Global Recovery Footwear Market Size, Share, Growth Analysis By Product Type (Flip-flop sandals, Slides sandals, Closed-toed shoes, Others), By Application (After-foot surgery, After-workout, Walking, Others), By Consumer Orientation (Men, Women, Children), By Sales Channel (Multi-brand stores, Convenience stores, Exclusive stores, Online retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151733

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

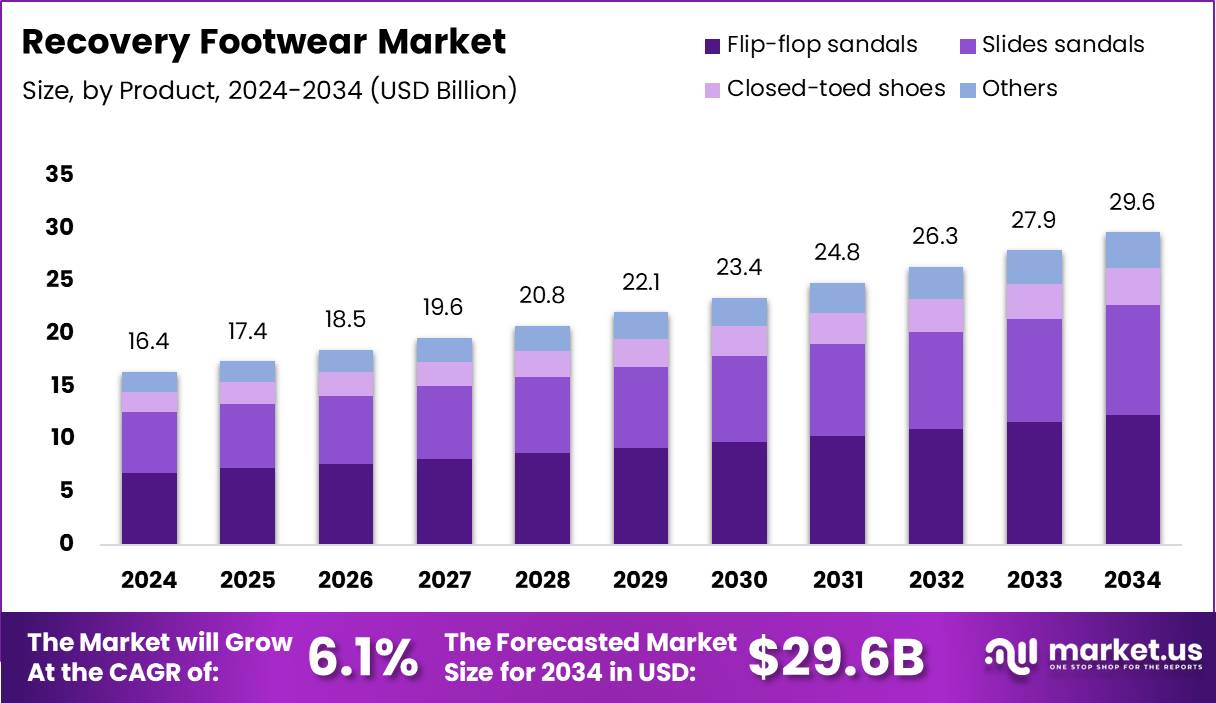

The Global Recovery Footwear Market size is expected to be worth around USD 29.6 Billion by 2034, from USD 16.4 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Recovery Footwear Market is steadily evolving, driven by rising consumer awareness around foot health and post-activity recovery. Recovery footwear is designed to reduce fatigue, support joints, and accelerate healing after physical exertion. Brands like OOFOS and Kane have popularized these products with foam-based designs targeting active and aging populations.

Globally, the market is seeing strong year-over-year growth, thanks to lifestyle shifts and the expansion of wellness culture. Governments are increasingly promoting injury prevention and fitness, indirectly supporting demand. Furthermore, evolving health reimbursement policies may create pathways for regulated recovery footwear to be covered under healthcare schemes.

According to M8Group, footwear using OOfoam technology absorbs 37% more impact than traditional shoes, aiding in muscle recovery and reducing joint strain. This type of innovation appeals to athletes, healthcare workers, and everyday consumers seeking relief from long periods of standing or walking.

Consumers are also growing more compliant with prescribed footwear usage. According to NCBI, mean overall adherence to recovery footwear is 63% (SD: 21%) during weight-bearing activities. This level of usage suggests that consumers are beginning to trust and adopt recovery footwear as part of their health routines.

With these dynamics, opportunity lies in product differentiation. Startups are entering with unique designs and sustainable materials to capture eco-conscious buyers. For instance, The Revive, highlighted by Yogalifelive, features a 31-millimeter cushioned sole that supports small foot muscles and reduces step impact—an innovation enhancing both comfort and performance.

Investment is flowing into R&D. Companies are merging biomechanics with design, offering arch support, shock absorption, and responsive foams. This opens doors for collaboration with physiotherapists, podiatrists, and sports rehab centers to position these products as medically supportive.

Additionally, the increasing focus on wellness post-pandemic has amplified consumer spending on recovery tools, including footwear. Athleisure trends are merging with orthopedic needs, pushing brands to develop footwear that is functional yet stylish for both recovery and casual wear.

Regulations around medical footwear remain moderate but are expected to tighten as the market matures. Compliance standards may be introduced, especially in Europe and North America, ensuring therapeutic claims are supported by clinical data and certifications.

Retailers are also adapting. Digital platforms now educate consumers on recovery benefits, while in-store experiences allow trial-based selling. This dual strategy improves customer confidence and boosts repeat purchases, further fueling market expansion.

In summary, the Recovery Footwear Market is positioned for continued double-digit growth, supported by innovation, consumer adoption, health policy shifts, and increasing product accessibility across global markets.

Key Takeaways

- The Global Recovery Footwear Market is projected to reach USD 29.6 Billion by 2034, up from USD 16.4 Billion in 2024, growing at a CAGR of 6.1% from 2025 to 2034.

- Flip-flop sandals held a dominant position in 2024 under the By Product Type segment due to their breathable design and ease of use for post-activity recovery.

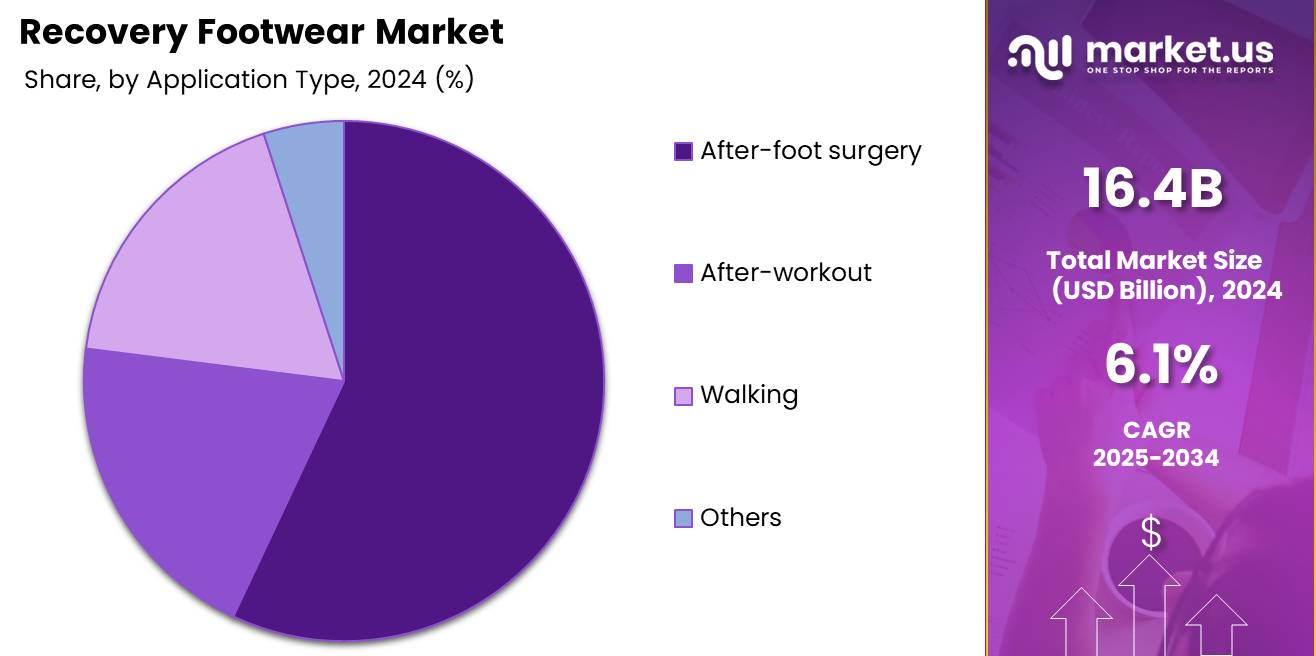

- The After-foot surgery application segment led the market in 2024, driven by medical endorsements and features like arch support and orthopedic materials.

- Men were the leading consumer group in 2024 under By Consumer Orientation, attributed to concerns like post-exercise recovery and work-related foot fatigue.

- Multi-brand stores dominated the By Sales Channel segment in 2024, thanks to their variety of brands and enhanced comparative shopping experiences.

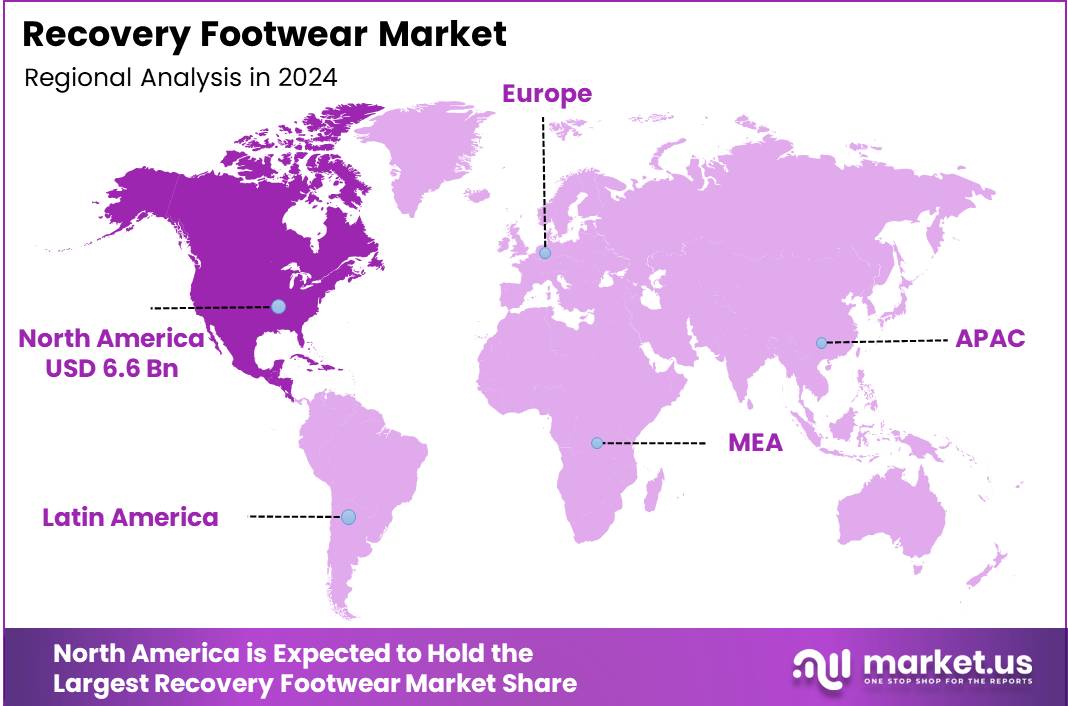

- North America led the global market with a 40.5% share (valued at USD 6.6 Billion in 2024).

Product Type Analysis

Flip-flop sandals lead the way with dominant market presence in 2024.

In 2024, Flip-flop sandals held a dominant market position in the By Product Type Analysis segment of the Recovery Footwear Market. Their popularity is largely attributed to their breathable design and ease of use, making them a preferred choice for post-activity and at-home recovery. They are especially favored for casual wear and provide sufficient foot support while allowing flexibility and air circulation.

Slides sandals followed, offering a comfortable alternative that is especially well-received by athletes and fitness enthusiasts post-workout. Their slip-on design and cushioned soles make them a convenient option, contributing significantly to the segment’s growth.

Closed-toed shoes have found niche adoption among consumers seeking more protective recovery footwear, especially for colder climates or post-surgical needs. Though less prevalent than open styles, they play a critical role in specialized recovery scenarios.

The Others category includes hybrid designs and innovative footwear technologies gaining attention. While still a smaller portion, these emerging products show promise as market preferences evolve with an increasing focus on foot health.

Application Analysis

After-foot surgery tops the charts in 2024 due to specialized recovery needs.

In 2024, After-foot surgery held a dominant market position in the By Application Analysis segment of the Recovery Footwear Market. Medical professionals increasingly recommend recovery footwear post-operatively to aid in healing and reduce pressure, leading to higher adoption rates. Features like arch support, non-slip soles, and orthopedic materials make this category essential.

After-workout recovery shoes came in second, propelled by the growing fitness culture. Athletes and gym-goers often experience foot strain and soreness post-exercise, creating a demand for cushioned and ergonomic footwear designed to promote faster recovery.

Walking as an application is steadily rising, especially among aging populations and wellness-conscious consumers. These shoes focus on comfort, motion control, and lightweight construction to reduce fatigue and support prolonged use.

The Others segment comprises general-purpose recovery shoes used in everyday life. Though smaller in share, they cater to users seeking comfort and support in non-specialized settings, indicating a growing preference for all-day wearability even outside of recovery-specific scenarios.

Consumer Orientation Analysis

Men lead recovery footwear demand in 2024 with strong market presence.

In 2024, Men held a dominant market position in the By Consumer Orientation Analysis segment of the Recovery Footwear Market. This dominance is driven by an increasing focus on post-exercise recovery, orthopedic concerns, and work-related foot fatigue, particularly among middle-aged and active male demographics.

Women represent a growing consumer base, driven by the rise of wellness and fitness culture among females. Footwear tailored to the female anatomy, featuring aesthetic designs and enhanced comfort, is driving uptake, though it currently lags behind the male segment.

Children make up the smallest share, primarily due to limited use cases. However, the market for children’s recovery footwear is gradually developing, especially for conditions like flat feet, foot alignment issues, or post-injury care. Parents are becoming more conscious of early foot health, which could spur future growth.

Overall, while men remain the primary consumers in this segment, tailored innovations and increased awareness across all age and gender groups are expected to balance the consumer orientation landscape in the coming years.

Sales Channel Analysis

Multi-brand stores rule 2024 recovery footwear sales due to wide product variety.

In 2024, Multi-brand stores held a dominant market position in the By Sales Channel Analysis segment of the Recovery Footwear Market. These stores offer a broad range of brands and styles under one roof, providing consumers with comparative shopping experiences and variety, which strongly appeals to both casual and informed buyers.

Convenience stores also contribute to the segment, offering recovery footwear as an impulse or necessity purchase. While less specialized, their accessibility makes them important in rural or transit-heavy areas.

Exclusive stores, often operated by leading brands, attract consumers seeking premium offerings and professional consultation. These stores focus on brand loyalty and customer experience, contributing to consistent though smaller volume sales.

Online retailers are steadily rising due to growing e-commerce penetration and consumer comfort with online shopping. Customers value home delivery, easy returns, and detailed reviews, making this channel a key growth area.

The Others category includes alternative or emerging channels like pop-up stores or health clinics. While currently minimal, these sales channels cater to niche audiences and could gain momentum with increasing health awareness and demand for convenience.

Key Market Segments

By Product Type

- Flip-flop sandals

- Slides sandals

- Closed-toed shoes

- Others

By Application

- After-foot surgery

- After-workout

- Walking

- Others

By Consumer Orientation

- Men

- Women

- Children

By Sales Channel

- Multi-brand stores

- Convenience stores

- Exclusive stores

- Online retailers

- Others

Drivers

Rising Incidence of Sports-Related Injuries Among Amateur Athletes Drives Market Growth

The rising number of sports-related injuries, especially among amateur athletes, is fueling the demand for recovery footwear. As more people take part in recreational sports and fitness activities, injuries such as sprains, strains, and muscle fatigue are becoming more common. Recovery footwear helps ease pain and support healing, making it a go-to option post-activity.

Healthcare professionals such as orthopedic specialists and podiatrists are increasingly recommending recovery footwear for patients recovering from foot and leg injuries. Their endorsements are building trust and boosting consumer confidence in the effectiveness of these products. This professional backing adds medical credibility and drives adoption among a wider audience.

Older adults are also turning to recovery footwear to ease discomfort after daily activities or minor injuries. As mobility and joint issues become more common with age, these individuals are seeking footwear that offers better support, cushioning, and recovery benefits. This growing adoption among the elderly is further pushing market growth, especially in regions with aging populations.

Restraints

High Cost Compared to Regular Footwear Limits Market Penetration

One of the main challenges in the recovery footwear market is the higher price tag compared to regular shoes. These products often use specialized materials and advanced designs, making them more expensive. This can deter price-sensitive customers from trying or regularly using recovery footwear.

Another issue is the lack of awareness in developing countries. Many consumers in these regions are unfamiliar with recovery footwear or its benefits. Without strong marketing efforts or medical endorsements, the product remains largely untapped in these markets.

Additionally, it is often hard for buyers to tell the difference between functional recovery footwear and regular fashion-oriented shoes. With both types looking similar, customers may overlook important recovery features. This confusion can reduce consumer confidence and affect purchase decisions, especially in retail environments without knowledgeable staff.

Growth Factors

Integration of Smart Technology for Performance Monitoring Opens New Market Avenues

The integration of smart technology into recovery footwear presents a promising opportunity for growth. Companies are starting to include sensors and connectivity features that monitor foot pressure, gait, and activity levels. These features provide valuable insights for users and healthcare professionals, adding a functional edge that appeals to tech-savvy consumers.

There’s also a growing market for recovery footwear designed for post-surgical rehabilitation. Patients recovering from surgeries, such as knee or foot operations, require specialized footwear to aid in healing and reduce strain. This opens new business opportunities for manufacturers to collaborate with hospitals and clinics to meet this demand.

Customization using 3D foot scanning and printing is another exciting area. Consumers can now get footwear tailored exactly to their foot shape, improving comfort and effectiveness. Personalized recovery footwear offers a premium experience and is expected to gain popularity, especially in developed markets.

Emerging Trends

Eco-Friendly and Sustainable Material Adoption Shapes Market Trends

The shift towards eco-friendly and sustainable materials is a key trend in the recovery footwear market. Consumers are increasingly choosing brands that use recycled or biodegradable materials. This not only reduces environmental impact but also aligns with the values of eco-conscious buyers, especially among younger demographics.

Innovations in minimalist and ergonomic design are also trending. Recovery footwear is becoming more stylish and comfortable, with designs that focus on natural foot movement and lightweight support. These improvements make the shoes more wearable for longer periods and for different activities.

The rise of direct-to-consumer (DTC) digital sales channels is another trend shaping the market. Brands are focusing on online platforms to sell recovery footwear directly to consumers. This allows for better customer engagement, faster feedback, and increased brand loyalty, all while reducing costs associated with traditional retail.

Regional Analysis

North America Dominates the Recovery Footwear Market with a Market Share of 40.5%, Valued at USD 6.6 Billion

North America leads the global recovery footwear market, holding a commanding 40.5% market share, valued at USD 6.6 Billion. The region’s dominance is fueled by growing awareness about post-workout recovery and increasing participation in fitness and wellness activities. High consumer spending, coupled with technological innovations in footwear design, continues to drive product demand. Moreover, the prevalence of athleisure trends further supports market growth across the U.S. and Canada.

Europe Recovery Footwear Market Insights

Europe represents a mature yet steadily growing segment of the recovery footwear market. Rising health consciousness, particularly in Western Europe, is contributing to greater product adoption. Increased interest in physiotherapy and orthotic footwear solutions among aging populations also plays a key role. Additionally, the growing trend of sustainable and eco-friendly footwear is shaping product innovation across the region.

Asia Pacific Recovery Footwear Market Trends

The Asia Pacific region is witnessing rapid growth in the recovery footwear market due to expanding urbanization and a rising middle-class population. Countries like China, India, and Japan are seeing increased consumer inclination towards health and wellness. Furthermore, the surge in e-commerce penetration and digital marketing initiatives is aiding product visibility and sales.

Middle East and Africa Recovery Footwear Market Overview

The Middle East and Africa are emerging markets for recovery footwear, with rising health awareness and growing sports participation. In Gulf countries, high disposable income and increasing adoption of premium lifestyle products are contributing to market expansion. Additionally, government initiatives promoting physical fitness are influencing consumer behavior positively.

Latin America Recovery Footwear Market Outlook

Latin America is gradually adopting recovery footwear as fitness and sports activities gain momentum across urban centers. Markets such as Brazil and Mexico are key contributors to regional growth, driven by increasing exposure to international health trends. While still developing, the market benefits from improving retail infrastructure and a growing youth demographic focused on wellness.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Recovery Footwear Company Insights

In the 2024 global Recovery Footwear Market, several key players have continued to shape the competitive landscape with product innovation, brand strength, and expanding market strategies.

OOFOS remains a dominant force, known for its proprietary OOfoam technology and emphasis on post-workout foot health. The brand’s medical endorsements and expanding customer base have cemented its role in both the athletic and wellness recovery segments.

Qiandan, a growing player from Asia, has made notable strides through affordable offerings and a strong domestic distribution network. Its focus on functional design and comfort appeals to younger demographics looking for cost-effective recovery footwear.

Superfeet leverages its orthotic expertise to offer recovery shoes that prioritize arch support and biomechanical alignment. Its niche appeal lies in its commitment to performance and injury prevention, gaining traction among serious athletes and healthcare professionals alike.

Under Armour has broadened its performance footwear line by integrating recovery-specific features into its designs. The company’s reputation in sportswear and strong global distribution channels help it maintain a competitive edge despite stiff competition.

Together, these companies illustrate the diversity of approaches in the recovery footwear market—ranging from specialized medical benefits to mainstream athletic integration—highlighting a trend toward multifunctionality, wellness, and innovation in 2024.

Top Key Players in the Market

- OOFOS

- Qiandan

- Superfeet

- Under Armour

- Adidas

- Mizuno

- Nike

- PR Soles

- LiNing

- Montrail

- ANTA

Recent Developments

- In Feb 2025, P3R announced a strategic partnership with OOFOS, the global leader in Active Recovery footwear. This collaboration aims to enhance athlete recovery experiences at major endurance events hosted by P3R.

- In Apr 2025, Nike partnered with Hyperice, a pioneer in recovery and compression technology, to co-develop advanced wearable solutions. These innovations are designed to speed up post-workout recovery for athletes and fitness enthusiasts.

- In May 2025, a former Apple and Samsung marketing executive was appointed to lead KANE Footwear‘s growth in the active recovery footwear market. This leadership move marks a bold step in KANE’s mission to scale its brand globally.

Report Scope

Report Features Description Market Value (2024) USD 16.4 Billion Forecast Revenue (2034) USD 29.6 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flip-flop sandals, Slides sandals, Closed-toed shoes, Others), By Application (After-foot surgery, After-workout, Walking, Others), By Consumer Orientation (Men, Women, Children), By Sales Channel (Multi-brand stores, Convenience stores, Exclusive stores, Online retailers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape OOFOS, Qiandan, Superfeet, Under Armour, Adidas, Mizuno, Nike, PR Soles, LiNing, Montrail, ANTA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- OOFOS

- Qiandan

- Superfeet

- Under Armour

- Adidas

- Mizuno

- Nike

- PR Soles

- LiNing

- Montrail

- ANTA