Global Remote Weapon Station Market By Platform (Land, Airborne, and Naval), By Technology (Remote-Controlled Gun Systems and Close-in Weapon Systems), By Platform, By Mobility, By Payload, By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: May 2024

- Report ID: 27123

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

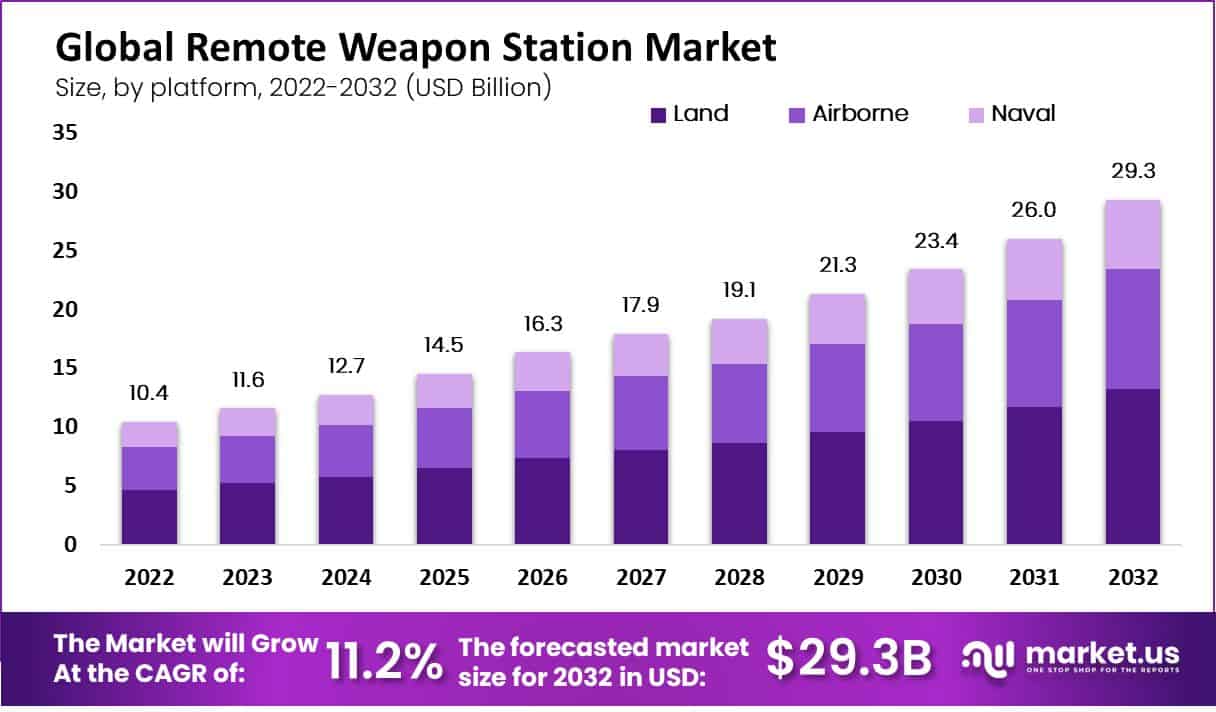

The Global Remote Weapon Station Market size is expected to be worth around USD 29.3 Billion By 2032, from USD 11.6 Billion in 2023, growing at a CAGR of 11.2% during the forecast period from 2023 to 2032.

A Remote Weapon Station (RWS) is a remotely operated weapons platform that can be installed on vehicles, ships, or land bases. It allows military personnel to operate firearms from a distance, using a joystick or computer. This system enhances safety by keeping operators protected and away from the direct line of fire. RWS systems can be equipped with various types of weapons like machine guns, grenade launchers, and missile launchers.

In the Remote Weapon Station market, growth is driven by the increasing need for advanced defense systems across the world. Governments are investing more in these technologies to ensure the safety of their forces and improve their combat capabilities. The market features a range of products from different manufacturers, each offering systems with varying capabilities and technologies. As countries modernize their military forces, the demand for RWS is expected to increase, contributing to the expansion of this market.

Note: Actual Numbers Might Vary In The Final Report

RWS technology has gained significant importance in modern warfare due to its ability to enhance the safety and effectiveness of military operations. By enabling operators to remotely control weapons, RWS provides increased protection to personnel by reducing their exposure to direct enemy fire. It also allows for precise targeting and improved accuracy, enhancing overall mission success.

For instance November 2022, Kongsberg Defence & Aerospace joined forces with Thales UK to work on the Protector Remote Weapon Systems (RWS) program for the British armed forces. Under this agreement, the two companies will work together on various aspects to enhance the weapon system for the UK military and also for markets abroad. The Protector RWS, which is a type of advanced weaponry system, is marketed worldwide by Kongsberg and Thales, with about 1,000 of these systems being used in British defense.

The Remote Weapon Station (RWS) market has witnessed significant contract awards and growth in recent years. In 2022, the US Army awarded a substantial contract worth approximately USD 1.5 billion to Kongsberg Defence & Aerospace. This contract was for the continued supply of Common Remotely Operated Weapon Stations (CROWS), showcasing the importance of RWS technology in modern defense systems.

Furthermore, in March 2023, General Dynamics European Land Systems (GDELS) awarded Elmet International SRL, a subsidiary of Elbit Systems, a follow-on contract valued at around USD 120 million. The contract was for the supply of unmanned turrets, Remote Controlled Weapon Stations (RCWS), and mortar systems. These systems are set to be deployed on the Romanian Armed Forces’ ‘Piranha V’ Armored Personnel Carrier (APC), highlighting the growing demand for RWS technology in military applications.

The global military expenditure also experienced significant growth in 2022, reaching approximately USD 2,240.1 billion. This represents a 6% increase compared to the previous year, indicating a substantial investment in defense spending worldwide.

The Indian Army has released a request for proposal to procure 90 Remote Weapon Station systems armed with 12.7mm machine guns. The procurement falls under the Buy India category, and the army plans to fast-track the procedure. These RCWS systems will be integrated with the Kalyani M4 armored personnel carrier, demonstrating the Indian Army’s focus on enhancing its defense capabilities through advanced RWS technology.

Key Takeaways

- Projected Market Growth: The Remote Weapon Station market is poised for substantial expansion, with a forecasted value exceeding USD 29.3 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 11.2% from 2023 to 2032.

- Dominance of Land Segment: In 2022, the Land segment held a dominant position in the Remote Weapon Station market, capturing over 45% share. This is primarily due to the high demand for land-based defense systems driven by the need to secure borders and enhance ground forces’ capabilities.

- Leading Role of Moving Segment: The Moving segment held a dominant market position in 2022, capturing over 65% share. This segment’s leadership is fueled by the increasing need for mobile defense solutions, offering versatility and agility in modern military operations.

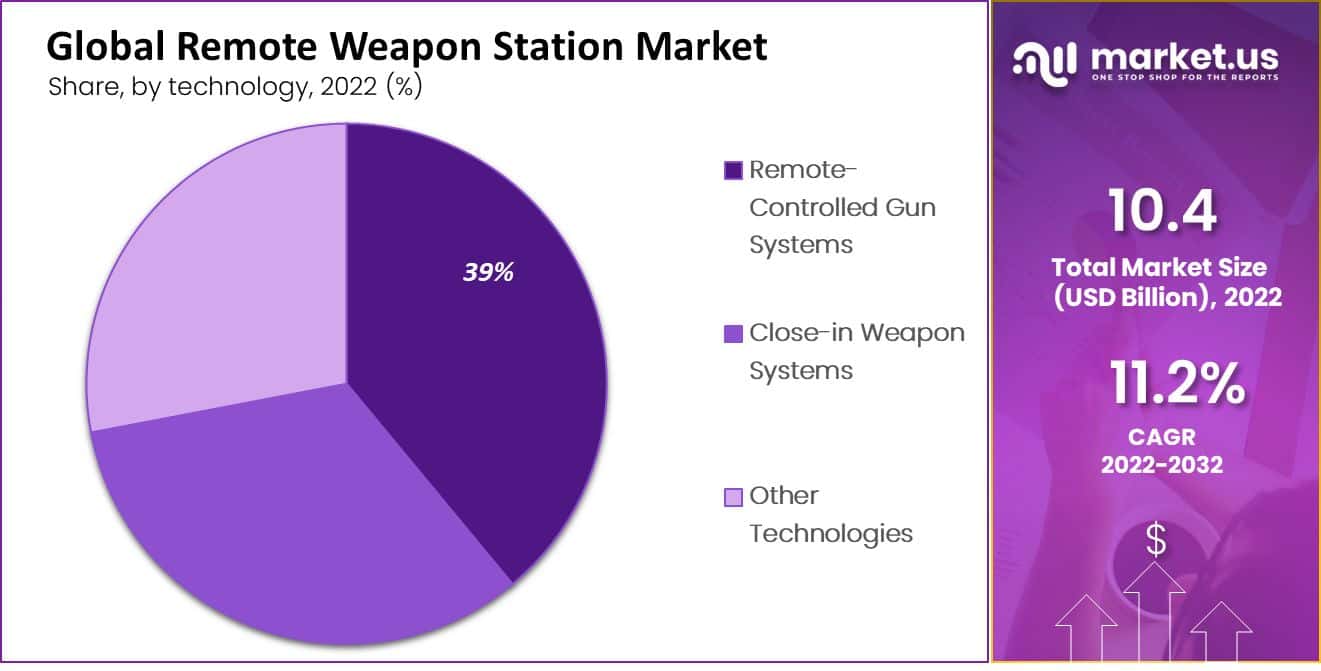

- Prevalence of Remote-Controlled Gun Systems: In 2022, the Remote-Controlled Gun Systems segment held a dominant market position, capturing more than 39% share. These systems are widely adopted across various military platforms due to their precision, reliability, and operational safety.

- Significance of Lethal Weapon Payloads: The Lethal Weapon segment held a dominant market position in 2022, capturing over 34% share. This is attributed to the procurement of highly effective and precise weaponry by military forces globally, essential for modern combat scenarios.

- Military Application Dominance: In 2022, the Military segment held a dominant market position, capturing over 76% share. Remote Weapon Stations play a critical role in military operations by offering precise targeting, real-time surveillance, and enhanced safety for troops, reducing soldier exposure to direct combat threats.

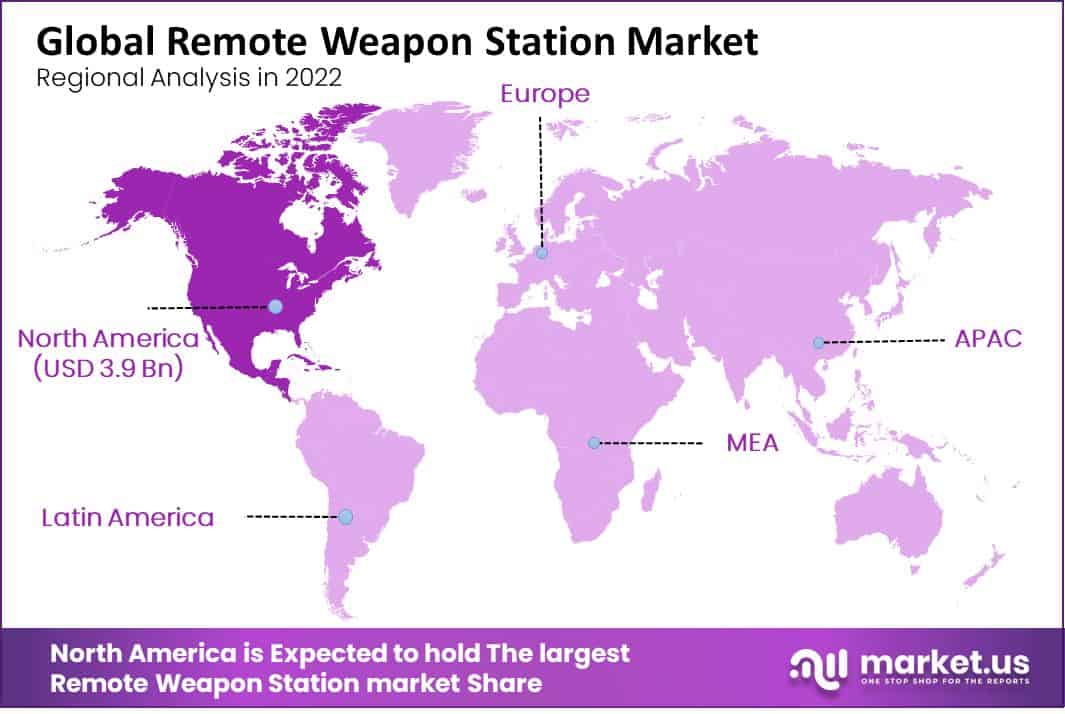

- Regional Market Analysis – North America: North America held a dominant market position in 2022, capturing over 38% share. The region’s robust defense spending, technological infrastructure, and strategic partnerships contribute to its leading role in the Remote Weapon Station market.

Platform Analysis

In 2022, the Land segment held a dominant position in the Remote Weapon Station market, capturing more than a 45% share. This significant market share is largely due to the high demand for land-based defense systems as countries around the globe prioritize securing their borders and enhancing their ground forces’ capabilities. Land-based remote weapon stations are integral to modern military operations, providing enhanced security and operational efficiency without exposing personnel to direct combat situations.

The leading position of the Land segment can also be attributed to the ongoing conflicts and rising geopolitical tensions in several regions. These factors compel nations to strengthen their armored vehicles, tanks, and military bases with advanced weapon systems. Moreover, the push for modernizing military equipment with the latest technology supports the adoption of RWS in land applications. Governments and defense agencies are investing heavily in these technologies, ensuring that their ground forces are equipped with the most effective and reliable systems available.

Furthermore, the integration of artificial intelligence and robotics in remote weapon stations has made the Land segment even more appealing. These technological advancements have enhanced the accuracy, response time, and overall effectiveness of RWS, making them a critical component of military arsenals. The continuous innovation and upgrades in RWS technology promise to drive further growth in this segment, as nations seek to maintain a competitive edge in defense capabilities.

Mobility Analysis

In 2022, the Moving segment held a dominant market position in the Remote Weapon Station market, capturing more than a 65% share. This segment’s leadership is primarily driven by the escalating need for mobile defense solutions that can provide protection while on the move. Moving remote weapon stations, which can be mounted on vehicles, aircraft, and naval vessels, offer the versatility and agility required in modern military operations. They enable forces to respond rapidly to threats in varying combat scenarios, enhancing operational capabilities and survivability.

The prevalence of the Moving segment is also due to the increased focus on asymmetrical warfare, where mobility and adaptability are key to countering threats in diverse environments. The integration of these mobile platforms with advanced targeting and surveillance systems allows for precise engagement and enhanced situational awareness. Furthermore, the trend toward modernization and the upgrading of existing military equipment with advanced technologies support the continuous demand for moving remote weapon stations.

As nations continue to invest in robust and flexible defense mechanisms, the market for moving remote weapon stations is expected to grow. These systems are increasingly viewed as essential components of national defense strategies, particularly for operations requiring rapid deployment and high mobility. The ongoing innovations in this area, including the incorporation of artificial intelligence and machine learning for autonomous operations, are set to further enhance the capabilities of moving remote weapon stations, ensuring their dominance in the market continues.

Technology Analysis

In 2022, the Remote-Controlled Gun Systems segment held a dominant market position in the Remote Weapon Station market, capturing more than a 39% share. This lead is primarily attributed to the widespread adoption of these systems across various military platforms due to their precision, reliability, and operational safety. Remote-controlled gun systems allow operators to engage targets effectively while remaining in protected positions, reducing the risk to personnel and enhancing mission success rates.

The prevalence of this technology segment stems from its integration across a broad range of military applications-from armored vehicles to naval ships and even airborne units. The flexibility and adaptability of remote-controlled gun systems to various platforms make them indispensable to modern military strategies. Additionally, ongoing technological advancements, such as the integration of AI for autonomous target recognition, continue to drive their adoption.

Investments in defense modernization programs by nations worldwide further bolster the demand for remote-controlled gun systems. As security environments become more complex, the need for remote weapon stations that can deliver high performance with minimal risk to operators becomes crucial. This trend is expected to sustain the growth of the remote-controlled gun systems segment, as defense forces seek more advanced, networked, and versatile weapon solutions to face emerging threats effectively.

Payload Analysis

In 2022, the Lethal Weapon segment held a dominant market position in the Remote Weapon Station market, capturing more than a 34% share. This leadership is primarily due to the increased procurement of highly effective and precise weaponry by military forces globally. Lethal weapons, including advanced machine guns and missile launchers integrated into remote weapon stations, provide significant tactical advantages in terms of range, accuracy, and firepower, which are essential in modern combat scenarios.

The dominance of the Lethal Weapon segment is further reinforced by the evolving nature of military engagements, which increasingly require forces to engage enemies at greater distances and with higher precision. The integration of lethal payloads in remote weapon stations allows for a safer engagement method, keeping operators out of harm’s way while maintaining the effectiveness of combat operations. Additionally, ongoing innovations in ammunition and weapon technology, such as smarter targeting systems and more reliable firing mechanisms, continue to drive the adoption of these systems.

Given the strategic importance of these weapon systems, nations are investing heavily in upgrading their current arsenals and incorporating new, more advanced lethal weapon systems. This trend is anticipated to continue as technological advancements open up new capabilities and as military strategies evolve to address new types of threats.

Application Analysis

In 2022, the Military segment held a dominant market position in the Remote Weapon Station market, capturing more than a 76% share. This substantial market share is driven by the heightened global military spending and the strategic emphasis on enhancing combat effectiveness with advanced technological tools. Remote Weapon Stations are critically valued in military operations for their ability to offer precise targeting, real-time surveillance, and enhanced safety for troops by enabling remote operation of weapon systems. This reduces soldier exposure to direct combat threats and increases operational efficiency.

The leadership of the Military segment is also bolstered by the ongoing modernization initiatives of armed forces worldwide. As countries strive to upgrade their military capabilities in response to evolving security challenges, the adoption of remote weapon systems becomes integral. These systems are increasingly equipped with sophisticated sensors, AI, and automation technologies that improve responsiveness and tactical decision-making in complex combat scenarios.

Moreover, the growing prevalence of asymmetric warfare and peacekeeping missions necessitates versatile and reliable weapon solutions, which remote weapon stations provide. They are essential for both offensive operations and defensive positions, ensuring that military forces have the tactical advantage and protection needed in diverse environments. Continued advancements in remote weapon technologies and their integration into various military platforms are likely to sustain the growth and dominance of the Military segment in the remote weapon station market.

Key Market Segments

By Platform

- Land

- Combat Vehicles

- Ground Station

- Main Battle Tanks

- Others

- Naval

- Destroyers

- Frigates

- Corvettes

- Others

- Airborne

- Fighter Aircraft

- Attack Helicopters

- Unmanned Aerial Vehicles

By Mobility

- Fixed

- Moving

By Technology

- Remote-controlled Gun Systems

- Close-in Weapon Systems

- Other Technologies

By Payload

- Machine Gun

- Grenade Launcher

- Lethal Weapons

- Other Payloads

By Application

- Military

- Homeland Security

Driving Factors

Increasing Demand in Military and Defense Fueling the Market Growth

Increasing demand in the military and defense sector is the primary factor for the growth of the market. Increasing demand for unmanned systems such as drones and unmanned ground vehicles, the demand for remote weapon stations is increasing. Remote weapon stations provide operators with enhanced situational awareness and accuracy, which enables them to engage targets more effectively; thus, the need for such systems, especially in modern military vehicles, is greater.

Remote weapon stations are not only used in military applications but are also increasingly being used by law enforcement agencies to provide additional firepower and protection for their personnel. These agencies have also started adopting remote weapon stations for various operations, such as SWAT raids and hostage situations. This system is implemented in strategic locations on borders for effective and correct detection to save borders from disputes, drug trafficking problems, and illegal immigration. The rising adoption of remote weapon station systems like containerized-based remote weapon systems (CBRWS) by several countries to secure borders is propelling market growth.

Technological Advancements Improving the Capabilities of the Remote Weapon Stations

The increasing development of new and advanced technologies, such as AI, sensors, and robotics, is driving the growth of the RWS market. These advancements in technologies help enhance the capabilities of remote weapon stations, making them more effective and efficient in various applications. Improved optronics, technological advancements, availability of high-resolution cameras, and the emergence of strong network services propelling the market growth.

Restraining Factor

High Costs and Rising Issues of Cyber Attacks to Oppose the Market Growth

RWS systems rely on electronics which makes them prone to cyberattacks. Remote weapon stations require specialized maintenance and training, which is costlier and time-consuming. RWS systems are highly advanced, which makes them more expensive to manufacture and maintain. The high costs of RWS make it difficult for many middle economic countries to afford them, which is expected to have a negative impact on market growth.

Growth Opportunity

Rising Governmental Investments in Defense Sector Expected to Drive Market During Forecast Period

Remote weapon stations are being increasingly used by homeland security organizations for border protection, counterterrorism operations, and critical infrastructure security. With rising global terrorism and border security concerns, the demand for advanced remote weapon stations that can be deployed quickly and effectively in any situation is increasing.

Governments around the world are increasingly investing in modernizing and strengthening their military equipment and remote weapon stations to build a strong and powerful military base. Manufacturers in the RWS industry are offering innovative, reliable, and cost-effective remote weapon station solutions to military and defense organizations which are expected to create lucrative growth opportunities in the global remote weapon station market.

Latest Trends

The Demand for Unmanned Military Vehicles with RWS is Increasing

Defense organizations around the world are increasingly shifting towards the adoption of ground-based vehicles with RWS to improve their military and defense capabilities. Manufacturers in the RWS industry focus on the development of more sophisticated and reliable systems that offer improved accuracy and performance. The adoption of unmanned systems in military and defense applications is increasing, which is driving demand for RWS systems.

Regional Analysis

In 2022, North America held a dominant market position in the Remote Weapon Station market, capturing more than a 38% share. This significant market share is largely attributed to the robust defense spending by the United States, which is home to some of the world’s leading defense contractors and technological innovators. The region’s emphasis on enhancing military capabilities through advanced technologies has driven substantial investments in remote weapon stations. These systems are critical for ensuring the safety and efficiency of military operations, particularly given the ongoing global security challenges.

In November 2022, the US Army signed a deal worth $1.5 billion with Kongsberg Defence & Aerospace. This contract is for Kongsberg to keep supplying the Army with a special kind of equipment called Common Remotely Operated Weapon Stations (CROWS). These are sturdy mounts that allow soldiers to locate and attack targets while staying protected inside armored vehicles. Under this five-year deal, Kongsberg will provide its Kongsberg Protector series of remote weapon stations, which are also used by NATO and its allied forces.

The dominance of North America in this market is also supported by the presence of a highly developed technological infrastructure and a strong focus on research and development. Innovations in areas such as automation, machine learning, and artificial intelligence are integrated into remote weapon systems, making them more precise and reliable. Additionally, the U.S. military’s strategy to modernize its combat vehicles and naval vessels includes the extensive deployment of remote weapon stations, further bolstering the market growth in this region.

Moreover, North America’s leading position is reinforced by its role in international security affairs and its strategic partnerships with other countries. The export of military technology, including remote weapon stations, to allies enhances the geopolitical influence of the region and supports the growth of its defense industry. With ongoing technological advancements and sustained government funding, North America is expected to maintain its leading role in the remote weapon station market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Remote Weapon Station (RWS) market features several key players that lead the industry through innovation, strategic partnerships, and expansive product portfolios. Kongsberg Defence Systems stands out as a prominent leader, known for its high-tech solutions like the PROTECTOR RWS, which has been widely adopted by NATO forces. General Dynamics Corporation, another major player, offers advanced RWS capabilities integrated into various armored vehicles, enhancing the operational flexibility and safety of military personnel.

Leonardo S.p.A., with its Hitrole RWS, focuses on versatility and compatibility with different platforms, ensuring a broad market appeal. Rafael Advanced Defense Systems Ltd. is renowned for its Samson RWS, which is equipped with multi-sensor options to provide superior situational awareness and targeting accuracy. Saab AB’s offerings emphasize innovation in automated target detection and tracking, helping to reduce the cognitive load on operators.

Top Key Players

- Kongsberg Defence Systems

- Systems Ltd.

- General Dynamics Corporation

- Leonardo S.p.A.

- Rafael Advanced Defense Systems Ltd.

- Saab AB

- Rheinmetall AG

- Raytheon Company

- BAE Systems plc

- ASELSAN A.S.

- Singapore Technologies Engineering Ltd

- Other Key Players

Recent Developments

- Kongsberg Defence & Aerospace received a significant order from the US Army in September 2023, valued at $94 million, for the delivery of 409 Common Remotely Operated Weapon Stations (CROWS) as part of a larger five-year framework. In 2024, they continued this trend by planning a technology refresh for the CROWS, aiming to update the legacy systems and integrate them into new platforms.

- In April 2023, EOS Defence Systems received a second conditional contract to provide Ukraine with up to fifty Remote Weapon Systems (RWS), along with ammunition, spare parts, and related services. This deal is valued at up to USD 41 million and requires the RWS to be delivered by 2024. This follows an earlier contract announced on April 3, 2023, where EOS Defence Systems agreed to supply up to one hundred RWS units to Ukraine for up to USD 80 million.

Report Scope

Report Features Description Market Value (2023) USD 11.6 Bn Forecast Revenue (2032) USD 29.3 Bn CAGR (2023-2032) 11.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform- Land, Naval, and Airborne; By Mobility- Fixed and Moving; By Technology- Remote-Controlled Gun Systems, Close-in Weapon Systems, and Other Technologies; By Payload- Machine Gun, Grenade Launcher, Lethal Weapons, and Other Payloads; By Application- Military and Homeland Security Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kongsberg Defence Systems, Elbit Systems Ltd., General Dynamics Corporation, Leonardo S.p.A., Rafael Advanced Defense Systems Ltd., Saab AB, Rheinmetall AG, Raytheon Company, BAE Systems plc, ASELSAN A.S., Singapore Technologies Engineering Ltd, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Remote Weapon Station (RWS)?A Remote Weapon Station (RWS) is a remotely operated system designed to mount and control weapons from a protected distance. It allows operators to engage targets with accuracy and safety using precise imaging systems, reducing the risk to personnel and collateral damage. RWS can be mounted on various platforms including ground vehicles, ships, and aircraft.

How big is Remote Weapon Station Market?The Global Remote Weapon Station Market size is expected to be worth around USD 29.3 Billion By 2033, from USD 11.6 Billion in 2023, growing at a CAGR of 11.2% during the forecast period from 2023 to 2032.

What are the main drivers of growth in the RWS market?The primary drivers include the increase in cross-border conflicts, the need for peace-keeping and humanitarian operations, and the rising use of unmanned aerial vehicles (UAVs) which pose a threat to army positions. Additionally, military modernization programs and the integration of advanced technologies in defense systems are contributing to market growth.

What challenges does the RWS market face?The main challenge is the high cost of remote weapon stations, which can be a barrier for countries with limited defense budgets. Financial constraints may lead some nations to continue relying on traditional methods involving soldiers rather than investing in advanced RWS.

Which regions hold the highest market share and are expected to grow?North America has dominated the market with the largest market share of 38% in 2022.

Who are the major players in the RWS market?Key players in the RWS market include Kongsberg Defence Systems, Systems Ltd., General Dynamics Corporation, Leonardo S.p.A., Rafael Advanced Defense Systems Ltd., Saab AB, Rheinmetall AG, Raytheon Company, BAE Systems plc, ASELSAN A.S., Singapore Technologies Engineering Ltd

Remote Weapon Station MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Remote Weapon Station MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Kongsberg Defence Systems

- Systems Ltd.

- General Dynamics Corporation

- Leonardo S.p.A.

- Rafael Advanced Defense Systems Ltd.

- Saab AB

- Rheinmetall AG

- Raytheon Company

- BAE Systems plc

- ASELSAN A.S.

- Singapore Technologies Engineering Ltd

- Other Key Players