Global Resolver Interface IC Market By Product Type (Analog Resolver Interface IC, Digital Resolver Interface IC, Integrated Resolver-to-Digital Converter IC), By System Type (Open-Loop Systems, Closed-Loop Servo Systems), By Application (Automotive, Industrial Automation, Others), By End-User (OEMs, Aftermarket), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172487

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Product Type Analysis

- System Type Analysis

- Application Analysis

- End-User Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Increasing Adoption Technologies

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

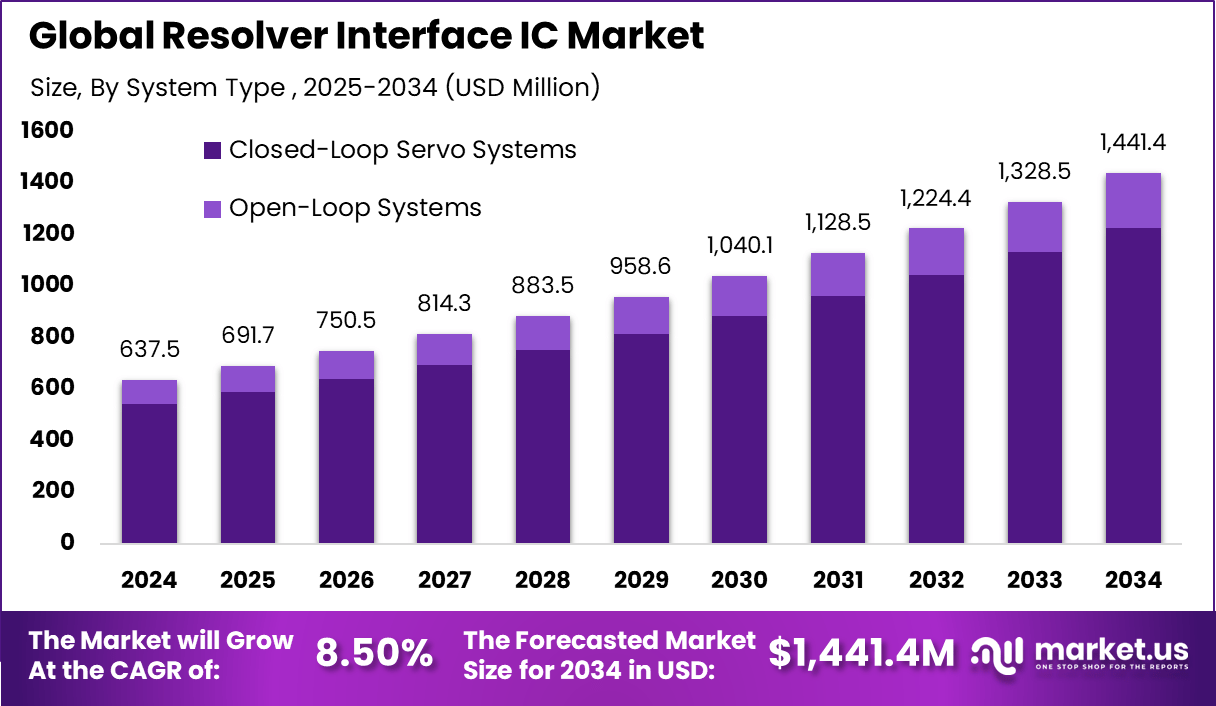

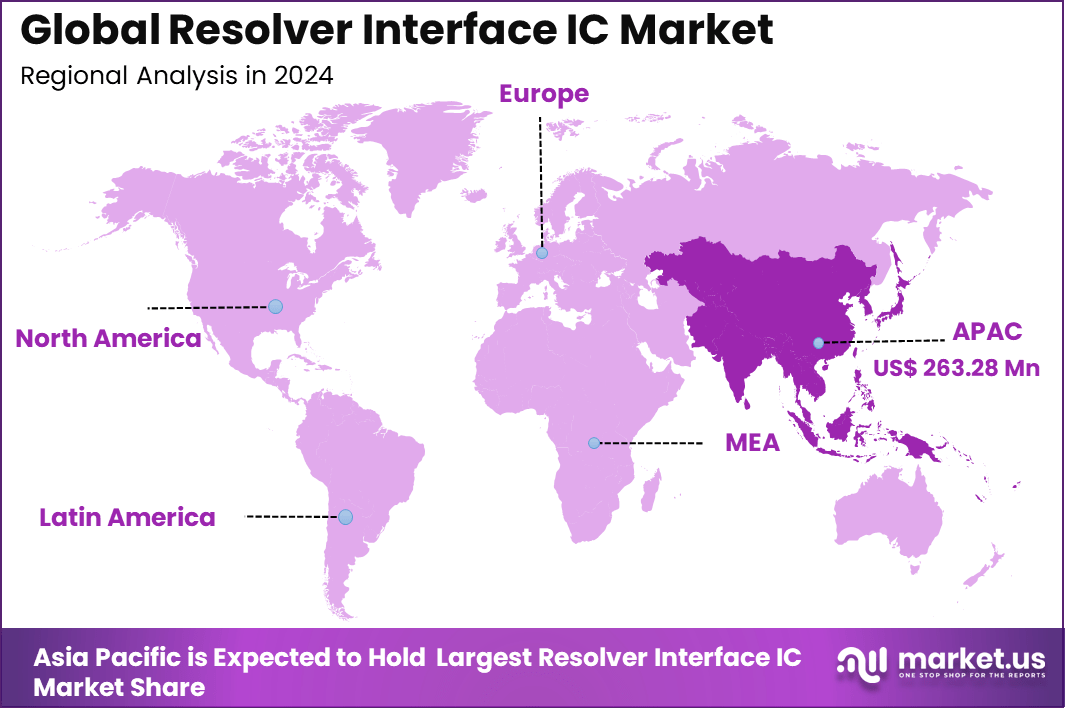

The Global Resolver Interface IC Market generated USD 637.5 million in 2024 and is predicted to register growth from USD 691.7 million in 2025 to about USD 1,441.4 million by 2034, recording a CAGR of 8.50% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 41.3% share, holding USD 263.28 Million revenue.

The resolver interface IC market refers to integrated circuits designed to convert resolver signals into digital position, speed, and angle data for control systems. Resolvers are electromagnetic sensors widely used in harsh and safety critical environments where reliability and accuracy are essential. Resolver interface ICs process sine and cosine signals generated by resolvers and translate them into precise digital outputs usable by control units.

These ICs are commonly deployed in industrial automation, aerospace, defense, automotive, and energy systems. Market development is supported by increasing use of electromechanical systems that require robust position sensing. Resolver interface ICs are preferred in environments with high temperature, vibration, and electrical noise where optical or Hall sensors may fail. Their long operational life and resistance to environmental stress make them suitable for mission critical applications.

One key driver of the resolver interface IC market is the growing adoption of electric motors in industrial and transportation applications. Precise motor control requires accurate feedback on rotor position and speed, which resolver systems provide reliably. Resolver interface ICs enable real time signal processing that supports smooth motor operation and torque control. This demand is particularly strong in servo drives, robotics, and traction systems.

Demand for resolver interface ICs is influenced by growth in industrial automation and motion control systems. Manufacturing facilities increasingly deploy advanced control systems to improve productivity and precision. These systems rely on dependable feedback devices for accurate positioning and synchronization. Resolver interface ICs support these requirements by enabling consistent signal conversion and integration with digital controllers.

Top Market Takeaways

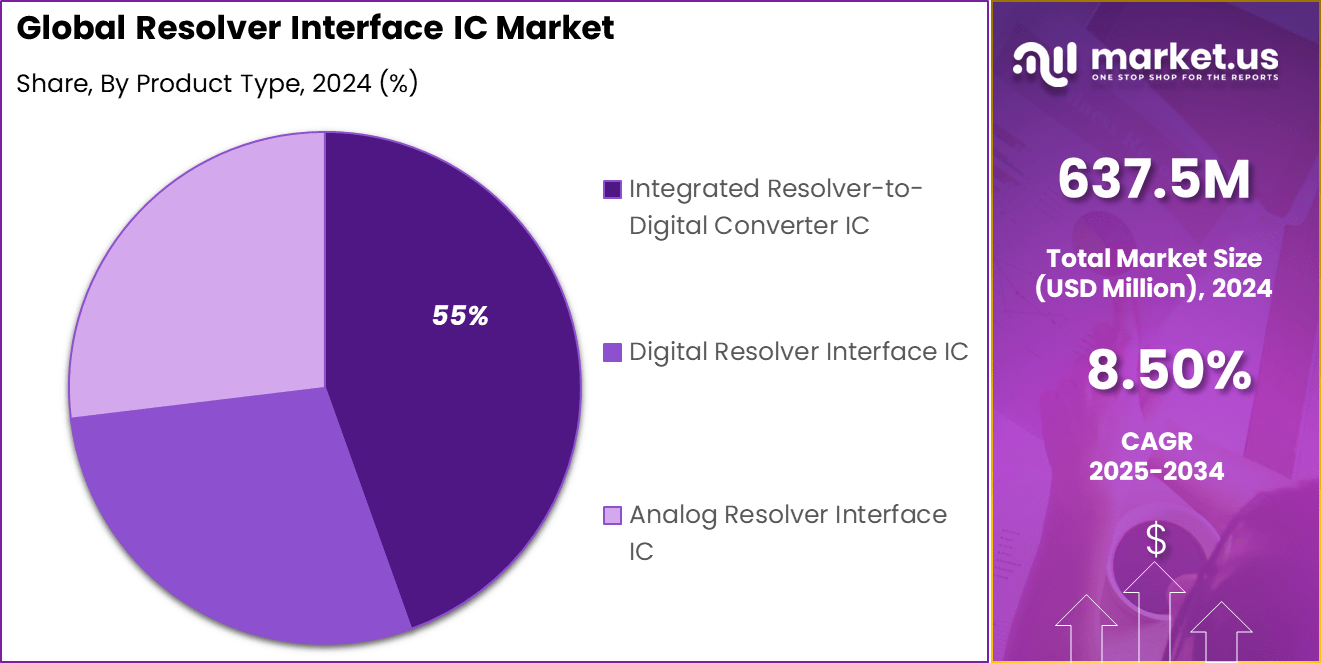

- By product type, integrated resolver-to-digital converter IC took 54.6% of the resolver interface IC market, converting analog signals to digital for precise motor control.

- By system type, closed-loop servo systems held 85.2% share, using resolvers for accurate feedback in high-precision motion applications.

- By application, automotive led with 47.8%, applying ICs in EV motors, steering, and ADAS for reliable position sensing.

- By end-user, OEMs captured 25.1%, integrating resolver ICs directly into vehicle and machinery designs.

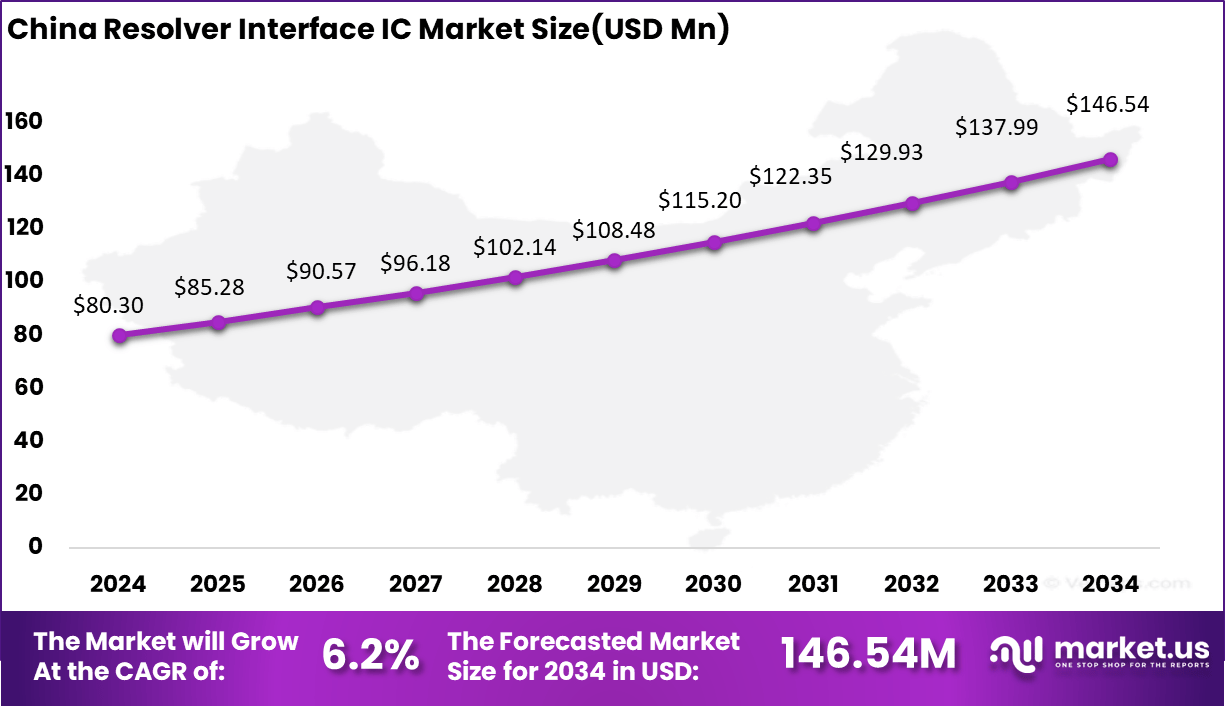

- Asia-Pacific had 41.3% of the global market, with China at USD 80.3 million in 2025 and growing at a CAGR of 6.2%

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Electrification of motion systems Rising use of precise motor control in electric systems ~2.4% Asia Pacific, Europe Short to Mid Term Growth in industrial automation Demand for accurate angular position sensing ~1.9% Global Mid Term Expansion of electric vehicles Increased resolver usage in traction motors ~1.7% Asia Pacific, Europe Mid Term OEM focus on reliability Preference for robust position sensing in harsh environments ~1.4% Global Long Term Aerospace and defense applications High precision requirements in critical systems ~1.1% North America, Europe Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Semiconductor supply volatility Dependency on specialized analog IC production ~2.0% Global Short Term Design complexity Integration challenges with advanced motor drives ~1.6% Global Mid Term Cost pressure from OEMs Pricing constraints in large volume contracts ~1.3% Asia Pacific Mid Term Alternative sensor adoption Competition from digital encoders ~1.0% Global Long Term Qualification cycle delays Lengthy validation processes ~0.8% Global Short to Mid Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High development cost Custom IC tuning for specific applications ~2.2% Global Mid Term Limited supplier base Dependence on few specialized vendors ~1.9% Asia Pacific Mid Term Slower adoption in low cost systems Preference for cheaper sensing solutions ~1.5% Emerging Markets Long Term Testing and calibration effort Increased time to market ~1.2% Global Short to Mid Term Component miniaturization limits Thermal and packaging constraints ~0.9% Global Long Term Product Type Analysis

Integrated resolver-to-digital converter ICs account for 55% of the Resolver Interface IC market, indicating strong demand for compact and efficient signal processing solutions. These ICs convert analog resolver signals into precise digital position data, which is essential for motion control systems. Integration of multiple functions into a single IC reduces system complexity and improves reliability. This makes them suitable for applications requiring accurate position and speed feedback.

From a system design perspective, integrated converter ICs simplify hardware architecture and reduce component count. They also support faster signal processing and improved noise immunity. The strong share of this segment reflects the growing need for high-precision and space-efficient solutions in modern control systems, especially where performance and reliability are critical.

System Type Analysis

Closed-loop servo systems dominate the market with a share of 85.2%, highlighting their importance in precision control applications. These systems continuously monitor position and speed feedback from resolvers and adjust motor performance accordingly. Resolver interface ICs play a key role by providing accurate feedback signals that enable real-time corrections. This ensures stable and precise motion control under varying operating conditions.

Closed-loop systems are widely used in applications where accuracy, responsiveness, and reliability are essential. They help reduce errors and improve system efficiency. The strong adoption of this system type reflects increased demand for advanced automation and control solutions across industries that rely on precise motor operation.

Application Analysis

The automotive sector accounts for 47.8% of application demand, making it the largest segment for resolver interface ICs. These ICs are used in electric power steering, traction motors, and drivetrain systems where accurate position sensing is required. Automotive applications demand components that can perform reliably under extreme temperatures and harsh conditions.

Resolver interface ICs support improved vehicle performance and safety by enabling precise motor control. Their growing use in electric and hybrid vehicles further strengthens this segment. The strong presence of automotive applications reflects the industry’s focus on electrification, efficiency, and advanced motion control technologies.

End-User Analysis

Original equipment manufacturers account for 25.1% of end-user adoption, reflecting their direct involvement in system design and integration. OEMs use resolver interface ICs to develop customized motion control solutions tailored to specific application requirements. Direct sourcing allows them to optimize performance, cost, and reliability at the system level.

OEMs value these ICs for their consistency and long-term availability. Integration at the design stage supports better system optimization and quality control. The presence of OEMs as a key end-user segment highlights the importance of close alignment between component suppliers and system designers in the motion control ecosystem.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior OEMs Very High ~25.1% Precision and system reliability Long term supply contracts Automotive suppliers High ~22% EV drivetrain performance Platform based sourcing Industrial equipment makers High ~21% Motion accuracy and durability Volume procurement Aerospace manufacturers Moderate ~17% Safety critical sensing Qualification driven Research institutions Low to Moderate ~14% Advanced motor control R and D Prototype focused Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Resolver to digital converters Core signal conversion ~3.0% Mature High precision ADCs Accurate angle measurement ~2.1% Mature Integrated motor control ICs Reduced system complexity ~1.7% Growing Noise filtering and compensation Stable operation in harsh conditions ~1.1% Growing Digital calibration algorithms Improved accuracy over lifecycle ~0.6% Developing Increasing Adoption Technologies

Advances in mixed signal semiconductor design have improved the performance of resolver interface ICs. Modern devices integrate excitation signal generation, demodulation, and digital conversion into compact ICs. This integration reduces component count and improves signal accuracy. Improved resolution and faster processing support high performance control applications.

Digital control architectures are also supporting adoption. Resolver interface ICs are increasingly designed to interface directly with microcontrollers, digital signal processors, and field programmable gate arrays. Standardized digital outputs simplify system integration and reduce software complexity. These technological improvements enhance usability and system efficiency.

One key reason organizations adopt resolver interface ICs is their robustness in demanding environments. These ICs maintain accurate performance despite electrical noise, temperature extremes, and mechanical vibration. This reliability reduces system failure risk and maintenance requirements. Long service life supports total cost of ownership advantages.

Another reason is precision and deterministic behavior in position sensing. Resolver interface ICs provide continuous position feedback without ambiguity across full rotational ranges. This characteristic is essential for safety critical and high precision motion control systems. Accurate feedback improves control stability and system performance.

Benefits

- Accurate angle and speed information improves control stability and system performance.

- Robust signal integrity supports consistent operation in electrically noisy conditions.

- Reduced maintenance needs lower downtime across the equipment lifecycle.

- Flexible interfacing enables use across different resolver types and control architectures.

- Compact designs help optimize board space and overall system efficiency.

Usage

- Motor control systems in industrial automation for reliable shaft position sensing.

- Electric mobility platforms to support traction motors and steering systems.

- Aerospace and defense equipment where durability and safety compliance are essential.

- Robotics and motion platforms requiring continuous and accurate angular feedback.

- Energy and heavy machinery applications operating in extreme environmental conditions.

Emerging Trends

Key Trend Description Higher Integration Levels Single chip designs combine excitation drivers, amplifiers, and diagnostics to simplify systems and reduce external components. AI Enhanced Processing Algorithms improve signal accuracy, noise immunity, and enable predictive fault detection for reliable operation. Miniaturization Advances Compact packages allow use in space limited applications such as robotics and electric vehicles. Sensor Fusion Capabilities Resolvers are combined with other sensors to improve precision in motion control and feedback systems. Serial Output Dominance SPI and I2C interfaces reduce wiring complexity and support digital connectivity in smart factories. Growth Factors

Key Factors Impact Electric Vehicle Adoption Rising use of electric and hybrid vehicles increases demand for accurate motor control under harsh conditions. Industrial Automation Rise Robotics and smart manufacturing require robust position sensing for precision tasks. Digital Transformation Push Industry 4.0 initiatives drive the need for connected and real time feedback systems. Regulatory Safety Standards Functional safety requirements accelerate adoption in critical and safety sensitive applications. Technological Miniaturization Smaller and efficient ICs expand use across consumer electronics and renewable energy systems. Opportunity

An opportunity in the resolver interface IC market exists in developing compact, integrated solutions for emerging electric mobility platforms. As electric vehicles, e-mobility devices, and autonomous systems proliferate, demand grows for high reliability position sensing in motor drives. IC providers that offer smaller packages with integrated diagnostics and calibration support can help reduce system complexity and support wider adoption.

Another opportunity lies in enhancing digital interface standards and support for multi-protocol connectivity. Resolver interface ICs that support flexible communication with common microcontroller and digital signal processor interfaces can simplify system design. Broader protocol support increases applicability across diverse embedded platforms.

Challenge

One of the main challenges for the resolver interface IC market is ensuring performance consistency across a wide range of operating conditions. Resolver signals can be affected by temperature variation, vibration, and electrical noise. Interface ICs must maintain accurate conversion and error mitigation throughout these conditions, which demands robust internal design and thorough validation.

Another challenge involves balancing power efficiency with signal processing capability. Advanced resolver interface ICs that include filtering, diagnostics, and high resolution conversion may consume more power. Optimising power consumption while delivering the required signal fidelity is essential for battery-driven applications and energy conscious systems.

Key Market Segments

By Product Type

- Analog Resolver Interface IC

- Digital Resolver Interface IC

- Integrated Resolver-to-Digital Converter IC

By System Type

- Open-Loop Systems

- Closed-Loop Servo Systems

By Application

- Automotive

- Industrial Automation

- Aerospace and Defense

- Robotics

- Medical Devices

- Others

By End-User

- OEMs

- Aftermarket

Regional Analysis

Asia Pacific accounted for 41.3% share, supported by strong growth in industrial automation, electric vehicles, robotics, and aerospace manufacturing across the region. Resolver interface ICs have been widely adopted to support precise position and speed sensing in harsh operating environments where reliability is critical.

Demand has been driven by increased deployment of servo motors and motion control systems in factories and automated production lines. The region’s expanding manufacturing base and focus on efficiency have reinforced steady adoption of resolver based sensing solutions.

Regional Driver Comparison

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn) Adoption Maturity Asia Pacific EV manufacturing and industrial automation 41.3% USD 263.7 Mn Advanced Europe Automotive electrification 27.8% USD 177.3 Mn Advanced North America Aerospace and industrial control systems 21.6% USD 137.7 Mn Advanced Latin America Industrial modernization 5.4% USD 34.4 Mn Developing Middle East and Africa Energy and infrastructure projects 3.9% USD 24.9 Mn Early China reached a market value of USD 80.3 Million and is projected to grow at a 6.2% CAGR, reflecting steady adoption of automation and motion control technologies. Resolver interface ICs are being used extensively in electric vehicles, industrial robots, and heavy machinery, where precise position feedback is essential for performance and safety. Growth has been supported by rising domestic production of motors, drives, and control systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Texas Instruments, Analog Devices, and Renesas Electronics hold a strong position in the resolver interface IC market. Their portfolios focus on high-precision signal conversion and robust performance. These companies support automotive and industrial motion control systems. Emphasis is placed on accuracy and reliability. Strong R&D investment improves product differentiation. Long-term relationships with OEMs support steady demand.

Infineon Technologies, STMicroelectronics, and NXP Semiconductors focus on resolver ICs for electric drives and automation. Their strengths include integration with power electronics and microcontrollers. Focus is placed on thermal stability and noise immunity. These vendors benefit from strong presence in automotive electrification. Product portfolios address both open-loop and closed-loop systems. Support for industrial standards improves adoption across diverse end-use environments.

Microchip Technology, Onsemi, ROHM Semiconductor, Melexis, ams OSRAM, Toshiba Electronic Devices & Storage, and Honeywell International address specialized motion sensing needs. These players focus on compact designs and reliability. Other vendors support niche and custom applications.

Top Key Players in the Market

- Texas Instruments

- Analog Devices

- Renesas Electronics

- Infineon Technologies

- STMicroelectronics

- NXP Semiconductors

- Maxim Integrated

- ROHM Semiconductor

- Panasonic Corporation

- Mitsubishi Electric

- Onsemi (ON Semiconductor)

- Microchip Technology

- Melexis

- ams OSRAM

- Toshiba Electronic Devices & Storage

- Honeywell International

- Others

Future Outlook

Growth in the Resolver Interface IC market is expected to continue as demand rises for precise position and speed sensing in motion control systems. These ICs are widely used in automotive, industrial automation, aerospace, and robotics applications where reliability in harsh environments is required.

Increasing use of electric vehicles, servo motors, and advanced robotics is supporting steady adoption. Over the coming years, better accuracy, lower power consumption, and improved integration with digital control systems are likely to expand usage across both traditional and emerging applications.

Recent Developments

- February, 2025, Renesas Electronics rolled out integrated resolver-to-digital converter tech in their next-gen EV solutions, enabling high-precision motor control at high speeds for autonomous driving systems.

- March, 2025, Analog Devices launched a new automotive-grade inductive resolver IC tailored for motor control, enhancing accuracy in EV and industrial drives.

Report Scope

Report Features Description Market Value (2024) USD 637.5 Bn Forecast Revenue (2034) USD 1,441.4 Bn CAGR(2025-2034) 8.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Analog Resolver Interface IC,Digital Resolver Interface IC,Integrated Resolver-to-Digital Converter IC), By System Type (Open-Loop Systems,Closed-Loop Servo Systems), By Application (Automotive,Industrial Automation,Others), By End-User (OEMs,Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Texas Instruments, Analog Devices, Renesas Electronics, Infineon Technologies, STMicroelectronics, NXP Semiconductors, Maxim Integrated, ROHM Semiconductor, Panasonic Corporation, Mitsubishi Electric, onsemi, Microchip Technology, Melexis, ams OSRAM, Toshiba Electronic Devices & Storage, Honeywell International, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Resolver Interface IC MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Resolver Interface IC MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Texas Instruments

- Analog Devices

- Renesas Electronics

- Infineon Technologies

- STMicroelectronics

- NXP Semiconductors

- Maxim Integrated

- ROHM Semiconductor

- Panasonic Corporation

- Mitsubishi Electric

- Onsemi (ON Semiconductor)

- Microchip Technology

- Melexis

- ams OSRAM

- Toshiba Electronic Devices & Storage

- Honeywell International

- Others