Global Recovery Drinks Market Size, Share Analysis Report By Product Type (Carbohydrate-based, Protein-based, Sport Drinks, Electrolyte Based Drinks, and Others), By Form (Ready-to-drink (RTD), Powder, and Concentrate), By Distribution Channel (Offline and Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172271

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

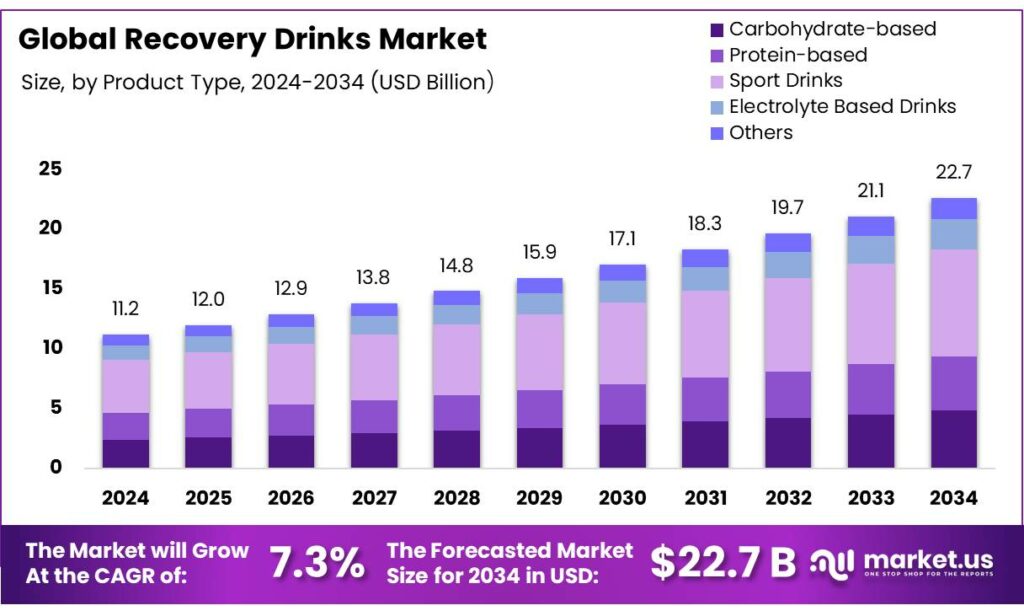

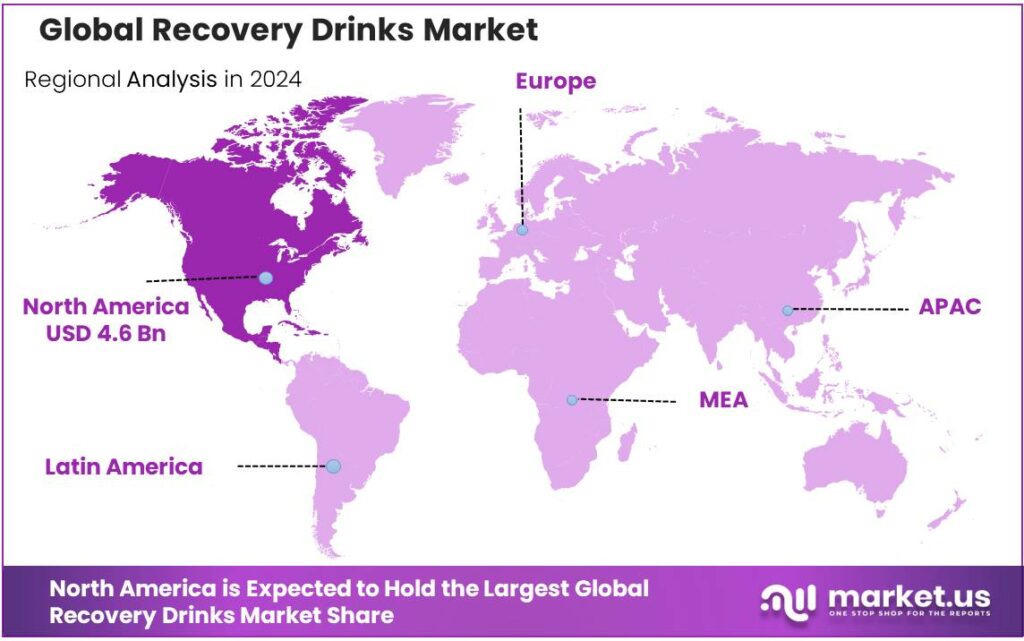

The Global Recovery Drinks Market size is expected to be worth around USD 22.7 Billion by 2034, from USD 11.2 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 41.2% share, holding USD 4.6 Billion in revenue.

Recovery drinks are beverages consumed after exercise, designed to replenish energy through carbs, repair muscles through protein, and rehydrate through electrolytes quickly, helping the body recover, reduce fatigue, or prepare for the next workout, often containing mixes of protein, simple sugars, and minerals such as sodium.

Its market is driven by the growing emphasis on fitness and wellness, with an increasing number of individuals participating in sports and regular exercise. These drinks cater to athletes and fitness enthusiasts looking to optimize recovery.

- In 2023, 242 million individuals in the United States, or 78.8% of Americans, participated in an activity one or more times, a 2.2% increase from 2022.

In particular, sports drinks are favored for their balanced nutrient profile and convenience, often being preferred over protein, carbohydrate, or electrolyte-based alternatives. Ready-to-drink (RTD) recovery beverages have gained significant traction due to their ease of use, as they require no preparation, making them ideal for on-the-go lifestyles.

While offline stores such as supermarkets and specialty shops dominate sales due to the demand for immediate availability and the ability to compare products in person, the market faces challenges related to palatability, accessibility, and rising production costs. Innovation in flavor, ingredient quality, and formulation continues to drive the market forward, addressing consumer preferences for healthier and more convenient options.

Key Takeaways

- The global recovery drinks market was valued at USD 11.2 billion in 2024.

- The global recovery drinks market is projected to grow at a CAGR of 7.3% and is estimated to reach USD 22.7 billion by 2034.

- On the basis of product type of recovery drinks, sports drinks dominated the market, constituting 39.8% of the total market share.

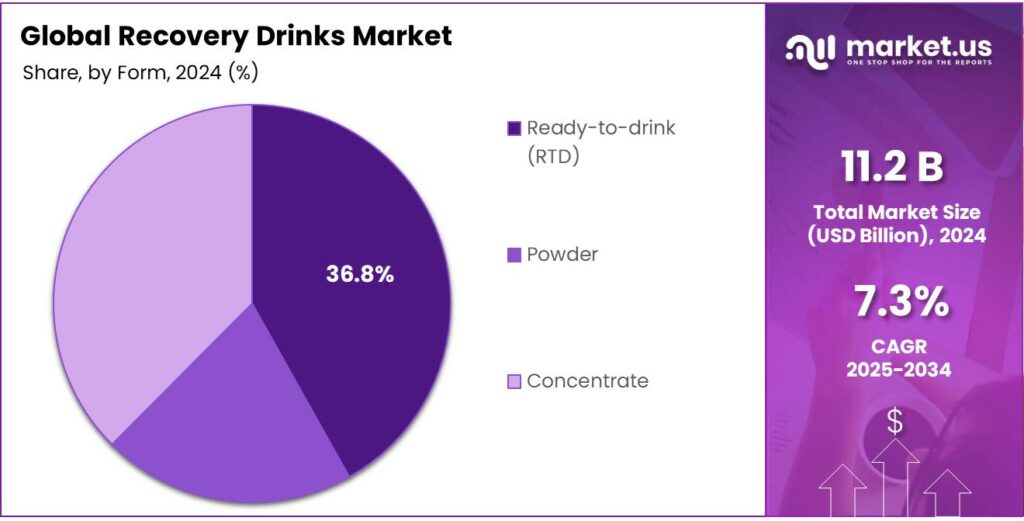

- Based on the form of recovery drinks, ready-to-drink (RTD) dominated the market, with a market share of around 36.8%.

- Among the distribution channels, offline stores held a major share in the recovery drinks market, 72.6% of the market share.

- In 2024, North America was the most dominant region in the recovery drinks market, accounting for 41.2% of the total global consumption.

Product Type Analysis

Sport Drinks Are a Prominent Segment in the Recovery Drinks Market.

The recovery drinks market is segmented based on product type into carbohydrate-based, protein-based, sport drinks, electrolyte-based drinks, and others. The sports drinks led the recovery drinks market, comprising 39.8% of the market share, as they are specifically formulated to address the needs of the body after intense physical activity. They offer a balanced combination of carbohydrates, electrolytes, and fluids that help replenish the energy lost during exercise.

Carbohydrates in sports drinks provide quick energy replenishment, while electrolytes such as sodium and potassium help restore the body’s fluid balance and prevent dehydration. Unlike protein-based drinks, which primarily focus on muscle recovery, sports drinks support overall hydration and energy replenishment, making them more versatile for a broad range of fitness levels. The sports drinks are widely favored over other types of recovery beverages due to this comprehensive, all-in-one approach.

Form Analysis

Ready-to-drink (RTD) Dominated the Recovery Drinks Market.

On the basis of the form of the recovery drinks, the market is segmented into ready-to-drink (RTD), powder, and concentrate. The ready-to-drink (RTD) dominated the recovery drinks market, comprising 36.8% of the market share, primarily due to their convenience and ease of use. RTDs require no preparation, making them ideal for individuals with busy lifestyles or those who need a quick post-workout solution. The ability to grab a bottle and drink it on the go, saving time and effort, makes it a preferred choice over other options.

In contrast, powder and concentrate drinks require mixing, which can be inconvenient, especially in environments such as gyms or during travel. Additionally, RTD drinks tend to have more consistent quality and taste, eliminating the variability that can sometimes occur during mixing. Moreover, the immediate availability of RTDs post-workout helps ensure optimal recovery, whereas powders may not be consumed as quickly, reducing their effectiveness in rehydrating or replenishing nutrients promptly after exercise.

Distribution Channel Analysis

The Offline Stores Sector Held a Major Share of the Recovery Drinks Market.

Based on the distribution channel, the market is divided into offline and online channels. Among the distribution channels, 72.6% of the total global consumption of recovery drinks is sold through offline stores. Recovery drinks are primarily sold through offline stores such as supermarkets, drug stores, and specialty stores, as these physical locations offer immediate access and allow consumers to make quick, in-person decisions. Many customers prefer to see and taste the product before purchasing, particularly as recovery drinks often involve specific flavors, ingredients, and formulations.

Additionally, the in-store experience allows customers to compare various products directly and seek advice from store staff, which enhances confidence in their purchase. Furthermore, physical stores provide the convenience of immediate availability, especially for those who need the product urgently after a workout. While online channels are growing in popularity, the tangible nature of recovery drinks and the desire for quick access to these products make offline stores a dominant distribution channel.

Key Market Segments

By Product Type

- Carbohydrate-based

- Protein-based

- Sport Drinks

- Electrolyte-Based Drinks

- Others

By Form

- Ready-to-drink (RTD)

- Powder

- Concentrate

By Distribution Channel

- Offline

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- Specialty Sports Stores

- Others

- Online

- E-commerce Platforms

- Brand-Owned Websites

Drivers

Increased Participation in Sports and Fitness Drives the Recovery Drinks Market.

The growing emphasis on health and wellness, coupled with a rise in participation across various sports and fitness activities, has significantly contributed to the expansion of the recovery drinks market. For instance, in Japan, 69.8% of people participated in sports and physical activities at least once in 2024. The percentage of those who participated in sports and physical activities at least once a week has risen since 1992, from 23.7% to 54.8% in 2024.

Similarly, in 2024, approximately 30 million adults in England played sport or took part in physical activity every week. As more individuals engage in regular physical exercise, recreational activities, and professional sports, the demand for effective post-workout recovery solutions has increased. Recovery drinks are becoming an essential part of the routines of many athletes and fitness enthusiasts, as proper replenishment of fluids and nutrients after intense physical activity can reduce muscle soreness and improve recovery times.

Additionally, the popularity of endurance sports, such as running and cycling, which require extensive recovery efforts, has notably driven demand for these drinks. Similarly, social media platforms have amplified awareness of fitness recovery, further encouraging their use among both amateur and professional athletes.

Restraints

Palatability and Accessibility Might Pose Challenges to the Recovery Drinks Market.

While the recovery drinks market continues to expand, palatability and accessibility remain key challenges for widespread adoption. Many consumers, particularly those new to fitness, may find the taste of certain recovery drinks unappealing, which can deter consistent use. Several studies conducted revealed, preference for taste as a reason for the consumption of energy drinks. For instance, a Polish study reported that 53-100% of respondents consumed energy drinks primarily for their flavour.

Furthermore, accessibility can be a barrier, particularly in regions with limited retail distribution or where consumers lack access to specialized health stores. For instance, in rural areas or smaller markets, athletes might not have easy access to high-quality recovery drinks or may resort to alternatives, which may not offer the same nutritional balance. Additionally, commercial recovery drinks can be expensive compared to whole-food alternatives such as chocolate milk, which is a cost-effective and readily available option for many consumers.

Opportunity

Product Innovation Creates Opportunities in the Recovery Drinks Market.

Product innovation in the recovery drinks market, particularly the development of low-sugar or no-sugar options, presents significant opportunities for brands to cater to evolving consumer preferences. As health-consciousness grows, more consumers are seeking beverages that align with their fitness goals while supporting broader dietary needs.

For instance, a substantial portion of fitness enthusiasts now prioritize products with minimal sugar content to avoid the post-consumption energy crashes associated with high-sugar drinks. The introduction of plant-based recovery drinks and the products enriched with functional ingredients such as branched-chain amino acids (BCAAs), antioxidants, and electrolytes has further expanded the market’s appeal.

For instance, in November 2025, Aquatein announced the launch of its Vegan Protein Water range in India. Moreover, the shift towards clean-label products has gained momentum, with consumers increasingly scrutinizing ingredients for artificial additives. These innovations meet demand for healthier, more sustainable fitness nutrition, consequently expanding market potential.

Trends

Shift Towards Ready-to-Drink (RTD) Options.

The shift towards ready-to-drink (RTD) options is a prominent trend in the recovery drinks market, driven by the growing demand for convenience and portability. As busy lifestyles become more common, consumers are increasingly seeking quick, on-the-go solutions that require minimal preparation. RTD recovery drinks, which are pre-mixed and ready for immediate consumption, cater to this demand by offering an easy way to refuel after a workout without the hassle of blending powders or mixing ingredients.

Several fitness enthusiasts, particularly those who commute or travel frequently, prefer RTD options for their convenience. Furthermore, RTD products are often designed to offer balanced nutrition, containing proteins, electrolytes, and carbohydrates, all in a single, portable bottle. This trend is especially popular among athletes and gym-goers who need a fast and efficient way to recover post-exercise. The RTD segment has seen growing availability in supermarkets, health stores, and vending machines, reflecting its increased consumer demand.

Geopolitical Impact Analysis

Increased Prices of Recovery Drinks Amid Geopolitical Tensions.

The geopolitical tensions have had a noticeable impact on the recovery drinks market, particularly in terms of supply chain disruptions, ingredient sourcing, and pricing. Ongoing geopolitical conflicts, trade restrictions, and rising energy costs have created challenges in the availability of raw materials required for production, such as whey protein, plant-based ingredients, and packaging materials.

For instance, the global disruption in supply chains of packaging materials due to tariffs on Chinese imports and conflict in the South China Sea, as China is the leading exporter of packaging materials, has led to increased prices of these materials. Similarly, the conflicts in Europe have led to delays in manufacturing and an increase in production costs, which can be reflected in higher retail prices. Furthermore, uncertainty around economic conditions has led some consumers to reduce discretionary spending, impacting the demand for premium recovery drinks.

However, despite these challenges, the market has seen a rise in demand for locally sourced products, as geopolitical tensions have made consumers more cautious about global supply chains. Moreover, companies are compelled to diversify their sourcing strategies and explore more sustainable production methods, which may help mitigate some of the risks in the long term.

Regional Analysis

North America Held the Largest Share of the Global Recovery Drinks Market.

In 2024, North America dominated the global recovery drinks market, holding about 41.2% of the total global consumption. The region has maintained the largest share of the global recovery drinks market, largely due to the region’s strong emphasis on fitness, wellness, and active lifestyles. The popularity of sports and fitness activities, including gym memberships, running, and professional sports, has fueled demand for recovery drinks.

In 2024, 23.6% of men in the United States alone participated in sports, exercise, and recreational activities daily. Similarly, in the country, 77 million Americans, 25% of individuals aged six and older, were members of a gym, studio, or other fitness facility in 2024, according to a report the Health & Fitness Association (HFA). Similarly, according to a physical activity and sport survey in 2024, 27% of Canadian adult’s report participating in sport. When including both members and non-member users, total fitness facility customers reached nearly 96 million, representing approximately one in three Americans, 31.0%.

Additionally, the prevalence of health-conscious consumers, who prioritize functional nutrition and supplement their workouts with recovery drinks, further drives this trend. Major brands in the region have capitalized on this demand, offering a wide range of products, including protein shakes, electrolyte drinks, and low-sugar options, aimed at enhancing recovery. The widespread availability of these products in supermarkets, fitness centers, and online stores boosts their accessibility.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the recovery drinks market focus on several strategic activities to boost sales and increase productivity. The companies invest heavily in product innovation, developing new formulations with health-conscious ingredients, such as low-sugar, plant-based, or fortified options to cater to shifting consumer preferences. In addition, the players are focusing on expanding distribution channels, particularly through partnerships with gyms, fitness centers, and online platforms, to increase product availability and convenience. Similarly, some major players emphasize expanding market reach through entering emerging markets.

The Major Players in The Industry

- PepsiCo, Inc.

- The Coca-Cola Company

- Nestlé S.A.

- Abbott Laboratories

- Glanbia plc

- Danone S.A.

- Nutrabolt (Cellucor / XTEND)

- MusclePharm Corporation

- BioSteel Sports Nutrition Inc.

- Herbalife International of America

- Kill Cliff

- Dymatize

- Amway

- Other Key Players

Key Development

- In February 2024, Gatorade, a PepsiCo brand, announced the launch of its unflavored water, which is alkaline with a pH of 7.5 or higher, electrolyte-infused for a refreshing, crisp taste, and the bottles are made from 100% recycled plastic.

- In April 2025, Nestlé launched a line of protein-based drinks aimed at supporting people on weight loss, particularly those using GLP-1 medications such as Ozempic.

Report Scope

Report Features Description Market Value (2024) USD 11.2 Bn Forecast Revenue (2034) USD 22.7 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Carbohydrate-based, Protein-based, Sport Drinks, Electrolyte-Based Drinks, and Others), By Form (Ready-to-drink (RTD), Powder, and Concentrate), By Distribution Channel (Offline and Online) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape PepsiCo, Inc., The Coca-Cola Company, Nestlé S.A., Abbott Laboratories, Glanbia plc, Danone S.A., Nutrabolt (Cellucor / XTEND), MusclePharm Corporation, BioSteel Sports Nutrition Inc., Herbalife International of America, Kill Cliff, Dymatize, Amway, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- PepsiCo, Inc.

- The Coca-Cola Company

- Nestlé S.A.

- Abbott Laboratories

- Glanbia plc

- Danone S.A.

- Nutrabolt (Cellucor / XTEND)

- MusclePharm Corporation

- BioSteel Sports Nutrition Inc.

- Herbalife International of America

- Kill Cliff

- Dymatize

- Amway

- Other Key Players