Global Renal Biomarker Market By Biomarker Type (Functional Biomarkers (Serum Creatinine, Blood Urea Nitrogen (BUN) and Estimated Glomerular Filtration Rate (eGFR)), Upregulated Proteins (Neutrophil Gelatinase-Associated Lipocalin (NGAL), Kidney Injury Molecule-1 (KIM-1), Cystatin C, Interleukin-18 (IL-18) and Others) and Others), By Technique (Immunoassays, Mass Spectrometry, Point-of-Care Tests, Enzyme-Linked Immunosorbent Assay (ELISA), Molecular Diagnostics and Others), By End-User (Hospitals, Diagnostic Laboratories, Academic & Research Institutes and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173054

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

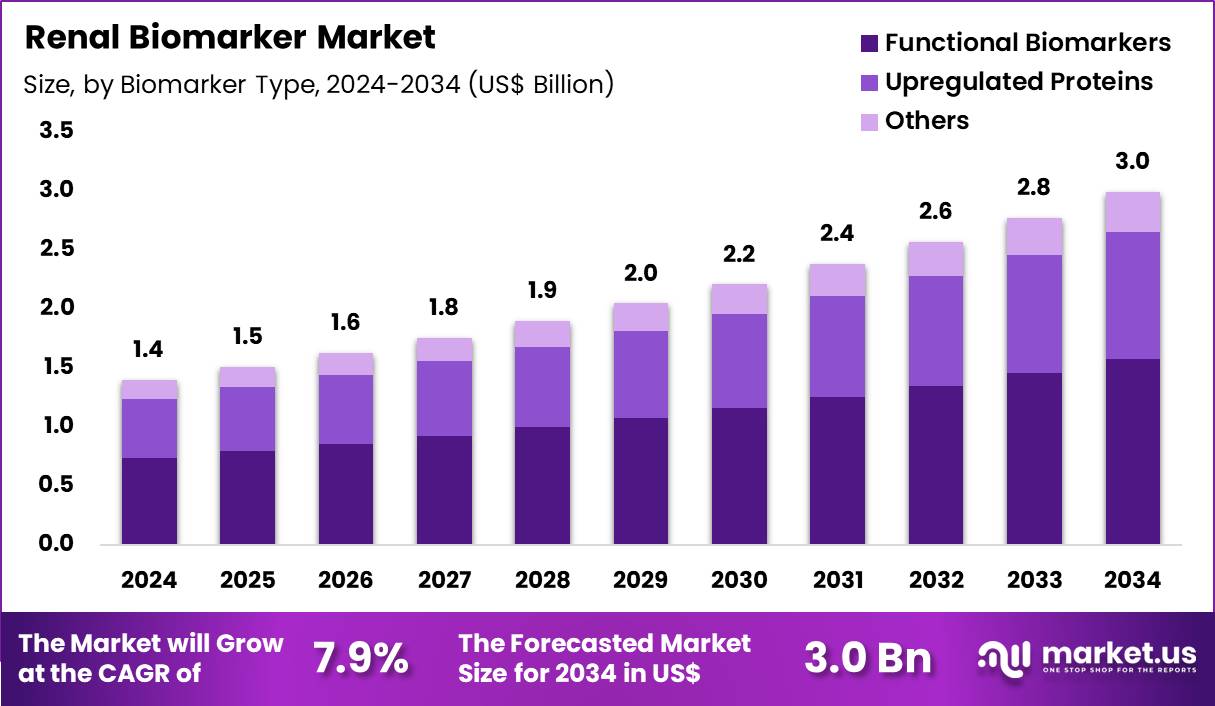

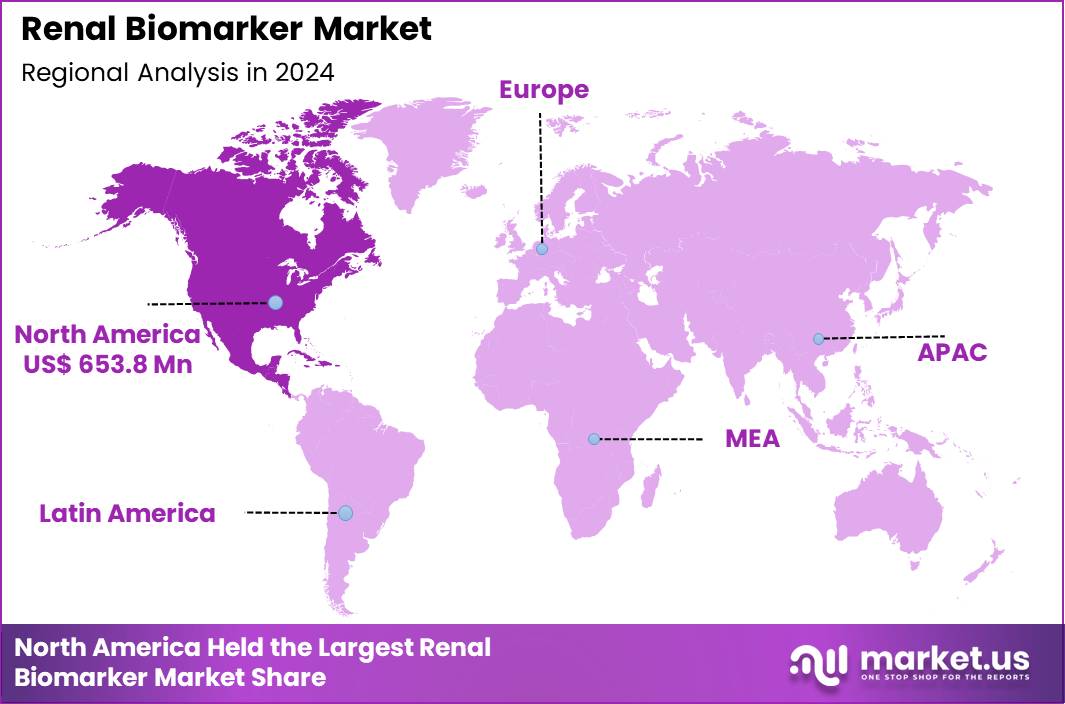

The Global Renal Biomarker Market size is expected to be worth around US$ 3.0 Billion by 2034 from US$ 1.4 Billion in 2024, growing at a CAGR of 7.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.7% share with a revenue of US$ 653.8 Million.

Rising prevalence of kidney-related disorders accelerates the adoption of renal biomarkers that enable early detection and precise monitoring of renal function across diverse clinical scenarios. Nephrologists increasingly measure novel urinary biomarkers like neutrophil gelatinase-associated lipocalin and kidney injury molecule-1 to identify acute kidney injury in critically ill patients, allowing prompt intervention before irreversible damage occurs. These markers support chronic kidney disease progression tracking by quantifying glomerular filtration rate alterations and proteinuria levels in diabetic nephropathy cases.

Clinicians apply renal biomarkers in drug safety assessments to detect nephrotoxicity from chemotherapeutic agents or antibiotics, guiding dose adjustments and treatment modifications. Transplant specialists utilize these tools to monitor allograft health, identifying subclinical inflammation through chemokine elevations that signal potential rejection episodes.

In May 2024, Thermo Fisher Scientific introduced a urine-based diagnostic test targeting CXCL10 to support monitoring of kidney transplant recipients. Elevated levels of this biomarker are associated with inflammatory activity and early signs of graft rejection. The test provides a non-invasive approach that can enable quicker and more cost-efficient detection of transplant complications, supporting closer patient monitoring and earlier clinical intervention.

Diagnostic laboratories capitalize on opportunities to implement multiplex biomarker panels that simultaneously assess multiple pathways, enhancing predictive accuracy in progressive kidney disease management. Developers engineer point-of-care assays for rapid urinary biomarker detection, facilitating bedside evaluation in intensive care settings for sepsis-induced renal impairment. These innovations expand applications in personalized medicine by stratifying risk in hypertensive nephropathy patients through integrated proteomic and metabolomic profiling.

Opportunities arise in combining renal biomarkers with imaging modalities to validate structural changes in polycystic kidney disease, informing therapeutic trial enrollment. Companies advance non-invasive alternatives to biopsy in lupus nephritis surveillance, leveraging chemokine signatures to guide immunosuppressive adjustments. Firms invest in longitudinal monitoring protocols that track biomarker trends, optimizing outcomes in cardiorenal syndrome cases with concurrent heart and kidney dysfunction.

Industry innovators integrate machine learning algorithms to interpret renal biomarker patterns, predicting acute kidney injury trajectories in postoperative patients with greater precision than traditional markers. Developers refine liquid chromatography-mass spectrometry platforms for high-sensitivity quantification of low-abundance proteins, improving detection in early-stage glomerular disorders.

Market participants emphasize urine-based panels that outperform serum creatinine in sensitivity, supporting proactive management in high-risk populations such as those with heart failure. Companies prioritize biomarker qualification initiatives that establish clinical utility in regulatory frameworks for novel nephroprotective agents. Ongoing research focuses on extracellular vesicle-derived biomarkers that capture dynamic renal responses, advancing applications in regenerative therapy evaluation and precision nephrology protocols.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.4 Billion, with a CAGR of 7.9%, and is expected to reach US$ 3.0 Billion by the year 2034.

- The biomarker type segment is divided into functional biomarkers, upregulated proteins and others, with functional biomarkers taking the lead in 2024 with a market share of 52.5%.

- Considering technique, the market is divided into immunoassays, mass spectrometry, point-of-care tests, enzyme-linked immunosorbent assay (ELISA), molecular diagnostics and others. Among these, enzyme-linked immunosorbent assay (ELISA)held a significant share of 42.3%.

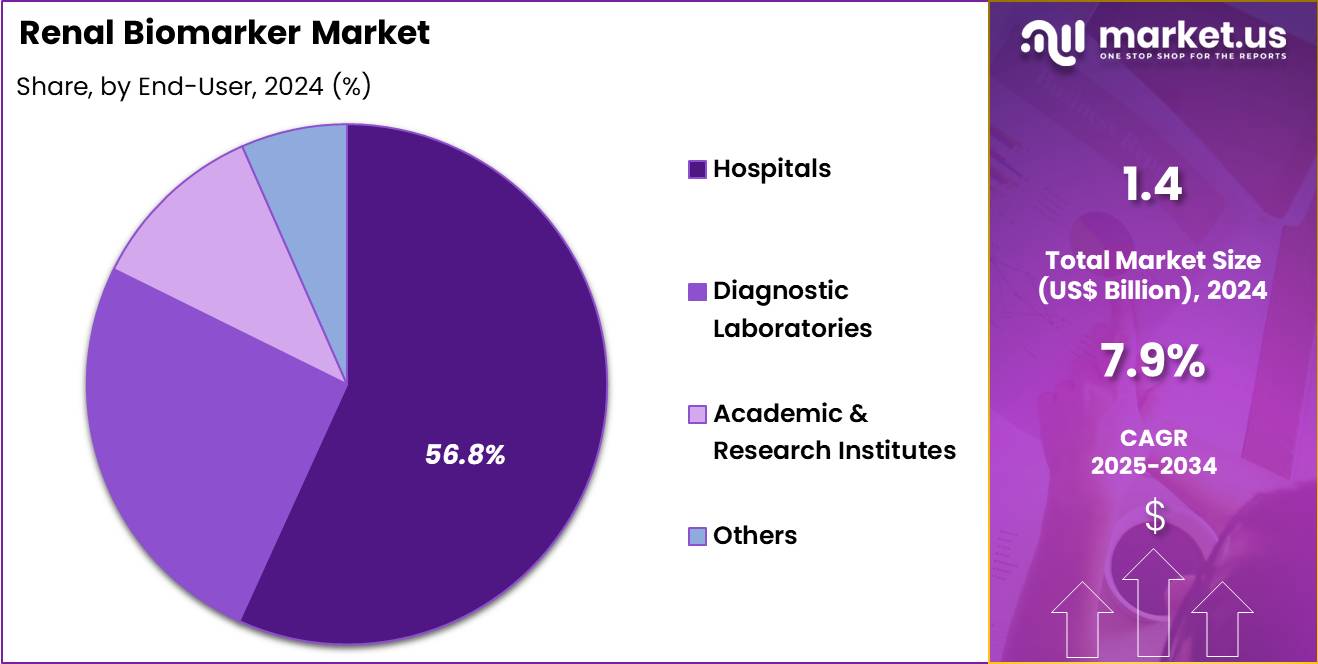

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic laboratories, academic & research institutes and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 56.8% in the market.

- North America led the market by securing a market share of 46.7% in 2024.

Biomarker Type Analysis

Functional biomarkers accounted for 52.5% of the renal biomarker market, reflecting their critical role in assessing real time kidney performance. Clinicians rely on functional markers to evaluate glomerular filtration and tubular function with direct clinical relevance. Rising prevalence of chronic kidney disease and acute kidney injury expands routine monitoring needs. Early detection initiatives prioritize functional biomarkers to guide timely intervention.

Integration into standard renal panels supports consistent testing volumes. Advancements in assay sensitivity improve clinical confidence in early stage diagnosis. Widespread guideline inclusion reinforces adoption across care settings. Functional biomarkers support treatment response monitoring and disease progression tracking. Increasing use in high risk populations strengthens demand. This segment is projected to maintain leadership due to strong clinical utility and diagnostic familiarity.

Technique Analysis

Enzyme linked immunosorbent assay techniques represented 42.3% of the renal biomarker market, driven by reliability and cost efficiency. Laboratories favor ELISA due to its high sensitivity and quantitative accuracy. Standardized protocols support reproducible results across facilities. Compatibility with high throughput workflows improves laboratory efficiency. Broad reagent availability ensures consistent supply.

Training familiarity reduces implementation barriers in routine diagnostics. ELISA platforms support multiplex testing for renal panels. Continuous improvements in assay kits enhance specificity and turnaround time. Budget conscious healthcare systems favor established technologies. As a result, ELISA is anticipated to remain the dominant technique due to scalability and proven performance.

End-User Analysis

Hospitals held a 56.8% share of the renal biomarker market, reflecting their central role in kidney disease management. These settings manage high volumes of patients with acute and chronic renal conditions. Integrated care pathways support routine biomarker testing for diagnosis and monitoring. Hospitals prioritize early detection to prevent disease progression and complications.

Availability of specialized nephrology services increases testing frequency. Inpatient monitoring drives repeated biomarker assessments. Advanced laboratory infrastructure supports in house testing capabilities. Emergency and intensive care units require rapid renal function evaluation. Reimbursement frameworks often favor hospital based diagnostics. Consequently, hospitals are likely to remain the dominant end users due to patient volume concentration and comprehensive care delivery.

Key Market Segments

By Biomarker Type

- Functional Biomarkers

- Serum creatinine

- Blood urea nitrogen (BUN)

- Estimated glomerular filtration rate (eGFR)

- Upregulated Proteins

- Neutrophil gelatinase-associated lipocalin (NGAL)

- Kidney injury molecule-1 (KIM-1)

- Cystatin C

- Interleukin-18 (IL-18)

- Others

- Others

By Technique

- Immunoassays

- Mass Spectrometry

- Point-of-Care Tests

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Molecular Diagnostics

- Others

By End-User

- Hospitals

- Diagnostic Laboratories

- Academic & Research Institutes

- Others

Drivers

Rising prevalence of chronic kidney disease is driving the market

The renal biomarker market is substantially driven by the rising prevalence of chronic kidney disease, which necessitates advanced diagnostic tools to enable early detection and effective management of renal impairment. Healthcare professionals increasingly rely on biomarkers to monitor kidney function in at-risk populations, including those with diabetes and hypertension, thereby supporting timely interventions. Pharmaceutical companies invest in biomarker research to develop assays that can identify disease progression before significant damage occurs.

Regulatory agencies promote the use of reliable biomarkers to improve patient outcomes in chronic kidney disease care. Global health organizations emphasize screening programs that incorporate renal biomarkers to address the growing burden on healthcare systems. Clinical laboratories adopt biomarker testing to facilitate personalized treatment plans for affected individuals. Academic institutions conduct studies to validate biomarkers for widespread application in chronic kidney disease epidemiology.

Patient awareness initiatives contribute to higher demand for diagnostic testing incorporating renal biomarkers. Economic impacts of untreated chronic kidney disease further incentivize biomarker utilization in preventive medicine. According to the Centers for Disease Control and Prevention, more than 1 in 7 US adults—about 35.5 million people, or 14%—are estimated to have chronic kidney disease.

Restraints

Limited FDA-qualified biomarkers for acute kidney injury is restraining the market

The renal biomarker market is restrained by the limited number of FDA-qualified biomarkers for acute kidney injury, which hinders their use in advanced clinical trials and therapeutic decision-making. Developers face challenges in demonstrating biomarker utility for efficacy claims in phase 3 studies, delaying product commercialization. Regulatory requirements for qualification demand extensive data on biomarker performance, increasing development timelines.

Pharmaceutical firms encounter difficulties in designing studies due to reliance on traditional markers like serum creatinine, complicating validation. Community efforts are diffused across numerous potential biomarkers, slowing progress on promising candidates. Organizations exhibit reluctance to share proprietary data, limiting collaborative advancements in biomarker evaluation. The complexity of acute kidney injury etiologies requires sub-phenotype identification, adding to validation hurdles.

Lack of effective therapies for acute kidney injury reduces incentives for biomarker adoption in clinical practice. Ethical considerations in biomarker research further contribute to cautious regulatory approaches. As of April 2022, there are no FDA-qualified biomarkers for acute kidney injury that can be used in phase 3 trials to support efficacy claims, according to the Kidney Health Initiative roadmap.

Opportunities

Increasing FDA clearances for novel renal biomarker tests is creating growth opportunities

The renal biomarker market presents growth opportunities through increasing FDA clearances for novel tests that enhance early detection of kidney injury, particularly in vulnerable populations like pediatrics. These clearances validate innovative assays, encouraging investment in biomarker platforms for expanded clinical applications. Developers can pursue market expansion by targeting unmet needs in acute kidney injury diagnostics with cleared technologies.

Regulatory support facilitates integration of biomarkers into routine screening protocols for high-risk patients. Pharmaceutical collaborations focus on commercializing cleared tests to improve diagnostic accuracy in hospital settings. Clinical research benefits from reliable biomarkers enabling better stratification in trials for renal therapies. Healthcare providers adopt cleared assays to reduce reliance on invasive procedures for kidney function assessment.

Global harmonization efforts may extend opportunities beyond the US market for similar clearances. Patient care advances with non-invasive options that allow prompt intervention in kidney injury cases. In December 2023, the U.S. Food and Drug Administration granted 510(k) clearance to BioPorto’s ProNephro AKI (NGAL) test as the first acute kidney injury biomarker for pediatric use.

Impact of Macroeconomic / Geopolitical Factors

Increasing healthcare investments and surging chronic kidney disease rates globally energize the renal biomarker market, as diagnostic firms ramp up development of innovative urine and blood-based tests for early detection and monitoring. Executives at major players strategically allocate resources to expand portfolios with multiplex assays, tapping into demographic shifts toward older populations and enhanced screening programs in prosperous regions.

Inflationary trends, however, escalate expenses for research reagents and clinical trials, leading companies to streamline budgets and postpone launches amid economic uncertainties. Geopolitical rivalries, such as U.S.-China trade frictions and disruptions in European supply networks, often block access to vital biomarkers and testing kits, resulting in prolonged lead times and heightened risks for firms with international dependencies.

Current U.S. tariffs under Section 301 impose duties up to 25% on Chinese-origin diagnostic reagents and lab equipment as of December 2025, elevating import costs for American distributors and compressing profit margins across the value chain. These tariffs further trigger retaliatory actions from global partners, restricting U.S. exports of advanced renal technologies and impeding collaborative research initiatives.

Despite these challenges, the tariff structure motivates targeted investments in domestic production facilities and alternative supplier networks, strengthening operational stability. This adaptation fosters greater independence, spurs technological advancements, and positions the market for robust, sustainable growth in the years ahead.

Latest Trends

Advancement in urine biomarker panels for drug-induced kidney injury is a recent trend

In 2025, the renal biomarker market has highlighted a prominent trend toward the advancement of urine biomarker panels designed to detect drug-induced kidney injury earlier than traditional measures. These panels consist of multiple urinary markers that provide sensitive indicators of renal response in clinical trial participants with normal baseline function. Developers emphasize the panels’ ability to complement standard tests, offering more precise monitoring of kidney safety during drug development.

Regulatory agencies engage with qualification plans to establish evidentiary standards for panel use in early-phase trials. Pharmaceutical companies integrate these panels into safety assessments to mitigate risks of nephrotoxicity in novel compounds. Clinical investigators utilize the panels to generate data supporting safer drug profiles for regulatory submissions. Academic consortia contribute to panel refinement through collaborative studies on biomarker specificity.

Ethical protocols ensure the panels’ application prioritizes participant safety in experimental settings. Global research networks explore panel adaptations for diverse populations affected by drug-related renal issues. On January 17, 2025, the U.S. Food and Drug Administration accepted a qualification plan for an eight-biomarker urine panel submitted by the Critical Path Institute’s Predictive Safety Testing Consortium.

Regional Analysis

North America is leading the Renal Biomarker Market

In 2024, North America held a 46.7% share of the global renal biomarker market, propelled by escalating chronic kidney disease burdens and innovations in early diagnostic tools that enable timely intervention in high-risk populations. Nephrologists increasingly rely on biomarkers such as neutrophil gelatinase-associated lipocalin and kidney injury molecule-1 to monitor acute kidney injury progression in intensive care settings, driven by federal initiatives promoting precision nephrology.

Pharmaceutical collaborations with diagnostic firms accelerate development of multiplex assays for cystatin C and albuminuria quantification, supporting regulatory pathways for companion diagnostics in diabetic nephropathy trials. Rising healthcare expenditures facilitate broader adoption of point-of-care testing kits, addressing gaps in rural access amid aging demographics.

Biotechnology investments focus on proteomic profiling for personalized dosing in transplant recipients, mitigating graft dysfunction risks. Guideline updates from professional societies endorse biomarker-driven protocols, enhancing reimbursement frameworks for outpatient monitoring. Collaborative research networks validate urinary exosome markers, optimizing sensitivity for subclinical damage detection. The Centers for Disease Control and Prevention estimates that more than 1 in 7 United States adults—about 35.5 million people, or 14%—have chronic kidney disease.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts foresee marked escalation in renal biomarker utilization across Asia Pacific over the forecast period, as demographic expansions intensify demands for proactive kidney health surveillance. Clinicians deploy novel panels to stratify glomerular filtration rates in hypertensive cohorts, tailoring therapies amid urbanization-driven lifestyle shifts. Authorities allocate budgets to subsidize cystatin C-based screenings in primary care, empowering early detection of tubular injuries from environmental toxins.

Biotech enterprises engineer affordable immunoassays for beta-2 microglobulin, customizing thresholds to regional genetic predispositions in polycystic kidney syndromes. Regional alliances conduct validation studies on emerging markers, integrating them into national dialysis registries for outcome tracking. Pharmaceutical innovators license advanced platforms, optimizing specificity for infection-associated acute exacerbations in tropical climates.

Community outreach teams train paramedics on rapid testing kits, bridging urban-rural divides in albuminuria assessments. A systematic review estimates that up to approximately 434.3 million adults across Asia have chronic kidney disease.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the renal biomarker market drive growth by developing high-sensitivity assays that enable earlier identification of kidney injury, disease progression, and therapy response across acute and chronic care settings. Companies expand adoption by embedding renal biomarker panels into hospital protocols and nephrology workflows to support faster clinical decision-making.

Commercial strategies emphasize collaborations with diagnostic laboratories and health systems to standardize kidney monitoring and generate recurring test volumes. Innovation priorities include multiplex capability, automation compatibility, and rapid turnaround times that improve efficiency in high-throughput environments.

Market expansion focuses on regions with increasing prevalence of diabetes, hypertension, and aging populations that elevate chronic kidney disease risk. Abbott Laboratories represents a leading participant through its broad diagnostics portfolio, global manufacturing scale, and strong laboratory partnerships that support widespread deployment of advanced renal biomarker testing solutions.

Top Key Players

- BioMerieux SA

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- BioPorto Diagnostics A/S

- SEKISUI Medical Co., Ltd.

- Danaher

- Randox Laboratories Ltd

- QIAGEN N.V.

- DiaSorin S.p.A.

- Becton, Dickinson & Co.

- Bio-Rad Laboratories Inc.

- SphingoTec GmbH

- EKF Diagnostics Holdings plc.

- Abbott Laboratories

- Nordic Bioscience

Recent Developments

- In May 2025, Boditech Med and SphingoTec introduced a new automated fluorescence immunoassay designed to measure Proenkephalin A 119-159 in blood-based samples. The test is intended for adults who face a high risk of acute kidney injury, including patients with severe infections, and is designed to support timely clinical decisions in emergency and intensive care settings. The assay is offered through Boditech’s diagnostic platforms under a licensing and commercialization arrangement, expanding access to kidney injury risk assessment in decentralized care environments.

- In October 2024, Beckman Coulter Diagnostics entered into a collaboration with SphingoTec to adapt the Proenkephalin 119-159 biomarker for use on high-throughput immunoassay systems in centralized laboratories. This marked the first effort to scale the biomarker for routine laboratory workflows, supporting earlier identification of acute kidney injury. Because this marker is less affected by systemic inflammation, it offers improved clinical reliability in critically ill patients compared with some conventional kidney function indicators.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 3.0 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Biomarker Type (Functional Biomarkers (Serum Creatinine, Blood Urea Nitrogen (BUN) and Estimated Glomerular Filtration Rate (eGFR)), Upregulated Proteins (Neutrophil Gelatinase-Associated Lipocalin (NGAL), Kidney Injury Molecule-1 (KIM-1), Cystatin C, Interleukin-18 (IL-18) and Others) and Others), By Technique (Immunoassays, Mass Spectrometry, Point-of-Care Tests, Enzyme-Linked Immunosorbent Assay (ELISA), Molecular Diagnostics and Others), By End-User (Hospitals, Diagnostic Laboratories, Academic & Research Institutes and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BioMerieux SA, Siemens Healthineers AG, Thermo Fisher Scientific Inc., BioPorto Diagnostics A/S, SEKISUI Medical Co., Ltd., Danaher, Randox Laboratories Ltd, QIAGEN N.V., DiaSorin S.p.A., Becton, Dickinson & Co., Bio-Rad Laboratories Inc., SphingoTec GmbH, EKF Diagnostics Holdings plc., Abbott Laboratories, Nordic Bioscience. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BioMerieux SA

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- BioPorto Diagnostics A/S

- SEKISUI Medical Co., Ltd.

- Danaher

- Randox Laboratories Ltd

- QIAGEN N.V.

- DiaSorin S.p.A.

- Becton, Dickinson & Co.

- Bio-Rad Laboratories Inc.

- SphingoTec GmbH

- EKF Diagnostics Holdings plc.

- Abbott Laboratories

- Nordic Bioscience