Global Retail POS Market Report By Component (Hardware, Software, Services), By Type (Fixed POS, Mobile POS), By End-User (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Grocery Stores, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 127957

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

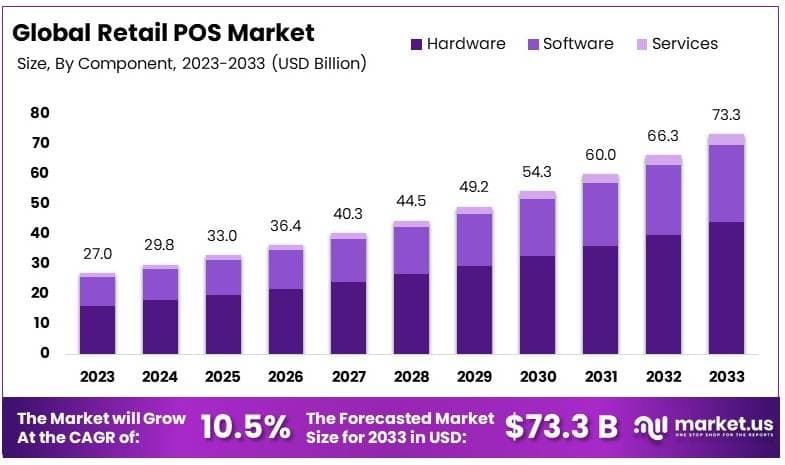

The Global Retail POS Market size is expected to be worth around USD 73.3 Billion by 2033, from USD 27.0 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

Retail Point of Sale (POS) systems serve as the central component in the operations of retail businesses, managing the sale of goods and services at retail locations. These systems typically include hardware such as computers or tablets, barcode scanners, receipt printers, and cash drawers. The software component of POS systems is critical as it processes transactions, manages inventory levels, handles customer management functions, and integrates with other back-end systems like accounting and inventory management.

The Retail POS Market is driven by the increasing demand for streamlined operations across retail businesses and the growing adoption of cloud-based solutions. This market is characterized by rapid technological advancements that cater to evolving consumer expectations, such as the integration of contactless payments and mobile POS systems.

The expansion of e-commerce has also spurred the need for POS systems that can seamlessly integrate online and offline sales channels. Key market players typically focus on innovation and adaptability to cater to a wide range of retail environments, from small boutiques to large, multi-store chains. For instance, Square’s POS system, favored for its ease of setup and lack of monthly fees, charges a transaction fee of approximately 2.6% plus 10 cents per swipe, dip, or tap.

The Retail POS market is heavily influenced by several factors, including technological advancements, changing consumer behavior, and regulatory developments. The demand for cloud-based POS systems has surged, with 95% of businesses using some type of cloud-based software, a number that has likely increased since the 2018 Cisco study. This shift is driven by the need for real-time data access, scalability, and the integration of multiple business functions into a single platform.

Opportunities in the market are abundant, particularly in the area of analytics and reporting. According to a 2020 Salesforce survey, 50% of small businesses consider analytics and reporting in their POS systems integral to their operations. Additionally, 71% of respondents in a 2023 HospitalityTech survey plan to purchase new features or functionality for their POS system, highlighting the ongoing evolution and expansion of POS capabilities.

The growth of the Retail POS market can be attributed to several key factors. The increasing demand for enhanced customer experiences and operational efficiency is driving retailers to upgrade their POS systems. For example, 46% of restaurants have prioritized upgrading their POS systems to support omnichannel services, including mobile payments and self-service kiosks. The initial costs for restaurant POS systems average around $9,300, but the long-term benefits in terms of improved customer satisfaction and streamlined operations are significant.

Government regulations and investments also play a crucial role in shaping the market. Governments are increasingly mandating digital payment systems and providing incentives for the adoption of advanced technologies, further fueling market growth. Additionally, the challenges faced by businesses, such as staffing issues—reported by 9 out of 10 restaurateurs in a 2021 National Restaurant Association survey—highlight the need for automated and efficient POS systems that can alleviate some of these operational pressures.

The Retail POS market is poised for continued growth, driven by technological advancements, regulatory support, and the evolving needs of retailers. The market offers significant opportunities for vendors and retailers alike, particularly in the areas of mobile POS solutions, cloud-based systems, and advanced analytics. As businesses increasingly recognize the value of integrated and flexible POS systems, the market is expected to expand further, offering enhanced capabilities and improved business outcomes.

Key Takeaways

- Retail POS Market was valued at USD 27.0 Billion in 2023, and is expected to reach USD 73.3 Billion by 2033, with a CAGR of 10.5%.

- In 2023, Hardware dominated the component segment with 59.5% due to its essential role in physical transactions.

- In 2023, Fixed POS led the type segment with 58.1% due to its reliability in high-volume retail environments.

- In 2023, Supermarkets and Hypermarkets dominated the end-user segment with 42.9% due to high transaction volumes.

- In 2023, Asia-Pacific led the market with 34.8%, driven by rapid retail sector expansion.

Component Analysis

Hardware dominates with 59.5% due to robust demand for advanced, integrated POS systems.

The component segment of the Retail POS market is critical to understanding the overall landscape. Among the components, Hardware stands out with a substantial 59.5% share, attributed primarily to the increased adoption of advanced, integrated POS systems in retail environments. This sub-segment benefits from technological advancements that enhance the efficiency and functionality of POS systems, including improved transaction processing speeds and enhanced data security features.

Software and Services also play essential roles but trail behind Hardware in dominance. Software is pivotal for the functionality of POS systems, providing the necessary applications for inventory management, sales reporting, and customer relationship management.

Services, including support and maintenance, are vital for ensuring the ongoing operation and updating of POS systems. Although they hold smaller market shares, these sub-segments contribute significantly to the market’s growth by enhancing the value and usability of the hardware through continuous improvements and support.

The persistent innovation in point of sale software, such as the integration of contactless payments and mobile POS systems, continues to drive the hardware segment’s growth. Retailers’ need to streamline operations and improve customer experiences fuels this demand, reinforcing Hardware’s dominant position in the market. Meanwhile, software and services are expected to grow in importance as they adapt to changing retail needs and technological advancements, supporting a holistic growth of the POS component market.

Type Analysis

Fixed POS leads with 58.1% due to its reliability and comprehensive features in high-volume environments.

In the Retail POS market, the Type segment is distinguished by the prevalence of Fixed POS systems, which hold a dominant 58.1% share. This dominance is largely due to the reliability and comprehensive features these systems offer, particularly in high-volume retail environments like supermarkets and hypermarkets. Fixed POS systems are favored for their robustness and ability to handle large volumes of transactions efficiently.

Mobile POS, while less dominant, is rapidly gaining traction due to its flexibility and ease of use, particularly in smaller retail formats such as pop-up stores or small boutiques. This sub-segment is enhancing customer service by enabling transactions at any location within the store, thus reducing wait times and improving the overall customer experience.

The continued dominance of Fixed POS can be attributed to its indispensable role in large retail operations, where comprehensive capabilities such as inventory management, sales tracking, and customer management are critical.

However, the evolving retail landscape, characterized by a shift towards omnichannel retailing, suggests a significant potential for growth in Mobile POS. This sub-segment’s adaptability and integration capabilities with smartphones and tablets are likely to boost its market share, offering retailers versatile solutions to meet changing consumer preferences.

End-User Analysis

Supermarkets and Hypermarkets dominate with 42.9% due to their extensive need for comprehensive POS solutions.

In analyzing the End-User segment of the Retail POS market, Supermarkets and Hypermarkets emerge as the dominant sub-segment, accounting for 42.9% of the market. This dominance is driven by their extensive need for comprehensive POS solutions that can manage large inventory volumes, handle high customer footfall, and integrate various payment systems seamlessly.

Specialty Stores, Convenience Stores, Grocery Stores, and Other End-Users also contribute to the market but at a lesser extent compared to Supermarkets and Hypermarkets. These segments benefit from tailored POS solutions that cater to their specific operational needs and customer handling requirements. For instance, specialty stores often require POS systems that can handle unique product ranges and offer detailed sales analytics.

Supermarkets and Hypermarkets continue to drive the demand for advanced POS systems due to their scale and the complexity of their operations. The efficiency of transaction processing, reliability in high-volume environments, and integration capabilities with other technological systems (such as CRM and ERP) are crucial for these large retailers. As retail evolves, the role of other end-user segments is also expected to expand, particularly with the increasing customization of POS solutions to meet diverse retail requirements.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Type

- Fixed POS

- Mobile POS

By End-User

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Grocery Stores

- Other End-Users

Driver

Technological Advancements Drive Market Growth

The Retail POS market is growing significantly due to several key factors. The adoption of cloud-based POS systems is a primary driver, offering retailers the flexibility to manage operations from anywhere.

This trend is coupled with the increasing demand for enhanced security features, as businesses seek to protect sensitive customer data against breaches. Additionally, the integration of advanced analytics in POS systems allows retailers to gain valuable insights into consumer behavior, aiding in more targeted marketing efforts.

The growth of e-commerce platforms and mobile payment solutions also plays a crucial role, as more consumers prefer digital transactions. These technological advancements are collectively transforming the retail landscape, leading to the widespread adoption of modern POS systems.

Retailers are increasingly recognizing the importance of upgrading their POS infrastructure to stay competitive, improve efficiency, and enhance the customer experience. The combined effect of these factors is driving robust growth in the Retail POS market, with businesses seeking to leverage the latest technologies to meet evolving consumer expectations.

Restraint

Cost and Complexity Restrain Market Growth

Several factors are restraining the growth of the Retail POS market, with cost and complexity being significant barriers. The high initial investment required for advanced POS systems can be a deterrent for small and medium-sized businesses, limiting market adoption.

In addition to cost, the complexity of integrating new POS systems with existing infrastructure presents challenges. Many retailers face difficulties in transitioning to modern systems, especially when they rely on outdated technology that requires extensive upgrades.

Another restraining factor is the ongoing concern about data security. Retailers must invest in robust cybersecurity measures to protect customer data, which can increase operational costs and add to the overall complexity of POS system management.

Moreover, the lack of skilled personnel to manage and maintain these systems can further hinder market growth. Training employees to effectively use new POS technology is time-consuming and can slow down the adoption process.

While the market holds potential, these restraining factors must be addressed to enable broader adoption and sustained growth. As a result, overcoming these challenges is crucial for the market to achieve its full potential and for businesses to reap the benefits of advanced POS solutions.

Opportunity

Emerging Technologies Provide Opportunities

Emerging technologies in the Retail POS market offer significant opportunities for growth. The rise of AI-driven analytics is a key factor, enabling retailers to make data-driven decisions, optimize inventory, and personalize customer experiences.

Additionally, the increasing adoption of Internet of Things (IoT) devices allows seamless integration between various retail systems, enhancing operational efficiency and enabling real-time tracking of sales and inventory. These technologies are particularly valuable for retailers looking to streamline processes and reduce costs.

Another opportunity lies in the expansion of mobile payment solutions, which cater to the growing preference for cashless transactions. Retailers can attract more customers by offering a variety of payment options, thereby increasing sales and customer satisfaction.

Finally, the shift towards omnichannel retailing creates a demand for integrated POS systems that can manage both online and in-store transactions. This presents an opportunity for market players to develop and offer solutions that bridge the gap between different sales channels.

Challenge

Operational Challenges Hinder Market Growth

Operational challenges are significant hurdles to the growth of the Retail POS market. One major issue is the ongoing need for system updates and maintenance, which can disrupt business operations and require continuous technical support. Retailers often find it challenging to keep their systems up to date, leading to potential downtime and reduced efficiency.

Another challenge is the integration of POS systems with other retail management tools. Many retailers struggle with ensuring seamless communication between their POS systems and inventory, customer relationship management (CRM), and e-commerce platforms. This lack of integration can result in data silos and operational inefficiencies.

The rapid pace of technological change also poses a challenge. Retailers must continuously adapt to new features and updates, which can be overwhelming, particularly for businesses with limited IT resources. Keeping up with these changes can strain operations and lead to additional costs.

Additionally, customer expectations for a seamless and speedy checkout experience put pressure on retailers to maintain high system performance. Any lag or failure in the POS system can negatively impact customer satisfaction and sales.

Growth Factors

Digital Payment Adoption and Analytics Are Growth Factors

The Retail POS market is experiencing substantial growth, driven by several key factors. The widespread adoption of digital payment solutions is a major contributor, as consumers increasingly prefer contactless and mobile payment options. This shift is encouraging retailers to upgrade their POS systems to accommodate various payment methods, thereby enhancing the customer experience.

Additionally, the integration of advanced data analytics into POS systems is transforming how retailers operate. By leveraging data insights, businesses can better understand customer behavior, optimize inventory management, and personalize marketing efforts. This data-driven approach not only improves operational efficiency but also drives sales growth by targeting consumer preferences more accurately.

The expansion of e-commerce also plays a critical role in the market’s growth. As online shopping continues to rise, retailers are adopting omnichannel strategies that require POS systems capable of managing both in-store and online transactions. This need for seamless integration across sales channels is prompting more retailers to invest in sophisticated POS solutions.

Moreover, the increasing focus on enhancing the overall customer experience is driving demand for modern POS systems. Retailers are recognizing the importance of providing quick, efficient, and personalized service, which is facilitated by advanced POS technologies.

Emerging Trends

Mobile POS and Cloud Integration Are Latest Trending Factors

The Retail POS market is being shaped by several trending factors that are driving its evolution. One of the most prominent trends is the increasing adoption of mobile POS (mPOS) systems. Retailers are embracing mPOS to offer greater flexibility and convenience, allowing staff to assist customers anywhere in the store, reducing checkout times and enhancing the shopping experience.

Another key trend is the shift toward cloud-based POS systems. These systems offer significant advantages, including easier updates, lower upfront costs, and the ability to access data remotely. Retailers are increasingly opting for cloud solutions to streamline operations and reduce IT management burdens.

The rise of integrated loyalty programs within POS systems is also a notable trend. Retailers are using these integrated features to gather customer data and offer personalized rewards, which not only enhances customer retention but also drives repeat business. This trend highlights the growing importance of customer relationship management within the retail environment.

Lastly, the trend towards contactless payments is gaining momentum, accelerated by the global pandemic and changing consumer preferences. Retailers are updating their POS systems to accept a wide range of contactless payment options, catering to the demand for safer, faster transactions.

Regional Analysis

Asia-Pacific Dominates with 34.8% Market Share

Asia-Pacific leads the Retail POS market, boasting a 34.8% share that translates into USD 9.40 billion. This region’s dominance is primarily fueled by rapid urbanization, increasing consumer spending, and technological advancements. The proliferation of retail outlets and a surge in e-commerce activities further amplify its market presence.

The Asia-Pacific market thrives on its ability to integrate advanced POS technologies, which cater to a growing retail sector. Enhanced mobile connectivity and the widespread adoption of mobile payment systems in countries like China and India play a critical role. The presence of major global players who invest heavily in the region bolsters the market’s robust infrastructure and technological edge.

The future of Asia-Pacific in the Retail POS market appears promising. With ongoing technological innovations and an increasing number of retailers adopting POS systems, the market is expected to expand further. Economic growth and the continued rise of consumer markets in the region suggest a sustained, if not increasing, influence on the global landscape.

Regional Mentions:

- North America: North America holds a significant position in the Retail POS market, driven by technological advancements and high consumer spending. The adoption of cloud-based and mobile POS solutions is particularly notable, supporting a diverse retail environment.

- Europe: Europe maintains a strong Retail POS market presence, supported by stringent data security regulations that foster trust in digital transactions. The market benefits from the adoption of EMV-compliant POS systems across various retail sectors.

- Middle East & Africa: The Middle East and Africa are steadily growing in the Retail POS sector, driven by retail expansion and digital transformation initiatives. The region’s focus on diversifying economic activities away from oil boosts its market potential.

- Latin America: Latin America’s Retail POS market is expanding due to increasing retail modernization and the penetration of mobile technologies. Economic recovery and a rising middle class contribute to the growing adoption of POS systems in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Retail Point of Sale (POS) market is driven by several key players who hold strong positions due to their innovation, strategic partnerships, and expansive customer bases. The top three companies in this market—Oracle Corporation, Block, Inc., and Shopify Inc.—stand out due to their market influence and strategic positioning.

Oracle Corporation holds a dominant position, leveraging its extensive software portfolio and global reach. Its cloud-based POS solutions integrate seamlessly with other Oracle applications, making it a preferred choice for large retailers. Oracle’s strategic focus on innovation and its ability to cater to both small and large businesses enhance its influence in the market.

Block, Inc. (formerly Square, Inc.) is a major disruptor in the retail POS space, known for its user-friendly and cost-effective solutions. Its strategic focus on small to medium-sized businesses, combined with an expanding ecosystem that includes financial services and e-commerce, strengthens its market presence. Block’s adaptability and continuous innovation make it a key player in shaping the future of POS systems.

Shopify Inc. has rapidly gained market share by integrating POS solutions with its robust e-commerce platform. Shopify’s strategic positioning is centered around empowering small and medium-sized retailers with an all-in-one solution that bridges in-store and online sales. Its growing influence is backed by a strong focus on customer experience and ease of use, making it a significant player in the retail POS market.

These companies are leading the market with their strategic innovations, wide-ranging solutions, and strong customer focus, setting the pace for the rest of the industry.

Top Key Players in the Market

- Oracle Corporation

- Block, Inc.

- Shopify Inc.

- VeriFone, Inc.

- Revel Systems

- Diebold Nixdorf, Inc.

- Toshiba Corporation

- Zebra Technologies Corporation

- Lightspeed POS Inc.

- Ingenico

- Other Key Players

Recent Developments

- Zoho Launches Zakya: In August 2024, Zoho Corporation launched a new business division called Zakya, specifically targeting small and medium-sized retail businesses in India. Zakya offers a cloud-based Point-of-Sale (POS) solution that aims to streamline day-to-day operations for retailers.

- Aptos Cloud POS at EES Retail Stores: Aptos, a leading provider of retail technology solutions, has enhanced its cloud-based POS solutions at EES retail stores. This implementation is designed to improve customer experiences and streamline store operations.

- GLORY Acquires Flooid: In December 2023, GLORY Ltd., a global leader in cash technology solutions, announced the acquisition of Flooid, a company known for its cloud-based retail POS solutions. This strategic move is expected to bolster GLORY’s position in the retail technology market, particularly in the POS segment.

- VSBLTY’s AI-Driven Retail POS Solutions: VSBLTY, a leader in artificial intelligence and computer vision technology, has received a $500,000 purchase order to co-develop AI-driven retail POS solutions. This project emphasizes the growing role of AI in enhancing retail operations, particularly through personalized customer interactions and improved inventory management.

Report Scope

Report Features Description Market Value (2023) USD 27.0 Billion Forecast Revenue (2033) USD 73.3 Billion CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Type (Fixed POS, Mobile POS), By End-User (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Grocery Stores, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle Corporation, Block, Inc., Shopify Inc., VeriFone, Inc., Revel Systems, Diebold Nixdorf, Inc., Toshiba Corporation, Zebra Technologies Corporation, Lightspeed POS Inc., Ingenico, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Retail POS Market?The Retail Point of Sale (POS) Market refers to the market for systems and devices used in retail environments to facilitate transactions. These systems typically include hardware such as cash registers, barcode scanners, receipt printers, and software that manages sales, inventory, and customer data.

How big is the Retail POS Market?The Retail POS Market was valued at USD 27.0 billion and is projected to reach USD 73.3 billion, growing at a compound annual growth rate (CAGR) of 10.5%.

What are the key factors driving the growth of the Retail POS Market?Key factors driving the growth include the increasing adoption of advanced POS systems by retailers to improve operational efficiency, the shift towards digital payments, and the need for enhanced customer experience. The rise of e-commerce and omnichannel retail strategies also contributes to the market's expansion.

What are the current trends and advancements in the Retail POS Market?Current trends include the growing use of mobile POS (mPOS) systems, the integration of AI and machine learning for better customer insights, and the shift towards cloud-based POS solutions. Additionally, there is a trend towards more secure and versatile payment options, including contactless payments.

What are the major challenges and opportunities in the Retail POS Market?Challenges include high initial setup costs and the need for ongoing maintenance and upgrades. Opportunities exist in emerging markets where retail digitization is on the rise, as well as in the development of more user-friendly and cost-effective POS solutions.

Who are the leading players in the Retail POS Market?Leading players include Oracle Corporation, Block, Inc., Shopify Inc., VeriFone, Inc., Revel Systems, Diebold Nixdorf, Inc., Toshiba Corporation, Zebra Technologies Corporation, Lightspeed POS Inc., Ingenico, and other key players.

-

-

- Oracle Corporation

- Block, Inc.

- Shopify Inc.

- VeriFone, Inc.

- Revel Systems

- Diebold Nixdorf, Inc.

- Toshiba Corporation

- Zebra Technologies Corporation

- Lightspeed POS Inc.

- Ingenico

- Other Key Players