Global Release Liners Market Size, Share, Growth Analysis By Substrate (Film-Based, Paper-Based), By Technology (Pressure Sensitive, Glue Applied, Shrink Sleeve, Stretch Sleeve, In-mold, Others), By Printing Process (Flexography, Digital Printing, Offset, Gravure, Screen), By Application (Food & Beverage, Medical & Pharmaceuticals, Cosmetics & Personal Care, Automotive, Construction, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155490

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

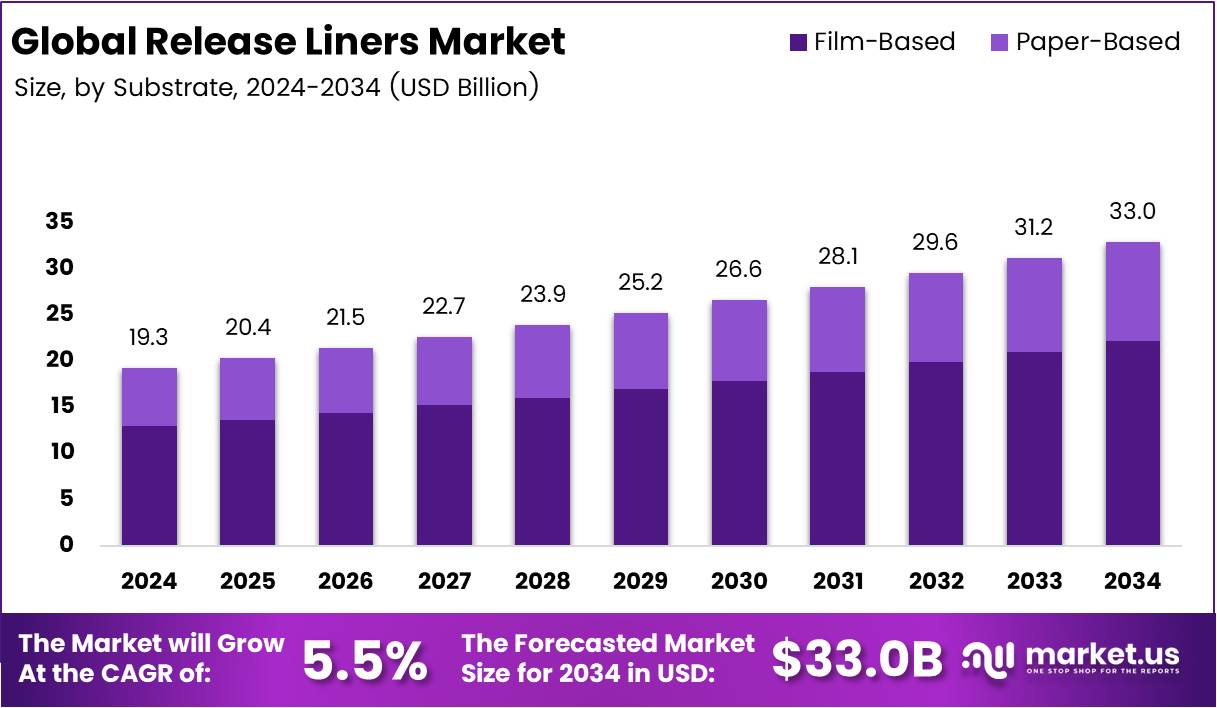

The Global Release Liners Market size is expected to be worth around USD 33.0 Billion by 2034, from USD 19.3 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The Release Liners Market has seen steady growth driven by its critical role in packaging, automotive, and electronics. Release liners are essential materials used in adhesive applications, particularly in product labels, medical tapes, and hygiene products. These liners protect the adhesive surface until it’s ready for application, ensuring better performance and ease of use.

Opportunities in the release liners market are immense, particularly in the expansion of eco-friendly and biodegradable liners. As environmental concerns rise, manufacturers are prioritizing sustainable materials, such as plant-based liners, to cater to the eco-conscious consumer base. This shift opens avenues for companies to introduce innovative, cost-effective, and sustainable products, enhancing their market position.

Government investment in infrastructure and manufacturing sectors has positively impacted the release liners market. Regulations promoting sustainable packaging materials and banning harmful chemicals in traditional products have further driven demand. Moreover, government subsidies and initiatives for environmentally friendly products are encouraging companies to invest in research and development for advanced release liner technologies.

In terms of regulations, the industry is becoming more stringent in response to growing environmental concerns. Governments worldwide are implementing policies to reduce plastic waste, influencing the development of recyclable and biodegradable release liners. These regulations create both challenges and opportunities for manufacturers to innovate in compliance with global sustainability goals.

The release liners market also faces challenges related to raw material costs and supply chain disruptions. As demand rises, so does the competition for materials, which can lead to price volatility. However, companies that can successfully balance cost management with innovation in material properties will likely gain a competitive edge in this dynamic market.

Key Takeaways

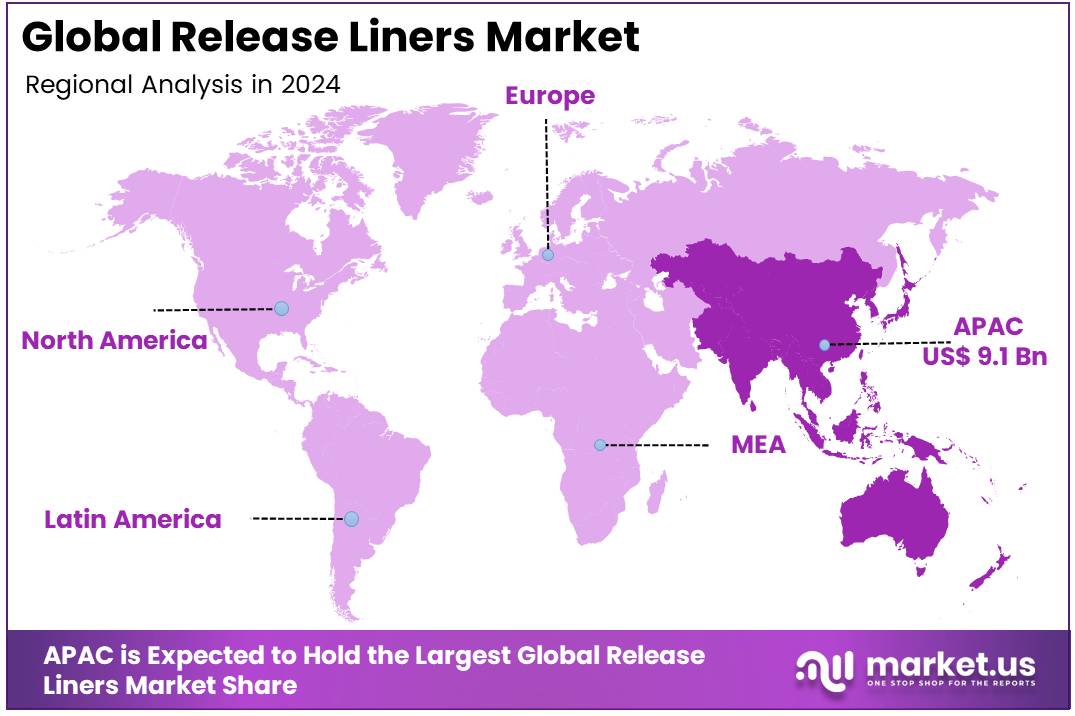

- Asia Pacific dominated the Release Liners Market in 2024 with a market share of 47.3%, valued at USD 9.1 Billion.

- The global Release Liners Market is projected to reach USD 33.0 Billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034.

- Film-Based substrates led the market in 2024, capturing 67.2% of the By Substrate Analysis segment.

- Pressure Sensitive technology accounted for 57.8% of the By Technology Analysis segment in 2024.

- Flexography dominated the By Printing Process Analysis segment in 2024, with a 41.3% market share.

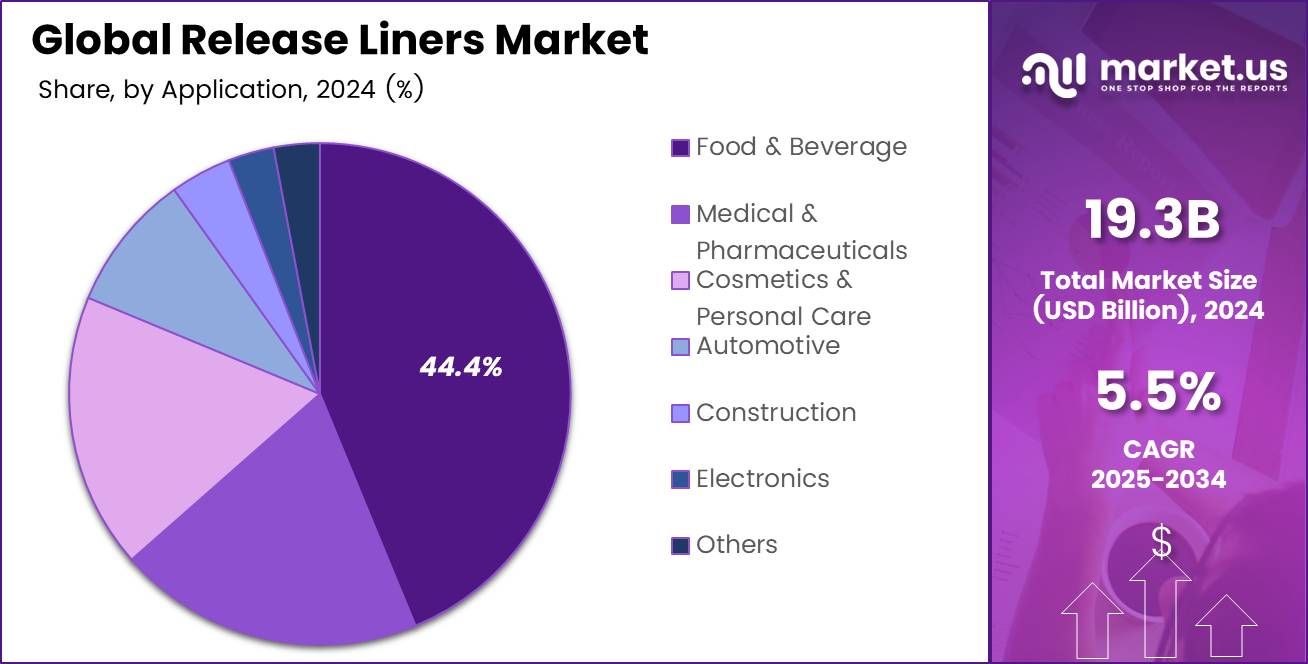

- Food & Beverage applications held the largest share in 2024, capturing 44.4% of the Release Liners Market.

Substrate Analysis

Film-Based holds a dominant market position in 2024, with a 67.2% share.

In 2024, Film-Based substrates led the Release Liners Market in the By Substrate Analysis segment, capturing a significant 67.2% share. The preference for film-based substrates can be attributed to their superior properties such as flexibility, durability, and resistance to moisture and chemicals. These characteristics make them an ideal choice for a variety of applications, particularly in industries requiring reliable protective liners.

Film-based release liners are increasingly used in sectors like automotive, electronics, and food packaging, where protection against external elements is crucial. Their excellent performance in providing clean and easy-to-peel surfaces enhances their popularity. The continuous innovation in film-based materials has also contributed to their market dominance.

On the other hand, Paper-Based substrates held a smaller portion of the market. While paper-based liners are more cost-effective, they tend to be less durable and versatile compared to their film counterparts. However, they remain a popular choice for applications where cost reduction is a priority, though they trail far behind film-based products in terms of market share.

Technology Analysis

Pressure Sensitive holds a dominant market position in 2024, with a 57.8% share.

In 2024, Pressure Sensitive technology took the lead in the By Technology Analysis segment of the Release Liners Market, accounting for a substantial 57.8% share. This dominance is due to the versatility and ease of use offered by pressure-sensitive adhesives, which require no heat or solvents to bond. These adhesives are widely used in applications like labels, tapes, and medical dressings.

Pressure-sensitive liners are increasingly favored across industries because they enable efficient processing, saving both time and cost. The rise of e-commerce and logistics further boosts the demand for pressure-sensitive solutions, particularly in packaging and labeling applications.

Other technologies like Glue Applied, Shrink Sleeve, and Stretch Sleeve accounted for a smaller market share. Although they offer unique benefits, such as superior strength or enhanced aesthetics, they do not yet match the widespread applicability and cost-effectiveness of pressure-sensitive technologies.

Printing Process Analysis

Flexography holds a dominant market position in 2024, with a 41.3% share.

Flexography dominated the By Printing Process Analysis segment in 2024, commanding a significant 41.3% share. This printing method’s ability to produce high-quality, fast prints on various materials, such as plastic films, labels, and packaging, makes it a preferred choice for industries demanding efficiency and precision. Flexographic printing is particularly popular in the packaging industry, driving its dominance in the Release Liners Market.

The other printing methods, such as Digital Printing, Offset, and Gravure, while valuable in niche markets, lag behind Flexography in terms of adoption. Digital Printing, though growing due to its customization and on-demand nature, still struggles with scalability for mass production. Gravure and Offset, being more expensive and slower in comparison, serve specific high-end applications, but have a limited presence in the broader release liners sector.

Application Analysis

Food & Beverage holds a dominant market position in 2024, with a 44.4% share.

In 2024, Food & Beverage applications held the largest share of the Release Liners Market, capturing an impressive 44.4% share. The demand for release liners in food and beverage packaging is driven by the increasing need for hygiene, convenience, and regulatory compliance. Release liners are extensively used in the food packaging industry, particularly in applications requiring tamper-proof seals, easy-to-remove labels, and moisture resistance.

While Food & Beverage leads, other sectors like Medical & Pharmaceuticals and Cosmetics & Personal Care also contributed significantly to the market. Medical applications require precise labeling and sterile packaging, which further boosts the demand for high-quality release liners. However, Food & Beverage remains the dominant sector, owing to its broad range of applications and high volume production requirements.

Key Market Segments

By Substrate

- Film-Based

- Paper-Based

By Technology

- Pressure Sensitive

- Glue Applied

- Shrink Sleeve

- Stretch Sleeve

- In-mold

- Others

By Printing Process

- Flexography

- Digital Printing

- Offset

- Gravure

- Screen

By Application

- Food & Beverage

- Medical & Pharmaceuticals

- Cosmetics & Personal Care

- Automotive

- Construction

- Electronics

- Others

Drivers

Increasing Demand for Sustainable and Eco-friendly Packaging Solutions Drives Release Liners Market Growth

The growing awareness around sustainability is one of the key drivers for the release liners market. As consumers and businesses alike push for more eco-friendly packaging, demand for sustainable release liners that can support recyclable and biodegradable materials is on the rise. Many industries, especially food and beverage, are shifting to environmentally friendly packaging solutions to reduce plastic waste. This trend is expected to fuel the adoption of release liners made from sustainable raw materials, further promoting market growth.

Additionally, the rapid expansion of the e-commerce sector is contributing to an increase in packaging requirements. E-commerce companies need packaging solutions that are lightweight, durable, and efficient. Release liners play a crucial role in ensuring smooth, protective packaging, and this demand is expected to rise as e-commerce continues to expand globally. The increase in online shopping has created a need for more efficient and reliable packaging solutions, further driving the market for release liners.

Moreover, the automotive industry’s need for advanced adhesive solutions is pushing the demand for high-quality release liners. Automotive manufacturers use release liners for various applications, including adhesive bonding in vehicle components. As the automotive sector grows, particularly in emerging markets, the demand for these specialized solutions will also increase, leading to further market expansion.

Restraints

Limited Availability of Raw Materials and Regulatory Challenges Restrain Release Liners Market Growth

A significant restraint in the release liners market is the limited availability of raw materials. The production of release liners requires specific substrates and coatings, which can sometimes be scarce or subject to price volatility. This creates challenges for manufacturers who must maintain consistent quality and availability of materials to meet market demand. Fluctuations in material costs can affect overall production costs and, in turn, limit market growth.

In addition, regulatory challenges in the global packaging and adhesive markets can impede the growth of the release liners market. Strict regulations around the use of certain chemicals in packaging materials, particularly in food and healthcare sectors, can slow down product development and market entry. Companies must navigate complex regulatory environments across different regions, which increases operational costs and delays market expansion efforts.

Growth Factors

Expansion of Healthcare and Smart Labels Creates Growth Opportunities for Release Liners Market

The medical and healthcare industries are increasingly utilizing release liners for various packaging applications. With growing demand for medical devices, diagnostic kits, and pharmaceuticals, there is a rising need for specialized release liners that offer high-performance protection. Release liners in healthcare applications help maintain sterility, enhance safety, and improve user convenience. This growing adoption in the healthcare sector represents a significant opportunity for the market.

The increasing integration of smart labels in packaging is also contributing to growth in the release liners market. Smart labels, equipped with technologies like RFID, are becoming common in sectors such as retail and logistics. These labels require specialized release liners that ensure smooth application while maintaining their functionality. The growing need for efficient and smart packaging solutions presents an exciting opportunity for the release liners market to expand.

Another promising growth area is the renewable energy sector, which requires durable adhesive products for various applications, such as solar panels and wind turbines. The rising demand for green energy solutions is pushing the need for high-quality release liners that meet specific environmental and functional requirements. This growing sector is likely to be a significant contributor to the market’s expansion.

Emerging Trends

Integration of Digital Printing Technologies Drives Release Liners Market Growth

One of the key trends influencing the release liners market is the integration of digital printing technologies. As packaging solutions become more customized and personalized, digital printing allows for greater flexibility in design and production. The ability to print directly on release liners is enabling brands to create unique packaging designs that stand out in the market, thus driving the adoption of these technologies.

There is also a noticeable shift towards customization in packaging solutions. Consumers and businesses are increasingly looking for packaging that reflects brand identity and meets specific needs. This trend towards personalized packaging is prompting packaging companies to look for release liner options that can cater to a variety of designs, materials, and functionalities, further driving market demand.

The growth of disposable and convenience packaging in the consumer goods sector is another factor trending in the release liners market. As consumers prioritize convenience and disposable solutions, packaging companies are focusing on products that are easy to use and discard. This shift is increasing the need for efficient release liners that support these packaging innovations, fueling the growth of the market.

Regional Analysis

Asia Pacific Dominates the Release Liners Market with a Market Share of 47.3%, Valued at USD 9.1 Billion

In 2024, the Asia Pacific region led the Release Liners Market with a dominant market share of 47.3%, valued at USD 9.1 Billion. This region’s rapid industrialization, growth in manufacturing sectors, and increasing demand for packaging solutions across various industries such as automotive, healthcare, and consumer goods contribute significantly to this growth. Moreover, the expansion of e-commerce platforms in countries like China and India further drives the demand for advanced packaging solutions.

North America Release Liners Market Trends

North America holds a significant position in the Release Liners Market, driven by advancements in packaging technology and the high demand for sustainable packaging solutions. The U.S. is the key contributor, with its established industries in consumer goods, pharmaceuticals, and food packaging sectors. The growing adoption of eco-friendly materials and innovations in the packaging space support market expansion in this region.

Europe Release Liners Market Outlook

Europe’s Release Liners Market is characterized by a steady growth rate, fueled by increasing environmental regulations and demand for sustainable packaging solutions. The European Union’s stringent environmental standards push industries to adopt eco-friendly alternatives. Furthermore, countries such as Germany and France are key markets due to their strong manufacturing and automotive sectors, which rely heavily on packaging innovations.

Middle East and Africa Release Liners Market Analysis

The Middle East and Africa region is witnessing gradual growth in the Release Liners Market. The demand is largely driven by expanding industries in packaging for food and beverages, as well as the growing manufacturing sectors in countries like the UAE and Saudi Arabia. However, the market faces challenges due to fluctuating economic conditions and dependence on raw material imports.

Latin America Release Liners Market Trends

In Latin America, the Release Liners Market is experiencing moderate growth, with countries like Brazil and Mexico being the key contributors. The growth is driven by the expanding consumer goods and food industries, particularly in the packaging of perishable goods. However, the region faces hurdles related to economic instability, which could impact market growth in the short term.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Release Liners Company Insights

The global Release Liners Market is witnessing significant contributions from key players who are driving the industry’s growth through innovation and strategic initiatives.

3M is a prominent player in the market, offering a wide range of release liners with advanced features such as high-performance adhesives and customized solutions for diverse applications. The company’s strong global presence and extensive product portfolio allow it to meet the varied needs of industries like automotive, electronics, and healthcare.

Loparex has established itself as a leader by focusing on producing high-quality release liners tailored to specific applications. Their emphasis on sustainability and eco-friendly products helps them cater to industries increasingly seeking environmentally conscious solutions, strengthening their position in the market.

Polyplex Corporation Ltd. stands out with its advanced technology and manufacturing capabilities for the production of release liners, especially in the packaging sector. The company’s ability to supply cost-effective, high-performance products has helped it maintain a competitive edge, especially in regions with high demand for flexible packaging solutions.

Avery Dennison Corporation is another dominant player known for its wide array of release liners, which are extensively used in the adhesive labeling and packaging sectors. The company’s commitment to innovation, particularly in smart labeling and sustainable products, enhances its appeal to industries prioritizing environmental responsibility and advanced labeling solutions.

These companies are pivotal in shaping the global Release Liners Market, leveraging innovation, sustainability, and strategic operations to capture and expand their market share.

Top Key Players in the Market

- 3M

- Loparex

- Polyplex Corporation Ltd.

- Avery Dennison Corporation

- Mondi

- LINTEC Corporation

- Gascogne

- Ahlstrom

- Sappi

- UPM

Recent Developments

- In January 2024, Heinzel Group successfully completed the acquisition of the Steyrermühl Paper Mill from UPM, strengthening its position in the European paper industry. The acquisition enhances Heinzel’s production capabilities and expands its market reach across key sectors.

- In June 2025, Ahlstrom finalized the acquisition of Pixelle’s Stevens Point Paper Mill, marking a significant expansion of its global footprint in the paper manufacturing industry. This move aligns with Ahlstrom’s strategy to diversify its product portfolio and increase production capacity.

Report Scope

Report Features Description Market Value (2024) USD 19.3 Billion Forecast Revenue (2034) USD 33.0 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Substrate (Film-Based, Paper-Based), By Technology (Pressure Sensitive, Glue Applied, Shrink Sleeve, Stretch Sleeve, In-mold, Others), By Printing Process (Flexography, Digital Printing, Offset, Gravure, Screen), By Application (Food & Beverage, Medical & Pharmaceuticals, Cosmetics & Personal Care, Automotive, Construction, Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3M, Loparex, Polyplex Corporation Ltd., Avery Dennison Corporation, Mondi, LINTEC Corporation, Gascogne, Ahlstrom, Sappi, UPM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Loparex

- Polyplex Corporation Ltd.

- Avery Dennison Corporation

- Mondi

- LINTEC Corporation

- Gascogne

- Ahlstrom

- Sappi

- UPM