Global Retail Cloud Computing Market Size, Share and Analysis Report By Service Model (Software as a Service, Platform as a Service, Infrastructure as a Service), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Supply Chain Management & Merchandising, Omnichannel Retail & Customer Experience, Store Operations & Workforce Management, Analytics & Business Intelligence, Security & Compliance, Others), By End-User Retail (Supermarkets & Hypermarkets, Specialty Stores & Apparel, Department Stores & Discount Stores, E-commerce Pure-play, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173412

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Retail Cloud Computing Insights

- Operational and Business Impact Insights

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Service Model

- By Deployment Model

- By Organization Size

- By Application

- By End-User Retail

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Demand Analysis

- Investment Opportunities

- Business Benefits

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

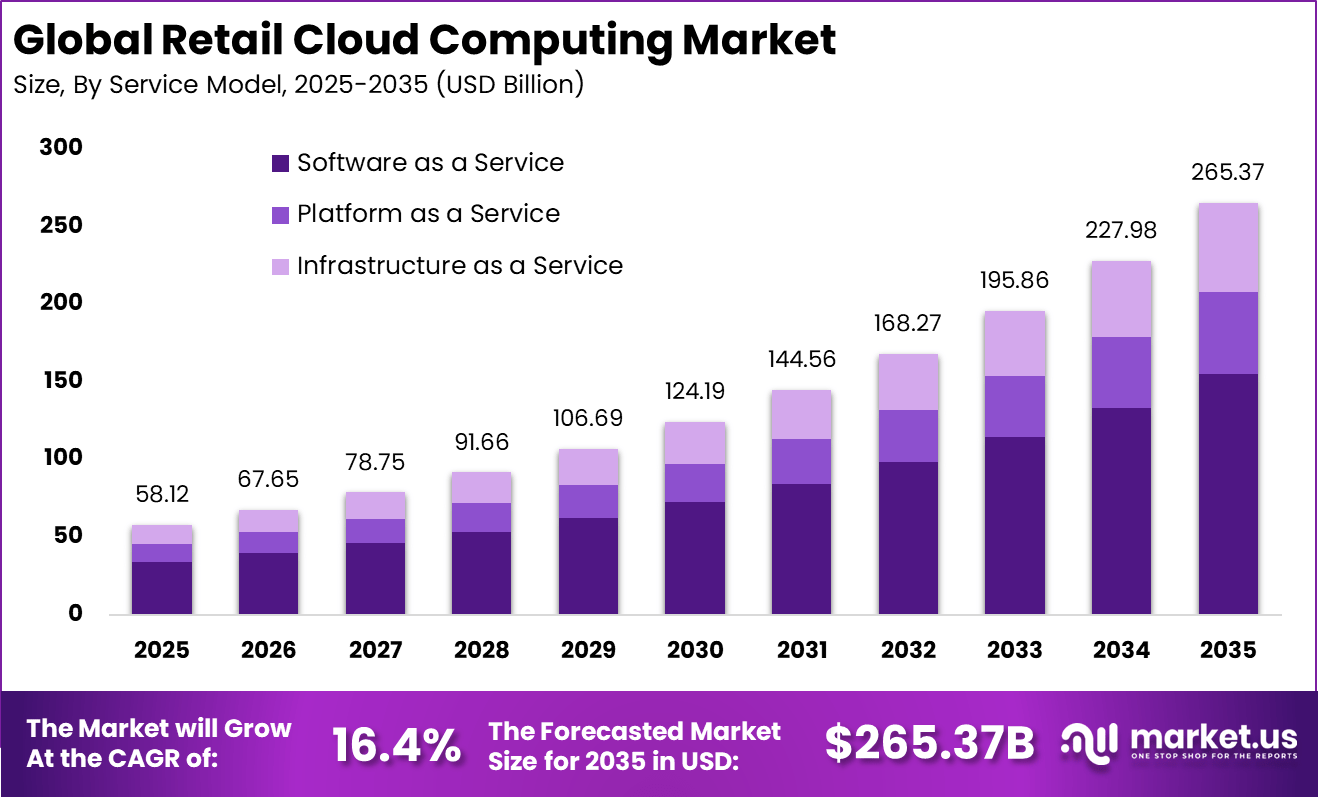

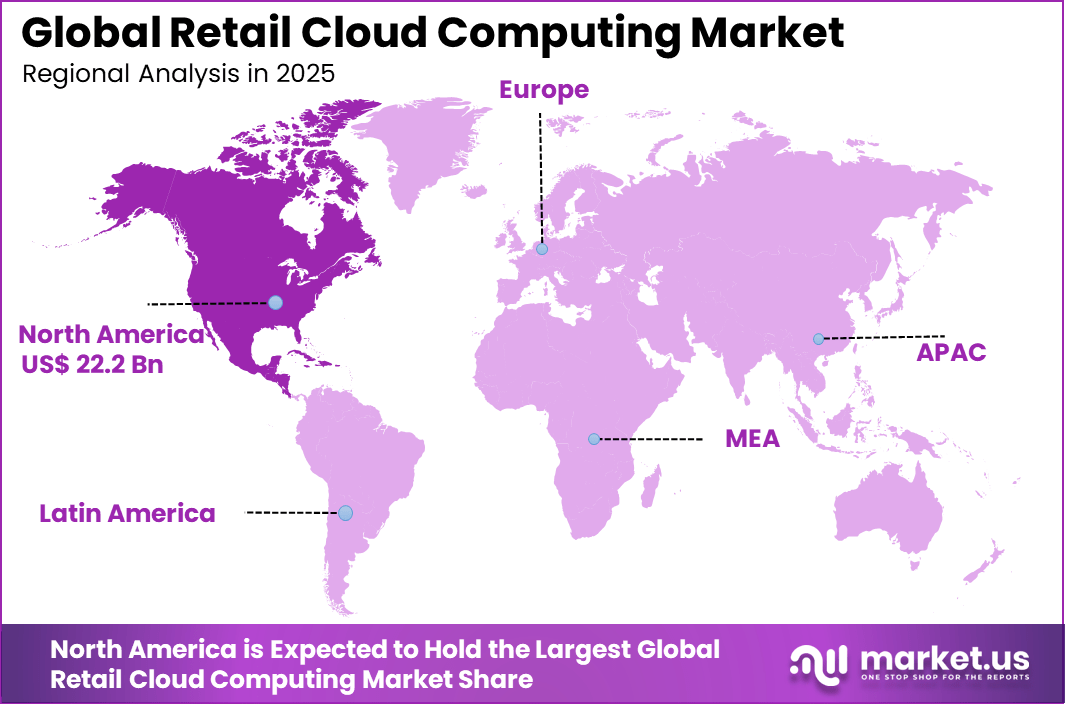

The Global Retail Cloud Computing Market size is expected to be worth around USD 265.37 billion by 2034, from USD 58.12 billion in 2025, growing at a CAGR of 16.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38.21% share, holding USD 22.2 billion in revenue.

The retail cloud computing market refers to cloud based technologies and services that enable retailers to run applications, store data, and manage operations on remote servers. These solutions include infrastructure as a service, platform as a service, software as a service, and data analytics tools designed specifically for retail environments. Adoption is observed across brick and mortar stores, e commerce platforms, and omnichannel retail operations that require scalable, flexible, and secure computing resources.

Retail cloud computing supports inventory management, customer experience, supply chain processes, and point of sale systems with real time accessibility. Growth in this market has been influenced by the rapid shift toward digital retailing and the need for agility in responding to changing consumer behaviour. Retailers face pressure to deliver seamless shopping experiences across online and physical channels while managing complex backend systems.

For instance, in April 2025, Adobe debuted Commerce as a Cloud Service and Optimizer at Summit 2025, offering versionless SaaS with edge delivery for ultra-fast storefronts. It supports massive catalogs and global expansion, cutting TCO for high-volume merchants.

Key Retail Cloud Computing Insights

- In 2025, Software as a Service emerged as the dominant delivery model, capturing a 68% share. This reflects retailer preference for scalable, subscription-based platforms that reduce IT complexity and speed up deployment.

- The Public Cloud segment led deployment choices with a 60% share in 2025. This dominance was supported by flexibility, rapid scalability, and lower upfront infrastructure requirements.

- Large enterprises accounted for a 65% share of adoption in 2025, highlighting their stronger digital maturity and ability to invest in advanced cloud ecosystems across regions and formats.

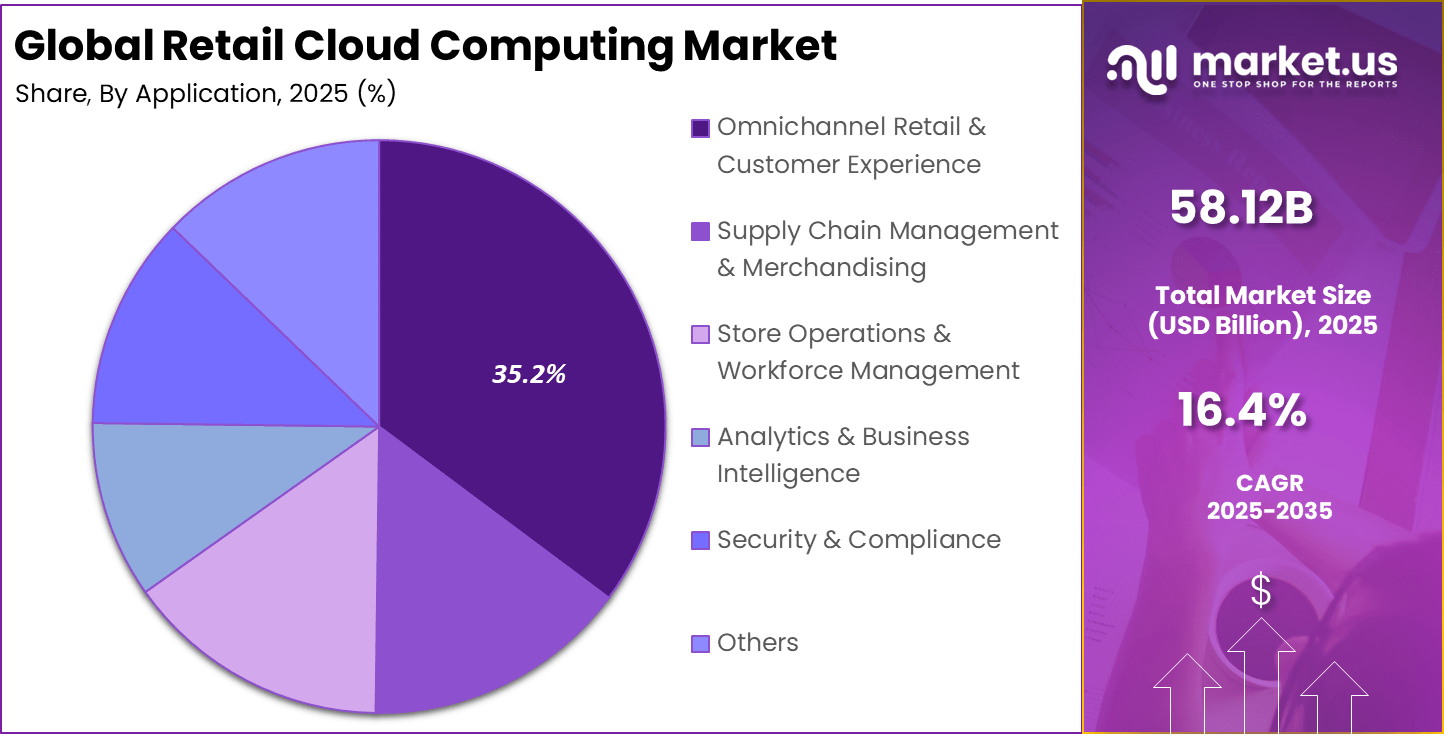

- Omnichannel retail and customer experience applications held a leading 65% share in 2025. This indicates that seamless integration of online and offline channels remained the primary business objective for cloud investments.

- The Supermarkets and Hypermarkets segment also captured a 65% share in 2025, driven by high transaction volumes, complex supply chains, and demand for real-time inventory visibility.

- The United States remained a central contributor to overall adoption in 2025, supported by early technology uptake and strong enterprise cloud readiness.

- North America maintained regional leadership with more than a 38.21% share in 2025, reflecting widespread cloud penetration and advanced retail digital infrastructure.

Operational and Business Impact Insights

- Sales performance has shown strong improvement, as retail organizations implementing cloud-based platforms recorded sales gains of up to 95%. This uplift was largely driven by unified sales channels and improved access to real-time customer and inventory data.

- Cost efficiency has improved materially with cloud adoption, as average operational expenses declined by 30%-40%. These savings were mainly achieved through infrastructure optimization, reduced maintenance needs, and better resource utilization.

- Customer experience has become a core driver, with 73% of shoppers using multiple channels during the purchase journey. As a result, nearly 80% of retailers now prioritize cloud-enabled omnichannel integration to maintain consistency and service quality.

- AI integration through cloud platforms continued to expand, with about 71% of retailers using cloud-based AI and machine learning for supply chain planning. In parallel, 86% adopted these tools to automate retail operations, improving speed, accuracy, and decision support.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Omnichannel retail expansion Integration of online and offline retail operations ~4.2% North America, Europe Short to Mid Term Demand for real time analytics Data driven pricing and inventory decisions ~3.6% Global Short Term Growth of e commerce platforms Need for scalable and flexible infrastructure ~3.1% Global Mid Term Cost optimization focus Shift from capital expenditure to operational models ~2.8% Global Mid Term AI driven customer engagement Personalized shopping experiences ~2.7% North America, Asia Pacific Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data security concerns Exposure of customer and payment data ~3.4% Global Short Term Regulatory compliance Data protection and consumer privacy rules ~2.6% Europe, North America Mid Term Cloud service outages Operational disruption during peak sales ~2.1% Global Short Term Vendor dependency Reliance on limited cloud providers ~1.7% Global Long Term Integration complexity Legacy system compatibility issues ~1.3% Global Mid Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High migration effort Complexity in moving legacy retail systems ~3.8% Global Short to Mid Term Skills shortage Lack of cloud skilled retail IT teams ~3.1% Global Mid Term Cost visibility challenges Difficulty forecasting cloud spending ~2.4% Global Short Term Latency concerns Real time processing limitations ~1.9% Emerging Markets Mid Term Resistance to change Conservative IT adoption in retail chains ~1.5% Global Long Term By Service Model

Software as a Service captured 58.4%, making it the leading service model in the retail cloud computing market. Retailers use SaaS solutions for inventory management, customer analytics, and point-of-sale systems. SaaS platforms reduce the need for in-house IT infrastructure. Easy deployment supports faster digital transformation. Subscription-based access improves cost control.

The dominance of SaaS is driven by operational flexibility. Retailers can scale services based on demand fluctuations. Regular updates improve functionality and security. SaaS platforms integrate easily with retail systems. This sustains high adoption across retail formats.

For Instance, in January 2025, Salesforce launched Agentforce for Retail, a set of AI agents built on its SaaS platform to automate retail tasks like order handling and personalization. This boosts store associate productivity by pulling data from sales and inventory into one view, helping retailers deliver faster, tailored shopper experiences without complex setups.

By Deployment Model

Public cloud deployment accounted for 62.7%, reflecting strong preference for shared cloud environments. Public cloud platforms offer scalability and cost efficiency. Retailers benefit from rapid deployment and reduced capital expenditure. Centralized access supports multi-store operations. Public cloud models simplify system management.

Adoption of public cloud is driven by expanding digital retail operations. Retailers use public cloud for data analytics and online platforms. Improved security standards increase trust in public cloud services. Continuous innovation supports performance improvements. This keeps public cloud as the dominant deployment model.

For instance, in December 2025, AWS rolled out Graviton5 processors and new public cloud tools for retail workloads, powering faster analytics and inventory management. Retailers leverage this for scalable storage during peaks, keeping costs low while handling massive data flows seamlessly.

By Organization Size

Large enterprises held 68.9%, highlighting their dominant role in retail cloud adoption. These organizations manage extensive store networks and digital channels. Cloud computing supports centralized control and reporting. Large enterprises require scalable and reliable systems. Cloud platforms meet these needs effectively.

Adoption among large enterprises is driven by digital transformation strategies. These retailers invest in advanced analytics and customer engagement tools. Cloud solutions support real-time decision-making. Integration across departments improves efficiency. This sustains strong enterprise-level adoption.

For Instance, in March 2025, IBM Cloud enhanced hybrid options for large enterprises, focusing on secure data handling for retail giants. It helps big chains modernize legacy systems with cloud, ensuring compliance while scaling enterprise-wide analytics and supply chain tools.

By Application

Omnichannel retail and customer experience accounted for 35.2%, making it a key application area. Cloud platforms enable seamless integration between online and physical stores. Retailers use cloud systems to unify customer data. Consistent experiences improve customer satisfaction. Omnichannel strategies rely heavily on cloud infrastructure.

Growth in this application is driven by changing consumer behavior. Customers expect consistent service across channels. Cloud solutions support personalization and engagement. Real-time data improves responsiveness. This drives continued investment in omnichannel applications.

For Instance, in March 2025, SAP launched Omnichannel Sales Transfer and Audit as SaaS for POS data unification. It offers real-time transaction visibility across channels, helping retailers boost stock accuracy and customer satisfaction without custom integrations.

By End-User Retail

Supermarkets and hypermarkets represent 31.8%, making them the leading retail end users. These retailers manage large transaction volumes and inventories. Cloud computing supports demand forecasting and supply chain coordination. Centralized systems improve store operations. Efficiency is critical in this segment.

Adoption in supermarkets and hypermarkets is driven by scale and complexity. Cloud platforms help manage pricing and promotions. Data analytics improve inventory accuracy. Integration with point-of-sale systems enhances control. This supports strong adoption in large-format retail.

For Instance, in December 2025, AWS announced AI agents like Security and DevOps Agents tailored for large retail formats such as supermarkets. These automate code reviews and incident fixes, ensuring stable cloud ops for high-traffic inventory and checkout systems in hypermarkets.

By Region

North America accounts for 38.21%, supported by advanced retail infrastructure and cloud adoption. Retailers in the region invest heavily in digital technologies. High internet penetration supports cloud-based retail systems. Customer experience remains a priority. The region remains a major contributor.

For instance, in January 2025, Google Cloud unveiled Vertex AI Search for commerce and Google Agentspace ahead of NRF 2025, enhancing retail AI capabilities with generative search, conversational commerce, and connected store solutions. These advancements boost product discovery and workforce productivity, reinforcing North American innovation in retail cloud platforms.

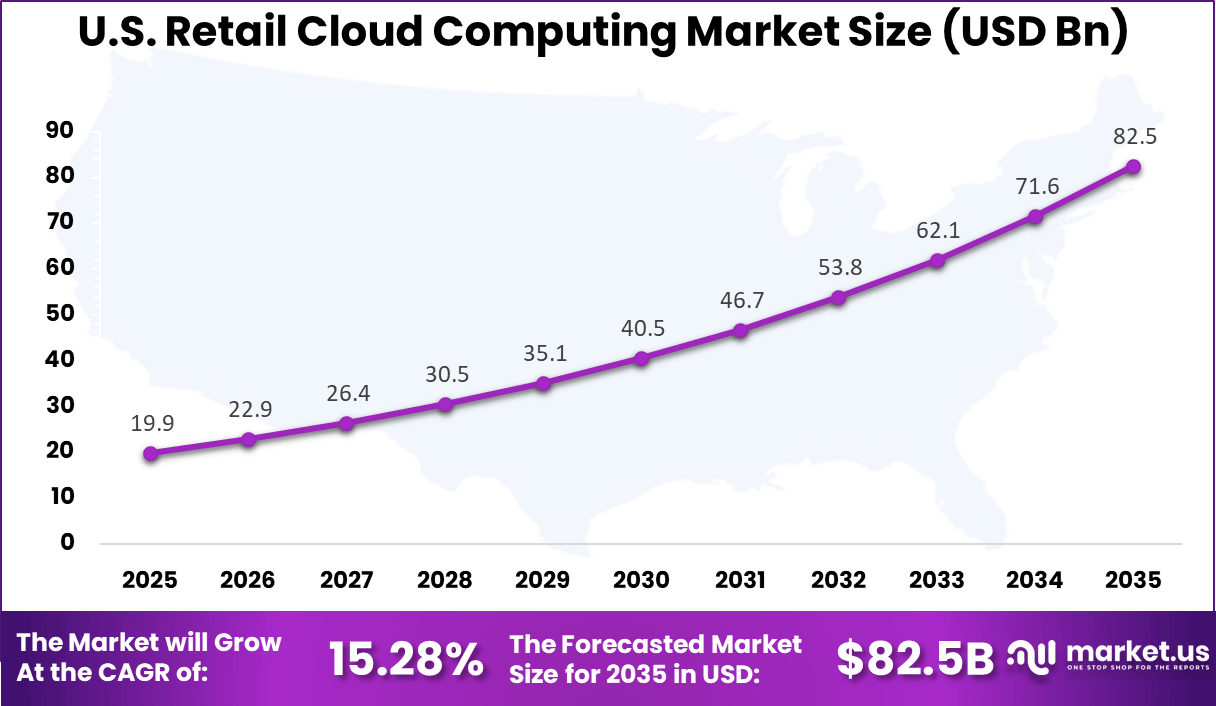

The United States reached USD 19.9 Billion with a CAGR of 15.28%, reflecting strong market growth. Expansion is driven by omnichannel retail strategies. Retailers adopt cloud platforms for scalability and analytics. Continuous innovation supports efficiency gains. Market growth remains robust.

For instance, in December 2025, Microsoft Cloud for Retail 2025 release wave introduced Personalized Shopping Agent and Store Operations Agent, leveraging AI for conversational shopping and operational insights. This strengthens U.S.-based Azure’s position in delivering omnichannel retail experiences and efficiency.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Large retail chains Very High ~39% Scalability and operational efficiency Long term cloud contracts E commerce companies High ~27% High traffic handling and analytics Continuous platform upgrades Technology providers Moderate to High ~18% Cloud service expansion Infrastructure investment Small and mid retailers Moderate ~11% Cost effective IT modernization Phased adoption System integrators Low to Moderate ~5% Retail transformation services Project based engagement Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Cloud infrastructure platforms Scalable compute and storage ~4.9% Mature Retail analytics engines Demand forecasting and insights ~3.8% Growing AI recommendation systems Personalized shopping experiences ~3.3% Growing API integration layers Unified retail systems ~2.5% Developing Edge computing Low latency in store processing ~1.9% Developing Demand Analysis

Demand for retail cloud computing is shaped by the expansion of e commerce and omnichannel retail strategies. Retailers increasingly require integrated systems that support online order fulfilment, real time inventory visibility, and customer service across multiple touch points. Cloud platforms enable centralized management of these functions and improve coordination between channels. As digital commerce continues to grow, demand for scalable cloud resources remains strong.

Demand is also influenced by the proliferation of mobile commerce and digital payments. Consumers expect retailers to offer secure and efficient mobile transactions, digital wallets, and contactless payment options. Cloud based payment processing and security services support these requirements while ensuring compliance with regulatory standards. Retailers view cloud computing as essential to meeting evolving payment and commerce expectations.

Investment Opportunities

Investment opportunities in the retail cloud computing market exist in specialised analytics and customer engagement platforms. Solutions that deliver actionable insights and support loyalty programmes can attract interest from retailers seeking competitive differentiation. Investments in real time analytics, recommendation engines, and customer journey optimisation tools may deliver strong value. These platforms support enhanced customer experiences and long term retention.

Another opportunity lies in hybrid cloud and multi cloud management services that help retailers balance performance, cost, and data governance. Many retailers require solutions that integrate private and public cloud assets while maintaining regulatory compliance. Providers that offer seamless orchestration and secure interoperability can capture demand among enterprise scale retailers. Investment in these management capabilities can strengthen market positioning.

Business Benefits

Adoption of retail cloud computing solutions can reduce total cost of ownership through lower infrastructure and maintenance expenses. Retailers shift from capital intensive hardware investments to operational expenditure models that align with business cycles. This cost efficiency frees funds for strategic initiatives such as marketing, innovation, and store enhancements. Over time, cost savings contribute to stronger financial performance.

Cloud computing also supports faster time to market for new services and applications. Retailers can deploy updates, launch services, and integrate third party tools more quickly on cloud platforms. This responsiveness is critical in competitive retail environments where agility influences customer satisfaction and market share. Cloud based development and deployment capabilities enable retailers to iterate and innovate with minimal delay.

Emerging Trends

In the retail cloud computing market, a notable trend is the increased use of real-time data platforms to support personalised customer experiences. Retailers are employing cloud solutions that consolidate point-of-sale data, online behaviour, and inventory movement to tailor offers, recommendations, and promotions at the individual level. This use of integrated data enhances engagement across digital and physical channels.

Another emerging trend is the adoption of edge computing in tandem with cloud infrastructure to reduce latency and support faster transaction processing at store locations. Edge nodes allow critical retail functions such as inventory checks, payment processing, and customer analytics to occur locally when network connectivity fluctuates, while cloud systems handle broader analytics and enterprise coordination.

Growth Factors

A primary growth factor in the retail cloud computing market is the need for scalable infrastructure to support omnichannel operations. Retailers now operate across e-commerce platforms, mobile apps, and physical stores. Cloud systems enable unified processing, consistent data access, and centralised management, which help companies synchronise operations and provide seamless customer experiences regardless of channel.

Another important growth factor is the expansion of cloud-native innovation in areas such as analytics, artificial intelligence, and automation. Cloud environments support rapid deployment of advanced capabilities for demand forecasting, customer segmentation, and supply chain optimisation. Access to these tools through the cloud lowers barriers to experimentation and helps retailers adapt more quickly to changing market demands.

Opportunity

A strong opportunity exists in the expansion of AI-powered customer engagement tools hosted in the cloud. Cloud platforms can deliver capabilities such as dynamic pricing, customer sentiment analysis, and predictive recommendations at scale. Retailers that leverage these insights can improve conversion rates and deepen loyalty by delivering contextually relevant interactions.

Another opportunity lies in enhanced supply chain cloud solutions that improve visibility and responsiveness. Cloud systems that unify demand planning, logistics tracking, supplier coordination, and inventory management can help retailers reduce stockouts, optimise fulfilment routes, and improve operational efficiency. Greater end-to-end transparency supports competitive advantage.

Challenge

A major challenge for the retail cloud computing market is ensuring performance and reliability during peak demand periods. Cloud services must handle seasonal spikes, flash sales, and high traffic events without degradation of user experience or transaction throughput. Retailers and cloud providers must design resilient architectures that maintain uptime and responsiveness under variable loads.

Another challenge involves managing governance and compliance in a multi-jurisdiction cloud environment. Retail operations often span multiple regions with diverse data protection laws, taxation rules, and consumer rights frameworks. Ensuring cloud deployments align with these legal requirements while maintaining consistent performance across markets adds complexity to strategic planning.

Key Market Segments

By Service Model

- Software as a Service

- Point-of-Sale Systems

- Inventory Management

- Customer Relationship Management

- E-commerce Platforms

- Workforce Management

- Others

- Platform as a Service

- Development & Deployment Platforms

- Analytics & Big Data Platforms

- Integration Platforms

- Others

- Infrastructure as a Service

- Compute

- Storage

- Networking

- Others

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Omnichannel Retail & Customer Experience

- Supply Chain Management & Merchandising

- Store Operations & Workforce Management

- Analytics & Business Intelligence

- Security & Compliance

- Others

By End-User Retail

- Supermarkets & Hypermarkets

- Specialty Stores & Apparel

- Fashion & Apparel

- Consumer Electronics

- Home & Furniture

- Others

- Department Stores & Discount Stores

- E-commerce Pure-play

- Others

Key Players Analysis

Amazon Web Services, Inc., Microsoft Corporation, and Google LLC dominate the retail cloud computing market through scalable infrastructure and advanced analytics services. Their platforms support demand forecasting, omnichannel operations, and real-time inventory visibility. Strong capabilities in artificial intelligence and data management enhance retail decision-making. Global data center networks improve performance and reliability.

International Business Machines Corporation, Oracle Corporation, SAP SE, Salesforce, Inc., and Adobe Inc. focus on enterprise-grade retail cloud applications. Their strengths include customer data platforms, ERP, CRM, and digital commerce tools. Emphasis is placed on secure data handling and system integration. These vendors support complex retail environments. Strong relationships with global brands improve adoption. Their solutions address personalization, loyalty management, and operational efficiency across physical and digital channels.

Cisco Systems, Inc., HCL Technologies Limited, and Fujitsu Limited support retail cloud deployment through networking and managed services. Specialized providers such as Infor, Inc., Epicor Software Corporation, LS Retail ehf, and Aptos, Inc. deliver industry-focused platforms. These solutions address merchandising and store operations. Other players serve niche needs.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- SAP SE

- Salesforce, Inc.

- Adobe Inc.

- Cisco Systems, Inc.

- HCL Technologies Limited

- Fujitsu Limited

- Infor, Inc.

- Epicor Software Corporation

- LS Retail ehf

- Aptos, Inc.

- Others

Recent Developments

- In September 2025, AWS hosted its Retail & Consumer Goods Symposium in London, showcasing AI acceleration across retail value chains and cloud infrastructure for rapid innovation. Retailers gained insights into data-driven decisions and scalable solutions amid evolving consumer behaviors.

- In January 2025, Oracle launched the redesigned Retail Xstore Point-of-Service on OCI’s containerized architecture, supporting up to 250 million SKUs with edge deployment options. This boosts agility for global retailers in high-throughput environments.

Report Scope

Report Features Description Market Value (2025) USD 58.1 Bn Forecast Revenue (2035) USD 265.3 Bn CAGR(2026-2035) 16.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Model (Software as a Service, Platform as a Service, Infrastructure as a Service), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Supply Chain Management & Merchandising, Omnichannel Retail & Customer Experience, Store Operations & Workforce Management, Analytics & Business Intelligence, Security & Compliance, Others), By End-User Retail (Supermarkets & Hypermarkets, Specialty Stores & Apparel, Department Stores & Discount Stores, E-commerce Pure-play, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Microsoft Corporation, Google LLC, International Business Machines Corporation, Oracle Corporation, SAP SE, Salesforce, Inc., Adobe Inc., Cisco Systems, Inc., HCL Technologies Limited, Fujitsu Limited, Infor, Inc., Epicor Software Corporation, LS Retail ehf, Aptos, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Retail Cloud Computing MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Retail Cloud Computing MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- SAP SE

- Salesforce, Inc.

- Adobe Inc.

- Cisco Systems, Inc.

- HCL Technologies Limited

- Fujitsu Limited

- Infor, Inc.

- Epicor Software Corporation

- LS Retail ehf

- Aptos, Inc.

- Others