents, enzyme master mixes, and optimized RT-PCR consumables used extensively in academic research, biopharmaceutical development, and advanced molecular assay manufacturing.

Top Key Players in the RT-PCR Kits Market

- Thermo Fisher Scientific

- QIAGEN

- Merck KGaA

- Takara Bio Inc.

- Promega Corporation

- altona Diagnostics GmbH

- Zymo Research Corporation

- Roche Diagnostics

- Bio-Rad Laboratories

- Agilent Technologies

- Abbott Laboratories

- Seegene Inc.

- Others

Recent Developments

- In April 2025: QIAGEN launched the QIAprep amp Plasmodium kit, combining rapid sample prep and PCR amplification to strengthen malaria detection and field-level surveillance programs.

- In March 2022: Roche and TIB Molbiol launched new RT-PCR assays capable of detecting and differentiating Omicron and other SARS-CoV-2 sub-variants, supporting global genomic surveillance efforts.

- In September 2024: QIAGEN launched the QIAcuityDx digital PCR system for clinical oncology, enabling highly sensitive detection of rare mutations and low-abundance biomarkers in cancer diagnostics.

Report Scope

Report Features Description Market Value (2024) US$ 4.87 billion Forecast Revenue (2034) US$ 8.89 billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Kit Type (Quantitative and Digital), By Application (Infectious diseases testing, Oncology testing, Human genetic testing, Blood screening, Forensic applications and Others), By End-User (Hospitals and diagnostic centres, Stand-alone diagnostic laboratories, Research laboratories, and Pharmaceutical & biotechnology companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, QIAGEN, Merck KGaA, Takara Bio Inc., Promega Corporation, altona Diagnostics GmbH, Zymo Research Corporation, Roche Diagnostics, Bio-Rad Laboratories, Agilent Technologies, Abbott Laboratories, Seegene Inc., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific

- QIAGEN

- Merck KGaA

- Takara Bio Inc.

- Promega Corporation

- altona Diagnostics GmbH

- Zymo Research Corporation

- Roche Diagnostics

- Bio-Rad Laboratories

- Agilent Technologies

- Abbott Laboratories

- Seegene Inc.

- Others