Global Reinsurance Market By Type (Facultative Reinsurance, Treaty Reinsurance), By Application (Property & Casualty Reinsurance, Life & Health Reinsurance), By Distribution Channel (Direct Writing, Broker), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 120883

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

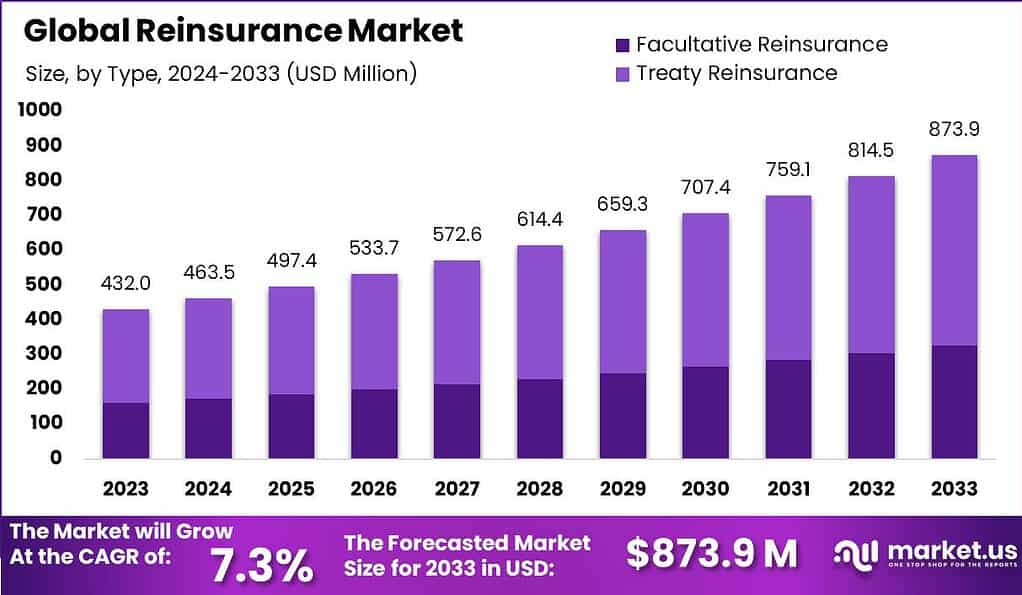

The Global Reinsurance Market size is expected to be worth around USD 873.9 Million By 2033, from USD 432.0 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

Reinsurance is a financial mechanism in the insurance industry that involves one insurance company transferring a portion of its risk to another insurance company. It is a way for insurance companies to protect themselves against large losses by spreading the risk across multiple insurers. When an insurance company sells a policy, they may face the possibility of having to pay out a large claim. To mitigate this risk, they can purchase reinsurance from another company, known as the reinsurer.

The reinsurance market plays a crucial role in the global insurance industry by ensuring that insurance companies can maintain stability even after significant losses. It allows insurers to handle larger policies and more clients as they share the risk with reinsurers. The market is influenced by factors such as economic conditions, natural disasters, and changes in regulations, which can affect the costs and demand for reinsurance. This market is essential for supporting the insurance industry’s health and overall financial strength.

According to recent data from the Swiss Re Institute, global losses from natural catastrophes in 2023 were approximately US$ 280 billion. Notably, only 38%, or US$ 108 billion, of these losses were covered by insurance. This substantial gap in coverage underscores a significant opportunity within the reinsurance sector, particularly in property and casualty reinsurance, which is observing a growing preference among leading industries.

Furthermore, the expansion of insurance coverage in emerging markets presents significant growth opportunities for the reinsurance industry. As economies develop and populations become more affluent, the demand for insurance products, including property, casualty, and life insurance, increases. Reinsurers play a crucial role in supporting the growth of these emerging markets by providing the necessary risk capacity and expertise.

While the reinsurance market offers numerous growth prospects, it also faces certain challenges. One of the challenges is the increasing complexity and interconnectedness of risks. As businesses and industries become more integrated globally, risks become more intricate and difficult to assess. Reinsurers must adapt to this changing landscape and develop innovative risk models and underwriting approaches to effectively manage these complex risks.

The global reinsurance market, a critical sector of the financial landscape, encompasses more than 200 active companies worldwide. As of 2025, the market size is forecasted to approach approximately 497.4 billion U.S. dollars, reflecting its significant economic impact and expansive scope.

Among the key players in this sector, Aon holds the distinction of being the world’s largest reinsurance brokerage. According to its 2020 factsheet, Aon intermediated premiums amounting to 122.3 billion USD, underscoring its leading position in the market. This highlights not only the scale of Aon’s operations but also the concentrated nature of market activity among top brokerages in the reinsurance domain.

Key Takeaways

- The global Reinsurance market size was valued at USD 873.9 Million in the year 2023 and is estimated to reach USD 432.0 Million in the year 2033 with a CAGR of 7.3% during the forecast period 2024 to 2033.

- Based on the type, the treaty reinsurance segment has dominated the market with a share of 62.5% in the year 2023.

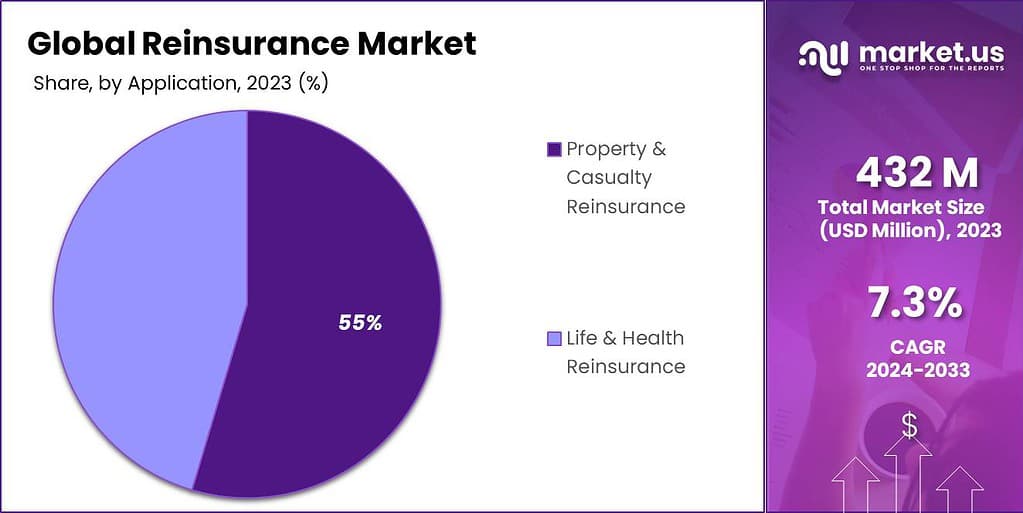

- Based on the application, the property and casualty reinsurance segment has the largest market share of 54.6% in the year 2023.

- Based on the distribution channel, the broker segment has dominated the market with a share of 52.1% in the year 2023.

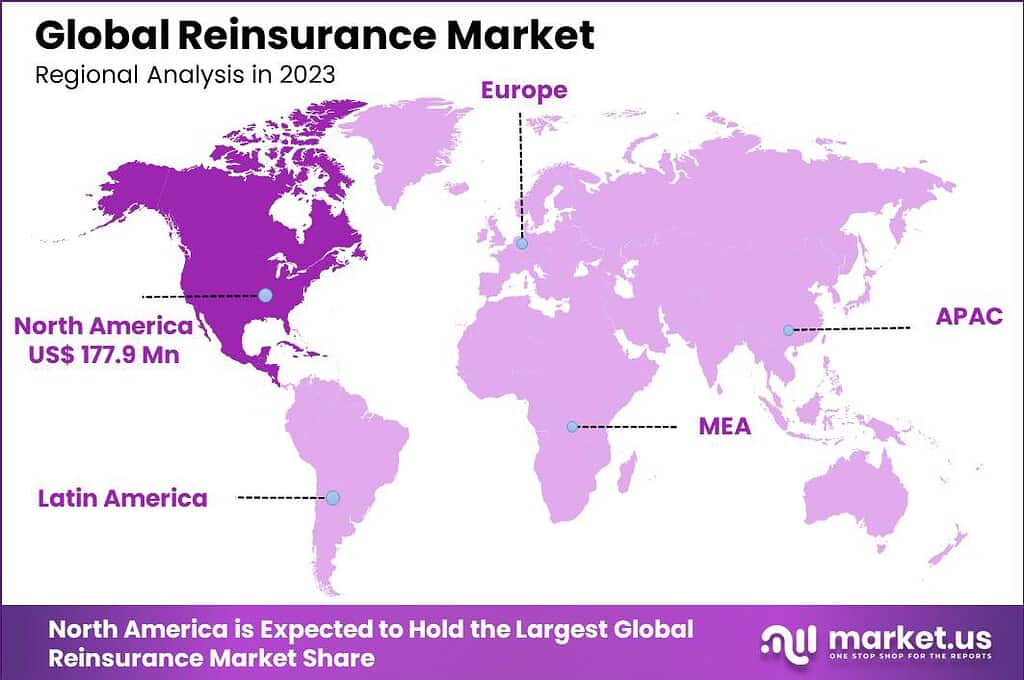

- In 2023, North America held a dominant market position in the reinsurance market, capturing more than a 41.2% share.

Type Analysis

In 2023, the Treaty Reinsurance segment held a dominant market position, capturing more than a 62.5% share of the global reinsurance market. This leadership can be attributed primarily to the segment’s streamlined approach to managing insurer risks through standardized agreements.

Treaty reinsurance agreements allow an insurer to cede a portfolio of risks under specific terms and conditions, which simplifies the process and enhances the efficiency of risk transfer. This method is particularly favored by large insurance companies seeking comprehensive coverage across a broad range of policies, enhancing their capacity to distribute risks more evenly and predictably.

Treaty reinsurance’s dominance is further reinforced by its ability to provide stable and continuous coverage, which is crucial in a market characterized by volatile and unpredictable risks. Insurers prefer this type of reinsurance because it helps stabilize their financial performance and reduce administrative burdens. Moreover, the growing complexity of risks, particularly those related to climate change and cyber threats, has made the broad coverage offered by treaty reinsurance more valuable.

Furthermore, the adaptation of treaty reinsurance to incorporate flexible terms and condition adjustments in response to evolving market conditions has made it increasingly attractive. This flexibility, combined with the development of customized treaty solutions that cater to specific geographical or sectoral needs, continues to drive the segment’s growth.

As insurers look to manage an array of emerging risks, the treaty reinsurance market is poised to expand, offering substantial opportunities for reinsurers to innovate and grow their client bases. This segment’s robust structure and adaptability make it a cornerstone of the reinsurance industry’s ongoing evolution.

Application Analysis

Based on the application, the market is segmented into Property & Casualty Reinsurance, and Life & Health Reinsurance segments. Among these, the property and casualty reinsurance segment has the largest market share of 54.6% in the year 2023.

This segment’s prominence is largely due to the increasing frequency and severity of natural disasters, such as hurricanes, earthquakes, and floods, which have heightened the demand for robust risk management solutions in property and casualty insurance. Property & Casualty Reinsurance offers insurers a way to mitigate the financial impact of these large-scale events by spreading the risk across multiple reinsurance entities, thereby enhancing their capacity to absorb shocks and maintain financial stability.

This segment’s leadership is also bolstered by the evolving regulatory requirements that compel insurance companies to maintain higher capital reserves against potential losses. Property & Casualty Reinsurance serves as a critical tool for insurers to comply with these regulations while managing the capital efficiency. The growing urbanization and asset values in vulnerable areas further drive the need for enhanced insurance coverage, which in turn fuels the demand for reinsurance as a risk transfer mechanism.

Additionally, the Property & Casualty Reinsurance market is witnessing innovations in terms of tailored reinsurance products and data-driven risk assessment techniques. Reinsurers are leveraging advanced analytics and modeling tools to better understand and price the risks associated with property and casualty policies.

This ability to offer customized and accurately priced reinsurance solutions not only helps in expanding the customer base but also in retaining existing clients by aligning reinsurance coverage closely with their risk profiles. As such, the Property & Casualty Reinsurance segment is expected to continue leading the market, driven by strategic innovation and the growing need for effective risk management solutions.

Distribution Channel Analysis

Based on the distribution channel, the market is segmented into Direct Writing and Broker segments, where the broker segment has dominated the market with a share of 52.1% in the year 2023.

This segment’s leadership is primarily due to the critical role that brokers play in facilitating and optimizing the complex negotiations between insurers and reinsurers. Brokers possess specialized knowledge and expertise that enable them to identify the best reinsurance solutions tailored to the specific needs of insurance companies. This expertise is particularly valuable in a market characterized by increasingly sophisticated and diverse risks.

Brokers add significant value by providing access to a global network of reinsurers, thereby enhancing the competitiveness and comprehensiveness of reinsurance offerings. This is crucial for insurers who seek the best possible terms and conditions to manage their portfolios of risk effectively. Furthermore, brokers play a pivotal role in the structuring and placement of reinsurance programs, which can involve multiple parties and layers of coverage, ensuring that insurers can achieve optimal risk transfer and capital relief.

The increasing complexity of the insurance market, with evolving risks such as cyber threats, climate change impacts, and regulatory changes, further underscores the importance of brokers. Their ability to navigate this dynamic environment, coupled with their analytical capabilities to assess and mitigate risks, continues to drive the preference for the broker distribution channel.

As the demand for more tailored and strategic reinsurance solutions grows, the broker segment is expected to maintain its leadership position, propelled by its capacity to deliver value through expertise and strategic guidance in risk management.

Key Market Segments

By Type

- Facultative Reinsurance

- Treaty Reinsurance

By Application

- Property & Casualty Reinsurance

- Life & Health Reinsurance

By Distribution Channel

- Direct Writing

- Broker

Drivers

The increasing awareness of insurance products

In recent years, the reinsurance business has been greatly impacted by heightened consumer awareness of insurance products. There is a growing demand for various insurance products as people and businesses realize how important it is to minimize risk through insurance. Major insurers are being forced by the surge in demand to broaden their coverage to accommodate the varied needs of their clientele. Therefore, by assigning some of their liabilities to reinsurers, primary insurers try to control their risks.

As reinsurers will provide financial support in the case of a significant or catastrophic loss, reinsurance is essential to enabling primary insurers to issue larger policies with certainty. Additionally, the significance of sound reinsurance plans has been underscored by an increasing understanding of the possible risks connected to pandemics, natural catastrophes, and other unanticipated events. Furthermore, the demand for insurance products rises along with economic expansion and urbanization in emerging nations, which intensifies the requirement for reinsurance capacity.

As a result, reinsurers are modifying their offerings and approaches to risk management to keep up with changing market conditions. All things considered, the increased public knowledge of insurance products serves as a stimulant for the reinsurance industry’s growth and innovation, fostering stability and resilience in the world insurance market.

Restraints

Financial market instability and low investment returns

The reinsurance business faces major challenges due to financial market volatility, low interest rates, and declining investment returns. Reinsurers need to make enough money to sustain their underwriting operations and stay profitable in a low-return investing market. Fixed-income assets, which frequently make up a sizable portion of reinsurers’ portfolios, yield lower returns when interest rates are low. Because of this, reinsurers could struggle to generate the appropriate amount of investment income to balance either underwriting losses or payouts for claims.

Furthermore, the volatility of financial markets adds risk and unpredictability to reinsurers’ investment portfolios, making it challenging to forecast and regularly manage investment activities. Geopolitical tensions, volatile stock markets, and exchange rates can all affect investment returns and weaken reinsurers’ capital positions.

In addition, as companies try to hold onto market share by lowering premiums or loosening underwriting requirements, persistently low interest rates may boost competitiveness in the reinsurance sector. Achieving sustainable returns on capital may become more challenging as a result of the rising competition, which might further erode the profit margins of reinsurers.

Reinsurers may need to put methods like portfolio diversification, better risk management procedures, and alternative revenue streams into place to address these issues. For the reinsurance sector, managing the intricate relationship between underwriting operations and financial market dynamics continues to be a major barrier.

Opportunities

Revolution in product development and modification of capital sources

In an environment that is changing quickly, the reinsurance market has a great opportunity to adapt and flourish thanks to innovation in capital diversification and product development. Reinsurers have an opportunity to set themselves apart from the competition as the insurance sector struggles with new risks and evolving customer demands by providing creative and novel insurance solutions.

Reinsurers can offer more extensive insurance alternatives or create customized policies to address risks that were previously uninsurable by utilizing data analytics, risk modeling, and technology advancements. Furthermore, capital diversification gives reinsurers access to non-conventional financing sources outside of standard reinsurance contracts.

Numerous strategies can be used to achieve this diversification, such as joint ventures with institutional investors, catastrophe bonds, insurance-linked securities (ILS), and other capital market products. Reinsurers can boost resilience to unfavorable occurrences, increase capital efficiency, and improve their capacity to absorb substantial losses by utilizing a wider range of capital providers.

Furthermore, working together with fintech startups and InsurTech businesses may help organizations create creative client acquisition plans and distribution channels, which can help them expand into new markets and become more competitive. All things considered, reinsurers can establish themselves as adaptable, progressive players in the international insurance ecosystem, prepared to grab fresh development chances and skillfully negotiate shifting market conditions, by implementing innovation in capital management and product development.

Challenges

Regulatory issues

The reinsurance industry has numerous obstacles due to regulatory concerns, which impact its operations, profitability, and competitiveness. Reinsurers are faced with compliance obligations due to the ever-changing and complicated regulatory landscape, which needs a high level of resources and experience to manage. Jurisdiction-specific criteria for compliance differ, and legislation affecting reinsurers operating in several markets is generally subject to frequent changes and revisions.

Additionally, because reinsurers must modify their business procedures and risk management systems, regulatory changes may lead to uncertainty and increase operational complexity. More expenses and restrictions on reinsurers’ capital deployment strategies could result from stricter capital adequacy standards, solvency laws, and reporting requirements. This could limit their capacity to manage risks and seize growth opportunities.

Furthermore, heightened attention, compliance issues, and legal concerns may arise from regulatory control of reinsurance transactions, particularly those involving complex financial instruments or cross-border transactions. To preserve trust and confidence in the regulatory environment, reinsurers need to act with accountability and openness when interacting with counterparties and regulators.

Growth Factors

- Growing global risks: Demand for reinsurance is rising due to the frequency and intensity of natural catastrophes, climate change, and other complex risks. This is particularly true in locations where catastrophic occurrences happen regularly.

- Regulatory changes: As a result of increasing capital requirements imposed by dynamic regulatory frameworks like Europe’s Solvency II and other comparable programs globally, insurance companies are incentivized to shift more risk to reinsurers.

- Emerging markets: As a result of increased insurance penetration rates brought about by economic growth in these areas, reinsurers have the chance to enlarge their clientele and find new sources of premium income.

- Technological developments: Data analytics, AI, and risk modeling innovations help reinsurers better evaluate and price risk, which raises the accuracy and profitability of insuring.

- Alternative capital: The reinsurance market is given more capacity and liquidity by the increasing involvement of institutional investors, including pension funds and hedge funds, through the purchase of catastrophe bonds and insurance-linked securities (ILS).

- Industry consolidation: Through mergers and acquisitions, insurers and reinsurers have grown into larger, more diverse companies with stronger market power and underwriting skills.

- Growth in specialist lines: As a result of the proliferation of specialty lines covering topics like cyber, and terrorism, and newly emerging risks like pandemics, reinsurers now have more room to innovate and provide specialized products and solutions.

- Long-term trends: The demand for insurance products is being driven by demographic shifts, urbanization, and rising affluence, which is improving the long-term growth prospects for the reinsurance business.

Latest Trends

- Development of capital management plans: The ongoing development of capital management plans and risk transfer methods is a significant trend in the reinsurance business. To diversify capital and improve their risk profile, reinsurers are increasingly looking into alternative risk transfer options such as collateralized reinsurance, catastrophe bonds, and insurance-linked securities (ILS). By eliminating traditional reinsurance middlemen and giving investors direct access to reinsurance risks, these tools give reinsurers more freedom to manage their capital and capacity.

- Technology advancements: The reinsurance market is also changing significantly as a result of technology advancements. Reinsurers can increase underwriting efficiency, pricing accuracy, and risk assessment through the use of data analytics, artificial intelligence, and predictive modeling. Reinsurers can enhance their understanding of emerging risks, optimize claims management procedures, and create specialized solutions that cater to their client’s requirements by utilizing big data and sophisticated analytics.

- Market consolidation: The tendency of market consolidation is still very much alive and well, propelled by things like tightening regulations, intensifying competition, and the pursuit of economies of scale. The competitive landscape and pricing dynamics are being reshaped by the mergers and acquisitions that are occurring between insurers and reinsurers. These transactions are producing larger, more diversified firms with improved market presence and underwriting capabilities.

Regional Analysis

In 2023, North America held a dominant market position in the reinsurance market, capturing more than a 41.2% share. This region’s leadership is largely driven by the United States, which houses some of the world’s largest and most influential insurance and reinsurance companies. The market in North America is characterized by advanced risk management practices and a robust regulatory framework that ensures a stable and secure environment for reinsurance operations.

The demand for Reinsurance in North America was valued at USD 177.9 Million in 2023 and is anticipated to grow significantly in the forecast period. The prevalence of natural disasters such as hurricanes, wildfires, and floods in the region significantly contributes to the high demand for reinsurance services. These events prompt insurance companies to seek extensive reinsurance coverage to manage potential financial impacts effectively.

Additionally, the sophisticated financial markets in North America facilitate the development of innovative reinsurance products and solutions, further bolstering the growth of this sector. Moreover, the increasing emphasis on cyber and liability risks, especially in the U.S., has led to the expansion of reinsurance offerings to cover these modern exposures.

The region’s strong technological infrastructure supports the implementation of advanced analytics and artificial intelligence in risk assessment processes, enhancing the precision of reinsurance underwriting. With ongoing investments in technology and a steady economic environment, North America is expected to continue leading the global reinsurance market, driven by innovation and a proactive approach to addressing complex and emerging risk

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The reinsurance market is quite fragmented, with several major companies participating. These competitors are always coming up with new tactics to stay afloat in the cutthroat industry. These tactics could include joint ventures, mergers, and acquisitions, among others. To introduce innovations to the market, businesses are also spending money on research and development.

The reinsurance market is highly competitive and features a variety of key players that significantly influence its dynamics. Among the top entities, Munich RE and Swiss Re stand out as industry leaders, renowned for their global reach and extensive portfolios covering a wide range of risks. Munich RE is known for its expertise in providing customized reinsurance solutions, while Swiss Re leads with innovative approaches to managing complex and emerging risks, particularly in climate change and cyber security.

Berkshire Hathaway Inc., under the leadership of Warren Buffett, brings a robust financial backing and a diverse investment portfolio, enhancing its capacity to underwrite substantial risks. Similarly, Everest Re Group, Ltd. and Hannover Re are pivotal in the market due to their strong capital positions and global network, offering both traditional reinsurance and specialized solutions like catastrophe bonds.

Top Key Players in the Market

- Barents Re Reinsurance Company, Inc.

- Munich RE

- Everest Re Group, Ltd.

- The Canada Life Assurance Company

- Swiss Re

- Berkshire Hathaway Inc.

- Markel Corporation

- China Reinsurance (Group) Corporation

- SCORE

- Hannover Re

- Tokio Marine HCC

- MAPFRE

- Lloyd’s

- RGA Reinsurance Company

- AXA XL

- Next Insurance, Inc.

- BMS Group

- Other Key Players

Recent Developments

- In May 2024, Bondaval launched a new reinsurance vehicle, to further increase the potential opportunities the business may seek to pursue.

- In February 2024, Irdai introduced collateral for the reinsurance transactions by collaborating with the CBR’s.

- December 2023: Swiss Re completed the acquisition of Fathom, a global leader in water risk intelligence and flood models. This acquisition enhances Swiss Re’s Reinsurance Solutions division, integrating Fathom’s expertise to strengthen their data and risk capabilities, particularly concerning flood threats.

- August 2023: Swiss Re collaborated with Wysa to develop Wysa Assure, an AI-driven mental health support app. This app combines Swiss Re’s risk expertise with Wysa’s AI solutions to provide support to insurers and their clients.

- April 2023: Munich Re Specialty Insurance expanded its E&S Lawyers Professional Liability solution. The expansion includes primary and excess coverage for firms with 11 or more attorneys and those with an Intellectual Property practice.

Report Scope

Report Features Description Market Value (2023) USD 432 Mn Forecast Revenue (2033) USD 873.9 Mn CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered by Type (Facultative Reinsurance, Treaty Reinsurance), by Application (Property & Casualty Reinsurance, Life & Health Reinsurance), by Distribution Channel (Direct Writing, Broker) Region. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Barents Re Reinsurance Company, Inc., Munich RE, Everest Re Group, Ltd., The Canada Life Assurance Company, Swiss Re, Berkshire Hathaway Inc., Markel Corporation, China Reinsurance (Group) Corporation, SCOR, Hannover Re, Tokio Marine HCC, MAPFRE, Lloyd’s, RGA Reinsurance Company, AXA XL, Next Insurance, Inc., BMS Group, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is reinsurance?Reinsurance is a financial practice where insurance companies transfer portions of their risk portfolios to other parties, known as reinsurers, to reduce the likelihood of paying large obligations resulting from claims.

How big is Reinsurance Market?The Global Reinsurance Market size is expected to be worth around USD 0.9 Billion By 2033, from USD 0.4 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

What are the key drivers of growth in the reinsurance market?Growth drivers include increasing insurance penetration, climate change, natural and man-made catastrophes, and advancements in risk modeling. Additionally, technological innovations like blockchain and predictive analytics are enhancing efficiency and underwriting accuracy.

What challenges does the reinsurance market face?Challenges include macroeconomic and geopolitical uncertainties, regulatory barriers, and inflation pressures. The sector also needs to remain vigilant about maintaining underwriting discipline amidst fluctuating market conditions.

What regions are leading the reinsurance market?In 2023, North America held a dominant market position in the reinsurance market, capturing more than a 41.2% share.

What are the future trends in the reinsurance market?Future trends include the adoption of sustainable practices, the emergence of alternative capital sources, the development of specialty reinsurance lines, and the increased use of parametric reinsurance products. These trends aim to address evolving risks and improve market resilience.

-

-

- Barents Re Reinsurance Company, Inc.

- Munich RE

- Everest Re Group, Ltd.

- The Canada Life Assurance Company

- Swiss Re

- Berkshire Hathaway Inc.

- Markel Corporation

- China Reinsurance (Group) Corporation

- SCORE

- Hannover Re

- Tokio Marine HCC

- MAPFRE

- Lloyd’s

- RGA Reinsurance Company

- AXA XL

- Next Insurance, Inc.

- BMS Group

- Other Key Players