Global Rechargeable Tyres Market By Product Type(Pneumatic Rechargeable Tires, Solid Rechargeable Tires, Semi-Pneumatic Rechargeable Tires, Airless Rechargeable Tires), By Vehicle Type(Passenger Cars, Commercial Vehicles, Off-Road and Construction Vehicles, Industrial Equipment), By Distribution Channel(OEMs, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123092

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

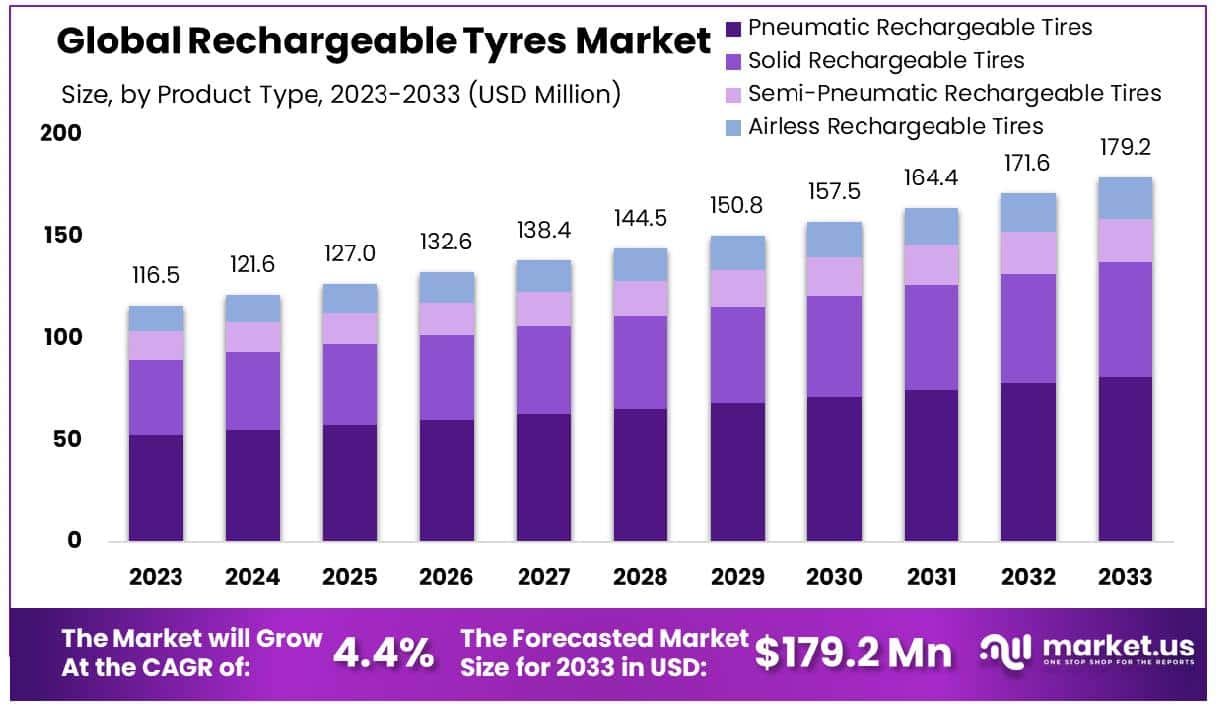

The Global Rechargeable Tyres Market size is expected to be worth around USD 179.2 Million by 2033, From USD 116.5 Million by 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

The rechargeable tyres market encompasses a cutting-edge segment in automotive technology focused on developing tyres that harness kinetic energy during vehicle operation to recharge their integrated battery components. These innovative tyres contribute to extended electric vehicle (EV) range and overall energy efficiency.

The market is driven by advancements in material science and sustainable automotive technologies, catering primarily to manufacturers seeking to meet stringent environmental regulations and consumer demand for greener transportation solutions. Strategic investments and partnerships among key automotive and tech companies are pivotal in propelling the development and commercialization of rechargeable tyres, promising significant impacts on the future of mobility.

The rechargeable tyres market, an emerging sector within the automotive industry, is poised for substantial growth, driven by advancements in electric vehicle (EV) technology and increasing environmental awareness. As the EV market expands, the integration of battery technology in tyres represents a significant innovation, enhancing energy efficiency and vehicle performance. The development of rechargeable tyres is likely to follow a trajectory similar to that observed in the broader EV market, where battery efficiencies and cost reductions have catalyzed adoption.

Market growth can be attributed to the continuous improvements in battery chemistry and manufacturing processes, which have reduced costs by 90% since 2010, making these advanced tyres more accessible. Additionally, with U.S. tyre shipments projected to marginally increase to 334.2 million units in 2023, the demand for innovative tyre solutions is expected to rise, further stimulating this nascent market.

Key Takeaways

- The Global Rechargeable Tyres Market is projected to grow from USD 116.5 million in 2023 to USD 179.2 million by 2033, at a CAGR of 4.4%.

- North America holds 38.6% of the rechargeable tyres market, USD 44.9 million.

- Pneumatic rechargeable tyres dominate with 45.3% of the market share.

- Passenger cars lead, constituting 53.6% of the vehicle type segment.

- OEMs are the primary distribution channel, holding 66.8% share.

Driving Factors

Integration of IoT Sensors in Tyre Technology

Advancements in tyre technology, particularly the integration of IoT sensors for smart monitoring and maintenance, significantly enhance the Rechargeable tyres Market. These sensors enable real-time monitoring of tyre conditions, such as pressure and tread wear, facilitating predictive maintenance and enhancing safety. By providing vital data that can be used to optimize driving conditions and tyre maintenance schedules, IoT-enhanced tyres reduce the overall cost of ownership and improve vehicle efficiency.

This technological enhancement not only attracts tech-savvy consumers but also aligns with the automotive industry’s shift towards connectivity and smart technology. The adoption of these advanced technologies is expected to drive market growth as consumers and fleet managers seek to minimize downtime and enhance vehicle performance.

Rising Adoption of Electric Vehicles

The increasing adoption of electric vehicles (EVs) serves as a pivotal driver for the Rechargeable Tyres Market. EVs require tyres that can handle higher torque outputs and provide greater durability without compromising performance. Rechargeable tyres, designed to be more durable and efficient, are ideally suited to meet these demands. As governments worldwide push for greener transportation options through incentives and regulations, the surge in EV sales directly correlates with an increased demand for high-performance, long-lasting tyres.

This trend is supported by the growing consumer awareness of environmental issues and the economic benefits of owning electric vehicles, further boosting the market for rechargeable tyres. Together, the rising EV adoption and the need for specialized tyres create a synergistic effect that accelerates the expansion of the Rechargeable tyres Market.

Restraining Factors

High Initial Cost and Manufacturing Complexity

The high initial cost and complexity involved in manufacturing rechargeable tyre systems act as significant restraining factors for the market’s growth. These tyres often require sophisticated materials and technologies, which elevate production costs and, consequently, the retail price. The advanced nature of rechargeable tyres, incorporating features like IoT sensors and enhanced durability for electric vehicles, necessitates substantial upfront investment in research and development.

This can deter potential customers, particularly in cost-sensitive markets, and limit market penetration. Manufacturers face challenges not only in optimizing production processes to reduce costs but also in convincing consumers of the long-term economic benefits of these premium-priced products. Without clear cost-benefit visibility, the adoption rate of rechargeable tyres may remain constrained.

Limited Infrastructure for Technology Integration

The growth of the Rechargeable Tyres Market is further restrained by the limited infrastructure for technology integration and support. This encompasses a lack of widespread service centres equipped to install, maintain, and repair advanced tyre systems, as well as insufficient charging stations for electric vehicles in many regions. The effectiveness of rechargeable tyres hinges on the broader ecosystem’s readiness to support such technologies.

In areas where this infrastructure is underdeveloped, the practical benefits of rechargeable tyres are not fully realized, which discourages adoption. Moreover, the integration of IoT technology requires a robust network infrastructure to process and transmit data effectively, which is not universally available. Thus, the pace of market growth is closely tied to the expansion and enhancement of these infrastructural elements.

By Product Type Analysis

Pneumatic rechargeable tires account for 45.3% of the market, driven by advances in air retention technology.

In 2023, Pneumatic Rechargeable Tires held a dominant market position in the By Product Type segment of the Rechargeable Tyres Market, capturing more than a 45.3% share. This was followed by Solid Rechargeable Tires, Semi-Pneumatic Rechargeable Tires, and Airless Rechargeable Tires. The pneumatic rechargeable tires segment benefited significantly from advancements in materials technology and design innovations that enhanced their durability and efficiency, making them a preferred choice for automotive manufacturers and consumers alike.

The solid rechargeable tires segment, capturing a 28.7% market share, is recognized for its low maintenance requirements and resilience in tough driving conditions. Meanwhile, semi-pneumatic rechargeable tires, holding an 18.5% share, offer a compromise between solid and pneumatic tires, providing a balance of comfort and resistance to punctures.

Airless rechargeable tires, though they held the smallest share at 7.5%, are projected to experience significant growth. Innovations in this category are driven by the increasing demand for durable, flat-free tires in commercial vehicle applications, particularly in industrial and construction settings. The development of this segment is further fueled by ongoing research and improvements in load-bearing capabilities and shock absorption.

Collectively, these segments underline a dynamic and evolving market landscape in the rechargeable tires industry. As environmental concerns and cost-efficiency remain pivotal, the market is expected to continue seeing shifts in consumer preferences and technological advancements, which will further define the trajectory of growth and innovation in the sector.

By Vehicle Type Analysis

Passenger cars dominate, constituting 53.6% of the market, favored for their efficiency and technological integration.

In 2023, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Rechargeable Tyres Market, capturing more than a 53.6% share. This was followed by Commercial Vehicles, Off-Road and Construction Vehicles, and Industrial Equipment. The predominance of the passenger cars segment can be attributed to the rising consumer demand for vehicles with enhanced fuel efficiency and lower maintenance costs, which rechargeable tires can provide.

Commercial vehicles accounted for 24.2% of the market share, driven by the increasing adoption of rechargeable tires in logistics and transportation industries aiming to reduce carbon footprints and operational costs. Off-road and Construction Vehicles captured a 13.9% share, where the demand is spurred by the necessity for durable and robust tire solutions capable of performing under harsh and variable conditions.

The smallest share was held by Industrial Equipment at 8.3%, where rechargeable tires are utilized in environments demanding high precision and reliability, such as warehouses and manufacturing plants. This segment, although smaller, is poised for growth due to the expanding industrial sector and the push towards automation and efficient material handling solutions.

Overall, the diverse applications of rechargeable tires across different vehicle types highlight a robust market with substantial growth prospects. Continued innovations in tire technology, coupled with increasing environmental awareness and stringent emissions regulations, are expected to drive further market expansion and penetration across all segments.

By Distribution Channel Analysis

Original Equipment Manufacturers (OEMs) lead distribution with 66.8%, ensuring quality and compatibility in new vehicles.

In 2023, OEMs held a dominant market position in the By Distribution Channel segment of the Rechargeable Tyres Market, capturing more than a 66.8% share, followed by the Aftermarket which accounted for the remainder of the market. The substantial share held by OEMs underscores the strong partnerships between tire manufacturers and original equipment manufacturers, which have been pivotal in integrating rechargeable tires into new vehicles. This integration is largely driven by increasing regulatory demands for higher fuel efficiency and reduced carbon emissions in new automotive designs.

The Aftermarket segment, while smaller at 33.2%, also shows significant potential. It benefits from the growing consumer awareness and preference for sustainable and cost-effective tire options. Vehicle owners looking to upgrade or replace their existing tires are increasingly turning to rechargeable options that offer longer life spans and better performance under varying climatic conditions.

The market dynamics within these distribution channels are influenced by several factors including technological advancements in tire production, the economic scale of OEM partnerships, and evolving consumer preferences towards more environmentally friendly and energy-efficient products. As rechargeable tire technology continues to mature and gain broader acceptance, both segments are expected to witness growth. However, OEMs are likely to maintain a leading position due to their direct access to vehicle manufacturers and influence over initial equipment specifications.

Key Market Segments

By Product Type

- Pneumatic Rechargeable Tires

- Solid Rechargeable Tires

- Semi-Pneumatic Rechargeable Tires

- Airless Rechargeable Tires

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Off-Road and Construction Vehicles

- Industrial Equipment

By Distribution Channel

- OEMs

- Aftermarket

Growth Opportunities

Development of Universal Charging Solutions

The growth of the global rechargeable tyres market in 2023 can be significantly attributed to the development of universal charging solutions compatible with a diverse range of vehicles. This innovation presents a strategic inflexion point, particularly as the automotive industry gravitates towards more integrated and user-friendly technologies. Universal charging solutions cater to a broad spectrum of vehicles, thereby enhancing market penetration and reducing compatibility barriers.

This expansion is likely to increase consumer adoption rates as the convenience of a singular, adaptable charging system simplifies the user experience. Moreover, the deployment of such technology enhances the value proposition of rechargeable tyres, making them a more attractive option for consumers seeking efficiency and sustainability in vehicle maintenance and operation.

Expansion into Emerging Markets

Emerging markets represent a fertile ground for the rechargeable tyres industry, especially given their increasing openness to innovative vehicle technologies. In 2023, these markets are poised to offer substantial growth opportunities due to their expanding automotive sectors and heightened environmental awareness. The push towards modernizing vehicle capabilities in these regions, coupled with rising economic growth, facilitates a higher demand for advanced automotive technologies, including rechargeable tyres.

As infrastructures improve and consumer incomes rise, the adoption of such technologies is expected to accelerate, offering a lucrative pathway for market expansion. Companies venturing into these territories are likely to encounter a responsive consumer base eager to embrace innovations that promise enhanced vehicle performance and environmental sustainability.

Latest Trends

Incorporation of Nanomaterials

In 2023, one of the foremost trends in the global rechargeable tyres market is the incorporation of nanomaterials to enhance tyre performance and energy storage capabilities. Nanotechnology plays a pivotal role in advancing the functional attributes of rechargeable tyres, such as durability, efficiency, and energy conductance. The integration of nanomaterials, such as carbon nanotubes or graphene, into tyre composition not only improves the mechanical properties like wear resistance and strength but also significantly boosts the energy storage capacity of the tyres.

This technology enables tyres to hold a charge longer and deliver energy more efficiently to the vehicle. The implementation of nanomaterials is a groundbreaking development, offering a competitive edge to manufacturers seeking to meet the increasing consumer demands for high-performance, long-lasting automotive solutions.

Strategic Partnerships

The rechargeable tyres market in 2023 is also characterized by strategic partnerships between tyre manufacturers and technology companies. These collaborations are essential in driving forward the development of sophisticated rechargeable tyre systems that integrate seamlessly with modern vehicle technologies. By pooling resources and expertise, these partnerships accelerate innovation, streamline production processes, and reduce time-to-market for new products.

Such alliances are instrumental in overcoming technical challenges and ensuring that the rechargeable tyres are not only highly functional but also compatible with existing and future automotive technologies. As companies combine strengths in materials science, engineering, and digital technologies, they forge pathways to unlocking substantial market opportunities and setting new benchmarks in the automotive industry.

Regional Analysis

The North American rechargeable tyres market holds a 38.6% share, valued at USD 44.9 million.

The global rechargeable tyres market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Each region exhibits distinct growth dynamics and market penetration influenced by regional automotive trends, technological adoption rates, and economic factors.

North America, dominating the market with a 38.6% share and valued at USD 44.9 million, is spearheaded by significant investments in automotive technologies and a robust presence of leading tyre manufacturers. The region’s focus on sustainable transportation solutions and high consumer readiness to adopt new technologies fuel this leading position. Europe follows closely, driven by stringent environmental regulations and the aggressive adoption of electric vehicles (EVs), which necessitates advanced rechargeable tyre solutions to enhance vehicle efficiency and range.

The Asia Pacific region is witnessing rapid growth due to expanding automotive manufacturing hubs in China, India, and Southeast Asia. Increasing urbanization and rising disposable incomes are propelling the demand for advanced automotive technologies, including rechargeable tyres. This region is expected to experience the highest growth rate, supported by governmental initiatives to promote electric vehicles and reduce carbon emissions.

Meanwhile, the Middle East & Africa and Latin America are emerging as potential growth areas. These regions are gradually embracing new technologies, with the Middle East focusing on diversifying oil-dependent economies and Latin America benefiting from incremental improvements in economic conditions and vehicle penetration rates. Although currently smaller in market size, these regions present untapped opportunities due to increasing technological awareness and infrastructure development aimed at supporting advanced automotive technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global rechargeable tyres market is significantly shaped by the activities and innovations of key players, including Goodyear Tire & Rubber Company, Michelin, Volvo Car Corporation, Nexen Tire Corporation, among others. Each of these companies brings distinct advancements and strategic approaches to the sector, influencing market dynamics and competitive landscapes.

Goodyear Tire & Rubber Company has been at the forefront, leveraging its extensive R&D capabilities to innovate within the rechargeable tyre space. The company focuses on integrating sensor-based technologies with advanced material science to enhance the performance and energy efficiency of its tyres. This approach not only reinforces their market position but also aligns with the growing consumer demand for sustainable and high-performance automotive solutions.

Michelin is another major player, renowned for its commitment to sustainability and innovation. Michelin’s research into eco-friendly materials and energy-efficient designs has set industry benchmarks, making it a pivotal force in driving the rechargeable tyre market forward. Their products are designed to optimize energy usage and reduce overall environmental impact, resonating with global sustainability goals.

Volvo Car Corporation brings a unique perspective as an automaker deeply invested in rechargeable tyre technology to complement their electric and hybrid vehicles. Volvo’s integration of tyre technologies aims to maximize vehicle efficiency and safety, indicative of a trend where automakers and tyre manufacturers collaborate more closely.

Nexen Tire Corporation has made significant inroads in market penetration by focusing on cost-effective yet durable rechargeable tyre solutions, particularly appealing in emerging markets.

Market Key Players

- Goodyear Tire & Rubber Company

- Michelin

- Volvo Car Corporation

- Nexen Tire Corporation

- Others

Recent Development

- In January 2023, The Goodyear Tire & Rubber Company made significant advancements in the rechargeable tires sector, notably with their ElectricDrive™ 2 and a 90% sustainable-material demonstration tire.

- In 2023, Volvo Cars reported a substantial increase in sales, setting a new global sales record with 708,716 cars sold, which represents a 15% increase from 2022.

Report Scope

Report Features Description Market Value (2023) USD 116.5 Million Forecast Revenue (2033) USD 179.2 Million CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Pneumatic Rechargeable Tires, Solid Rechargeable Tires, Semi-Pneumatic Rechargeable Tires, Airless Rechargeable Tires), By Vehicle Type(Passenger Cars, Commercial Vehicles, Off-Road and Construction Vehicles, Industrial Equipment), By Distribution Channel(OEMs, Aftermarket) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Goodyear Tire & Rubber Company, Michelin, Volvo Car Corporation, Nexen Tire Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Rechargeable Tyres Market Size in 2023?The Global Rechargeable Tyres Market Size is USD 116.5 Million in 2023.

What is the projected CAGR at which the Global Rechargeable Tyres Market is expected to grow at?The Global Rechargeable Tyres Market is expected to grow at a CAGR of 4.4% (2024-2033).

List the segments encompassed in this report on the Global Rechargeable Tyres Market?Market.US has segmented the Global Rechargeable Tyres Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type(Pneumatic Rechargeable Tires, Solid Rechargeable Tires, Semi-Pneumatic Rechargeable Tires, Airless Rechargeable Tires), By Vehicle Type(Passenger Cars, Commercial Vehicles, Off-Road and Construction Vehicles, Industrial Equipment), By Distribution Channel(OEMs, Aftermarket)

List the key industry players of the Global Rechargeable Tyres Market?Goodyear Tire & Rubber Company, Michelin, Volvo Car Corporation, Nexen Tire Corporation, Others

Name the key areas of business for Global Rechargeable Tyres Market?The US, Canada, Mexico are leading key areas of operation for Global Rechargeable Tyres Market.

-

-

- Goodyear Tire & Rubber Company

- Michelin

- Volvo Car Corporation

- Nexen Tire Corporation

- Others