Global Refrigerated Van Insurance Market Size, Share and Analysis Report By Coverage Type (Comprehensive Insurance, Third-Party Liability Insurance, Goods in Transit Insurance, Others), By Vehicle Type (Light Commercial Refrigerated Vans, Medium & Heavy Refrigerated Trucks/Vans), By End-User (Food & Beverage Distributors, Pharmaceutical & Healthcare Logistics, Florists & Horticulture, Others), By Policy Duration (Annual Policies, Short-Term/Seasonal Policies), By Sales Channel (Insurance Brokers & Agents, Direct/Online), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 174084

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

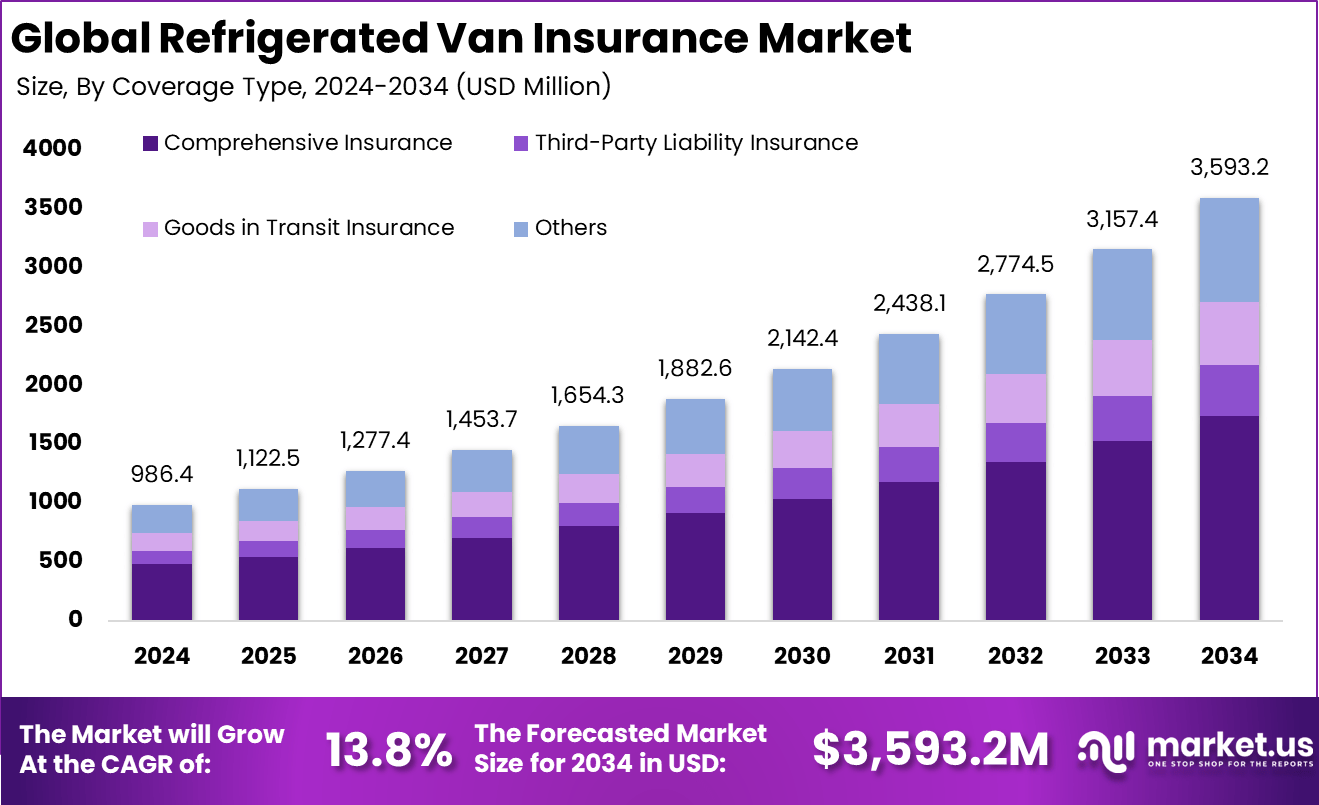

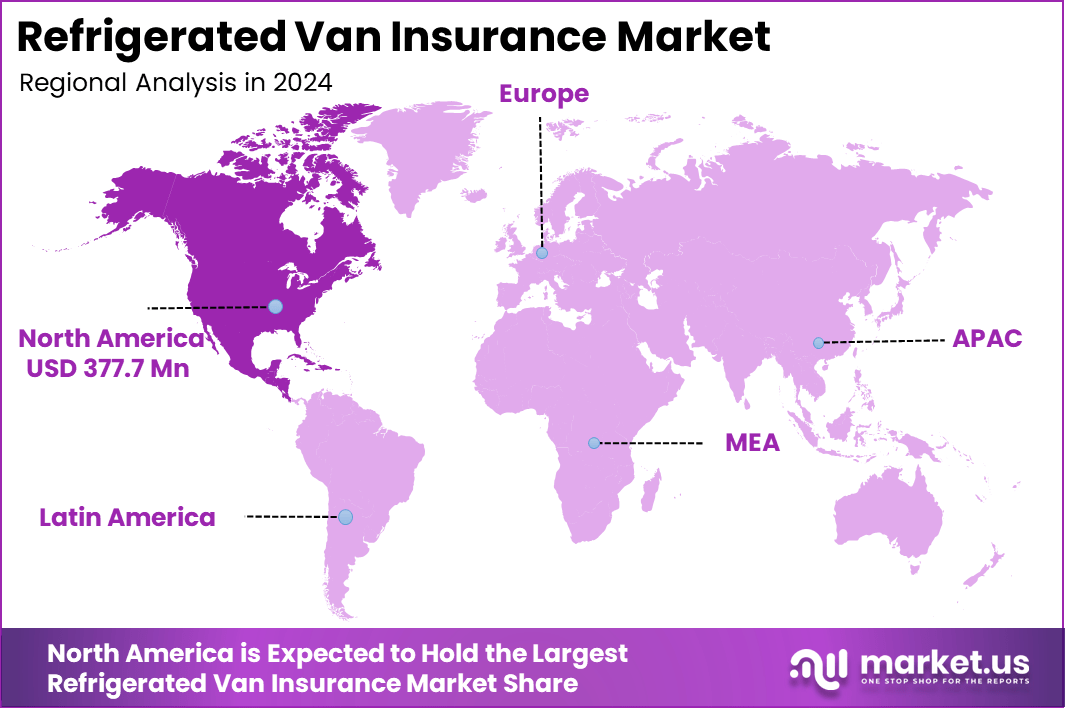

The Global Refrigerated Van Insurance Market size is expected to be worth around USD 3,593.2 million by 2034, from USD 986.4 million in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.3% share, holding USD 377.7 million in revenue.

The refrigerated van insurance market refers to insurance products specifically designed to protect refrigerated vans and their temperature-sensitive cargo from financial losses arising from accidents, mechanical failure, spoilage, theft, and liability claims. These specialised policies cover vehicle damage, cargo loss due to temperature excursions, third-party liability, and optional services like roadside assistance and temperature monitoring support.

Refrigerated vans are critical in cold-chain logistics for food, pharmaceuticals, and perishable goods, making tailored insurance essential for carriers, logistics providers, and businesses that operate or lease such vehicles. Adoption spans small fleet owners, large transport companies, and businesses integrating cold-chain distribution into their supply networks.

This growth has been influenced by the expansion of cold-chain logistics driven by rising demand for fresh food delivery, pharmaceutical distribution, and e-commerce. Regulatory requirements for temperature-controlled transport, coupled with increased consumer expectations for product freshness and safety, have elevated risk exposure. This environment reinforces the need for comprehensive insurance that protects both the physical vehicle and the integrity of high-value, temperature-controlled cargo.

For instance, in February 2025, Aviva plc launched specialized refrigerated van coverage via broker panels, including RAC breakdown and £250 personal belongings protection. Tailored for UK food transporters with continental extensions, Aviva’s policies adapt well to North American exporters. Their market-leading motor expertise extends to reefer innovations.

Demand for refrigerated van insurance is influenced by growth in online grocery and food delivery services. Consumers increasingly expect fresh, chilled, or frozen products delivered rapidly to their doorstep, fuelling demand for temperature-controlled fleets at regional and local levels. This trend has encouraged small and medium businesses to invest in refrigerated vans and seek appropriate insurance to protect their operations.

Key Takeaway

- In 2024, comprehensive insurance dominated with a 48.5% share, reflecting strong preference for full coverage that protects both vehicles and high value refrigeration equipment against theft, damage, and operational risks.

- Light commercial refrigerated vans held a leading 62.8% share, driven by their widespread use in urban and regional distribution for food, pharmaceuticals, and temperature sensitive goods.

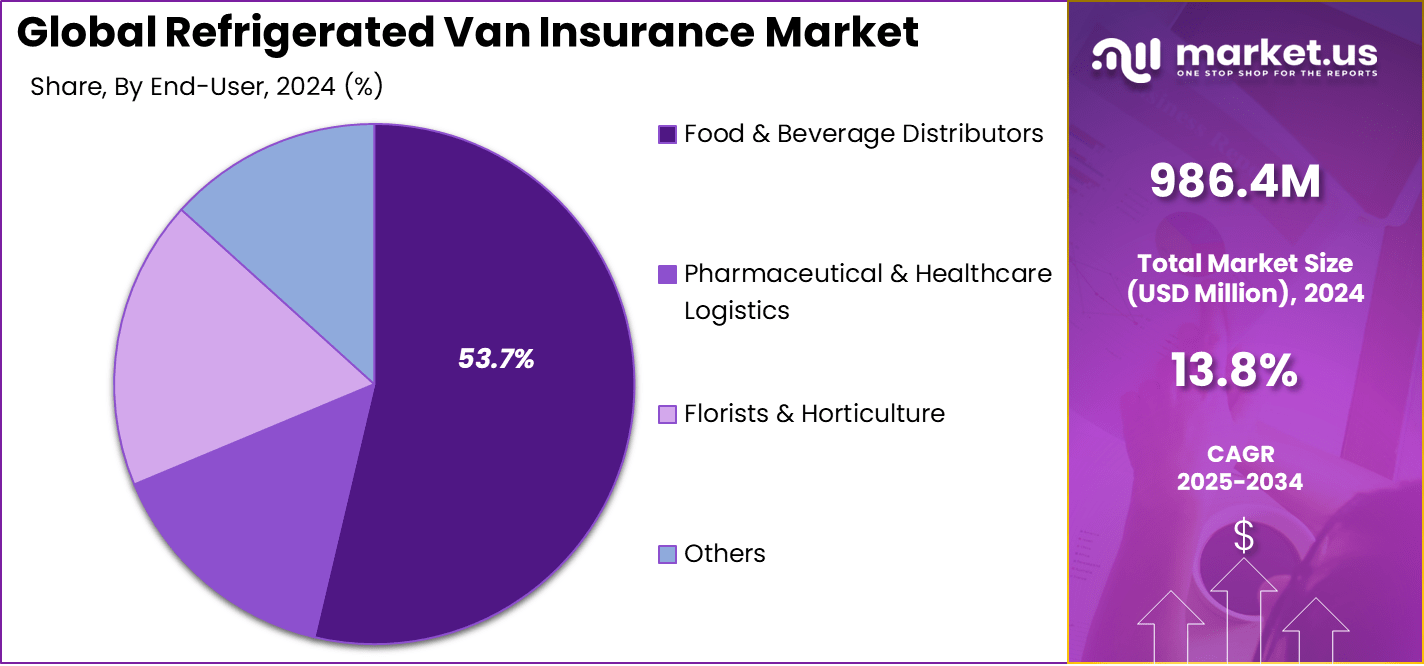

- The food and beverage distributors segment accounted for a dominant 53.7% share, supported by strict cold chain compliance requirements and high delivery frequency.

- Annual policies captured a commanding 87.4% share, indicating clear preference for long term coverage stability, predictable costs, and uninterrupted protection across operating cycles.

- Insurance brokers and agents led distribution with a 73.2% share, highlighting their role in tailoring coverage, managing risk assessments, and supporting fleet based insurance needs.

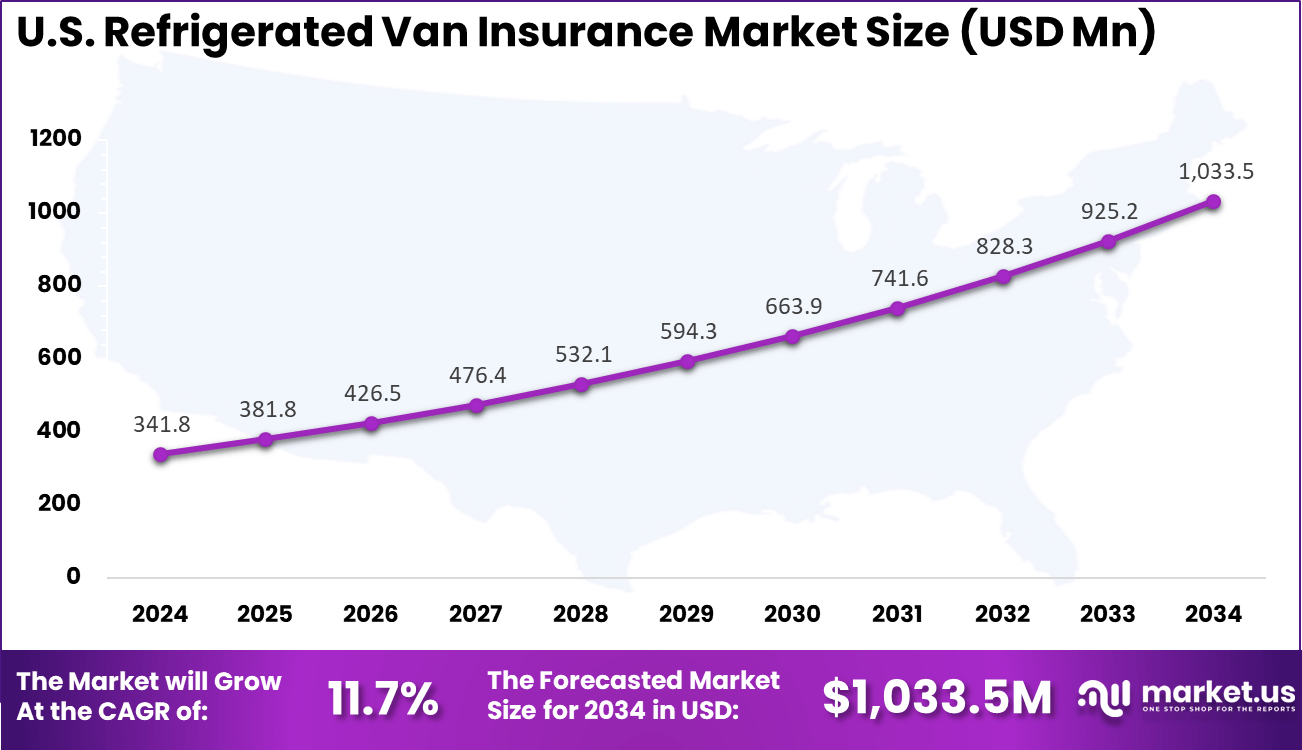

- The U.S. market was valued at USD 341.8 million in 2024, expanding at a strong 11.7% growth rate, supported by rising cold chain logistics demand and increasing reliance on insured refrigerated fleets.

Key Insights

Premium and Cost Dynamics

- Insurance costs for refrigerated vans stayed higher than standard vans due to specialized insulation and cooling systems that increase repair and replacement expenses.

- In the UK, the average annual premium for business use vans stood at around £575, while refrigerated delivery and courier vehicles typically faced premiums between £800 and £1,200 or more, reflecting elevated risk profiles.

- Premium trends softened slightly after peaking in 2024, with a 4.7% decline recorded in the twelve months to May 2026. However, a modest 3% increase was expected later in 2026, linked to rising claims costs.

- Regional disparities were pronounced, as operators in London paid nearly 2.7 times more than those in rural regions such as the South West, driven by congestion, theft risk, and accident frequency.

Usage and Coverage Characteristics

- Segment dominance was observed among technology enabled fleets, as 66% of revenue in refrigerated transport came from fleets using integrated tracking and IoT systems. These tools helped reduce risk exposure and supported lower loss ratios.

- Coverage preferences favored comprehensive insurance, which protected both the vehicle and high value refrigeration equipment. Basic third party only coverage remained uncommon due to the high capital cost of refrigerated vans.

- Key risk factors included higher insurance group ratings caused by powerful engines required to operate cooling units and the use of proprietary components. These factors contributed to higher premiums and stricter underwriting requirements.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Expansion of cold chain logistics Growth in temperature sensitive goods transport ~4.2% North America, Europe Short Term Rising food safety regulations Compliance driven insurance demand ~3.5% Global Short Term Growth of e commerce grocery delivery Higher utilization of refrigerated vans ~2.9% North America, Asia Pacific Mid Term Increased vehicle asset values Higher insured values and coverage needs ~1.8% Global Mid Term Risk awareness among distributors Loss prevention and financial protection ~1.4% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High claim frequency Accidents and cargo spoilage incidents ~3.6% Global Short Term Premium affordability issues Cost pressure on small fleet operators ~2.9% Emerging Markets Short Term Climate related disruptions Extreme weather increasing claims ~2.4% Global Mid Term Fraud and misreporting Cargo loss and damage disputes ~1.8% Global Mid Term Regulatory variation Different insurance compliance norms ~1.2% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High insurance premiums Cost sensitivity among fleet owners ~4.1% Emerging Markets Short to Mid Term Limited awareness Underinsurance of refrigerated fleets ~3.3% Global Short Term Claims processing delays Disputes over spoilage assessment ~2.6% Global Mid Term Complex policy terms Difficulty in understanding coverage scope ~2.0% Global Mid Term Dependency on brokers Limited direct digital adoption ~1.4% Global Long Term By Coverage Type

In 2025, Comprehensive insurance accounts for 48.5%, making it the leading coverage type for refrigerated vans. This coverage protects vehicles against a wide range of risks, including accidents, theft, and damage. Refrigerated vans carry high-value goods that require strong protection. Comprehensive policies help reduce financial losses from unexpected events. Coverage stability is important for fleet operators.

The dominance of comprehensive insurance is driven by cargo sensitivity. Temperature-controlled goods face higher risk exposure during transit. Operators prefer broader protection to avoid service disruption. Comprehensive coverage supports business continuity. This sustains strong demand for this coverage type.

For Instance, in April 2025, Progressive launched Cargo Plus endorsement, expanding comprehensive coverage for refrigerated loads against temperature changes, wetness, rust, and driver errors. This update builds on their motor truck cargo policies, offering better protection for perishable goods in transit. It helps fleet operators avoid losses from common refrigeration issues during deliveries.

By Vehicle Type

In 2025, Light commercial refrigerated vans represent 62.8%, making them the most insured vehicle type. These vans are widely used for short and medium-distance deliveries. Their flexibility supports urban and regional distribution. High usage increases exposure to operational risks. Insurance coverage becomes essential for daily operations.

Growth in this segment is driven by last-mile delivery demand. Food and pharmaceutical deliveries rely on light commercial vehicles. These vans operate frequently in dense traffic areas. Insurance supports risk management for frequent trips. This keeps light commercial vans dominant.

For instance, in March 2025, AXA enhanced its van insurance policies with comprehensive options tailored for light commercial vehicles, including refrigerated models used in urban deliveries. The updates cover wrong fuel, key theft, and courtesy vans, making it easier for small operators to stay on the road. This fits the needs of city-based food haulers relying on compact vans.

By End User

In 2025, Food and beverage distributors account for 53.7%, making them the largest end-user group. These distributors rely heavily on refrigerated transport to maintain product quality. Insurance coverage protects against spoilage-related losses. Timely delivery is critical for business reputation. Risk mitigation remains a priority.

Adoption in this segment is driven by strict quality standards. Distributors must comply with food safety regulations. Insurance supports compliance and operational confidence. Coverage helps manage transport-related disruptions. This sustains strong demand from food and beverage distributors.

For Instance, in January 2022, Liberty Mutual introduced a new motor cargo product for small commercial fleets, targeting food and beverage distributors in last-mile delivery. It provides flexible coverage for regional hauls under 500 miles, addressing spoilage risks for perishables like fresh produce and frozen items. The policy supports gig operators and e-commerce growth in food transport.

By Policy Duration

In 2025, Annual policies account for 87.4%, showing a strong preference for long-term coverage. Refrigerated vans operate year-round, requiring continuous protection. Annual policies simplify administrative processes. Predictable premiums support budgeting. Coverage consistency reduces operational risk.

The dominance of annual policies is driven by convenience and cost efficiency. Fleet operators avoid frequent renewals. Insurers offer stable terms for annual contracts. Long-term coverage supports planning. This keeps annual policies widely preferred.

For Instance, in October 2025, State Farm partnered with Volvo Car Financial Services to integrate annual insurance quotes into vehicle purchases, streamlining long-term coverage for commercial vans. This makes it simpler for businesses to secure yearly policies during fleet expansions. Operators benefit from consistent protection without frequent renewals.

By Sales Channel

In 2025, Insurance brokers and agents represent 73.2%, making them the primary sales channel. These intermediaries provide tailored insurance solutions. They help clients understand coverage options and risks. Brokers support policy customization. Personalized service remains valuable.

Growth in this channel is driven by policy complexity. Refrigerated van insurance involves specialized risk factors. Brokers assist with compliance and claims support. Trust and expertise influence buyer decisions. This sustains strong broker-led distribution.

For Instance, in October 2025, Covea expanded its broker network through the AA van insurance launch, emphasizing agent-led sales for customized policies. Brokers provide hands-on advice for refrigerated van risks, simplifying complex needs. This reinforces trust in agents for quick setups and claims support in the channel.

By Region

North America accounts for 38.3%, supported by strong cold-chain logistics infrastructure. The region has high demand for temperature-controlled transport. Insurance adoption remains steady among fleet operators. Regulatory standards support coverage uptake. The region remains a key contributor.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn) Adoption Maturity North America Advanced cold chain and food logistics 38.3% USD 378.8 Mn Advanced Europe Stringent food transport regulations 27.6% USD 272.3 Mn Advanced Asia Pacific Rapid expansion of cold storage networks 22.1% USD 218.1 Mn Developing Latin America Growth in food exports 7.1% USD 70.1 Mn Developing Middle East and Africa Emerging temperature controlled logistics 4.9% USD 48.4 Mn Early For instance, in October 2025, The Hartford Financial Services Group enhanced its inland marine program with endorsements for refrigeration-related cargo losses and debris removal in commercial truck policies. This strengthens coverage for temperature-sensitive freight, underscoring North American dominance in comprehensive refrigerated van insurance solutions.

The United States reached USD 341.8 Million with a CAGR of 11.7%, reflecting solid growth. Expansion is driven by food distribution and logistics activity. Fleet modernization increases insurance needs. Risk awareness continues to rise. Market growth remains consistent.

For instance, in April 2025, Progressive Casualty Insurance Company announced Cargo Plus coverage, expanding protection for refrigerated truck loads against temperature changes, driver error, wetness, rust, and corrosion when paired with Refrigeration Breakdown coverage. Available in 49 states by May and nationwide by year-end, this innovation reinforces U.S. leadership in specialized reefer insurance, protecting perishable cargo for trucking fleets.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Food and beverage distributors Very High ~53.7% Cargo and vehicle protection Annual policy renewals Logistics service providers High ~21% Fleet risk mitigation Long term contracts Third party cold chain operators Moderate ~13% Operational continuity Selective coverage Retail grocery chains Moderate ~8% Supply chain protection Bundled insurance Independent transporters Low ~4% Cost driven compliance Minimal coverage Key Market Segments

By Coverage Type

- Comprehensive Insurance

- Third-Party Liability Insurance

- Goods in Transit Insurance

- Others

By Vehicle Type

- Light Commercial Refrigerated Vans

- Medium & Heavy Refrigerated Trucks/Vans

By End-User

- Food & Beverage Distributors

- Pharmaceutical & Healthcare Logistics

- Florists & Horticulture

- Others

By Policy Duration

- Annual Policies

- Short-Term/Seasonal Policies

By Sales Channel

- Insurance Brokers & Agents

- Direct/Online

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Refrigerated Van Insurance Market is led by large multiline insurers such as Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, Zurich Insurance Group, Ltd., AXA SA, and Allianz SE. These players offer tailored commercial auto policies covering temperature controlled vehicles. Strong underwriting expertise supports food, dairy, and pharmaceutical transport. Risk assessment models focus on cargo value and spoilage exposure.

Specialty and enterprise focused insurers strengthen market depth through advanced risk protection. Companies such as Chubb, Ltd., Liberty Mutual Insurance Company, Nationwide Mutual Insurance Company, The Hartford Financial Services Group, Inc., and Travelers Companies, Inc. focus on customized fleet coverage. Their policies include equipment breakdown and goods in transit protection. Claims management efficiency is a key differentiator.

Regional insurers in Europe contribute to competitive balance and local specialization. Providers including Aviva plc, Direct Line Insurance Group plc, Admiral Group plc, Covea Insurance, and Markerstudy Insurance Company, Ltd. offer flexible refrigerated van policies. Emphasis is placed on SME transport operators. Competitive pricing and digital policy management improve accessibility. Other insurers support niche coverage needs.

Top Key Players in the Market

- Progressive Casualty Insurance Company

- State Farm Mutual Automobile Insurance Company

- Zurich Insurance Group, Ltd.

- AXA SA

- Allianz SE

- Chubb, Ltd.

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- The Hartford Financial Services Group, Inc.

- Travelers Companies, Inc.

- Aviva plc

- Direct Line Insurance Group plc

- Admiral Group plc

- Covea Insurance

- Markerstudy Insurance Company, Ltd.

- Others

Recent Developments

- In June 2025, Chubb, Ltd. unveiled fleet insurance upgrades for refrigerated vehicles in its agribusiness line, covering heavy rigs and tippers with spill liability. Tailored for logistics operators, Chubb’s comprehensive packages highlight its dominance in premium reefer fleet protection.

- In May 2025, The Hartford Financial Services Group, Inc. added refrigerated van coverage to its commercial auto suite, protecting against cargo deterioration from power failures. This practical enhancement serves urban distributors, keeping Hartford competitive in niche transport.

Report Scope

Report Features Description Market Value (2024) USD 986.4 Mn Forecast Revenue (2034) USD 3,593.2 Mn CAGR(2024-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2024-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Comprehensive Insurance, Third-Party Liability Insurance, Goods in Transit Insurance, Others), By Vehicle Type (Light Commercial Refrigerated Vans, Medium & Heavy Refrigerated Trucks/Vans), By End-User (Food & Beverage Distributors, Pharmaceutical & Healthcare Logistics, Florists & Horticulture, Others), By Policy Duration (Annual Policies, Short-Term/Seasonal Policies), By Sales Channel (Insurance Brokers & Agents, Direct/Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, Zurich Insurance Group, Ltd., AXA SA, Allianz SE, Chubb, Ltd., Liberty Mutual Insurance Company, Nationwide Mutual Insurance Company, The Hartford Financial Services Group, Inc., Travelers Companies, Inc., Aviva plc, Direct Line Insurance Group plc, Admiral Group plc, Covea Insurance, Markerstudy Insurance Company, Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refrigerated Van Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Refrigerated Van Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Progressive Casualty Insurance Company

- State Farm Mutual Automobile Insurance Company

- Zurich Insurance Group, Ltd.

- AXA SA

- Allianz SE

- Chubb, Ltd.

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- The Hartford Financial Services Group, Inc.

- Travelers Companies, Inc.

- Aviva plc

- Direct Line Insurance Group plc

- Admiral Group plc

- Covea Insurance

- Markerstudy Insurance Company, Ltd.

- Others