Global Records Management In BFSI Market By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Customer Account & Onboarding Records, Loan & Mortgage Documentation, Others), By Record Type (Electronic Records, Physical Records), By End-User (Banks, Insurance Companies, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176627

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraints Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By Record Type

- By End User

- Emerging Trends

- Growth Factors

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Challenges

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

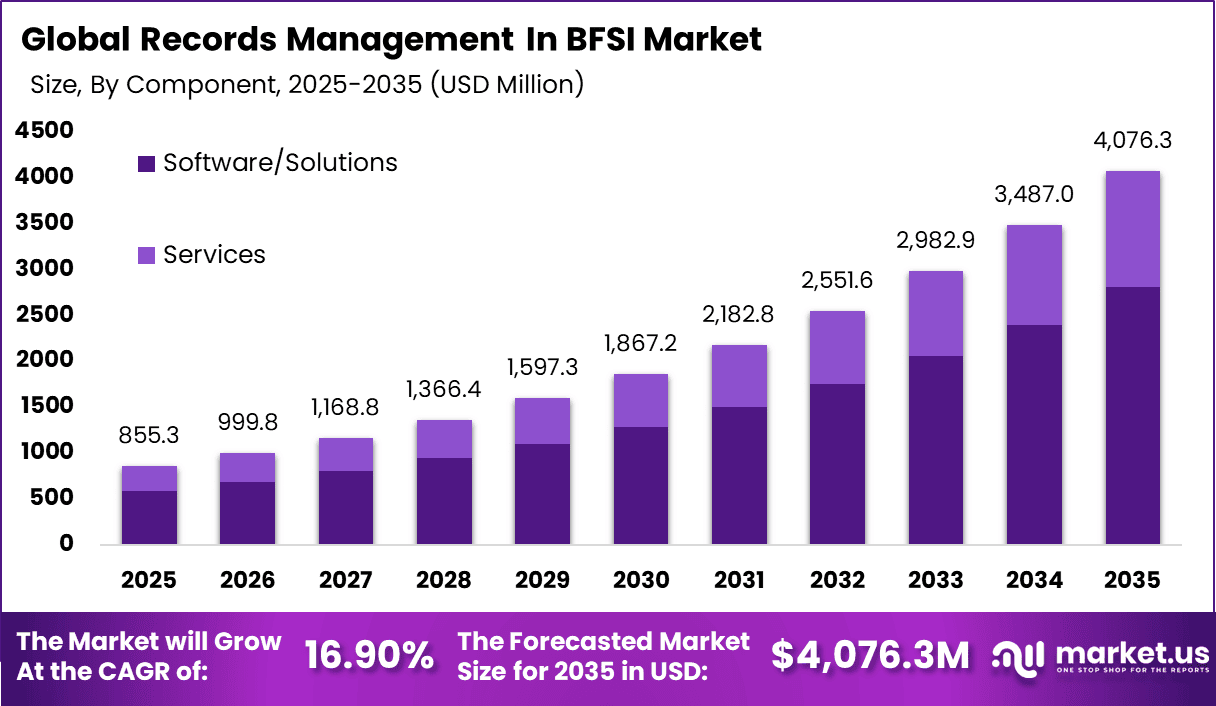

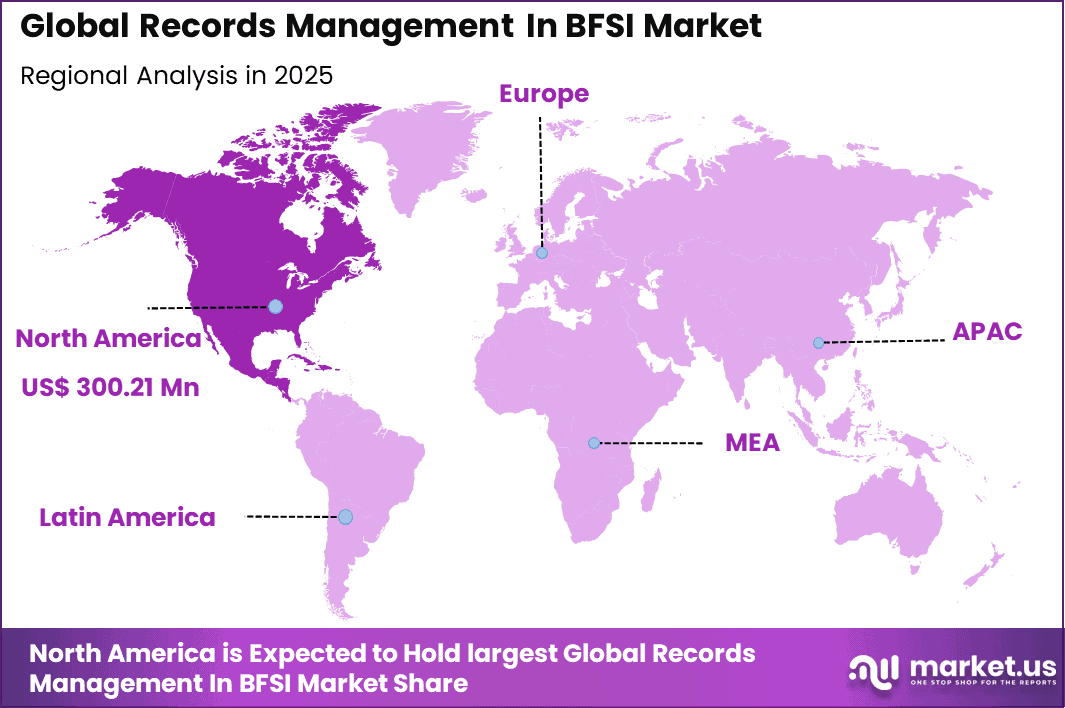

The Global Records Management In BFSI Market generated USD 855.3 million in 2025 and is predicted to register growth from USD 999.8 million in 2026 to about USD 4,076.3 million by 2035, recording a CAGR of 16.90% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 35.1% share, holding USD 300.21 Million revenue.

The Records Management in BFSI Market refers to systems, services, and processes used by banks, financial institutions, and insurance providers to manage physical and digital records throughout their lifecycle. These records include customer data, transaction logs, loan documents, policy files, compliance reports, and audit trails. Effective records management ensures that information is stored securely, retrieved efficiently, and disposed of in line with legal requirements.

The market covers document management platforms, digital archiving solutions, retention scheduling tools, and secure storage services. With BFSI institutions handling millions of records daily, manual processes are no longer sufficient. Industry observations show that over 75% of BFSI operational data is now generated in digital form, increasing the need for structured and automated record handling frameworks.

A primary driver of the records management in BFSI market is the stringent regulatory environment governing financial data retention and reporting. Banks and insurers are required to store records for defined periods and produce them accurately during audits, investigations, or disputes. Failure to comply can result in penalties and reputational damage. Records management systems help standardize retention policies and ensure timely access to required information.

A significant opportunity in the records management in BFSI market lies in automation and intelligent classification. Technologies that automatically categorize, index, and apply retention rules to records reduce manual effort and improve accuracy. Intelligent search and retrieval capabilities also enhance audit response times. These efficiencies make advanced records management systems more attractive to large institutions.

Top Market Takeaways

- By component, software/solutions account for 68.9% of the market, delivering automated archiving, retrieval, and retention tools tailored to financial data governance.

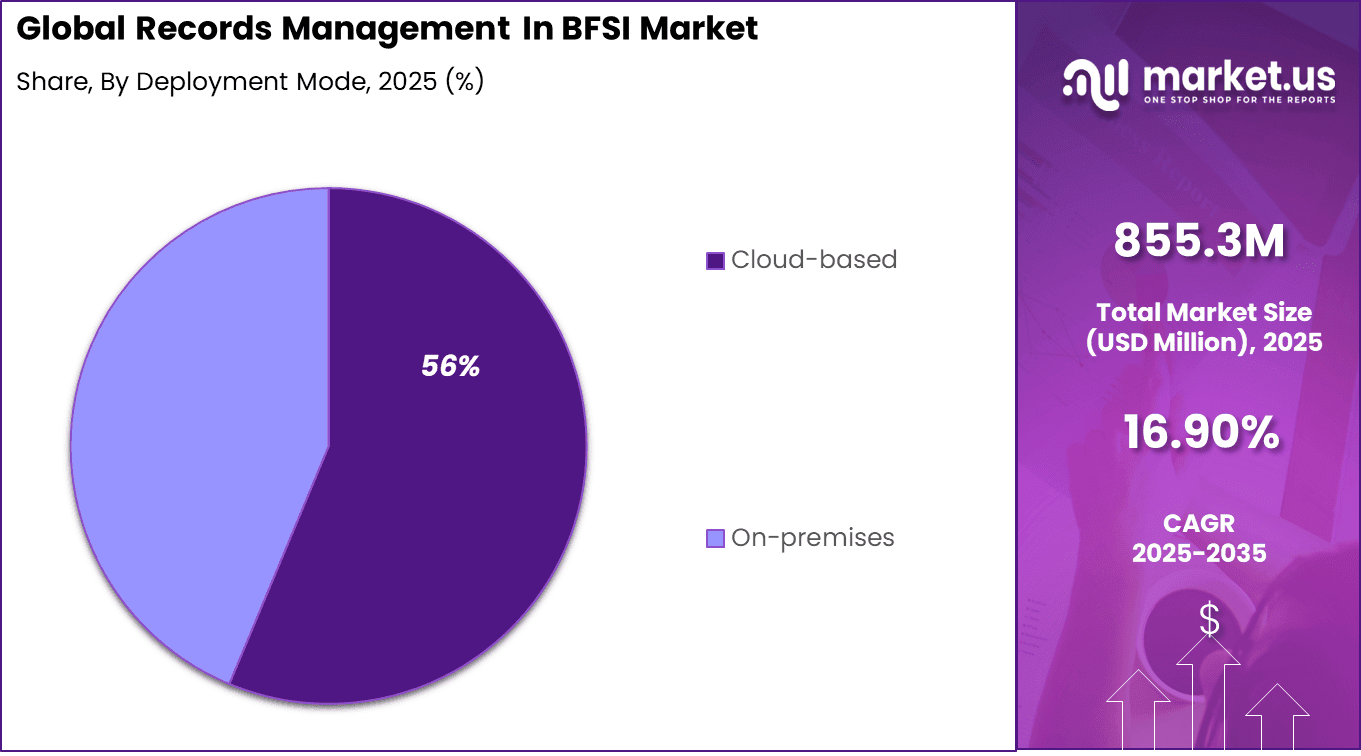

- By deployment mode, cloud-based systems represent 56.3%, offering scalability, remote access, and cost efficiency for distributed BFSI operations.

- By organization size, large enterprises hold 76.4% share, requiring robust systems for vast transaction volumes and multi-jurisdictional compliance.

- By application, compliance & regulatory records capture 43.7%, supporting mandates like GDPR, SOX, and local banking laws through audit-ready storage.

- By record type, electronic records dominate with 72.8%, reflecting the shift to digital transactions, e-statements, and blockchain-integrated ledgers.

- By end-user, banks command 52.1%, driven by needs for customer data protection, KYC/AML documentation, and historical audit trails.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising regulatory and compliance requirements for financial records +4.2% North America, Europe Short to medium term Rapid digitization of banking and financial services +3.6% Global Medium term Growing data volumes from digital transactions and customer interactions +3.1% Global Medium term Increased focus on audit readiness and risk mitigation +2.8% North America, Europe Medium term Adoption of cloud-based document and records management platforms +2.3% North America, Asia Pacific Medium to long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High migration costs from legacy record systems -3.1% Global Short to medium term Complexity of integrating records management with core banking systems -2.6% Global Medium term Data privacy and cross-border data residency concerns -2.2% Europe, North America Medium term Limited digitization readiness among small financial institutions -1.9% Asia Pacific, Latin America Medium term Long procurement cycles in regulated BFSI environments -1.5% North America, Europe Medium to long term By Component

Software and solutions account for 68.9% of total adoption in the Records Management in BFSI Market. This dominance reflects the growing reliance on digital platforms to manage large volumes of financial and customer related records. BFSI institutions require centralized systems that ensure secure storage and controlled access.

The shift toward software driven solutions is closely linked to operational efficiency needs. Manual record handling increases the risk of errors, data loss, and compliance gaps. Automated systems improve accuracy while reducing administrative burden.

Software solutions also support advanced features such as audit trails, retention scheduling, and access monitoring. These capabilities are critical for meeting regulatory expectations. As compliance requirements increase, software based components continue to dominate market adoption.

By Deployment Mode

Cloud based deployment represents 56.3% of overall adoption within the market. Cloud platforms provide scalable storage and enable institutions to manage records across distributed branches and digital channels. Centralized governance remains possible even with remote access.

The adoption of cloud deployment is also driven by flexibility and cost efficiency. Financial institutions avoid heavy infrastructure investment while maintaining secure environments. Cloud models support faster system upgrades and configuration changes.

Security enhancements and compliance certifications have improved trust in cloud deployment. Encryption, access controls, and monitoring tools reduce risk exposure. These developments reinforce cloud based deployment as the preferred option.

By Organization Size

Large enterprises account for 76.4% of total market demand by organization size. Large BFSI organizations manage extensive customer bases, high transaction volumes, and complex reporting obligations. Effective records management is essential to maintain operational continuity.

The scale of operations increases the importance of standardized record handling processes. Centralized systems help large institutions ensure consistency across departments and regions. This reduces compliance risk and operational inefficiencies.

Large enterprises also face frequent regulatory audits and inspections. Automated record systems improve audit readiness and response speed. These factors sustain strong adoption among large BFSI organizations.

By Application

Compliance and regulatory records represent 43.7% of application based demand. BFSI institutions must retain records related to transactions, customer identity, reporting, and regulatory filings. Failure to maintain accurate records can lead to penalties and reputational damage.

The importance of this application area has increased with stricter regulatory oversight. Regulators require timely access to historical and transactional data. Automated record retrieval supports faster regulatory response.

Compliance focused record management also improves internal governance. Institutions gain better visibility into record status and retention timelines. This strengthens risk management and reinforces demand for compliance applications.

By Record Type

Electronic records account for 72.8% of total record type usage in the market. Digital records allow faster retrieval, improved organization, and reduced reliance on physical storage. BFSI institutions continue to digitize legacy paper documents. The transition toward electronic records is driven by digital banking expansion. Online transactions and customer interactions generate primarily digital data.

Managing this data requires structured electronic record systems. Electronic records also support automation and analytics. Searchability and metadata improve operational efficiency. These advantages maintain the dominance of electronic records within the market.

By End User

Banks represent 52.1% of total end user adoption in the Records Management in BFSI Market. Banks handle extensive customer documentation, transaction histories, and compliance records. Secure record management is essential to daily banking operations.

The reliance on records management systems is driven by risk exposure and regulatory scrutiny. Banks must demonstrate data integrity and access control at all times. Centralized systems support these requirements effectively.

Banks also use records management to improve customer service and operational transparency. Faster access to historical records improves decision making. These factors sustain strong demand from banking institutions.

Emerging Trends

The Records Management in BFSI market is increasingly shaped by a shift toward fully digital and compliance-centric record systems. Financial institutions are moving away from manual and fragmented storage toward centralized digital repositories that support faster retrieval, automated retention controls, and secure access.

This trend is closely linked to the growing use of electronic customer onboarding, digital transactions, and paperless workflows across banking and financial services. As a result, records management is being treated as a core risk and governance function rather than a back-office activity.

Growth Factors

A key growth factor is the rising regulatory pressure on BFSI institutions to maintain accurate, auditable, and tamper-proof records across the entire customer lifecycle. Regulators increasingly expect clear documentation trails, long-term data retention, and timely record availability during audits, which strengthens demand for structured records management practices.

Another important driver is the rapid increase in digital data volumes, driven by online banking, mobile payments, and digital lending. Managing this growing data load efficiently and securely is encouraging BFSI organizations to invest more consistently in advanced records management frameworks.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Enterprise content and records management vendors Very High Medium North America, Europe Strong recurring SaaS revenue BFSI-focused IT solution providers High Medium Global Cross-sell and long-term contracts Banks and financial institutions Medium Low to Medium Global Strategic compliance investment Private equity firms Medium Medium North America, Europe Consolidation of mature platforms Venture capital investors Medium High North America Selective interest in AI-driven records tech Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Cloud-based records management and archiving platforms +4.0% Scalable and secure storage Global Short to medium term AI-powered document classification and indexing +3.4% Faster retrieval and compliance North America, Europe Medium term Automation of retention schedules and disposal policies +2.9% Regulatory adherence Global Medium term Integration with core banking and compliance systems +2.4% Unified data governance Global Medium to long term Advanced encryption and access control technologies +2.0% Data security and privacy Europe, North America Long term Key Challenges

- High compliance burden related to data retention, privacy, and regulatory audits

- Complexity in managing both physical and digital records within the same framework

- Data security risks linked to unauthorized access and legacy storage systems

- Integration challenges with existing core banking and document management platforms

- Limited awareness of long term cost benefits among smaller financial institutions

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Customer Account & Onboarding Records

- Loan & Mortgage Documentation

- Transaction & Audit Trail Archives

- Compliance & Regulatory Records

- Employee & Contract Documentation

- Others

By Record Type

- Electronic Records

- Physical Records

- Hybrid Records Management

By End-User

- Banks

- Insurance Companies

- Investment Firms & Brokerages

- Others

Regional Analysis

North America holds a 35.1% share of the records management market in BFSI due to strict regulatory requirements around data retention, audit readiness, and customer information protection. Banks and financial institutions in the region manage large volumes of physical and digital records linked to transactions, compliance reporting, and risk management.

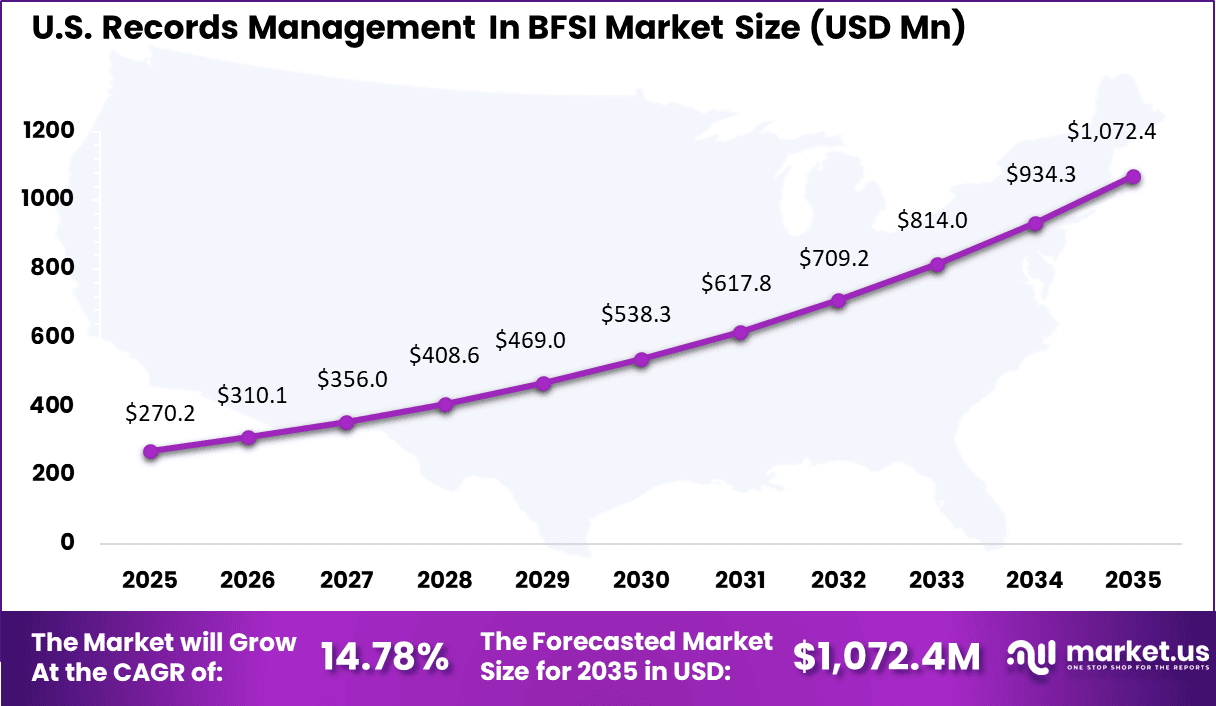

The United States market is valued at USD 270.2 Mn and is expanding at a CAGR of 14.78%, driven by rapid digitalization of banking operations and rising compliance pressure. Demand is shaped by increasing volumes of digital records, legacy data migration, and tighter enforcement of data privacy and retention rules. Growth is further supported by the shift toward centralized records systems that improve operational efficiency, reduce compliance risk, and support faster audit and reporting cycles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Large enterprise technology providers such as IBM Corporation, Microsoft Corporation, and Oracle Corporation lead records management adoption across BFSI institutions. Their platforms support secure document storage, retention scheduling, and regulatory compliance. Integration with core banking and analytics systems improves operational control. Adobe, Inc. strengthens document governance through secure digital records.

Dedicated enterprise content and records management specialists such as OpenText Corporation, Hyland Software, Inc., and M-Files Corporation focus on compliance-driven workflows and lifecycle automation. Laserfiche and Alfresco Software, Inc. support digital transformation initiatives in banks and insurers. These solutions help BFSI organizations meet audit, retention, and data privacy requirements.

Physical and hybrid records management providers such as Iron Mountain, Incorporated and GRM Information Management address secure storage and destruction needs. Zasio Enterprises, Inc., Fabasoft AG, and FileTrail, Inc. support governance and compliance programs. Other vendors expand regional coverage and niche solutions.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Hyland Software, Inc.

- M-Files Corporation

- Adobe, Inc.

- Oracle Corporation

- Laserfiche

- GRM Information Management

- Iron Mountain, Incorporated

- Zasio Enterprises, Inc.

- Dokmee, Inc.

- Fabasoft AG

- Alfresco Software, Inc.

- FileTrail, Inc.

- Others

Future Outlook

The future outlook for the Records Management in BFSI Market suggests steady growth as banks, financial institutions, and insurance companies place greater emphasis on secure and efficient handling of data. Demand for digital records management solutions is expected to rise with increasing regulatory compliance requirements, data privacy standards, and the shift from paper-based to electronic systems.

Adoption of technologies such as cloud storage, automation, and analytics will support improved accuracy and faster retrieval of information. Overall, growth can be attributed to stronger focus on risk control, operational efficiency, and compliance in the financial services sector.

Recent Developments

- December 2025, OpenText Corporation expanded Google Cloud tie-up for AI agents in financial services, launching Aviator Studio for no-code AI and Knowledge Discovery for metadata tagging to boost BFSI record security and search.

- December 2025, Iron Mountain pushed Insight DXP SaaS for secure records amid 175 zettabytes global data projection, focusing on BFSI digital-physical hybrid storage.

Report Scope

Report Features Description Market Value (2025) USD 855.3 Million Forecast Revenue (2035) USD 4,076.3 Million CAGR(2025-2035) 16.90% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Customer Account & Onboarding Records, Loan & Mortgage Documentation, Others), By Record Type (Electronic Records, Physical Records) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, OpenText Corporation, Hyland Software, Inc., M-Files Corporation, Adobe, Inc., Oracle Corporation, Laserfiche, GRM Information Management, Iron Mountain, Incorporated, Zasio Enterprises, Inc., Dokmee, Inc., Fabasoft AG, Alfresco Software, Inc., FileTrail, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Records Management In BFSI MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Records Management In BFSI MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Hyland Software, Inc.

- M-Files Corporation

- Adobe, Inc.

- Oracle Corporation

- Laserfiche

- GRM Information Management

- Iron Mountain, Incorporated

- Zasio Enterprises, Inc.

- Dokmee, Inc.

- Fabasoft AG

- Alfresco Software, Inc.

- FileTrail, Inc.

- Others