Global Recreational Vehicle Market Report By Vehicle Type (Motorhomes, Class A, Class B, Class C, Towable RVs, Fifth Wheel, Travel Trailer, Camping Trailer), By Application (Personal, Commercial), By Propulsion (Internal-Combustion Engine (ICE), Hybrid, Battery-Electric RVs), By Length Category (20 - 30 ft, Below 20 ft, Above 30 ft) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 108513

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Recreational Vehicle Market size is expected to be worth around USD 203.5 Billion by 2033, from USD 67.9 Billion in 2023, growing at a CAGR of 11.6% during the forecast period from 2024 to 2033.

A recreational vehicle (RV) is a motorized or towable vehicle designed for temporary living while traveling. It offers mobile accommodation, including sleeping, kitchen, and bathroom facilities. RVs come in different forms like motorhomes, campervans, travel trailers, and fifth wheels.

The RV market includes the manufacturing, distribution, and sales of recreational vehicles. It covers various types such as motorized and towable RVs. This market also involves the sales of accessories and after-sales services.

The Recreational Vehicle (RV) market has shown significant growth over the past few decades, becoming a crucial component of the U.S. outdoor leisure industry. According to the RV Industry Association, the RV sector contributes an impressive $140 billion annually to the U.S. economy, supporting nearly 680,000 jobs and generating over $48 billion in wages.

This represents a 23% increase in economic output over the last three years. The rise in economic activity signals not only a growing market but also an increase in consumer demand for recreational vehicles as a lifestyle choice.

The market is supported by a diverse customer base. A study by Go RVing shows that RV ownership has surged by 62% in the past twenty years, reaching a record 11.2 million RV-owning households. The market is split almost equally between older demographics (above 55 years) and younger consumers (under 55 years).

Notably, individuals aged 18 to 34 now constitute 22% of the RV market, indicating a shift in consumer behavior and preferences among younger generations. Additionally, 9.6 million households plan to buy an RV in the next five years, suggesting sustained growth prospects.

The RV market is experiencing a strong growth trajectory due to several factors. One key driver is the increasing preference for flexible, independent travel options, especially post-pandemic, as consumers prioritize personal space and outdoor activities. RVs offer an ideal solution, blending mobility and comfort, appealing to both younger consumers seeking adventure and older consumers desiring convenience.

Furthermore, the economic impact at both the local and national levels is profound. The U.S. Bureau of Economic Analysis (BEA) reports that RVing is the second-largest conventional outdoor activity nationwide. States like Indiana and Texas are major contributors, generating $3.4 billion and $1.7 billion respectively, underscoring the importance of RV manufacturing hubs and local economies that benefit from the industry.

Despite its growth, the RV market shows signs of approaching saturation, particularly in established regions where ownership rates are high. However, market competitiveness remains intense, with a growing number of manufacturers and rental services entering the market. Companies are focusing on product differentiation, such as advanced technology integration (e.g., solar-powered units and smart systems) and luxury amenities, to capture a broader audience.

Key Takeaways

- The Recreational Vehicle Market was valued at USD 67.9 billion in 2023 and is expected to reach USD 203.5 billion by 2033, with a CAGR of 11.6%.

- In 2023, Towable RVs dominated the market with 72.7% due to their affordability and variety of travel options.

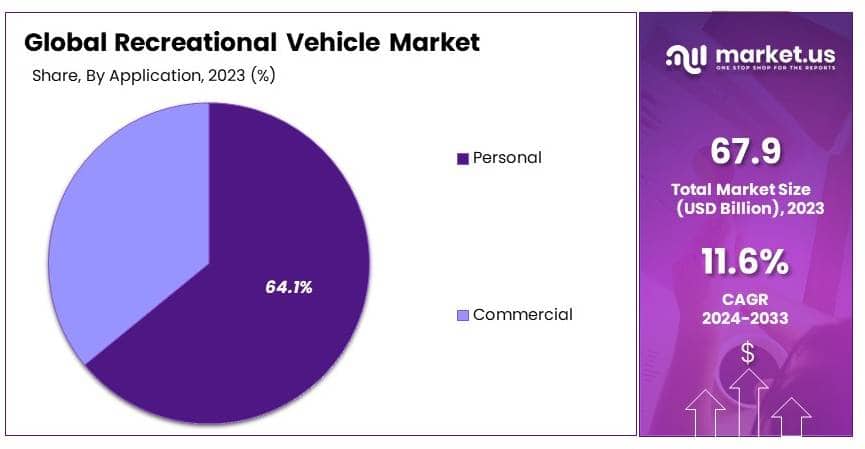

- In 2023, Personal Use led the application segment with 64.1%, reflecting consumer preference for flexible travel experiences.

- In 2023, North America held the largest share at 56.5%, driven by high demand for outdoor leisure and road trips.

Type Analysis

Travel Trailer dominates with 72.7% due to its versatility and affordability.

The recreational vehicle (RV) market is segmented primarily by vehicle type, encompassing Motorhomes and Towable RVs. Among these, Towable RVs emerge as the dominant sub-segment, particularly the Travel Trailer category, which commands a substantial 72.7% market share.

Travel Trailers offer significant advantages such as lower initial costs compared to motorhomes and the flexibility to detach the trailer upon reaching the destination, which enhances convenience and utility. These factors significantly drive consumer preference, contributing to their high market share.

Additionally, the increasing interest in road trips and outdoor activities, especially post-pandemic, has fueled the demand for Travel Trailers.

On the other hand, other sub-segments within Towable RVs, such as Fifth Wheels and Camping Trailers, also play critical roles in the market. Fifth Wheels offer enhanced space and comfort, making them suitable for long-term vacations or luxury camping.

Although they represent a smaller portion of the market, their importance grows among demographics valuing comfort and extended travel periods. Camping Trailers, being more compact and accessible, cater to the needs of solo travelers and small groups, thus supporting market diversity.

Application Analysis

Personal use dominates with 64.1% due to the rising trend of family vacations and road trips.

The dominance of the Personal segment is primarily driven by the increasing preference for family vacations, road trips, and the growing trend of ‘staycations’, where families opt to travel within their own country rather than abroad.

The flexibility and convenience offered by RVs for personal use align well with the rising consumer interest in exploring remote locations and the desire for safe travel options amid ongoing global health concerns.

Commercial use of RVs, while smaller in comparison, is nonetheless significant, particularly in niche markets such as mobile marketing campaigns, mobile offices, or temporary accommodation solutions in areas affected by tourism peaks or seasonal workforces.

The commercial segment benefits from the customization capabilities of RVs, which can be tailored to specific business needs, thereby enhancing their utility in various commercial applications.

The growth in the Personal application segment is further supported by advancements in RV facilities and technology, such as connectivity features, better ergonomic designs, and improved safety features, which enhance the overall user experience.

As manufacturers continue to innovate with more user-friendly and sustainable models, the attractiveness of RVs for personal use is expected to rise, further cementing its dominance in the market.

Propulsion Analysis

Internal-Combustion Engine (ICE) Dominates the Recreational Vehicle Market with a 78.9% Share

In 2024, Internal-Combustion Engine (ICE) held a dominant market position in the By Propulsion Analysis segment of the Recreational Vehicle Market, with a 78.9% share. This segment’s large share is attributed to the widespread adoption of ICE vehicles in the RV market, given their long-standing dominance in the automotive industry and established infrastructure for fueling and maintenance. Additionally, ICE-powered RVs continue to be favored for their reliability and performance, especially for long-distance travel.

Hybrid propulsion systems are also gaining traction in the market, with a growing interest in environmentally friendly alternatives. The hybrid segment’s share is expanding as consumers seek a balance between fuel efficiency and the convenience of traditional combustion engines.

Battery-electric RVs, while still a nascent segment, are expected to experience substantial growth, driven by advancements in battery technology and a push for sustainable travel solutions. However, they currently hold a smaller market share compared to ICE and hybrid models due to the need for more charging infrastructure and longer driving ranges.

Length Category Analysis

In 2024, 20 – 30 ft held a dominant market position in the By Length Category Analysis segment of the Recreational Vehicle Market, with a 56.1% share. This length category is favored due to its versatility, offering a good balance of space and maneuverability. RVs in this range cater to a wide audience, from families seeking comfort to individuals looking for a more compact vehicle.

The Below 20 ft category follows, capturing the interest of consumers who prioritize portability and ease of use. These smaller RVs are particularly popular among first-time buyers or those with limited storage space.

The Above 30 ft category, while offering ample living space, holds a smaller market share. This size is typically preferred by consumers who value luxurious amenities and are willing to trade maneuverability for additional space and comfort during extended trips.

Key Market Segments

By Vehicle Type

- Motorhomes

- Class A

- Class B

- Class C

- Towable RVs

- Fifth Wheel

- Travel Trailer

- Camping Trailer

By Application

- Personal

- Commercial

By Propulsion

- Internal-Combustion Engine (ICE)

- Hybrid

- Battery-Electric RVs

By Length Category

- 20 – 30 ft

- Below 20 ft

- Above 30 ft

Drivers

Increasing Demand for Outdoor Leisure Drives Market Growth

The growth of the Recreational Vehicle (RV) market is primarily driven by an increasing interest in outdoor leisure and adventure activities. People are increasingly seeking travel options that provide flexibility and freedom, favoring RVs as they offer a unique combination of transportation and accommodation.

The rise in disposable income, especially among millennials and retirees, further boosts the demand for these vehicles as they invest in travel experiences. Additionally, the growing popularity of “work-from-anywhere” trends allows professionals to combine work and travel, making RVs an appealing option for remote work setups.

This shift has led to the development of RVs equipped with modern amenities like Wi-Fi and power sources, enhancing their attractiveness. Another key factor is the rising inclination toward eco-friendly travel. Manufacturers are responding by producing energy-efficient RVs, such as electric and hybrid models, which align with consumers’ sustainability concerns.

This shift not only attracts environmentally conscious customers but also complies with government regulations promoting green vehicles, further driving market growth. Moreover, the expanding infrastructure, including RV parks and campsites with modern facilities, provides convenience and accessibility, supporting the increase in RV ownership.

Restraints

High Costs and Economic Uncertainty Restraints Market Growth

The Recreational Vehicle (RV) market faces challenges due to high manufacturing and maintenance costs. The production of RVs requires significant investment in raw materials, advanced technologies, and skilled labor, making the final product expensive. These high prices often deter potential buyers, particularly younger customers who may not have the financial flexibility for such large purchases.

In addition, economic uncertainties also restrain market growth. Fluctuations in the global economy impact consumer spending, with people prioritizing essential needs over luxury items like RVs during economic downturns. Inflation and rising interest rates further discourage RV purchases as financing options become less affordable, leading to reduced market demand.

Stringent environmental regulations are another barrier for the RV industry. Governments in many regions are enforcing strict emissions standards, making it necessary for manufacturers to invest in cleaner technologies. While this shift is beneficial for the environment, it increases production costs and may limit profit margins for companies, affecting their ability to price competitively.

Furthermore, the lack of adequate infrastructure, such as well-equipped campsites and charging stations for electric RVs, hampers market growth. In many developing regions, limited access to proper facilities discourages RV use and travel, particularly for long-distance trips. This gap in infrastructure development prevents the market from expanding into new areas, limiting its overall growth potential.

Opportunity

Digital Nomad Culture Provides Opportunities

The Recreational Vehicle (RV) market has significant opportunities due to the rising digital nomad culture. With remote work becoming more widespread, many professionals seek flexible, mobile lifestyles. This trend encourages RV manufacturers to design models tailored for remote work, featuring efficient workspaces, connectivity, and modern amenities.

Adventure tourism is another growing trend that offers opportunities. People are seeking unique and immersive outdoor experiences. This creates a demand for compact and off-road RVs designed for rugged terrains. Developing specialized models for adventure travelers allows companies to tap into this expanding market.

Additionally, the shift in travel preferences towards domestic and local exploration presents opportunities. With travel restrictions and safety concerns impacting international travel, many people choose road trips instead. RV companies can capitalize on this trend by marketing RVs as the perfect solution for safe, self-contained travel.

Technological advancements in RV manufacturing also present opportunities. Innovations like smart home integration, solar power systems, and advanced navigation tools enhance user experience. By incorporating these technologies, RV manufacturers can attract tech-savvy customers looking for modern, efficient solutions.

Challenges

Rising Fuel Prices and Supply Chain Issues Challenge Market Growth

The Recreational Vehicle (RV) market faces significant challenges due to rising fuel prices. As fuel costs increase, the expenses associated with owning and operating RVs rise, making them less attractive to potential buyers. High fuel prices particularly affect larger RV models, which consume more fuel, leading to a decline in demand as consumers seek more cost-effective travel options.

Supply chain disruptions also pose a major challenge for RV manufacturers. Shortages in essential components, such as microchips and specialized parts, have delayed production schedules. This results in longer delivery times and increased manufacturing costs. Such delays can frustrate customers and impact brand loyalty, limiting market expansion.

Another challenge is the limited availability of skilled technicians and labor required for RV assembly and maintenance. As RV models become more technologically advanced, the demand for specialized skills grows. The shortage of such expertise can lead to higher labor costs, further driving up the price of RVs and affecting affordability for customers.

The unpredictability of the weather is a challenge, as RV travel is often dependent on favorable conditions. Extreme weather events or longer off-seasons can reduce travel activities, impacting sales and rentals. This reliance on weather patterns makes it difficult for companies to maintain steady growth.

Growth Factors

Rising Disposable Income and Technological Advancements Are Growth Factors

The growth of the Recreational Vehicle (RV) market is influenced by rising disposable income levels worldwide. As people have more money to spend, they seek unique travel experiences and leisure options. RVs offer flexibility and freedom, making them a preferred choice for these consumers.

Technological advancements are another strong growth factor. Modern RVs now come equipped with features like smart controls, solar panels, and efficient energy management systems. These innovations attract tech-savvy buyers looking for comfort and sustainability.

Additionally, the expansion of RV rental services boosts market growth. More people are choosing rental options over ownership due to lower costs and flexibility. Rental platforms are making it easier for users to book RVs for vacations, leading to higher market demand.

Lastly, supportive government policies promoting domestic tourism and leisure travel contribute to growth. By investing in campsite infrastructure and promoting RV-friendly destinations, governments help drive market demand. Incentives and tax benefits for eco-friendly models further encourage purchases.

Emerging Trends

Eco-Conscious Travel and Customization Are Latest Trending Factors

The shift towards eco-conscious travel is a significant trend shaping the Recreational Vehicle (RV) market. Many consumers are now prioritizing sustainability in their travel choices. RV manufacturers respond by developing electric and hybrid models that lower emissions and offer efficient fuel consumption. This trend attracts environmentally conscious buyers who seek greener travel options, expanding the market base.

Another emerging trend is the increasing demand for personalized and customizable RVs. Customers want RVs that reflect their lifestyle and needs. Manufacturers offer a variety of layouts and add-ons, such as solar panels, smart home integration, and luxury interiors.

The influence of social media and digital platforms is also trending. Social media influencers and travel bloggers are promoting RV travel as an aspirational lifestyle. Their content showcases the freedom and flexibility of RV living, inspiring more people to explore this option.

Lastly, increased focus on wellness and nature-focused vacations drives demand for RVs. Travelers are prioritizing wellness, looking for ways to escape city life and immerse themselves in natural surroundings. RVs provide a perfect solution, enabling safe, self-contained travel to serene locations.

Regional Analysis

North America Dominates with 56.5% Market Share

North America leads the Recreational Vehicle (RV) Market with a 56.5% share, amounting to USD 38.36 billion. This dominance is driven by a high preference for outdoor leisure activities and well-established camping infrastructure. Strong consumer spending and a rise in road trips among millennials and retirees also boost the region’s RV market growth.

The region benefits from favorable government policies promoting domestic tourism and investments in campgrounds and RV parks. Additionally, the presence of leading RV manufacturers and a robust network of dealerships provide easy access to products and after-sales services, supporting market expansion.

North America’s influence in the RV market is expected to grow as consumers continue to prefer flexible travel options. Increasing technological advancements in RV designs, such as eco-friendly and smart features, will further solidify the region’s market leadership in the coming years.

Regional Mentions:

- Europe: Europe shows steady growth in the RV market, driven by increasing tourism in countries like Germany and France. The region’s focus on sustainable travel options also contributes to its market expansion.

- Asia Pacific: Asia Pacific is emerging as a fast-growing RV market, fueled by rising disposable incomes and a growing interest in recreational tourism in countries such as China and Australia.

- Middle East & Africa: The Middle East and Africa are slowly adopting RV culture, focusing on promoting adventure tourism and improving camping facilities in regions like the UAE and South Africa.

- Latin America: Latin America is gradually entering the RV market, with demand growing in countries like Brazil and Argentina, as people seek more economical and flexible travel experiences.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Recreational Vehicle (RV) market is highly competitive and diverse, with several key players operating globally. It includes various segments such as motorhomes, travel trailers, and pop-up campers. The market is driven by an increasing interest in outdoor recreational activities, demand for long-distance travel solutions, and innovative designs.

Prominent companies in this market include ALINER (Columbia Northwest, Inc.), Dethleffs GmbH & Co. KG, Forest River Inc., Gulf Stream Coach, Inc., Hymer GmbH & Co. KG, Northwood Manufacturing, REV Recreation Group, Swift Group Limited, Thor Industries Inc., Trigona SA, and Winnebago Industries Inc. These companies dominate the market through diversified product portfolios, global reach, and strong brand reputations.

These firms offer a wide range of RVs, including compact trailers, luxury motorhomes, and lightweight, innovative pop-up campers. Leading companies like Thor Industries Inc. and Winnebago Industries Inc. are particularly strong in the premium segment, providing luxury features and advanced technology integration. In contrast, brands such as ALINER and Northwood Manufacturing focus on lightweight, compact models, which are suitable for outdoor enthusiasts looking for more affordable and practical options.

Market strategies among these players vary. Hymer GmbH and Swift Group emphasize high-quality, feature-rich models with premium pricing, appealing to a luxury segment of the market. On the other hand, companies like Forest River Inc. and Gulf Stream Coach, Inc. offer affordable, entry-level RVs to attract a broader customer base. Brand presence is strengthened through loyalty programs and digital marketing efforts, with many companies investing in online and e-commerce channels to connect with tech-savvy consumers.

Innovation is central to the strategies of these key players. Companies invest heavily in research and development to introduce eco-friendly, lightweight, and technologically advanced RV models. Features such as solar-powered systems, smart controls, and sustainable materials are becoming common, aimed at attracting environmentally conscious customers and enhancing the overall travel experience.

Top Key Players in the Market

- ALINER (Columbia Northwest, Inc.)

- Dethleffs GmbH & Co. KG

- Forest River Inc.

- Gulf Stream Coach, Inc.

- Hymer GmbH & Co. KG

- Northwood Manufacturing

- REV Recreation Group

- Swift Group Limited

- Thor Industries Inc.

- Trigona SA

- Winnebago Industries Inc.

Recent Developments

- JCBL RV Signature Motorhomes: In October 2024, JCBL Group launched its luxury motorhome, the JCBL RV Signature, targeting the Indian market. This vehicle offers extensive customization options, including king-sized beds, a full kitchen, and advanced entertainment features, aimed at redefining the travel experience. The company emphasizes its commitment to providing a blend of luxury and practicality to attract a growing market of RV enthusiasts in India.

- Thor Industries and Harbinger: In February 2024, Thor Industries and Harbinger announced their collaboration on the world’s first hybrid Class A motorhome. This partnership aims to integrate advanced hybrid powertrains, enhancing fuel efficiency and sustainability without compromising luxury. The motorhome represents a significant technological advancement, with a focus on delivering zero-emission travel solutions.

- Ricardo and Winnebago: In October 2023, Ricardo collaborated with Winnebago to develop its first zero-emission, all-electric RV prototype. This initiative underscores Winnebago’s commitment to sustainability and innovation, aiming to reduce the carbon footprint associated with recreational vehicles. The prototype is designed to offer a full range of amenities while operating on a completely electric platform.

Report Scope

Report Features Description Market Value (2023) USD 67.9 Billion Forecast Revenue (2033) USD 203.5 Billion CAGR (2024-2033) 11.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Motorhomes, Class A, Class B, Class C, Towable RVs, Fifth Wheel, Travel Trailer, Camping Trailer), By Application (Personal, Commercial), By Propulsion (Internal-Combustion Engine (ICE), Hybrid, Battery-Electric RVs), By Length Category (20 – 30 ft, Below 20 ft, Above 30 ft) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ALINER (Columbia Northwest, Inc.), Dethleffs GmbH & Co. KG, Forest River Inc., Gulf Stream Coach, Inc., Hymer GmbH & Co. KG, Northwood Manufacturing, REV Recreation Group, Swift Group Limited, Thor Industries Inc., Trigona SA, Winnebago Industries Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Recreational Vehicle MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Recreational Vehicle MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ALINER (Columbia Northwest, Inc.)

- Dethleffs GmbH & Co. KG

- Forest River Inc.

- Gulf Stream Coach, Inc.

- Hymer GmbH & Co. KG

- Northwood Manufacturing

- REV Recreation Group

- Swift Group Limited

- Thor Industries Inc.

- Trigona SA

- Winnebago Industries Inc.