Global Recurring Payments Market Size, Share, Industry Analysis Report By Component (Services, Payment Platforms), By Payment Type (Fixed, Variable), By End User (Subscription-based Businesses, Financial Services, E-learning, Utilities, Telecom, Subscription E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162415

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

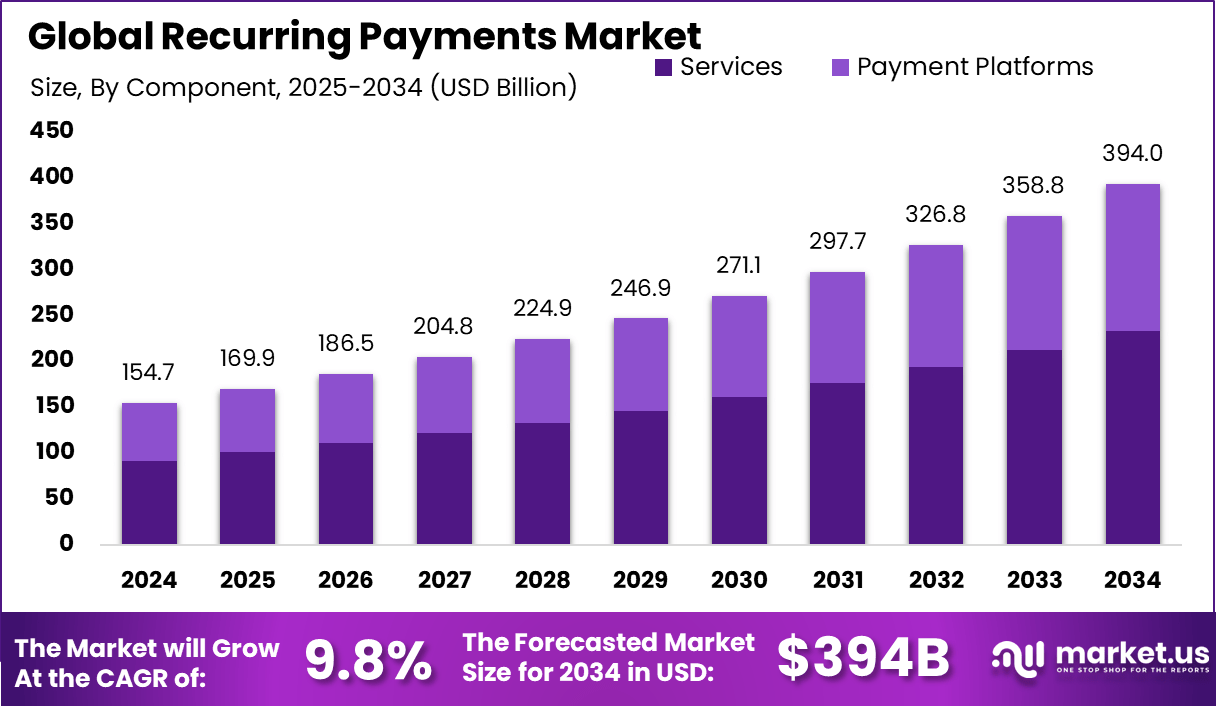

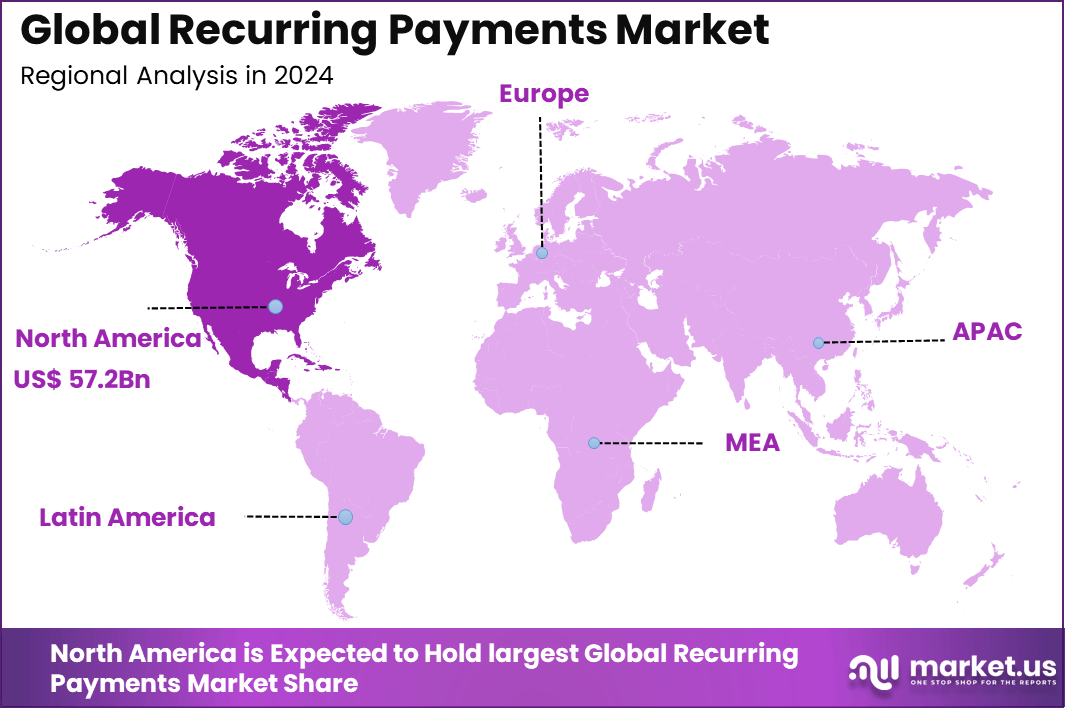

The Global Recurring Payments Market generated USD 154.7 billion in 2024 and is predicted to register growth from USD 169.9 billion in 2025 to about USD 394.0 billion by 2034, recording a CAGR of 5.94% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 37% share, holding USD 57.2 Billion revenue.

The recurring payments market refers to the ecosystem of automatic, scheduled transactions where customers authorise businesses or service providers to deduct funds at regular intervals for access to a product or service. These transactions include fixed-amount subscriptions, usage-based billing and automated billing for utilities and memberships. As business models move from one-time purchases to continuous service relationships, the underlying recurring payments infrastructure becomes essential.

The largest force behind this trend is the surge in subscription-based services, now used by more than 80% of adults in the UK and much of Western Europe. Payment platform integration and the need for predictable, seamless billing are adding momentum. Digital transformation policies and increasing consumer preference for easy, automated payments have made recurring models the norm in sectors like streaming, utility billing, and digital software.

Demand for recurring payment solutions is particularly strong among digital-services providers, financial service firms, utilities, telecoms and online retail platforms. Organizations operating in business-to-consumer (B2C) and business-to-business (B2B) models that involve ongoing relationships show the highest uptake. Research indicates that developed markets such as North America lead adoption, whereas emerging markets show increasing interest as digital infrastructure expands.

Top Market Takeaways

- The Services segment dominated with 59.3%, driven by growing demand for automated billing, payment management, and customer support solutions.

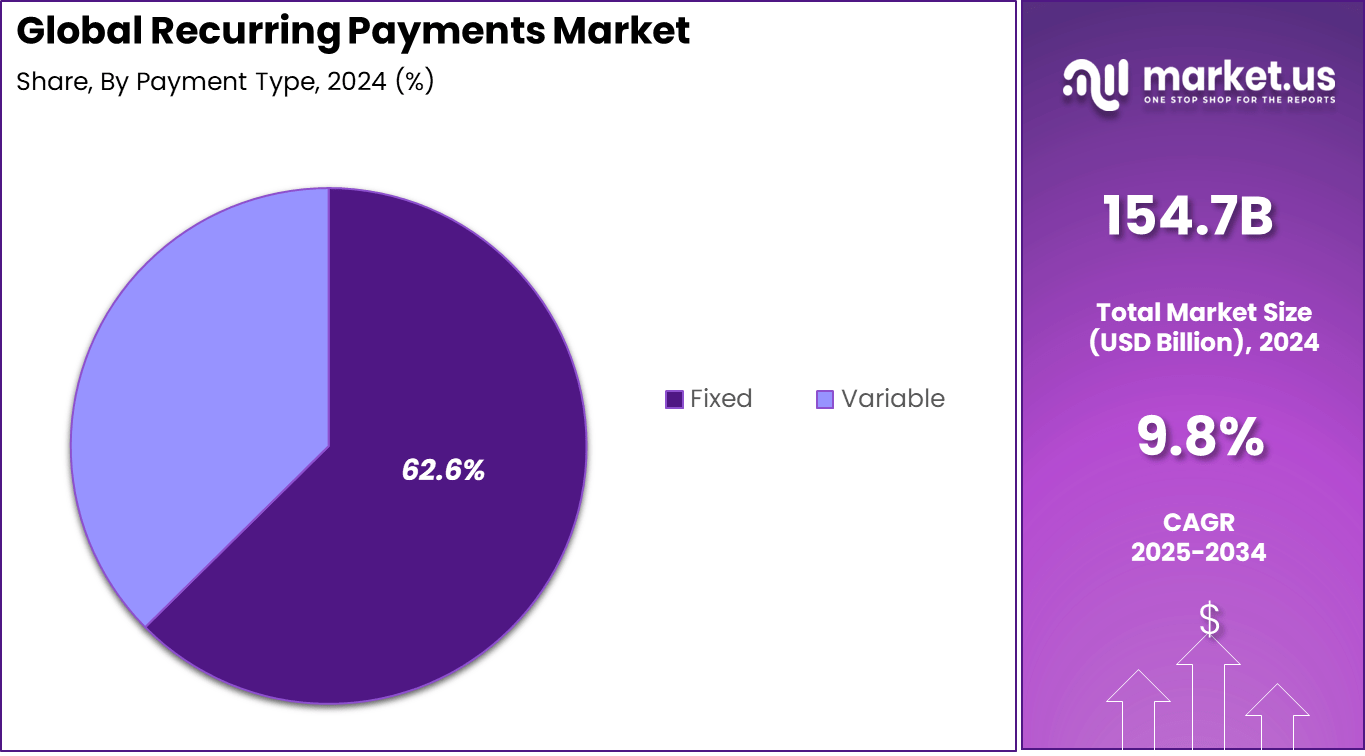

- Fixed payment models held 62.6%, reflecting stability in subscription pricing and predictable revenue streams for businesses.

- Subscription-based businesses accounted for 34.2%, highlighting their reliance on recurring payment systems to ensure steady cash flow and retention.

- North America captured 37% of the global market, supported by advanced digital payment infrastructure and strong consumer adoption of auto-pay models.

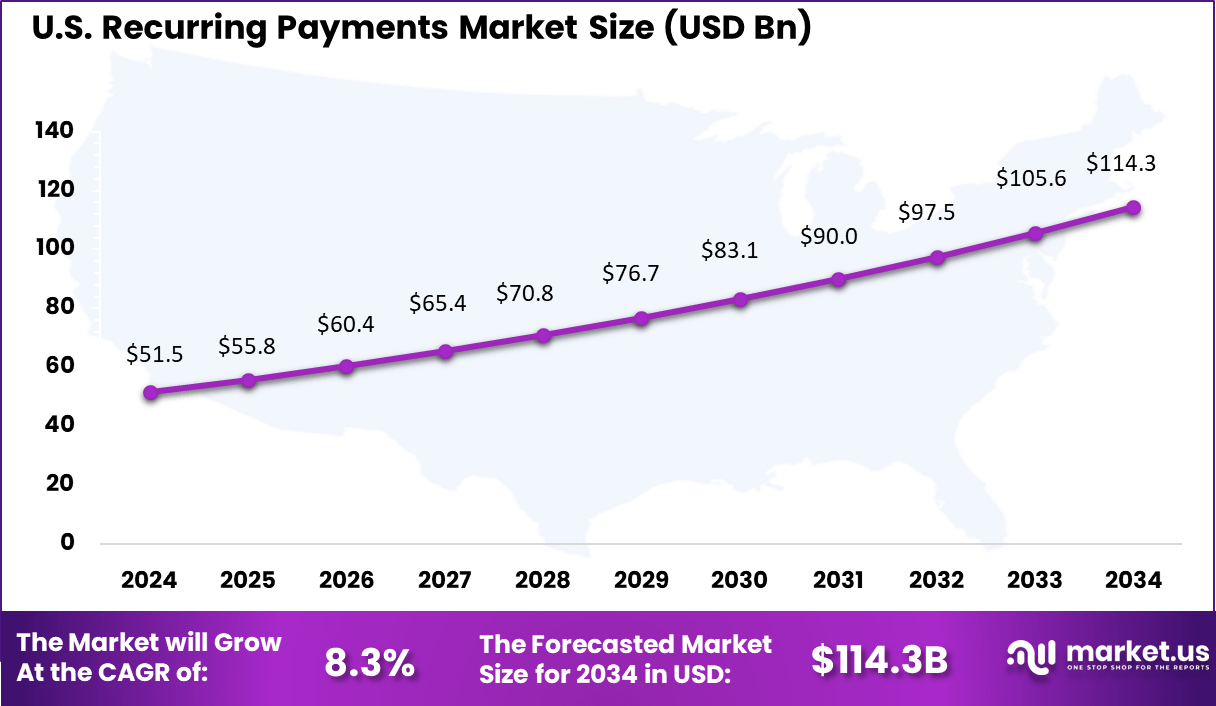

- The US market reached USD 51.5 Billion in 2024, recording a healthy 8.3% CAGR, driven by the expansion of SaaS, OTT, and e-commerce subscription ecosystems.

Role of Generative AI

Generative AI is quickly changing how companies handle recurring payments by analyzing payment data and helping to prevent fraud in real time. In 2024, AI models reduced false positives in customer onboarding by 50% and allowed 20% more customers to pass through onboarding without human checks.

AI-powered tools have also enabled payment providers to cut marketing spend by 12% while delivering more personalized payment offers to users. This shift means businesses are seeing smoother sign-ups and improved user experiences driven by data.

Generative AI tools are also helping to spot suspicious patterns in transactions by continuously learning from new data and building dynamic customer profiles. With the US reporting annual consumer fraud losses as high as $10.3 billion, better fraud detection is more urgent than ever. AI’s ability to create synthetic data for testing has led to stronger defenses and lower error rates across the recurring payments lifecycle.

US Market Size

The United States, contributing around USD 51.5 billion, maintains a steady 8.3% CAGR backed by expanding payment infrastructure and digital commerce innovation. Rising adoption in entertainment, retail, and professional services is strengthening the country’s leadership in subscription economies.

The focus remains on ensuring compliance with evolving data standards and seamless cross-border payment experiences. This regional dominance underscores North America’s pivotal role in shaping the digital subscription landscape globally.

North America leads with 37% share, reflecting the region’s early adoption of digital platforms and strong consumer acceptance of subscription billing. Growth is largely driven by enterprises modernizing their financial infrastructure with advanced automation and cloud-based billing solutions. Financial institutions and fintechs are actively collaborating to enhance recurring payment frameworks that meet evolving regulatory and security requirements.

By Component

In 2024, Services represent the largest segment, holding 59.3% of the recurring payments market. The growing complexity of subscription platforms and billing ecosystems has made managed and consulting services critical for smooth operations.

Businesses rely on service providers for payment integration, compliance monitoring, and system upgrades that ensure uninterrupted transaction flows. These services also help enterprises reduce internal IT burdens while maintaining secure recurring billing infrastructure across global markets.

As digital payment systems become more intricate, value-added service offerings such as fraud management, analytics, and data reconciliation are gaining ground. The integration of automation tools further enhances efficiency and transparency in recurring billing. Service providers are also focusing on offering scalable and API-driven models that align with different business sizes.

By Payment Type

In 2024, Fixed recurring payments lead with 62.6% share, indicating their stability and popularity among both businesses and consumers. Predictable, consistent billing cycles appeal to organizations in digital media, utilities, and insurance, where fixed pricing simplifies customer management.

This approach also facilitates budgeting and revenue forecasting, which are key priorities for subscription-based companies. Fixed plans help maintain customer trust by preventing billing surprises and ensuring transparent pricing structures. Over time, fixed plans have expanded beyond traditional sectors into fitness, healthcare, and online education, where users expect convenience and cost control.

Their increasing adoption has also encouraged fintech firms to develop sophisticated billing platforms that automate invoicing and renewals. These solutions use machine learning to detect payment failures and assist in customer retention. The sustained demand for predictability within the payment experience continues to anchor the dominance of fixed recurring transactions.

By End User

In 2024, Subscription-based businesses make up 34.2% of this market, reflecting their rapid growth across entertainment, software, and e-commerce sectors. As consumers increasingly prefer usage-based and renewal models, companies are adopting powerful subscription management platforms.

These systems handle payment scheduling, customer onboarding, and usage data synchronization, enabling businesses to scale efficiently. Digital-first enterprises, in particular, depend on recurring models to stabilize revenue streams and foster long-term customer relationships. The growing influence of streaming and SaaS providers has solidified subscriptions as a key commercial model.

Advanced payment solutions now allow easy integration of global methods, including wallets and instant payments, creating a unified experience for users. As emerging businesses enter the subscription economy, reliability and flexibility in recurring billing tools are becoming strong competitive advantages. This segment’s momentum highlights recurring payments’ central role in sustaining continuous digital value exchange.

Emerging Trends

Across 2024, recurring payments have been shaped by the rise of subscription-based services and the expansion of mobile-driven payment tech. Evidence from the UK reveals that 81% of people subscribed to at least one digital service in 2021, jumping from 65% the year before – a sign that more consumers favor automated payment models.

The market has seen rapid advances in payment security, with biometric verification and new fraud prevention features now common in AI-powered solutions. Open banking initiatives are accelerating this trend, with governments supporting more flexible account-to-account payment options and piloting variable recurring payments.

Growth Factors

Recurring payments continue to grow thanks to consumer demand for convenience, predictability, and seamless digital experiences. As digital commerce expands, companies are moving to subscription models and automated billing, creating more regular revenue and reducing customer churn. The expansion of digital subscription services is driving this growth core to the recurring payments sector.

Security advances have also fuelled adoption, as improved authentication methods and tokenization are making consumers feel safer using automatic payments. Recent data highlights the upward momentum, with adoption of digital recurring payments models rising 10% year-over-year as businesses and consumers embrace faster, safer ways to pay.

Key Market Segments

By Component

- Services

- Payment Platforms

By Payment Type

- Fixed

- Variable

By End User

- Subscription-based Businesses

- Financial Services

- E-learning

- Utilities

- Telecom

- Subscription E-commerce

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growth of Subscription-Based Business Models

The increasing adoption of subscription-based models is the primary driver for the recurring payments market. Businesses across industries such as media, software, and e-commerce are shifting to recurring revenue streams by charging customers on a regular basis.

This approach offers predictable income for companies and convenience for customers, who benefit from uninterrupted service without the hassle of repeated manual payments. As consumers grow more comfortable with subscriptions, the demand for automated recurring payments continues to rise.

Furthermore, businesses are expanding digital offerings in response to changing consumer habits, such as streaming entertainment and cloud services. This expansion increases the volume of recurring transactions and encourages the use of sophisticated payment platforms that manage billing cycles, retries, and customer communication.

Restraint

Regulatory and Security Concerns

Regulations surrounding payment data security, consumer protection, and privacy pose a significant restraint on the recurring payments market. Compliance with laws like PCI-DSS and GDPR requires firms to invest in secure infrastructure and practices, which raises costs and complexity. Data breaches and payment fraud remain risks that can undermine customer trust and slow adoption of automated payment solutions.

Additionally, inconsistent regulations across regions complicate the market landscape. Companies operating internationally must navigate varying rules, which can stall global expansion of recurring payment services. Ensuring secure, legally compliant transactions across borders is both a technological and regulatory challenge that restrains faster market growth.

Opportunity

Technological Advancements in Payment Automation

Technological innovation presents great opportunities for the recurring payments market. The integration of AI and machine learning into payment platforms enables smarter payment retries, fraud detection, and personalized billing schedules. These features help reduce friction for customers, decreasing failed payments and involuntary churn while improving overall user experiences.

Additionally, advancements in mobile payments and digital wallets enhance convenience and broaden accessibility to recurring payments. Improved interoperability between banks, platforms, and merchants opens new avenues for scaling subscription services across different markets. These innovations promise to fuel strong growth and diversification in the recurring payments ecosystem.

Challenge

Managing Customer Churn and Payment Failures

One of the key challenges facing recurring payments is managing customer churn caused by payment failures or dissatisfaction with subscription services. Even with automated billing, failed transactions can disrupt service continuity, frustrate customers, and result in revenue loss for businesses. Reducing involuntary churn requires continuous optimization of payment retry mechanisms and customer communication.

Moreover, keeping customers engaged and maintaining subscription value is critical to reducing voluntary cancellations. Businesses must also navigate competition in a crowded subscription market while preserving user trust and satisfaction. Strategically addressing churn at multiple points in the payment lifecycle is essential to success in this growing market.

Competitive Analysis

The Recurring Payments Market is dominated by major fintech and payment service providers such as American Express Company, PayPal Holdings Inc., Square Inc., Stripe Inc., and Adyen N.V. These companies enable seamless subscription billing and automated payment processing for digital platforms, SaaS providers, and e-commerce businesses.

Emerging and mid-tier platforms including Klarna Inc., Recurly Inc., Chargebee Inc., Zuora Inc., and GoCardless focus on flexible billing automation, analytics, and integration with customer relationship management (CRM) systems. These solutions cater to subscription-based industries such as streaming, online education, and digital services by offering personalized billing cycles, retention tracking, and automated revenue management.

Additional contributors such as Zoho Corporation Pvt. Ltd., Elavon Inc., Odoo S.A., QuickBooks, Braintree, and other market participants enhance the ecosystem through accounting integration, payment gateway solutions, and business management platforms. Their innovations in recurring billing workflows, data security, and AI-based payment optimization continue to support the rapid growth of subscription-driven digital economies worldwide.

Top Key Players in the Market

- American Express Company

- PayPal Holdings Inc.

- Square Inc.

- Stripe Inc.

- Adyen N.V

- Klarna Inc.

- Zoho Corporation Pvt. Ltd.

- Recurly Inc.

- Elavon Inc.

- Odoo S.A.

- GoCardless

- Chargebee Inc.

- QuickBooks

- Zuora Inc.

- Braintree

- Others

Recent Developments

- May 2025 – Zoho Corporation launched Zoho Payments, a unified payment processing solution in the US. It supports card and ACH payments in over 135 currencies, integrating with Zoho’s business software to simplify recurring and one-time payments for businesses.

- June 2025 – Square made significant enhancements to its recurring payments and analytics platform. Key improvements included over 25% faster transaction processing through partnerships, expanded Tap-to-Pay Android support to 95+ countries, and subscription tools now supporting over 650,000 merchants globally.

- July 2025 – Adyen introduced a Global Partner Programme to deepen partner collaboration with over 1000 partners worldwide. The program aims to unlock more value through tiered incentives and co-marketing, supporting partners to deploy payments and recurring billing solutions more effectively.

Report Scope

Report Features Description Market Value (2024) USD 154.7 Bn Forecast Revenue (2034) USD 394.0 Bn CAGR(2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Services, Payment Platforms), By Payment Type (Fixed, Variable), By End User (Subscription-based Businesses, Financial Services, E-learning, Utilities, Telecom, Subscription E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape American Express Company, PayPal Holdings Inc., Square Inc., Stripe Inc., Adyen N.V, Klarna Inc., Zoho Corporation Pvt. Ltd., Recurly Inc., Elavon Inc., Odoo S.A., GoCardless, Chargebee Inc., QuickBooks, Zuora Inc., Braintree, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Express Company

- PayPal Holdings Inc.

- Square Inc.

- Stripe Inc.

- Adyen N.V

- Klarna Inc.

- Zoho Corporation Pvt. Ltd.

- Recurly Inc.

- Elavon Inc.

- Odoo S.A.

- GoCardless

- Chargebee Inc.

- QuickBooks

- Zuora Inc.

- Braintree

- Others