Global RFID Enabled Smart Cabinets Market By Product Type (Standalone and Integrated), By Component (RFID Tags, RFID Antenna, RFID Readers, and Others), By End-user (Hospitals & Clinics, Manufacturing Facilities, Bio-Pharmaceutical Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140323

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

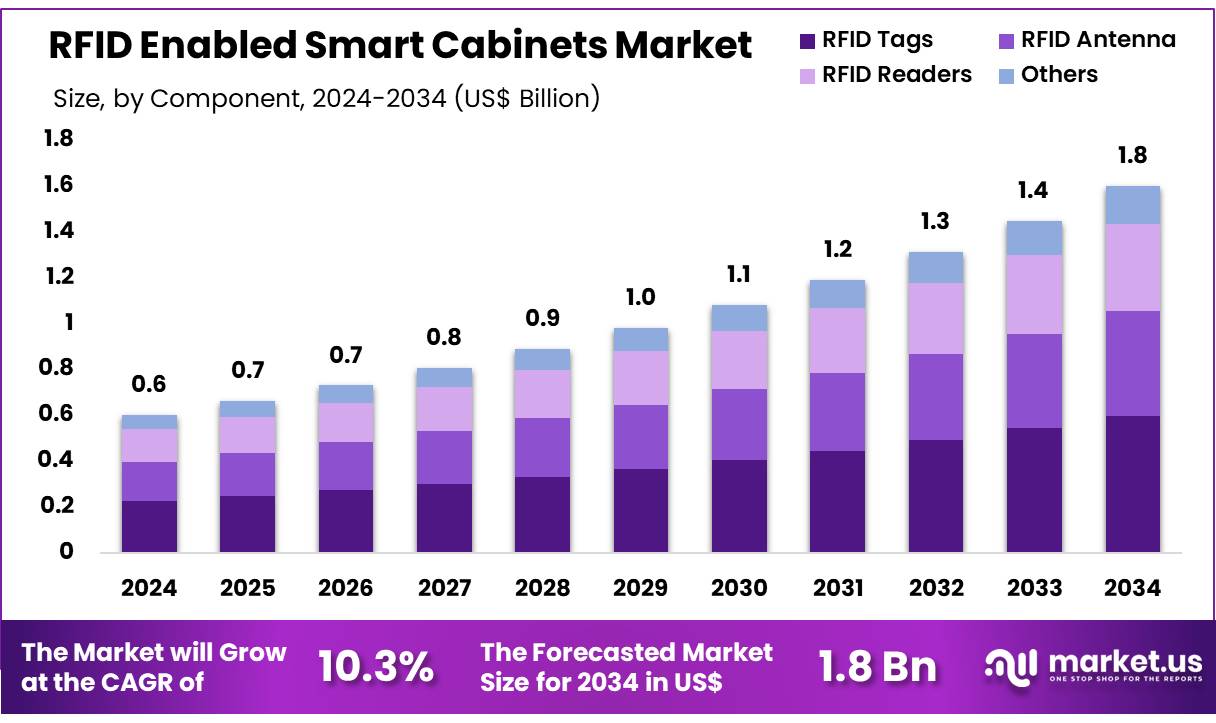

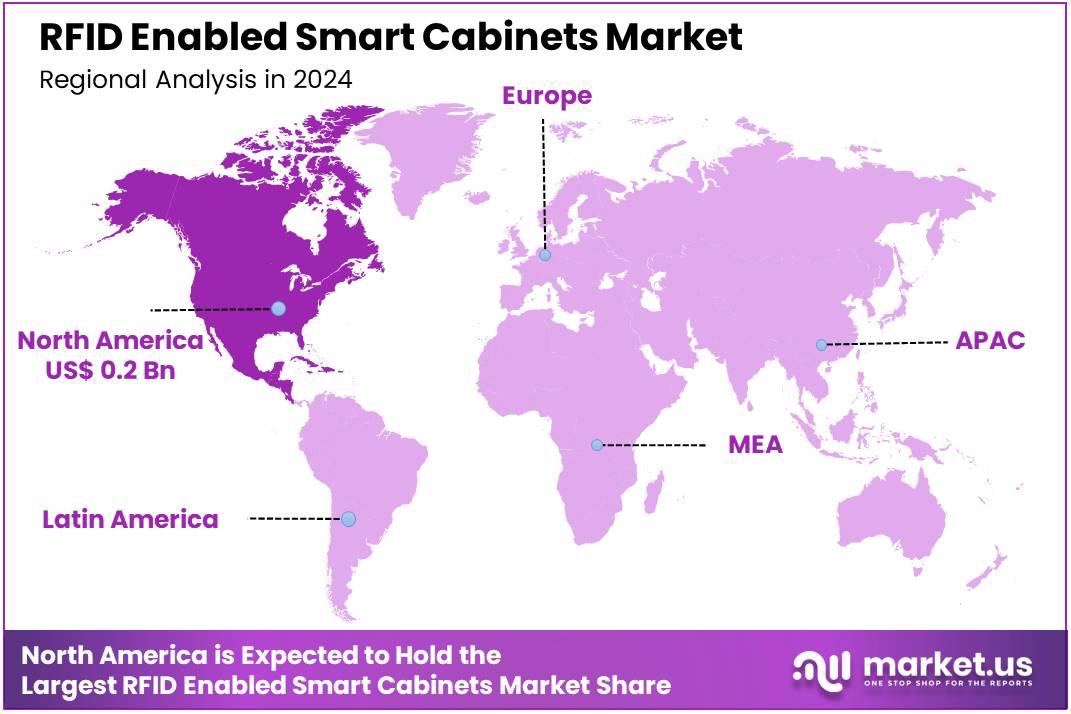

Global RFID Enabled Smart Cabinets Market size is expected to be worth around US$ 1.8 billion by 2034 from US$ 0.6 billion in 2024, growing at a CAGR of 10.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 0.2 Billion.

Increasing demand for efficient inventory management and streamlined operations is driving the growth of the RFID-enabled smart cabinets market. These innovative cabinets utilize radio frequency identification (RFID) technology to automate tracking, storage, and retrieval of items, offering significant benefits in various sectors such as healthcare, retail, and hospitality.

RFID-enabled cabinets are particularly valuable in environments where secure access and real-time inventory tracking are essential, such as hospitals for storing pharmaceuticals and equipment or offices for managing supplies. The rise of e-commerce and the need for efficient logistics and supply chain management also boost the market.

In May 2022, Selfly Store introduced a new range of RFID-enabled intelligent cabinets designed for contactless, self-service purchases. The series includes models like Selfly Cool for refrigerated items, Selfly Fresh for room temperature goods, and Selfly Frozen for frozen products. These smart cabinets offer an efficient, fully digitalized solution for venues such as hotels and offices, enabling easy access to meals and snacks.

Recent trends indicate increasing adoption of RFID-enabled solutions for enhancing customer experience and improving operational efficiency in various industries. Additionally, the growing need for touchless and secure systems, especially in the wake of the COVID-19 pandemic, presents substantial opportunities for further market expansion. As technology advances, RFID-enabled cabinets are poised to become a cornerstone of automated, on-demand services.

Key Takeaways

- In 2024, the market for RFID enabled smart cabinets generated a revenue of US$ 6 billion, with a CAGR of 10.3%, and is expected to reach US$ 1.8 billion by the year 2033.

- The product type segment is divided into standalone and integrated, with standalone taking the lead in 2024 with a market share of 58.3%.

- Considering component, the market is divided into RFID tags, RFID antenna, RFID readers, and others. Among these, RFID tags held a significant share of 37.4%.

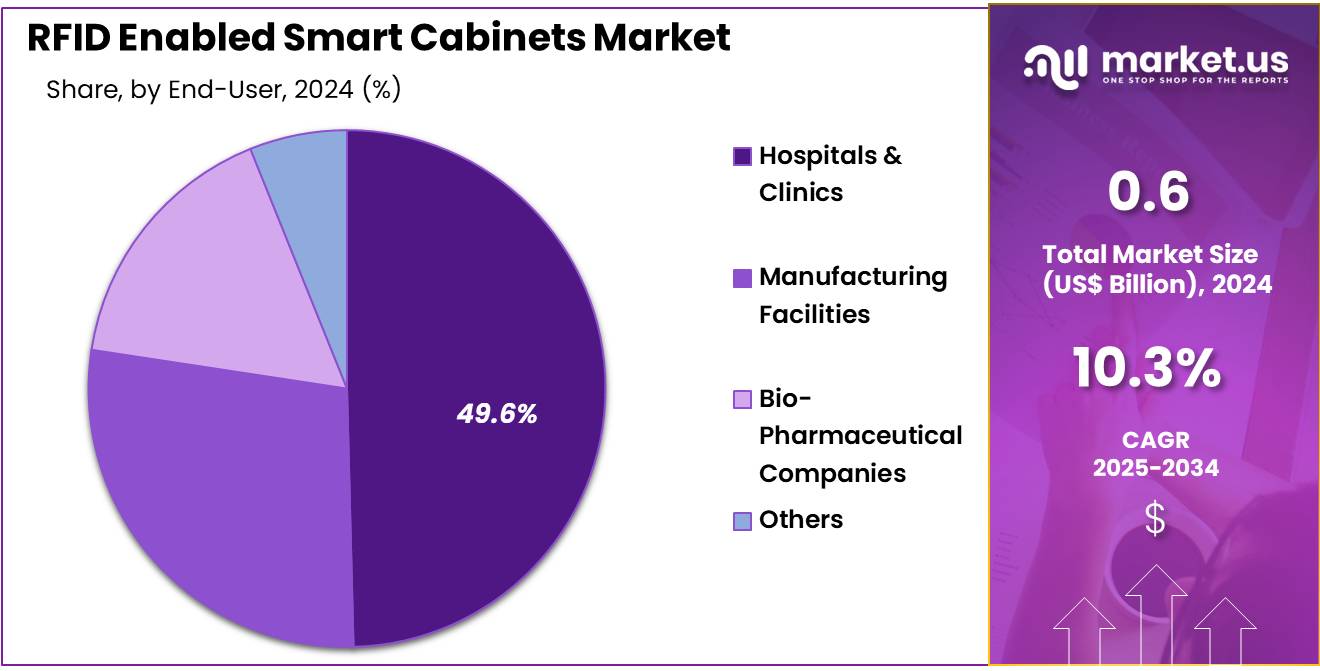

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, manufacturing facilities, bio-pharmaceutical companies, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 49.6% in the RFID enabled smart cabinets market.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

The standalone segment led in 2024, claiming a market share of 58.3% owing to its ability to offer flexible and cost-effective solutions for inventory management and security. Standalone RFID systems are anticipated to see greater adoption in various industries, particularly in healthcare and retail, as they provide efficient tracking of assets and supplies without the need for integrated systems.

The increasing need for streamlined operations, inventory accuracy, and real-time monitoring in hospitals, clinics, and other sectors is likely to drive demand for standalone RFID smart cabinets. Furthermore, as standalone systems are more scalable and easier to implement than integrated solutions, they are expected to be favored by small and medium-sized organizations, further contributing to the growth of this segment.

Component Analysis

The RFID tags held a significant share of 37.4% due to the essential role RFID tags play in the functionality of smart cabinet systems. RFID tags, which are used to uniquely identify and track items, are expected to see increasing demand as organizations seek more efficient ways to manage and secure their inventory.

The growing use of RFID technology for asset management, security, and inventory control in industries such as healthcare, manufacturing, and logistics is likely to propel the growth of this segment. Additionally, advancements in RFID tag technology, including the development of more durable and versatile tags that can withstand harsh environments, are anticipated to drive further market growth as businesses increasingly adopt RFID enabled smart cabinets for their operations.

End-User Analysis

The hospitals & clinics segment had a tremendous growth rate, with a revenue share of 49.6% owing to the increasing need for efficient inventory management and asset tracking in healthcare settings. Hospitals and clinics are likely to adopt RFID enabled smart cabinets to improve the management of medical supplies, pharmaceuticals, and equipment, enhancing operational efficiency and reducing the risk of theft or loss.

The growing focus on patient safety, regulatory compliance, and inventory control in healthcare facilities is expected to drive the adoption of these systems. Furthermore, the rising demand for real-time tracking of critical medical assets, especially in large hospitals and multi-site clinics, is projected to contribute to the growth of this segment, ensuring its continued expansion in the RFID enabled smart cabinets market.

Key Market Segments

Product Type

- Standalone

- Integrated

Component

- RFID Tags

- RFID Antenna

- RFID Readers

- Others

End-user

- Hospitals & Clinics

- Manufacturing Facilities

- Bio-Pharmaceutical Companies

- Others

Drivers

Launch of IoT-Driven Solutions Driving the RFID Enabled Smart Cabinets Market

The launch of IoT-driven solutions is anticipated to drive the RFID enabled smart cabinets market significantly. In August 2023, Schneider Electric introduced an IoT-driven solution through its EcoStruxure platform, aimed at enhancing the efficiency and resilience of healthcare systems in India. Similar innovations integrate IoT technologies into smart cabinets, enabling real-time tracking and inventory management of medical supplies and devices.

Hospitals and healthcare providers adopt these cabinets to improve operational efficiency, reduce inventory wastage, and ensure compliance with regulatory standards. IoT integration allows seamless connectivity with healthcare management systems, enhancing transparency and decision-making. Advanced analytics provide actionable insights into usage patterns, optimizing supply chain workflows. Expanding demand for automated solutions in healthcare facilities drives investments in IoT-enabled smart storage systems.

These technologies enhance patient safety by ensuring timely availability of critical medical supplies. Growing awareness about the benefits of IoT-driven solutions fosters adoption across other sectors, including pharmaceuticals and retail. Collaborative efforts between technology providers and healthcare institutions accelerate innovation in RFID-enabled smart cabinets. These trends underscore the transformative impact of IoT in revolutionizing inventory management systems.

Restraints

High Costs Are Restraining the RFID Enabled Smart Cabinets Market

High costs associated with RFID enabled smart cabinets are restraining the market. Advanced systems require significant investments in IoT integration, RFID technology, and supporting infrastructure. Smaller healthcare facilities and clinics face financial constraints, limiting their ability to adopt these cabinets. The expense of regular maintenance, software upgrades, and RFID tags adds to operational costs, further restricting widespread adoption.

In low-income regions, inadequate funding for healthcare technology hampers market penetration. Training requirements for staff to effectively operate these advanced systems increase operational expenses. Variability in global regulatory requirements leads to additional compliance costs, creating barriers for manufacturers and users. Addressing these challenges requires cost-effective innovations and government support to improve accessibility and affordability of RFID enabled smart cabinets.

Opportunities

Increasing Production Expansion as an Opportunity for the RFID Enabled Smart Cabinets Market

Increasing production expansion is projected to create significant opportunities for the RFID enabled smart cabinets market. In January 2023, Avery Dennison announced plans to establish a new manufacturing facility in Mexico, highlighting the growing focus on meeting regional demand. Such expansions enhance the availability of RFID components, reducing supply chain bottlenecks and manufacturing costs.

Companies invest in scaling production capacities to cater to the increasing adoption of smart cabinets across diverse industries. Collaborative efforts with local suppliers and distributors strengthen market presence in emerging economies. Streamlined production processes enable manufacturers to introduce cost-effective solutions for price-sensitive markets.

Rising government initiatives to promote technological adoption further boost the demand for RFID-enabled systems. These trends emphasize the critical role of production expansion in addressing growing market demands and advancing the adoption of smart cabinets globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the RFID enabled smart cabinets market. On the positive side, increasing global investments in healthcare, retail, and logistics drive demand for innovative and efficient storage solutions like smart cabinets. As industries focus on improving inventory management and security, the adoption of advanced technologies like RFID is likely to expand.

However, economic downturns or reduced healthcare spending in certain regions can limit the ability of businesses to invest in advanced technologies, delaying market growth. Geopolitical tensions and trade restrictions may disrupt the supply chain for RFID components, affecting product availability and increasing costs.

Regulatory differences between countries may also complicate the market, as manufacturers face challenges in meeting varying standards. Despite these challenges, the growing need for more efficient inventory management systems and automation in multiple industries ensures a strong future for the market.

Latest Trends

Surge in Partnerships and Collaborations Driving the RFID Enabled Smart Cabinets Market:

Rising partnerships and collaborations are driving significant growth in the RFID enabled smart cabinets market. High levels of cooperation between technology providers, healthcare institutions, and logistics companies are expected to accelerate the development and adoption of innovative solutions. These partnerships enable the integration of complementary expertise and resources, enhancing the functionality and efficiency of smart cabinets.

Increasing collaboration is anticipated to address challenges such as scalability, customization, and integration with existing systems. In August 2023, Bitua Smart Cabinets and Vanguard Medical Logistics entered into a strategic partnership aimed at revolutionizing the healthcare sector.

By combining Bitua’s state-of-the-art smart cabinet technology with Vanguard’s expertise in medical logistics, the partnership seeks to enhance the management and accessibility of medical supplies across healthcare institutions. As more collaborations emerge, the market is likely to experience rapid growth and innovation, further expanding the adoption of RFID-enabled solutions.

Regional Analysis

North America is leading the RFID enabled smart cabinets Market

North America dominated the market with the highest revenue share of 39.6% owing to advancements in healthcare technology, increasing demand for operational efficiency, and the need to improve patient safety. RFID technology has proven to be highly effective in automating the tracking of consumable medical items, reducing waste, and improving inventory management. Hospitals and healthcare facilities increasingly adopt these smart cabinets to streamline supply chain operations and enhance real-time tracking of medications and equipment.

In January 2024, Meditek launched the Skytron SkyTrac Smart Cabinets in the Canadian healthcare market, integrating RFID technology to optimize the management of consumable items used in patient care. This innovation is expected to improve operational efficiency, reduce costs, and bolster patient safety by ensuring that medical supplies are properly tracked and available when needed.

Meditek’s collaboration with Skytron to introduce this advanced technology to healthcare facilities across Canada reflects the growing recognition of RFID-enabled smart cabinets as a solution to address key operational challenges, further driving market growth in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing adoption of advanced healthcare technologies, the expansion of healthcare infrastructure, and the growing demand for operational efficiency in medical facilities. Countries such as China, India, and Japan are likely to see an increasing demand for smart cabinets as healthcare providers look for solutions to streamline inventory management and enhance patient care.

The adoption of RFID technology in healthcare is anticipated to increase as the region continues to invest in modernizing its healthcare systems, particularly in urban areas with high patient volumes. The integration of RFID-enabled smart cabinets into hospitals, pharmacies, and healthcare settings is projected to significantly improve supply chain visibility, reduce errors, and increase efficiency.

As the region’s healthcare needs continue to evolve, especially with the rise in chronic diseases and aging populations, the demand for innovative solutions like RFID-enabled smart cabinets is expected to surge, positioning the market for strong growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the RFID-enabled smart cabinets market focus on developing advanced inventory management solutions that enhance efficiency and reduce wastage in healthcare and retail sectors. Companies invest in R&D to integrate features like real-time tracking, automated restocking, and cloud connectivity for seamless operations.

Collaborations with hospitals, pharmacies, and supply chain providers expand the adoption of these solutions in critical environments. Geographic expansion into regions with increasing digitization in inventory management supports market growth. Many players also prioritize user-friendly interfaces and compliance with industry regulations to ensure widespread adoption and reliability.

LogiTag Systems is a leading company in this market, offering innovative RFID-based inventory management solutions designed for healthcare and industrial applications. The company combines advanced technology with robust customer support to deliver efficient and reliable smart cabinet systems. LogiTag’s commitment to innovation and its strong market presence make it a key player in the industry.

Top Key Players

- UPS

- Stanley Healthcare

- Selfly

- Nexess

- LogiQuip LLC

- Impinj, Inc.

- Avery Dennison Corporation

- Alien Technology, LLC

Recent Developments

- In February 2023, UPS announced its plan to expand its smart package program across its entire U.S. network, following a successful trial in select locations in 2022. The program aims to reduce misloads and enhance parcel throughput by equipping parcels with RFID tags and providing wearable devices to staff for improved manual scanning efficiency.

- In November 2023, Impinj, Inc., a leading provider of RAIN RFID technology, introduced the Impinj R720 RFID reader. This upgraded reader features increased processing power and memory, improving edge processing capabilities and reducing network load and latency, marking a significant enhancement over its predecessor.

- In May 2022, Selfly expanded its inventory of RFID-enabled micro-stores designed for seamless, contactless mobile shopping. These intelligent cabinets incorporate advanced RFID, sensor, cloud computing, and IoT technologies, providing store managers with real-time insights into inventory levels and product expiration dates, optimizing operational efficiency.

Report Scope

Report Features Description Market Value (2024) US$ 0.6 billion Forecast Revenue (2034) US$ 1.8 billion CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standalone and Integrated), By Component (RFID Tags, RFID Antenna, RFID Readers, and Others), By End-user (Hospitals & Clinics, Manufacturing Facilities, Bio-Pharmaceutical Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UPS, Stanley Healthcare, Selfly, Nexess, LogiQuip LLC, Impinj, Inc., Avery Dennison Corporation, and Alien Technology, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  RFID Enabled Smart Cabinets MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

RFID Enabled Smart Cabinets MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- UPS

- Stanley Healthcare

- Selfly

- Nexess

- LogiQuip LLC

- Impinj, Inc.

- Avery Dennison Corporation

- Alien Technology, LLC