Global Robot Mission Replay Tools Market By Component (Platform, Services (Professional Services, Managed Services)), By Deployment (On-Premises, Cloud-based), By Application (Industrial Automation, Defense & Security, Research & Education, Healthcare, Logistics & Warehousing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170551

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

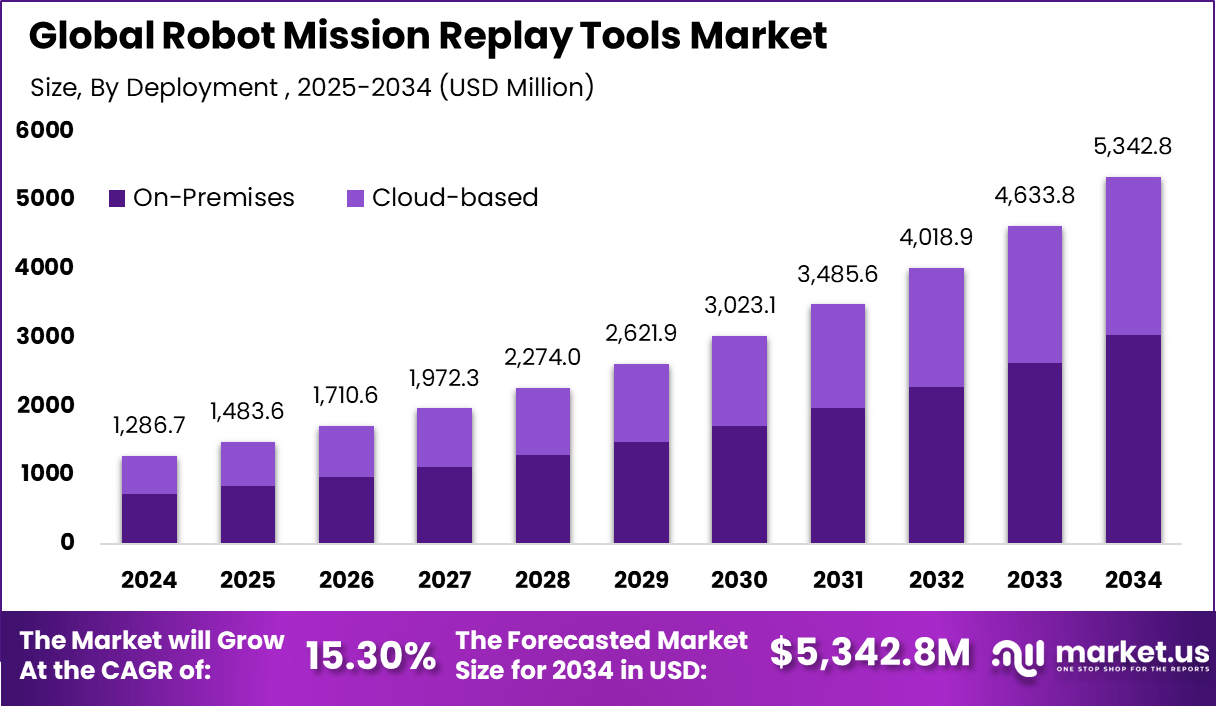

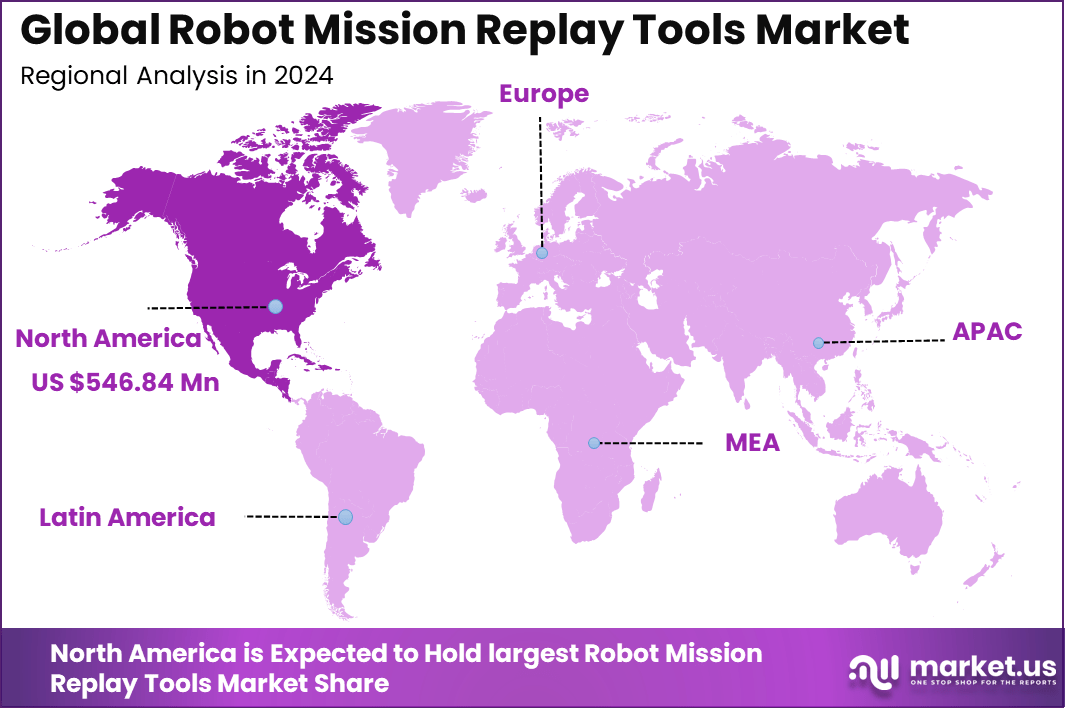

The Global Robot Mission Replay Tools Market generated USD 1,286.7 million in 2024 and is predicted to register growth from USD 1,483.6 million in 2025 to about USD 5,342.8 million by 2034, recording a CAGR of 15.30% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.5% share, holding USD 546.84 Million revenue.

The robot mission replay tools market focuses on software solutions that record, replay, and analyze robot missions and task executions. These tools capture detailed operational data such as robot movements, sensor inputs, decision paths, and environmental conditions during a mission. Replay tools are used to review completed tasks, identify errors, optimize workflows, and support training and validation.

This market plays a crucial role in improving transparency and traceability of robotic operations. Mission replay tools allow operators and engineers to visually review how a robot performed a task and why specific actions were taken. This is especially important in complex or autonomous environments where real time monitoring alone is not sufficient. Replay capabilities support incident investigation, compliance audits, and continuous improvement programs.

Growth is driven by the increasing use of autonomous and semi autonomous robots in dynamic environments. As robots handle more complex tasks, the need for diagnostic and validation tools has increased. Safety regulations and quality standards also require detailed logs and proof of correct operation. Rising deployment of robots in shared human environments has further increased the need for post mission review.

Operational data reports indicate that automated facilities using replay tools reduce repeat errors by nearly 30%. Demand for robot mission replay tools is increasing among manufacturers, warehouse operators, system integrators, and research institutions. Logistics and warehouse automation is a major demand area due to high task repetition and continuous optimization needs. Demand is also strong in autonomous robotics development, where replay is essential for testing and algorithm improvement.

Top Market Takeaways

- By component, platform software captured 67.3% of the robot mission replay tools market, providing core functionality for recording, analyzing, and replaying robotic trajectories to optimize mission planning and error debugging.

- By deployment, on-premises solutions accounted for 56.8%, favored by industries requiring data sovereignty, low-latency replay, and integration with existing industrial control systems.

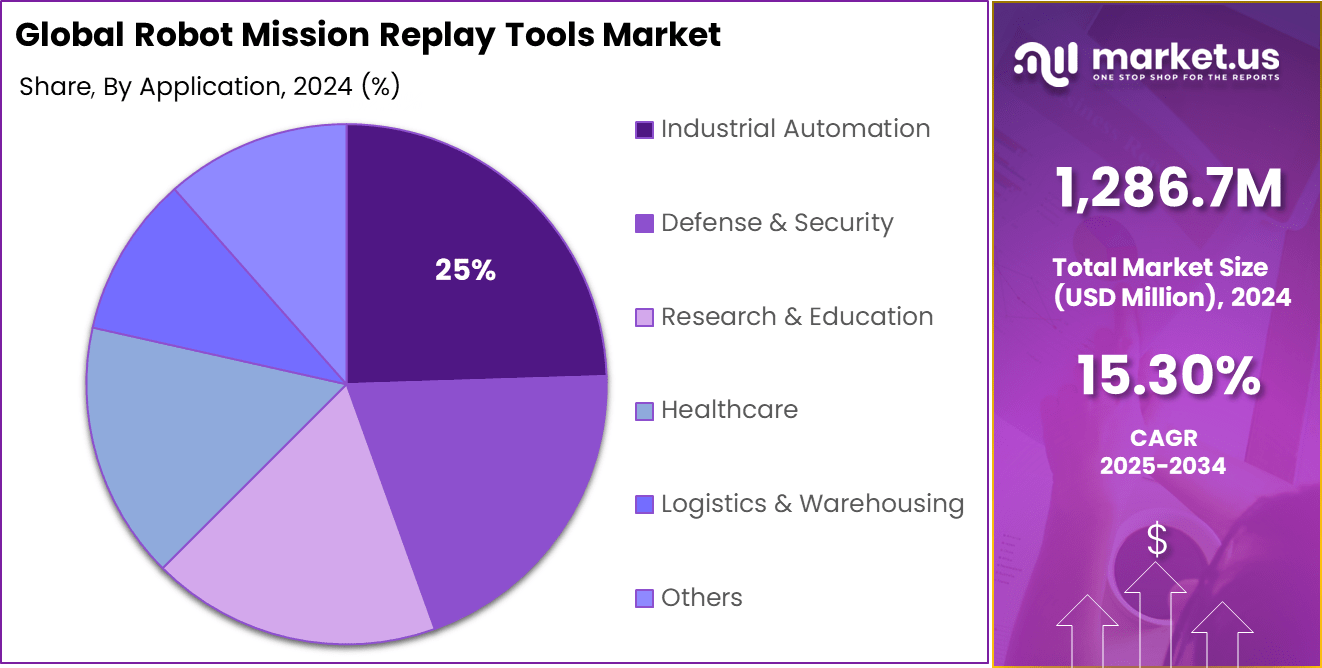

- By application, industrial automation represented 24.5%, driven by needs for mission validation, process refinement, and predictive simulation in manufacturing and assembly lines.

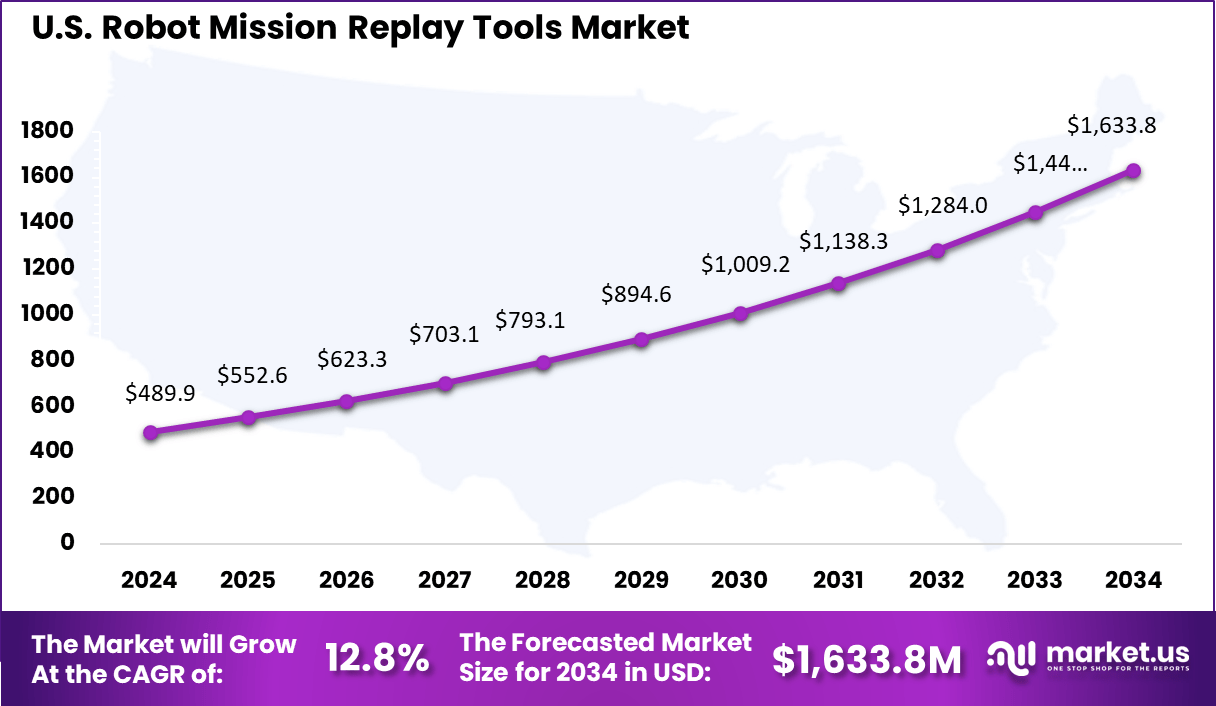

- North America held 42.5% of the global market, with the U.S. valued at USD 489.9 million in 2025 and projected to grow at a CAGR of 12.8% supported by advanced robotics R&D and factory digitalization.

Component Analysis

The platform or software segment accounts for 67.3% of the Robot Mission Replay Tools market, reflecting its central role in robot operation analysis and optimization. These software platforms are used to record, replay, and analyze robot missions across different environments. The dominance of software is driven by its ability to provide detailed visibility into robot behavior, task execution, sensor performance, and error patterns.

Software platforms are preferred because they can be updated regularly, scaled across fleets, and integrated with existing robotic control systems without changing physical hardware. From an operational perspective, platform software supports faster debugging, performance benchmarking, and continuous improvement of robotic missions.

It allows engineers and operators to simulate past missions, identify inefficiencies, and adjust algorithms with higher accuracy. The strong share of this segment is also supported by rising adoption of data-driven robotics, where software analytics plays a key role in reducing downtime and improving mission success rates. As robotic systems become more complex, reliance on robust mission replay software continues to increase across industries.

Deployment Analysis

The on-premises deployment segment holds 56.8% of the market, indicating a clear preference for local control over robotic mission data. On-premises solutions are widely adopted in environments where data security, system reliability, and low-latency access are critical. Many industrial and mission-critical users prefer to store and process robot mission data within their own infrastructure to avoid external network dependencies and potential data exposure.

On-premises deployment also allows organizations to customize replay tools based on specific operational requirements. This is especially important in facilities with strict compliance rules or sensitive production data. Local deployment ensures uninterrupted access to mission logs and replay functions even in environments with limited internet connectivity. The strong share of this segment reflects continued demand from manufacturers and automation operators who prioritize system stability and direct control over their robotic assets.

Application Analysis

Industrial automation represents 24.5% of the application segment, making it a key use case for robot mission replay tools. In automated factories and production lines, replay tools are used to analyze robot movements, task timing, and interaction with machines and materials. This helps in identifying production bottlenecks, reducing cycle time, and improving overall equipment efficiency.

Industrial users rely on replay data to maintain consistent output quality and reduce downtime. The adoption in industrial automation is further supported by the increasing use of collaborative robots and autonomous mobile robots on factory floors.

Mission replay tools allow operators to review past incidents, safety events, and process deviations in a controlled manner. As factories move toward higher levels of automation and smart manufacturing practices, the use of mission replay tools becomes essential for maintaining reliability and optimizing robotic workflows.

Key reasons for adoption

- Mission repeatability is improved, so the same task can be run again with the same path, timing, and logic across shifts and sites.

- Ramp up time is reduced because proven missions can be cloned and adjusted instead of being built from scratch each time.

- Operational risk is lowered by capturing known safe motions and validated sequences, which supports safer changes and faster troubleshooting.

- Process standardization becomes easier across mixed robot fleets and different facilities, helping quality teams keep outcomes consistent.

- Skills gaps are handled better, as replay workflows let non expert operators run and adapt missions with less reliance on advanced programming.

Benefits of Users

- Cycle consistency is strengthened because motion variations can be minimized, supporting more stable output quality.

- Downtime can be reduced since faults can be reproduced quickly and root causes can be isolated using the same recorded mission conditions.

- Engineering workload is optimized, as teams reuse mission libraries and focus on improvements instead of repeating setup work.

- Change management is improved through version control, approvals, and rollback options that keep production stable during updates.

- Training becomes simpler because operators learn by running validated missions, supported by clear steps and repeatable outcomes.

Usage

- Replaying industrial automation tasks such as pick and place, machine tending, and inspection where consistency matters.

- Capturing and replaying mobile robot routes in warehouses for repeatable transport missions and safer traffic patterns.

- Validating process changes by running a recorded baseline mission, then comparing performance after tuning or layout updates.

- Supporting incident analysis by reproducing a mission sequence to understand where timing, sensing, or interactions failed.

- Building mission libraries for new sites so deployment teams can reuse proven workflows and adapt them to local constraints.

Emerging Trends

Key Trend Description AI Finds Errors Fast AI reviews mission replays to quickly detect mistakes and improve robot movement paths. VR See Missions Again Virtual reality allows teams to walk through past robot missions as if present on site. Cloud Share Replays Mission replay data is stored online so teams can review tasks from any location. Train Robots from Past Successful mission runs are reused to train new robots with proven movement patterns. Live Compare Real Time Past replays are shown beside live operations to identify issues as they occur. Growth Factor

Key Factors Description More Robots in Plants Manufacturing sites deploy more robots, increasing the need for mission review after tasks. Cut Down Crash Fixes Replay analysis helps explain failures, reducing damage and repair effort. Train Workers Easy New employees learn faster by watching real robot mission replays instead of manuals. Rules Want Proof Safety regulations require stored robot mission records for audits and compliance. Robot Teams Grow Big Larger robot fleets require replay tools to coordinate and optimize joint operations. Key Market Segments

By Component

- Platform

- Services

- Professional Services

- Managed Services

By Deployment

- On-Premises

- Cloud-based

By Application

- Industrial Automation

- Defense & Security

- Research & Education

- Healthcare

- Logistics & Warehousing

- Others

Regional Analysis

North America held 42.5% share, supported by early and wide deployment of industrial robots in automotive, electronics, logistics, and process industries. Higher use of collaborative robots and mobile robots has increased the need to capture, replay, and standardize missions across multiple sites.

Demand has also been strengthened by stricter safety and quality expectations, where repeatable robot behavior, audit trails, and faster incident review are required. As multi shift operations expand, mission replay tools have been adopted to reduce downtime, simplify operator training, and ensure consistent task execution even when production lines are reconfigured.

The U.S. market reached USD 489.9 Mn and is projected at a 12.8% CAGR, reflecting stronger spending on factory automation, warehouse robotics, and robotics software platforms. Adoption has been driven by the need to shorten commissioning time, lower integration cost, and improve reliability when robots move between facilities or production cells.

Use cases have been concentrated in high throughput warehouses, advanced manufacturing, and mixed model production, where mission replay supports faster changeovers and more stable performance. Growth has also been supported by rising focus on remote monitoring, diagnostics, and compliance reporting, which increases the value of replayable mission data for troubleshooting and continuous improvement.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunities & Threats

The Robot Mission Replay Tools market presents strong opportunities as industries continue to move toward higher levels of automation and repeatable robotic operations. The growing use of robots in manufacturing, logistics, and inspection is increasing the need for tools that can record, analyze, and replay missions with high accuracy.

These tools support faster training of robots, reduce programming time, and improve consistency in task execution. Demand is also supported by the rising focus on productivity improvement and error reduction, where mission replay helps identify performance gaps and optimize workflows. As more companies adopt flexible production models, the value of reusable and scalable robot missions is expected to increase.

Despite positive growth prospects, the market faces several threats that may slow adoption in certain regions. High initial costs related to software integration, system customization, and skilled workforce requirements remain a concern for small and mid sized companies.

In some industries, limited awareness about the long term benefits of mission replay tools leads to delayed investment decisions. Cybersecurity risks related to stored mission data and remote access also create hesitation, especially in critical infrastructure and defense related applications.

Competitive Analysis

The competitive landscape for robot mission replay tools is shaped by large automation groups and robot makers that can bundle replay, diagnostics, and optimization features directly into robot controllers, PLC systems, and factory software stacks.

ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Siemens AG, Rockwell Automation, Omron Corporation, Mitsubishi Electric Corporation, Schneider Electric, Honeywell International Inc., and Bosch Rexroth AG are positioned strongly because mission replay can be integrated with industrial controls, SCADA, MES, digital twins, and safety systems, which improves traceability and speeds up root cause analysis.

In parallel, robot OEMs and specialists such as Universal Robots, Staubli International AG, Denso Corporation, Epson Robots, Kawasaki Robotics, and Comau S.p.A. compete by embedding replay features into robot programming environments, service tools, and remote support workflows, which helps reduce downtime and makes maintenance more repeatable across sites.

Top Key Players in the Market

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Siemens AG

- Universal Robots

- Omron Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation

- Staubli International AG

- Denso Corporation

- Epson Robots

- Kawasaki Robotics

- Comau S.p.A.

- Schneider Electric

- Honeywell International Inc.

- Bosch Rexroth AG

- Others

Future Outlook

The future outlook for the Robot Mission Replay Tools market is expected to remain positive as factories and warehouses move toward more repeatable, software led automation. Demand is being supported by the need to shorten robot commissioning time, standardize tasks across sites, and reduce production interruptions caused by manual reprogramming.

Wider use of collaborative robots, mobile robots, and vision guided systems is also expected to increase the value of mission replay, because replay features help keep workflows consistent even when layouts, product mixes, or operators change. Over time, tighter integration with digital twins, MES, and quality systems is likely to be adopted, so that replayed missions can be validated, tracked, and improved using real shop floor data, not only offline testing.

Opportunities lie in

- Faster deployment services for SMEs: Simple setup mission libraries and guided templates can help smaller manufacturers adopt replay tools without large engineering teams.

- Cross brand and multi site standardization: Tools that support mixed robot fleets and allow mission sharing across plants can reduce training effort and improve operational consistency.

- Data driven optimization and compliance: Replay logs linked with traceability and quality checks can support audits, root cause analysis, and continuous improvement programs.

Recent Developments

- June, 2025 – ABB expanded RobotStudio with cloud‑based collaboration and recording/playback features so engineers can record robot motion, scrub through time, and visualize Category 0/1 stop positions for mission replay and safety validation in simulation.

- July, 2025 – FANUC highlighted new AI‑driven monitoring functions that trace robot status in real time, log paths and operations, and feed failure‑prediction and traceability tools, making it easier to replay missions for quality audits and preventive maintenance.

Report Scope

Report Features Description Market Value (2024) USD 1,286.7 Mn Forecast Revenue (2034) USD 5,342.8 Mn CAGR(2025-2034) 15.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platform, Services (Professional Services, Managed Services)), By Deployment (On-Premises, Cloud-based), By Application (Industrial Automation, Defense & Security, Research & Education, Healthcare, Logistics & Warehousing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Siemens AG, Universal Robots, Omron Corporation, Mitsubishi Electric Corporation, Rockwell Automation, Staubli International AG, Denso Corporation, Epson Robots, Kawasaki Robotics, Comau S.p.A., Schneider Electric, Honeywell International Inc., Bosch Rexroth AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robot Mission Replay Tools MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Robot Mission Replay Tools MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Siemens AG

- Universal Robots

- Omron Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation

- Staubli International AG

- Denso Corporation

- Epson Robots

- Kawasaki Robotics

- Comau S.p.A.

- Schneider Electric

- Honeywell International Inc.

- Bosch Rexroth AG

- Others