Global Retinal Vein Occlusion Market By Disease Type (Central Retinal Vein Occlusion (CRVO) and Branch Retinal Vein Occlusion (BRVO)), By Condition (Non-Ischemic and Ischemic), By Diagnosis- (Optical Coherence Tomography, Fundoscopic Examination, and Fluorescein Angiography), By Treatment (Anti-vascular Endothelial Growth Factor (Anti-VEGF), Corticosteroid Drugs, Laser Photocoagulation, Vitrectomy and Others) and End-User (Hospital & Clinics, Ophthalmic Clinics and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139837

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

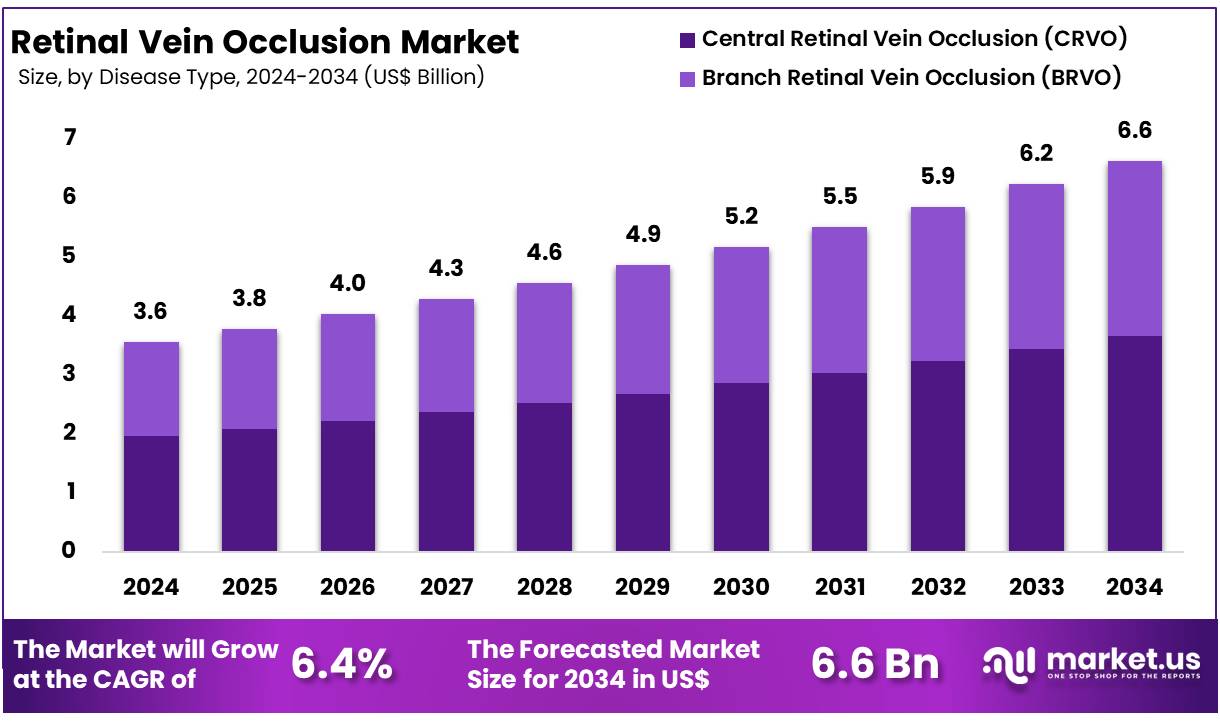

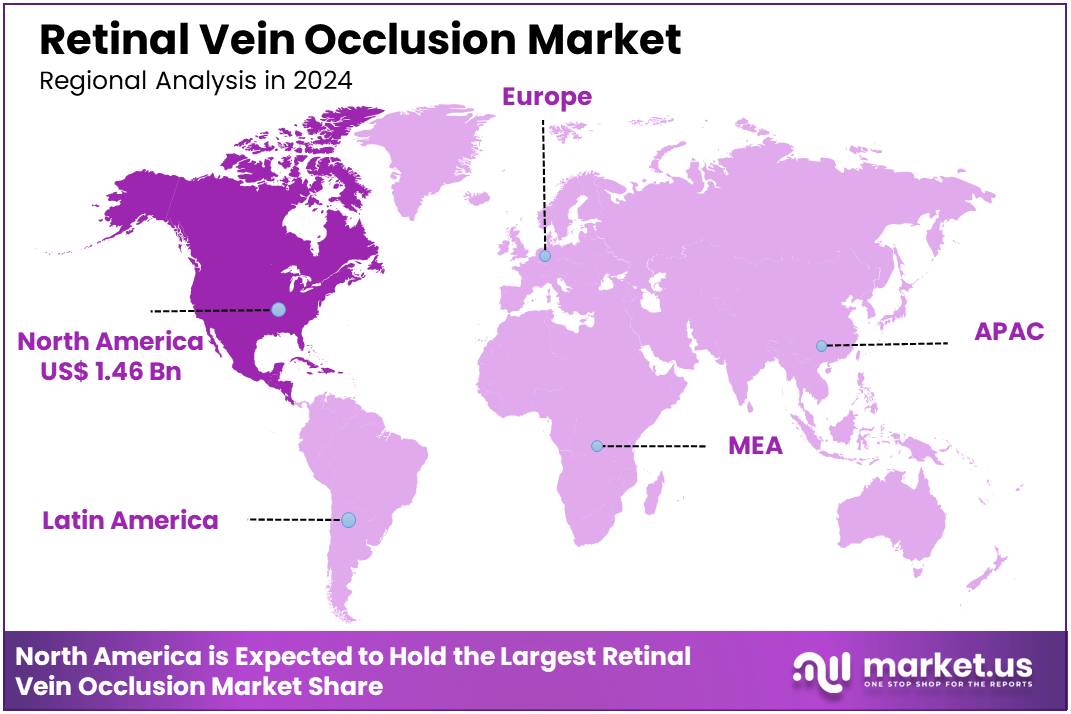

Global Retinal Vein Occlusion Market size is expected to be worth around US$ 6.6 Billion by 2034 from US$ 3.6 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034. In 2023, North America led the market, achieving over 41.10% share with a revenue of US$ 1.46 Million.

The increasing geriatric population, the growing prevalence of retinal diseases, and rising awareness about eye health significantly drive market growth for Retinal Vein Occlusion (RVO) management. Aging populations are particularly vulnerable, with the World Health Organization estimating that by 2030, 1 in 6 people globally will be aged 60 or older, increasing the incidence of age-related retinal conditions.

Additionally, the prevalence of retinal diseases, including RVO, has risen due to chronic conditions like diabetes and hypertension. Enhanced public awareness and education campaigns encourage early diagnosis and treatment, further boosting demand for advanced therapies and diagnostic tools in the ophthalmology market.

The Retinal Vein Occlusion (RVO) market is experiencing lucrative growth, driven by the increasing prevalence of risk factors such as atherosclerosis, glaucoma, and hypertension. Atherosclerosis, marked by the buildup of plaques in arteries, is a significant contributor to vascular blockages like RVO. According to the World Health Organization (WHO), over 17.9 million deaths annually are attributed to cardiovascular diseases, including atherosclerosis, highlighting its widespread impact.

Glaucoma, a chronic condition characterized by elevated intraocular pressure, is another critical risk factor. The Glaucoma Research Foundation estimates that more than 80 million people globally are living with glaucoma, with cases projected to rise due to aging populations. This condition compromises retinal blood flow, increasing the likelihood of vein occlusions. Hypertension, affecting 1.28 billion adults worldwide as reported by the WHO, is a leading contributor to weakened blood vessels, particularly in the retina.

Research indicates that hypertensive individuals are 2–3 times more likely to develop RVO than those with normal blood pressure levels. As these conditions become more prevalent due to lifestyle changes and an aging global population, the demand for advanced RVO treatments, such as anti-VEGF injections and corticosteroid implants, continues to grow, supporting the robust expansion of the market

Key Takeaways

- The Retinal Vein Occlusion Market generated a revenue of US$ 3.56 Billion in 2024 and is predicted to reach US$ 6.26 Billion, with a CAGR of 6.5%.

- Based on the Disease Type, the Central Retinal Vein Occlusion (CRVO) segment generated the most revenue for the market with a market share of 55.2%.

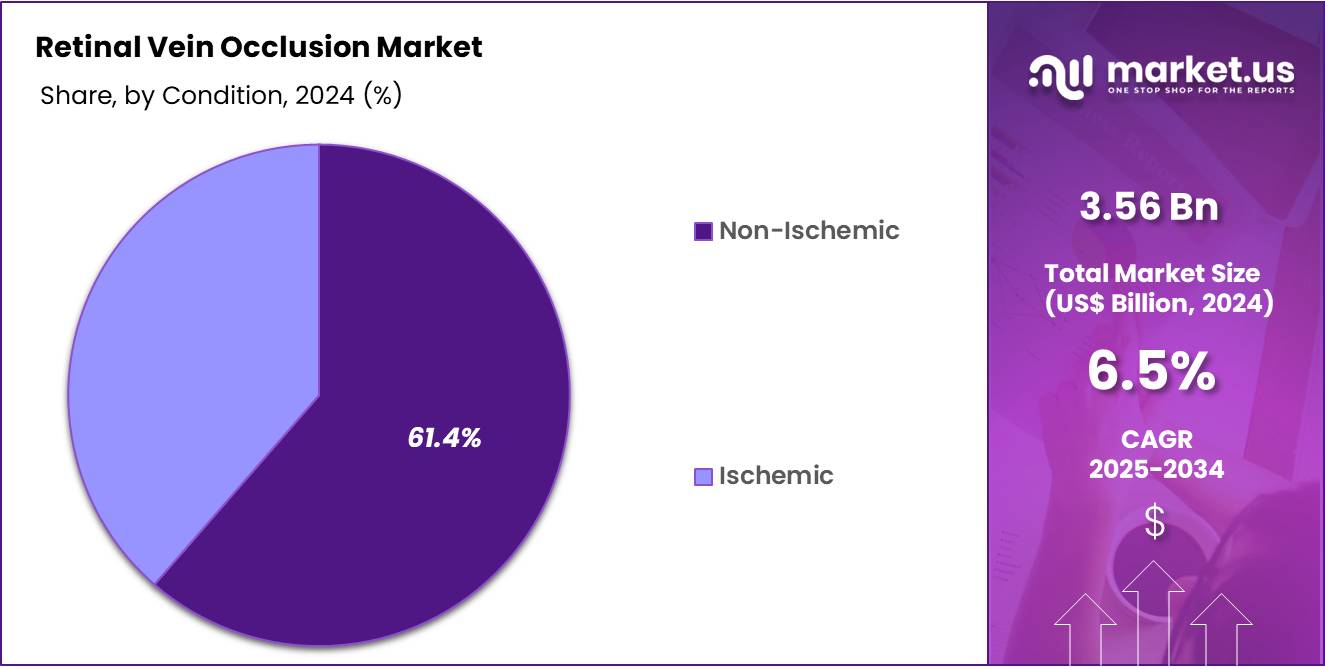

- Based on the Condition, the Non-Ischemic segment generated the most revenue for the market with a market share of 61.4%.

- By Diagnosis, the Optical Coherence Tomography segment contributed the most to the market and secured a market share of 38.7%.

- By Treatment, the Anti-vascular Endothelial Growth Factor (Anti-VEGF) segment contributed the most to the market and secured a market share of 44.8%.

- Based on the End-User, the Hospital & Clinics segment generated the most revenue for the market with a market share of 52.9%.

- Region-wise North America remained the lead contributor to the market, by claiming the highest market share, amounting to 41.10%.

Disease Type Analysis

Central Retinal Vein Occlusion (CRVO) leads the Retinal Vein Occlusion (RVO) market due to its high prevalence and significant impact on vision. CRVO is more severe than branch retinal vein occlusion (BRVO), often resulting in greater visual impairment and requiring intensive treatment. The condition drives demand for advanced therapies like anti-VEGF drugs (e.g., Eylea, Lucentis) and corticosteroid implants (e.g., Ozurdex).

The growing aging population, rising diabetes rates, and increased awareness of CRVO contribute to its dominance. Additionally, ongoing research into novel therapies and personalized medicine further solidifies CRVO’s prominent role in shaping the RVO treatment landscape.

While the Branch Retinal Vein Occlusion (BRVO) accounted for a significant 44.8% market share in the Retinal Vein Occlusion (RVO) market, driven by its higher prevalence compared to Central Retinal Vein Occlusion (CRVO). BRVO typically presents milder symptoms, often making patients more likely to seek treatment. Effective therapies, such as anti-VEGF drugs (Eylea, Lucentis) and laser photocoagulation, have improved patient outcomes, boosting market demand.

The condition’s association with common risk factors like hypertension and diabetes further contributes to its widespread occurrence. Additionally, advancements in diagnostic tools and increasing awareness of RVO conditions support BRVO’s robust presence in the global market.

Condition Analysis

The Non-Ischemic segment dominated the Retinal Vein Occlusion (RVO) market with a 61.4% market share, driven by its higher prevalence and less severe clinical manifestations compared to ischemic RVO. Patients with non-ischemic RVO often retain better vision, encouraging earlier diagnosis and treatment, which fuels market growth. Effective management options, such as anti-VEGF therapies and corticosteroids, further support this segment’s prominence.

Additionally, non-ischemic cases are more responsive to treatment, leading to improved patient outcomes and increased adoption of advanced therapies. Rising awareness and advancements in diagnostic capabilities also contribute to the significant market share of the non-ischemic RVO segment.

Diagnosis Analysis

The diagnosis segment of the global Retinal Vein Occlusion (RVO) market includes Optical Coherence Tomography (OCT), Fundoscopic Examination, and Fluorescein Angiography. Among these, OCT emerged as the leading diagnostic modality, capturing 38.7% of the segment share. Its dominance is attributed to its non-invasive nature, high precision, and ability to provide detailed cross-sectional images of the retina. OCT is particularly effective in assessing retinal thickness, edema, and structural changes, which are critical for diagnosing and monitoring RVO.

The widespread adoption of OCT is further driven by advancements in imaging technology, improved accessibility, and growing awareness among healthcare providers about its diagnostic accuracy. Compared to other methods, OCT offers faster results and greater patient comfort, making it the preferred choice in clinical practice. The increasing prevalence of RVO, coupled with a rising demand for advanced diagnostic tools, ensures OCT’s prominent role in the diagnosis segment of the RVO market.

Treatment Analysis

The anti-vascular endothelial growth factor (Anti-VEGF) segment accounted for the largest market share of 44.8% in 2024, solidifying its position as a breakthrough treatment for Retinal Vein Occlusion (RVO) and age-related macular degeneration. Anti-VEGF therapies effectively prevent vision loss and have demonstrated sustained vision improvement lasting up to five years.

As a result, key market players are actively focusing on developing and securing approvals for novel anti-VEGF treatments. For example, in February 2020, Novartis received European Commission approval for Beovu (brolucizumab) injection, an anti-VEGF therapy for age-related macular degeneration, further driving adoption and market growth.

Meanwhile, the corticosteroid drugs segment is projected to grow at a notable CAGR during the forecast period. These drugs address the three main components of RVO pathophysiology by stabilizing the blood-retina barrier, reducing vascular permeability, and decreasing macular edema by inhibiting inflammatory mediators. Approved corticosteroids such as dexamethasone, fluocinolone acetonide, and triamcinolone acetonide offer efficacy lasting up to six months, enhancing their appeal and contributing to the segment’s growth trajectory.

End-User Analysis

The Hospital & Clinics segment dominated the end-user category of the global Retinal Vein Occlusion (RVO) market, driven by their comprehensive care capabilities and accessibility. Hospitals are often the preferred choice for RVO treatment due to their advanced diagnostic equipment, availability of skilled ophthalmologists, and favorable reimbursement policies.

Clinics, particularly ophthalmic centers, are gaining traction in developing regions, where increasing patient visits and improved accessibility to specialized care contribute to market growth. The rising prevalence of RVO, coupled with a growing demand for precise and effective treatments, ensures the dominance of hospitals and clinics in the RVO market landscape.

Key Market Segments

By Disease Type

- Central Retinal Vein Occlusion (CRVO)

- Branch Retinal Vein Occlusion (BRVO)

By Condition

- Non-Ischemic

- Ischemic

By Diagnosis

- Optical Coherence Tomography

- Fundoscopic Examination

- Fluorescein Angiography

By Treatment

- Anti-vascular Endothelial Growth Factor (Anti-VEGF)

- Corticosteroid Drugs

- Laser Photocoagulation

- Vitrectomy

- Others

By End-User

- Hospital & Clinics

- Ophthalmic Clinics

- Ambulatory Surgical Centers

Drivers

Increasing Prevalence of Chronic Diseases is Driving the Market Growth

The rising incidence of diabetes, hypertension, and other vascular disorders significantly contributes to the growing prevalence of Retinal Vein Occlusion (RVO). These chronic conditions damage blood vessels and increase the risk of vascular blockages in the retina, leading to vision impairment or loss. According to the International Diabetes Federation (IDF), approximately 537 million adults globally were living with diabetes in 2021, a figure expected to reach 783 million by 2045. Diabetes increases the likelihood of microvascular complications, including RVO.

Similarly, hypertension, a key risk factor for RVO, affects over 1.28 billion people worldwide, as per the World Health Organization (WHO). Chronic high blood pressure weakens retinal veins, increasing susceptibility to occlusions. Studies indicate that individuals with hypertension are 2.5 times more likely to develop RVO compared to those with normal blood pressure.

Additionally, lifestyle changes, aging populations, and urbanization have escalated the global burden of these chronic diseases, further amplifying RVO cases. This growing patient pool drives the demand for effective treatment options, such as anti-VEGF injections and corticosteroid implants, which aim to manage complications and preserve vision. Improved awareness and diagnostic advancements also contribute to early detection and intervention, enhancing market growth for RVO therapies.

Restrains

High Costs of Advanced Therapies and Lower Affordability in Low Income Regions

Advanced therapies for Retinal Vein Occlusion (RVO), such as anti-VEGF injections, offer significant benefits but remain prohibitively expensive for many patients, particularly in low- and middle-income regions. A single anti-VEGF injection can cost between $1,500 and $2,000 in the U.S., with patients requiring multiple injections annually.

This cumulative cost is a significant barrier, especially for uninsured or underinsured individuals. Globally, only 60% of people have access to essential health services, according to the World Health Organization (WHO), highlighting the disparity in treatment accessibility.

Restricted access to specialized eye care services further exacerbates the problem, particularly in low-resource settings. For example, regions such as sub-Saharan Africa and parts of Southeast Asia have a low density of ophthalmologists, with fewer than 2 specialists per million people in some countries, as reported by the International Agency for the Prevention of Blindness (IAPB). This shortage limits timely diagnosis and treatment of RVO.

In rural areas, patients face challenges such as long travel distances and limited availability of advanced treatment modalities like intravitreal injections or retinal laser therapy. These barriers contribute to untreated cases, worsening vision outcomes and hindering market growth. Addressing these disparities requires policy reforms, cost-reduction strategies, and increased investment in healthcare infrastructure.

Opportunities

Integration of AI and Digital Health Tools

Artificial intelligence (AI) and telemedicine are transforming the management of Retinal Vein Occlusion (RVO) by enhancing diagnosis and patient care. AI-powered tools, such as deep learning algorithms, enable accurate and early detection of RVO through retinal imaging techniques like optical coherence tomography (OCT) and fundus photography. Studies report that AI systems achieve diagnostic accuracy rates exceeding 90%, comparable to expert ophthalmologists, ensuring timely intervention.

Telemedicine platforms facilitate remote consultations, bridging gaps in care for patients in underserved or rural areas. According to the World Health Organization (WHO), telemedicine adoption surged during the COVID-19 pandemic, and its benefits in ophthalmology have been widely recognized. Patients can upload retinal images for analysis and receive expert guidance without needing in-person visits.

These technologies improve accessibility, reduce travel-related barriers, and optimize healthcare resource utilization, making RVO management more efficient and patient-centric, especially in resource-constrained settings.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global Retinal Vein Occlusion (RVO) market. Economic instability or slowdowns in major economies can limit healthcare spending, reducing patient access to advanced treatments like Anti-VEGF therapies and vitrectomy. High inflation impacts the affordability of diagnostic tools and medications, particularly in developing regions.

Geopolitical tensions, such as trade restrictions or conflicts, disrupt global supply chains, delaying the availability of essential drugs and equipment. Sanctions on certain countries can hinder access to innovative healthcare technologies. Additionally, disparities in healthcare infrastructure, especially in low-income regions, are exacerbated by economic inequality and geopolitical challenges.

Conversely, government-backed healthcare initiatives and investments in emerging markets present opportunities for growth. Global collaborations on affordable biosimilars and cost-effective treatments can mitigate these challenges. As the world stabilizes post-pandemic, efforts to strengthen healthcare systems and increase awareness of retinal disorders may offset these negative impacts over time.

Latest Trends

The global Retinal Vein Occlusion (RVO) market is witnessing transformative trends driven by advancements in technology and treatment approaches. The adoption of Anti-VEGF therapies continues to grow as they demonstrate high efficacy in managing RVO-related vision loss. Additionally, the emergence of biosimilar is making these treatments more accessible and affordable, especially in developing regions.

Technological innovations, such as Artificial Intelligence (AI) and machine learning, are being integrated into diagnostic tools like Optical Coherence Tomography (OCT) to enhance early detection and treatment planning. Furthermore, personalized medicine is gaining traction, with tailored therapies targeting individual patient profiles for improved outcomes.

Combination therapies, which integrate Anti-VEGF drugs with corticosteroids, are being explored to enhance treatment effectiveness while reducing side effects. The increasing preference for minimally invasive procedures, like vitrectomy, highlights a shift toward patient-centric care. Lastly, growing awareness campaigns and telemedicine services are expanding patient access to timely diagnosis and care, driving market growth.

Regional Analysis

North America Dominated the Global Retinal Vein Occlusion Market

In 2024, North America held the largest revenue share of 41.10%, attributed to its well-developed and highly regulated healthcare infrastructure. The region’s market growth is driven by collaborative efforts among key industry players to enhance product portfolios and maintain high-quality standards, fueling demand for Retinal Vein Occlusion (RVO) treatments. Additionally, the rising prevalence of eye-related disorders significantly influences market expansion.

According to the CDC, approximately 12 million individuals aged 40 and older in the U.S. experience vision impairment. Favorable reimbursement policies further support market growth, with the U.S. healthcare system providing coverage to about 84% of the population through public (26%) or private (70%) insurance plans. This robust reimbursement framework and the increasing focus on advancing treatment options are key factors propelling the RVO market in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Retinal Vein Occlusion (RVO) market is characterized by intense competition, driven by the presence of key players focusing on innovation, strategic partnerships, and portfolio expansion. Leading companies like Roche, Novartis, and Bayer AG dominate the market with well-established Anti-VEGF therapies such as ranibizumab (Lucentis) and aflibercept (Eylea).

Emerging players are introducing biosimilar versions of these treatments, aiming to improve affordability and accessibility. Additionally, companies like Regeneron Pharmaceuticals and Allergan are actively investing in R&D for novel therapies, including combination drugs and long-acting formulations. Strategic collaborations, mergers, and acquisitions are shaping the competitive dynamics, with players seeking to expand their geographical reach and enhance their market share. The increasing adoption of AI-based diagnostic tools and personalized medicine is encouraging innovation among companies.

Regional players in emerging markets focus on cost-effective solutions, while global giants emphasize advanced therapies, ensuring a dynamic and evolving competitive landscape.

Top Key Players

- AbbVie

- Hoffmann-La Roche AG

- Regeneron Pharmaceuticals, Inc.

- Taiwan Liposome Company

- Aerie Pharmaceuticals, Inc.

- Graybug Vision

- Outlook Therapeutics

- Kodiak Sciences, Inc.

- Chugai Pharmaceutical Co. Ltd.

- Novartis AG

- Bayer AG

- Carl Zeiss AG

- Annexin Pharmaceuticals AB (publ)

Recent Developments

- In August 2023, Regeneron Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved EYLEA HD (aflibercept) Injection 8 mg as a treatment option for wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and diabetic retinopathy (DR).

- In December 2020, Arctic Vision, a China-based clinical-stage ophthalmology company specializing in groundbreaking innovations, announced the approval of a Phase III Investigational New Drug (IND) for treating Uveitic Macular Edema (UME). This marked China’s first clinical trial for UME therapy using suprachoroidal space (SCS) injection, aiming to offer a novel therapeutic option for UME patients in the country.

- Meanwhile, Novartis reported positive results from the first interpretable Phase III data for Beovu, demonstrating its efficacy and safety. Beovu emerged as a strong competitor to Regeneron’s anti-VEGF therapy Eylea, a leading treatment for diabetic macular edema.

Report Scope

Report Features Description Market Value (2024) US$ 3.56 Billion Forecast Revenue (2034) US$ 6.26 Billion CAGR (2024-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Disease Type- Central Retinal Vein Occlusion (CRVO) and Branch Retinal Vein Occlusion (BRVO), Condition- Non-Ischemic and Ischemic, Diagnosis- Optical Coherence Tomography, Fundoscopic Examination, and Fluorescein Angiography, Treatment- Anti-vascular Endothelial Growth Factor (Anti-VEGF), Corticosteroid Drugs, Laser Photocoagulation, Vitrectomy and Others and End-User- Hospital & Clinics, Ophthalmic Clinics and Ambulatory Surgical Centers. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AbbVie, F. Hoffmann-La Roche AG, Regeneron Pharmaceuticals, Inc., Taiwan Liposome Company, Aerie Pharmaceuticals, Inc., Graybug Vision, Outlook Therapeutics. Kodiak Sciences, Inc., Chugai Pharmaceutical Co. Ltd., Novartis AG, Bayer AG, Carl Zeiss AG and Annexin Pharmaceuticals AB (publ). Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Retinal Vein Occlusion MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Retinal Vein Occlusion MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AbbVie

- Hoffmann-La Roche AG

- Regeneron Pharmaceuticals, Inc.

- Taiwan Liposome Company

- Aerie Pharmaceuticals, Inc.

- Graybug Vision

- Outlook Therapeutics

- Kodiak Sciences, Inc.

- Chugai Pharmaceutical Co. Ltd.

- Novartis AG

- Bayer AG

- Carl Zeiss AG

- Annexin Pharmaceuticals AB (publ)